Automotive Radar Market Report

Published Date: 02 February 2026 | Report Code: automotive-radar

Automotive Radar Market Size, Share, Industry Trends and Forecast to 2033

This report offers an extensive analysis of the Automotive Radar market, covering market trends, segmentation, regional insights, competitive landscape, and growth forecasts from 2023 to 2033.

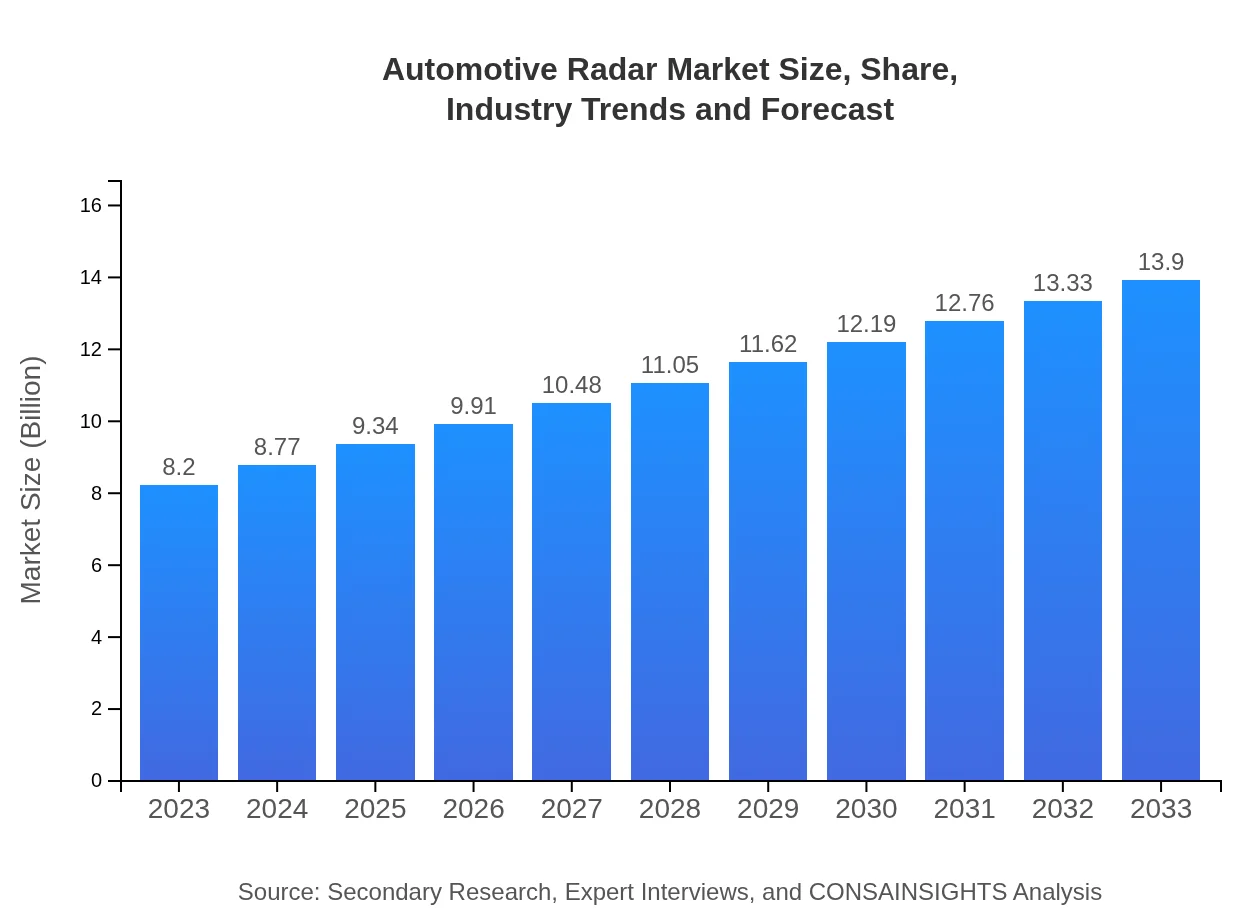

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.20 Billion |

| CAGR (2023-2033) | 5.3% |

| 2033 Market Size | $13.90 Billion |

| Top Companies | Bosch, Continental AG, Denso Corporation, Valeo, NXP Semiconductors |

| Last Modified Date | 02 February 2026 |

Automotive Radar Market Overview

Customize Automotive Radar Market Report market research report

- ✔ Get in-depth analysis of Automotive Radar market size, growth, and forecasts.

- ✔ Understand Automotive Radar's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Radar

What is the Market Size & CAGR of Automotive Radar market in 2023?

Automotive Radar Industry Analysis

Automotive Radar Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Radar Market Analysis Report by Region

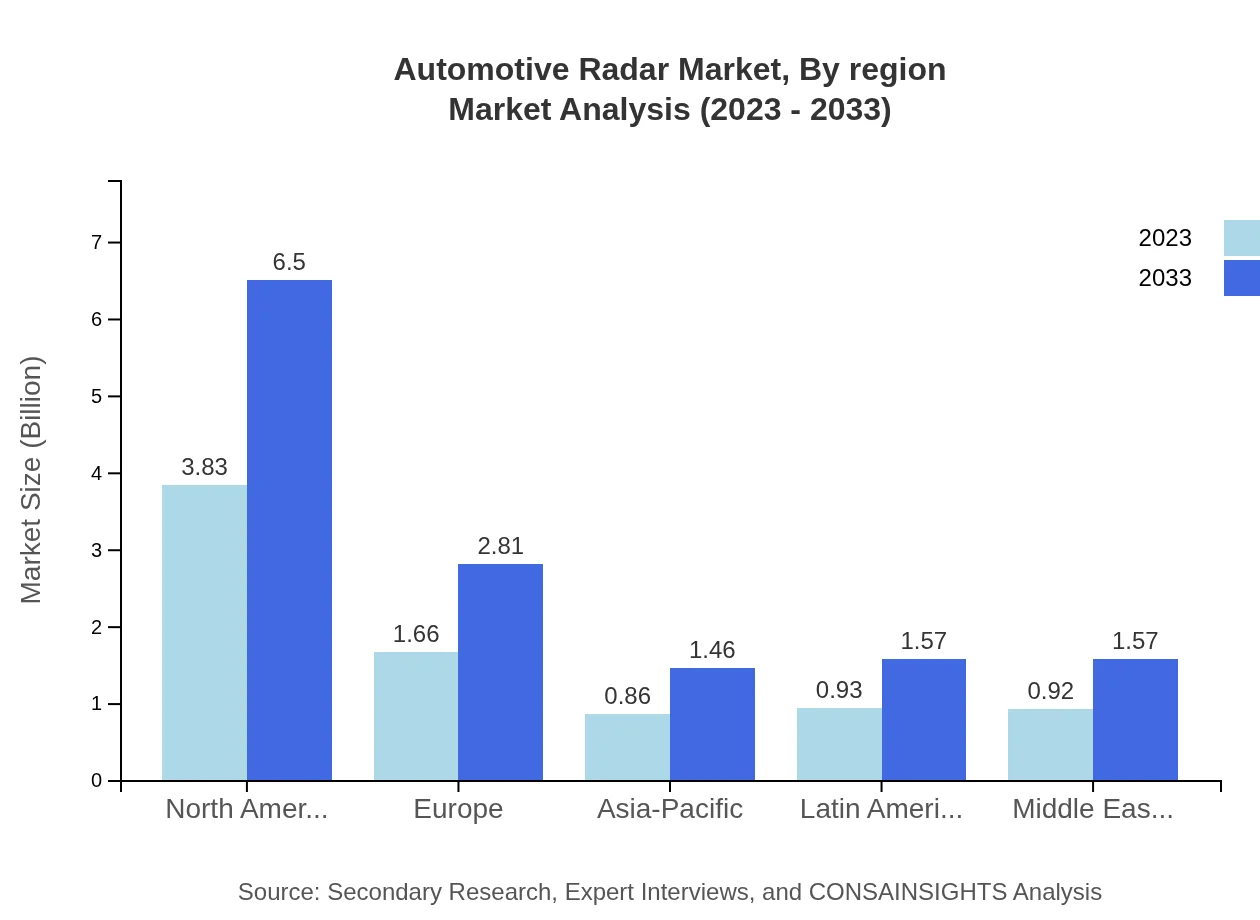

Europe Automotive Radar Market Report:

Europe's market is valued at approximately $2.28 billion in 2023, projected to grow to $3.87 billion by 2033. The region's stringent safety regulations and a commitment to reducing road fatalities through advanced safety systems significantly contribute to the market growth.Asia Pacific Automotive Radar Market Report:

The Asia-Pacific region, valued at approximately $1.64 billion in 2023, is projected to reach $2.78 billion by 2033. The market is primarily driven by high vehicle production rates in countries like China and Japan, coupled with increasing investments in advanced vehicle technologies. Favorable government regulations promoting safety standards further boost the demand in this region.North America Automotive Radar Market Report:

North America leads the Automotive Radar market with a valuation of approximately $2.65 billion in 2023, anticipated to reach $4.49 billion by 2033. The strong presence of major automotive manufacturers and consistent innovation in ADAS technologies are key factors driving the market in this region.South America Automotive Radar Market Report:

In South America, the market is valued at $0.50 billion in 2023 and is expected to grow to $0.85 billion by 2033. The automotive industry in this region is rebounding, with rising disposable incomes and improved consumer access to new technologies spurring growth.Middle East & Africa Automotive Radar Market Report:

The Middle East and Africa region is valued at $1.12 billion in 2023 and is forecasted to increase to $1.90 billion by 2033. The market is supported by improving regulatory frameworks and growing automotive manufacturing within the region.Tell us your focus area and get a customized research report.

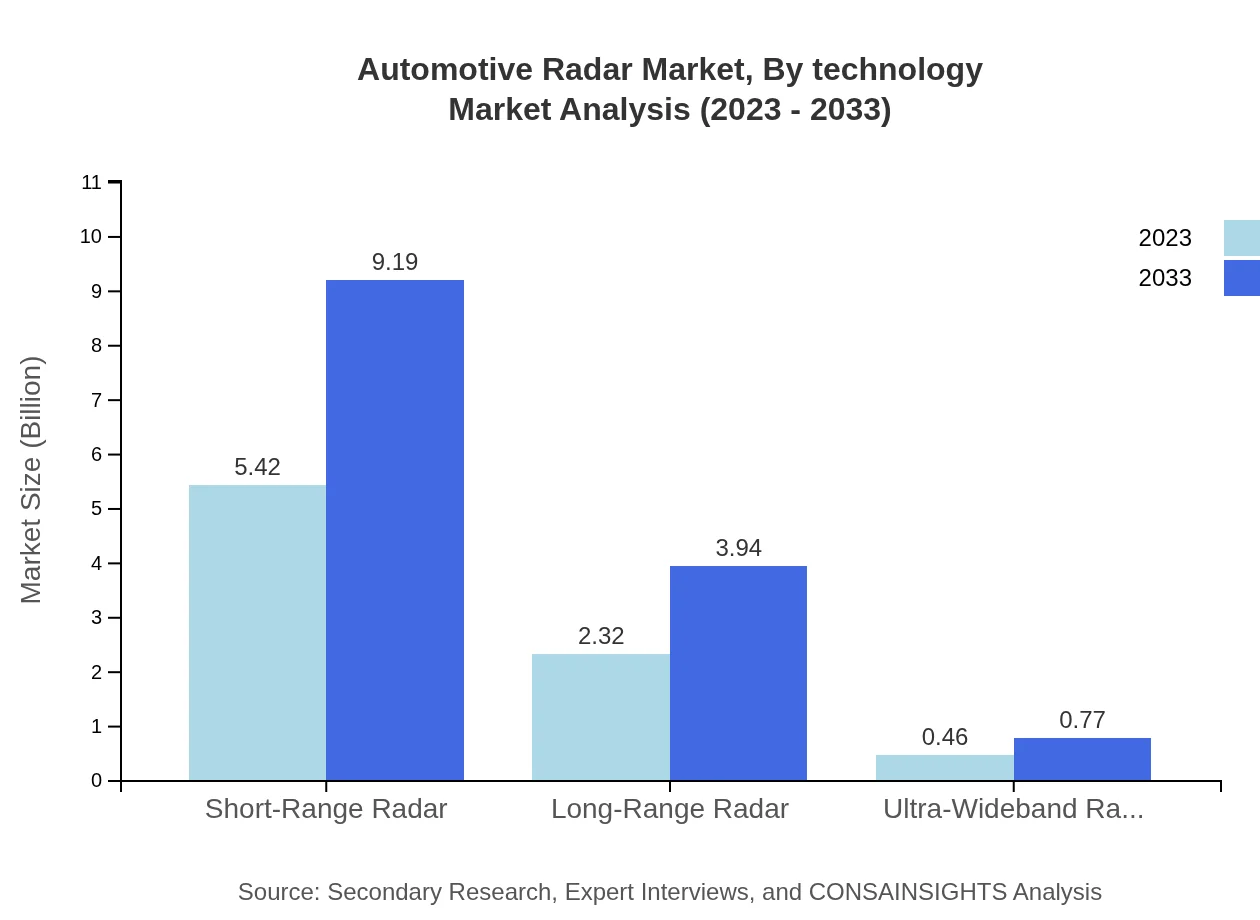

Automotive Radar Market Analysis By Technology

The market for Automotive Radar by technology predominantly includes Short-Range Radar (SRR) and Long-Range Radar (LRR). SRR represents about 66.1% of the market in 2023, valued at $5.42 billion, growing to $9.19 billion by 2033. LRR accounts for approximately 28.34% of the market in 2023, with a projected growth from $2.32 billion to $3.94 billion by 2033. New innovations, such as Ultra-Wideband Radar are gaining significance, albeit from a smaller base.

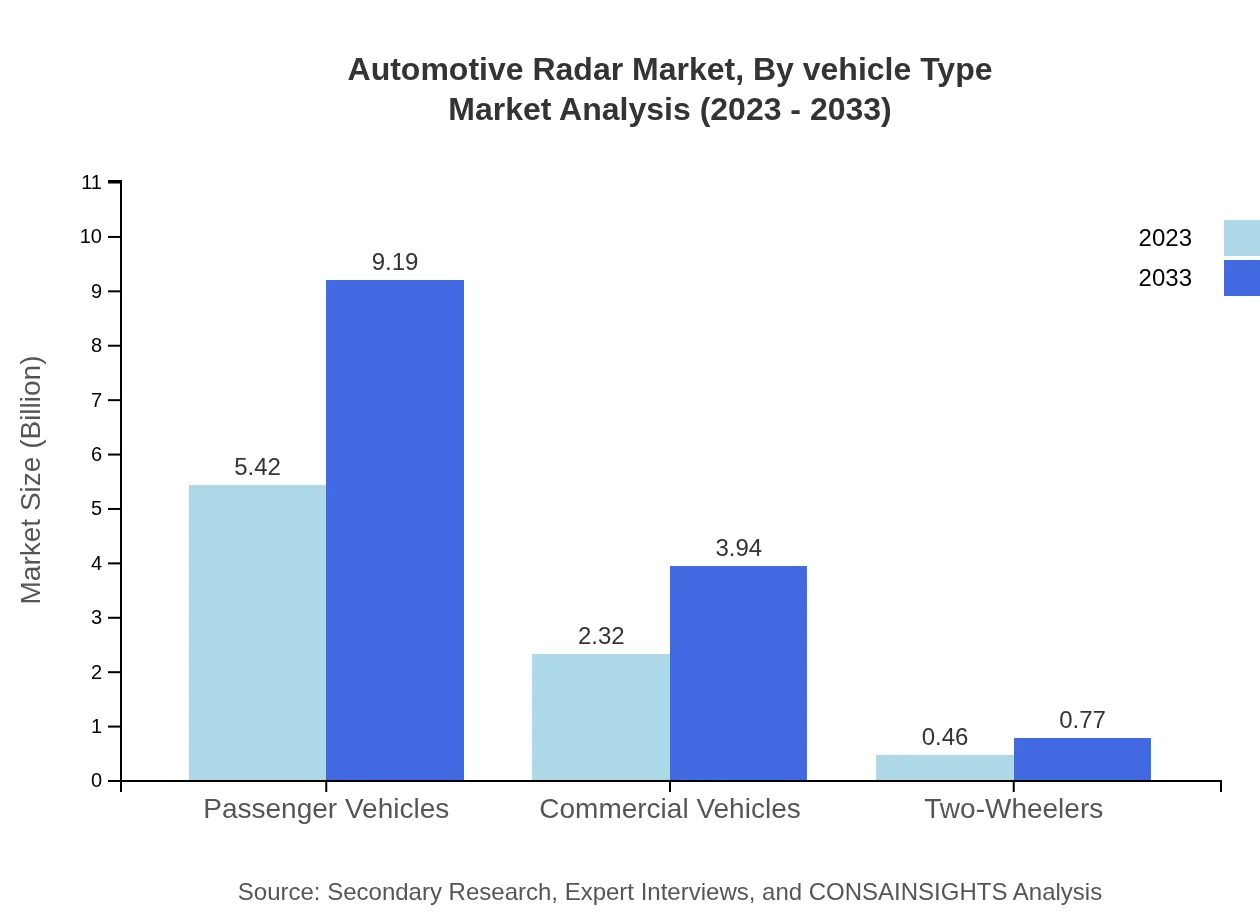

Automotive Radar Market Analysis By Vehicle Type

Passenger Vehicles contribute significantly to the Automotive Radar market, holding a share of 66.1% in 2023 with revenues of $5.42 billion, expected to grow to $9.19 billion by 2033. Commercial Vehicles are also key players with a share of 28.34%, anticipated to grow from $2.32 billion to $3.94 billion. Two-Wheelers represent a smaller segment but are important for OEMs adapting safety and radar technologies.

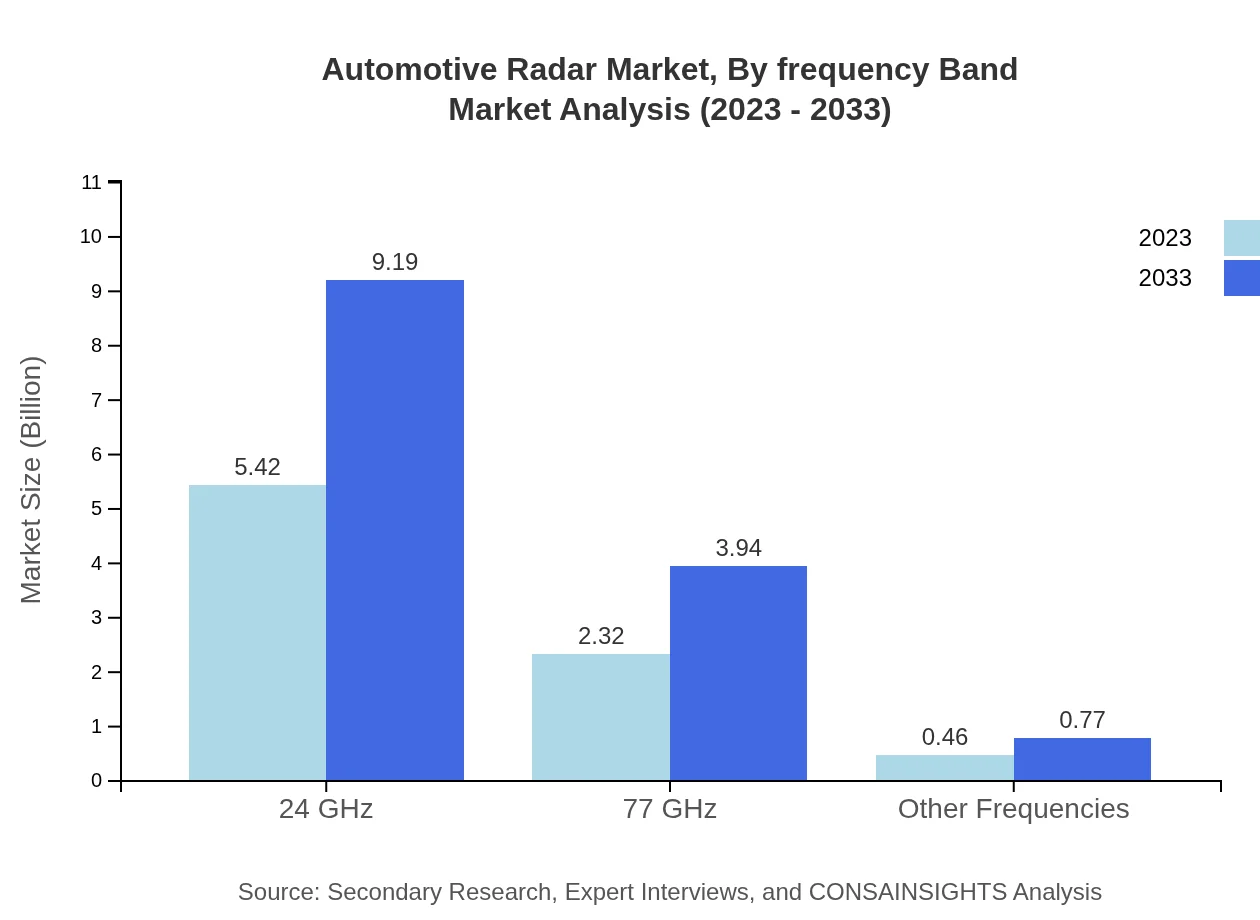

Automotive Radar Market Analysis By Frequency Band

Frequency band segmentation shows that 24 GHz radar is dominating the market with a $5.42 billion valuation in 2023, and expected to reach $9.19 billion by 2033. The 77 GHz radar segment represents a significant market share of 28.34% in 2023 and is projected to grow from $2.32 billion to $3.94 billion. Other frequencies, while smaller, play an increasingly important role in system enhancements.

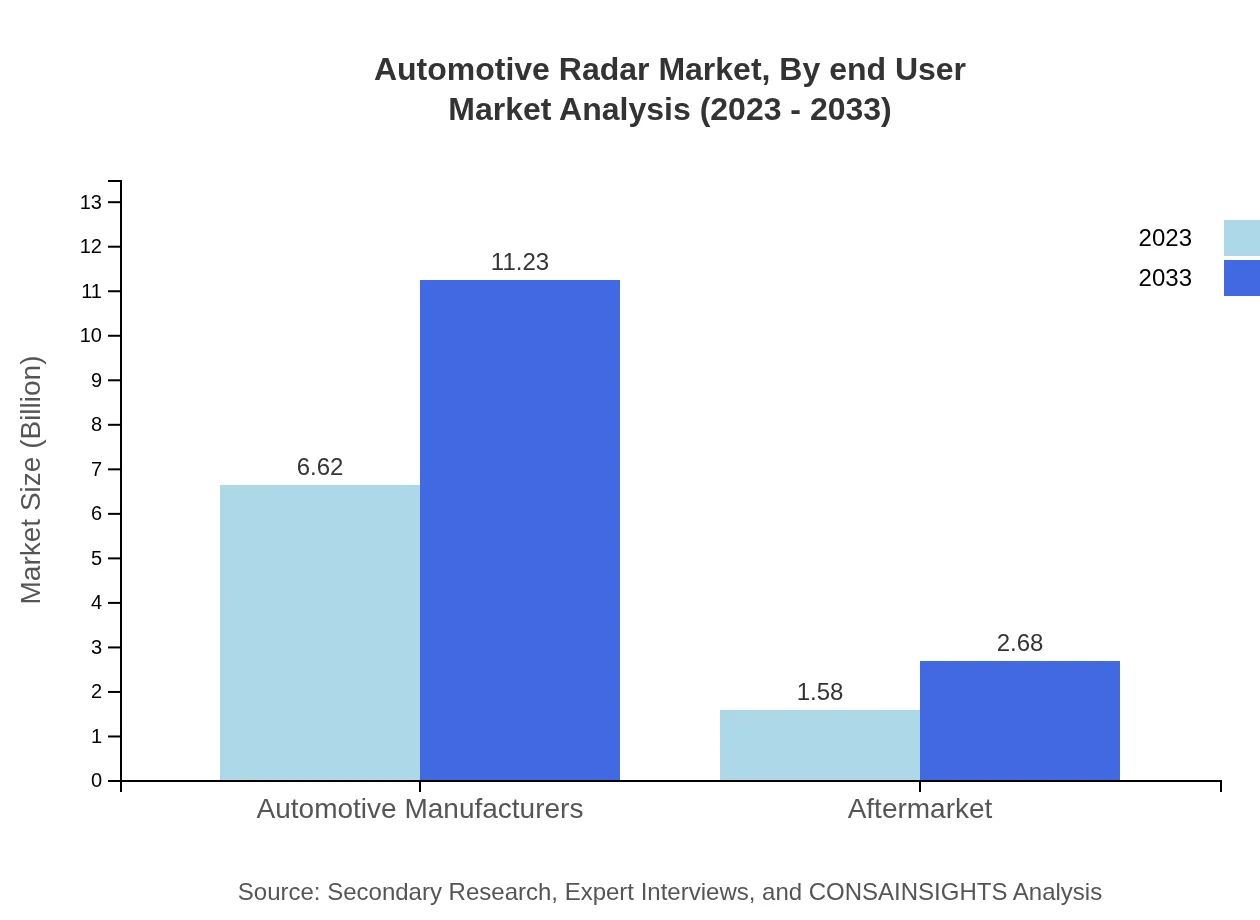

Automotive Radar Market Analysis By End User

The market is largely driven by automotive manufacturers, holding a dominant share of 80.75% in 2023 with revenues of $6.62 billion, expected to rise to $11.23 billion by 2033. The aftermarket segment, accounting for 19.25%, reflects the growing potential for retrofitting safety technologies and increasing consumer demand for enhanced vehicle features.

Automotive Radar Market Analysis By Region

The regional breakdown reveals North America as a leader holding a market share of 46.74% in 2023, increasing its share to the same percentage by 2033. Europe follows with a market share of 20.19%, anticipated to maintain its position in 2033. Asia-Pacific's share accounts for 10.52% in 2023, remaining steady through the analyzed period. The Middle East and Africa as well as Latin America show potential for growth in market share, reflecting increasing adoption rates of advanced automotive technologies.

Automotive Radar Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Radar Industry

Bosch:

A leading global supplier of technology and services, Bosch develops innovative radar technology solutions for the automotive industry, focusing on advanced safety systems and automated driving.Continental AG:

Continental AG is known for its advanced automotive technologies, including radar solutions that enhance vehicle safety and enable automated driving functions.Denso Corporation:

Denso is a key player in automotive electronics and technologies, producing a range of radar systems aimed at improving vehicle safety and efficiency.Valeo:

Specializing in automotive technology, Valeo offers innovative radar and sensor solutions designed for advanced driver assistance and autonomous vehicles.NXP Semiconductors:

NXP provides advanced radar processing solutions and integrated circuits, supporting the growing automotive market's shift towards safety and connectivity.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive radar?

The global automotive radar market size is valued at approximately $8.2 billion in 2023 with a projected CAGR of 5.3%, expected to reach significant growth by 2033. This reflects a growing dependency on advanced radar technology in vehicles.

What are the key market players or companies in the automotive radar industry?

Key players in the automotive radar market include major automotive manufacturers and technology firms. These include companies heavily investing in R&D and various radar technologies to enhance vehicular safety and automation in the industry.

What are the primary factors driving the growth in the automotive radar industry?

Growth in the automotive radar industry is primarily driven by rising safety regulations, an increase in demand for advanced driver-assistance systems (ADAS), and the rapid development of autonomous vehicles, which rely heavily on radar technology for functionality.

Which region is the fastest Growing in the automotive radar?

North America is the fastest-growing region in the automotive radar market, with its 2023 market size at $2.65 billion. By 2033, it is projected to grow to $4.49 billion, reflecting robust investments in vehicle safety technologies.

Does ConsaInsights provide customized market report data for the automotive radar industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the automotive radar industry, allowing clients to gain detailed insights and strategic guidance based on their unique market conditions and requirements.

What deliverables can I expect from this automotive radar market research project?

Deliverables from the automotive radar market research project typically include comprehensive market analysis reports, growth forecasts, competitive landscape assessment, trend analysis, and actionable insights to aid in strategic decision-making efforts.

What are the market trends of automotive radar?

Current market trends in automotive radar include increasing adoption of short-range and long-range radar technologies, focus on enhancing safety features in vehicles, and innovation in frequency bands including 24 GHz and 77 GHz for improved performance.