Automotive Microcontrollers Market Report

Published Date: 22 January 2026 | Report Code: automotive-microcontrollers

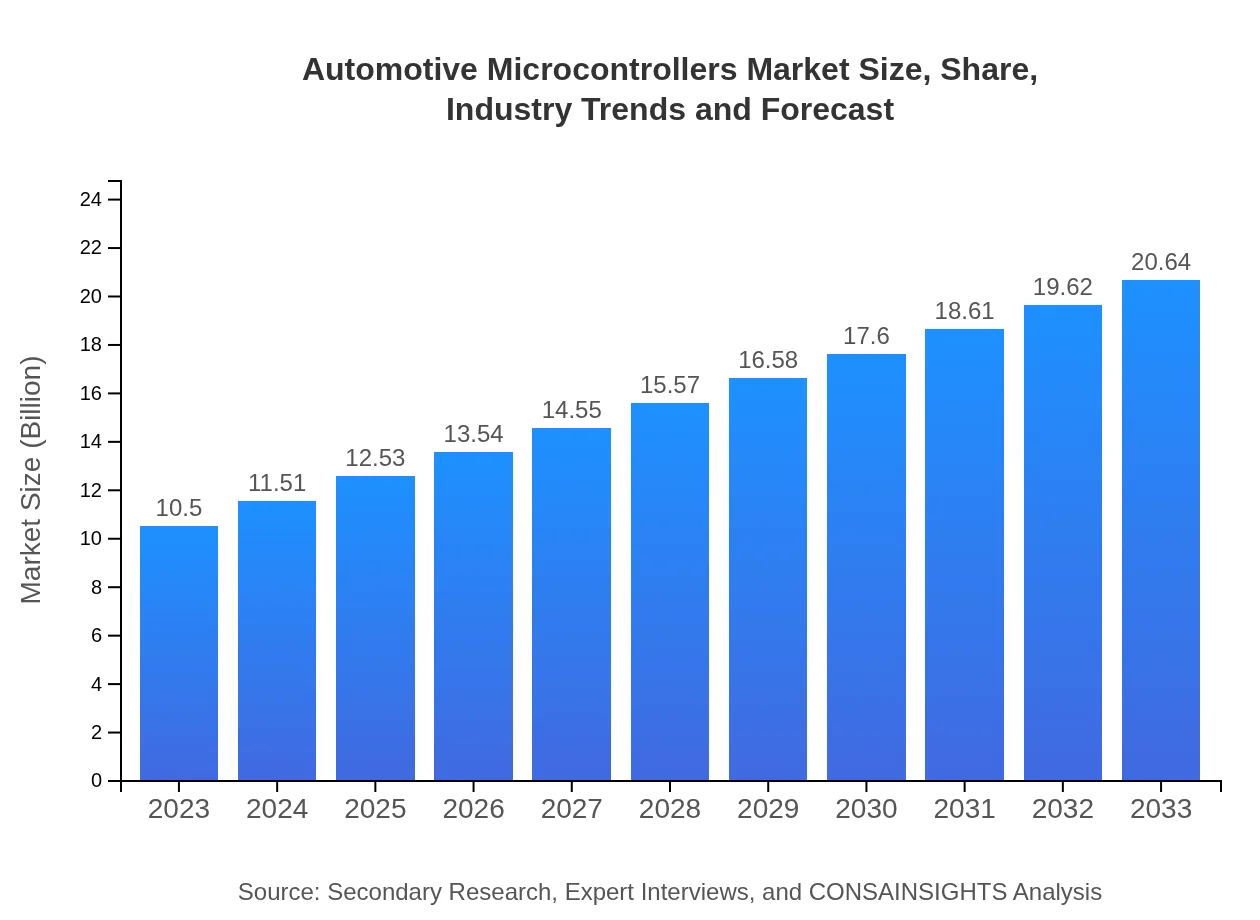

Automotive Microcontrollers Market Size, Share, Industry Trends and Forecast to 2033

This detailed market report covers the Automotive Microcontrollers sector, analyzing market size, segmentation, trends, and regional dynamics. It provides insights into growth forecasts covering the period from 2023 to 2033, helping stakeholders make informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | NXP Semiconductors, Microchip Technology, Infineon Technologies, Texas Instruments, STMicroelectronics |

| Last Modified Date | 22 January 2026 |

Automotive Microcontrollers Market Overview

Customize Automotive Microcontrollers Market Report market research report

- ✔ Get in-depth analysis of Automotive Microcontrollers market size, growth, and forecasts.

- ✔ Understand Automotive Microcontrollers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Microcontrollers

What is the Market Size & CAGR of the Automotive Microcontrollers market in 2023?

Automotive Microcontrollers Industry Analysis

Automotive Microcontrollers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Microcontrollers Market Analysis Report by Region

Europe Automotive Microcontrollers Market Report:

In Europe, the market was valued at $2.89 billion in 2023 and is expected to reach $5.68 billion by 2033. This growth is underpinned by stringent regulatory emissions standards and the push for electrification, which necessitate the deployment of sophisticated microcontroller technologies in vehicles.Asia Pacific Automotive Microcontrollers Market Report:

In the Asia Pacific region, the automotive microcontrollers market is projected to grow from $2.02 billion in 2023 to $3.96 billion by 2033. The robust presence of leading automotive manufacturers and the surge in electric vehicle production are key drivers of this growth, while technological innovation and infrastructural developments in countries such as China and Japan further enhance market potential.North America Automotive Microcontrollers Market Report:

North America holds a significant share of the automotive microcontrollers market, projected to rise from $4.01 billion in 2023 to $7.89 billion in 2033. The adoption of advanced driver assistance systems (ADAS) and a strong push towards electric and hybrid vehicles are propelling the demand for high-performance microcontrollers.South America Automotive Microcontrollers Market Report:

South America’s automotive microcontrollers market, valued at $0.55 billion in 2023, is expected to reach $1.09 billion by 2033. The growth is largely influenced by increasing vehicle production and a shift towards more technologically advanced vehicle models. However, challenges such as economic fluctuations and regulatory hurdles pose obstacles to growth.Middle East & Africa Automotive Microcontrollers Market Report:

The Middle East and Africa market is anticipated to grow from $1.03 billion in 2023 to $2.02 billion by 2033. Growing urbanization, along with increased investment in smart vehicle technologies, is expected to boost demand, although the market is hindered by developmental challenges and infrastructure inadequacies in certain areas.Tell us your focus area and get a customized research report.

Automotive Microcontrollers Market Analysis Original_equipment_manufacturers

Global Automotive Microcontrollers Market, By Original Equipment Manufacturers (OEMs) (2023 - 2033)

The OEM segment dominates the market, with a size of $9.12 billion in 2023 and projected growth to $17.92 billion by 2033, accounting for approximately 86.82% of the market share. This underscores the critical role OEMs play in integrating microcontroller technologies into new vehicles.

Automotive Microcontrollers Market Analysis Aftermarket

Global Automotive Microcontrollers Market, By Aftermarket (2023 - 2033)

The aftermarket segment is valued at $1.38 billion in 2023 and is expected to grow to $2.72 billion by 2033, representing 13.18% of the market. The aftermarket segment is crucial as it supports vehicle enhancements and retrofits for improved functionalities.

Automotive Microcontrollers Market Analysis Processors

Global Automotive Microcontrollers Market, By Processors (2023 - 2033)

This segment, which includes various microcontroller processors, is expected to grow from $6.49 billion in 2023 to $12.75 billion in 2033, holding a share of 61.78%. The demand for advanced processing capabilities is driving technological advancements within this segment.

Automotive Microcontrollers Market Analysis Memory_components

Global Automotive Microcontrollers Market, By Memory Components (2023 - 2033)

Memory components are estimated to grow from $2.66 billion to $5.24 billion by 2033, maintaining a market share of 25.38%. The trend of smarter vehicles requiring more efficient non-volatile memory solutions is promoting this segment.

Automotive Microcontrollers Market Analysis Interfaces

Global Automotive Microcontrollers Market, By Interfaces (2023 - 2033)

This segment encompasses communication and control interfaces, estimated to grow from $1.35 billion to $2.65 billion by 2033, accounting for 12.84%. The increasing reliance on seamless connectivity in modern vehicles is a key driver for this segment.

Automotive Microcontrollers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Microcontrollers Industry

NXP Semiconductors:

NXP is a leading supplier of automotive microcontrollers, focusing on advanced technologies that enhance vehicle safety and performance. They are known for their extensive portfolio in automotive applications.Microchip Technology:

Microchip offers a wide range of microcontroller solutions catering to automotive applications, specializing in low-power consumption microcontrollers for electric vehicles.Infineon Technologies:

Infineon provides complex microcontroller solutions that ensure high performance and energy efficiency, leading to significant advancements in the vehicle's electronic systems.Texas Instruments:

Texas Instruments is known for its innovative technologies encompassing a variety of automotive applications, particularly in connectivity and processing.STMicroelectronics:

STMicroelectronics is recognized for its robust microcontroller products tailored for automotive safety and control systems, promoting the integration of advanced technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Microcontrollers?

The automotive microcontrollers market is projected to reach approximately $10.5 billion by 2033, growing at a CAGR of 6.8%. This growth reflects increasing vehicle electrification and advanced driver-assistance systems.

What are the key market players or companies in this automotive Microcontrollers industry?

Key players in the automotive microcontrollers market include major semiconductor manufacturers such as NXP Semiconductors, Texas Instruments, and Infineon Technologies, who focus on innovation and meeting the escalating demands for automotive applications.

What are the primary factors driving the growth in the automotive Microcontrollers industry?

Growth drivers include the shift towards electric vehicles, the rise of advanced safety features, the demand for in-vehicle connectivity, and innovations in automotive electronics leading to more sophisticated microcontroller applications.

Which region is the fastest Growing in the automotive Microcontrollers?

The fastest-growing region in the automotive microcontrollers market is North America, projected to grow from $4.01 billion in 2023 to $7.89 billion by 2033, driven by technological advancements and the rise of EVs.

Does ConsaInsights provide customized market report data for the automotive Microcontrollers industry?

Yes, ConsaInsights offers customized market report data for the automotive microcontrollers industry, allowing clients to tailor their insights according to specific needs such as regional focus, market segments, and competitive analysis.

What deliverables can I expect from this automotive Microcontrollers market research project?

Deliverables include a comprehensive market analysis report, segment breakdowns, regional insights, growth forecasts, competitive landscape assessments, and actionable recommendations customized to client needs in the automotive microcontrollers space.

What are the market trends of automotive Microcontrollers?

Market trends include increased adoption of 16-bit and 32-bit microcontrollers, growing demand for embedded software solutions, and innovations in wireless connectivity, which cater to the rise of connected and autonomous vehicles.