Automotive Sensors Market Report

Published Date: 02 February 2026 | Report Code: automotive-sensors

Automotive Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automotive Sensors market, offering insights into its size, growth forecasts, technological advancements, and key players from 2023 to 2033.

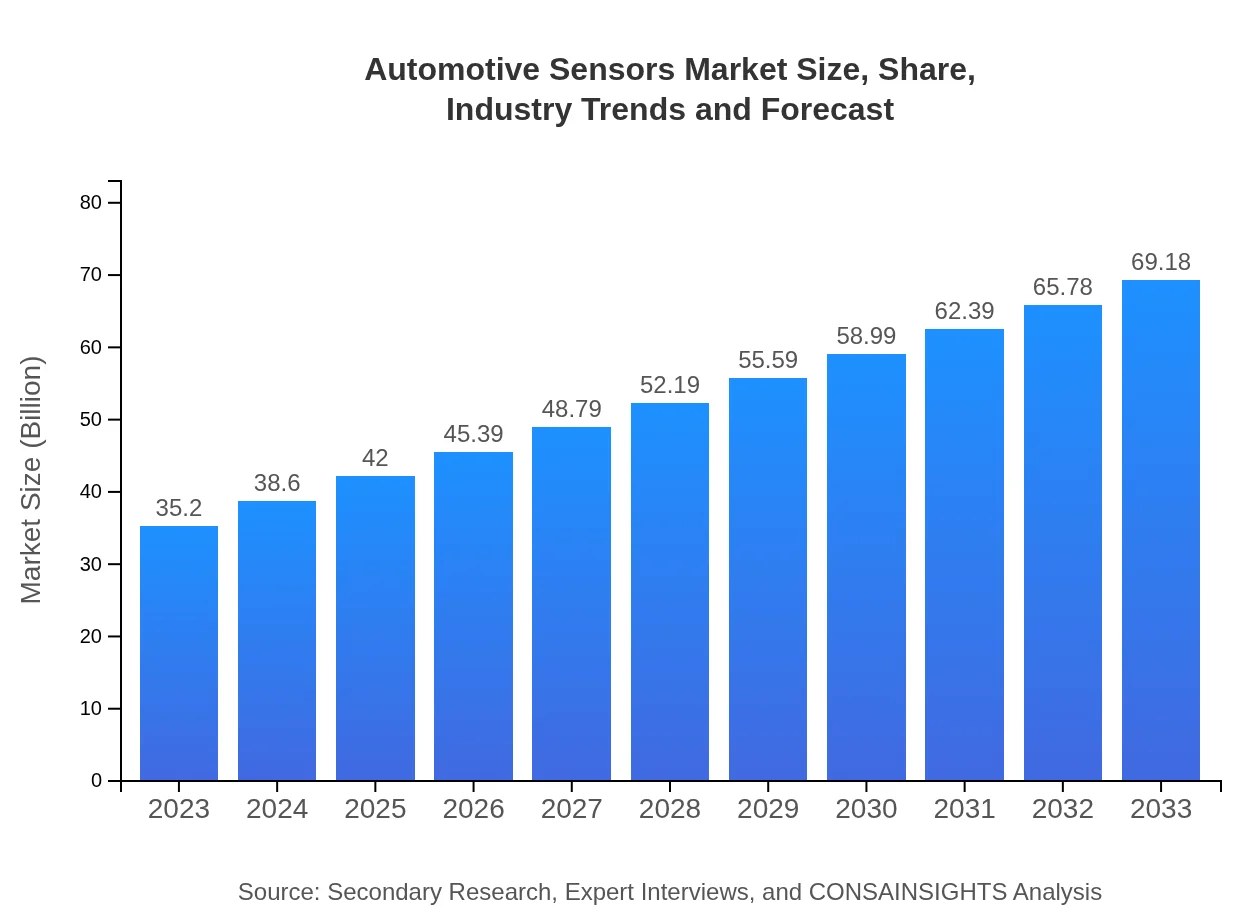

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $35.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $69.18 Billion |

| Top Companies | Bosch, Denso Corporation, Continental AG, Delphi Technologies, STMicroelectronics |

| Last Modified Date | 02 February 2026 |

Automotive Sensors Market Overview

Customize Automotive Sensors Market Report market research report

- ✔ Get in-depth analysis of Automotive Sensors market size, growth, and forecasts.

- ✔ Understand Automotive Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Sensors

What is the Market Size & CAGR of Automotive Sensors market in 2023?

Automotive Sensors Industry Analysis

Automotive Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Sensors Market Analysis Report by Region

Europe Automotive Sensors Market Report:

Europe is another critical region, with the market valued at $9.22 billion in 2023, expected to reach $18.13 billion by 2033. The EU's stringent environmental regulations and push for sustainable technologies are leading automotive manufacturers to integrate advanced sensors into their vehicles.Asia Pacific Automotive Sensors Market Report:

The Asia Pacific region is experiencing robust growth in the Automotive Sensors market, with a market size of $6.96 billion in 2023, projected to double to $13.68 billion by 2033. Countries like China and Japan are leading the charge, driven by increasing automotive production and a burgeoning demand for EVs and advanced safety features.North America Automotive Sensors Market Report:

North America holds a significant position in the Automotive Sensors market, with a size of $12.44 billion in 2023, forecasted to reach $24.44 billion by 2033. The U.S. is driving this growth, with a strong emphasis on ADAS, connected vehicles, and EV technology.South America Automotive Sensors Market Report:

In South America, the market is currently valued at $1.78 billion and is expected to grow to $3.50 billion by 2033. The growth drivers include rising automotive sales and improvements in road safety regulations, particularly in Brazil and Argentina.Middle East & Africa Automotive Sensors Market Report:

The Middle East and Africa market is smaller but growing rapidly, projected to expand from $4.80 billion in 2023 to $9.43 billion by 2033. This growth can be attributed to increasing investments in automotive infrastructure and rising consumer demand for safety features.Tell us your focus area and get a customized research report.

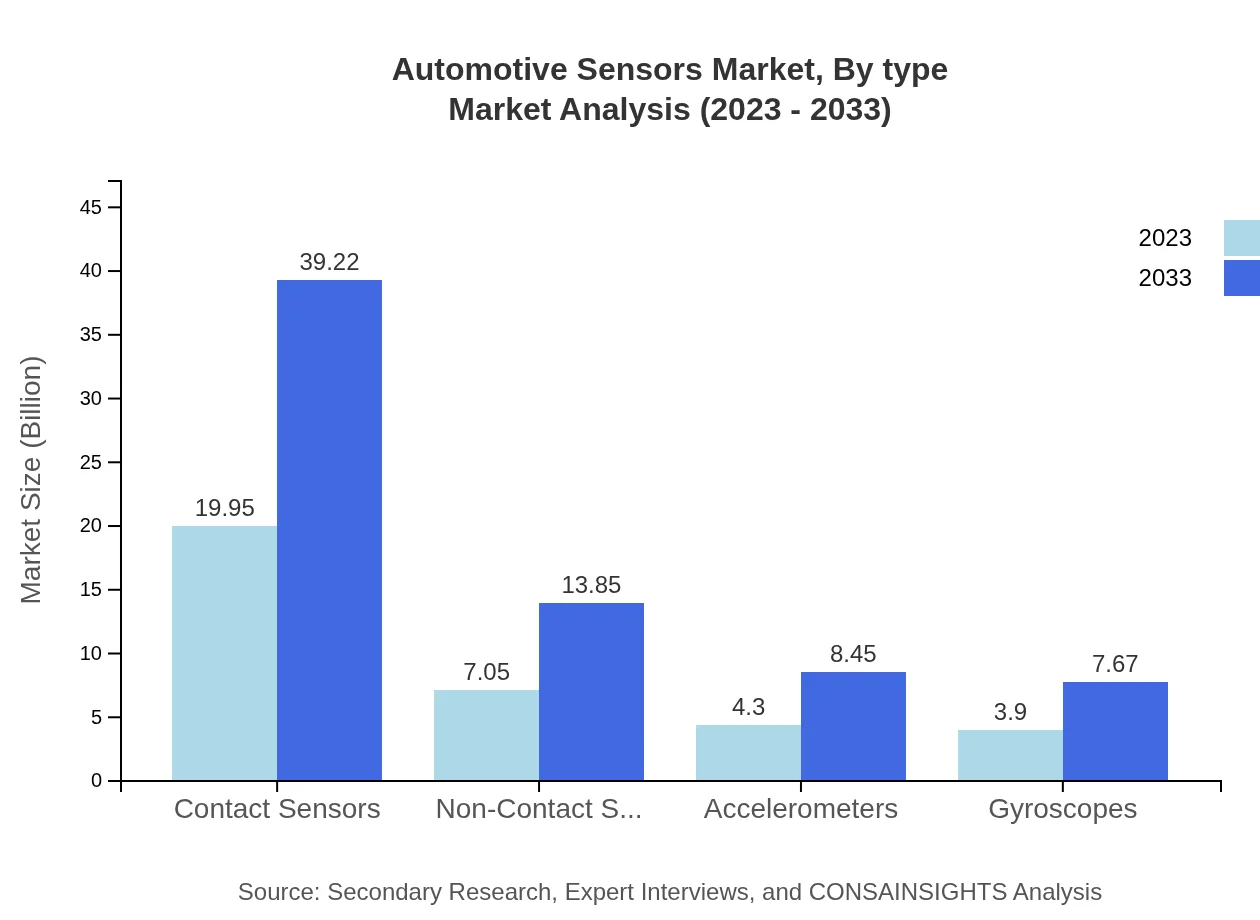

Automotive Sensors Market Analysis By Type

The market can be divided into contact and non-contact sensors. Contact sensors are expected to grow significantly, from $19.95 billion in 2023 to $39.22 billion by 2033, accounting for a 66.4% market share. Non-contact sensors are projected to grow from $7.05 billion to $13.85 billion, capturing a 20.02% share by 2033.

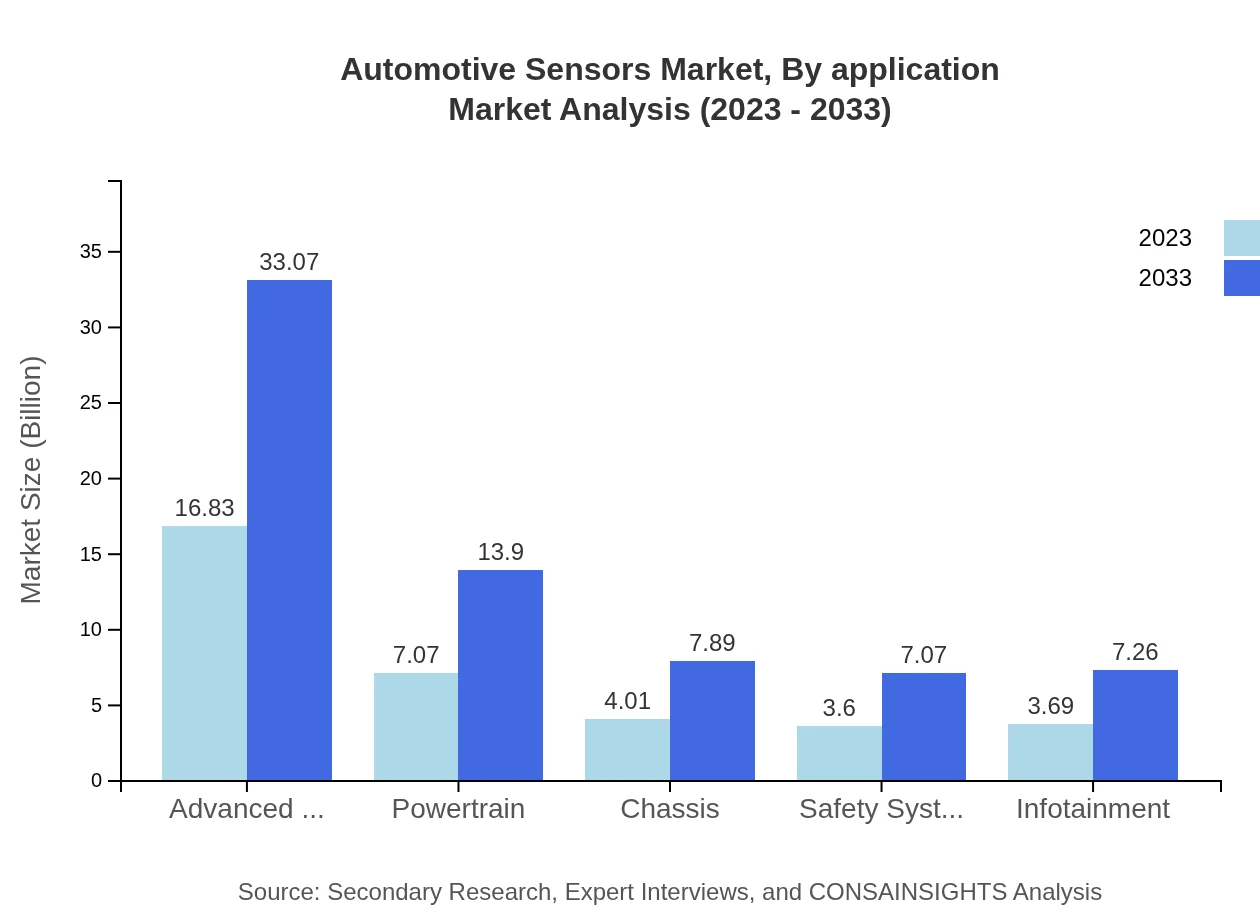

Automotive Sensors Market Analysis By Application

In terms of applications, Advanced Driver-Assistance Systems (ADAS) dominate, expected to grow from $16.83 billion in 2023 to $33.07 billion by 2033. Other applications like infotainment and powertrain systems are also significant, indicating a trend towards more integrated vehicle systems.

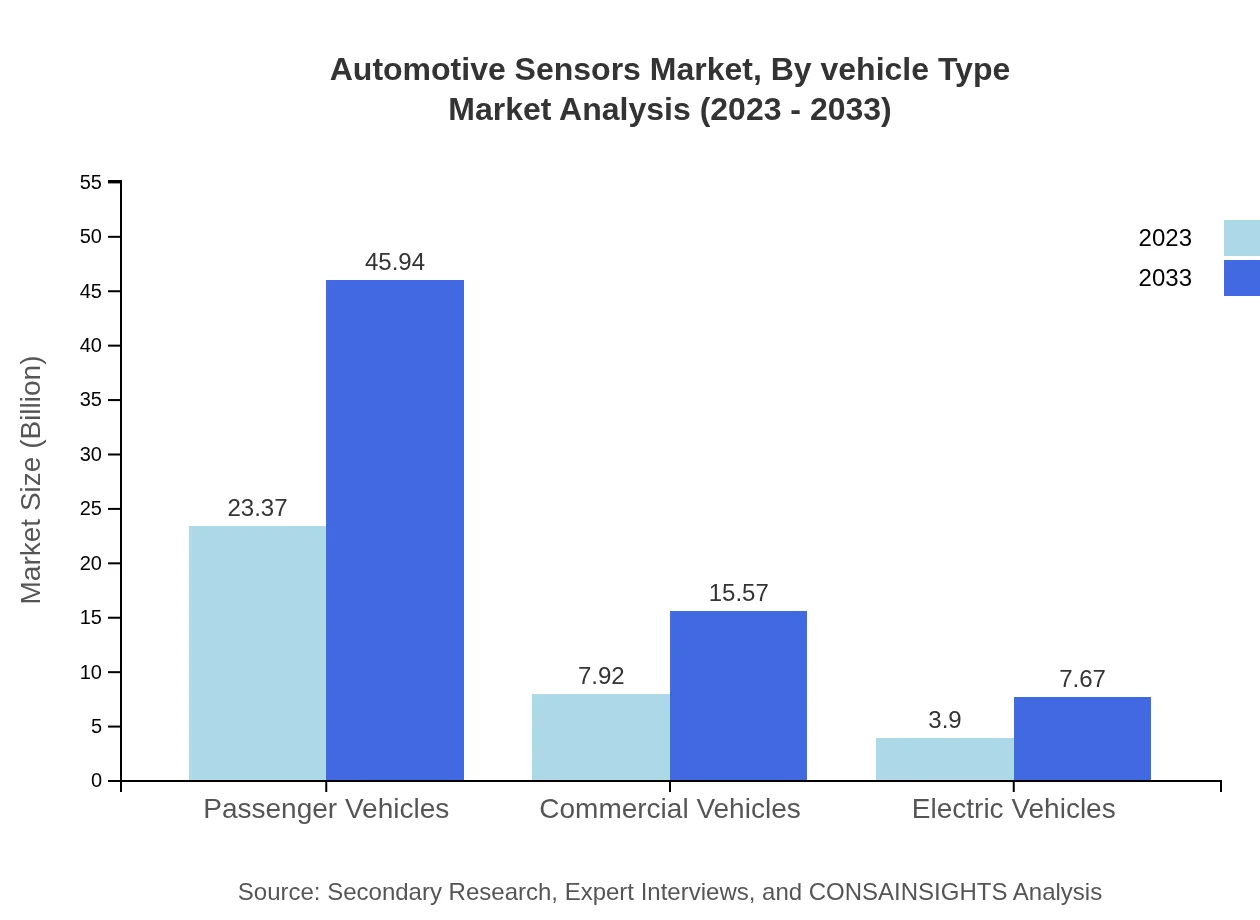

Automotive Sensors Market Analysis By Vehicle Type

The market is segmented by vehicle type, with passenger vehicles leading at $23.37 billion in 2023 and projected to grow to $45.94 billion by 2033, while commercial vehicles and electric vehicles are also on the rise, reflecting changes in consumer behavior and industry standards.

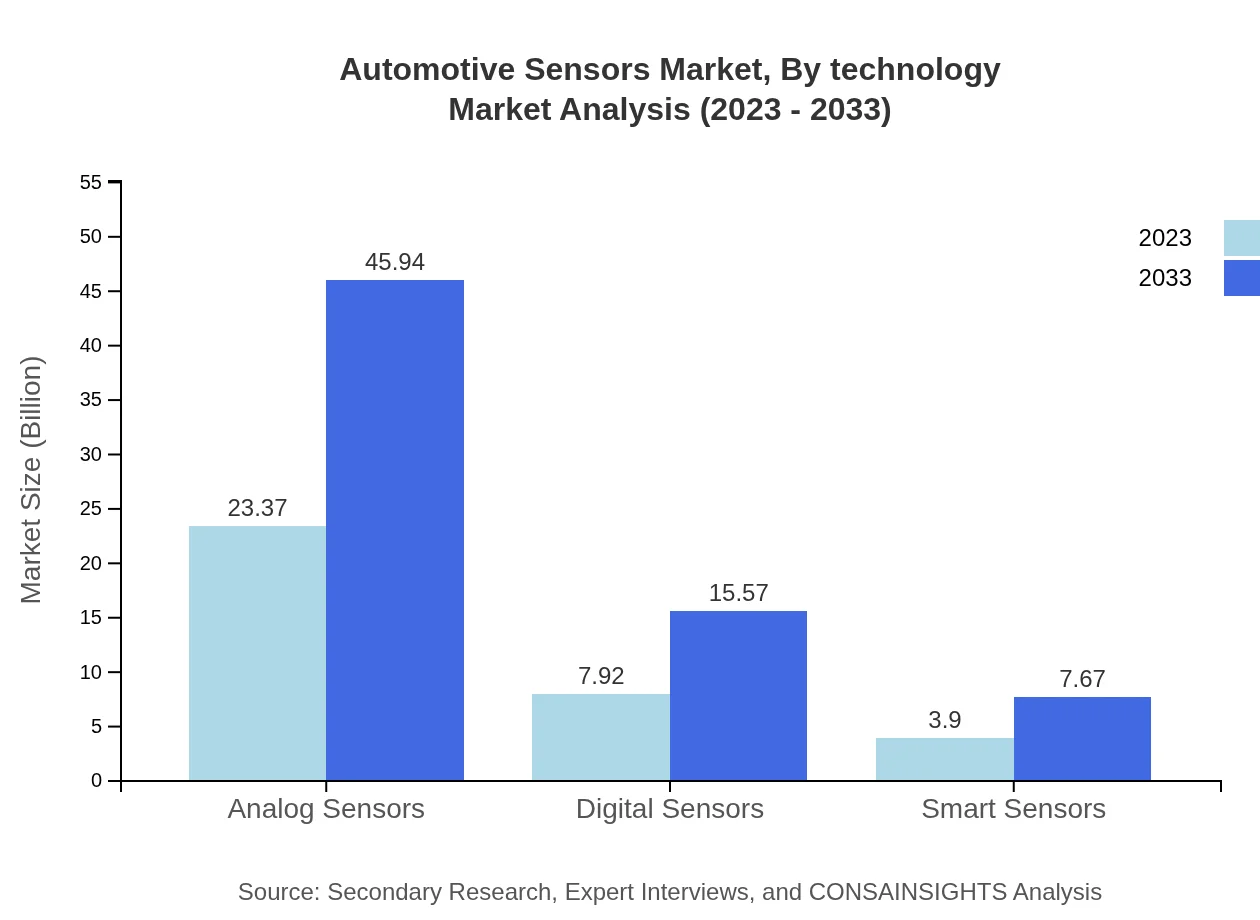

Automotive Sensors Market Analysis By Technology

The analysis reveals that both analog and digital sensors have a significant role, each with expected values increasing to $45.94 billion and $15.57 billion respectively by 2033, highlighting the industry's shift towards digitalization.

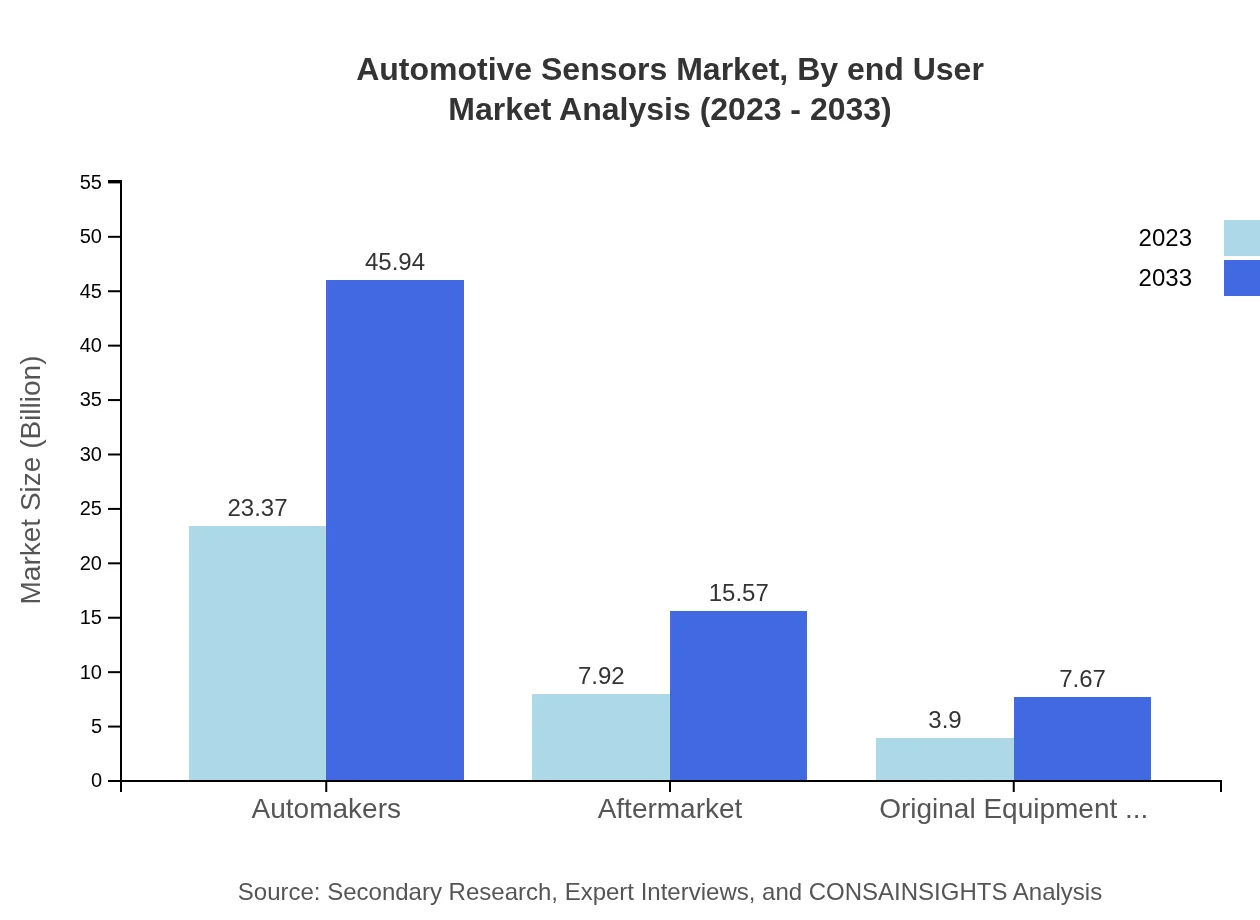

Automotive Sensors Market Analysis By End User

The Automotive Sensors market is tailored to various end-users, including Original Equipment Manufacturers (OEMs) and the aftermarket segment. The aftermarket is projected to see significant growth, catering to the rising demand for replacements and upgrades, while OEMs continue to dominate.

Automotive Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Sensors Industry

Bosch:

Robert Bosch GmbH is a leading global supplier of automotive components, specifically in the field of sensors with a strong focus on innovation in automotive technology.Denso Corporation:

Denso is a prominent player in the automotive sectors, manufacturing a wide array of sensors and contributing significantly to automotive technologies.Continental AG:

A key player offering advanced technologies and components in the automotive market, with a focus on safety and efficiency through innovative sensors.Delphi Technologies:

Delphi is known for its extensive range of automotive solutions including sensors that enhance vehicle performance and safety.STMicroelectronics:

They provide semiconductor solutions for automotive applications, pushing the boundaries of sensor technology integration in vehicles.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive sensors?

The automotive sensors market is projected to reach $35.2 billion by 2033, growing at a CAGR of 6.8%. This growth reflects increasing demand in various automotive applications and technological advancements in sensor technologies.

What are the key market players or companies in the automotive sensors industry?

Key players in the automotive sensors market include Bosch, Continental AG, Delphi Technologies, and Texas Instruments. These companies are foundational in innovating and producing advanced sensors utilized in modern automotive systems.

What are the primary factors driving the growth in the automotive sensors industry?

Factors driving growth include increasing demand for advanced driver-assistance systems (ADAS), rising vehicle electrification, and the need for improved safety and security in automobiles. Furthermore, the push towards autonomous vehicles significantly enhances sensor demand.

Which region is the fastest Growing in the automotive sensors market?

The fastest-growing region for automotive sensors is North America, expected to grow from $12.44 billion in 2023 to $24.44 billion by 2033. This rapid growth is driven by technological advancements and increasing consumer preferences for safety features.

Does ConsaInsights provide customized market report data for the automotive sensors industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the automotive sensors industry. This ensures clients receive relevant insights and comprehensive data aligned with their business requirements.

What deliverables can I expect from this automotive sensors market research project?

Deliverables from the automotive sensors market research project include detailed market analysis reports, segmentation insights, regional forecasts, competitive landscape summaries, and actionable recommendations tailored to your strategic needs.

What are the market trends of automotive sensors?

Emerging trends include the integration of smart sensors for enhanced functionality, increased adoption of IoT technologies in vehicles, and a shift towards electrification and autonomous driving. These trends are reshaping the market landscape, driving innovation.