Automotive Smart Lighting Market Report

Published Date: 02 February 2026 | Report Code: automotive-smart-lighting

Automotive Smart Lighting Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the automotive smart lighting market, detailing its current state, growth trends, and future forecasts from 2023 to 2033, with insights into the market size, segments, and leading companies in the industry.

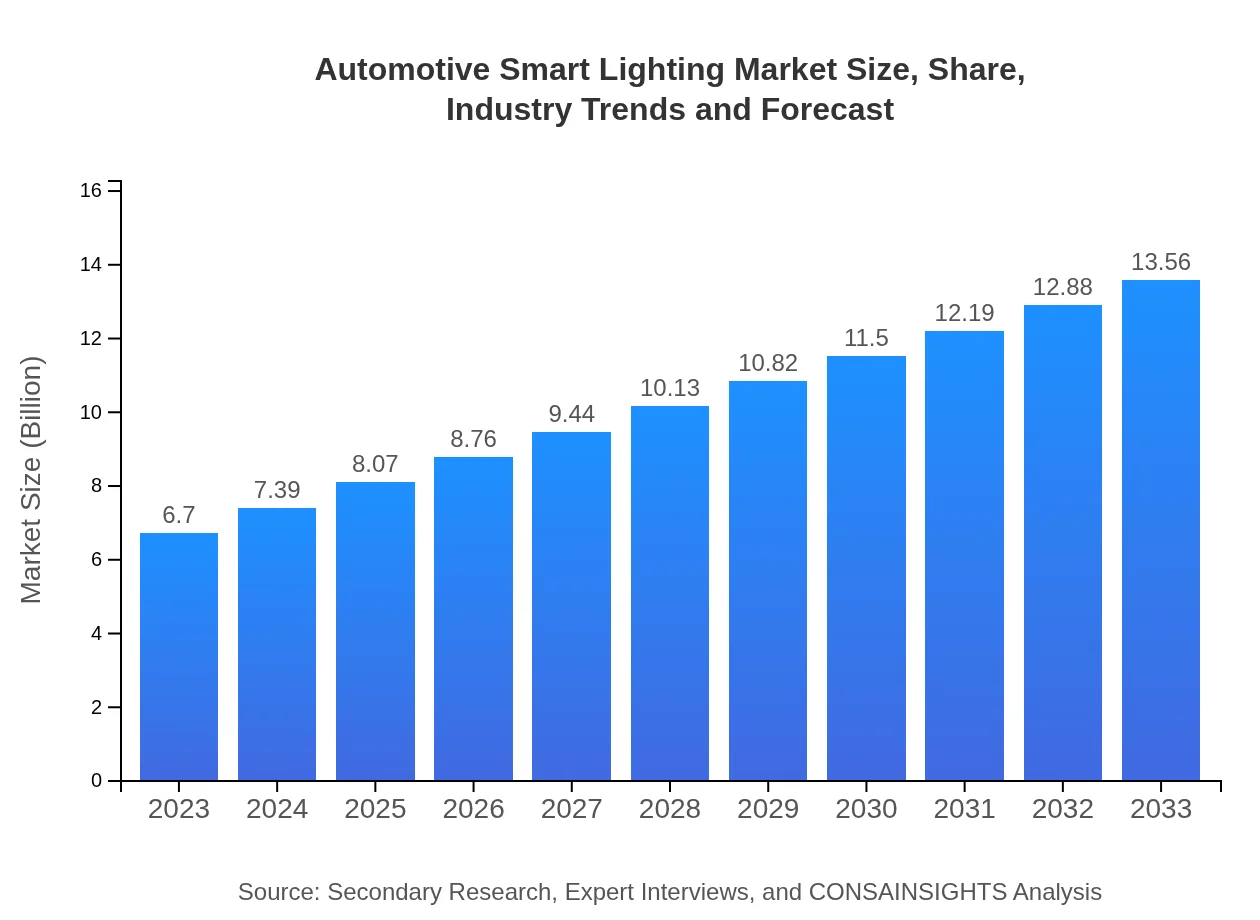

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.70 Billion |

| CAGR (2023-2033) | 7.1% |

| 2033 Market Size | $13.56 Billion |

| Top Companies | Osram Licht AG, Cree, Inc., Hella GmbH & Co. KGaA, Valeo |

| Last Modified Date | 02 February 2026 |

Automotive Smart Lighting Market Overview

Customize Automotive Smart Lighting Market Report market research report

- ✔ Get in-depth analysis of Automotive Smart Lighting market size, growth, and forecasts.

- ✔ Understand Automotive Smart Lighting's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Smart Lighting

What is the Market Size & CAGR of Automotive Smart Lighting market in 2033?

Automotive Smart Lighting Industry Analysis

Automotive Smart Lighting Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Smart Lighting Market Analysis Report by Region

Europe Automotive Smart Lighting Market Report:

The European market showcases robust growth potential, with size estimates rising from $2.04 billion in 2023 to $4.13 billion in 2033. Europe's stringent safety regulations and an increasing preference for premium vehicles equipped with advanced lighting systems drive this trend.Asia Pacific Automotive Smart Lighting Market Report:

The Asia Pacific region is expected to witness significant growth in the Automotive Smart Lighting market, with the market size anticipated to rise from $1.29 billion in 2023 to $2.61 billion in 2033. Rapid urbanization, increasing vehicle production, and a growing middle-class population are major factors driving this expansion.North America Automotive Smart Lighting Market Report:

North America is a significant market for Automotive Smart Lighting with a projected growth from $2.33 billion in 2023 to $4.72 billion in 2033. High consumer demand for advanced safety features and a strong regulatory framework favoring innovative lighting solutions play vital roles in this growth.South America Automotive Smart Lighting Market Report:

In South America, the market size is projected to increase from $0.42 billion in 2023 to $0.86 billion by 2033. Growth in this region is supported by rising vehicle sales and increasing investments in automotive technologies, although challenges such as economic volatility may impact growth rates.Middle East & Africa Automotive Smart Lighting Market Report:

The Middle East and Africa are expected to see gradual growth in the Automotive Smart Lighting market, projecting an increase from $0.61 billion in 2023 to $1.24 billion by 2033, as regional manufacturers begin adopting innovative lighting technologies to meet customer demands.Tell us your focus area and get a customized research report.

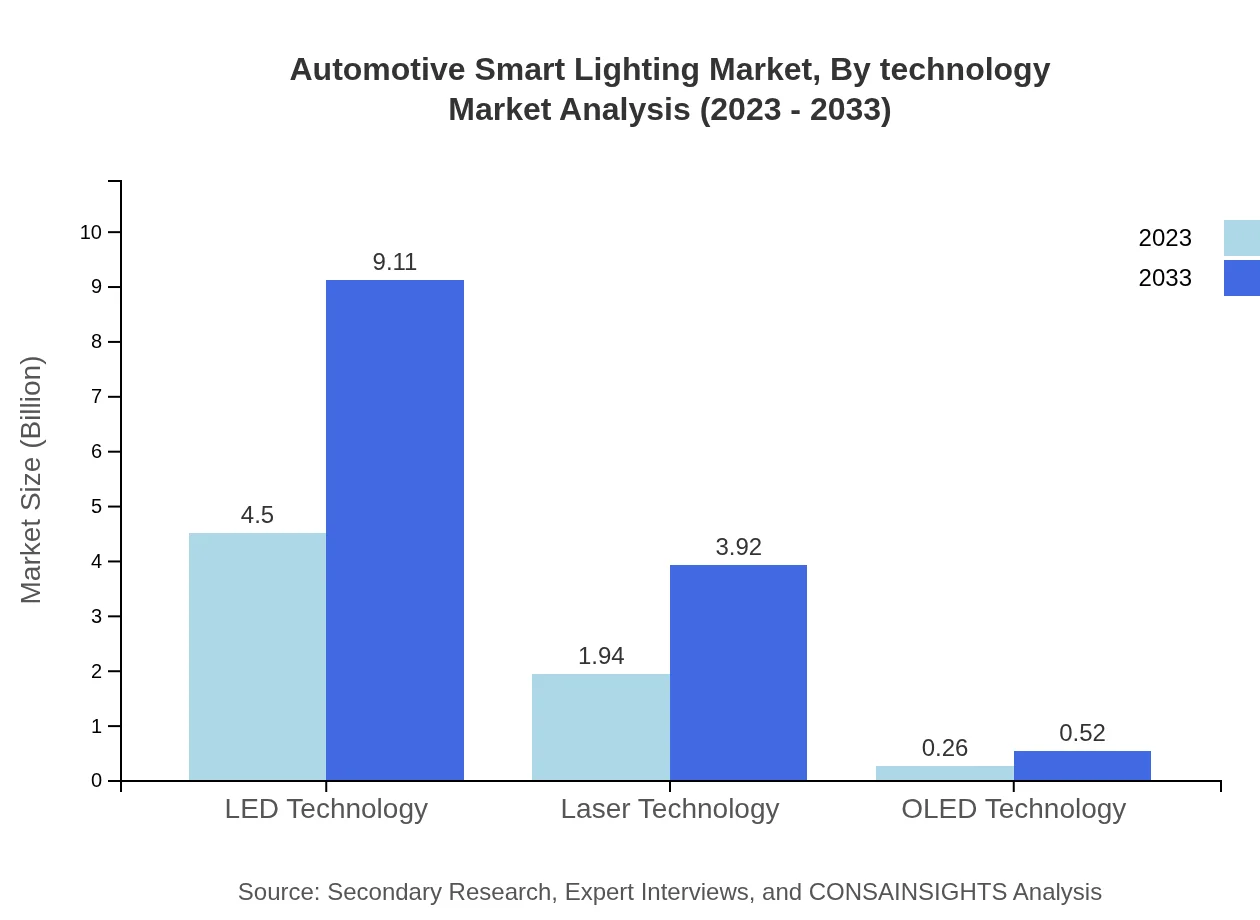

Automotive Smart Lighting Market Analysis By Technology

The automotive smart lighting market by technology comprises LED, laser, and OLED technologies: 1. **LED Technology**: Estimated to grow from $4.50 billion in 2023 to $9.11 billion by 2033, capturing a market share of 67.21%. 2. **Laser Technology**: Expected to increase from $1.94 billion to $3.92 billion, maintaining 28.92% of the market share. 3. **OLED Technology**: While currently smaller, OLED technology is set to double its size from $0.26 billion to $0.52 billion, with a 3.87% share.

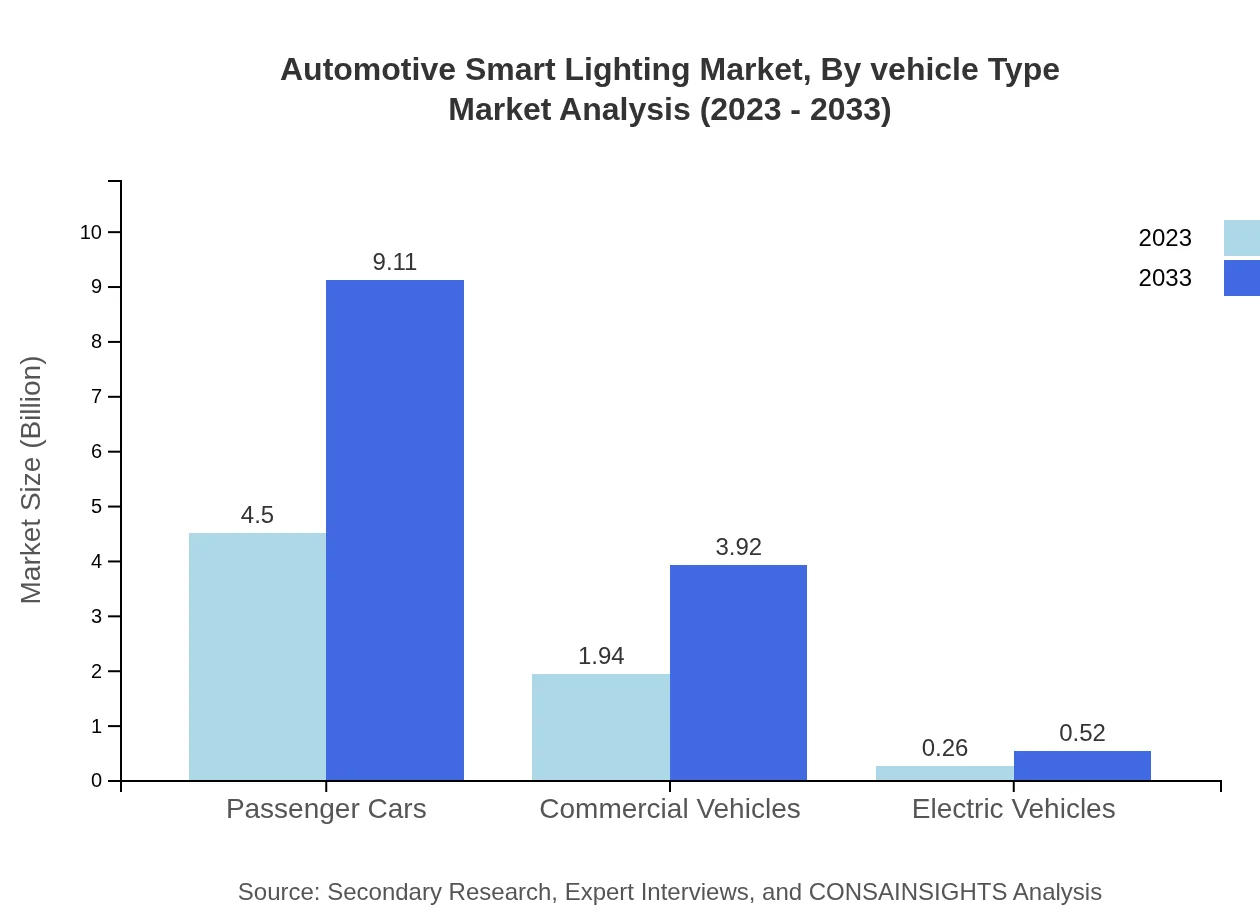

Automotive Smart Lighting Market Analysis By Vehicle Type

Segmenting by vehicle type includes passenger cars, commercial vehicles, and electric vehicles: 1. **Passenger Cars**: Growth from $4.50 billion to $9.11 billion (67.21% market share). 2. **Commercial Vehicles**: From $1.94 billion to $3.92 billion (28.92% share). 3. **Electric Vehicles**: Expected rise from $0.26 billion to $0.52 billion (3.87% share).

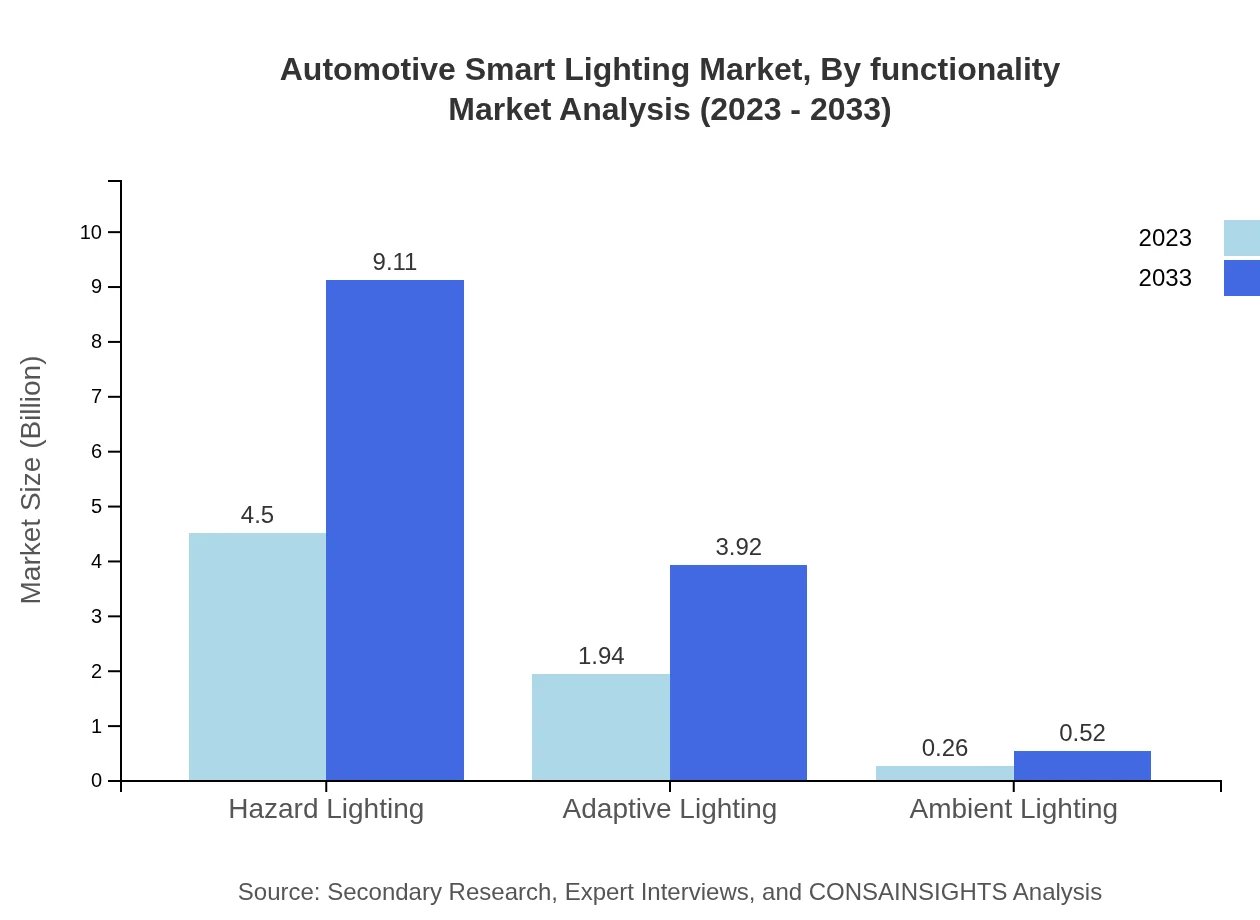

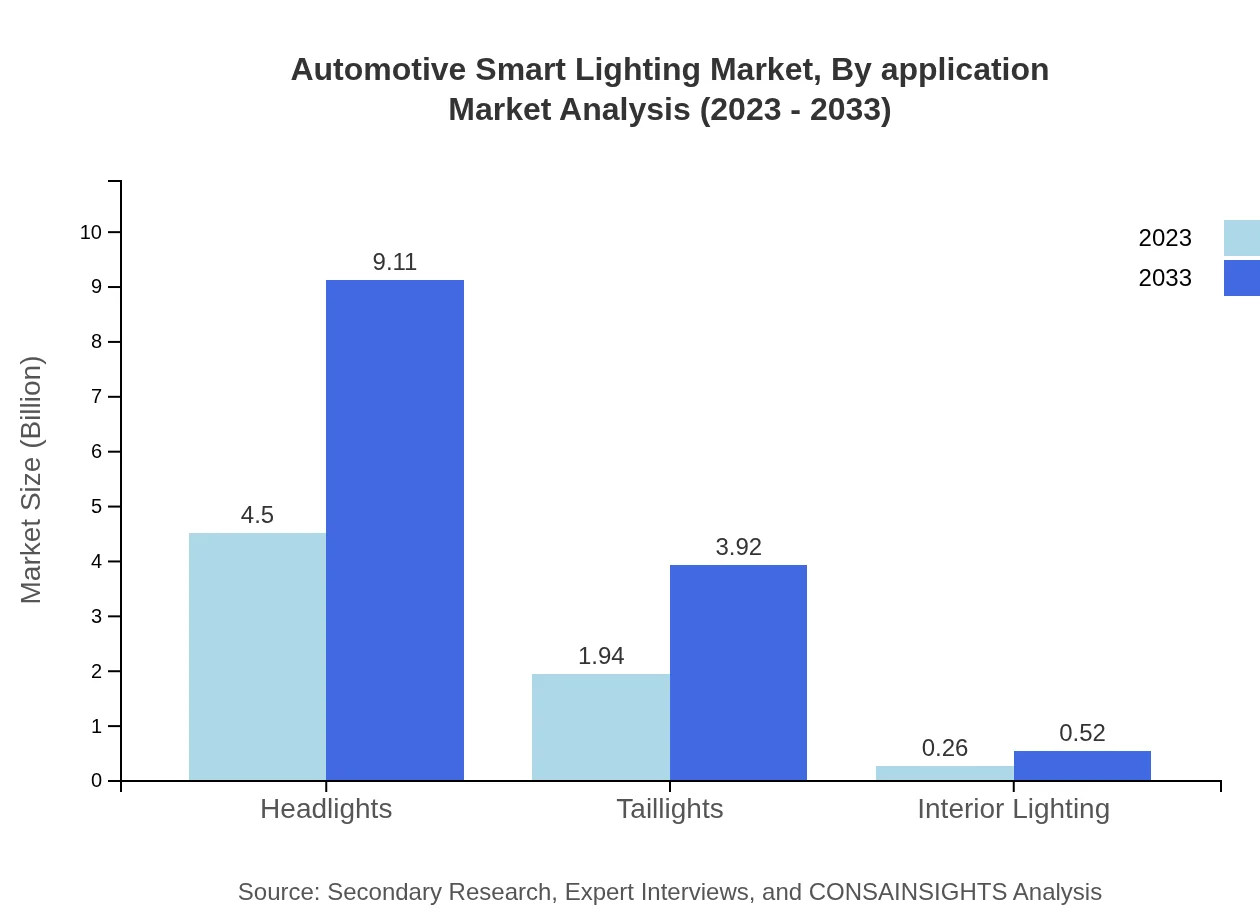

Automotive Smart Lighting Market Analysis By Functionality

The market functionality segments include headlights, taillights, hazard lighting, and ambient lighting: 1. **Headlights**: Leading segment, rising from $4.50 billion to $9.11 billion, comprising 67.21% share. 2. **Taillights**: Expected to increase from $1.94 billion to $3.92 billion (28.92% share). 3. **Hazard Lighting**: Also seeks growth from $4.50 billion to $9.11 billion (67.21% share). 4. **Ambient Lighting**: Smaller segment, doubling from $0.26 billion to $0.52 billion (3.87% share).

Automotive Smart Lighting Market Analysis By Application

Application of smart lighting is broad, mapping to various vehicle functionalities including safety applications in adaptive and hazard lighting: 1. **Adaptive Lighting**: Grow from $1.94 billion to $3.92 billion (28.92% market share). 2. **Ambient Lighting**: From $0.26 billion to $0.52 billion (3.87% share).

Automotive Smart Lighting Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Smart Lighting Industry

Osram Licht AG:

A leading global player known for its innovative lighting solutions and significant investments in developing smart lighting technologies tailored for automotive applications.Cree, Inc.:

A prominent manufacturer of LED lighting, contributing advanced products that enhance safety and efficiency in automotive smart lighting.Hella GmbH & Co. KGaA:

Specializing in automotive lighting technology, Hella is renowned for its adaptive lighting solutions and strong focus on sustainability.Valeo:

A key innovator in automotive lighting, Valeo emphasizes smart technologies that enhance driving comfort and safety.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Smart Lighting?

The automotive smart lighting market is valued at $6.7 billion in 2023, with a projected CAGR of 7.1% from 2023 to 2033. This growth reflects increasing demand for advanced lighting technologies in modern vehicles.

What are the key market players or companies in this automotive Smart Lighting industry?

Key players in the automotive smart lighting industry include prominent companies like OSRAM, HELLA, Valeo, and Koito Manufacturing. These companies lead in innovation, providing high-quality lighting solutions for diverse automotive applications.

What are the primary factors driving the growth in the automotive smart lighting industry?

The growth of automotive smart lighting is driven by increasing vehicle safety demands, advancements in LED technology, and consumer preferences for aesthetic and functional lighting features in vehicles, alongside the rise of electric and autonomous vehicles.

Which region is the fastest Growing in the automotive smart lighting market?

The fastest-growing region in the automotive smart lighting market is expected to be North America, with market size projected to grow from $2.33 billion in 2023 to $4.72 billion by 2033, driven by technological advancements and consumer adoption.

Does ConsaInsights provide customized market report data for the automotive smart lighting industry?

Yes, ConsaInsights offers customized market report data tailored to client-specific needs in the automotive smart lighting industry, allowing businesses to obtain detailed insights and trends relevant to their market strategies.

What deliverables can I expect from this automotive smart lighting market research project?

Deliverables from the automotive smart lighting market research project typically include comprehensive reports, market analysis, competitive landscape assessments, trend forecasts, and actionable insights for strategic decision-making.

What are the market trends of automotive smart lighting?

Current trends in the automotive smart lighting market include the rise of LED and laser technologies, increased integration of adaptive lighting systems, a focus on energy-efficient solutions, and growing demand for personalized interior lighting experiences.