Automotive Pressure Sensors Market Report

Published Date: 22 January 2026 | Report Code: automotive-pressure-sensors

Automotive Pressure Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report covers the current landscape and future predictions of the automotive pressure sensors market from 2023 to 2033. Key insights include market size analysis, technological advancements, and regional trends affecting the industry, providing a comprehensive view for stakeholders.

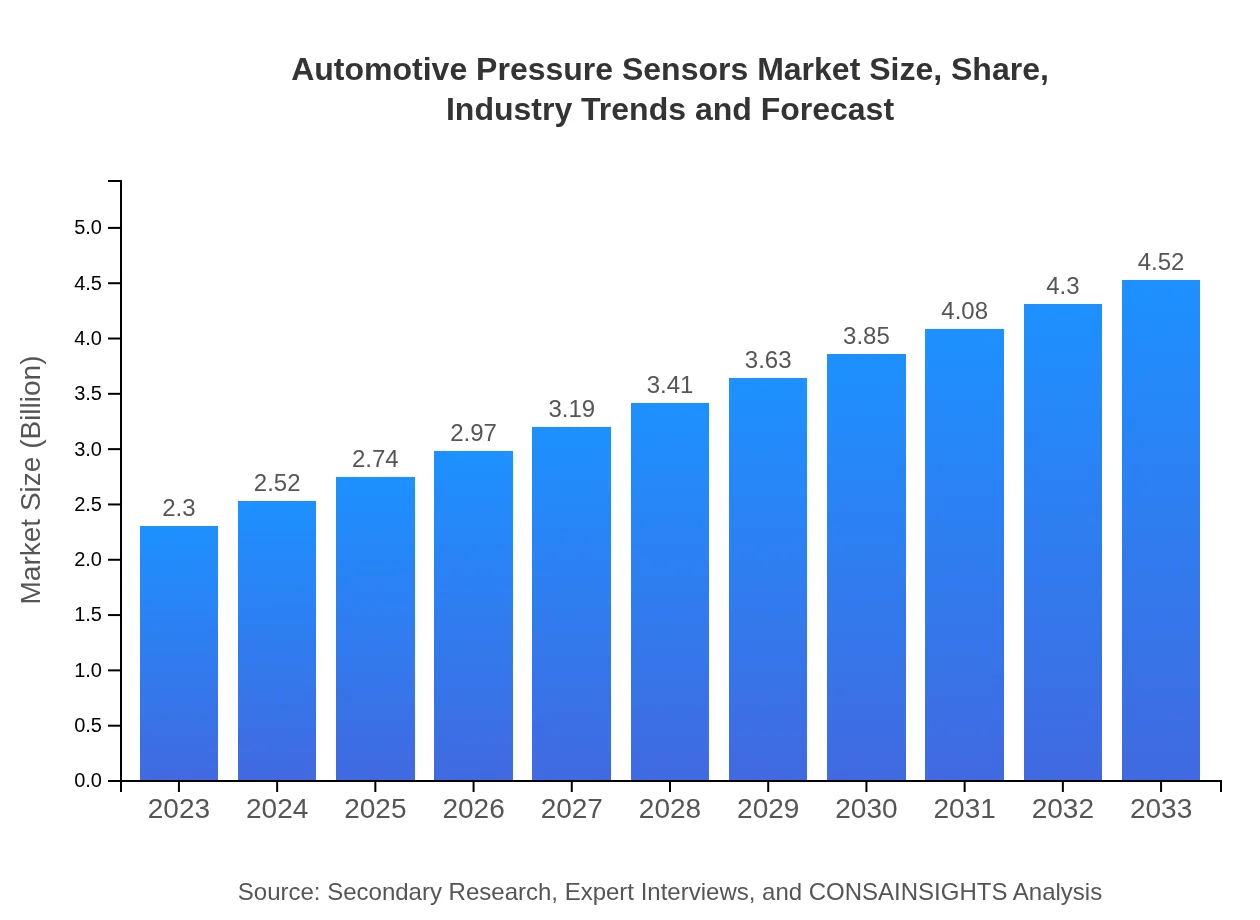

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.52 Billion |

| Top Companies | Honeywell International Inc., Bosch Sensortec, Analog Devices, Inc., TE Connectivity |

| Last Modified Date | 22 January 2026 |

Automotive Pressure Sensors Market Overview

Customize Automotive Pressure Sensors Market Report market research report

- ✔ Get in-depth analysis of Automotive Pressure Sensors market size, growth, and forecasts.

- ✔ Understand Automotive Pressure Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Pressure Sensors

What is the Market Size & CAGR of Automotive Pressure Sensors market in 2023?

Automotive Pressure Sensors Industry Analysis

Automotive Pressure Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Pressure Sensors Market Analysis Report by Region

Europe Automotive Pressure Sensors Market Report:

Europe is a significant market for automotive pressure sensors, anticipated to grow from $0.71 billion in 2023 to $1.39 billion by 2033. The stringent regulatory environment regarding emissions and safety standards drives innovation and demand for pressure sensors, alongside the increasing trend of electric vehicle adoption across the region.Asia Pacific Automotive Pressure Sensors Market Report:

The Asia Pacific region is projected as one of the largest markets for automotive pressure sensors, with a market size of $0.43 billion in 2023, expected to reach $0.85 billion by 2033. The growth is driven by the booming automotive industry in countries like China and India, which produce a significant volume of vehicles. Furthermore, the increasing adoption of advanced technologies in automotive manufacturing enhances the demand for sophisticated pressure sensors.North America Automotive Pressure Sensors Market Report:

The North American market for automotive pressure sensors is robust, with a value of $0.82 billion anticipated to rise to $1.60 billion by 2033. This is propelled by a mature automotive industry in the U.S. and Canada, along with rising consumer demand for advanced vehicle safety features and performance enhancements, leading to greater sensor integration in vehicles.South America Automotive Pressure Sensors Market Report:

In South America, the automotive pressure sensors market is relatively smaller, with a market size of $0.05 billion in 2023, forecasted to grow to $0.09 billion by 2033. The growth in this market is driven by increasing vehicle production, especially in Brazil and Argentina, alongside government initiatives to stimulate the automotive sector.Middle East & Africa Automotive Pressure Sensors Market Report:

In the Middle East and Africa, the automotive pressure sensors market had a size of $0.30 billion in 2023, projected to grow to $0.58 billion by 2033. The region is observing a gradual increase in automotive manufacturing and vehicle sales, which together with government initiatives to promote local automotive production, is expected to drive the demand for pressure sensors.Tell us your focus area and get a customized research report.

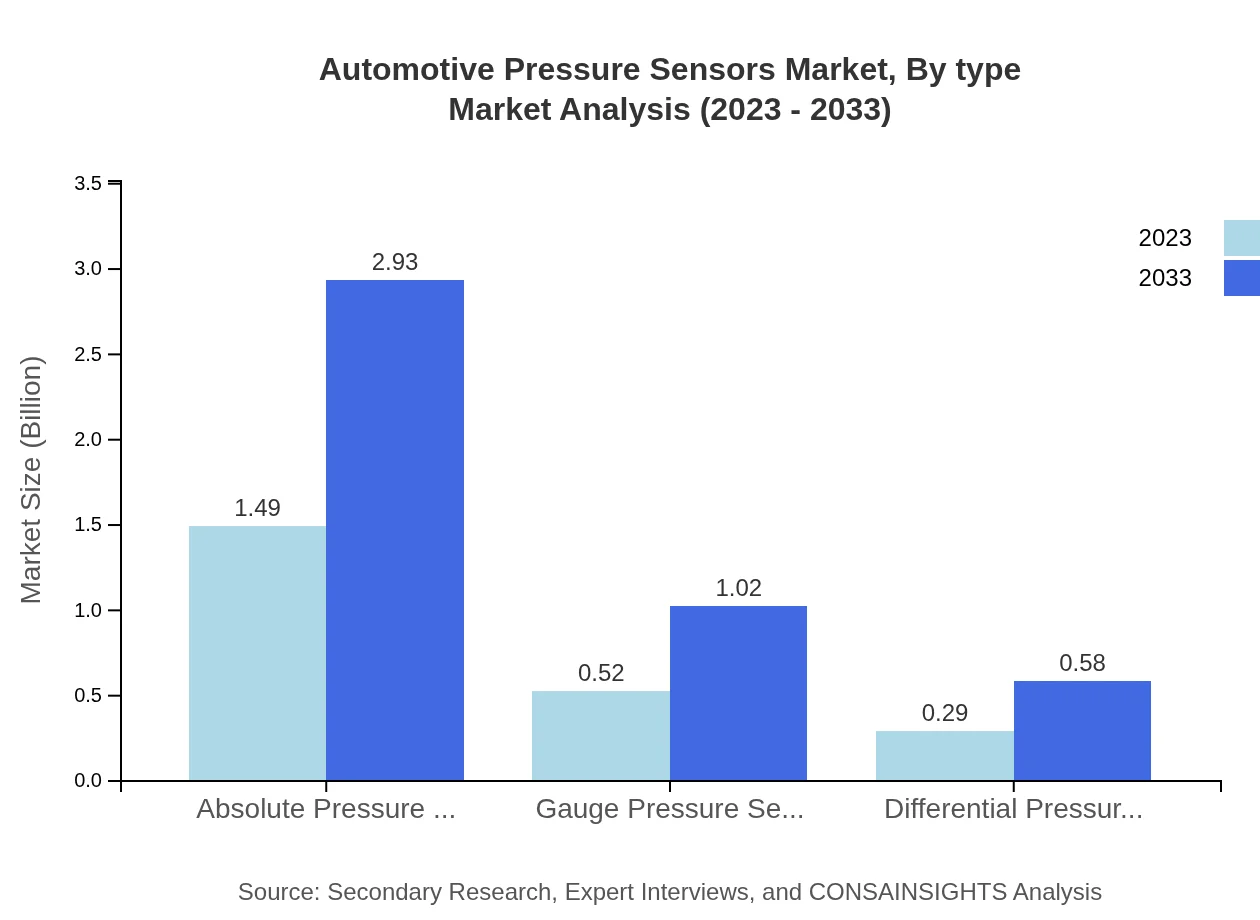

Automotive Pressure Sensors Market Analysis By Type

The automotive pressure sensors market is predominantly characterized by absolute pressure sensors, which held a market size of $1.49 billion in 2023 with a forecast of $2.93 billion by 2033, comprising 64.76% market share. Gauge pressure sensors follow with a market size of $0.52 billion (22.52% share) in 2023 and expected growth to $1.02 billion by 2033. Differential pressure sensors stand at $0.29 billion in 2023, set to grow to $0.58 billion, capturing 12.72% share.

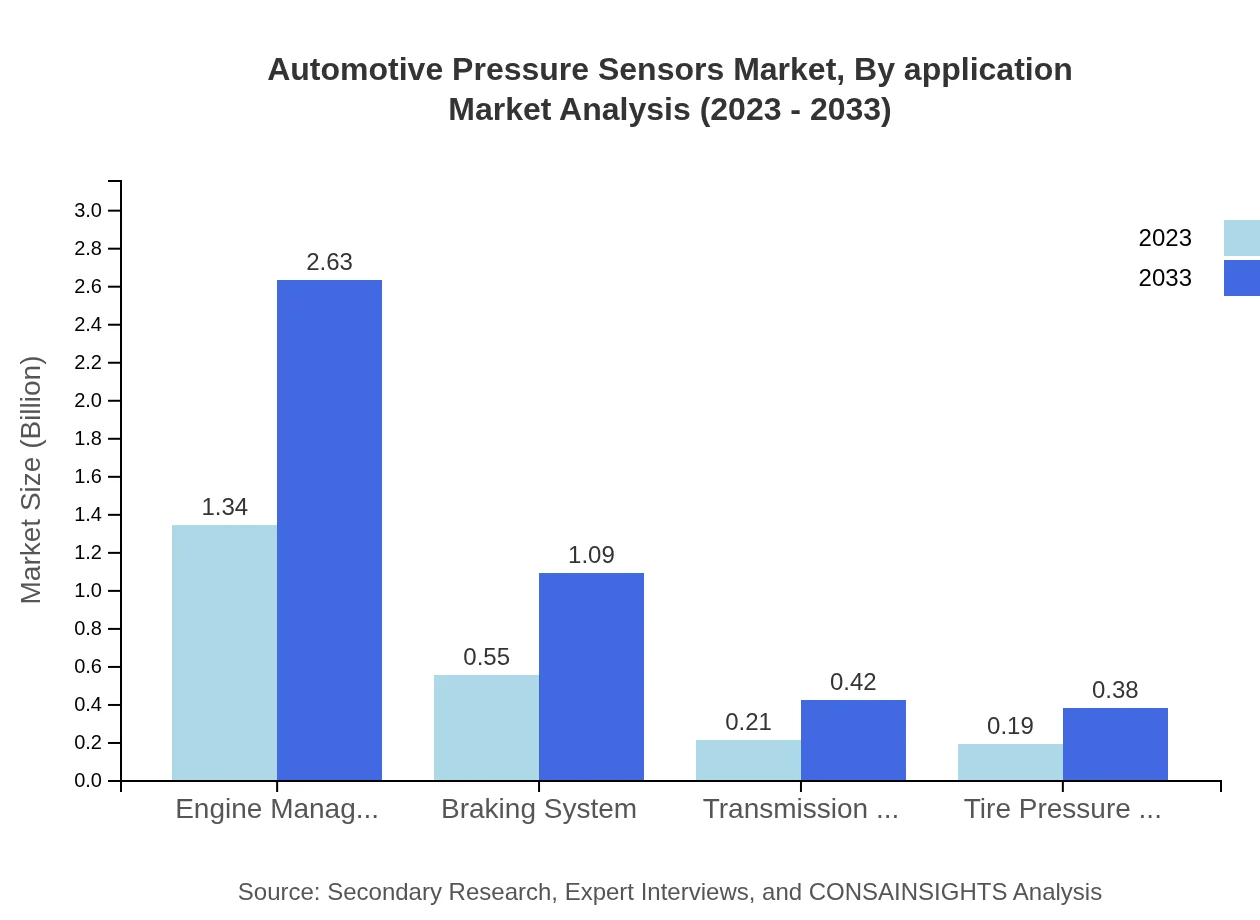

Automotive Pressure Sensors Market Analysis By Application

Applications of automotive pressure sensors include engine management systems ($1.34 billion in 2023, 58.18% share, forecast to reach $2.63 billion by 2033), braking systems ($0.55 billion, 24.11% share, expected to grow to $1.09 billion), transmission systems ($0.21 billion, growing to $0.42 billion), and tire pressure monitoring systems ($0.19 billion, forecasted to double to $0.38 billion by 2033).

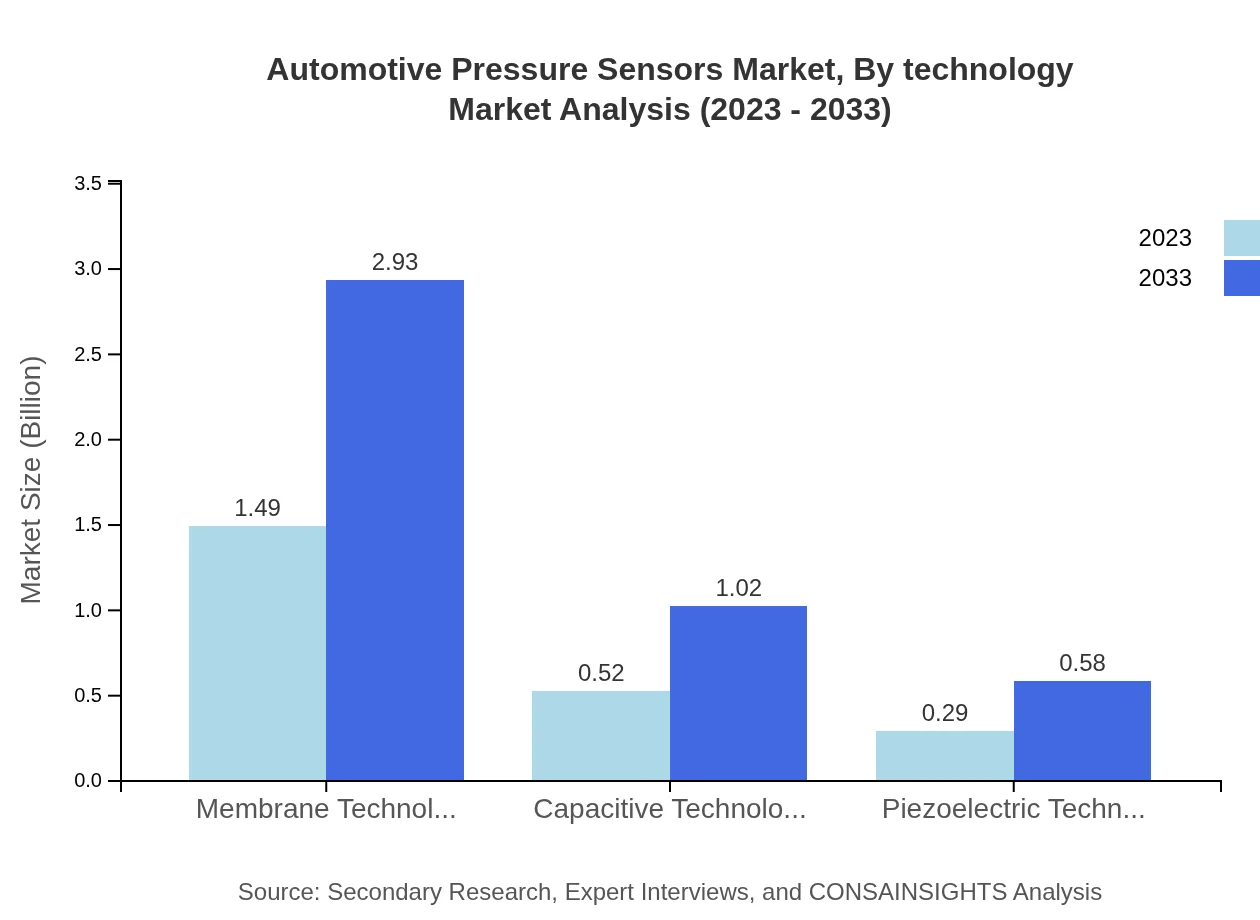

Automotive Pressure Sensors Market Analysis By Technology

In terms of technology, membrane technology remains dominant with a market size of $1.49 billion in 2023, representing 64.76% of the market, forecasted to grow to $2.93 billion. Capacitive technology follows this trend at $0.52 billion (22.52%), expected to elevate to $1.02 billion. Piezoelectric technology, though smaller, has a notable share at $0.29 billion growing to $0.58 billion.

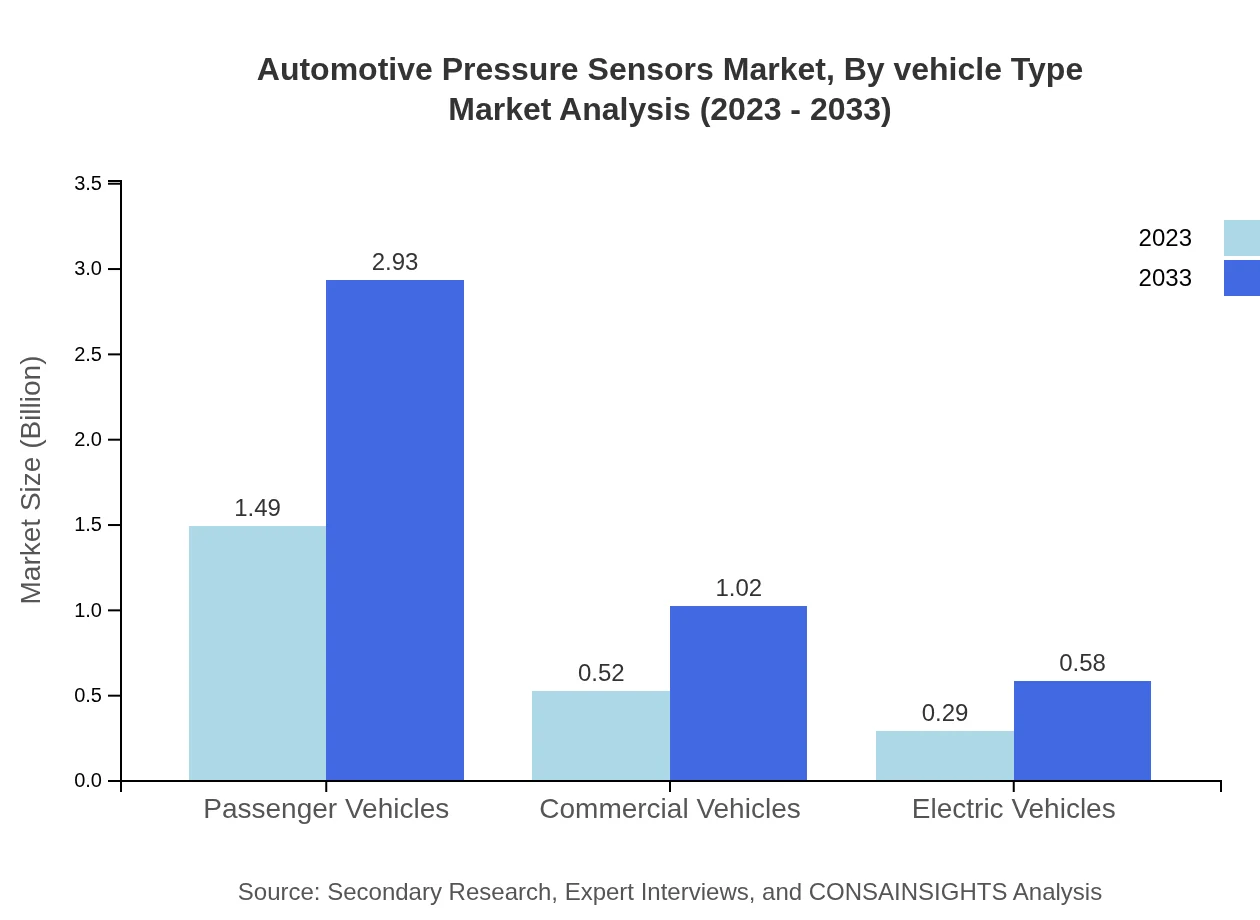

Automotive Pressure Sensors Market Analysis By Vehicle Type

Passenger vehicles lead the market, with a size of $1.49 billion and a 64.76% share in 2023, expected to double by 2033. Commercial vehicles, with a $0.52 billion size captured 22.52% of the market, forecast to rise to $1.02 billion. The electric vehicle segment, although currently at $0.29 billion, is projected to grow significantly with advancements in EV technology.

Automotive Pressure Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Pressure Sensors Industry

Honeywell International Inc.:

Honeywell is a leading manufacturer of automotive pressure sensors, providing high-performance sensing solutions. Their products are widely used in various applications including engine management and safety systems, enhancing vehicle performance and safety.Bosch Sensortec:

A subsidiary of Robert Bosch GmbH, Bosch Sensortec specializes in automotive sensors, including pressure sensors. Their rigorous focus on innovation enables advancements in vehicle technology targeting enhanced safety and efficiency.Analog Devices, Inc.:

Analog Devices produces a range of automotive sensors, including pressure sensors for critical applications. Their solutions are pivotal in enabling the deployment of advanced driver assistance systems.TE Connectivity:

TE Connectivity is known for robust automotive sensor solutions, offering various pressure sensors that contribute significantly to the control of engine performance and other automotive applications.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Pressure Sensors?

The automotive pressure sensors market is currently valued at approximately $2.3 billion and is projected to grow with a CAGR of 6.8% over the next decade, indicating a robust expansion in response to increasing automotive technologies.

What are the key market players or companies in this automotive Pressure Sensors industry?

Key players in the automotive pressure sensors market include major manufacturers like Bosch, Honeywell, and Continental. These companies are pivotal in driving innovation, enhancing sensor technologies, and maintaining significant market share in the industry.

What are the primary factors driving the growth in the automotive Pressure Sensors industry?

Growth in the automotive pressure sensors industry is driven by increasing demand for advanced driver assistance systems, rising safety standards, and the shift towards electric vehicles, which necessitate sophisticated sensor technologies for optimal performance.

Which region is the fastest Growing in the automotive Pressure Sensors?

The fastest-growing region in the automotive pressure sensors market is expected to be North America, with a market size projected to increase from $0.82 billion in 2023 to $1.60 billion by 2033, demonstrating strong growth in automotive applications.

Does ConsaInsights provide customized market report data for the automotive Pressure Sensors industry?

Yes, ConsaInsights offers customized market report services tailored to the unique requirements of clients in the automotive pressure sensors industry, allowing for insights that align specifically with business goals and market needs.

What deliverables can I expect from this automotive Pressure Sensors market research project?

Expect comprehensive deliverables from the automotive pressure sensors market research project, including market size analysis, competitive landscape, growth forecasts, and detailed segment breakdowns providing insights into automotive enhanced technologies.

What are the market trends of automotive Pressure Sensors?

Current trends in the automotive pressure sensors market include increased adoption of IoT technology, an emphasis on sustainable automotive solutions, and a shift towards sensor integration in electric vehicles, enhancing overall vehicle efficiency and safety.