Automotive Pumps Market Report

Published Date: 22 January 2026 | Report Code: automotive-pumps

Automotive Pumps Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automotive Pumps market, covering insights on market size, trends, segmentation, and regional dynamics from 2023 to 2033. It aims to serve industry stakeholders with strategic insights and market forecasts.

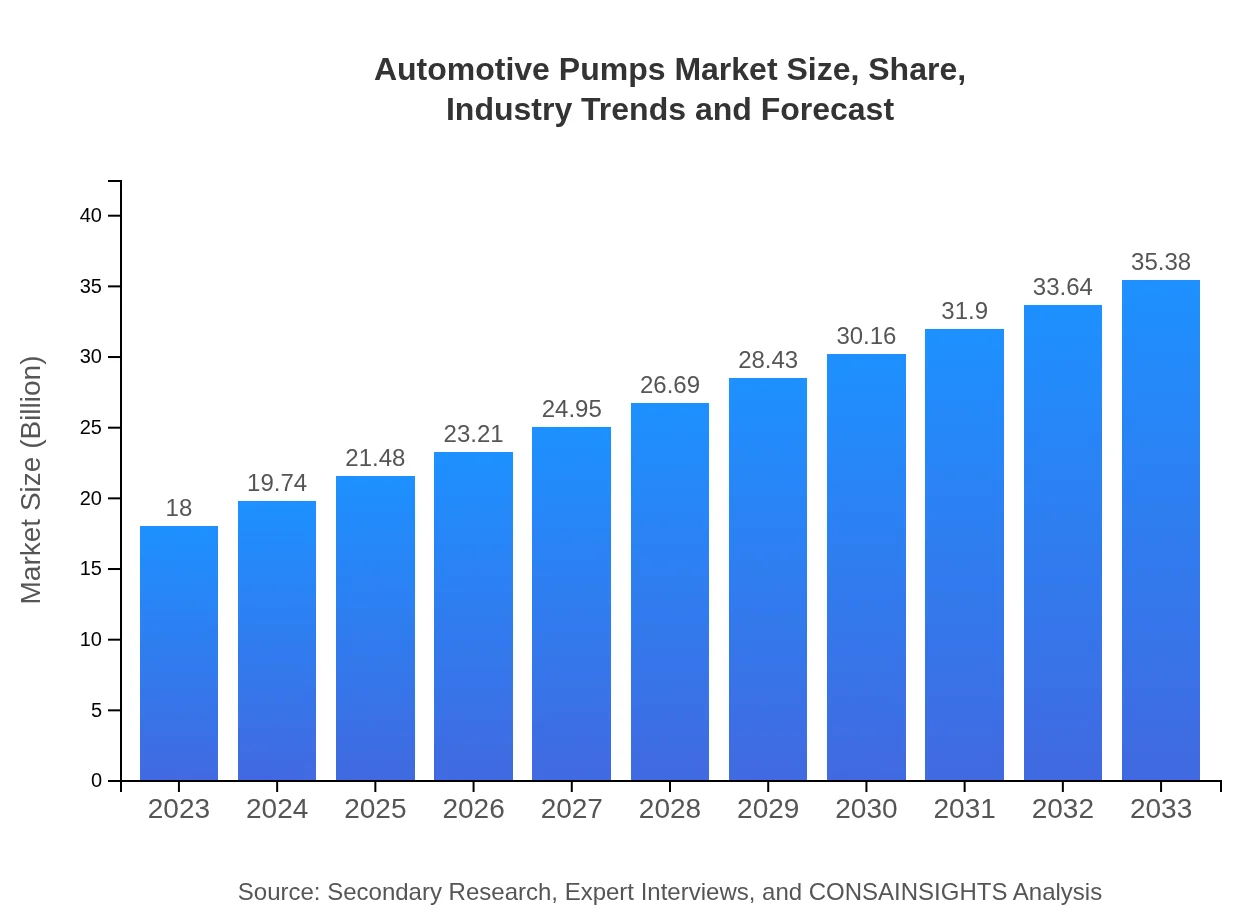

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $18.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $35.38 Billion |

| Top Companies | Bosch, Continental AG, Denso Corporation, Aisin Seiki Co., Ltd., Delphi Technologies |

| Last Modified Date | 22 January 2026 |

Automotive Pumps Market Overview

Customize Automotive Pumps Market Report market research report

- ✔ Get in-depth analysis of Automotive Pumps market size, growth, and forecasts.

- ✔ Understand Automotive Pumps's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Pumps

What is the Market Size & CAGR of Automotive Pumps market in 2023?

Automotive Pumps Industry Analysis

Automotive Pumps Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Pumps Market Analysis Report by Region

Europe Automotive Pumps Market Report:

The European market for Automotive Pumps is anticipated to grow from USD 5.00 billion in 2023 to USD 9.84 billion by 2033. Stringent regulations promoting emissions reduction in automotive operations and the shift toward electric mobility are key factors driving this growth.Asia Pacific Automotive Pumps Market Report:

In 2023, the Asia-Pacific region's Automotive Pumps market is estimated at USD 3.75 billion, expected to reach USD 7.37 billion by 2033. The region's rapid automotive production and increasing disposable incomes are driving demand, with countries like China and India leading in automotive sales.North America Automotive Pumps Market Report:

North America, with a market size of USD 6.28 billion in 2023, is expected to grow to USD 12.34 billion by 2033. The region is characterized by the presence of advanced automotive technologies and a focus on electric vehicles.South America Automotive Pumps Market Report:

The South American Automotive Pumps market is projected to grow from USD 0.49 billion in 2023 to USD 0.96 billion by 2033. This growth is owed to an increase in automotive production and a gradual recovery in economic conditions across various countries.Middle East & Africa Automotive Pumps Market Report:

The Middle East and Africa region is predicted to expand from USD 2.49 billion in 2023 to USD 4.89 billion by 2033. Economic development and increased vehicle sales in countries like the UAE and South Africa are driving this market.Tell us your focus area and get a customized research report.

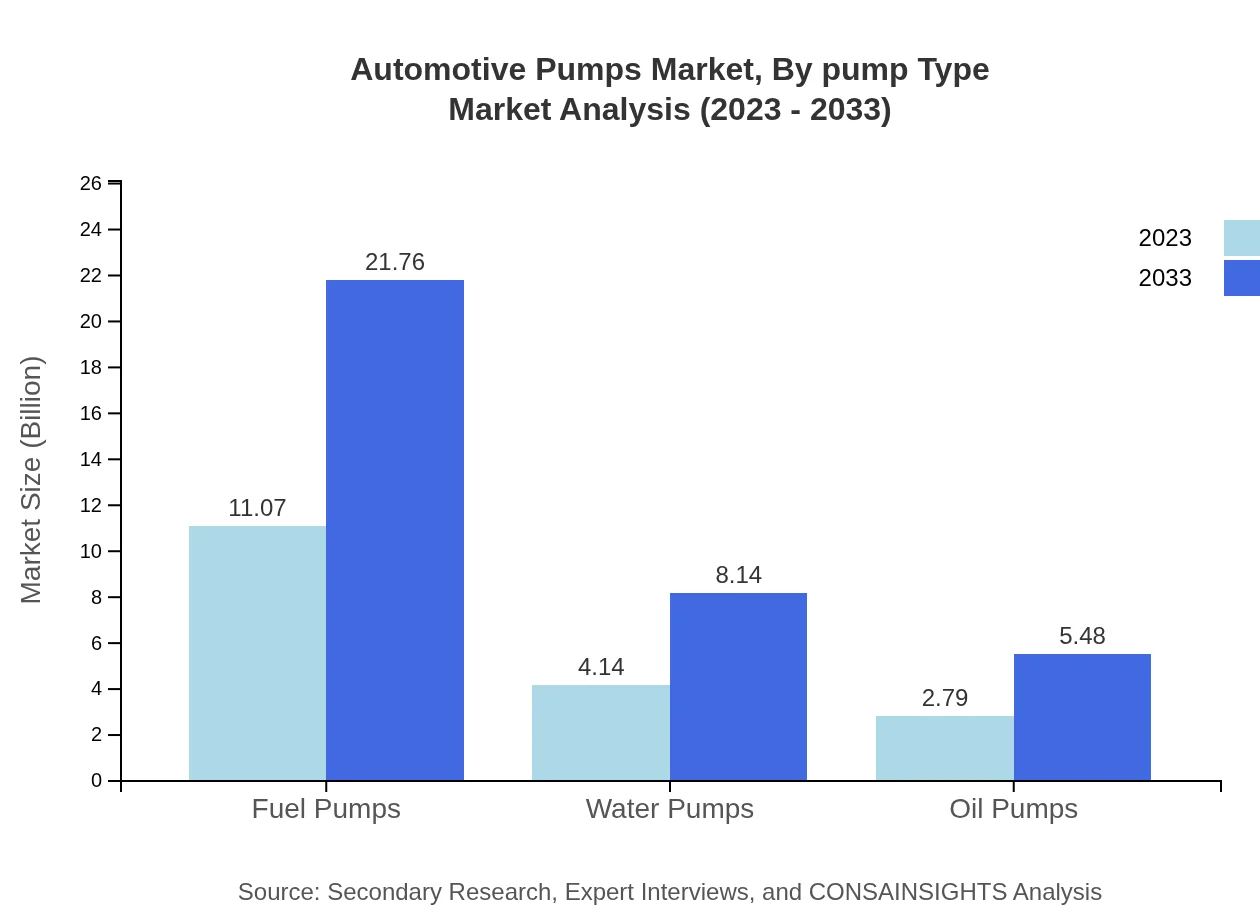

Automotive Pumps Market Analysis By Pump Type

In 2023, the fuel pumps segment leads the market with a size of USD 11.07 billion, expected to grow to USD 21.76 billion by 2033, maintaining a significant market share of 61.5%. Water pumps follow at USD 4.14 billion in 2023 and are projected to reach USD 8.14 billion by 2033, representing 23% of the market. Oil pumps contribute USD 2.79 billion in 2023, with a projected growth to USD 5.48 billion (15.5% share) by 2033.

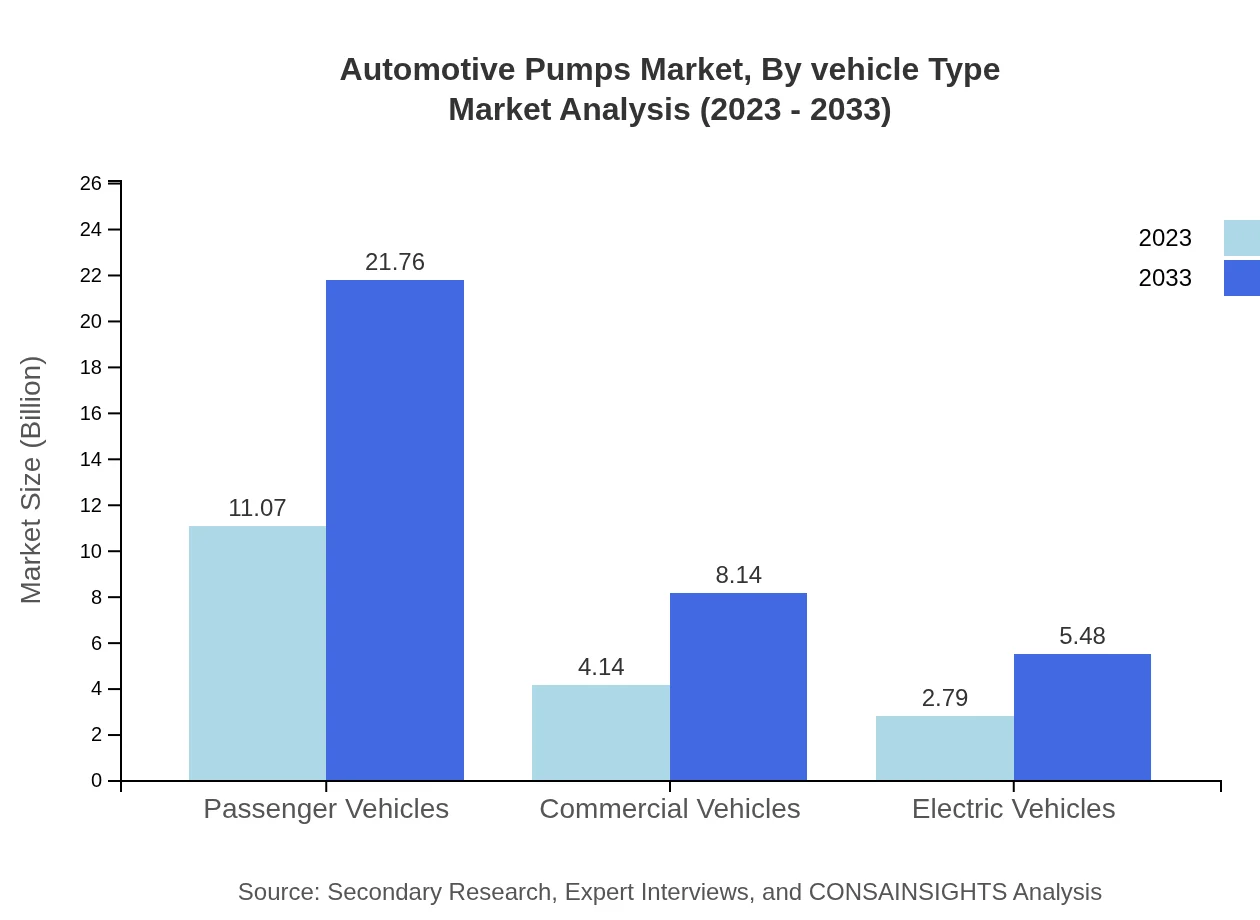

Automotive Pumps Market Analysis By Vehicle Type

Passenger vehicles dominate the Automotive Pumps market with an estimated USD 11.07 billion in 2023, expected to reach USD 21.76 billion by 2033. The commercial vehicle segment holds a 23% share, beginning at USD 4.14 billion and projected to achieve USD 8.14 billion. The electric vehicle segment, although smaller, is growing rapidly, with an increase from USD 2.79 billion in 2023 to USD 5.48 billion (15.5% share) by 2033.

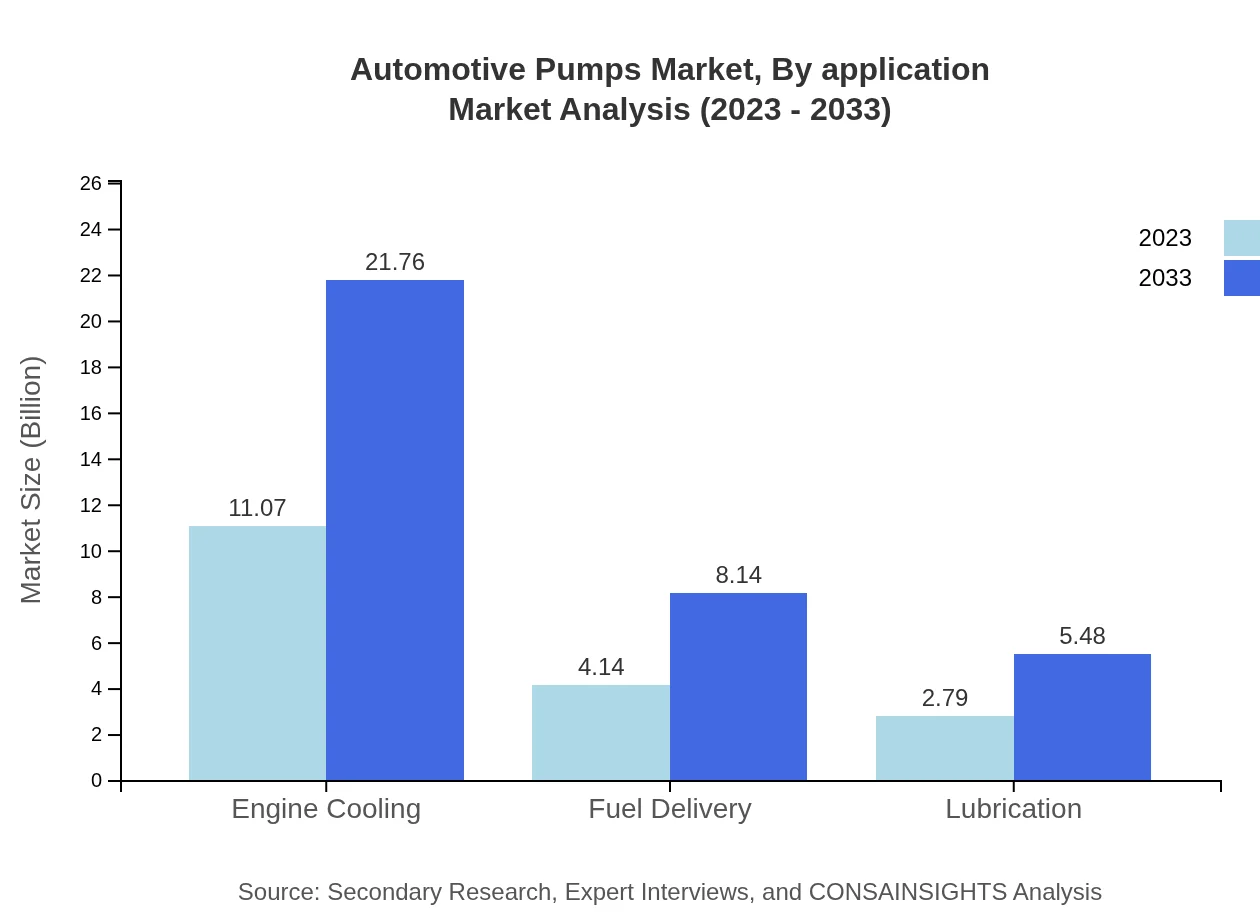

Automotive Pumps Market Analysis By Application

Applications for automotive pumps include engine cooling, fuel delivery, and lubrication. Engine cooling applications are estimated at USD 11.07 billion in 2023, while lubrication applications start at USD 2.79 billion, both segments forecasted for significant growth, reflecting the essential nature of these functions in vehicle performance.

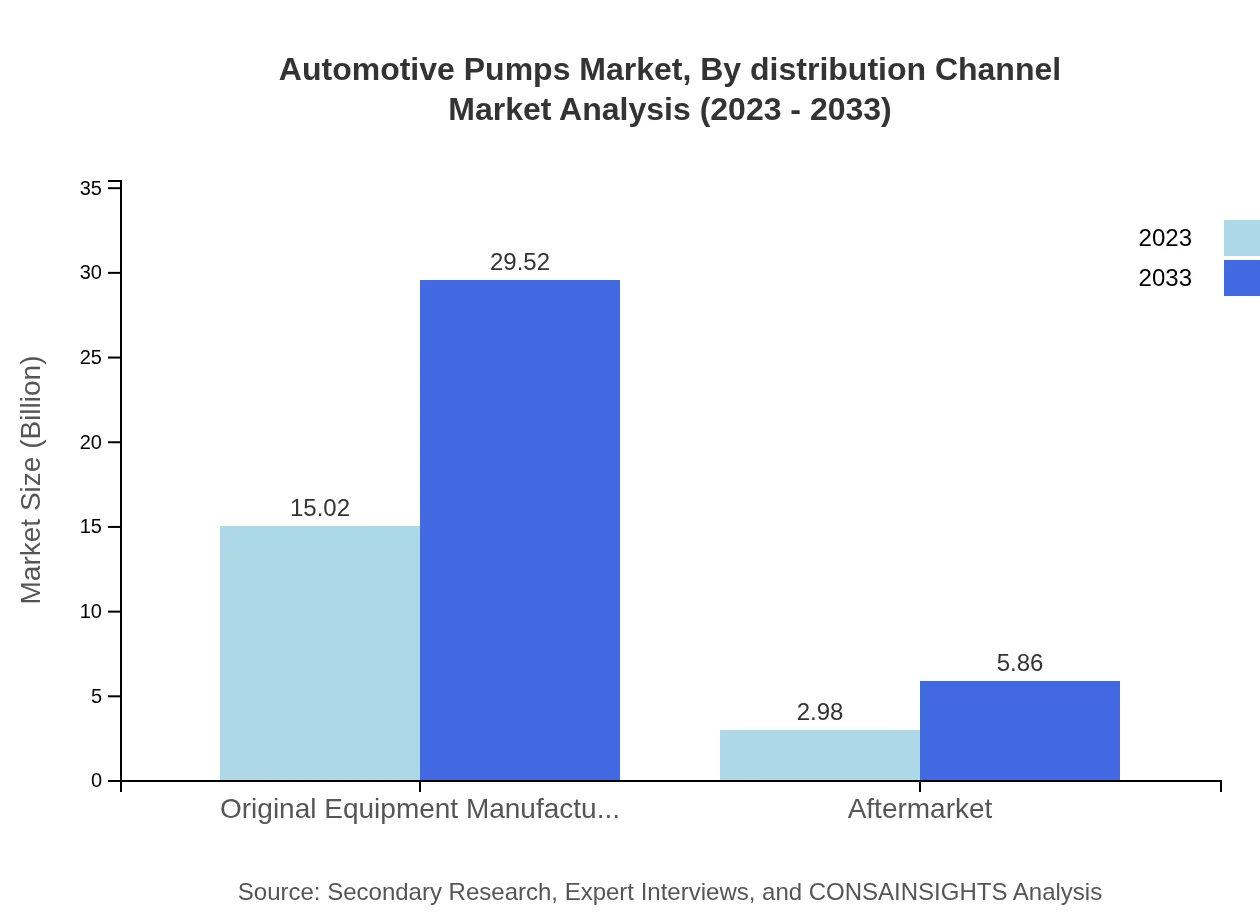

Automotive Pumps Market Analysis By Distribution Channel

Distribution channels are segmented into Original Equipment Manufacturers (OEM) and Aftermarket. OEMs constitute a significant portion of the market with 83.43% share starting at USD 15.02 billion in 2023 and forecasted to grow to USD 29.52 billion by 2033. The aftermarket is comparatively smaller, valued at USD 2.98 billion, anticipated to rise to USD 5.86 billion (16.57% share) as vehicle maintenance needs continue.

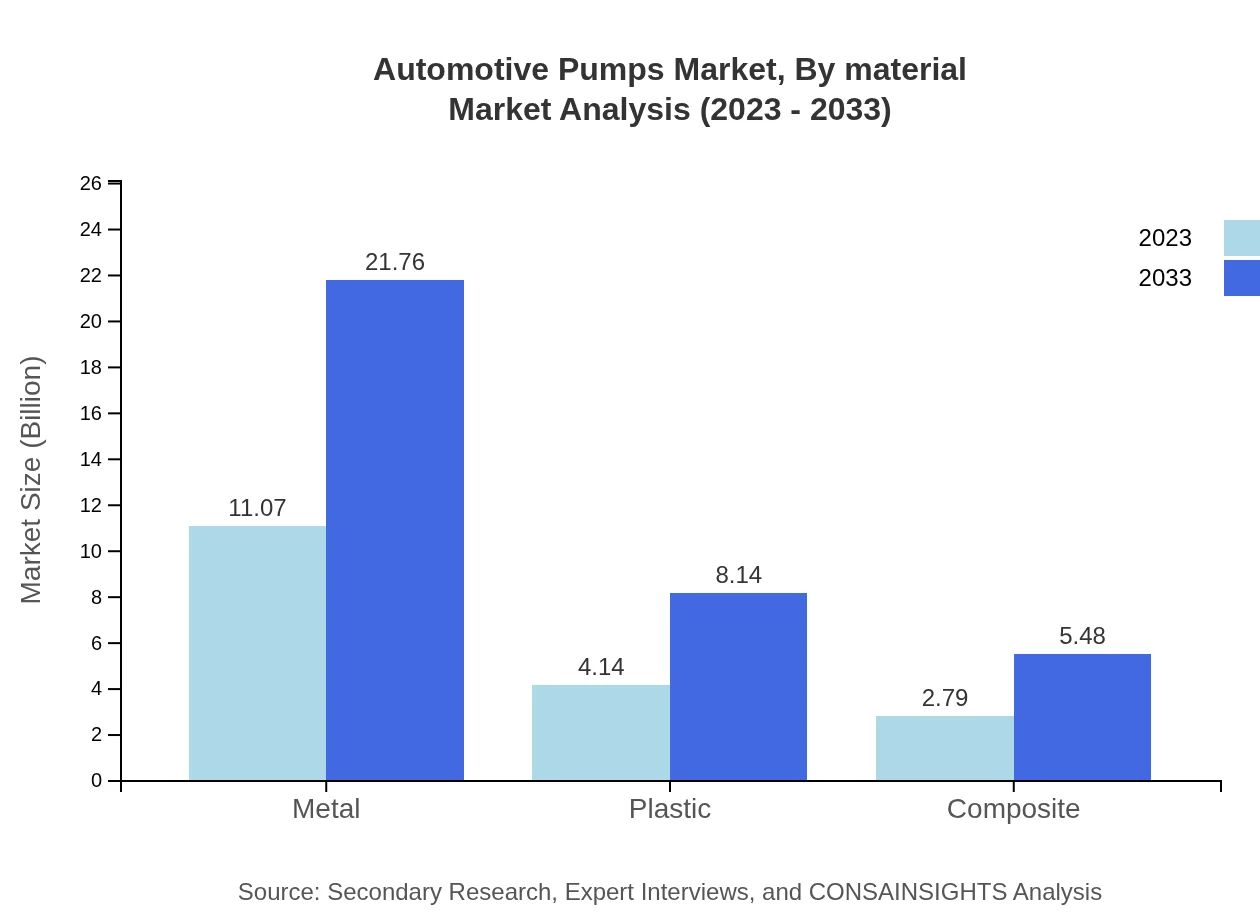

Automotive Pumps Market Analysis By Material

Metal pumps dominate the market with a revenue of USD 11.07 billion in 2023, expected to rise to USD 21.76 billion by 2033. Plastic pumps, with a projected market value of USD 4.14 billion, are also gaining traction for cost-effective and lightweight alternatives, expected to expand to USD 8.14 billion over the same period.

Automotive Pumps Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Pumps Industry

Bosch:

A prominent player in automotive technology, Bosch excels in manufacturing fuel pumps, known for reliability and efficiency, contributing significantly to the automotive pumps market.Continental AG:

Continental AG focuses on automotive components, including advanced pump solutions designed for both traditional and electric vehicles, driving innovation in sustainable mobility.Denso Corporation:

Denso is recognized for its high-quality automotive pumps and components, heavily investing in R&D to enhance fuel efficiency and reduce emissions in vehicles.Aisin Seiki Co., Ltd.:

Aisin develops a wide range of automotive parts, including pumps that are integral to vehicle performance and efficiency, particularly in hybrid and electric models.Delphi Technologies:

Delphi specializes in advanced automotive technology components, including robust pump systems critical for modern vehicle designs and performance.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Pumps?

The global automotive pumps market is valued at approximately $18 billion in 2023, with a projected CAGR of 6.8%. This growth indicates a robust expansion in demand and adoption across the automotive sector over the next decade.

What are the key market players or companies in this automotive Pumps industry?

Key players in the automotive pumps market include leading manufacturers and suppliers who play a significant role in innovation and distribution. Their involvement shapes industry dynamics and impacts market growth trajectories through competitive strategies.

What are the primary factors driving the growth in the automotive Pumps industry?

Major factors driving growth in the automotive pumps sector include rising automotive production rates, increasing adoption of electric vehicles, and the demand for advanced fuel management systems that improve performance and efficiency in vehicles.

Which region is the fastest Growing in the automotive Pumps?

The fastest-growing region in the automotive pumps market is North America, with market growth increasing from $6.28 billion in 2023 to $12.34 billion by 2033, showcasing significant demand for automotive components.

Does ConsaInsights provide customized market report data for the automotive Pumps industry?

Yes, ConsaInsights offers tailored market report data specific to the automotive pumps industry. This customization allows stakeholders to gain insights that align with their unique business needs and strategic objectives.

What deliverables can I expect from this automotive Pumps market research project?

Deliverables from the automotive pumps market research include comprehensive reports featuring market size analysis, competitive landscape evaluations, trends, forecasts, and detailed regional and segment insights tailored to the client's requirements.

What are the market trends of automotive Pumps?

Current market trends in automotive pumps include innovations in pump technology, a shift towards environmentally friendly materials, increased integration of pumps in electric vehicles, and the continuous evolution of fuel efficiency standards.