Automotive Power Module Packaging Market Report

Published Date: 31 January 2026 | Report Code: automotive-power-module-packaging

Automotive Power Module Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report offers an in-depth analysis of the Automotive Power Module Packaging market from 2023 to 2033, providing insights into market trends, dynamics, and future forecasts essential for stakeholders in the automotive sector.

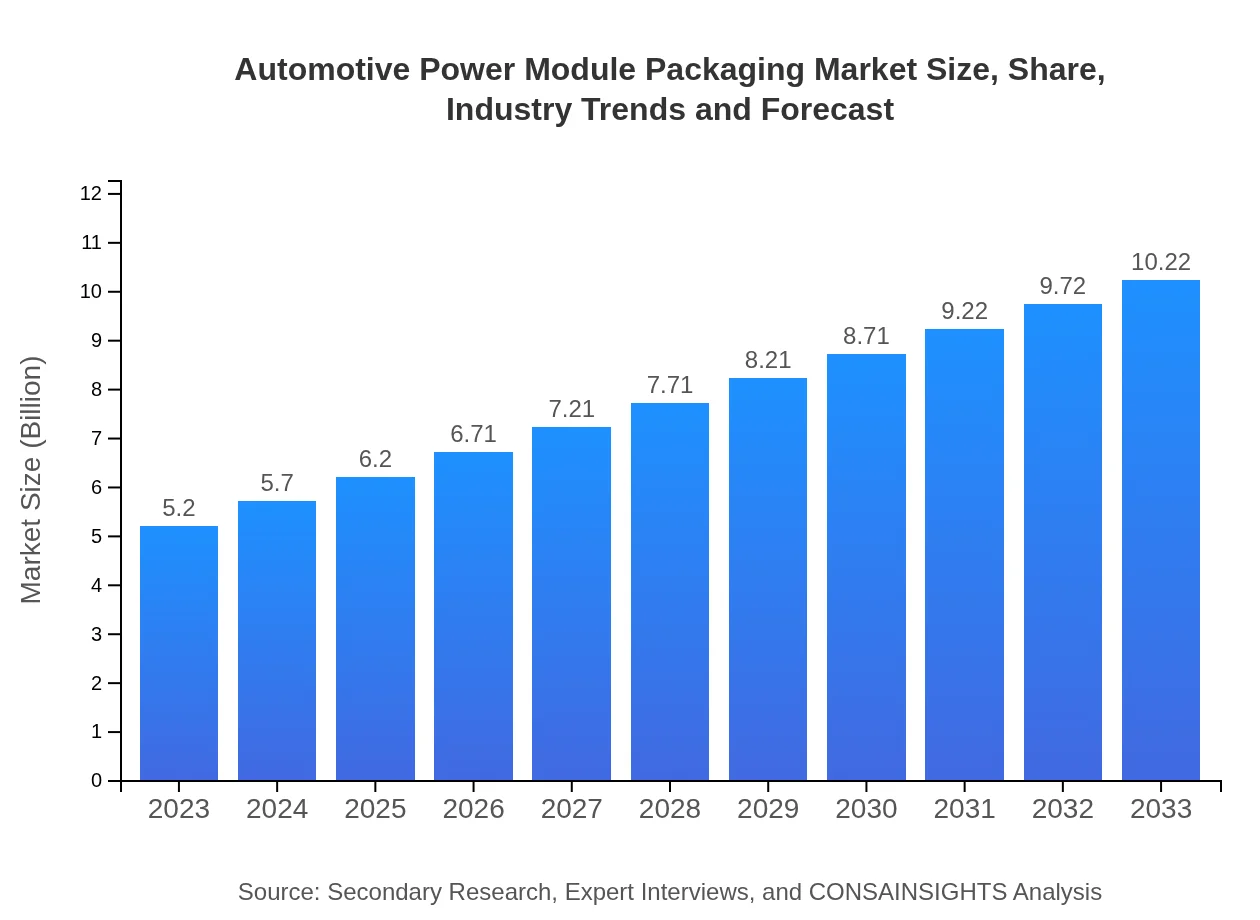

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | Infineon Technologies AG, Texas Instruments, ON Semiconductor, STMicroelectronics, NXP Semiconductors |

| Last Modified Date | 31 January 2026 |

Automotive Power Module Packaging Market Overview

Customize Automotive Power Module Packaging Market Report market research report

- ✔ Get in-depth analysis of Automotive Power Module Packaging market size, growth, and forecasts.

- ✔ Understand Automotive Power Module Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Power Module Packaging

What is the Market Size & CAGR of Automotive Power Module Packaging market in 2023?

Automotive Power Module Packaging Industry Analysis

Automotive Power Module Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Power Module Packaging Market Analysis Report by Region

Europe Automotive Power Module Packaging Market Report:

Europe's market is valued at USD 1.57 billion in 2023 and is projected to nearly double to USD 3.09 billion by 2033. Stringent emissions regulations and the push for greener technologies, particularly in countries like Germany, France, and the UK, foster significant growth within the Automotive Power Module Packaging sector.Asia Pacific Automotive Power Module Packaging Market Report:

The Asia Pacific region held a significant share of the Automotive Power Module Packaging market in 2023, valued at USD 0.91 billion, and is expected to grow to USD 1.80 billion by 2033. This growth is propelled by rising demands for electric vehicles and advancements in manufacturing technology across countries like China, Japan, and South Korea.North America Automotive Power Module Packaging Market Report:

North America is a pivotal market, starting at USD 1.96 billion in 2023, projected to grow to USD 3.84 billion by 2033. The robust automotive sector in the U.S. and Canada, along with increasing investments in electric vehicle technologies, are key factors driving growth in this region.South America Automotive Power Module Packaging Market Report:

In South America, the market was worth USD 0.38 billion in 2023 and is anticipated to reach USD 0.76 billion by 2033. The increasing focus on automotive electrification and sustainability initiatives in countries like Brazil and Argentina contribute to market growth, despite challenges related to infrastructure and investment.Middle East & Africa Automotive Power Module Packaging Market Report:

The Middle East and Africa market is currently valued at USD 0.37 billion in 2023, with expectations to reach USD 0.74 billion by 2033. Although still emerging, the demand for energy-efficient vehicle solutions is promoting new investments in automotive technologies across the region.Tell us your focus area and get a customized research report.

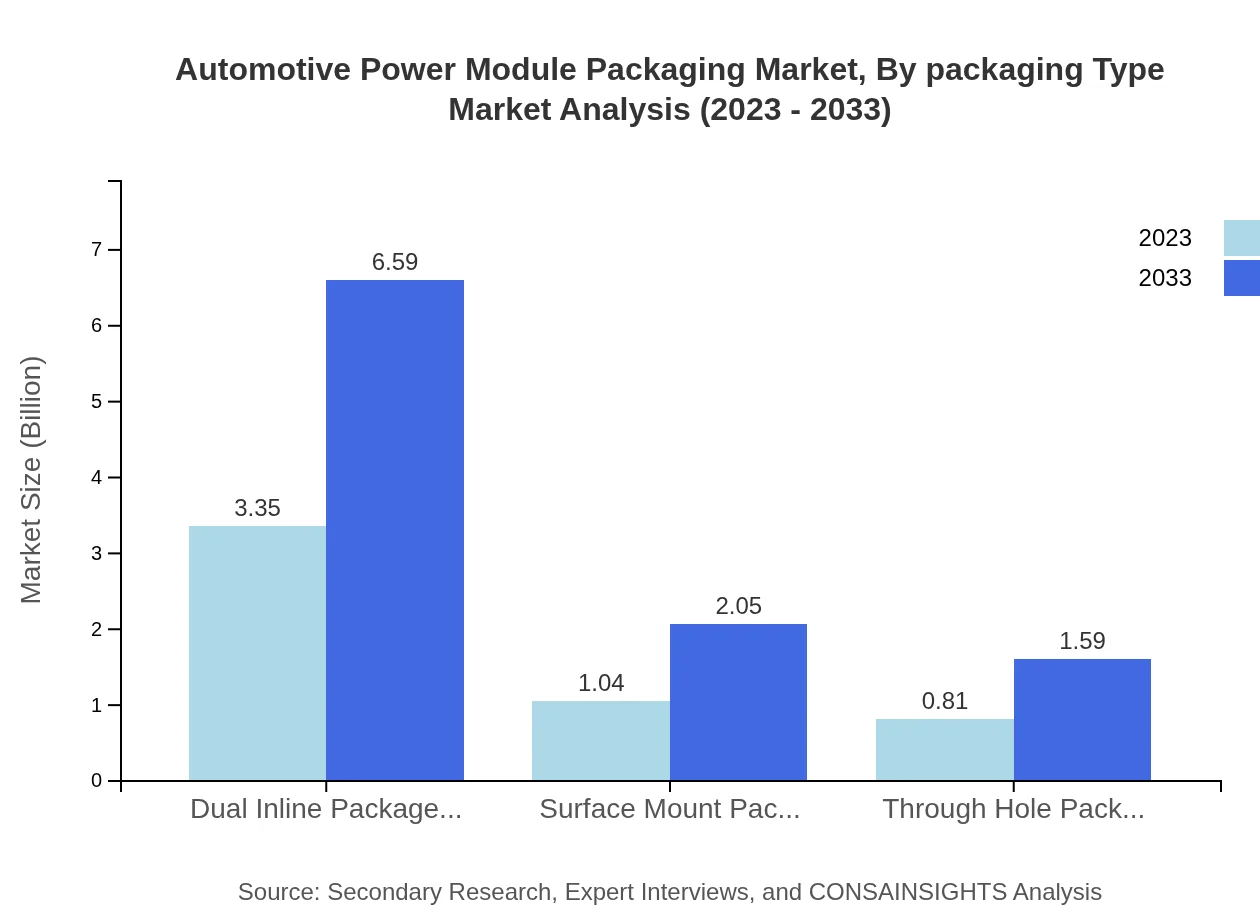

Automotive Power Module Packaging Market Analysis By Packaging Type

The Automotive Power Module Packaging market by packaging type primarily includes Dual Inline Package (DIP), Surface Mount Package (SMD), and Through Hole Package. The DIP segment leads the market with a share of 64.45% in 2023, valued at USD 3.35 billion, and is projected to increase to USD 6.59 billion by 2033. The SMD segment represents a significant proportion with a market value of USD 1.04 billion in 2023, growing to USD 2.05 billion over the same period.

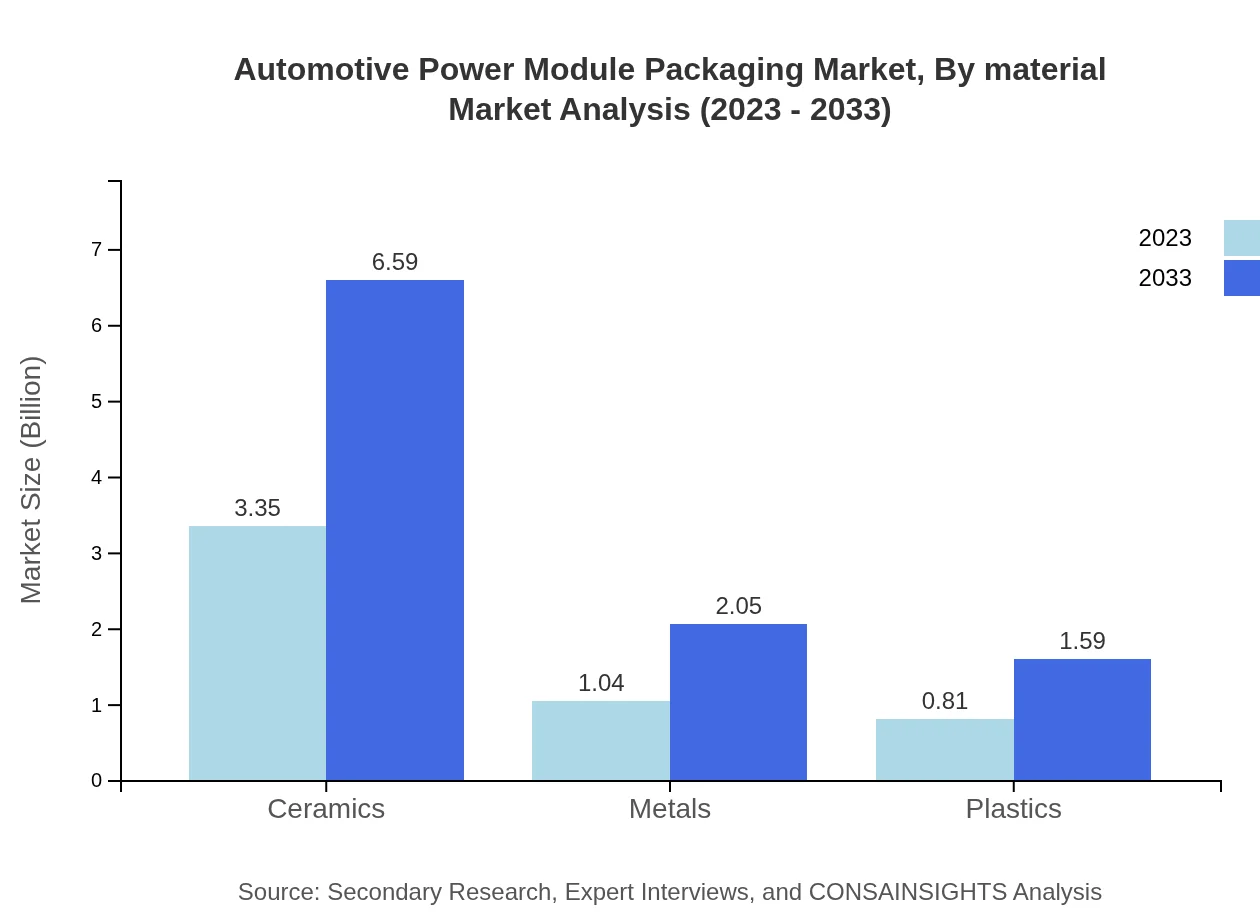

Automotive Power Module Packaging Market Analysis By Material

In terms of materials, ceramics dominate the market with a significant share of 64.45% for power module packaging. The ceramics segment generated USD 3.35 billion in 2023 and is expected to reach USD 6.59 billion by 2033. Metals account for about 20.04% of the market, valued at USD 1.04 billion in 2023, while plastics hold a smaller share of 15.51%, starting at USD 0.81 billion and projected to grow to USD 1.59 billion.

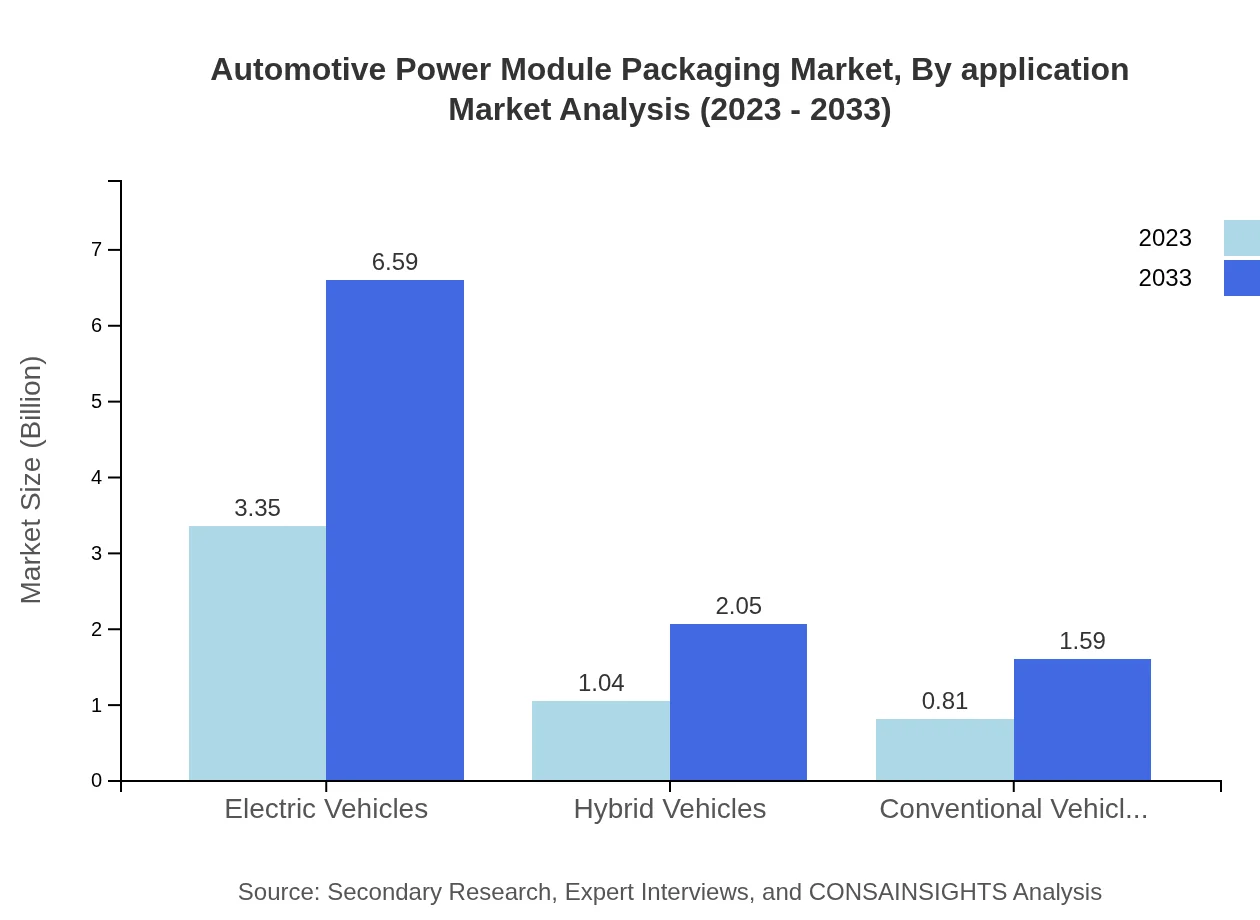

Automotive Power Module Packaging Market Analysis By Application

The market analysis by application reveals that Electric Vehicles (EVs) dominate the landscape, accounting for 64.45% of the market share, valued at USD 3.35 billion in 2023, and expected to reach USD 6.59 billion by 2033. Hybrid vehicles follow with a share of 20.04%, while conventional vehicles account for 15.51%. The increasing adoption of EVs is a driving force for this segment.

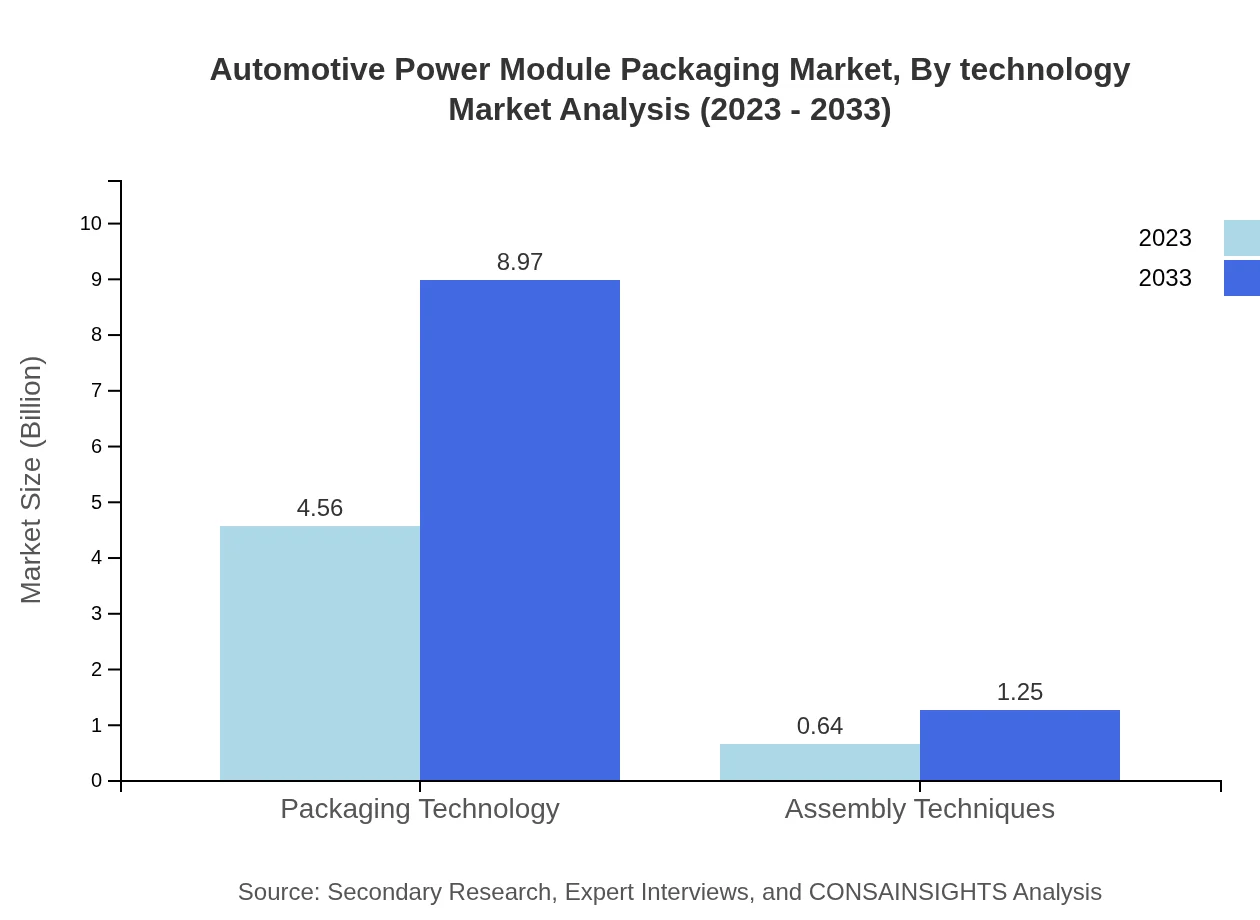

Automotive Power Module Packaging Market Analysis By Technology

Technologically, the Packaging Technology segment exceeds the rest with a commanding share of 87.75% in 2023, valued at USD 4.56 billion. Technological advancements and innovation in material formulations drive this growth, with expectations to reach USD 8.97 billion by 2033. Assembly Techniques, while smaller in stature, hold critical energy-saving potential with a projected market growth from USD 0.64 billion to USD 1.25 billion during the same period.

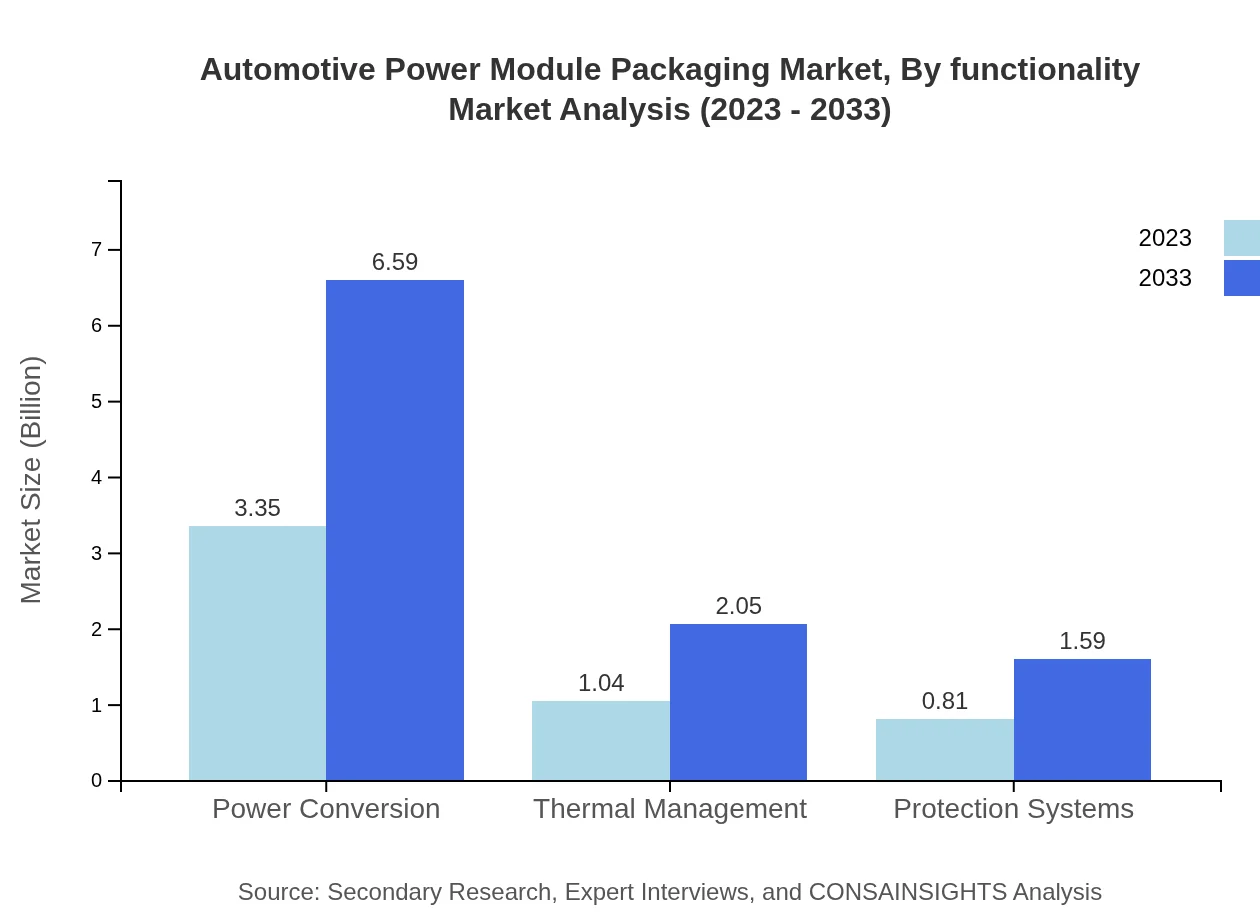

Automotive Power Module Packaging Market Analysis By Functionality

In terms of functionality, Power Conversion leads the pack, with a segment value of USD 3.35 billion in 2023 and projected growth to USD 6.59 billion by 2033, maintaining a market share of 64.45%. This is closely followed by Thermal Management at 20.04%, valued at USD 1.04 billion, and Protection Systems at 15.51%, valued at USD 0.81 billion, showcasing crucial roles in the performance of power modules.

Automotive Power Module Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Power Module Packaging Industry

Infineon Technologies AG:

A leading semiconductor manufacturer, Infineon specializes in power semiconductor solutions, contributing innovative packaging technologies for electric and hybrid vehicles.Texas Instruments:

Known for their extensive range of semiconductor and analog technologies, Texas Instruments plays a crucial role in developing power modules that provide reliability and efficiency.ON Semiconductor:

ON Semiconductor focuses on fulfilling energy-efficient solutions for automotive applications, emphasizing advanced packaging methodologies to enhance performance.STMicroelectronics:

As a key player in the automotive semiconductor market, STMicroelectronics offers robust power management solutions and packaging technologies aimed at the growing electric vehicle market.NXP Semiconductors:

NXP specializes in automotive application solutions including adaptive power management and smart vehicle technologies, significantly impacting packaging developments.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Power Module Packaging?

The automotive power module packaging market is valued at approximately $5.2 billion in 2023, with an expected CAGR of 6.8% through 2033, indicating steady growth driven by advancements in technology and increasing demand.

What are the key market players or companies in this automotive Power Module Packaging industry?

Key players in the automotive power module packaging industry include major semiconductor manufacturers and electronics companies, which are pivotal in driving innovation and product development to meet increasing market demands.

What are the primary factors driving the growth in the automotive power module packaging industry?

Growth is primarily driven by the increasing production of electric vehicles, higher demand for energy-efficient technologies, and advancements in semiconductor packaging techniques that enhance performance and reliability.

Which region is the fastest Growing in the automotive power module packaging?

North America is the fastest-growing region, expected to expand from $1.96 billion in 2023 to $3.84 billion by 2033, driven by strong automotive manufacturing and a shift towards electric vehicles.

Does ConsaInsights provide customized market report data for the automotive power module packaging industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the automotive power module packaging industry, allowing clients to obtain insights that fit their unique needs and strategic goals.

What deliverables can I expect from this automotive power module packaging market research project?

Deliverables include detailed market analyses, segmentation insights, competitive landscape evaluations, and regional growth forecasts, all aimed at empowering your strategic decision-making in the automotive power module packaging sector.

What are the market trends of automotive Power Module Packaging?

Market trends indicate a growing preference for advanced packaging technologies such as ceramics, which will dominate market share. Additionally, there is increased focus on thermal management systems and eco-friendly materials for packaging solutions.