Automotive Piston Market Report

Published Date: 02 February 2026 | Report Code: automotive-piston

Automotive Piston Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Automotive Piston market, covering key insights, trends, and forecasts from 2023 to 2033. It delves into market size, segmentation, regional insights, and major players, providing valuable information for industry stakeholders.

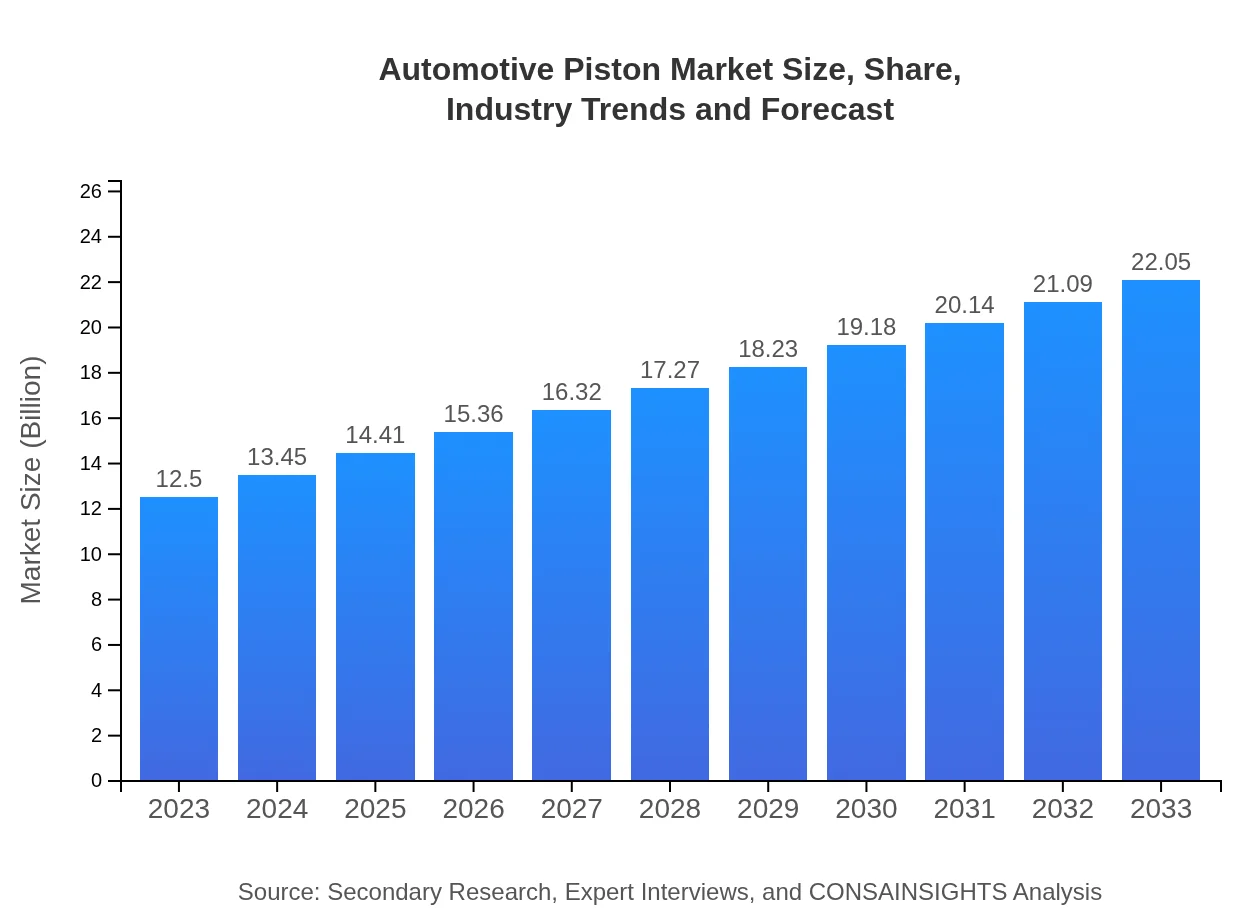

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $22.05 Billion |

| Top Companies | Mahle GmbH, Federal-Mogul Holdings, Aisin Seiki Co. Ltd., Pistone C.P. |

| Last Modified Date | 02 February 2026 |

Automotive Piston Market Overview

Customize Automotive Piston Market Report market research report

- ✔ Get in-depth analysis of Automotive Piston market size, growth, and forecasts.

- ✔ Understand Automotive Piston's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Piston

What is the Market Size & CAGR of Automotive Piston market in 2023?

Automotive Piston Industry Analysis

Automotive Piston Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Piston Market Analysis Report by Region

Europe Automotive Piston Market Report:

In Europe, the market size was estimated at USD 3.26 billion in 2023, with projections of reaching USD 5.75 billion by 2033. The automotive industry in Europe is heavily influenced by stringent emission norms and a strong push towards electrification, leading to higher demand for innovative piston designs that comply with regulations.Asia Pacific Automotive Piston Market Report:

The Asia Pacific region held a significant share of the Automotive Piston market in 2023, with an estimated market size of USD 2.61 billion. Predicted to grow to USD 4.61 billion by 2033, this growth is driven by booming automotive production in countries like China and India, coupled with expanding middle-class populations increasing vehicle ownership. The region is also a hub of innovation, with numerous manufacturers investing in advanced piston technologies.North America Automotive Piston Market Report:

North America contributes substantially to the global Automotive Piston market, with a value of USD 4.54 billion in 2023. Forecasts suggest it will grow to USD 8.02 billion by 2033, fueled by the presence of major automobile manufacturers and increasing advancements in piston technology that cater to performance and efficiency.South America Automotive Piston Market Report:

In South America, the Automotive Piston market was valued at approximately USD 1.25 billion in 2023 and is projected to reach USD 2.20 billion by 2033. Driven by economic recovery and rising automotive sales, this market shows potential, particularly in Brazil and Argentina, where local manufacturers are starting to gain traction.Middle East & Africa Automotive Piston Market Report:

The Middle East and Africa region displayed a smaller market size of USD 0.83 billion in 2023, expected to increase to USD 1.47 billion by 2033. Growth prospects are promising due to ongoing infrastructural developments and increasing demand for commercial vehicles in emerging economies such as South Africa and Egypt.Tell us your focus area and get a customized research report.

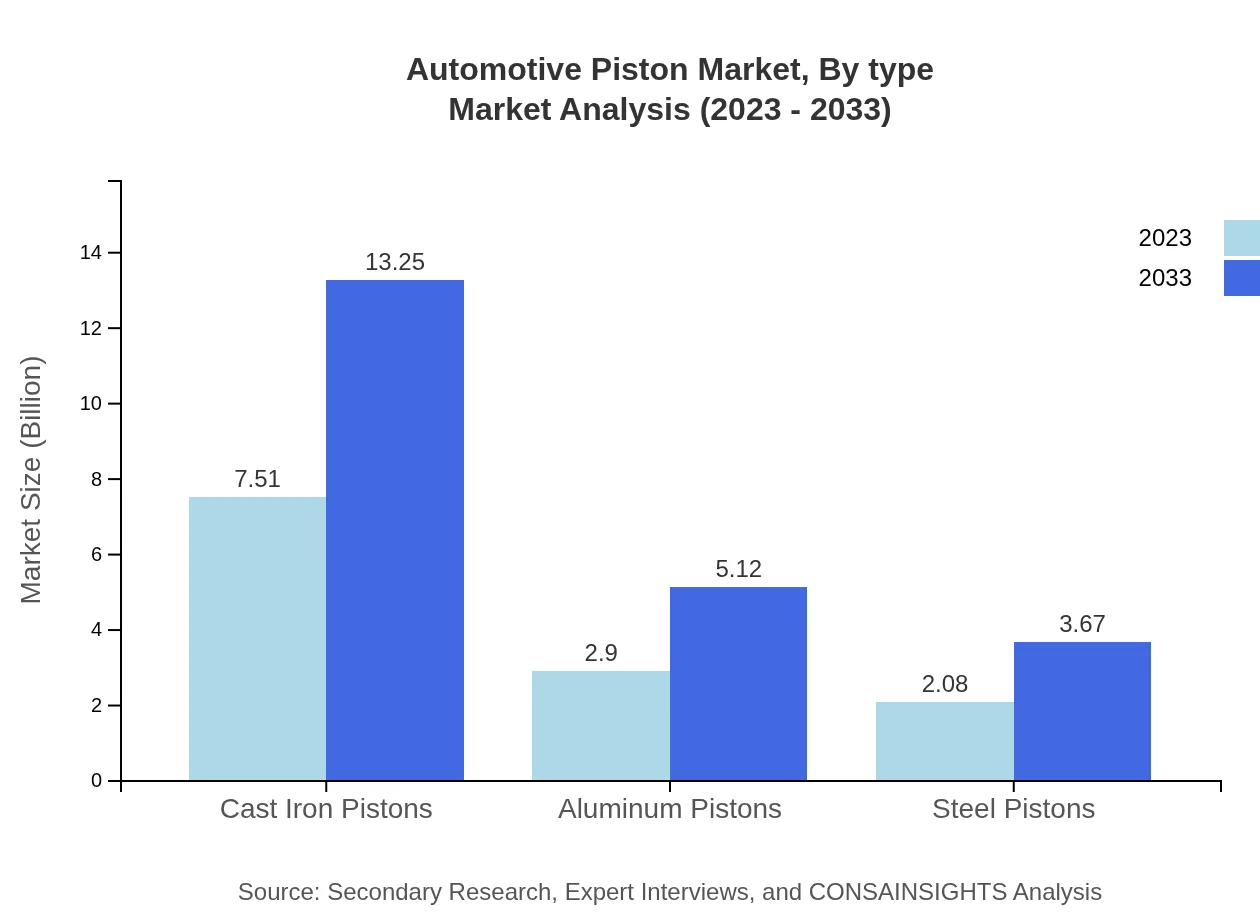

Automotive Piston Market Analysis By Type

The market segmentation by type includes Cast Iron, Aluminum, and Steel pistons. Cast Iron Pistons dominate the market, accounting for a market size of USD 7.51 billion in 2023 and expected to reach USD 13.25 billion by 2033, holding a market share of 60.12%. Aluminum Pistons, valued at USD 2.90 billion in 2023 with a share of 23.24%, will grow to USD 5.12 billion by 2033. Steel Pistons are smaller in size, at USD 2.08 billion in 2023, growing to USD 3.67 billion with a market share of 16.64%.

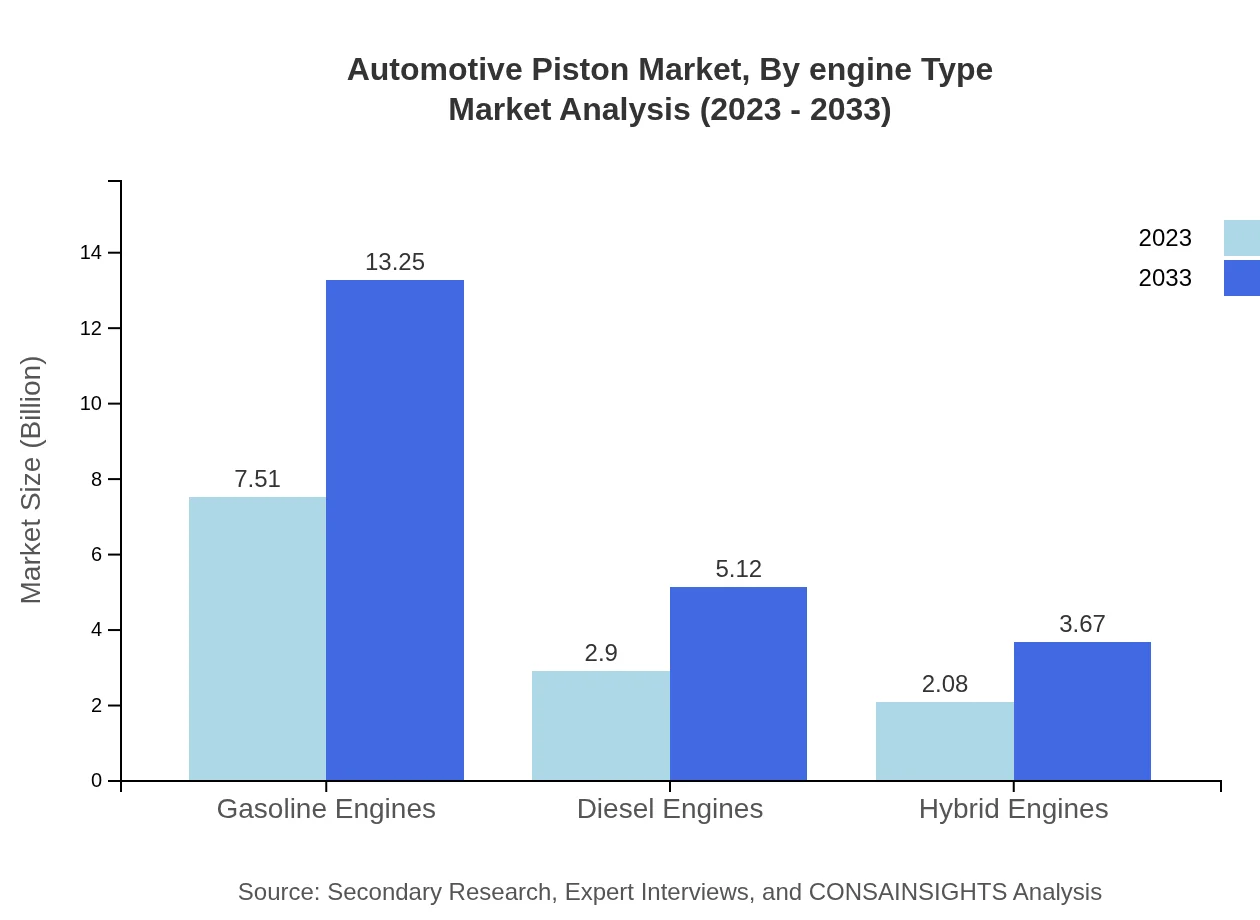

Automotive Piston Market Analysis By Engine Type

Market segmentation by engine type illustrates that Gasoline Engines lead with a size of USD 7.51 billion in 2023 and are estimated to grow to USD 13.25 billion by 2033. Diesel Engines follow closely with a size of USD 2.90 billion in 2023, expected to increase to USD 5.12 billion. Hybrid Engines, confined to a size of USD 2.08 billion, are projected to climb to USD 3.67 billion in the same period.

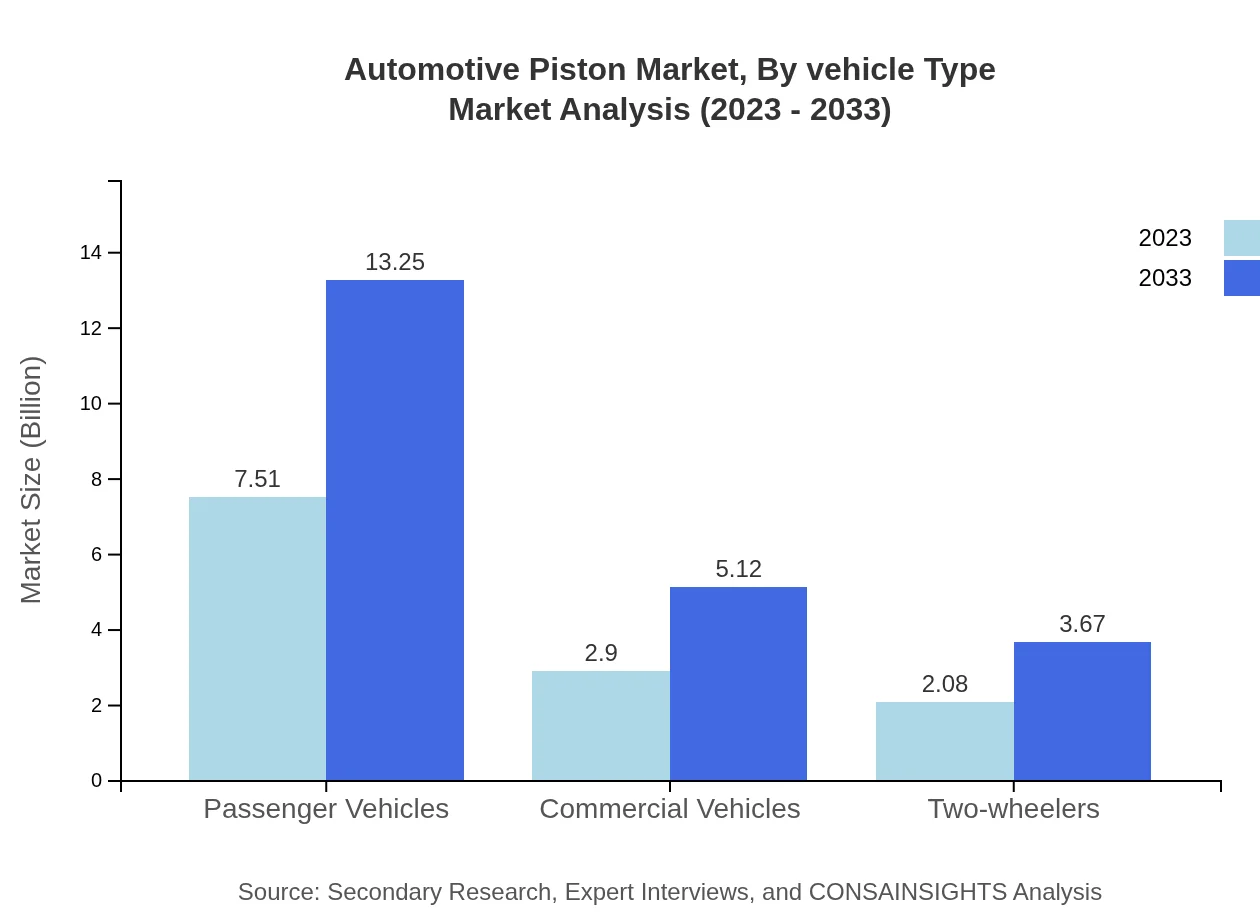

Automotive Piston Market Analysis By Vehicle Type

When assessing the market by vehicle type, Passenger Vehicles occupy the leading position with a size of USD 7.51 billion in 2023 and are expected to grow to USD 13.25 billion by 2033. Commercial Vehicles and Two-wheelers are smaller segments, with Commercial Vehicles at USD 2.90 billion and Two-wheelers at USD 2.08 billion for 2023, increasing to USD 5.12 billion and USD 3.67 billion respectively by 2033.

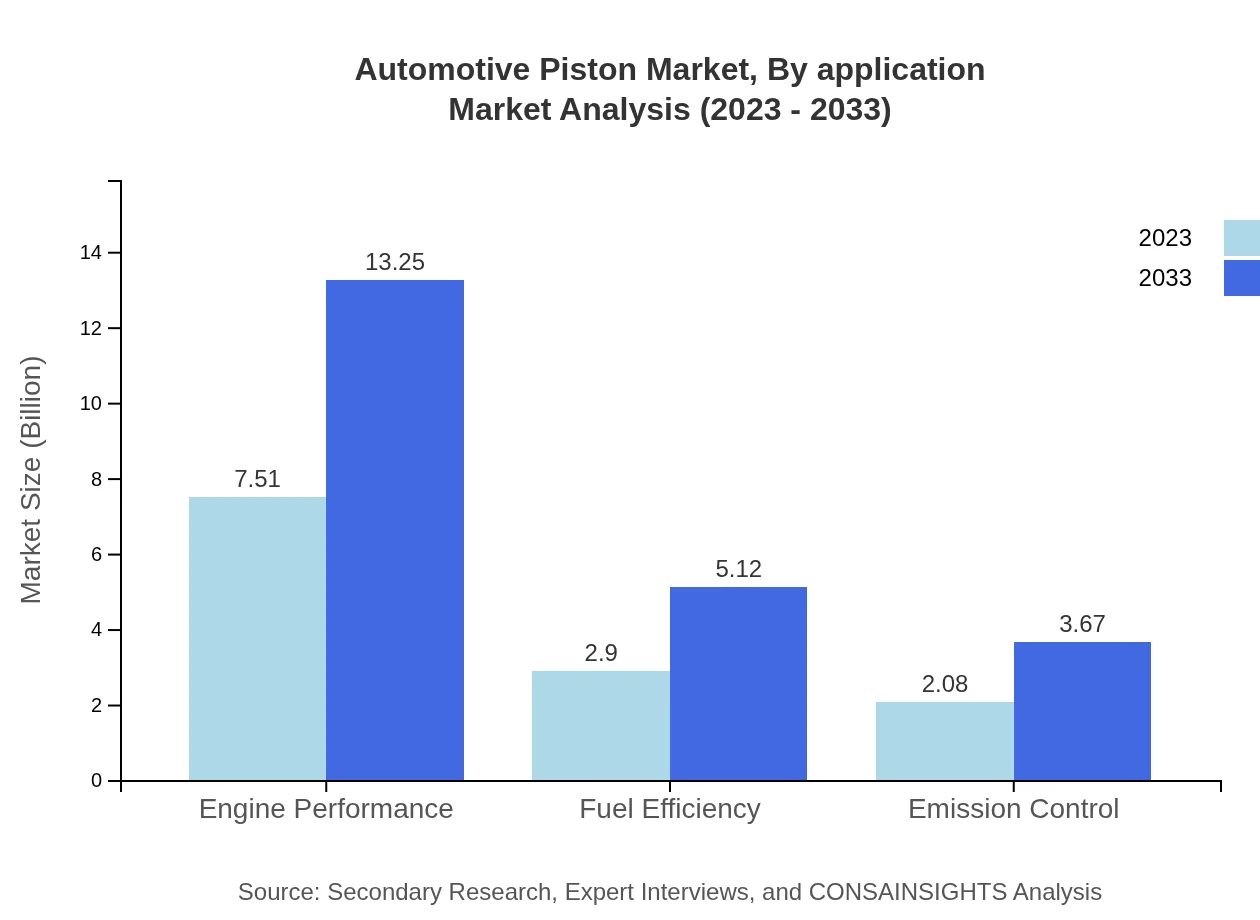

Automotive Piston Market Analysis By Application

The application segmentation indicates that Engine Performance is paramount in the market, valued at USD 7.51 billion in 2023 and projected to reach USD 13.25 billion by 2033. Fuel Efficiency takes a notable share of USD 2.90 billion, expanding to USD 5.12 billion, while Emission Control represents USD 2.08 billion and is expected to grow to USD 3.67 billion.

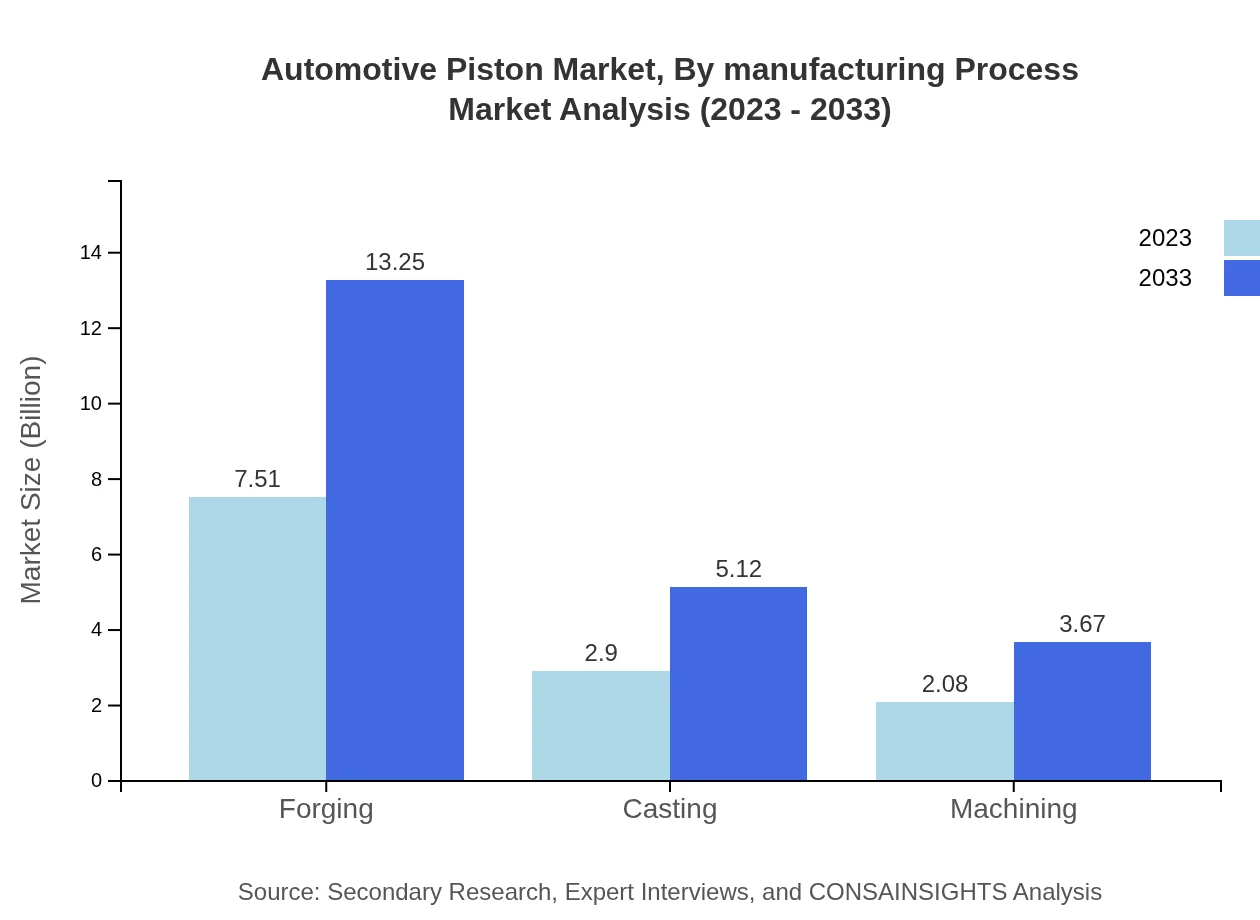

Automotive Piston Market Analysis By Manufacturing Process

Examining by manufacturing process, Forging dominates with USD 7.51 billion in 2023 and an expected rise to USD 13.25 billion by 2033. Casting and Machining processes follow with sizes of USD 2.90 billion and USD 2.08 billion respectively for 2023, with projected growths of USD 5.12 billion and USD 3.67 billion.

Automotive Piston Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Piston Industry

Mahle GmbH:

A leading global supplier of components and systems to the automotive industry, Mahle specializes in engine pistons and related technologies, emphasizing high performance and emissions reduction.Federal-Mogul Holdings:

Federal-Mogul is known for producing advanced technological solutions for the automotive sector and has a diverse range of piston products that cater to various engine types and applications.Aisin Seiki Co. Ltd.:

As a major manufacturer in the automotive parts sector, Aisin designs and produces pistons while focusing on innovation and sustainable development.Pistone C.P.:

Pistone C.P. is recognized for its expertise in manufacturing high-performance pistons designed to improve engine efficiency and performance.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Piston?

The global automotive piston market is valued at approximately $12.5 billion in 2023, with a projected CAGR of 5.7% leading to significant growth by 2033.

What are the key market players or companies in this automotive Piston industry?

Key players in the automotive piston industry include leading manufacturers such as Mahle GmbH, Federal-Mogul Corporation, and Koehler Group, which are pivotal in innovation and market expansion.

What are the primary factors driving the growth in the automotive piston industry?

Growth is driven by increasing vehicle production, advancements in piston technology for improved fuel efficiency, and the demand for lightweight materials, alongside stringent emission regulations.

Which region is the fastest Growing in the automotive piston market?

The Asia Pacific region is the fastest-growing market for automotive pistons, anticipated to rise from $2.61 billion in 2023 to $4.61 billion by 2033.

Does ConsaInsights provide customized market report data for the automotive Piston industry?

Yes, ConsaInsights offers customized market reports for the automotive piston industry, catering to specific client needs with tailored data insights.

What deliverables can I expect from this automotive Piston market research project?

Deliverables include comprehensive market analysis reports, detailed segmentation studies, competitive landscape assessments, and forecasts for market trends up to 2033.

What are the market trends of automotive Piston?

Trends include increasing adoption of lightweight and materials such as aluminum, growth in hybrid and electric vehicle segments, and a focus on enhancing engine performance and fuel efficiency.