Automotive Powertrain Market Report

Published Date: 02 February 2026 | Report Code: automotive-powertrain

Automotive Powertrain Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automotive Powertrain market, covering insights from 2023 to 2033, including market size, growth rates, industry dynamics, segmentation, regional analysis, and trends shaping the future of automotive powertrains.

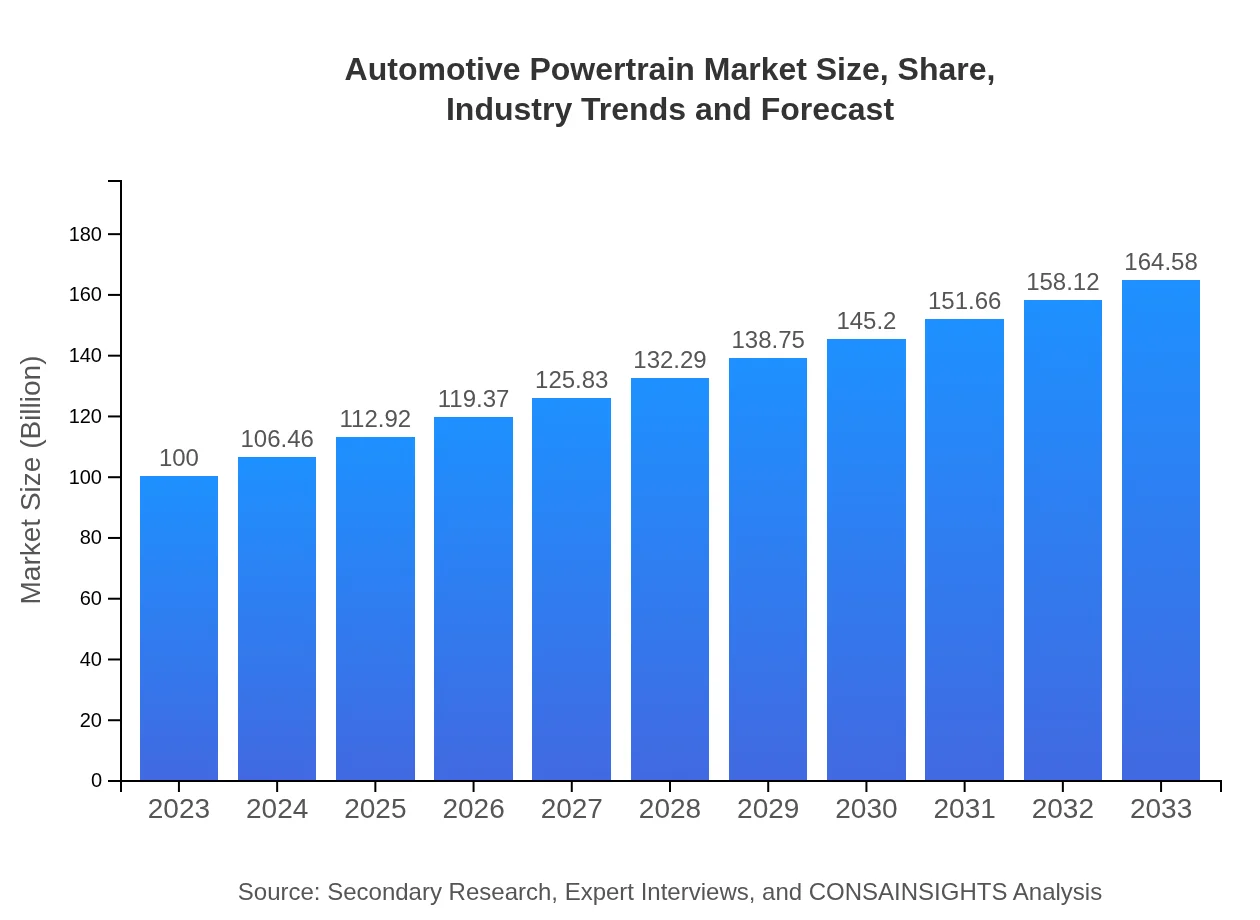

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Billion |

| Top Companies | General Motors, Toyota , Ford , Volkswagen, Daimler AG |

| Last Modified Date | 02 February 2026 |

Automotive Powertrain Market Overview

Customize Automotive Powertrain Market Report market research report

- ✔ Get in-depth analysis of Automotive Powertrain market size, growth, and forecasts.

- ✔ Understand Automotive Powertrain's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Powertrain

What is the Market Size & CAGR of Automotive Powertrain market in 2023?

Automotive Powertrain Industry Analysis

Automotive Powertrain Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Powertrain Market Analysis Report by Region

Europe Automotive Powertrain Market Report:

The European Automotive Powertrain market accounted for $31.24 billion in 2023, with expectations of reaching $51.41 billion by 2033. Europe is a leader in automotive innovation, focusing heavily on sustainability and advanced powertrain solutions, propelled by stringent environmental regulations.Asia Pacific Automotive Powertrain Market Report:

The Asia Pacific region is witnessing rapid growth in the Automotive Powertrain market, with a market size of $16.89 billion in 2023 and projected to reach $27.80 billion by 2033. Key drivers include the rise in vehicle production, increasing disposable incomes, and a growing focus on electric vehicles in countries like China and India.North America Automotive Powertrain Market Report:

North America, with a market size of $38.37 billion in 2023 and projected to reach $63.15 billion by 2033, is a significant market due to the presence of major automobile manufacturers and an increasing shift towards electric and hybrid vehicle adoption driven by government regulations on emissions.South America Automotive Powertrain Market Report:

In South America, the Automotive Powertrain market size was $9.21 billion in 2023 and is expected to grow to $15.16 billion by 2033. Growth in this region is primarily driven by expanding automotive manufacturing capacities and increasing vehicle sales in Brazil and Argentina.Middle East & Africa Automotive Powertrain Market Report:

The Middle East and Africa market was valued at $4.29 billion in 2023 and is expected to increase to $7.06 billion by 2033. Growth is limited but steady, driven by increasing investments in infrastructure and vehicle production.Tell us your focus area and get a customized research report.

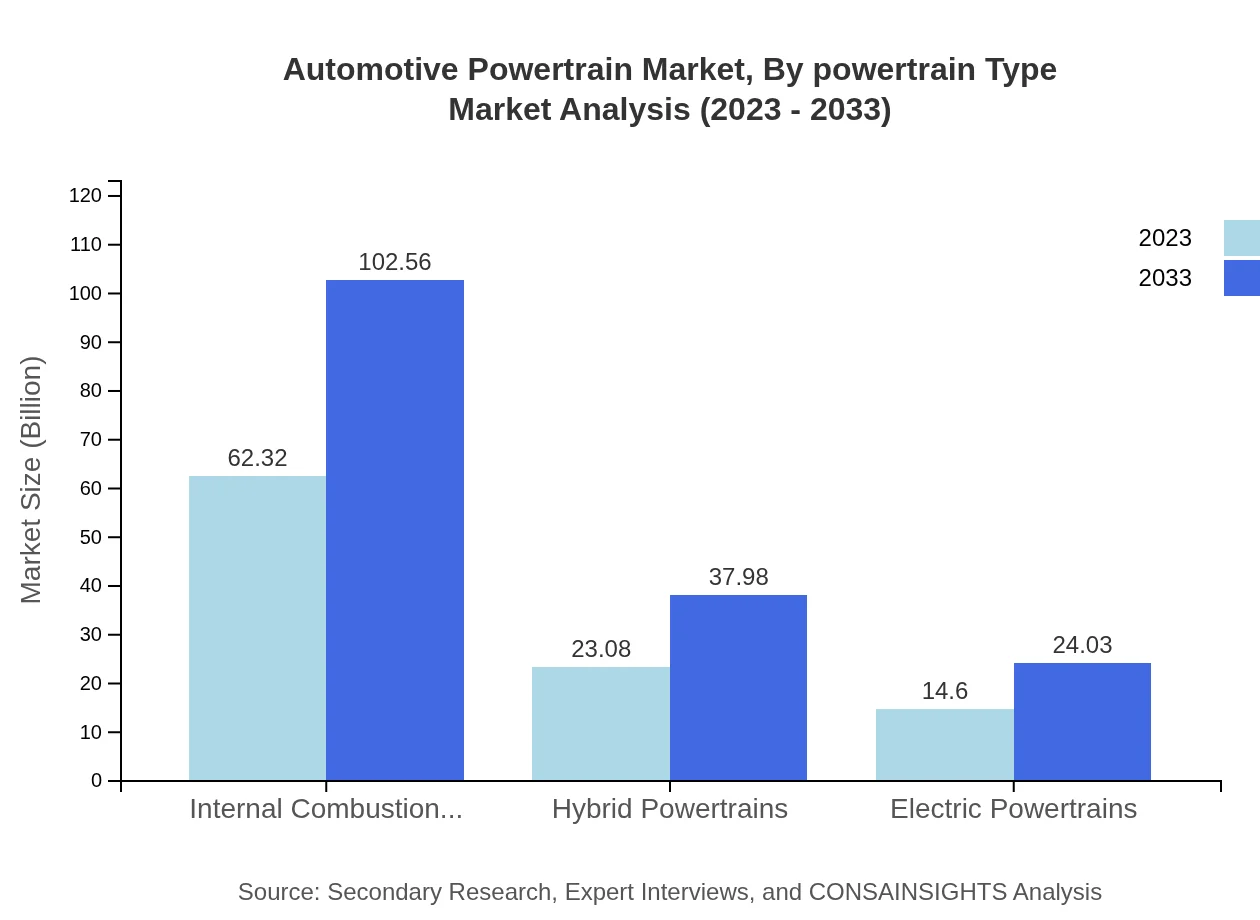

Automotive Powertrain Market Analysis By Powertrain Type

The Automotive Powertrain market segmented by powertrain type includes Internal Combustion Engine (ICE), hybrid powertrains, and electric powertrains. In 2023, the ICE market is valued at $62.32 billion, expected to grow to $102.56 billion by 2033. Hybrid powertrains generate $23.08 billion in 2023, forecasted to reach $37.98 billion, while electric powertrains, starting at $14.60 billion, are projected to grow to $24.03 billion.

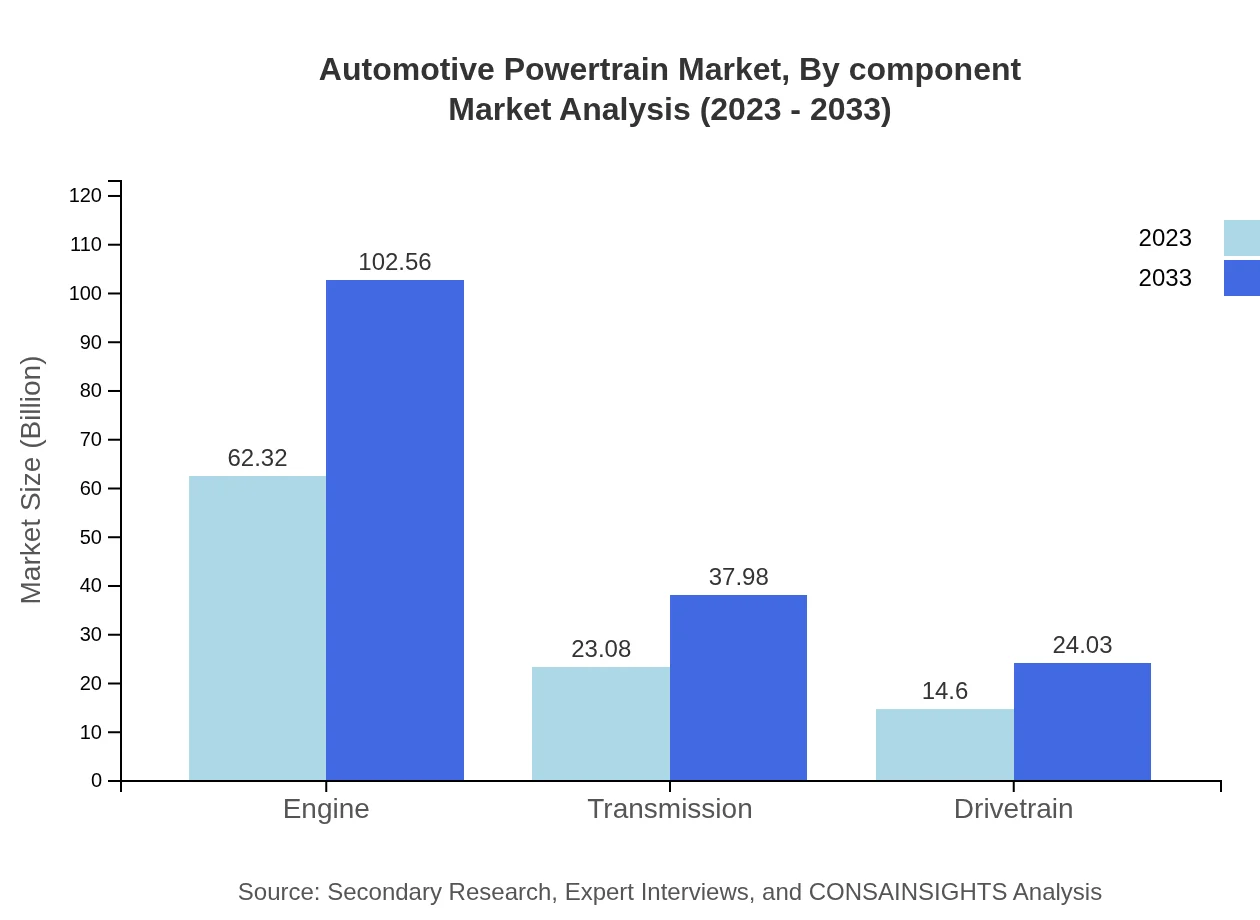

Automotive Powertrain Market Analysis By Component

Components of powertrains include engines, transmissions, and drivetrains. The engine segment dominates with a market size of $62.32 billion in 2023, projected to maintain its size until 2033. Transmissions are valued at $23.08 billion, with an expected increase to $37.98 billion, while drivetrains are forecasted to grow from $14.60 billion to $24.03 billion.

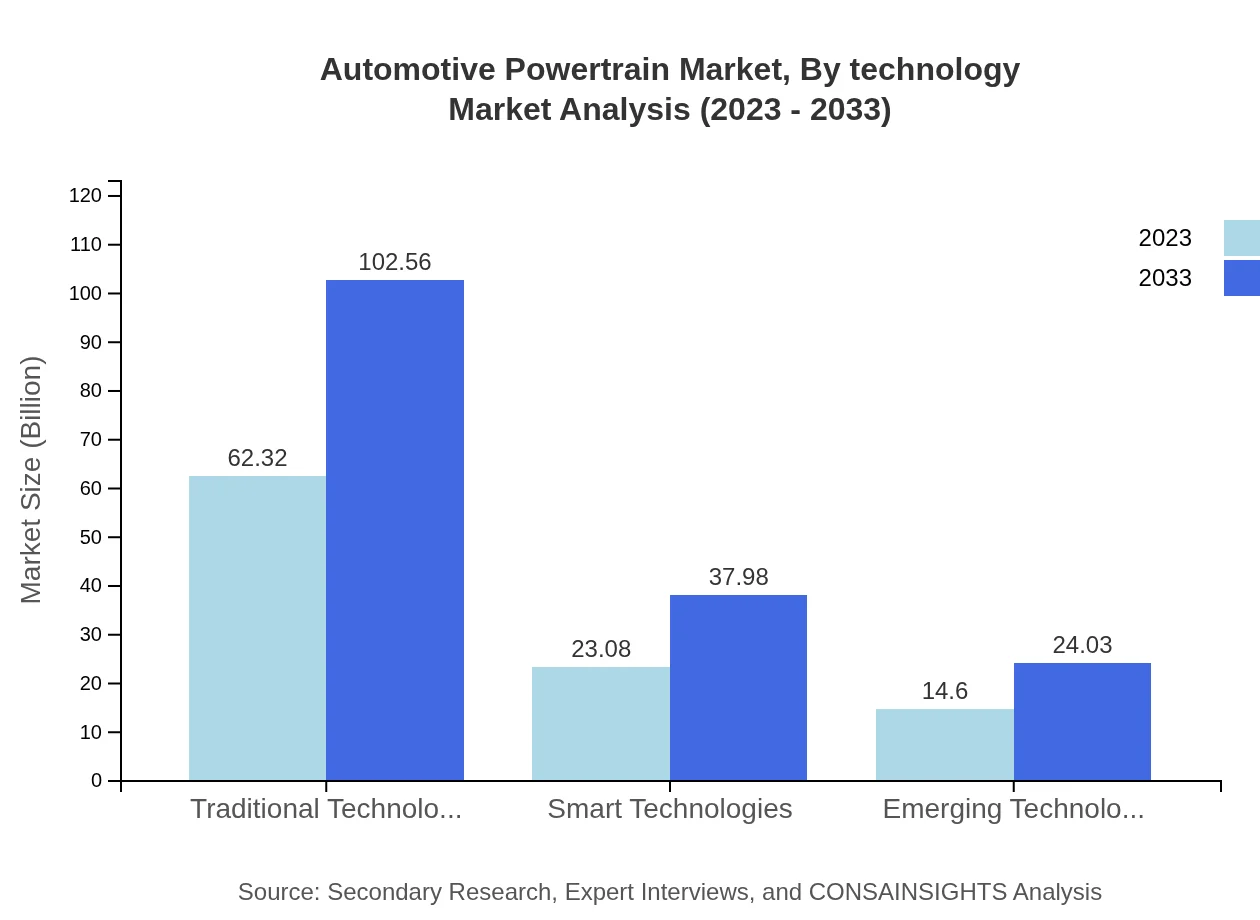

Automotive Powertrain Market Analysis By Technology

The market is segmented by technology into traditional, smart, and emerging technologies. Traditional technology covers the majority at $62.32 billion in 2023, anticipated to grow to $102.56 billion. Smart technologies offer growth from $23.08 billion to $37.98 billion, while emerging technologies are expected to rise from $14.60 billion to $24.03 billion by 2033.

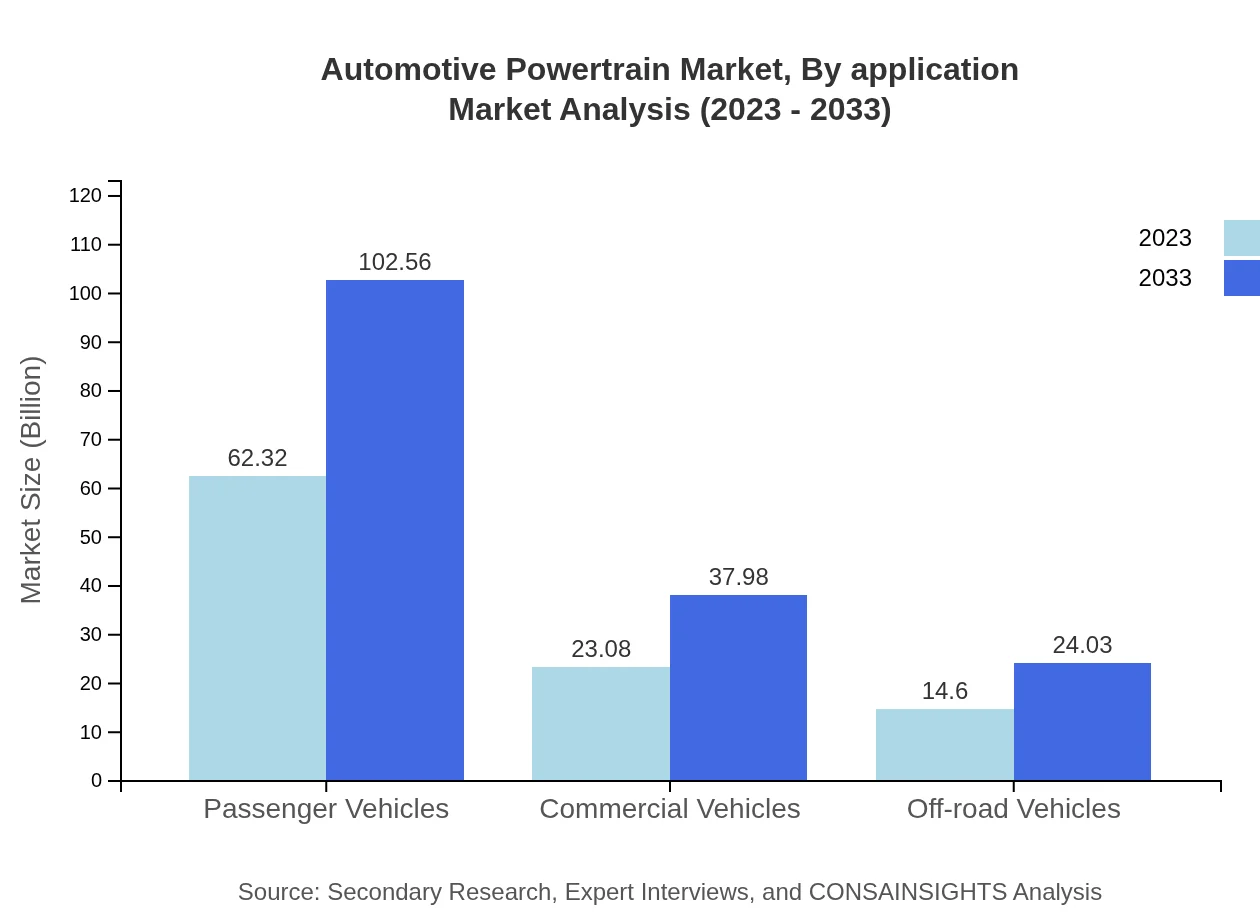

Automotive Powertrain Market Analysis By Application

The applications include passenger vehicles, commercial vehicles, and off-road vehicles. Passenger vehicles dominate the market with $62.32 billion in 2023 and a projection of $102.56 billion by 2033. Commercial vehicles show growth from $23.08 billion to $37.98 billion, while off-road vehicles' market is expected to rise from $14.60 billion to $24.03 billion.

Automotive Powertrain Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Powertrain Industry

General Motors:

General Motors is a global automotive company known for its production of a wide range of vehicles and powertrain technologies, leading the transition towards electric mobility.Toyota :

Toyota has been a pioneer in hybrid electric powertrains and is expanding its investment in battery technology to increase efficiency in electric vehicles.Ford :

Ford is championing electrification and innovation in internal combustion engines, with significant investments focused on sustainable powertrains.Volkswagen:

Volkswagen is reshaping its powertrain strategies towards electric vehicles, aiming to lead the global market for electric powertrains.Daimler AG:

Daimler AG focuses on advanced technology in engines and drivetrains for various vehicle applications, continuing to invest in hybrid and electric innovations.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Powertrain?

The automotive powertrain market is valued at approximately $100 billion in 2023, with a projected growth at a CAGR of 5% through 2033. This signifies a healthy expansion driven by innovations and increasing vehicle production globally.

What are the key market players or companies in this automotive Powertrain industry?

The automotive powertrain industry is characterized by major players like Bosch, General Motors, Ford, Toyota, and Volkswagen, which lead through technological advancements and diverse product offerings, promoting market competition and growth.

What are the primary factors driving the growth in the automotive Powertrain industry?

Key growth factors include rising demand for fuel-efficient vehicles, innovations in electric and hybrid powertrains, stricter emission regulations, and increased collaboration among automakers and technology firms aimed at advancing powertrain technologies.

Which region is the fastest Growing in the automotive Powertrain?

The fastest-growing region is North America, with the market expected to increase from $38.37 billion in 2023 to $63.15 billion by 2033, fueled by advancements in smart technologies and robust automotive manufacturing.

Does ConsaInsights provide customized market report data for the automotive Powertrain industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, providing in-depth analysis and insights that help stakeholders make informed decisions and adapt strategies within the automotive powertrain industry.

What deliverables can I expect from this automotive Powertrain market research project?

Deliverables include detailed market analysis reports, growth forecasts, competitive landscape evaluations, consumer insights, and segmented data across various parameters such as geography and technology types.

What are the market trends of automotive Powertrain?

Current trends in the automotive powertrain market involve a shift toward electrification, advancements in hybrid technology, societal moves towards sustainability, and digitization of vehicle operations that enhance performance and efficiency.