Automotive Pcb Market Report

Published Date: 31 January 2026 | Report Code: automotive-pcb

Automotive Pcb Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Automotive PCB market, exploring its current dynamics and future projections from 2023 to 2033. Key insights on market size, trends, segmentation, and competitive landscape will be discussed to offer a comprehensive view of the industry's trajectory.

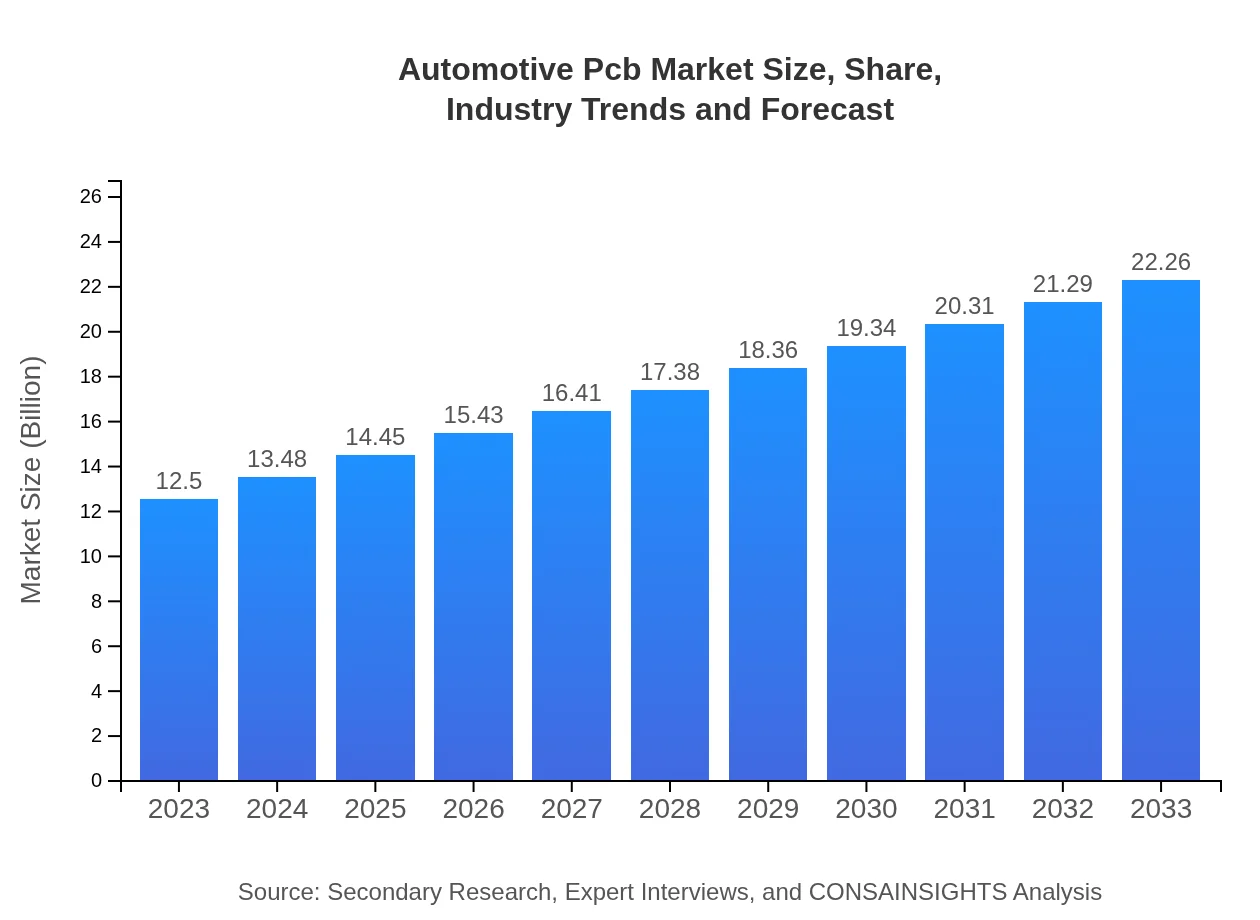

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $22.26 Billion |

| Top Companies | Flex Ltd., Leoni AG, Yageo Corporation, TTM Technologies |

| Last Modified Date | 31 January 2026 |

Automotive PCB Market Overview

Customize Automotive Pcb Market Report market research report

- ✔ Get in-depth analysis of Automotive Pcb market size, growth, and forecasts.

- ✔ Understand Automotive Pcb's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Pcb

What is the Market Size & CAGR of Automotive PCB market in 2023?

Automotive PCB Industry Analysis

Automotive PCB Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive PCB Market Analysis Report by Region

Europe Automotive Pcb Market Report:

Europe had a market size of $3.49 billion in 2023, projected to reach $6.21 billion by 2033. The European automotive market is characterized by strong regulations on vehicle emissions, prompting manufacturers to adopt advanced PCBs that comply with environmental standards.Asia Pacific Automotive Pcb Market Report:

The Asia Pacific region is expected to dominate the Automotive PCB market, with a market size of $2.68 billion in 2023, projected to grow to $4.77 billion by 2033. The growth is fueled by a surge in automobile production in countries like China and Japan, alongside significant investments in electric vehicle technologies.North America Automotive Pcb Market Report:

North America accounted for a market size of $4.04 billion in 2023, expected to grow to $7.20 billion by 2033. The region's growth is largely driven by advancements in automotive technologies and the shift towards electric and hybrid vehicles.South America Automotive Pcb Market Report:

South America is gradually emerging in the automotive landscape, with a current market size of $0.66 billion projected to reach $1.18 billion by 2033. This growth is supported by increasing vehicle production and a rise in demand for fuel-efficient vehicles.Middle East & Africa Automotive Pcb Market Report:

The Middle East and Africa region has a current market size of $1.63 billion, expected to grow to $2.90 billion by 2033. The growth in this region is spurred by rising investments in the automotive sector and increasing demand for high-tech vehicle features.Tell us your focus area and get a customized research report.

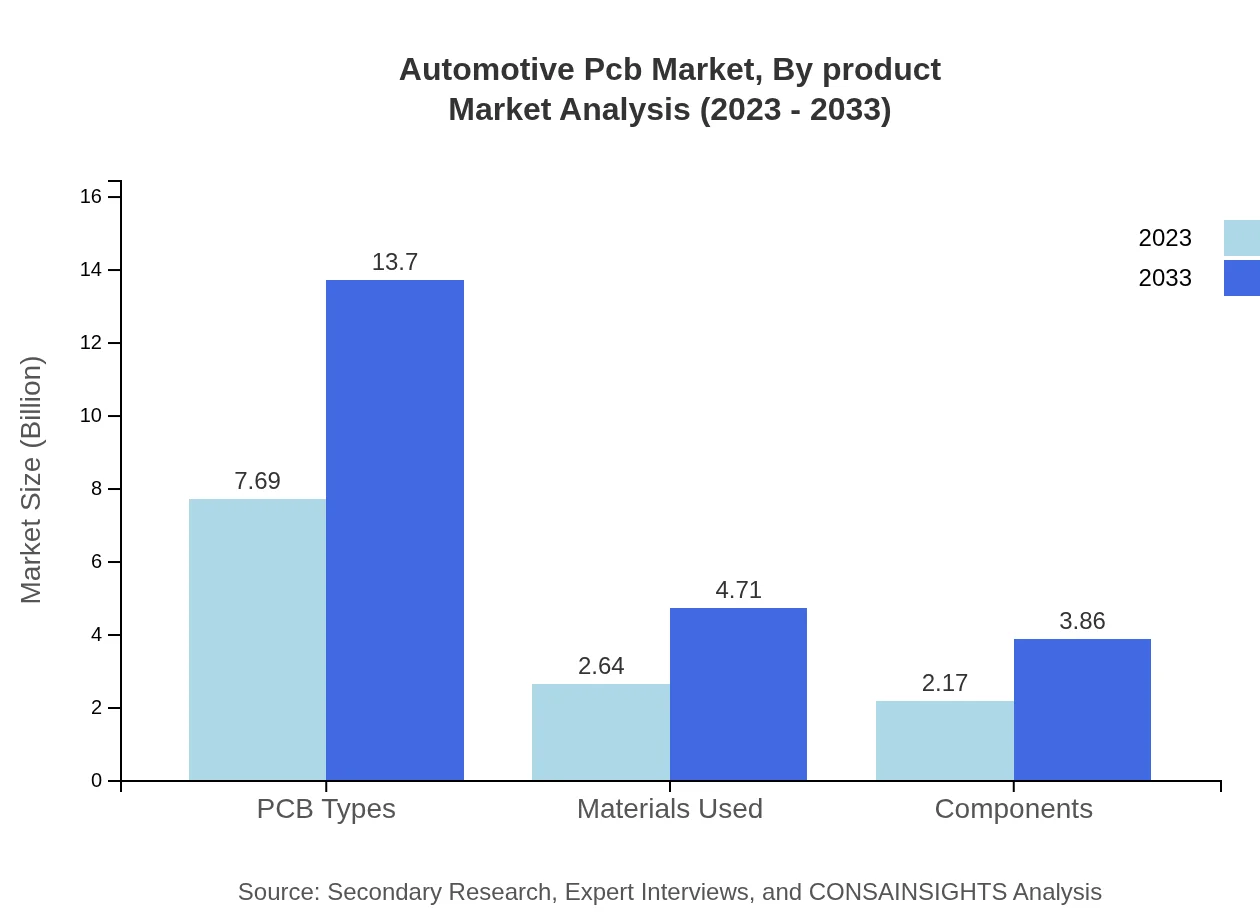

Automotive Pcb Market Analysis By Product

The global market for automotive PCBs is projected to be sizable, with a market valuation of $7.69 billion in 2023 and expected to increase to $13.70 billion by 2033. This segment remains significant due to the predominance of various PCB types in vehicle applications.

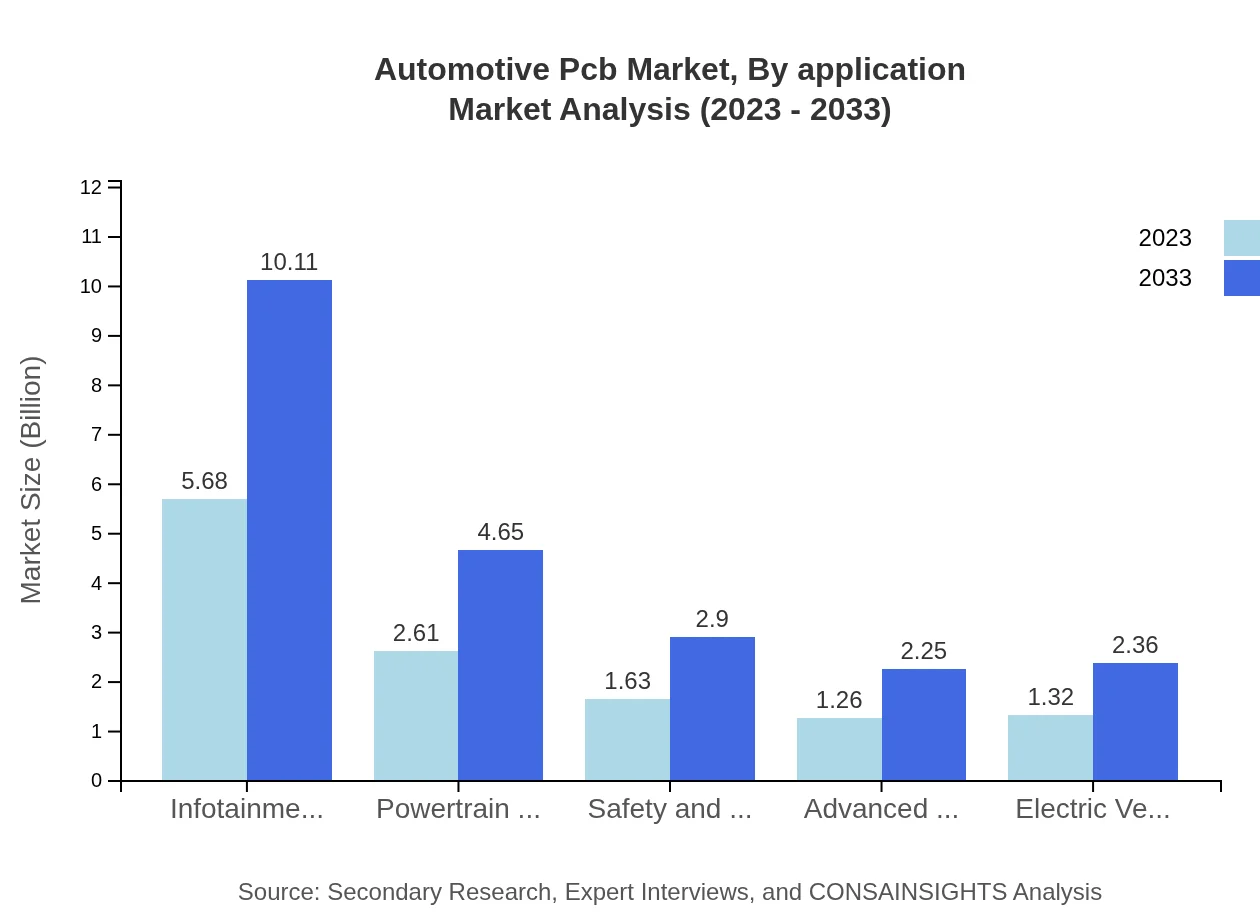

Automotive Pcb Market Analysis By Application

The market encapsulating various applications such as infotainment systems and ADAS is vital, with the infotainment segment alone expected to account for a significant share of the automotive PCB market, reflecting the rising consumer preference for advanced connectivity features.

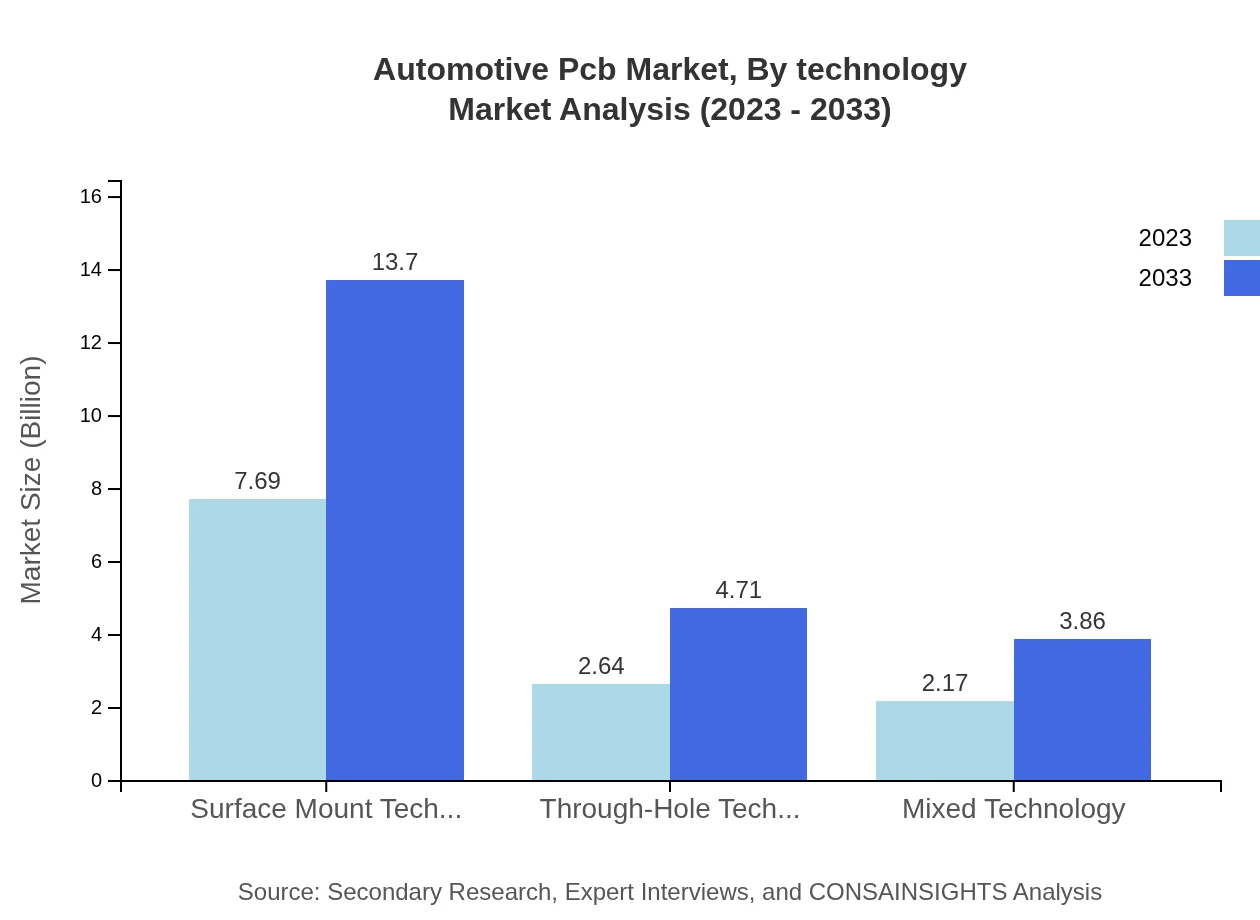

Automotive Pcb Market Analysis By Technology

Among the technologies utilized, Surface Mount Technology (SMT) continues to dominate the automotive PCB market, expected to maintain a market share of over 60%. The evolving need for compact and efficient electronic devices is bolstering the adoption of SMT.

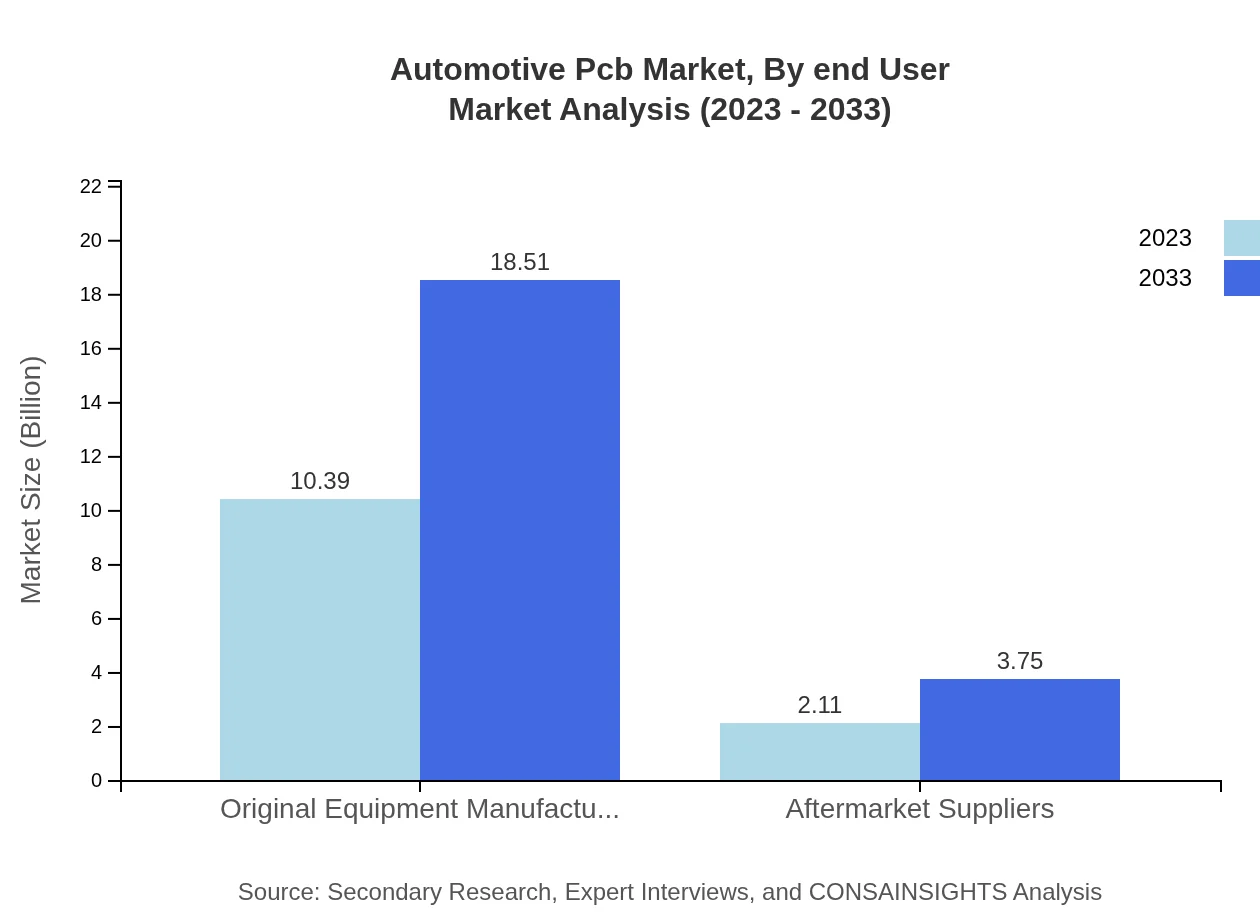

Automotive Pcb Market Analysis By End User

Original Equipment Manufacturers (OEMs) represent the largest end-user segment, accounting for approximately 83.14% of the automotive PCB market in 2023, reflecting the focus on high-quality components for vehicle assembly.

Automotive Pcb Market Analysis By Region

Global Automotive PCB Market, By Region (Not Included) Market Analysis (2023 - 2033)

Given the geographic diversity of automotive production, regional analyses have highlighted differing market drivers, with North America and Europe leading in technological advancements while Asia Pacific displays rapid growth potential due to manufacturing hubs.

Automotive PCB Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive PCB Industry

Flex Ltd.:

Flex is a leading provider of engineered and flexible PCB solutions, heavily involved in automotive electronics, especially in electric vehicles, with a focus on innovation and sustainability.Leoni AG:

Leoni AG specializes in various automotive cables and PCBs, known for their high-quality and advanced technologies catering to next-gen automotive applications.Yageo Corporation:

Yageo Corporation is recognized for its extensive portfolio of passive components and advanced PCBs, supporting the automotive industry's shift towards increased connectivity and electric mobility.TTM Technologies:

TTM Technologies operates as a leader in PCB manufacturing solutions, providing tailored solutions for automotive applications focusing on efficiency and performance.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Pcb?

The automotive PCB market is valued at approximately $12.5 billion in 2023, with a forecasted CAGR of 5.8% leading up to 2033, indicating significant growth within this essential sector.

What are the key market players or companies in this automotive Pcb industry?

The automotive PCB industry features prominent players including companies specializing in electronic components, automotive technology providers, and manufacturers with a focus on innovation in PCB technologies for vehicles.

What are the primary factors driving the growth in the automotive Pcb industry?

Key factors driving growth include the rise of electric vehicles, advancements in automotive technology, increased demand for automation and safety features, and regulatory requirements for enhanced vehicle functionality.

Which region is the fastest Growing in the automotive Pcb?

The fastest-growing region in the automotive PCB market is Europe, projected to grow from $3.49 billion in 2023 to $6.21 billion by 2033, reflecting robust automotive sector advancements and technological integration.

Does ConsaInsights provide customized market report data for the automotive Pcb industry?

Yes, ConsaInsights offers customized market report data for the automotive PCB industry to suit specific research needs, allowing clients to access detailed insights tailored to their objectives.

What deliverables can I expect from this automotive Pcb market research project?

Clients can expect comprehensive deliverables such as detailed market analysis, regional forecasts, competitive landscape assessments, and segmentation insights to inform strategic decisions in the automotive PCB market.

What are the market trends of automotive Pcb?

Notable trends in the automotive PCB market include increasing integration of advanced driver-assistance systems (ADAS), growth in electric vehicle production, and the shift towards more sophisticated infotainment systems, all driving technological innovations.