Automotive Transmission Engineering Services Outsourcing Market Report

Published Date: 22 January 2026 | Report Code: automotive-transmission-engineering-services-outsourcing

Automotive Transmission Engineering Services Outsourcing Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Automotive Transmission Engineering Services Outsourcing market, analyzing trends, market size, growth projections through 2033, and regional insights, providing valuable data for stakeholders in the automotive industry.

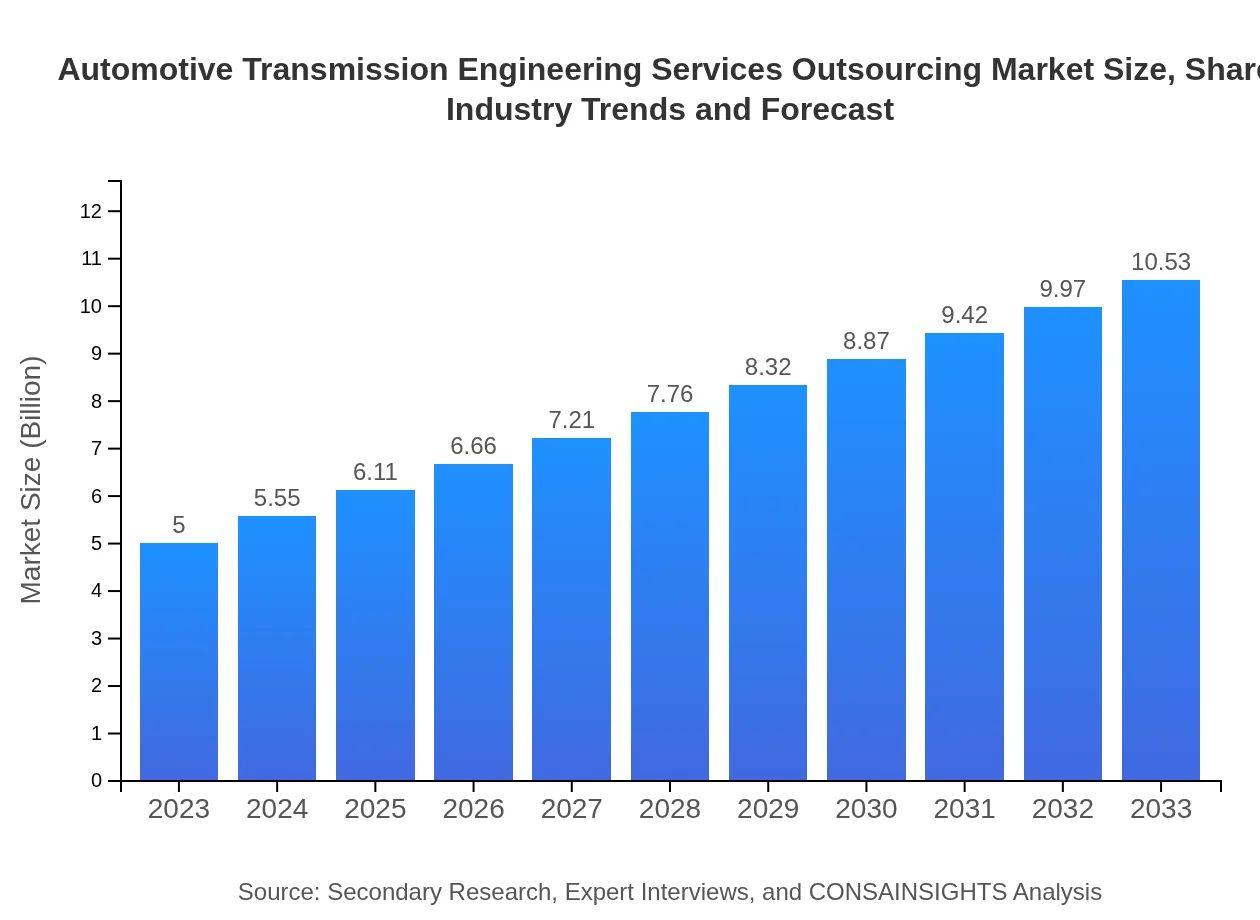

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $10.53 Billion |

| Top Companies | Bosch Engineering GmbH, Magna International Inc., Aptiv PLC |

| Last Modified Date | 22 January 2026 |

Automotive Transmission Engineering Services Outsourcing Market Overview

Customize Automotive Transmission Engineering Services Outsourcing Market Report market research report

- ✔ Get in-depth analysis of Automotive Transmission Engineering Services Outsourcing market size, growth, and forecasts.

- ✔ Understand Automotive Transmission Engineering Services Outsourcing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Transmission Engineering Services Outsourcing

What is the Market Size & CAGR of Automotive Transmission Engineering Services Outsourcing market in 2023?

Automotive Transmission Engineering Services Outsourcing Industry Analysis

Automotive Transmission Engineering Services Outsourcing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Transmission Engineering Services Outsourcing Market Analysis Report by Region

Europe Automotive Transmission Engineering Services Outsourcing Market Report:

Europe's market will see significant growth, estimated to rise from USD 1.30 billion in 2023 to USD 2.74 billion by 2033, due to stringent regulations and a commitment to sustainable automotive practices.Asia Pacific Automotive Transmission Engineering Services Outsourcing Market Report:

In Asia Pacific, the market is expected to expand from USD 0.97 billion in 2023 to USD 2.05 billion in 2033, driven by rising vehicle production and the demand for advanced transmission systems.North America Automotive Transmission Engineering Services Outsourcing Market Report:

North America remains a dominant region, with the market poised to increase from USD 1.80 billion in 2023 to USD 3.79 billion in 2033, propelled by advanced engineering capabilities and a strong focus on electric vehicles and automated transmission systems.South America Automotive Transmission Engineering Services Outsourcing Market Report:

The South American market, though smaller, is projected to grow from USD 0.42 billion in 2023 to USD 0.89 billion in 2033, supported by increasing automotive manufacturing activities and foreign investments.Middle East & Africa Automotive Transmission Engineering Services Outsourcing Market Report:

The Middle East and Africa market is projected to grow from USD 0.50 billion in 2023 to USD 1.05 billion in 2033, as regional growth in the automotive sector and investments in industrial development drive demand for engineering services.Tell us your focus area and get a customized research report.

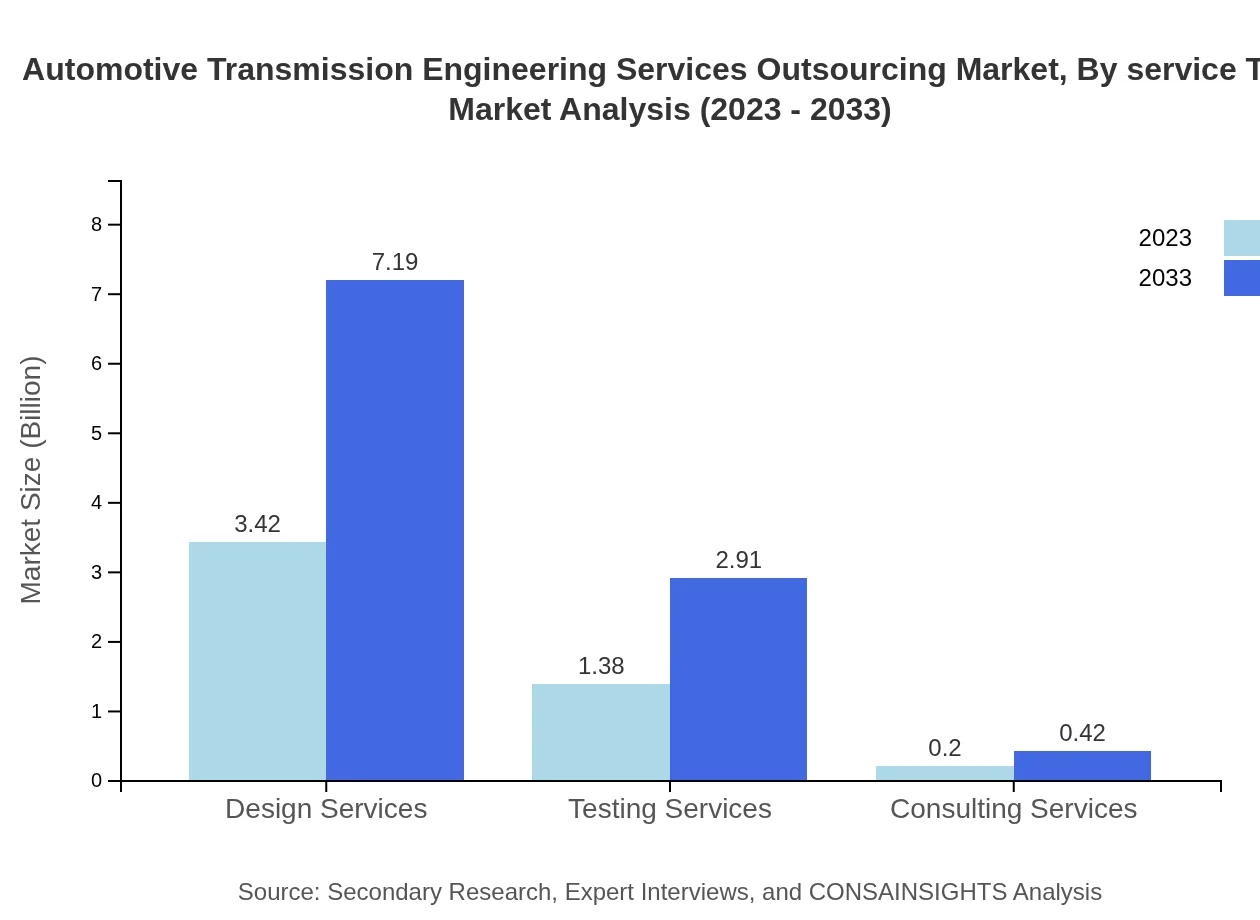

Automotive Transmission Engineering Services Outsourcing Market Analysis By Service Type

In 2023, the service type segment's market size is dominated by design services at USD 3.42 billion, expected to reach USD 7.19 billion by 2033, holding a share of 68.33%. Testing services follow with a forecast from USD 1.38 billion in 2023 to USD 2.91 billion in 2033, covering 27.67%. Consulting services represent a smaller share, estimated at USD 0.20 billion in 2023, growing to USD 0.42 billion by 2033.

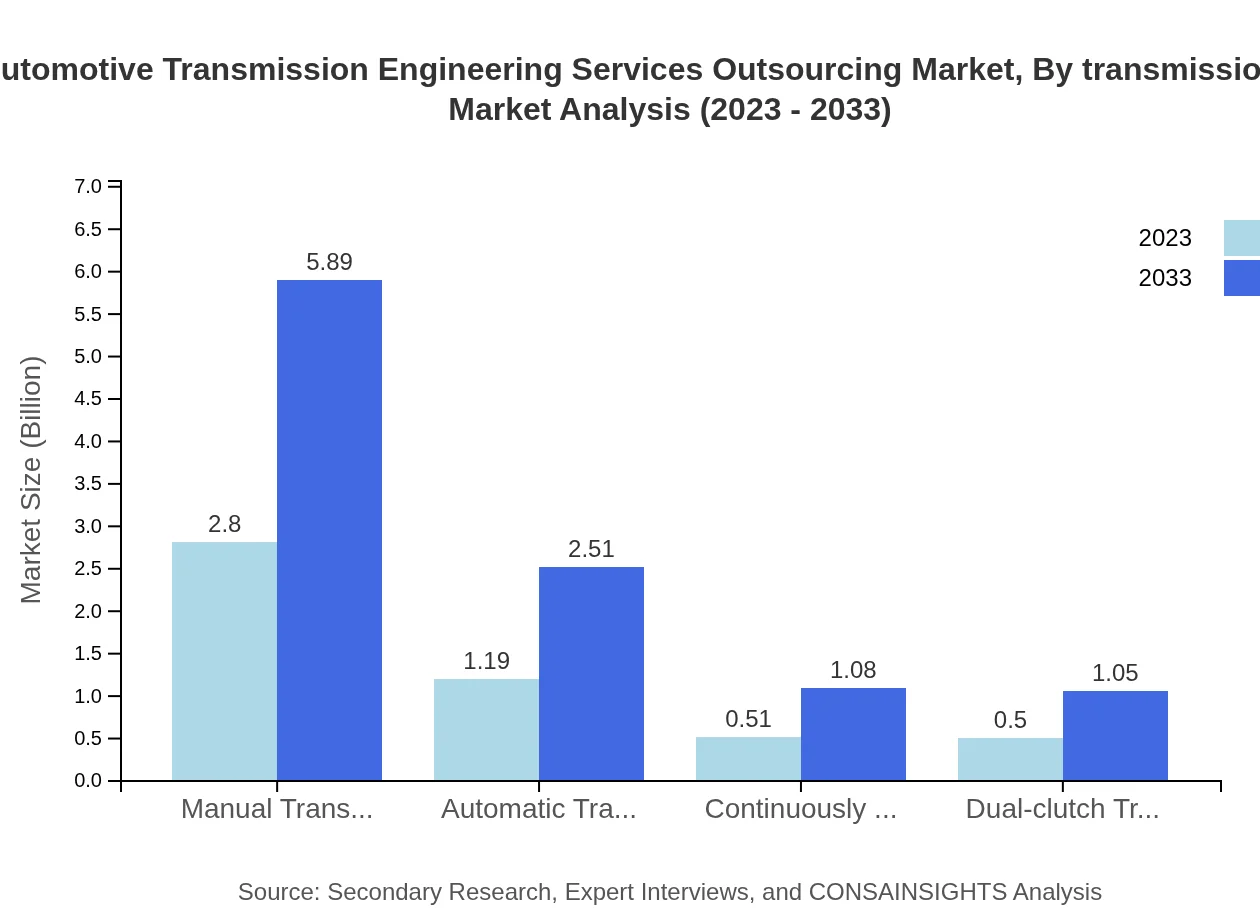

Automotive Transmission Engineering Services Outsourcing Market Analysis By Transmission Type

The market for manual transmission is anticipated to grow from USD 2.80 billion in 2023 to USD 5.89 billion in 2033, capturing a share of 55.94%. Automatic transmission services will increase from USD 1.19 billion to USD 2.51 billion, taking 23.81% of the share. CVTs and dual-clutch transmissions will also see notable growth, with CVTs moving from USD 0.51 billion to USD 1.08 billion, and DSG increasing from USD 0.50 billion to USD 1.05 billion.

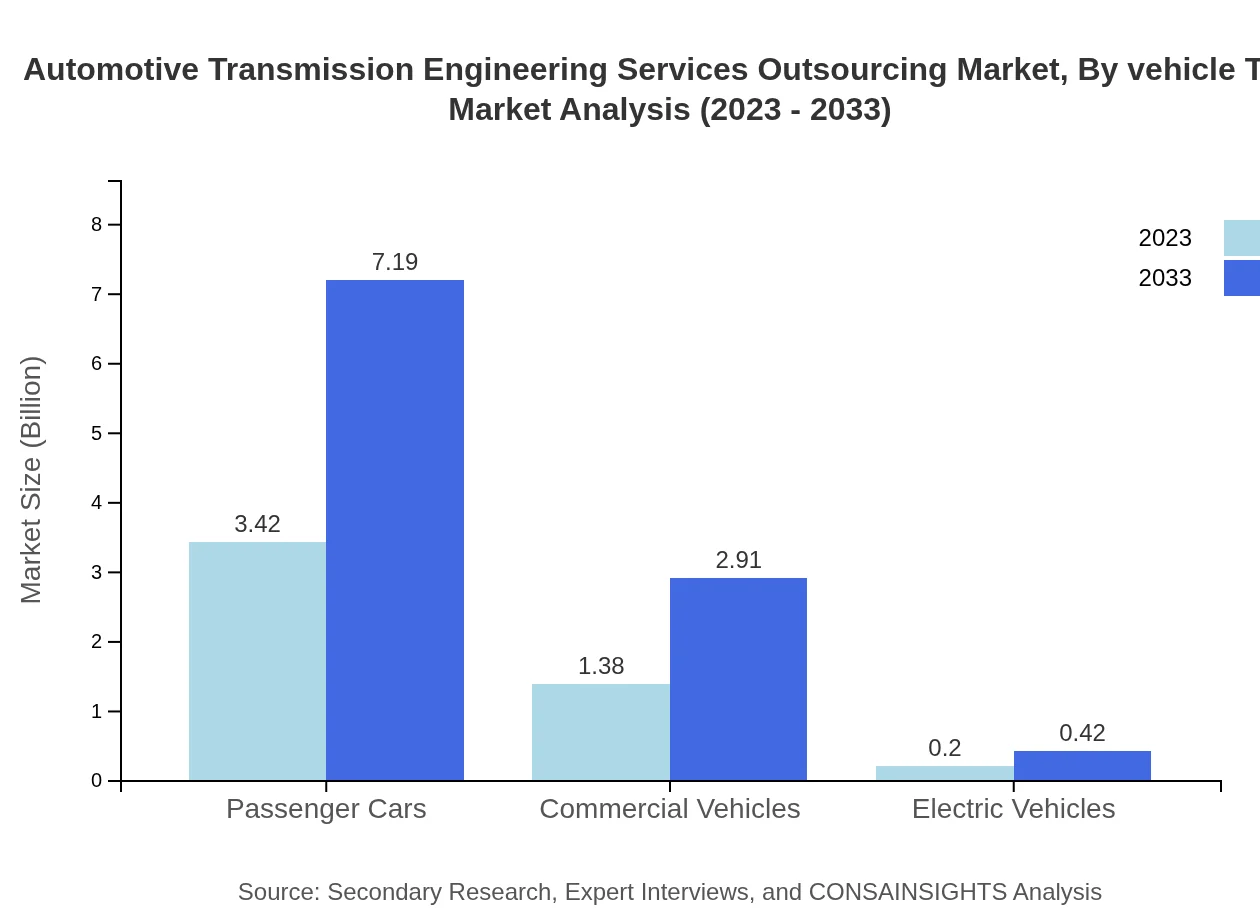

Automotive Transmission Engineering Services Outsourcing Market Analysis By Vehicle Type

For vehicle types, passenger cars will generate significant revenues, expected to grow from USD 3.42 billion in 2023 to USD 7.19 billion by 2033, holding 68.33% of the market. Commercial vehicles will rise from USD 1.38 billion to USD 2.91 billion, representing 27.67%, while electric vehicle services will expand from USD 0.20 billion to USD 0.42 billion.

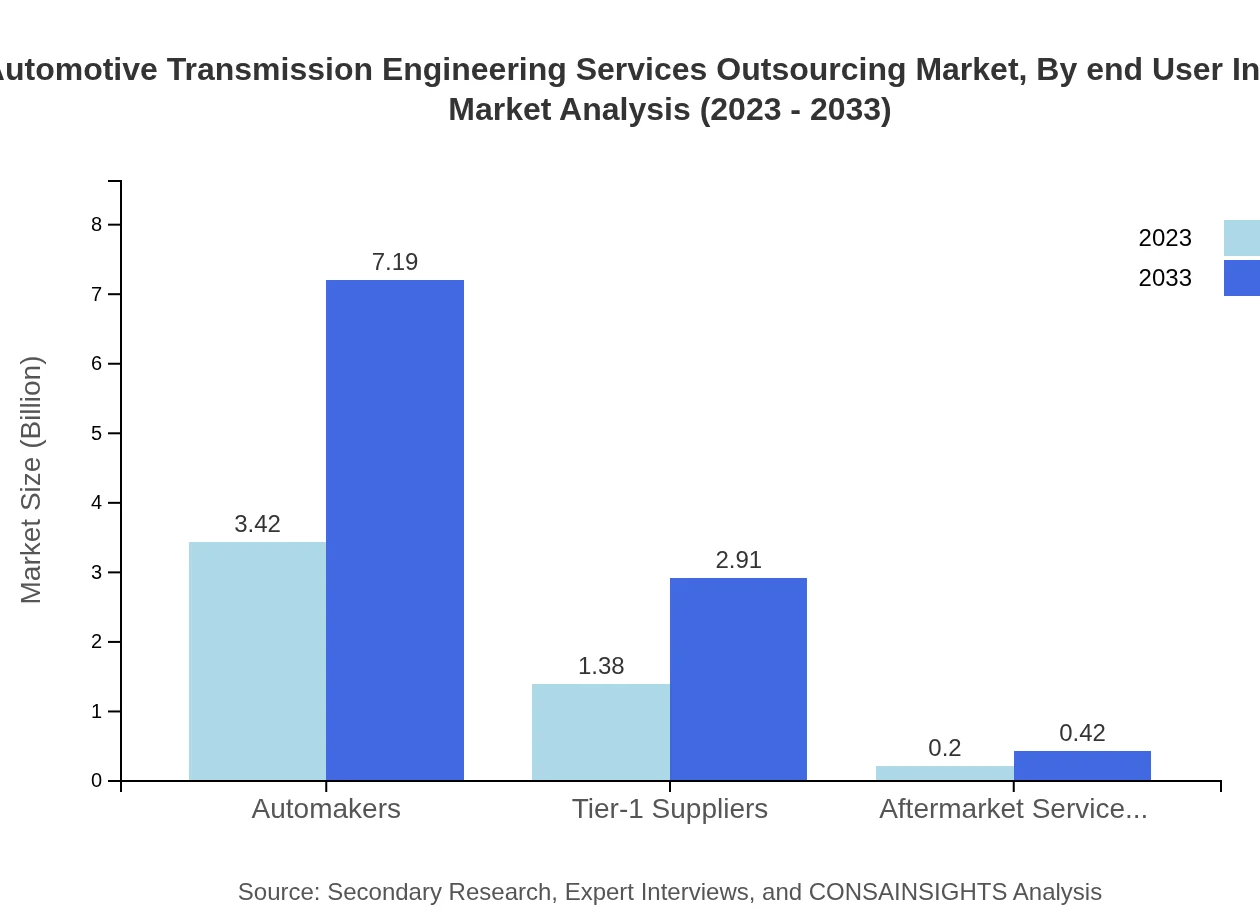

Automotive Transmission Engineering Services Outsourcing Market Analysis By End User Industry

The automotive manufacturers segment commands the market with service revenues growing from USD 3.42 billion to USD 7.19 billion, constituting 68.33%. Tier-1 suppliers will achieve growth from USD 1.38 billion to USD 2.91 billion at 27.67%, while aftermarket service providers represent a smaller share, from USD 0.20 billion to USD 0.42 billion.

Automotive Transmission Engineering Services Outsourcing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Transmission Engineering Services Outsourcing Industry

Bosch Engineering GmbH:

Bosch Engineering GmbH is a prominent player specializing in automotive engineering services, including advanced transmission systems, striving for innovation, efficiency, and compliance with global standards.Magna International Inc.:

Magna International Inc. provides comprehensive engineering and manufacturing services, focusing on advanced transmission and driveline systems for numerous automotive firms worldwide.Aptiv PLC:

Aptiv PLC is a technology-focused company that delivers advanced electrical and electronic components and systems, driving innovation in transmission technologies to enhance vehicle performance.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive transmission engineering services outsourcing?

As of 2023, the automotive transmission engineering services outsourcing market is valued at approximately $5 billion. It is projected to grow at a CAGR of 7.5%, indicating significant growth potential through 2033.

What are the key market players or companies in this industry?

The automotive transmission engineering services outsourcing industry features key players including major automakers, Tier-1 suppliers, and specialized engineering service providers that focus on transmission design and testing.

What are the primary factors driving the growth in automotive transmission engineering services outsourcing?

The growth of the automotive transmission engineering services outsourcing market is driven by increasing vehicle production, advancements in transmission technology, and a rising demand for fuel efficiency and electric vehicles.

Which region is the fastest Growing in the automotive transmission engineering services outsourcing?

Asia Pacific is the fastest-growing region in this market, with its size increasing from $0.97 billion in 2023 to $2.05 billion by 2033, supported by a booming automotive industry and manufacturing capabilities.

Does ConsaInsights provide customized market report data for the automotive transmission engineering services outsourcing industry?

Yes, Consainsights offers customized market report data tailored to the unique requirements of clients, providing insights and detailed analysis in the automotive transmission engineering services outsourcing sector.

What deliverables can I expect from this automotive transmission engineering services outsourcing market research project?

From this market research project, clients can expect comprehensive reports featuring market size estimates, segment analysis, competitive landscape insights, and growth forecasts tailored for the automotive transmission engineering outsourcing sector.

What are the market trends of automotive transmission engineering services outsourcing?

Key trends in the automotive transmission engineering services outsourcing market include increased adoption of electric vehicles, advancements in automatic and manual transmission systems, and a shift towards integrating AI and digital technologies in engineering processes.