Automotive Tic Market Report

Published Date: 22 January 2026 | Report Code: automotive-tic

Automotive Tic Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Automotive TIC market, covering insights, trends, and forecasts from 2023 to 2033. It encompasses market size, segmentation, regional analysis, technology advancements, and key players in the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

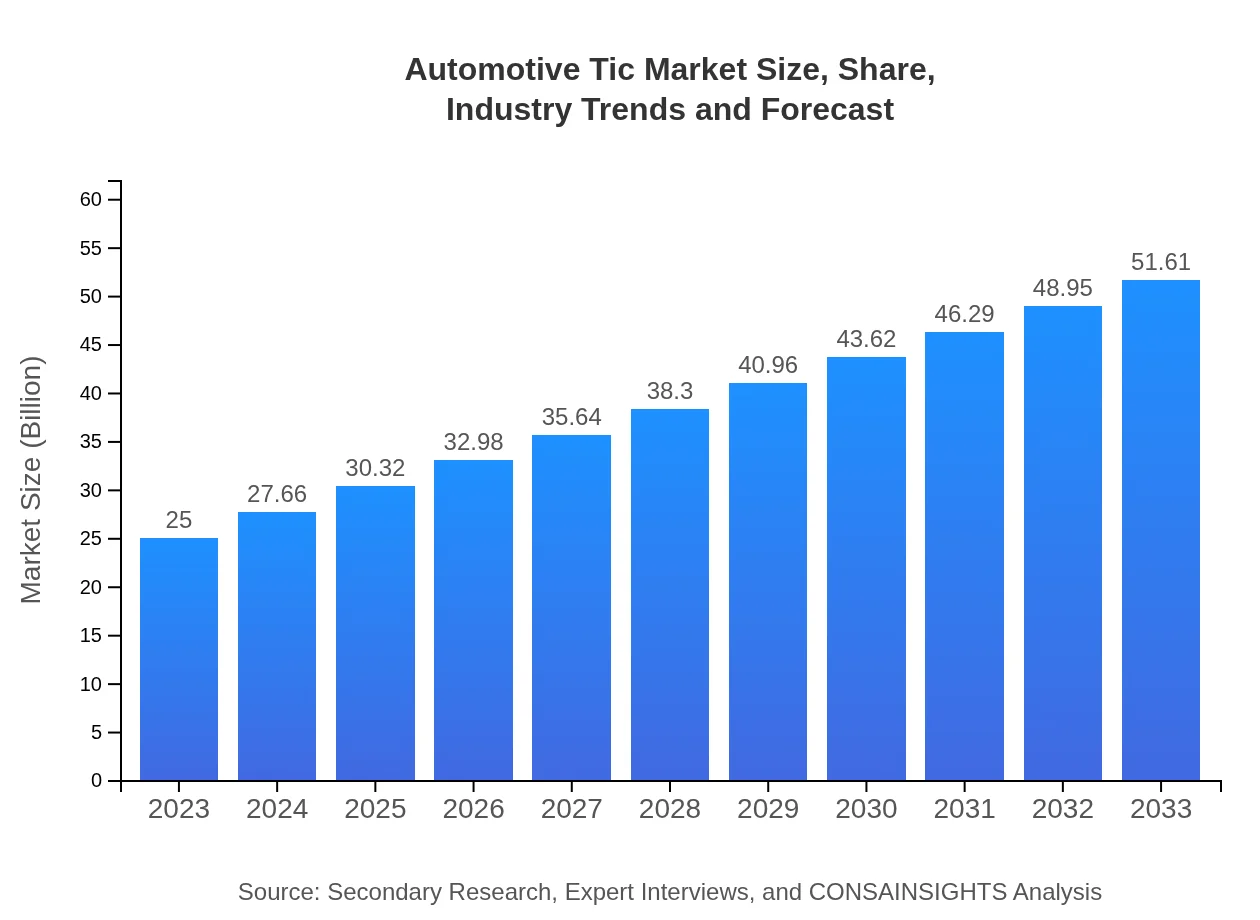

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $51.61 Billion |

| Top Companies | SGS SA, TÜV SÜD, Bureau Veritas, Intertek Group, Dekra |

| Last Modified Date | 22 January 2026 |

Automotive Tic Market Overview

Customize Automotive Tic Market Report market research report

- ✔ Get in-depth analysis of Automotive Tic market size, growth, and forecasts.

- ✔ Understand Automotive Tic's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Tic

What is the Market Size & CAGR of the Automotive Tic market in 2023?

Automotive Tic Industry Analysis

Automotive Tic Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Tic Market Analysis Report by Region

Europe Automotive Tic Market Report:

Europe's Automotive TIC market is projected to increase from $6.47 billion in 2023 to $13.36 billion by 2033. The European automotive market is marked by rigorous compliance standards and a robust push toward electric vehicles and sustainable practices.Asia Pacific Automotive Tic Market Report:

In the Asia Pacific region, the Automotive TIC market size is estimated at $5.04 billion in 2023, growing to $10.39 billion by 2033. The rapid development of the automotive sector, particularly in countries like China and India, is propelling demand for comprehensive TIC services due to rising vehicle production and regulatory requirements.North America Automotive Tic Market Report:

North America holds a significant market share, starting at $9.18 billion in 2023 and expected to reach $18.94 billion by 2033. The region's stringent regulations and consumer emphasis on safety contribute heavily to the demand for TIC services.South America Automotive Tic Market Report:

In South America, the market is smaller but growing, with a projected size of $1.37 billion in 2023, reaching $2.83 billion by 2033. The increasing automotive production and expanding regulatory frameworks are key factors driving market growth in this region.Middle East & Africa Automotive Tic Market Report:

In the Middle East and Africa, the Automotive TIC market is estimated at $2.95 billion in 2023, anticipated to grow to $6.08 billion by 2033. Increasing investment in infrastructure and growth in automotive sales contribute significantly to this upward trend.Tell us your focus area and get a customized research report.

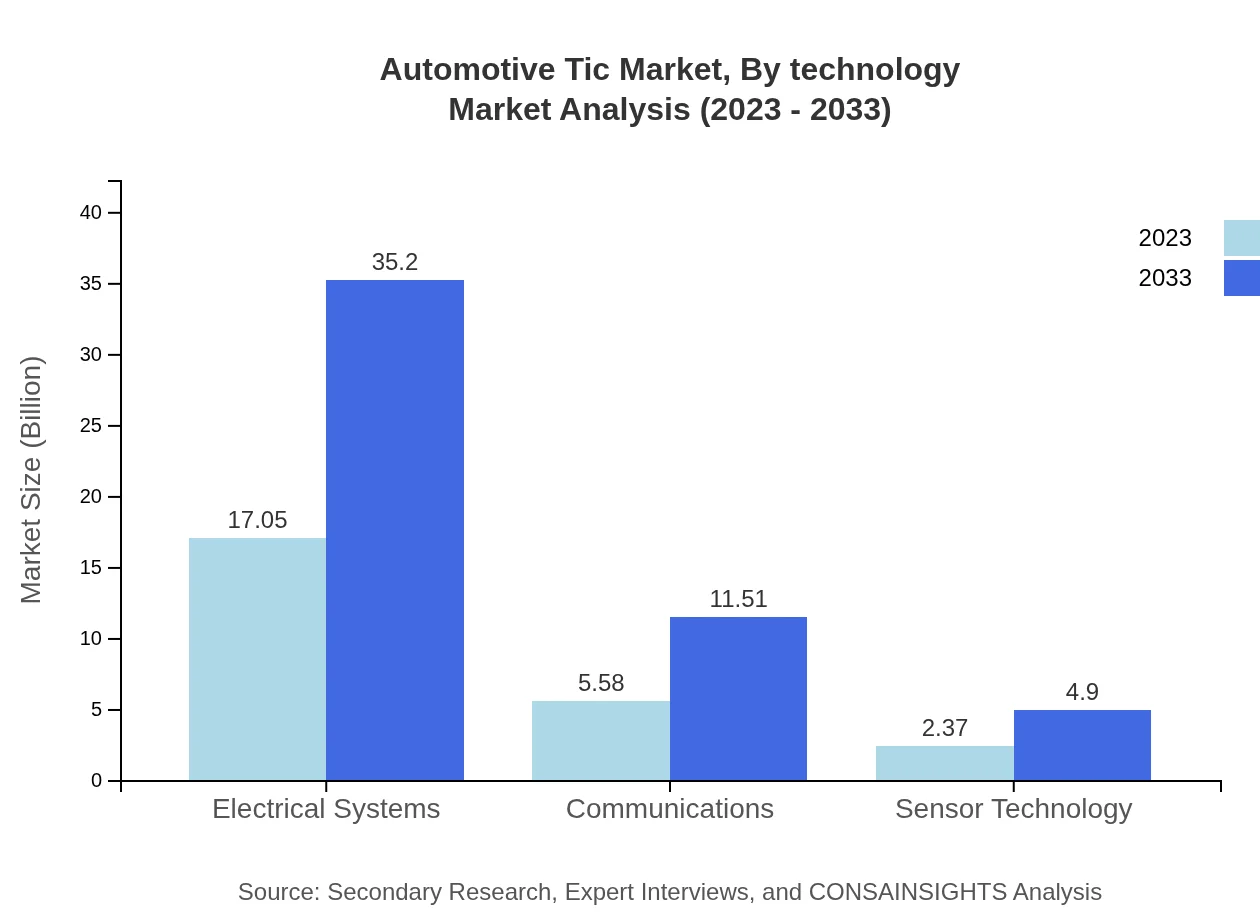

Automotive Tic Market Analysis By Technology

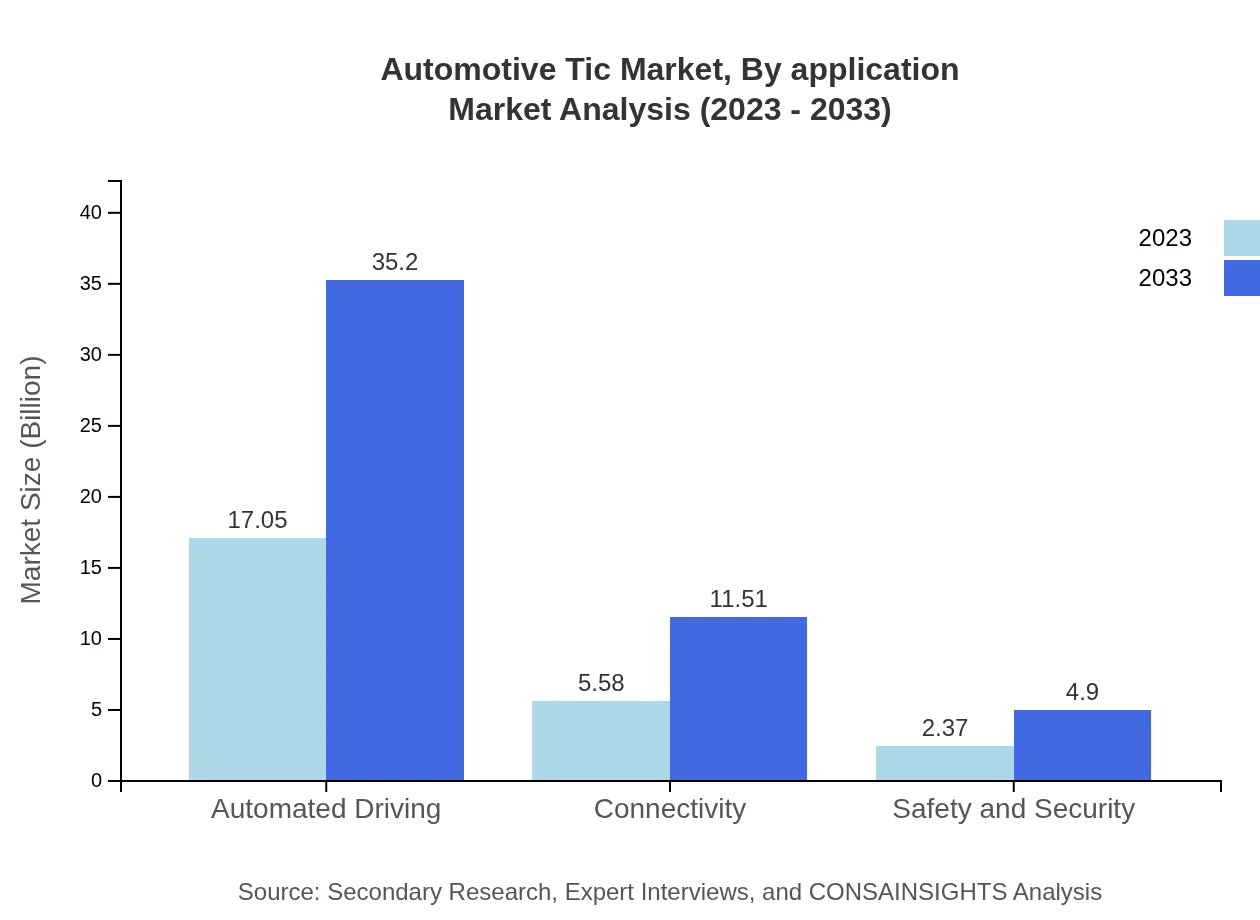

In this segment, electrical systems dominate with a market size of $17.05 billion in 2023, anticipated to escalate to $35.20 billion by 2033. Following closely, automated driving technology represents the same figures, indicating a critical area of investment from manufacturers. Communications technology, with a current market size of $5.58 billion growing to $11.51 billion, indicates its crucial role in ensuring connectivity in modern vehicles. Sensor technology is anticipated to grow from $2.37 billion to $4.90 billion, highlighting advances in safety features. The trends suggest significant expansion in testing-driven technological complexity.

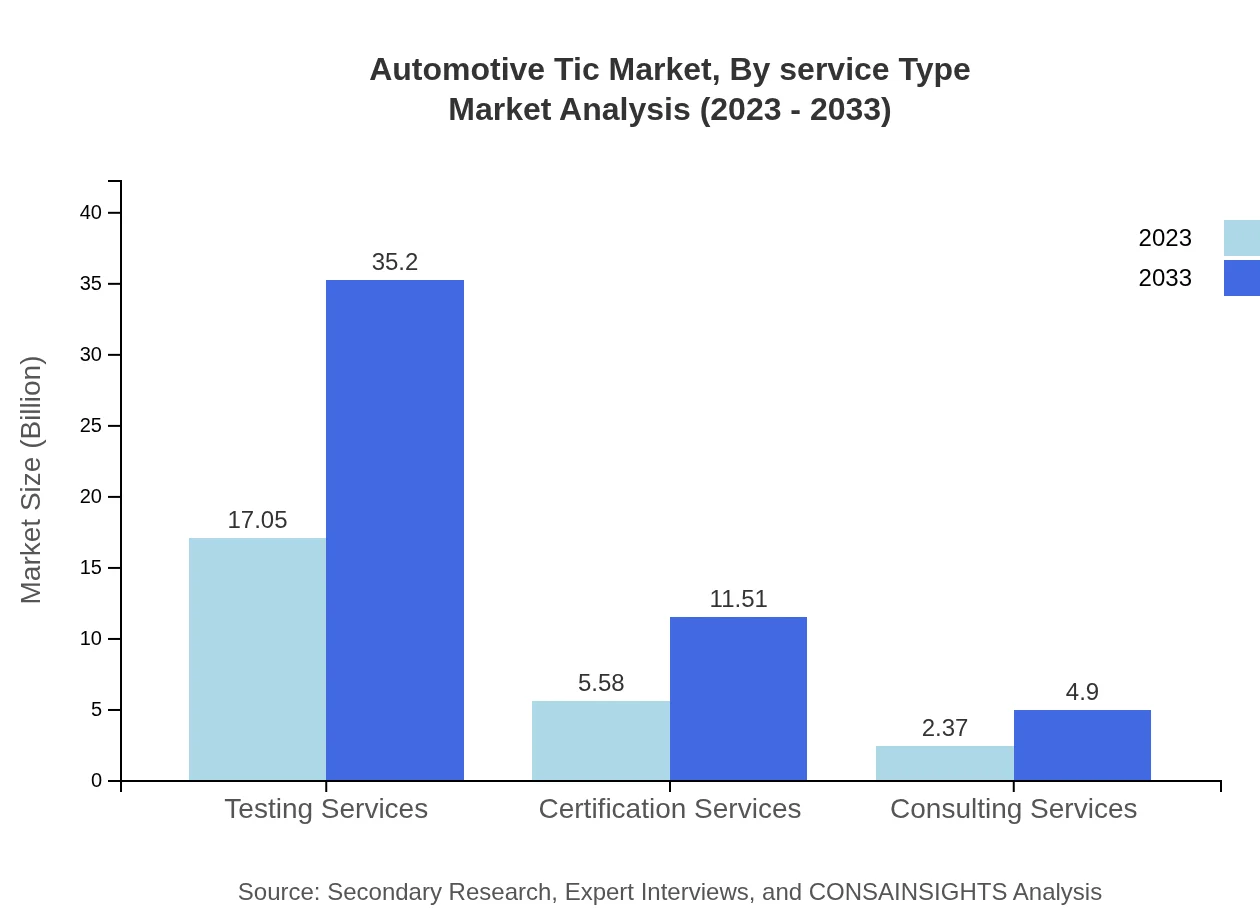

Automotive Tic Market Analysis By Service Type

Testing services currently command a market share of $17.05 billion in 2023, with predictions of growth to $35.20 billion by 2033, reaffirming their essential role in validating safety and compliance. Certification services show a promising evolution from $5.58 billion to $11.51 billion, reflecting the need for approved compliance with automotive standards. Consulting services, although smaller at $2.37 billion, will grow to $4.90 billion due to increased strategic advisory needs in the industry.

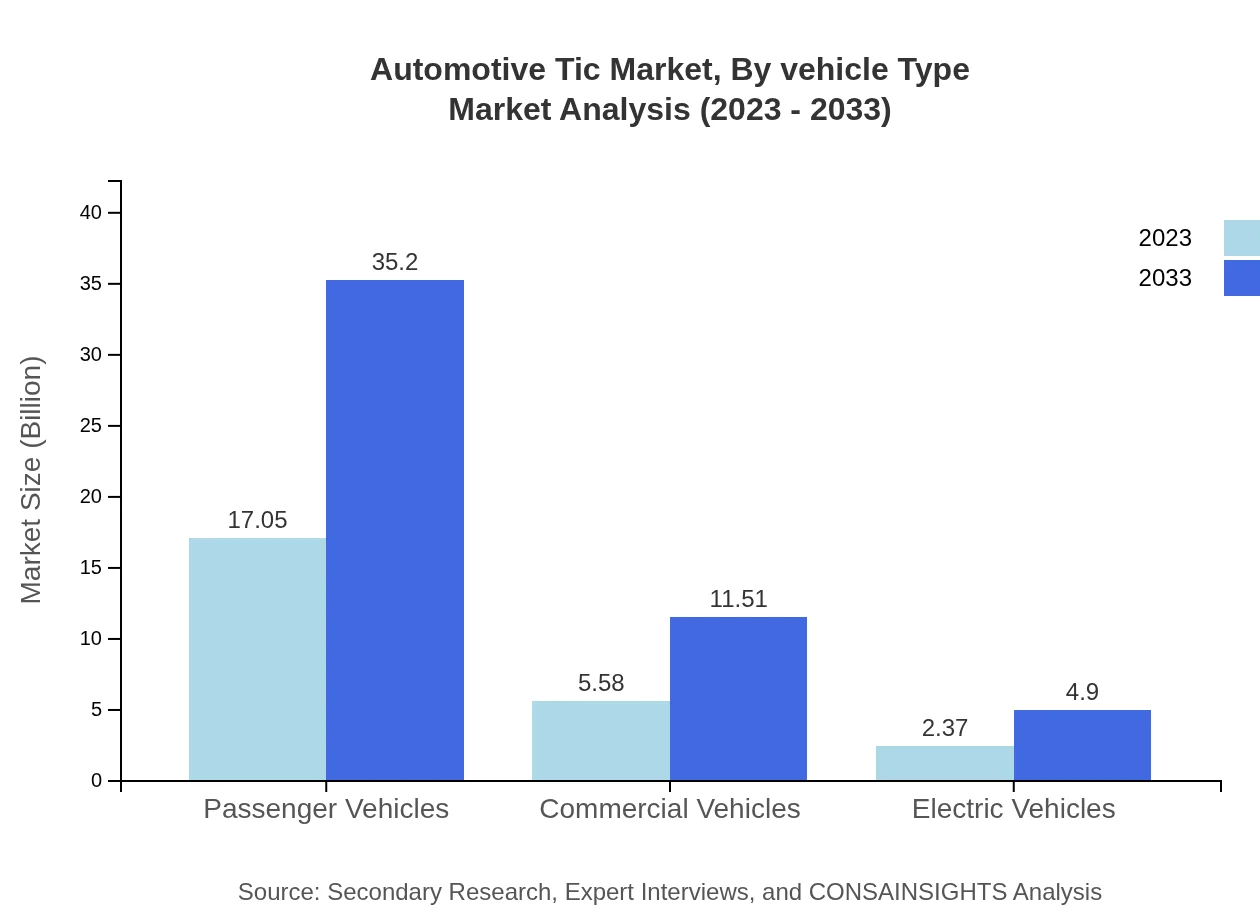

Automotive Tic Market Analysis By Vehicle Type

Passenger vehicles dominate the market with a substantial share of $17.05 billion in 2023, forecasted to double to $35.20 billion by 2033. Commercial vehicles are expected to expand from $5.58 billion to $11.51 billion, responding to the logistics industry's growth. Electric vehicles, while still emerging, will transition from $2.37 billion to $4.90 billion as manufacturers respond to stricter emission regulations and environmental imperatives.

Automotive Tic Market Analysis By Application

The applications of TIC services span across various domains, with emphasis on safety testing, quality inspection, and regulatory compliance. The rising complexity of automotive systems creates a demand for specialized services, necessitating continuous innovation in testing methodologies.

Automotive Tic Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Tic Industry

SGS SA:

SGS is a global leader in inspection, verification, testing, and certification. They provide innovative solutions tailored for the automotive industry, ensuring compliance with standards and improving quality assurance processes.TÜV SÜD:

TÜV SÜD offers diverse services including testing and certification for automotive manufacturers. Their expertise in vehicle safety and environmental compliance is pivotal in managing risk in automotive production.Bureau Veritas:

Bureau Veritas provides comprehensive TIC services to the automotive sector, helping manufacturers meet stringent regulatory requirements through customized testing solutions.Intertek Group:

Intertek offers total quality assurance monitoring, and certification services aimed at improving product quality and safety across various automotive sectors.Dekra:

Dekra specializes in vehicle testing, inspection, and certification services, focusing on automotive safety, and environmental standards adherence.We're grateful to work with incredible clients.

FAQs

What is the market size of Automotive TIC?

The market size of the Automotive TIC industry in 2023 is approximately $25 billion, with a projected compound annual growth rate (CAGR) of 7.3% towards 2033. This growth reflects increasing technological integration within the automotive sector.

What are the key market players or companies in the Automotive TIC industry?

Key market players in the Automotive TIC industry include major companies specializing in testing, inspection, and certification services. They focus on improving safety, compliance, and efficiency, crucial for navigating this evolving market landscape.

What are the primary factors driving the growth in the Automotive TIC industry?

Primary factors driving growth in the Automotive TIC industry include advancements in safety regulations, increased demand for electric vehicles, and the push for automated driving technologies. These factors necessitate robust testing and certification services.

Which region is the fastest Growing in the Automotive TIC?

The fastest-growing region in the Automotive TIC market is North America, projected to grow from $9.18 billion in 2023 to $18.94 billion by 2033. This growth is supported by burgeoning automotive advancements and regulatory demands.

Does ConsaInsights provide customized market report data for the Automotive TIC industry?

Yes, ConsaInsights offers customized market report data tailored for the Automotive TIC industry. Clients can obtain insights specialized to their needs, ensuring relevant and actionable data for their business strategies.

What deliverables can I expect from this Automotive TIC market research project?

From the Automotive TIC market research project, you can expect comprehensive market analysis reports, insights into key trends, competitive landscape assessments, and detailed forecasts, equipping stakeholders with informed decision-making tools.

What are the market trends of Automotive TIC?

Current Automotive TIC market trends include a shift towards electric and automated vehicles, heightened focus on safety standards, and growing demand for connectivity solutions. These trends foster innovation and influence industry investments.