Automotive Refinish Coatings Market Report

Published Date: 02 February 2026 | Report Code: automotive-refinish-coatings

Automotive Refinish Coatings Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automotive Refinish Coatings market from 2023 to 2033, highlighting key trends, market dynamics, and forecasts. It aims to equip stakeholders with vital insights for informed decision-making and strategy formulation.

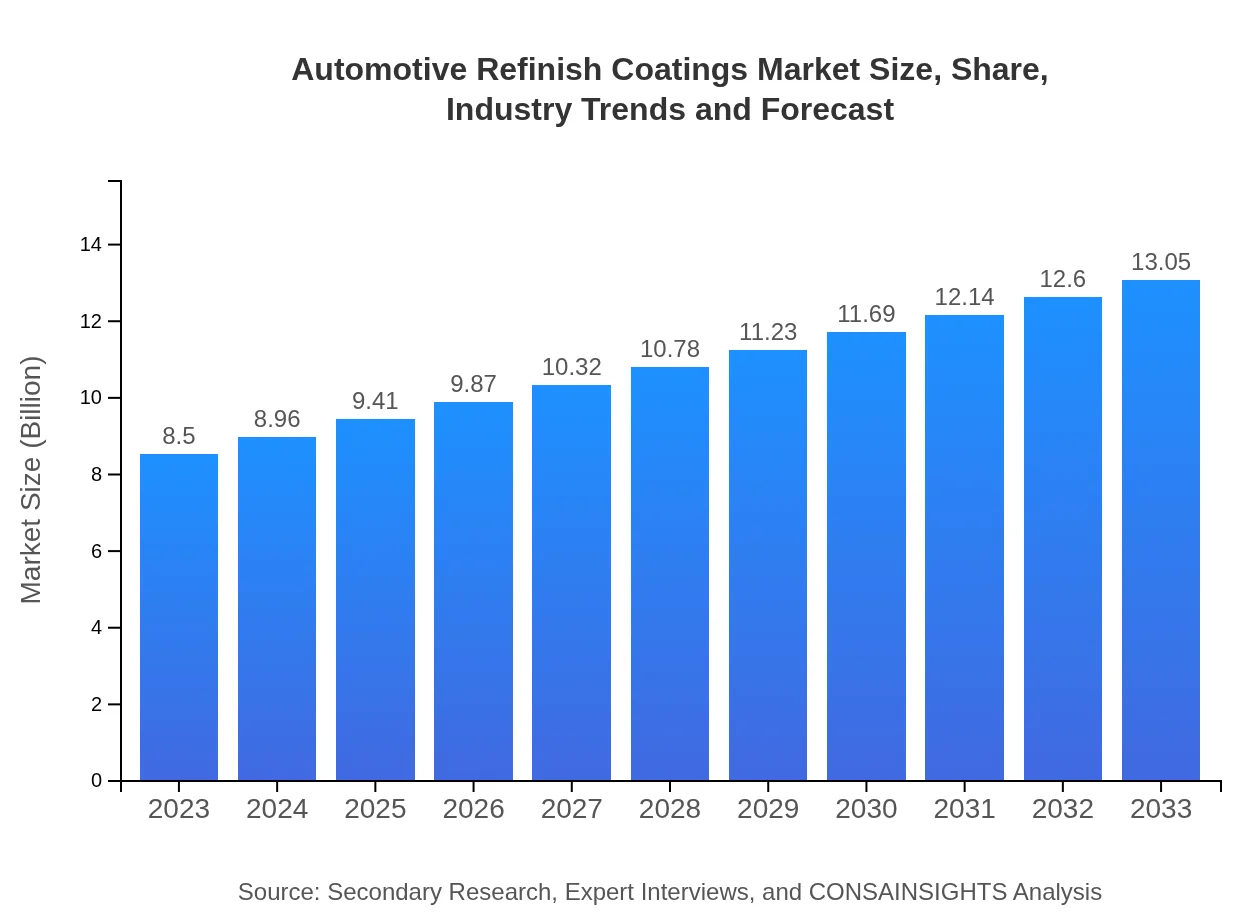

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 4.3% |

| 2033 Market Size | $13.05 Billion |

| Top Companies | PPG Industries, Inc., Axalta Coating Systems Ltd., BASF SE, Sherwin-Williams Company |

| Last Modified Date | 02 February 2026 |

Automotive Refinish Coatings Market Overview

Customize Automotive Refinish Coatings Market Report market research report

- ✔ Get in-depth analysis of Automotive Refinish Coatings market size, growth, and forecasts.

- ✔ Understand Automotive Refinish Coatings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Refinish Coatings

What is the Market Size & CAGR of Automotive Refinish Coatings market in 2023?

Automotive Refinish Coatings Industry Analysis

Automotive Refinish Coatings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Refinish Coatings Market Analysis Report by Region

Europe Automotive Refinish Coatings Market Report:

Europe's automotive refinish coatings market, valued at $2.38 billion in 2023, is expected to reach $3.65 billion by 2033. The region emphasizes sustainable practices and innovation, with an increasing focus on low-VOC coatings. The presence of prominent automotive manufacturers correlates with substantial market opportunities.Asia Pacific Automotive Refinish Coatings Market Report:

The Asia Pacific region is expected to show significant growth, with a market size of $1.64 billion in 2023 projected to reach $2.52 billion by 2033. This growth is primarily fueled by increasing automotive production, notably in countries like China and India, which are investing heavily in their automotive sectors. The growing middle class and their desire for vehicle ownership also drive demand for refinish coatings.North America Automotive Refinish Coatings Market Report:

North America generated a market size of $2.76 billion in 2023, projected to increase to $4.24 billion by 2033. The growth can be attributed to high vehicle ownership rates and established automotive aftermarket segments. Stringent environmental regulations also drive the adoption of advanced coatings technologies in this region.South America Automotive Refinish Coatings Market Report:

In South America, the automotive refinish coatings market size is currently valued at $0.70 billion and is expected to grow to $1.07 billion by 2033. The rise in urbanization, coupled with a growing automotive aftermarket, propels the demand for refinish coatings in this region. Challenges such as economic fluctuations and regulatory frameworks may influence market trends.Middle East & Africa Automotive Refinish Coatings Market Report:

The Middle East and Africa region's market size is set to grow from $1.02 billion in 2023 to $1.56 billion by 2033. The rise in vehicle repair and maintenance services and the developing automotive industry in countries like South Africa and the UAE highlight the region's potential for growth.Tell us your focus area and get a customized research report.

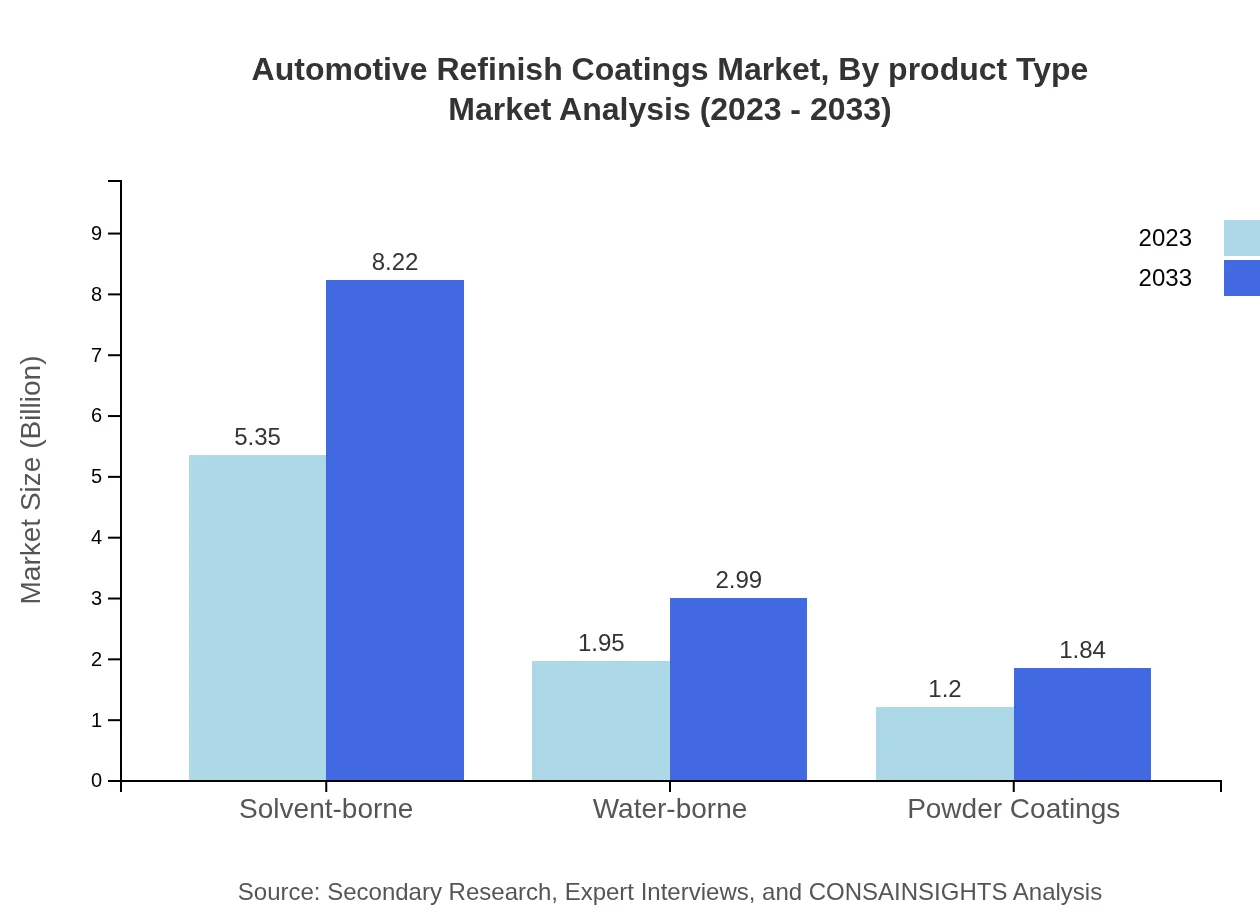

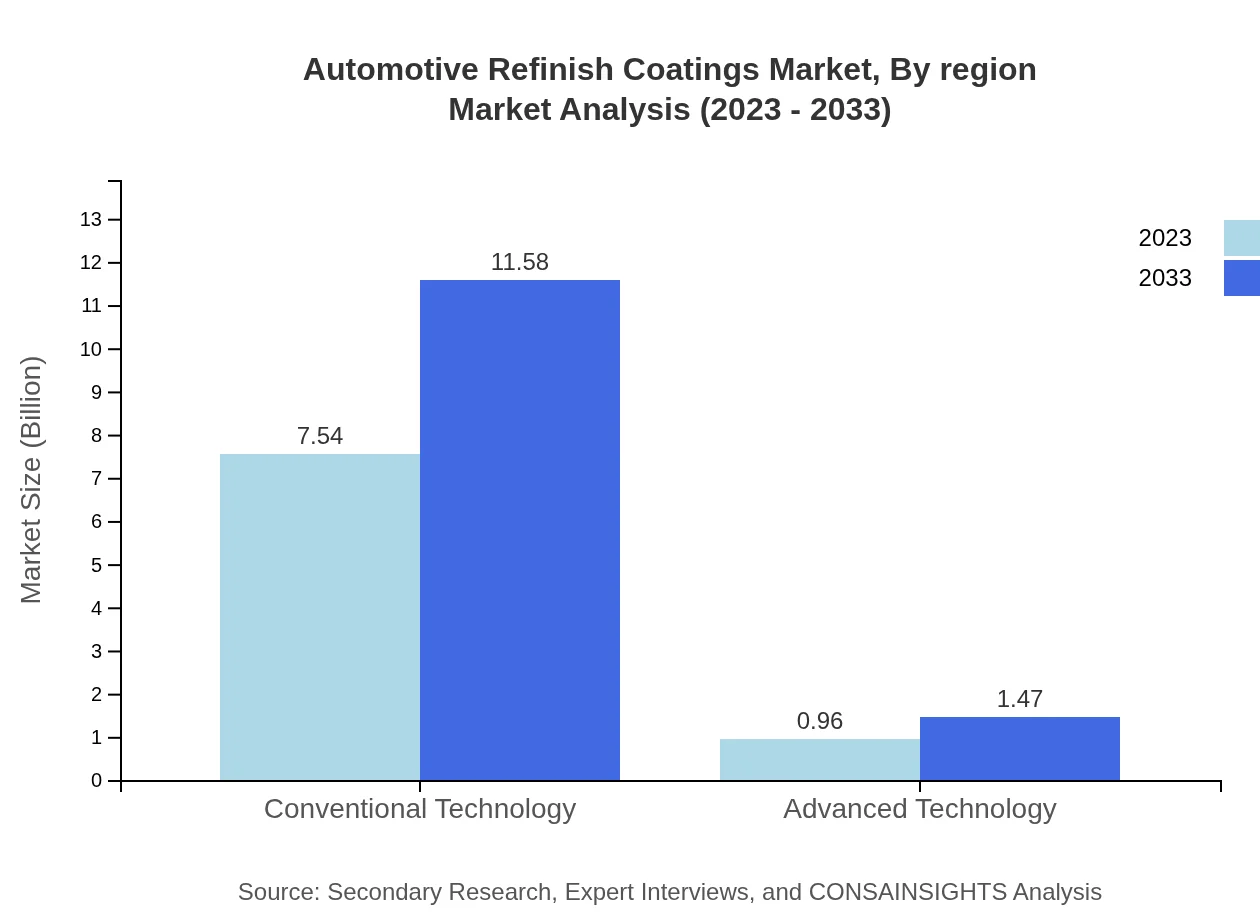

Automotive Refinish Coatings Market Analysis By Product Type

The Automotive Refinish Coatings market is primarily segmented by product type, with solvent-borne coatings leading the market at $5.35 billion in 2023, anticipated to grow to $8.22 billion by 2033. Water-borne coatings, valued at $1.95 billion in 2023, are expected to rise to $2.99 billion due to a shift towards environmentally friendly solutions. Powder coatings, with an estimated market size of $1.20 billion in 2023, are projected to increase to $1.84 billion, propelled by their durability and low environmental impact.

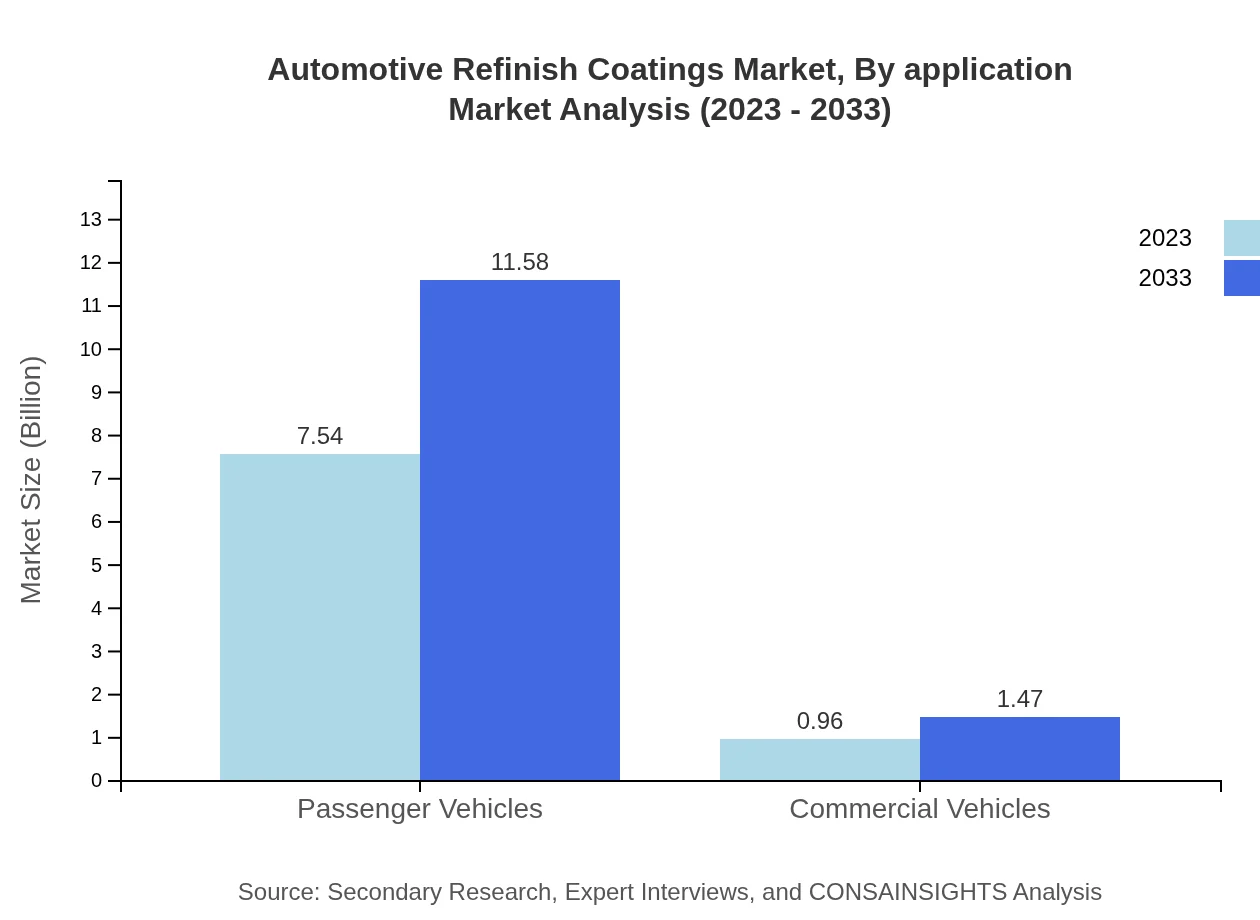

Automotive Refinish Coatings Market Analysis By Application

The market is segmented by application into passenger vehicles and commercial vehicles. Passenger vehicles dominate the segment, with a market size of $7.54 billion in 2023, expected to reach $11.58 billion by 2033. The commercial vehicle segment, with a current valuation of $0.96 billion, is projected to grow to $1.47 billion, driven by increasing logistics and transportation sectors.

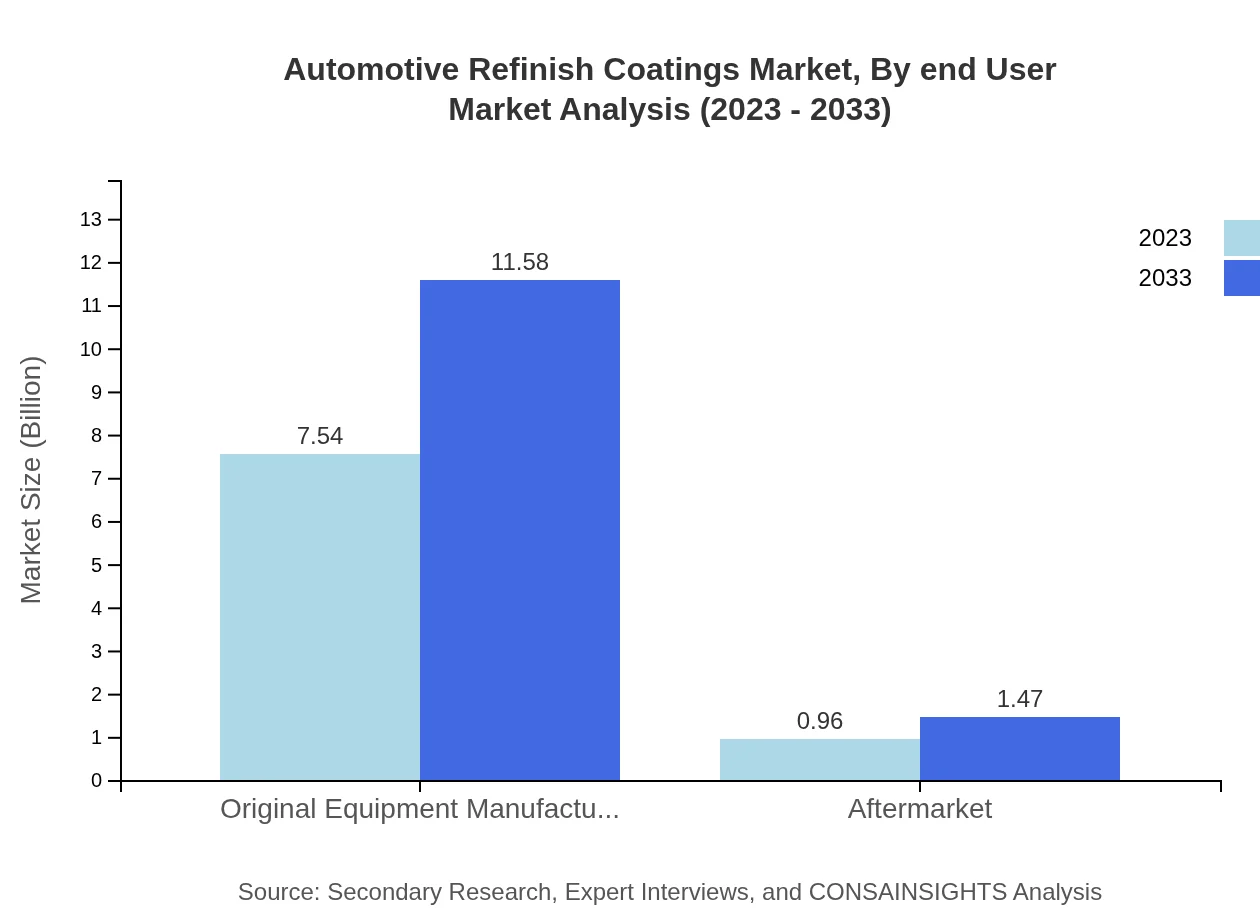

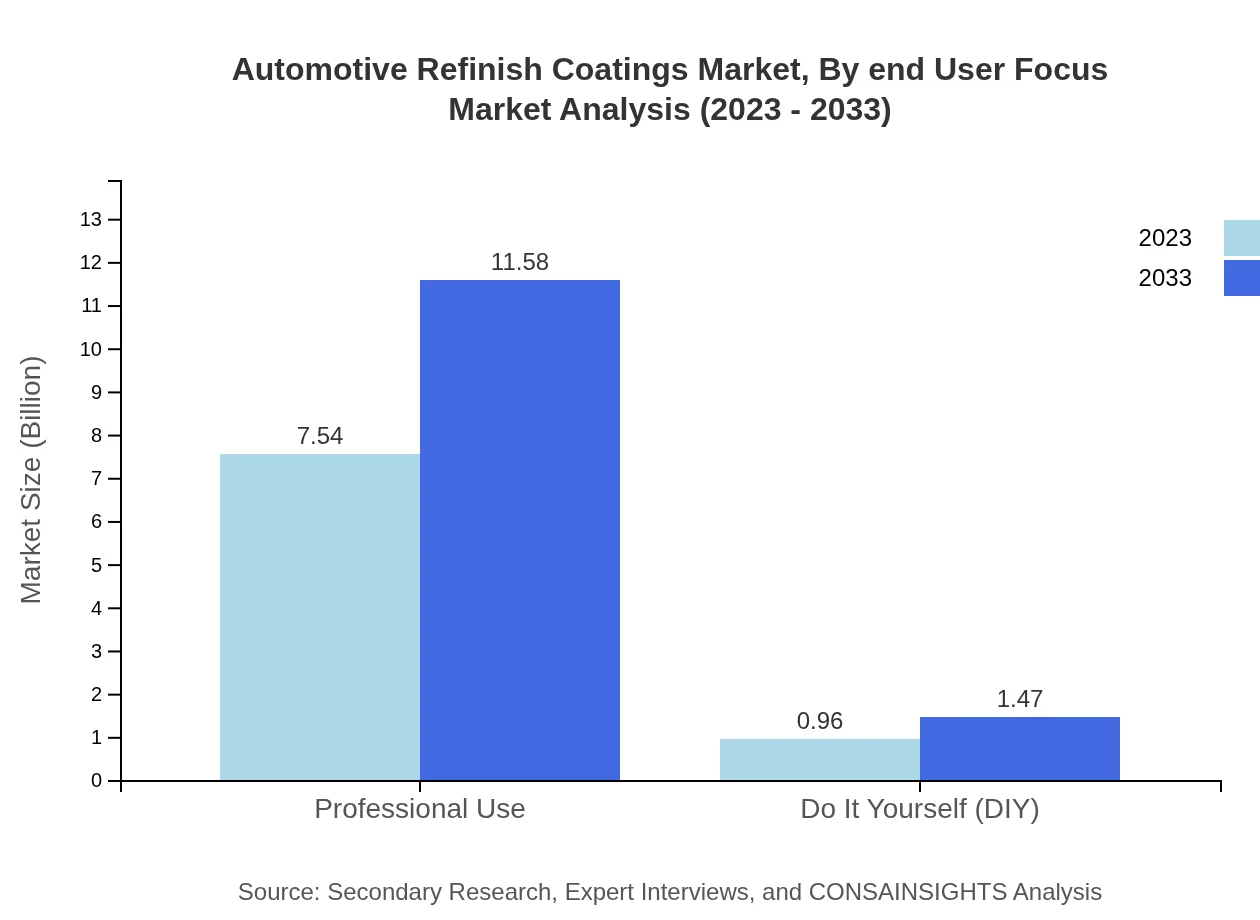

Automotive Refinish Coatings Market Analysis By End User

The segmentation by end-user focuses on professional use and do-it-yourself (DIY) applications. Professional use dominates the market, valued at $7.54 billion in 2023 and projected to witness significant growth to $11.58 billion by 2033. DIY applications, currently at $0.96 billion, are projected to grow to $1.47 billion, influenced by rising trends in consumer-led automotive maintenance.

Automotive Refinish Coatings Market Analysis By Region

Regional segmentation shows varying dominance across the global market. Asia Pacific and North America are anticipated to contribute significantly, with emerging markets in South America and the Middle East and Africa presenting additional growth potential.

Automotive Refinish Coatings Market Analysis By End User Focus

The market's focus segment evaluates the strategic approaches of leaders in the sector who emphasize both traditional and innovative solutions to meet customer demands while addressing environmental and regulatory pressures.

Automotive Refinish Coatings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Refinish Coatings Industry

PPG Industries, Inc.:

A leading global manufacturer of coatings and specialty materials, PPG is renowned for its innovation in automotive coatings and commitment to sustainability.Axalta Coating Systems Ltd.:

Axalta specializes in automotive coatings and provides cutting-edge solutions focusing on innovation and sustainability to reduce environmental impact.BASF SE:

BASF is a global player in specialty chemicals with a strong focus on automotive refinish coatings, known for high-performance and eco-friendly product lines.Sherwin-Williams Company:

With a rich history in coatings, Sherwin-Williams offers a diverse range of automotive refinish products, focusing on quality and extensive customer service.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Refinish Coatings?

The automotive refinish coatings market is valued at approximately $8.5 billion in 2023, with a projected CAGR of 4.3%. By 2033, the market is expected to grow significantly, driven by increasing automotive sales and repair demand.

What are the key market players or companies in the automotive Refinish Coatings industry?

Key players in the automotive refinish coatings market include large companies such as PPG Industries, Sherwin-Williams, BASF, AkzoNobel, and RPM International. These companies lead the way in product innovation and market reach.

What are the primary factors driving the growth in the automotive Refinish Coatings industry?

Growth in the automotive refinish coatings industry is primarily driven by rising vehicle ownership, increasing road accidents, demand for vehicle repair and maintenance, and advancements in coating technologies that enhance durability and finish.

Which region is the fastest Growing in the automotive Refinish Coatings?

The region of North America is currently the fastest-growing in the automotive refinish coatings market, with market size projected to expand from $2.76 billion in 2023 to $4.24 billion by 2033, reflecting a robust automotive industry.

Does ConsaInsights provide customized market report data for the automotive Refinish Coatings industry?

Yes, ConsaInsights offers customized market report data for the automotive refinish coatings industry. Clients can request tailored insights based on specific geographic, product, or market segment analysis.

What deliverables can I expect from this automotive Refinish Coatings market research project?

Expect comprehensive deliverables like market size analysis, growth forecasts, competitive landscape assessments, trends identification, and segment breakdowns across various categories within the automotive refinish coatings industry.

What are the market trends of automotive Refinish Coatings?

Current trends in the automotive refinish coatings market include a shift towards eco-friendly coatings, growing popularity of water-borne and powder coatings, and increased use of advanced technology coatings that offer better performance and sustainability.