Automotive Printed Circuit Board Pcb Market Report

Published Date: 02 February 2026 | Report Code: automotive-printed-circuit-board-pcb

Automotive Printed Circuit Board Pcb Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Automotive Printed Circuit Board (PCB) market, highlighting key trends, growth opportunities, and forecasts for the years 2023 to 2033. It includes insights into market dynamics, segmentation, and regional performance.

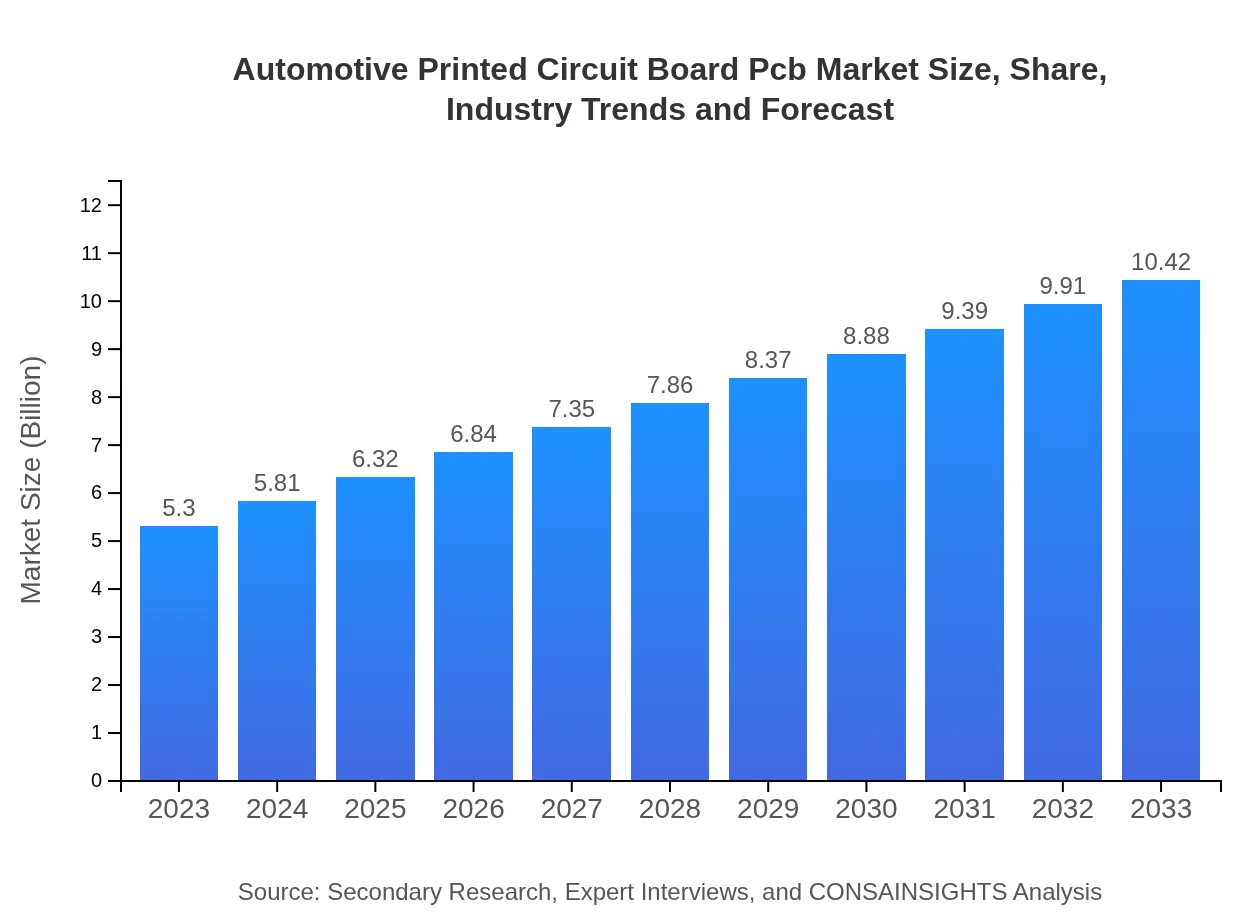

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.42 Billion |

| Top Companies | Intel Corporation, NXP Semiconductors, TE Connectivity, Flex Ltd. |

| Last Modified Date | 02 February 2026 |

Automotive Printed Circuit Board Pcb Market Overview

Customize Automotive Printed Circuit Board Pcb Market Report market research report

- ✔ Get in-depth analysis of Automotive Printed Circuit Board Pcb market size, growth, and forecasts.

- ✔ Understand Automotive Printed Circuit Board Pcb's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Printed Circuit Board Pcb

What is the Market Size & CAGR of Automotive Printed Circuit Board Pcb market in 2023?

Automotive Printed Circuit Board Pcb Industry Analysis

Automotive Printed Circuit Board Pcb Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Printed Circuit Board Pcb Market Analysis Report by Region

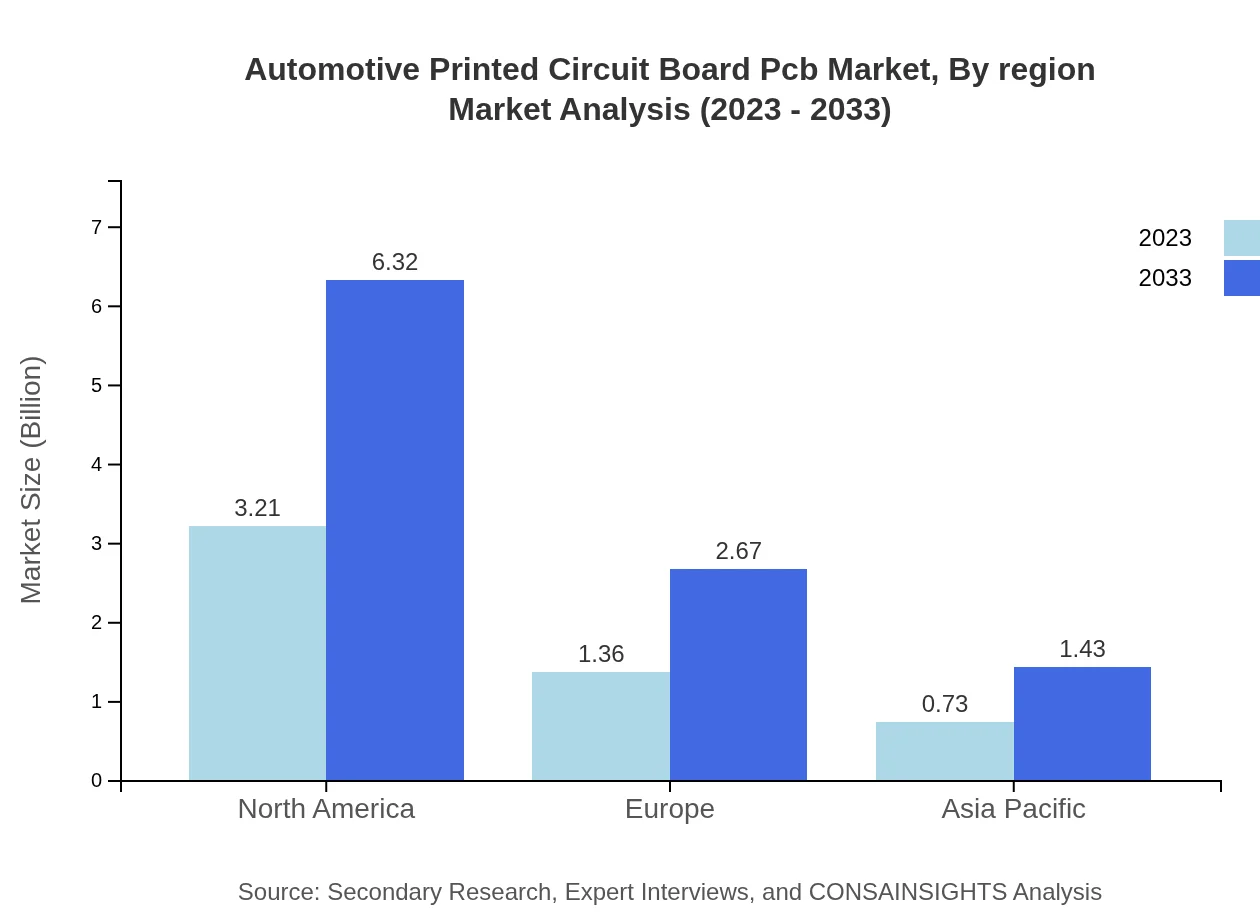

Europe Automotive Printed Circuit Board Pcb Market Report:

Europe is a key market for automotive PCBs, valued at $1.39 billion in 2023, with projections to reach $2.74 billion by 2033. The region benefits from stringent regulatory standards that enhance the demand for advanced PCB technologies.Asia Pacific Automotive Printed Circuit Board Pcb Market Report:

In 2023, the Automotive PCB market in the Asia Pacific region is valued at approximately $1.08 billion, and it is expected to grow to $2.12 billion by 2033. The region is a hub for automotive manufacturing, with countries like China, Japan, and South Korea leading in production capacity and technology advancements.North America Automotive Printed Circuit Board Pcb Market Report:

North America has a market size of $1.96 billion in 2023, expected to reach $3.85 billion by 2033. The region is characterized by a strong presence of major automotive manufacturers and a growing focus on electric vehicle production, significantly impacting PCB demand.South America Automotive Printed Circuit Board Pcb Market Report:

In South America, the market is valued at $0.24 billion in 2023 and is projected to grow to $0.46 billion by 2033. The increase in domestic vehicle production and exports is driving the demand for automotive PCBs in this region.Middle East & Africa Automotive Printed Circuit Board Pcb Market Report:

The Middle East and African markets are valued at $0.63 billion in 2023 and expected to reach approximately $1.24 billion by 2033. Growing automotive industries and investments in infrastructure are pushing the demand for automotive PCBs in these regions.Tell us your focus area and get a customized research report.

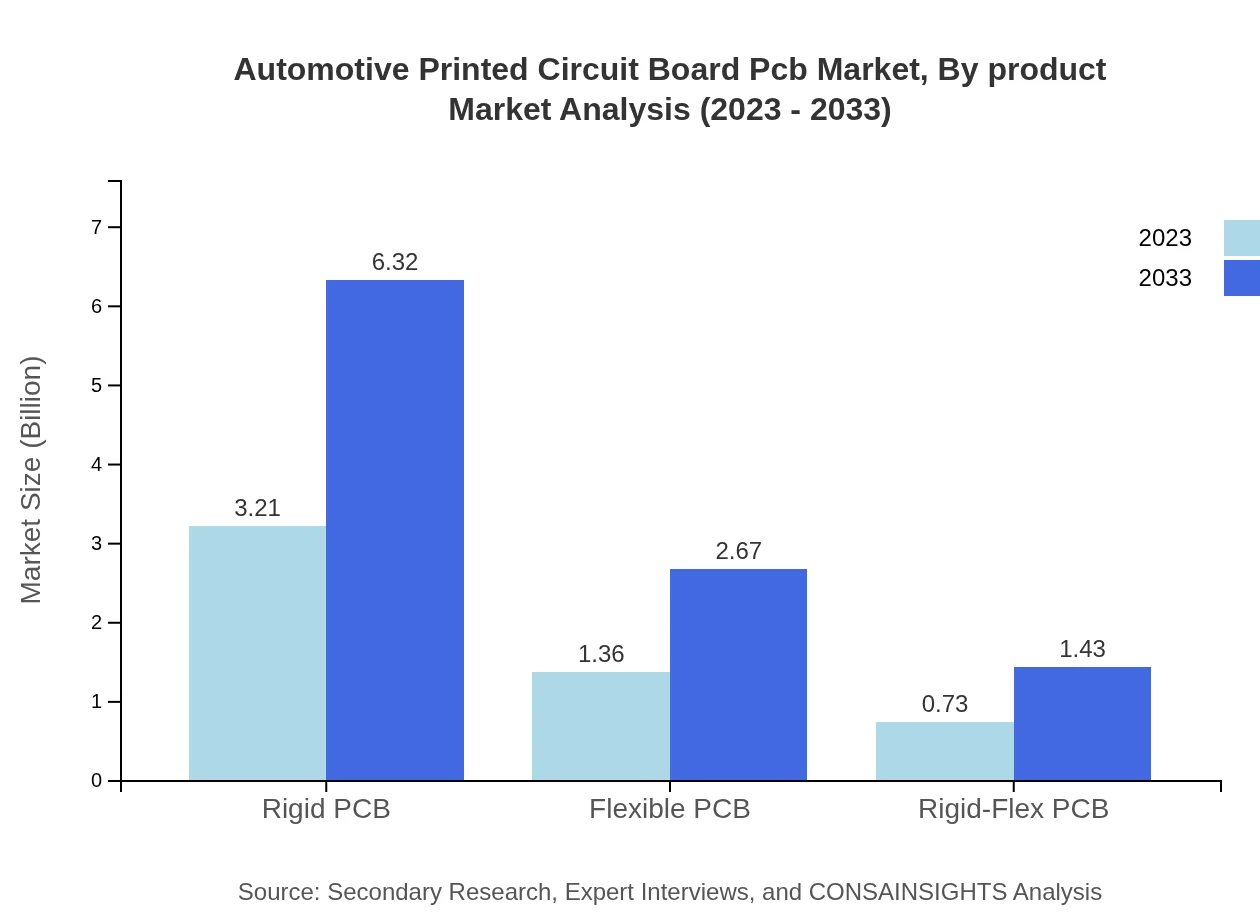

Automotive Printed Circuit Board Pcb Market Analysis By Product

The market includes rigid PCBs, which account for about 60.64% of the total share in North America, and flexible PCBs, making up 25.65%. Rigid-flex PCBs, although a smaller segment, are gaining traction, particularly in high-performance applications.

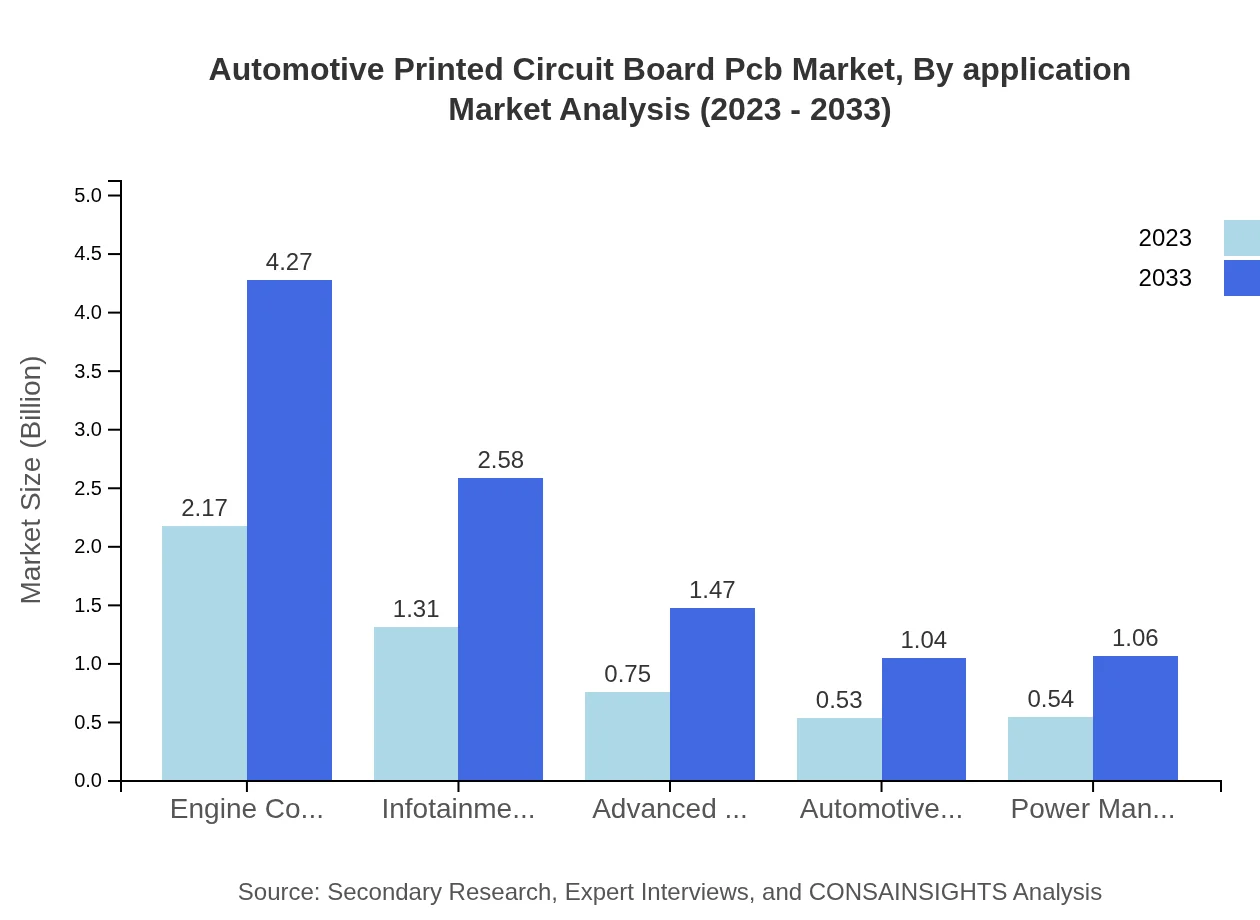

Automotive Printed Circuit Board Pcb Market Analysis By Application

Applications in Engine Control Units (ECUs) lead the market, comprising 40.95% of the share in 2023. Infotainment systems follow, with significant growth projected due to the increasing integration of connectivity features in modern vehicles.

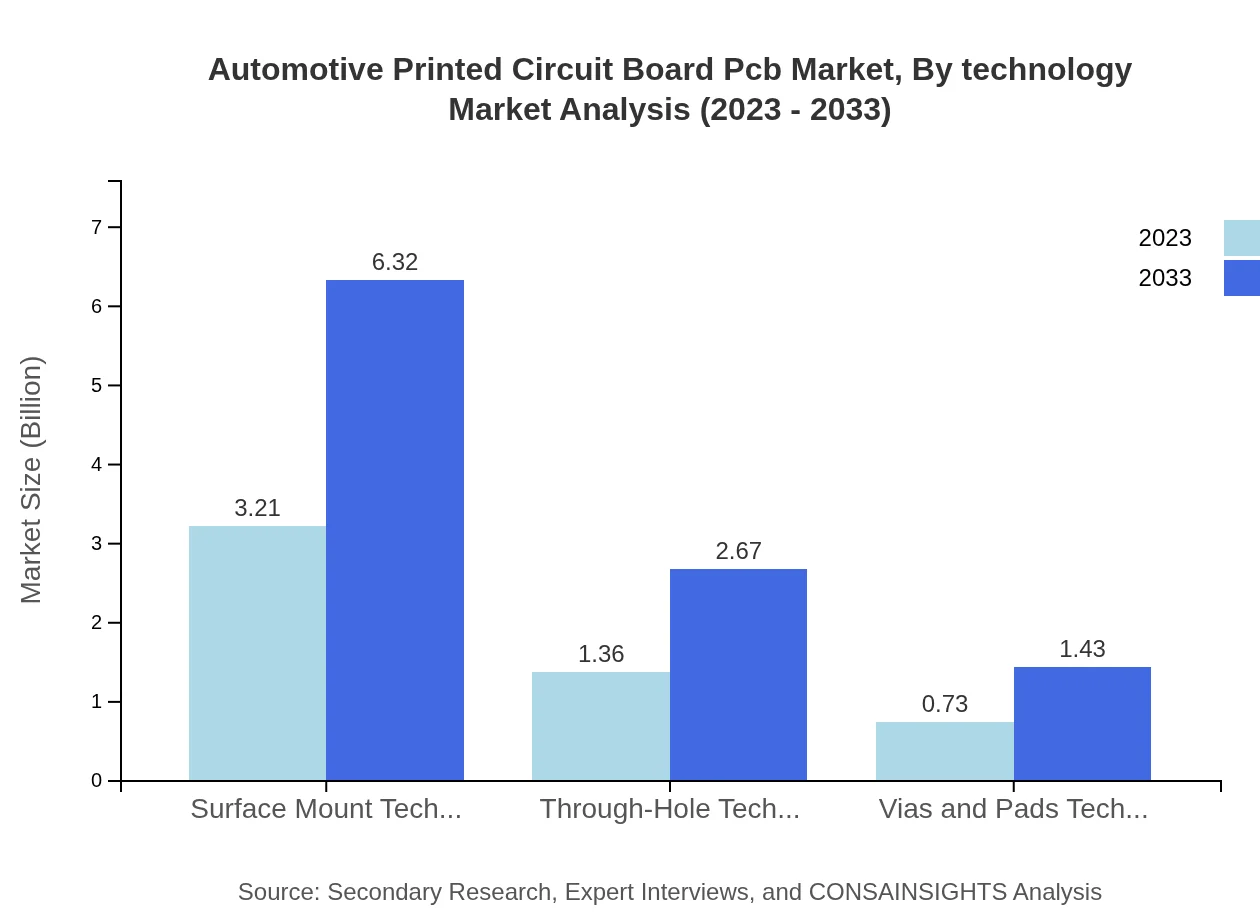

Automotive Printed Circuit Board Pcb Market Analysis By Technology

Technologies such as Surface Mount Technology (SMT) and Through-Hole Technology remain dominant. SMT holds a market share of 60.64%, underscoring its preferred use in high-density applications due to reduced size and better performance.

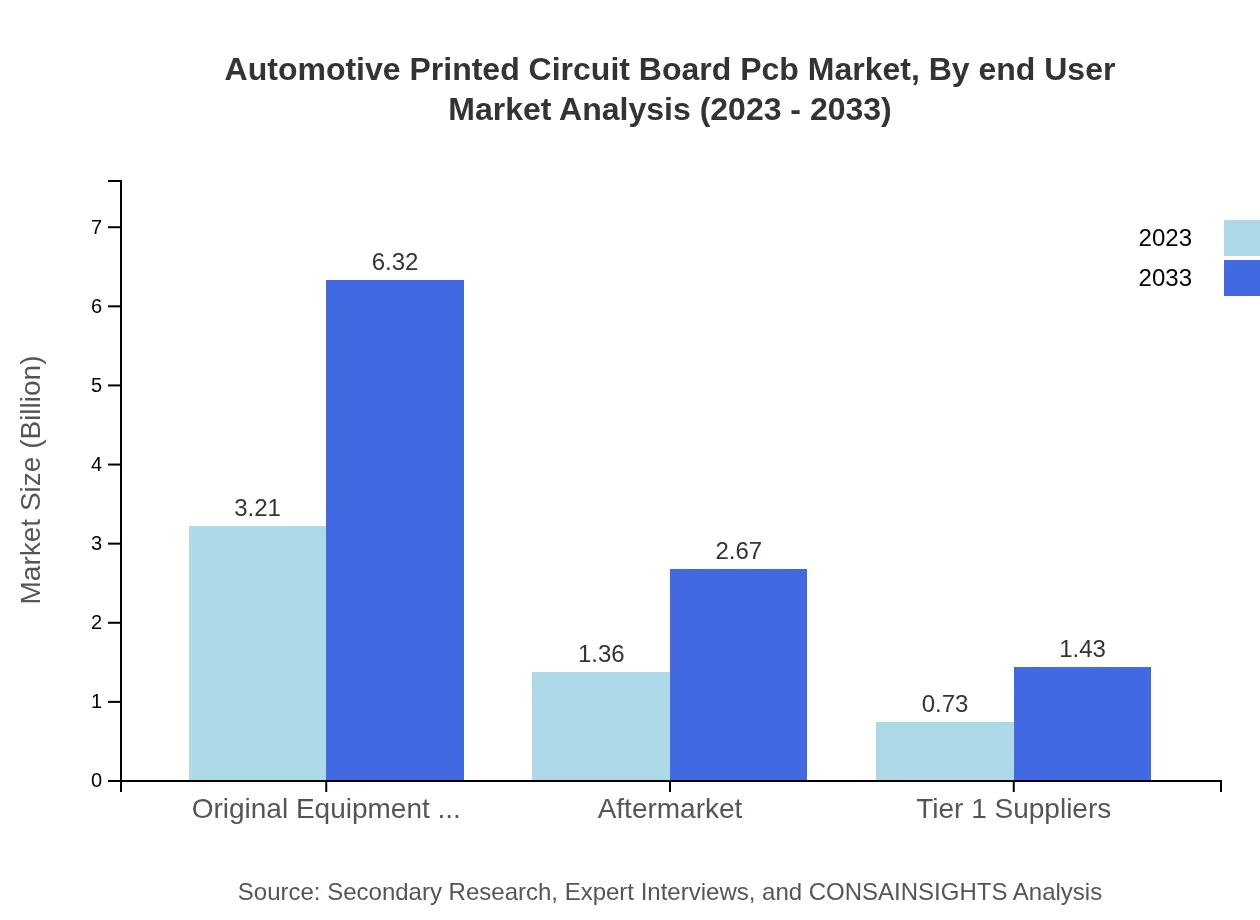

Automotive Printed Circuit Board Pcb Market Analysis By End User

The predominant end-users include Original Equipment Manufacturers (OEMs) and Tier 1 Suppliers. OEMs represent 60.64% of the market share, driven by their demand for dependable and innovative PCB solutions.

Automotive Printed Circuit Board Pcb Market Analysis By Region

Regional performances differ significantly. North America holds the largest market share, followed closely by Europe. The Asia Pacific region is rapidly expanding, driven by its strong automotive industry presence and increasing adoption of electronic systems in vehicles.

Automotive Printed Circuit Board Pcb Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Printed Circuit Board Pcb Industry

Intel Corporation:

A leading technology company known for its semiconductor products, including those used for automotive applications. Intel invests heavily in R&D to develop advanced electronics for various automotive technologies.NXP Semiconductors:

A prominent player in automotive electronics, producing automotive-grade microcontrollers and processors widely used in Vehicle Control Units (VCUs) and ADAS.TE Connectivity:

A global leader in connectivity and sensor solutions, TE Connectivity enhances automotive PCB performance through innovative technologies aimed at improving safety and efficiency.Flex Ltd.:

A significant contract manufacturer specializing in automotive electronic systems. They offer advanced PCB manufacturing services, particularly in complex and high-reliability applications.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Printed Circuit Board Pcb?

In 2023, the automotive printed circuit board (PCB) market is valued at approximately $5.3 billion and is projected to grow at a CAGR of 6.8%, reaching a size of over $9.4 billion by 2033.

What are the key market players or companies in the automotive Printed Circuit Board Pcb industry?

Key players in the automotive PCB market include major manufacturers such as Jabil, Flex, and Celestica, which are renowned for their technological advancements and operational excellence in the automotive sector.

What are the primary factors driving the growth in the automotive Printed Circuit Board Pcb industry?

Key growth drivers include the increasing adoption of advanced driver-assistance systems (ADAS), the rise in electric vehicle production, and the growing demand for infotainment and connectivity solutions in vehicles.

Which region is the fastest Growing in the automotive Printed Circuit Board Pcb?

The Asia-Pacific region is the fastest-growing market, projected to grow from $1.08 billion in 2023 to $2.12 billion by 2033, driven by rising automotive manufacturing in countries like China and Japan.

Does ConsaInsights provide customized market report data for the automotive Printed Circuit Board Pcb industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs, ensuring insights are relevant to ongoing projects and strategic decisions within the automotive PCB industry.

What deliverables can I expect from this automotive Printed Circuit Board Pcb market research project?

Deliverables include comprehensive market analysis reports, detailed segment data, competitive landscapes, and strategic recommendations based on the latest trends in the automotive PCB market.

What are the market trends of automotive Printed Circuit Board Pcb?

Current trends include an increasing shift towards lightweight materials, integration of smart technologies, and a significant focus on sustainability practices, as manufacturers innovate their PCB offerings.