Automotive Safety Technology Market Report

Published Date: 02 February 2026 | Report Code: automotive-safety-technology

Automotive Safety Technology Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the automotive safety technology market, including market trends, size, segments, and region-wise insights with forecasts ranging from 2023 to 2033.

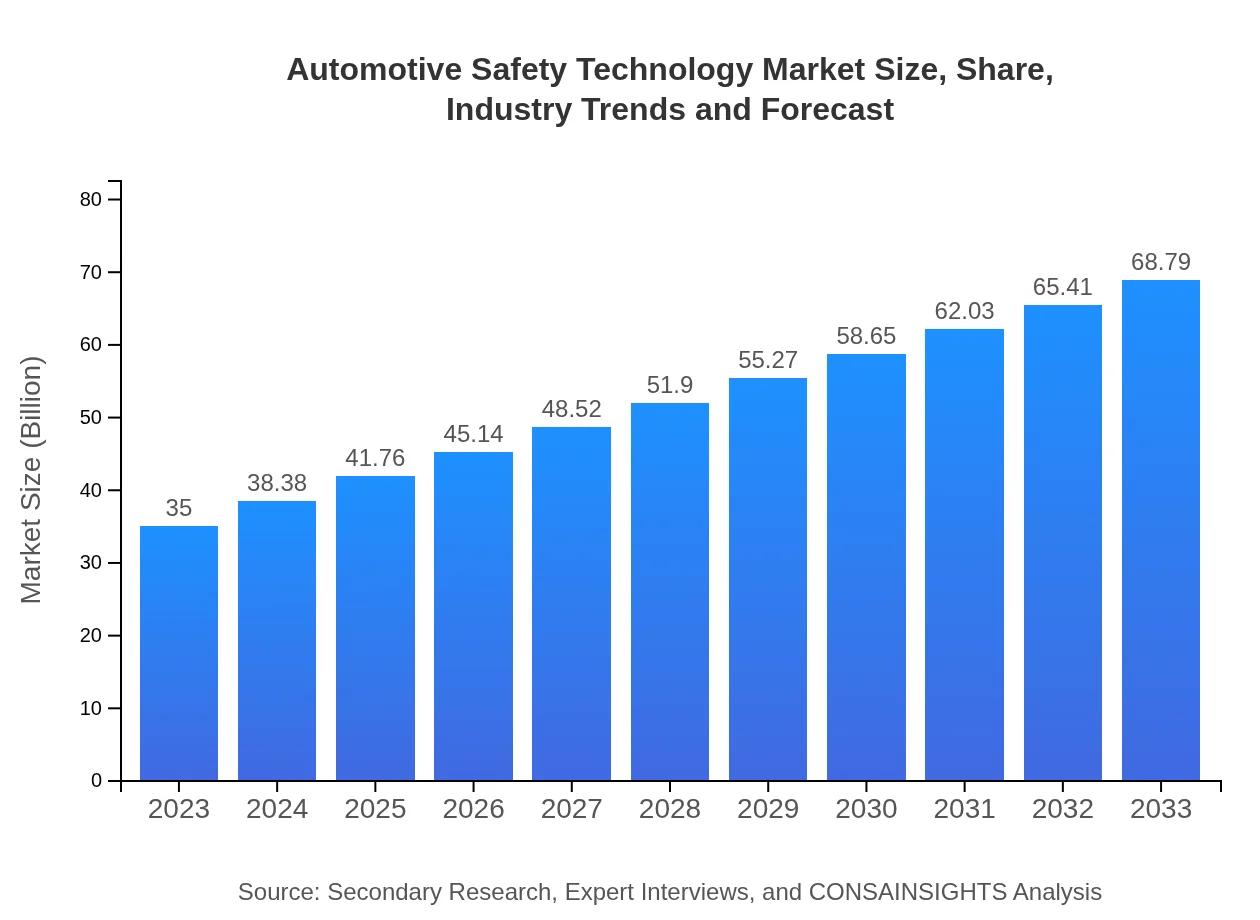

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $35.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $68.79 Billion |

| Top Companies | Continental AG, Daimler AG, Toyota Motor Corporation, Robert Bosch GmbH, Volvo Cars |

| Last Modified Date | 02 February 2026 |

Automotive Safety Technology Market Overview

Customize Automotive Safety Technology Market Report market research report

- ✔ Get in-depth analysis of Automotive Safety Technology market size, growth, and forecasts.

- ✔ Understand Automotive Safety Technology's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Safety Technology

What is the Market Size & CAGR of Automotive Safety Technology market in 2023?

Automotive Safety Technology Industry Analysis

Automotive Safety Technology Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Safety Technology Market Analysis Report by Region

Europe Automotive Safety Technology Market Report:

The European market for automotive safety technology is expected to expand from $9.11 billion in 2023 to $17.91 billion by 2033, driven by stringent safety regulations and increased demand for technologically advanced safety systems in passenger and commercial vehicles.Asia Pacific Automotive Safety Technology Market Report:

The Asia Pacific region holds a significant share of the automotive safety technology market, valued at $6.79 billion in 2023 and projected to reach $13.34 billion by 2033. Growing vehicle production, increased awareness of vehicle safety, and government initiatives supporting safety regulations drive this growth in countries like China and Japan.North America Automotive Safety Technology Market Report:

North America remains the largest market, valued at $12.51 billion in 2023, with projections of reaching $24.59 billion by 2033. Robust regulatory frameworks, high disposable income, and a focus on advanced safety features have positioned this region as a leader in automotive safety technology.South America Automotive Safety Technology Market Report:

The South America automotive safety technology market is expected to grow from $2.27 billion in 2023 to $4.46 billion in 2033. With increasing vehicle sales and rising safety concerns among consumers, investment in automotive safety solutions is gradually gaining momentum in this region.Middle East & Africa Automotive Safety Technology Market Report:

The Middle East and Africa automotive safety technology market, valued at $4.32 billion in 2023, is forecasted to grow to $8.49 billion by 2033. Rising road safety awareness, improved vehicle safety regulations, and new vehicle sales in countries such as South Africa and the UAE are key growth drivers.Tell us your focus area and get a customized research report.

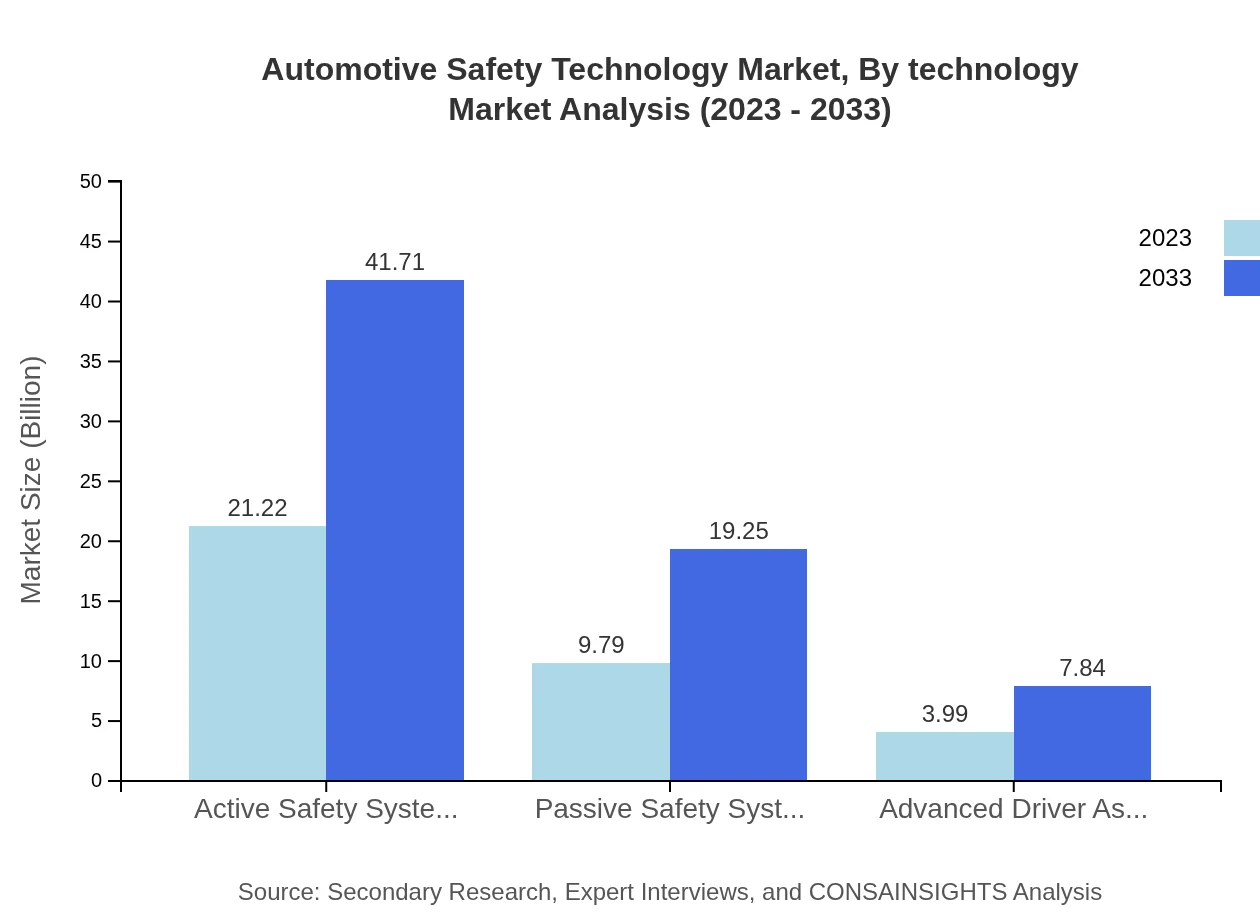

Automotive Safety Technology Market Analysis By Technology

The automotive safety technology sector is primarily driven by active safety systems, which have a market size of $21.22 billion in 2023 and are projected to reach $41.71 billion by 2033. Passive safety systems and advanced driver assistance systems (ADAS) also play significant roles, with market sizes of $9.79 billion and $3.99 billion in 2023, respectively. Each technology segment contributes uniquely to enhancing overall vehicle safety.

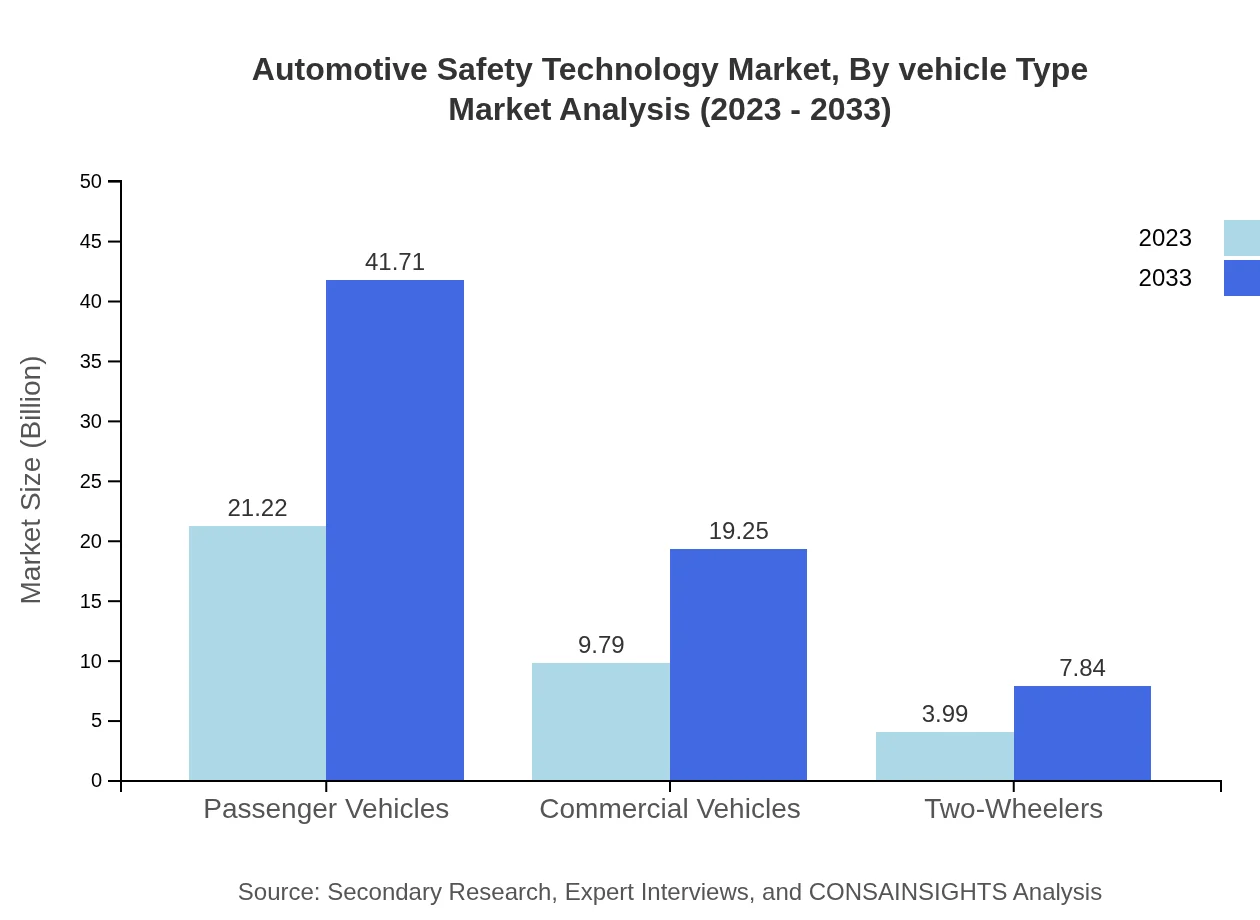

Automotive Safety Technology Market Analysis By Vehicle Type

In terms of vehicle type, passenger vehicles dominate with a market of $21.22 billion in 2023, expected to rise to $41.71 billion by 2033. Commercial vehicles and two-wheelers also represent important segments, with commercial vehicles valued at $9.79 billion and two-wheelers at $3.99 billion in 2023. The significance of safety technologies in these segments is increasingly recognized.

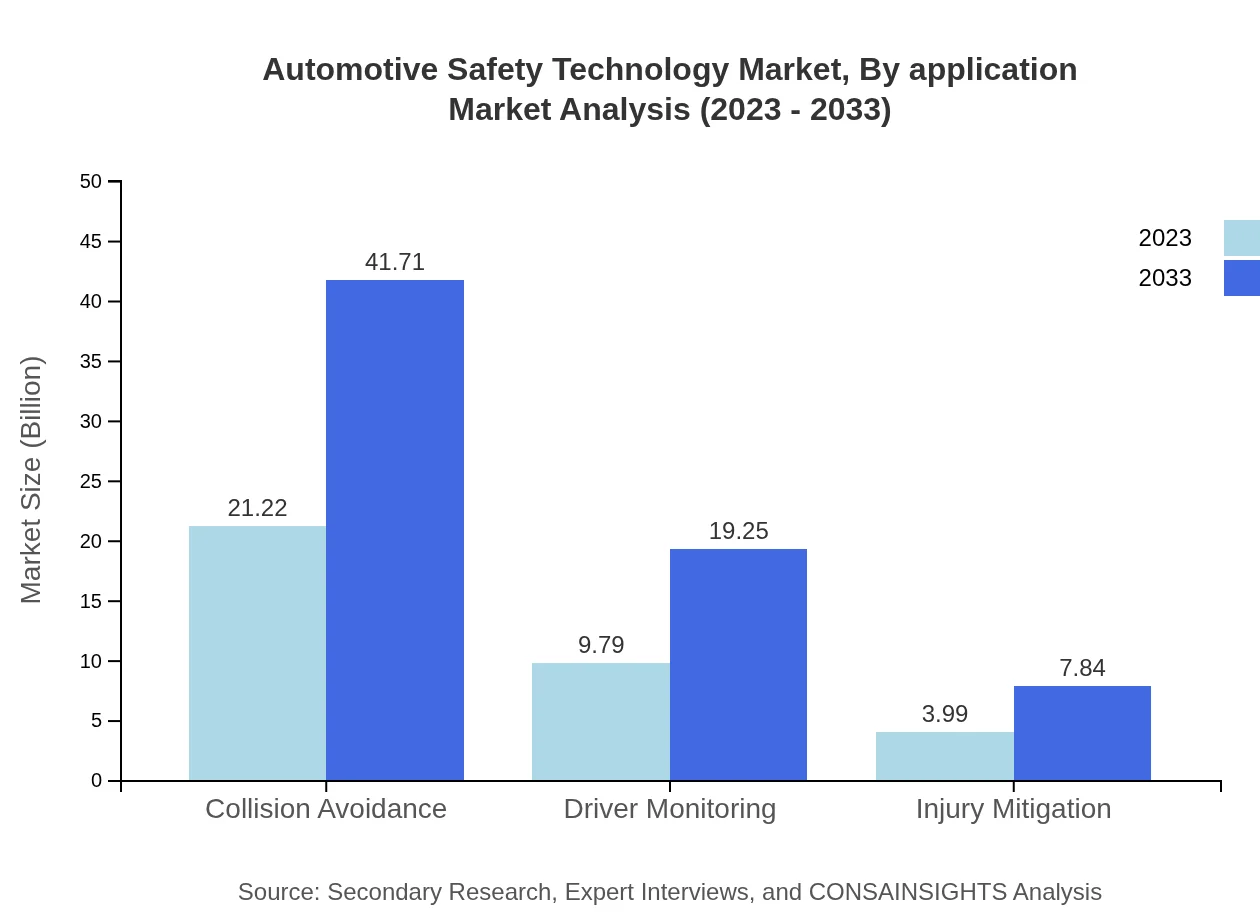

Automotive Safety Technology Market Analysis By Application

The automotive safety technology market can be segmented by application, with collision avoidance technologies leading at $21.22 billion in 2023, forecasted to reach $41.71 billion by 2033. Other applications in this sphere include driver monitoring and injury mitigation, showing vital growth in the context of enhancing passenger safety.

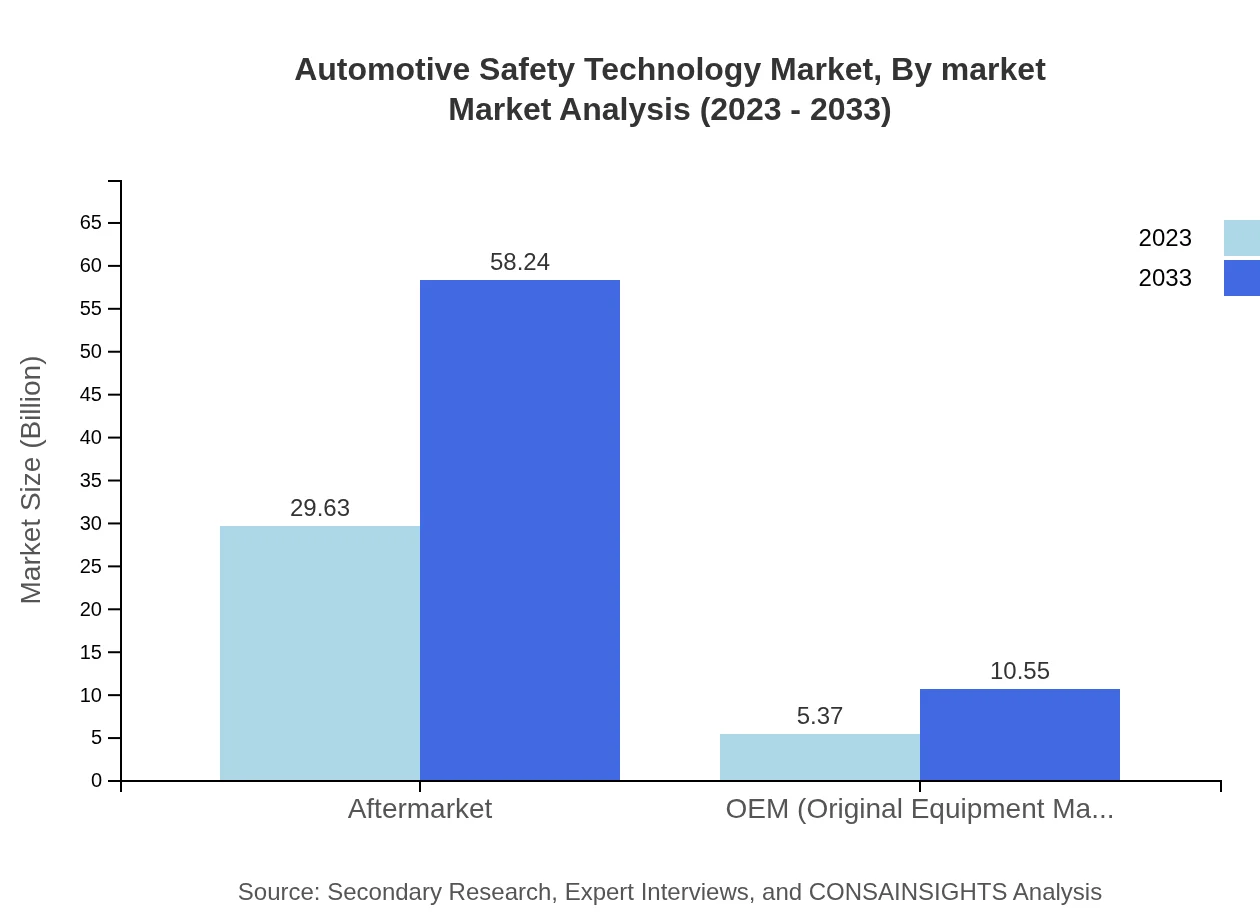

Automotive Safety Technology Market Analysis By Market

The market comprises two main segments – OEM (Original Equipment Manufacturer) and aftermarket. The aftermarket segment is substantial, valued at $29.63 billion in 2023 and projected to grow to $58.24 billion by 2033. In comparison, OEM has a size of $5.37 billion in 2023, expected to reach $10.55 billion by 2033.

Automotive Safety Technology Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Safety Technology Industry

Continental AG:

A leading global supplier of automotive safety systems, Continental AG develops innovative solutions, including advanced braking systems, driver assistance systems, and vehicle dynamics controllers.Daimler AG:

Daimler AG focuses on enhancing vehicle safety as part of their vehicle production, incorporating advanced safety features across their luxury vehicles and trucks.Toyota Motor Corporation:

Toyota is a pioneer in integrating safety technologies in their vehicles, consistently investing in research and development to improve their active and passive safety systems.Robert Bosch GmbH:

Bosch supplies a range of automotive technologies, including sensors, safety systems, and software solutions that enhance vehicle safety.Volvo Cars:

Renowned for its emphasis on safety, Volvo Cars implements advanced safety technologies into their vehicles to minimize accidents and enhance occupant protection.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Safety Technology?

The automotive safety technology market is currently valued at approximately $35 billion and is projected to grow at a compounded annual growth rate (CAGR) of 6.8% from 2023 to 2033, indicating robust growth potential in the sector.

What are the key market players or companies in the automotive Safety Technology industry?

Key players in the automotive safety technology sector include major manufacturers like Bosch, Continental AG, and Autoliv. These companies are at the forefront of innovation, continuously enhancing safety systems in vehicles.

What are the primary factors driving the growth in the automotive Safety Technology industry?

The growth is primarily driven by increasing consumer demand for vehicle safety features, stringent government regulations promoting safety standards, and advancements in technology such as ADAS and collision avoidance systems.

Which region is the fastest Growing in the automotive Safety Technology market?

North America is the fastest-growing region in the automotive safety technology market, with its market size projected to increase from $12.51 billion in 2023 to $24.59 billion by 2033, showcasing significant demand.

Does ConsaInsights provide customized market report data for the automotive Safety Technology industry?

Yes, Consainsights offers customized market reports tailored to client specifications in the automotive safety technology sector, ensuring that businesses get relevant data and insights specific to their needs.

What deliverables can I expect from this automotive Safety Technology market research project?

Deliverables include detailed market analysis reports, trend forecasts, competitive landscape assessments, and segment-wise data that will aid decision-making strategies for stakeholders in the automotive industry.

What are the market trends of automotive Safety Technology?

Current trends in automotive safety technology include the increasing adoption of active safety systems, integration of AI for driver monitoring, and a shift towards sustainable technology, enhancing vehicle safety and user experience.