Automotive Oem Interior Coatings Market Report

Published Date: 02 February 2026 | Report Code: automotive-oem-interior-coatings

Automotive Oem Interior Coatings Market Size, Share, Industry Trends and Forecast to 2033

This report provides insights into the Automotive OEM Interior Coatings market, covering market size, trends, and forecasts from 2023 to 2033. It details regional analysis, industry dynamics, and profiles of market leaders.

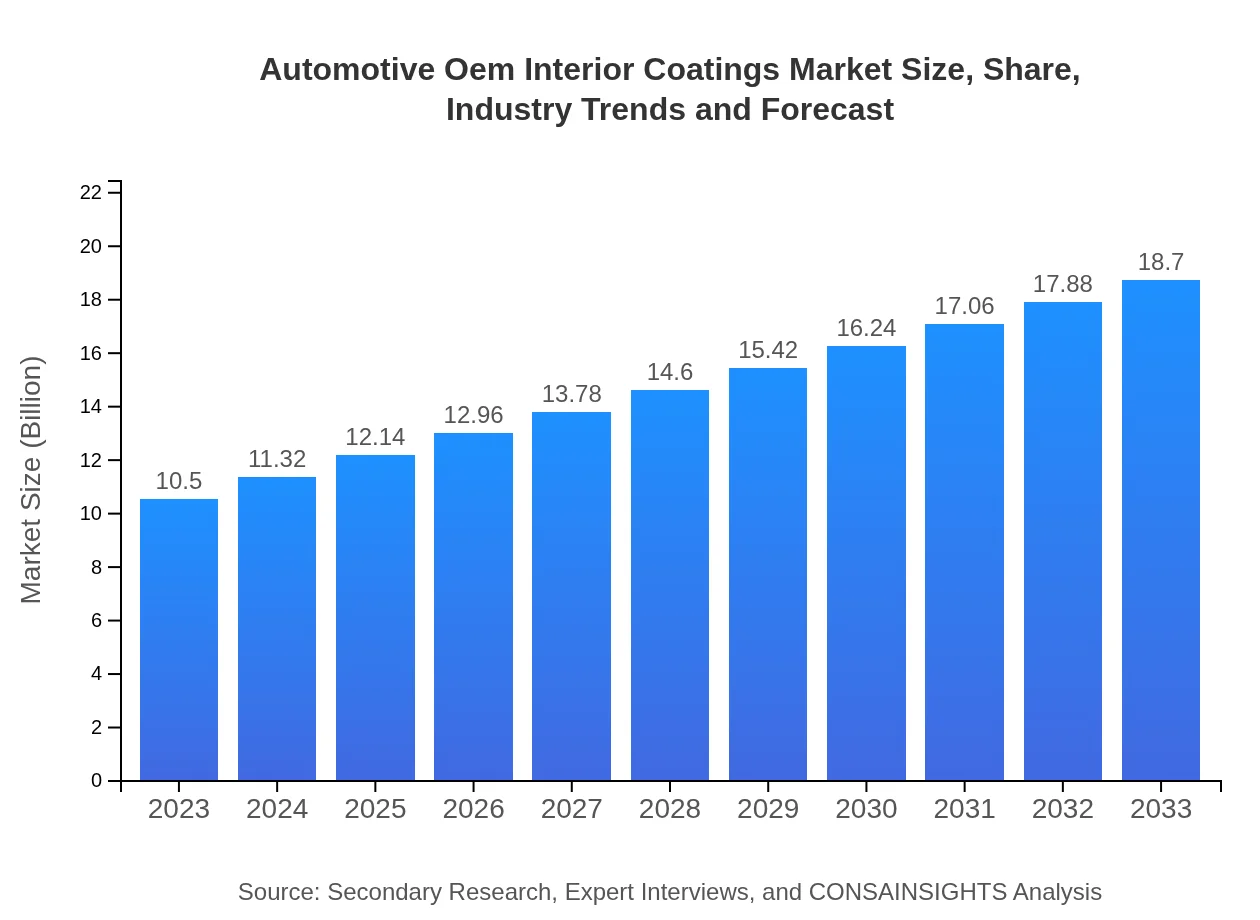

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $18.70 Billion |

| Top Companies | BASF SE, PPG Industries, AkzoNobel N.V., Sherwin-Williams, Henkel AG & Co. KGaA |

| Last Modified Date | 02 February 2026 |

Automotive Oem Interior Coatings Market Overview

Customize Automotive Oem Interior Coatings Market Report market research report

- ✔ Get in-depth analysis of Automotive Oem Interior Coatings market size, growth, and forecasts.

- ✔ Understand Automotive Oem Interior Coatings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Oem Interior Coatings

What is the Market Size & CAGR of Automotive Oem Interior Coatings market in 2023?

Automotive Oem Interior Coatings Industry Analysis

Automotive Oem Interior Coatings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Oem Interior Coatings Market Analysis Report by Region

Europe Automotive Oem Interior Coatings Market Report:

The European market stands as one of the largest, with a market size of $3.29 billion in 2023, projected to reach $5.86 billion by 2033. The emphasis on environmentally sustainable coatings and compliance with strict EU regulations are key factors supporting market growth.Asia Pacific Automotive Oem Interior Coatings Market Report:

In the Asia-Pacific region, the market is expected to experience robust growth with a size of approximately $2.14 billion in 2023, projected to rise to $3.82 billion by 2033. This growth is attributed to the increasing automotive production in countries like China and India, along with rising consumer preferences for luxury vehicle interiors.North America Automotive Oem Interior Coatings Market Report:

North America is projected to be a significant market, with a size of about $3.37 billion in 2023, increasing to $6.00 billion by 2033. This growth is driven by major automotive manufacturers focusing on innovative interior coatings for enhanced consumer appeal and premium features.South America Automotive Oem Interior Coatings Market Report:

The South American market, albeit smaller, is showing potential, with a market size of $0.77 billion in 2023 and expected growth to $1.37 billion by 2033. The growth can be linked to rising vehicle sales and improvements in manufacturing capabilities in the region.Middle East & Africa Automotive Oem Interior Coatings Market Report:

The Middle East and Africa region is forecasted to have a market size of $0.93 billion in 2023, expanding to $1.66 billion by 2033. Rising disposable incomes and an increase in luxury vehicle sales are significant drivers.Tell us your focus area and get a customized research report.

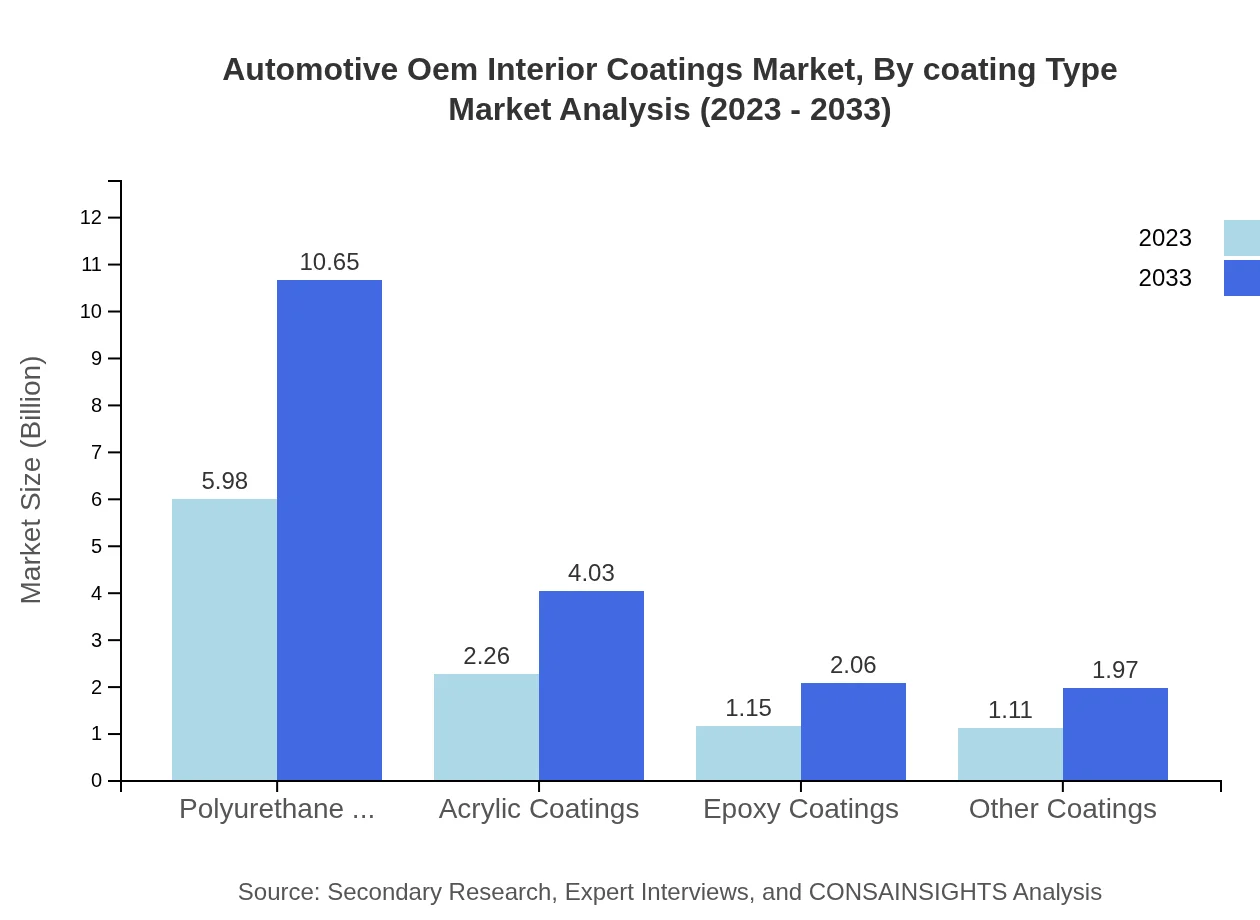

Automotive Oem Interior Coatings Market Analysis By Coating Type

In terms of coating types, polyurethane coatings dominate the market, representing $5.98 billion in 2023, expected to reach $10.65 billion by 2033, holding 56.93% market share. Acrylic coatings follow with $2.26 billion and a projected growth to $4.03 billion. Epoxy coatings and others also contribute significantly to the market size.

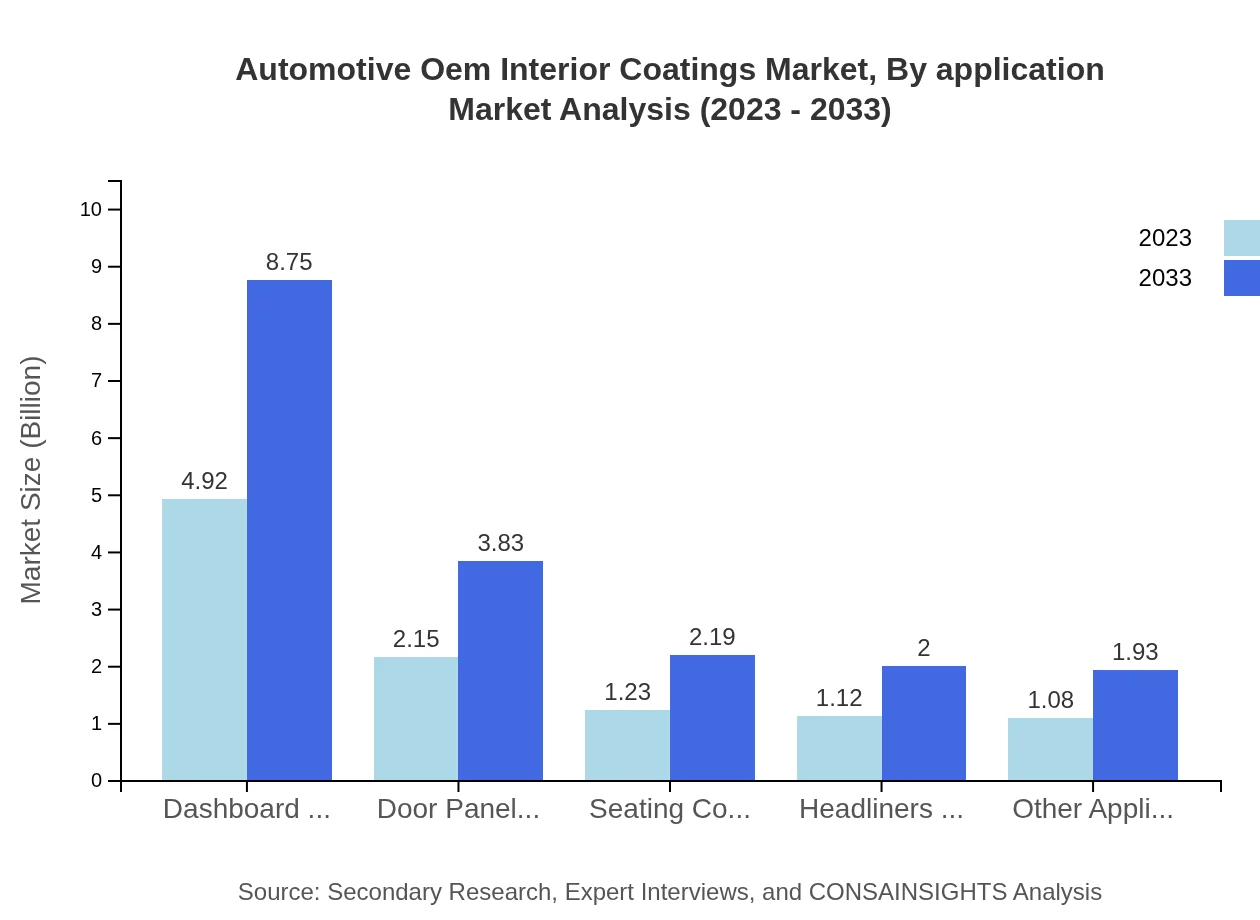

Automotive Oem Interior Coatings Market Analysis By Application

The application segment reveals dashboard coatings leading with a market size of $4.92 billion in 2023 and anticipated growth to $8.75 billion by 2033. Door panels, seating, and headliners also play substantial roles, showcasing diverse applications across vehicle interiors.

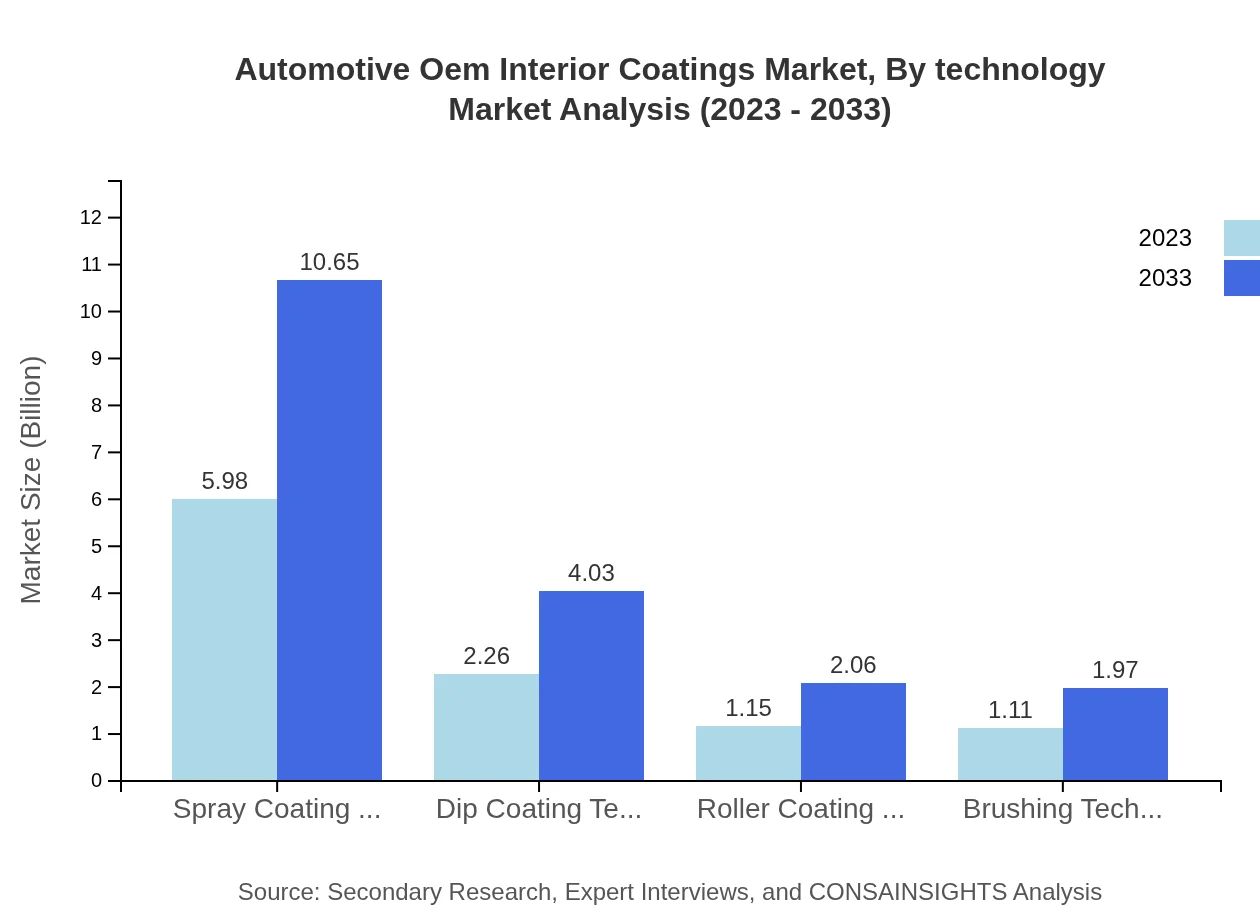

Automotive Oem Interior Coatings Market Analysis By Technology

Spray coating technology is the largest segment, accounting for $5.98 billion in 2023, increasing to $10.65 billion by 2033. Dip coating and roller coating technologies serve specific applications, whereas advanced methods like brushing technology continue to gain traction in certain markets.

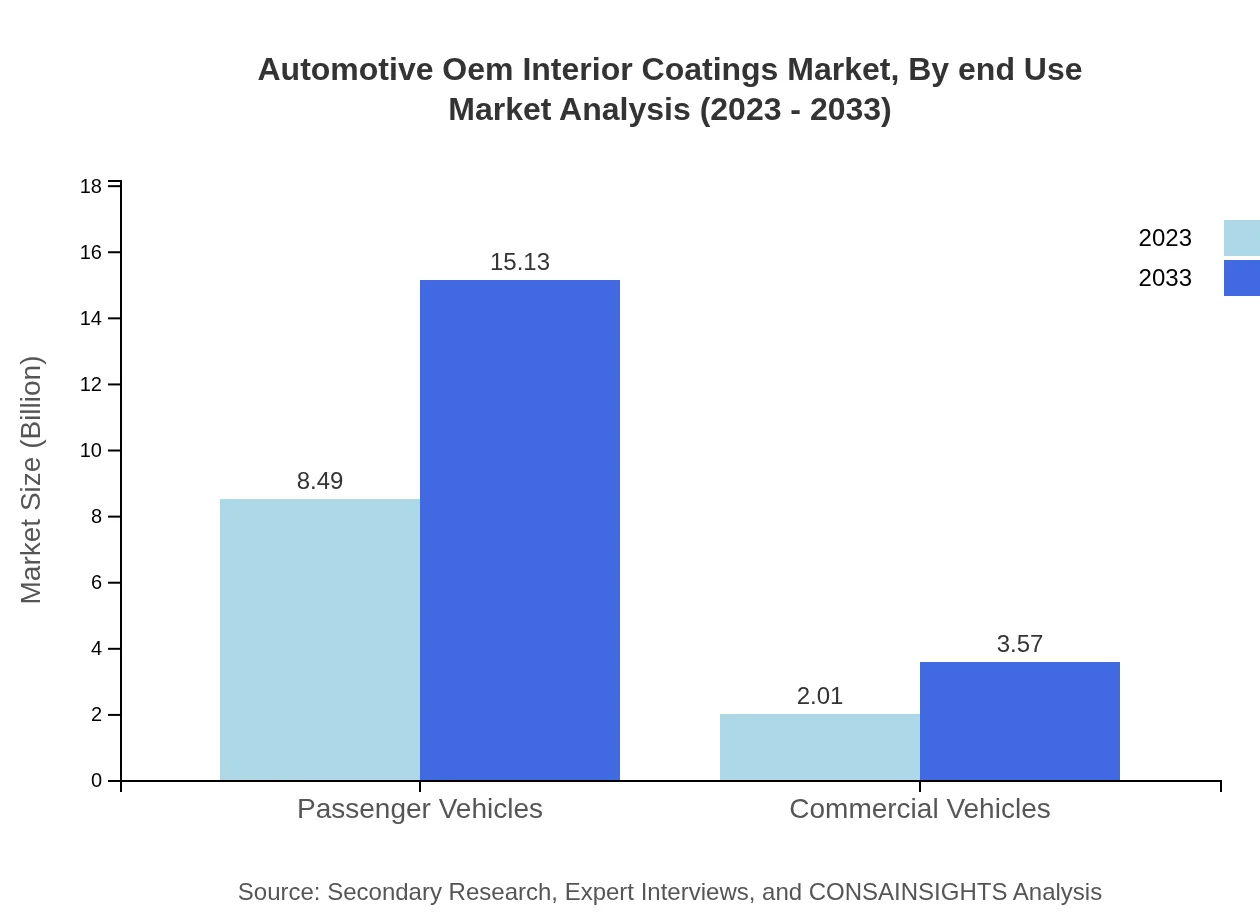

Automotive Oem Interior Coatings Market Analysis By End Use

The market primarily serves passenger vehicles, holding a significant share with $8.49 billion in 2023 and expected growth to $15.13 billion. Commercial vehicles constitute a smaller segment, yet they are expected to grow accordingly, contributing to the overall market landscape.

Automotive Oem Interior Coatings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Oem Interior Coatings Industry

BASF SE:

BASF SE is a leading global chemical company with a broad portfolio that includes innovative automotive coatings, known for their high performance and sustainability.PPG Industries:

PPG Industries specializes in paint and coating products, providing advanced solutions for automotive interiors that combine durability with aesthetic appeal.AkzoNobel N.V.:

AkzoNobel is renowned for its advanced coatings and paints, focusing on innovation and sustainability in the automotive industry.Sherwin-Williams:

Sherwin-Williams offers diverse coating solutions tailored for automotive interiors, recognized for their quality and environmental compliance.Henkel AG & Co. KGaA:

Henkel is a global leader in adhesive and coatings technologies, producing high-quality automotive coatings that cater to functional and aesthetic requirements.We're grateful to work with incredible clients.

FAQs

What is the market size of Automotive OEM Interior Coatings?

The Automotive OEM Interior Coatings market is valued at approximately $10.5 billion in 2023, with an expected compound annual growth rate (CAGR) of 5.8%, reaching a projected market size by 2033.

What are the key market players or companies in the Automotive OEM Interior Coatings industry?

Key market players in the Automotive OEM Interior Coatings industry include well-established manufacturers like BASF, PPG Industries, and Axalta Coating Systems, known for their innovations and market competitiveness.

What are the primary factors driving the growth in the Automotive OEM Interior Coatings industry?

The growth of the Automotive OEM Interior Coatings industry is driven by increasing vehicle production, advancements in coating technologies, and the rising demand for aesthetic features in vehicle interiors.

Which region is the fastest Growing in the Automotive OEM Interior Coatings?

The Asia Pacific region is the fastest-growing in the Automotive OEM Interior Coatings market, projected to grow from $2.14 billion in 2023 to $3.82 billion by 2033, supported by emerging markets and increased automotive manufacturing.

Does ConsaInsights provide customized market report data for the Automotive OEM Interior Coatings industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the Automotive OEM Interior Coatings industry, enabling businesses to derive actionable insights.

What deliverables can I expect from this Automotive OEM Interior Coatings market research project?

Deliverables from the Automotive OEM Interior Coatings market research project include comprehensive market analysis, forecasts, competitive landscape overview, and strategic recommendations based on consumer trends.

What are the market trends of Automotive OEM Interior Coatings?

Key trends in the Automotive OEM Interior Coatings market include a shift towards eco-friendly coatings, increased customization in automotive interiors, and expanding applications in electric vehicles.