Automotive Smart Factory Market Report

Published Date: 02 February 2026 | Report Code: automotive-smart-factory

Automotive Smart Factory Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automotive Smart Factory market, covering insights on market size, trends, technological advancements, and regional performance from 2023 to 2033.

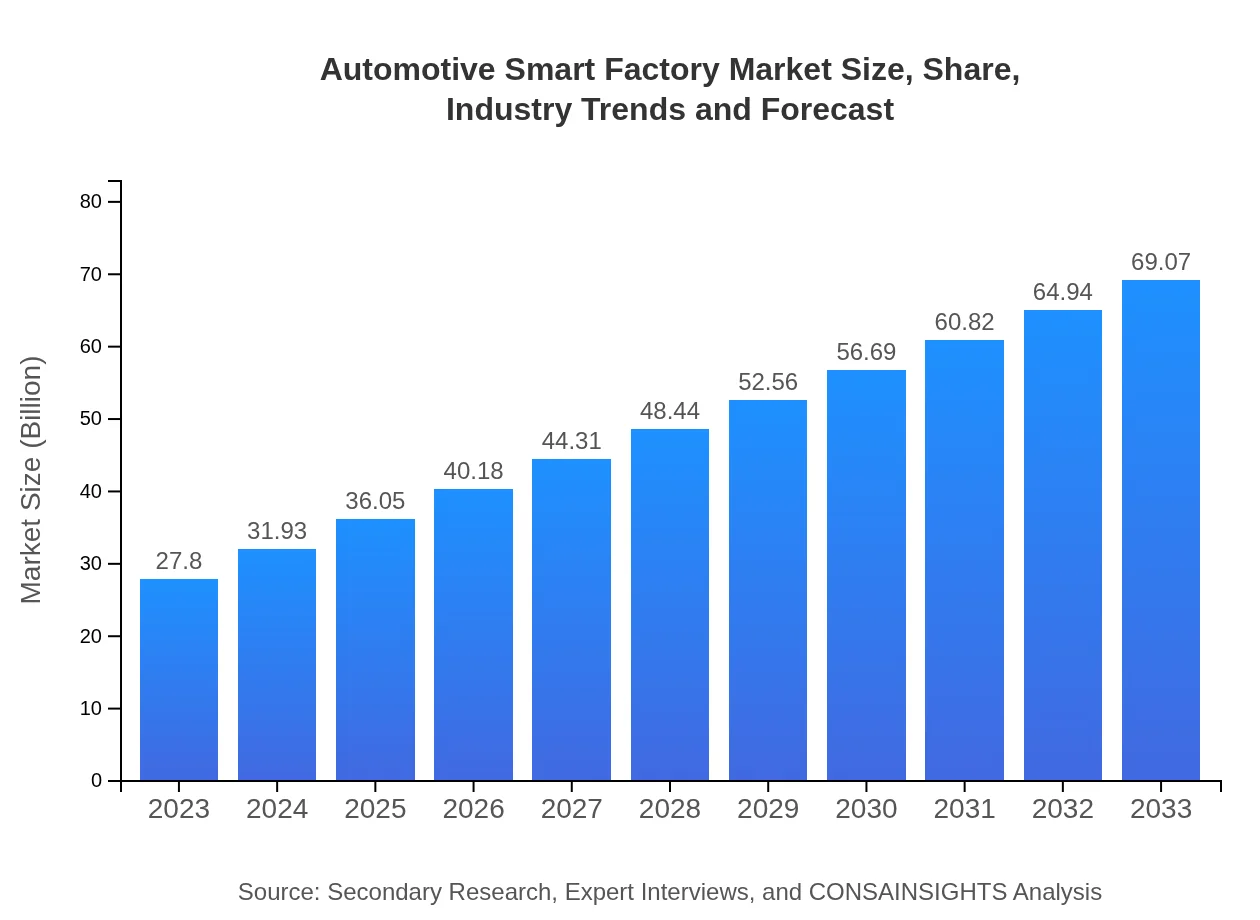

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $27.80 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $69.07 Billion |

| Top Companies | Siemens AG, Rockwell Automation, ABB Ltd., Honeywell International Inc., Schneider Electric |

| Last Modified Date | 02 February 2026 |

Automotive Smart Factory Market Overview

Customize Automotive Smart Factory Market Report market research report

- ✔ Get in-depth analysis of Automotive Smart Factory market size, growth, and forecasts.

- ✔ Understand Automotive Smart Factory's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Smart Factory

What is the Market Size & CAGR of Automotive Smart Factory market in 2023?

Automotive Smart Factory Industry Analysis

Automotive Smart Factory Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Smart Factory Market Analysis Report by Region

Europe Automotive Smart Factory Market Report:

Europe's market is set to expand significantly, projected to increase from $9.67 billion in 2023 to $24.02 billion by 2033, supported by regulatory frameworks promoting sustainability and the integration of smart technologies in manufacturing.Asia Pacific Automotive Smart Factory Market Report:

In the Asia Pacific region, the market is expected to grow from $5.03 billion in 2023 to $12.49 billion by 2033. This growth is driven by increasing automotive production in countries like China, Japan, and South Korea, alongside the adoption of smart manufacturing practices to enhance competitive advantage.North America Automotive Smart Factory Market Report:

North America is anticipated to grow from $9.06 billion in 2023 to $22.51 billion by 2033. The U.S. automotive industry is at the forefront of automation adoption, leveraging advanced technologies from local players to improve operational efficiency and production quality.South America Automotive Smart Factory Market Report:

The South American market for Automotive Smart Factory is projected to rise from $0.69 billion in 2023 to $1.72 billion by 2033. This growth is fueled by economic recovery initiatives and the gradual digitalization of manufacturing processes across Brazil and Argentina.Middle East & Africa Automotive Smart Factory Market Report:

In the Middle East and Africa, the market is estimated to grow from $3.35 billion in 2023 to $8.32 billion by 2033. The region's growth is underpinned by investments in infrastructure and a strategic focus on diversifying economic dependencies beyond oil.Tell us your focus area and get a customized research report.

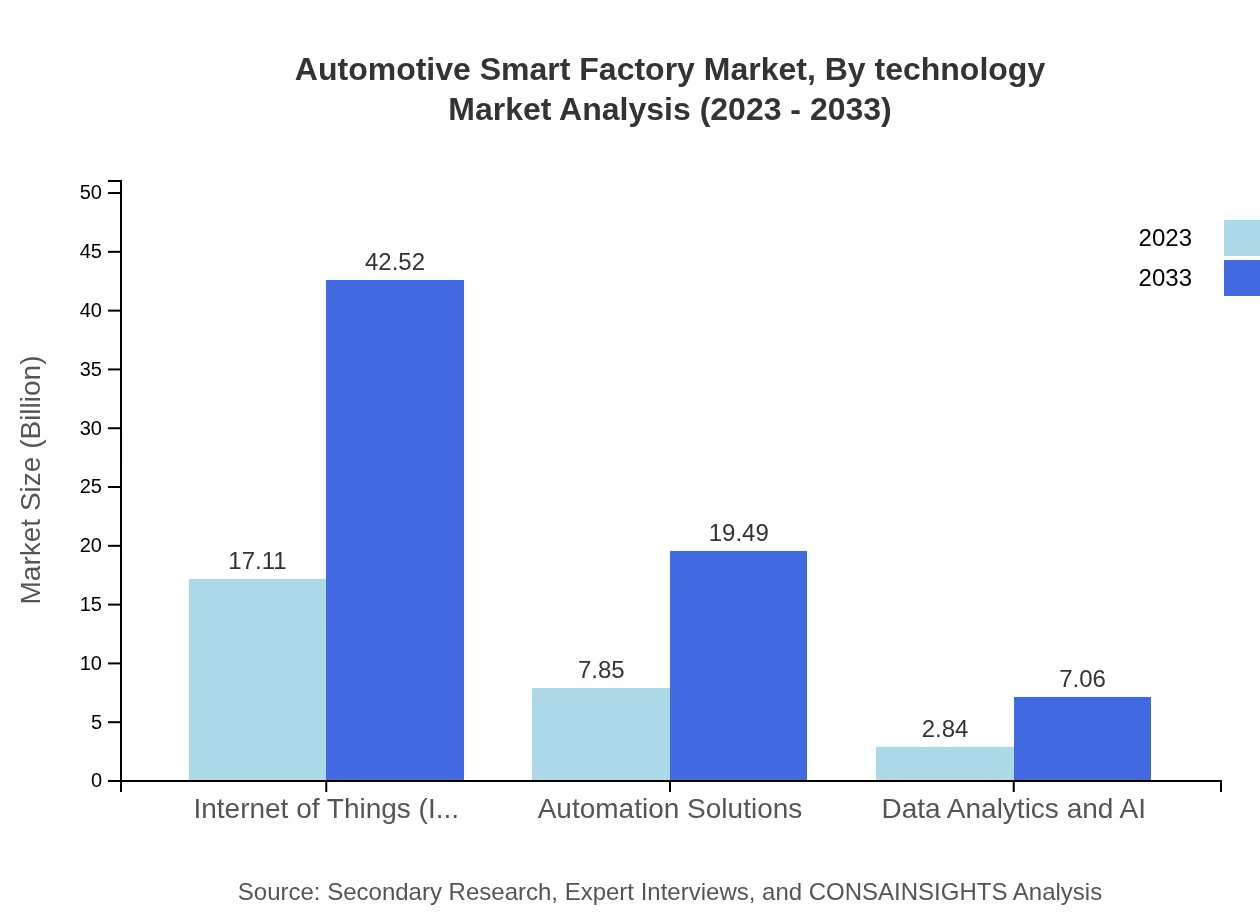

Automotive Smart Factory Market Analysis By Technology

The market by technology is led by the Internet of Things (IoT), which holds a 61.56% share in 2023 and is expected to maintain the same share by 2033. Automation solutions and data analytics also contribute significantly, with sizes projected to grow from $7.85 billion in 2023 to $19.49 billion in 2033.

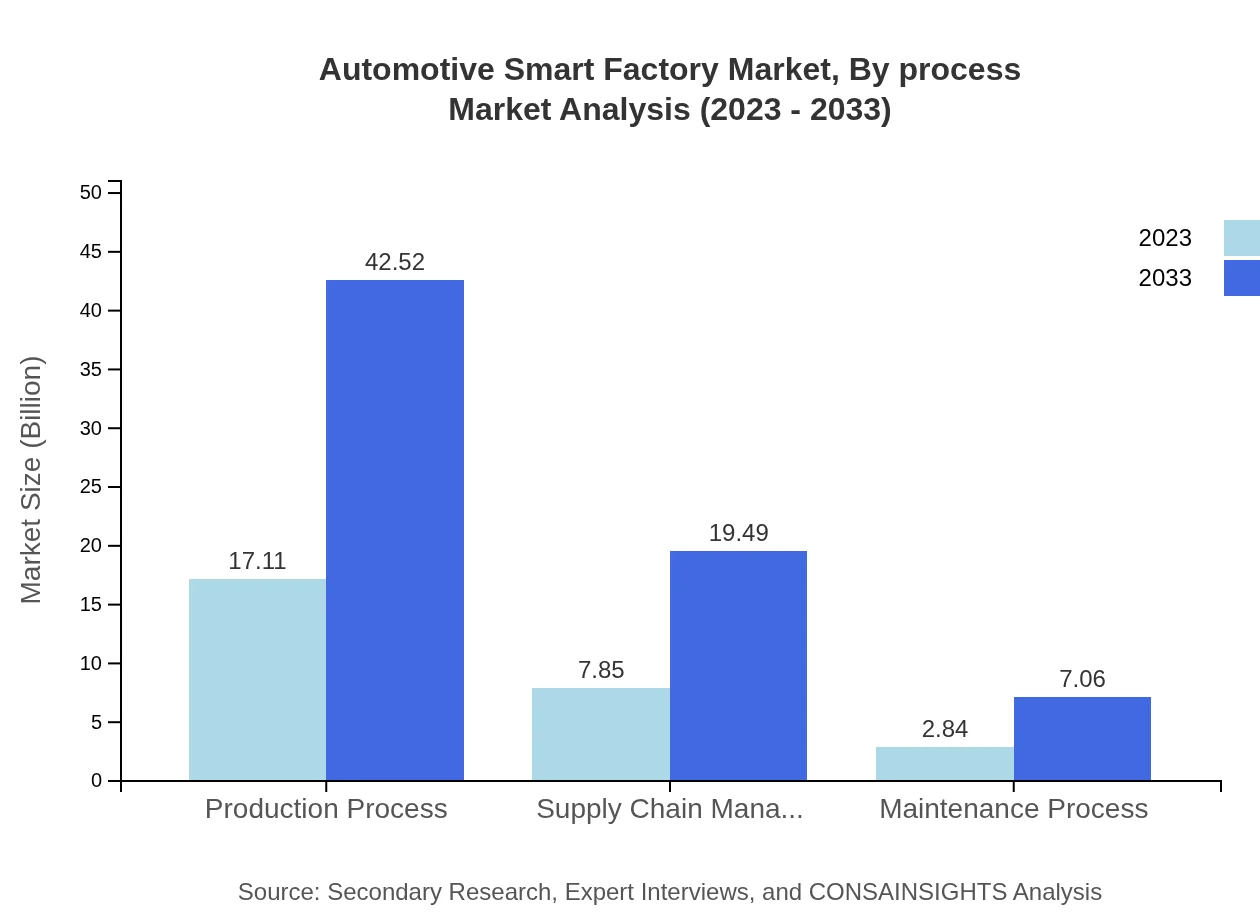

Automotive Smart Factory Market Analysis By Process

The Production Process segment dominates the market with a size of $17.11 billion in 2023, expected to increase to $42.52 billion by 2033. Supply Chain Management follows with a notable growth, driven by efficiency needs, projected to grow from $7.85 billion in 2023 to $19.49 billion by 2033.

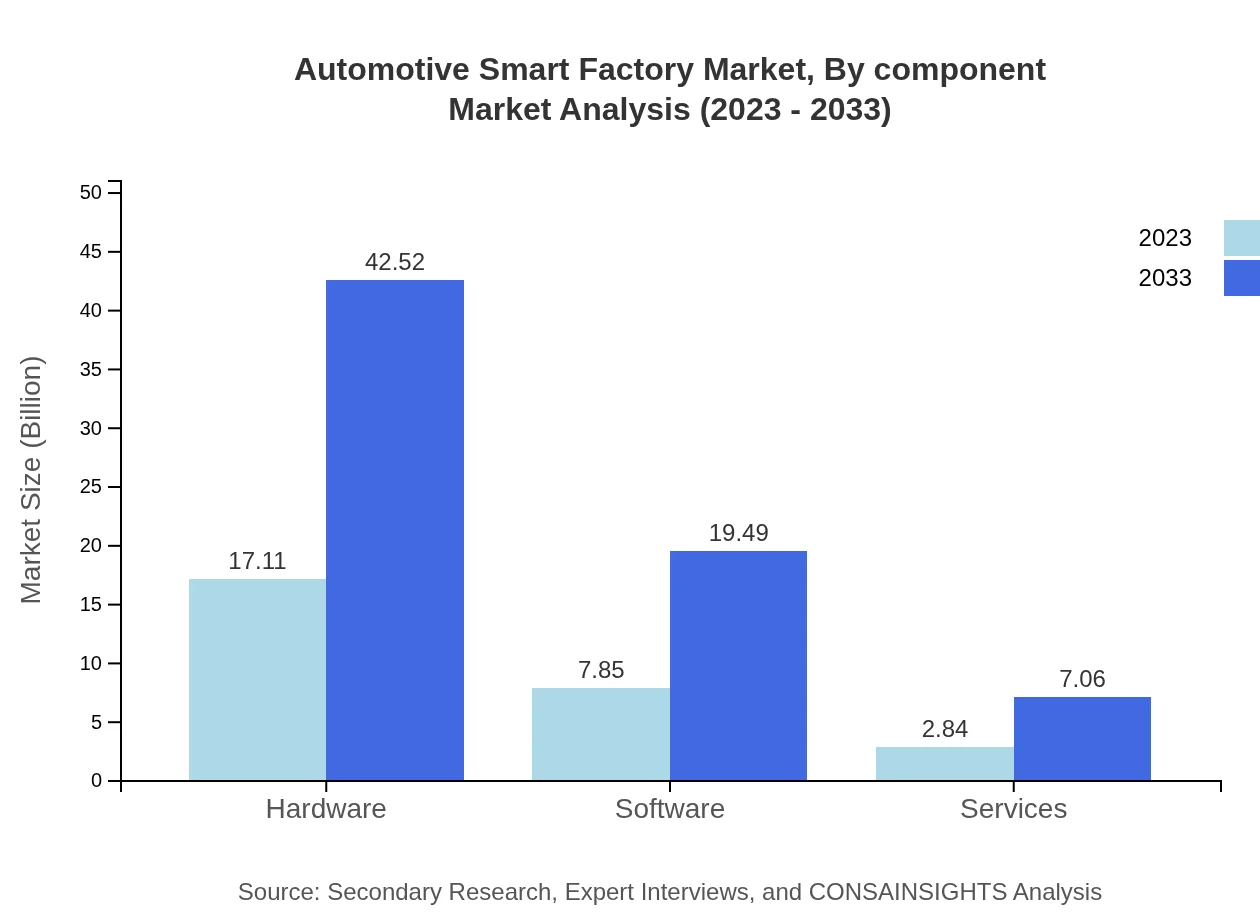

Automotive Smart Factory Market Analysis By Component

Hardware remains the cornerstone, with a size of $17.11 billion in 2023, reflecting 61.56% of the market, and expected growth to $42.52 billion by 2033. Software and services present notable interests as well, accounting for 28.22% of the market in their sections.

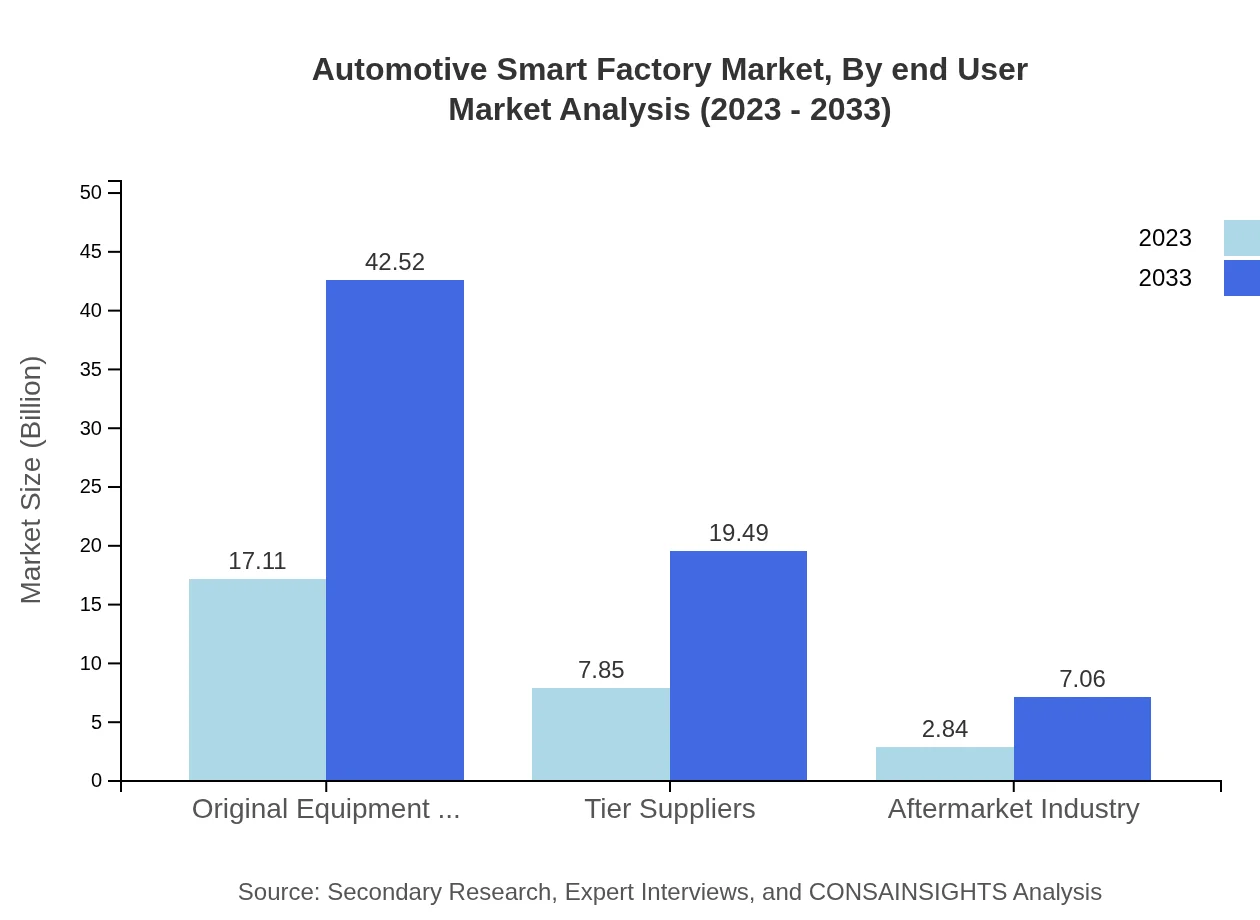

Automotive Smart Factory Market Analysis By End User

Original Equipment Manufacturers (OEMs) hold a significant market share of 61.56% in 2023 with a size of $17.11 billion, anticipated to grow to $42.52 billion by 2033. Tier Suppliers and the Aftermarket Industry also exhibit growth, driven by the demand for smart production strategies.

Automotive Smart Factory Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Smart Factory Industry

Siemens AG:

Siemens is a leader in manufacturing and automation technology, providing comprehensive smart factory solutions and innovations in manufacturing processes.Rockwell Automation:

Rockwell Automation specializes in industrial automation and information technology, helping manufacturers increase productivity through smart factory implementations.ABB Ltd.:

ABB is renowned for its robotics and automation technologies, offering a wide array of solutions for automotive manufacturers aiming to innovate their factories.Honeywell International Inc.:

Honeywell provides advanced automation solutions and controls that optimize process integrity in automotive smart manufacturing.Schneider Electric:

Schneider Electric is focused on providing energy management and automation solutions, leading the charge towards digitized manufacturing systems.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Smart Factory?

The automotive smart factory market reached a size of $27.8 billion in 2023, with a projected CAGR of 9.2%, signifying robust growth opportunities from 2023 to 2033.

What are the key market players or companies in this automotive Smart Factory industry?

Key players in the automotive smart factory market include renowned automotive manufacturers, technology giants specializing in IoT and automation, as well as software providers focusing on data analytics and AI solutions.

What are the primary factors driving the growth in the automotive Smart Factory industry?

Key drivers of growth in the automotive smart factory sector include advancements in automation technologies, increasing demand for smart manufacturing solutions, the push for sustainability in manufacturing processes, and the ongoing digital transformation within the automotive industry.

Which region is the fastest Growing in the automotive Smart Factory?

The fastest-growing region in the automotive smart factory market is Europe, projected to grow from $9.67 billion in 2023 to $24.02 billion by 2033, reflecting significant expansion opportunities.

Does ConsaInsights provide customized market report data for the automotive Smart Factory industry?

Yes, ConsaInsights offers customized market report data for the automotive smart factory industry, allowing clients to obtain tailored insights specific to their business needs and market goals.

What deliverables can I expect from this automotive Smart Factory market research project?

From the automotive smart factory market research project, you can expect comprehensive reports, detailed market analysis, competitive landscape assessments, and actionable recommendations tailored to your specific sector of interest.

What are the market trends of automotive Smart Factory?

Current trends in the automotive smart factory market include the integration of IoT and automation technologies, increased investment in data analytics and AI for enhanced operational efficiency, and a growing emphasis on sustainable manufacturing practices.