Autosamplers Market Report

Published Date: 31 January 2026 | Report Code: autosamplers

Autosamplers Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Autosamplers market from 2023 to 2033, including market size, growth trends, segmentations, regional insights, and competitive landscape. It aims to give stakeholders comprehensive data for strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

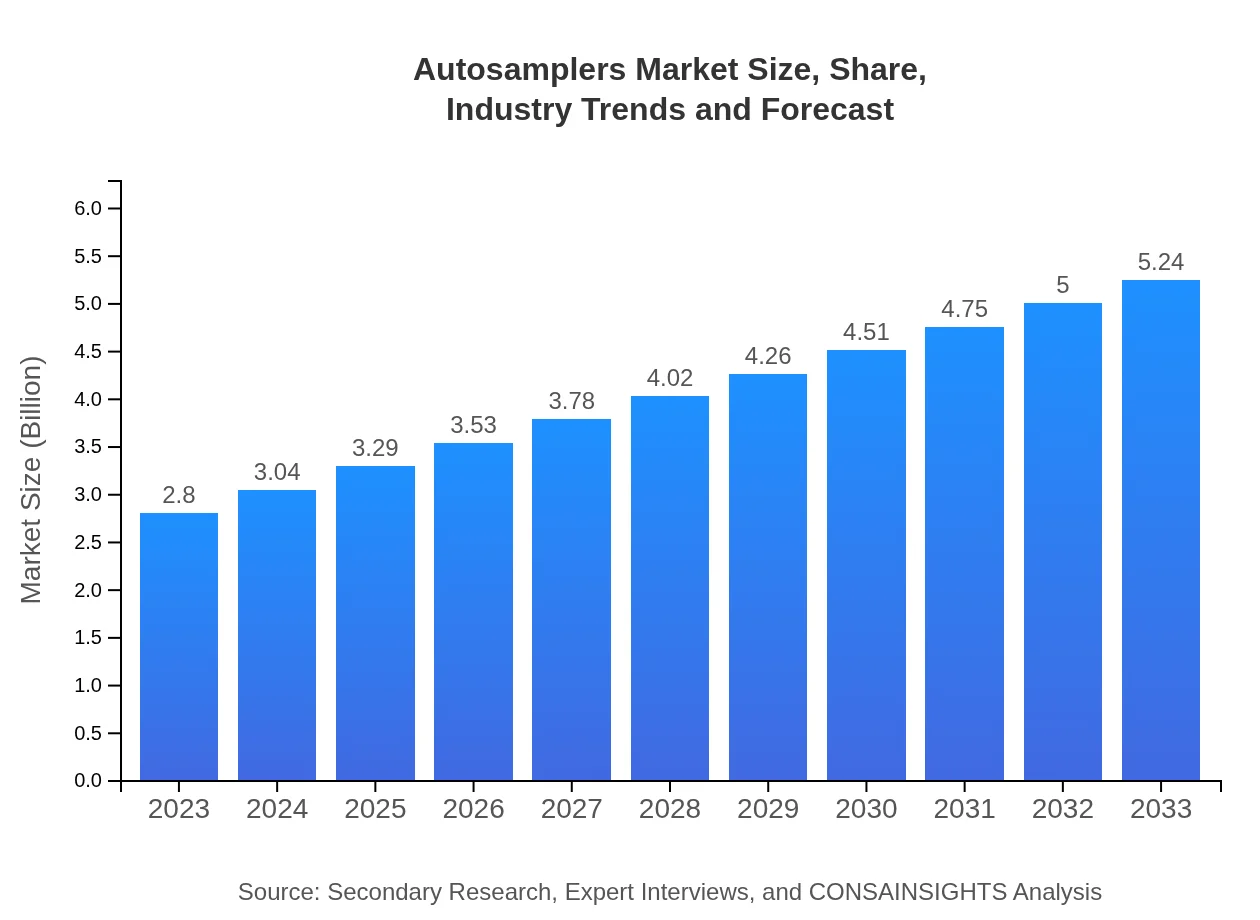

| 2023 Market Size | $2.80 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $5.24 Billion |

| Top Companies | Agilent Technologies, Thermo Fisher Scientific, PerkinElmer, Metrohm AG, Horiba, Ltd. |

| Last Modified Date | 31 January 2026 |

Autosamplers Market Overview

Customize Autosamplers Market Report market research report

- ✔ Get in-depth analysis of Autosamplers market size, growth, and forecasts.

- ✔ Understand Autosamplers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Autosamplers

What is the Market Size & CAGR of Autosamplers market in 2023?

Autosamplers Industry Analysis

Autosamplers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Autosamplers Market Analysis Report by Region

Europe Autosamplers Market Report:

Europe's Autosamplers market is anticipated to increase from $0.73 billion in 2023 to $1.36 billion by 2033, with significant application in pharmaceutical and environmental testing sectors.Asia Pacific Autosamplers Market Report:

In the Asia Pacific region, the Autosamplers market is expected to grow from $0.56 billion in 2023 to $1.05 billion by 2033, fueled by increased investments in laboratory infrastructure and heightened pharmaceutical production.North America Autosamplers Market Report:

North America leads the market with an expected growth from $1.04 billion in 2023 to $1.94 billion by 2033, driven by advanced research facilities and stringent regulatory compliance requirements.South America Autosamplers Market Report:

The South American market, valued at $0.26 billion in 2023, is projected to reach $0.49 billion by 2033 due to growing demand from pharmaceutical and food testing laboratories.Middle East & Africa Autosamplers Market Report:

In the Middle East and Africa, the market is expected to grow from $0.21 billion in 2023 to $0.40 billion by 2033, as the region invests in improving its laboratory capabilities.Tell us your focus area and get a customized research report.

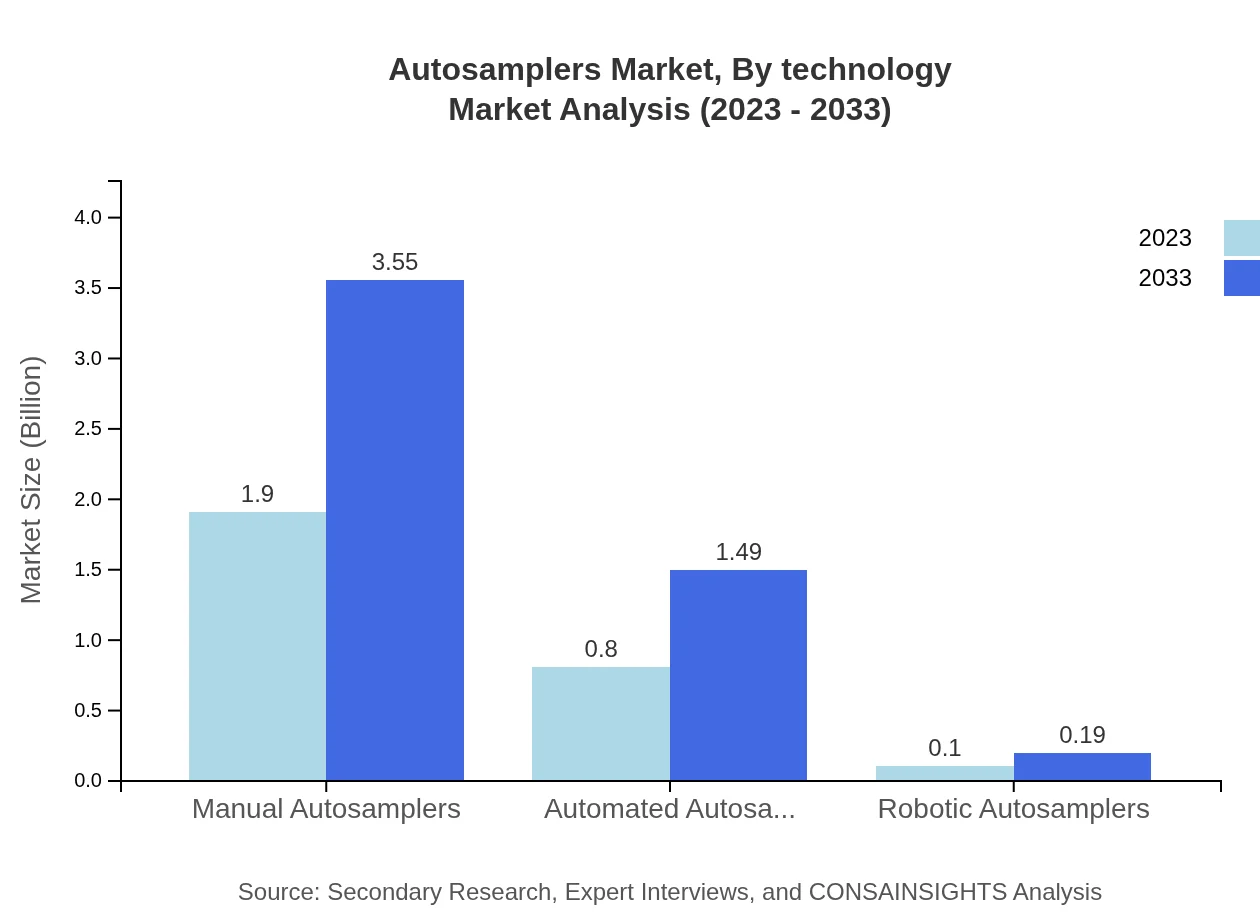

Autosamplers Market Analysis By Product Type

The market is segmented into Manual, Automated, and Robotic Autosamplers. In 2023, the Manual Autosamplers segment leads with a market size of $1.90 billion, maintaining a share of 67.83%. Automated Autosamplers, with a market size of $0.80 billion and a share of 28.45%, are witnessing an increase in adoption due to their efficiency. Robotic Autosamplers, although smaller at $0.10 billion and 3.72% share, are anticipated to grow as laboratory automation advances.

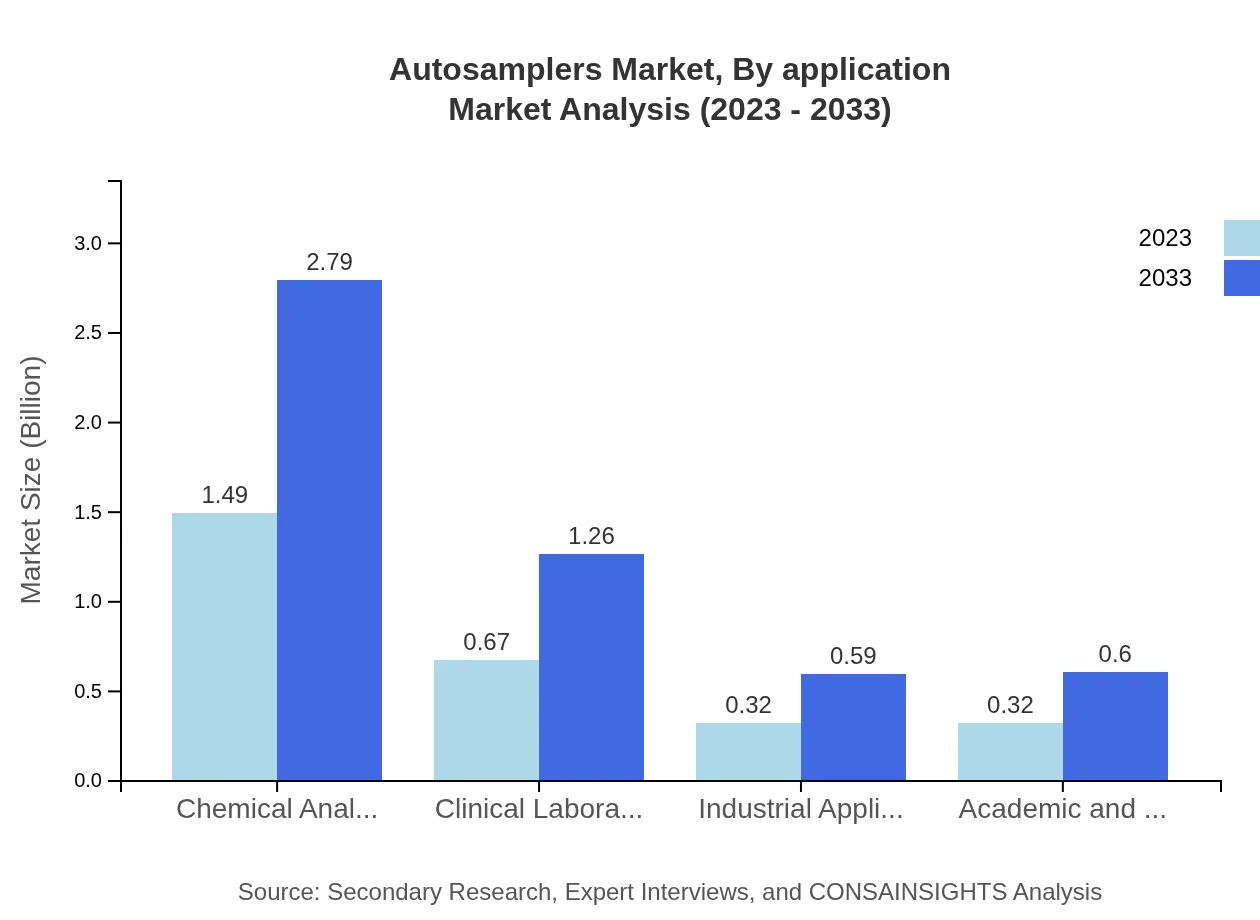

Autosamplers Market Analysis By Application

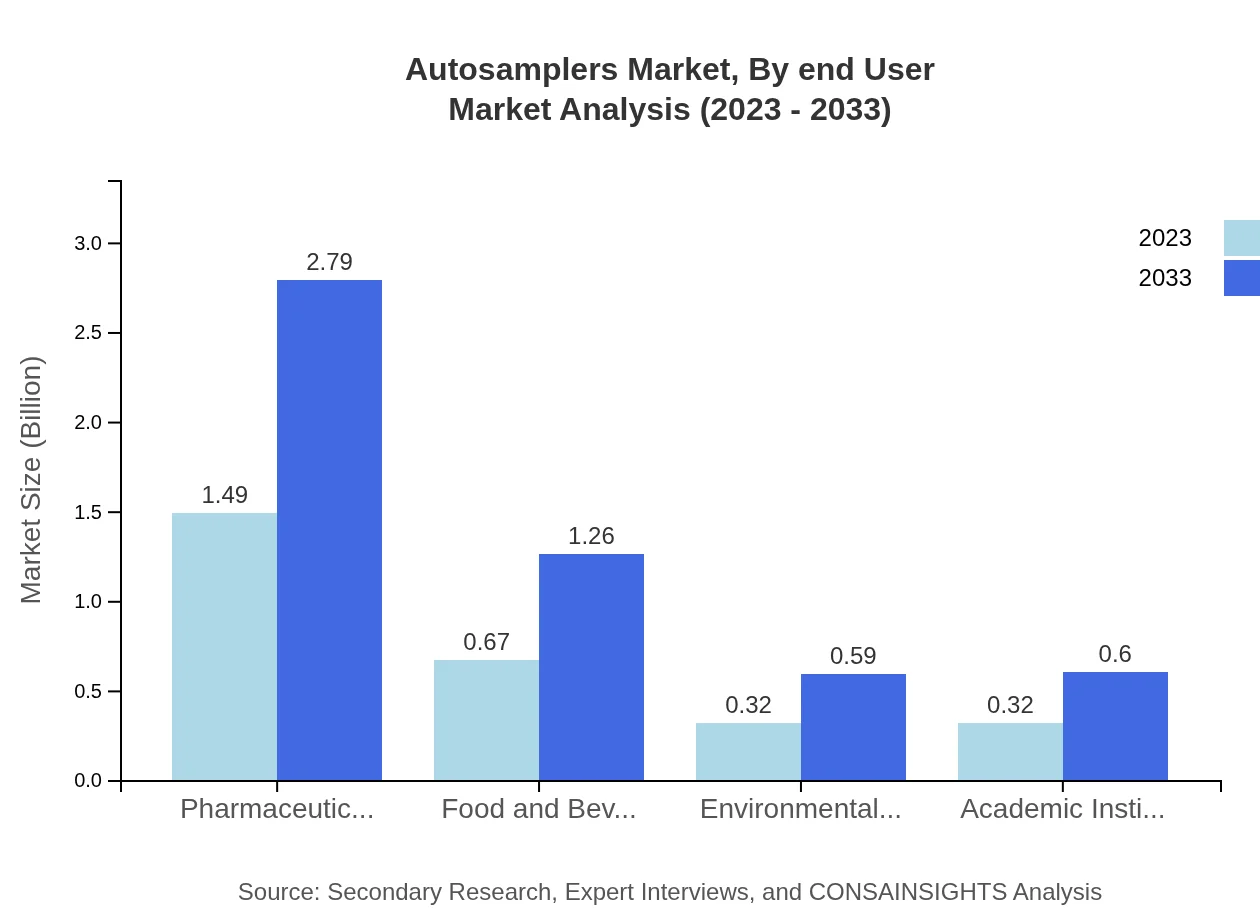

The Autosamplers market by application reveals the pharmaceutical sector as the dominant category, expected to grow from $1.49 billion in 2023 to $2.79 billion in 2033, holding a market share of 53.26%. The food and beverage industry follows, with a projected market of $0.67 billion growing to $1.26 billion. Environmental agencies and academic institutions also contribute significantly to the overall market, driven by the increasing focus on quality control and regulatory compliance.

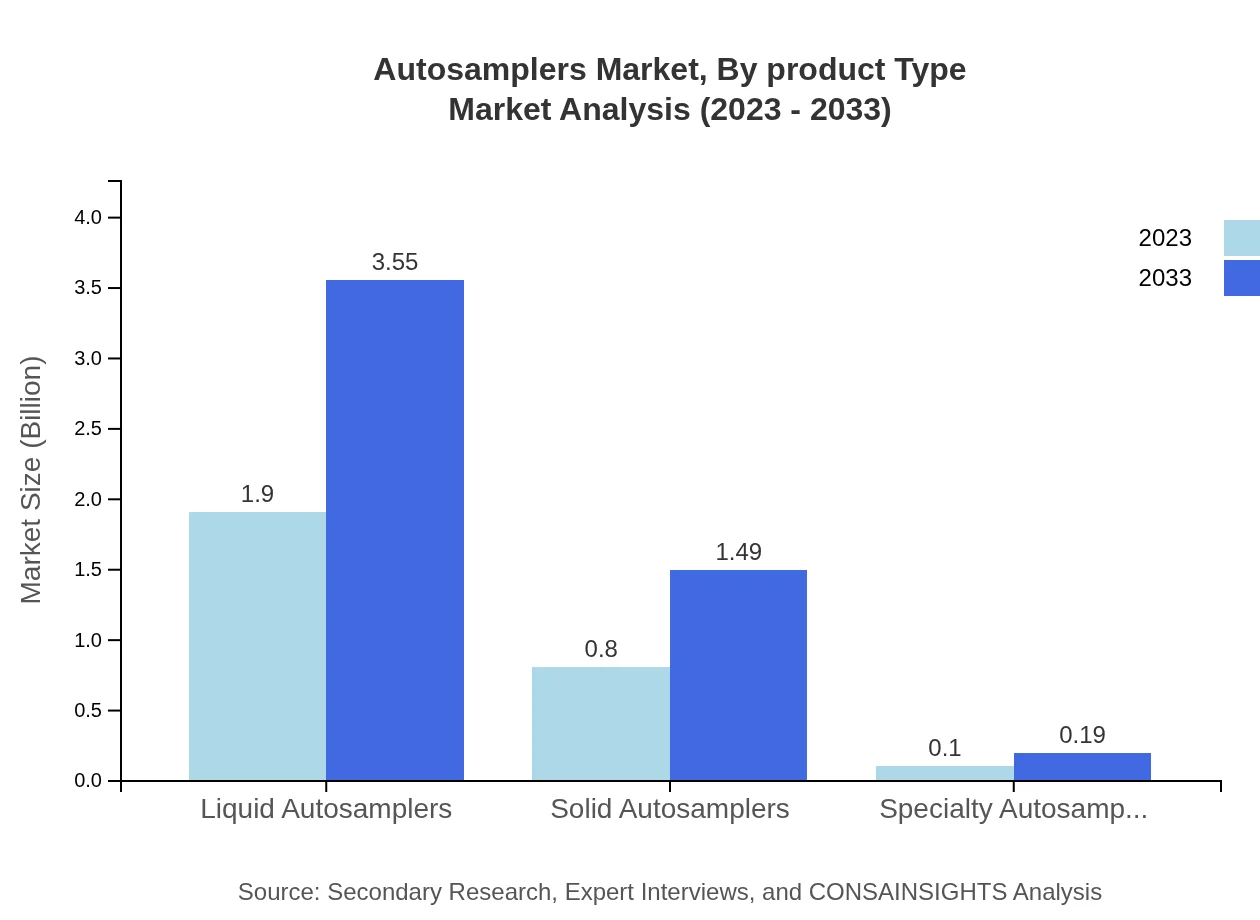

Autosamplers Market Analysis By Technology

Different technologies for Autosamplers include Liquid, Solid, and Specialty Autosamplers. Liquid Autosamplers, a leading segment, are projected to grow from $1.90 billion in 2023 to $3.55 billion by 2033. Solid Autosamplers also show substantial market presence, expected to grow to $1.49 billion from $0.80 billion. Specialty Autosamplers, while smaller in size, are catering to niche applications in analytical laboratories.

Autosamplers Market Analysis By End User

Key end-users of Autosamplers include clinical laboratories, industrial applications, and academic institutions. Clinical laboratories, valued at $0.67 billion in 2023, are anticipated to grow to $1.26 billion, benefitting from the rise in medical testing and diagnostics. Academic institutions also represent a significant share, with demand driven by research and development activities.

Autosamplers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Autosamplers Industry

Agilent Technologies:

Agilent is a leading global provider of scientific instruments and supplies, recognized for its innovative autosampling technology in analytical laboratories.Thermo Fisher Scientific:

Thermo Fisher specializes in laboratory equipment and provides a diverse range of autosamplers that enhance operational efficiency in clinical and environmental testing.PerkinElmer:

PerkinElmer offers advanced autosampling solutions specifically designed for pharmaceutical, environmental, and industrial applications.Metrohm AG:

Metrohm is known for its precision instruments in chemical analysis, including a range of reliable autosamplers enhancing laboratory productivity.Horiba, Ltd.:

Horiba provides comprehensive solutions for various analytical applications, contributing innovative autosamplers to the market.We're grateful to work with incredible clients.

FAQs

What is the market size of autosamplers?

The global autosamplers market is valued at approximately $2.8 billion in 2023, with a projected growth at a CAGR of 6.3%. This indicates robust expansion, reflecting the continuous demand across various industries and strengthening market presence globally.

What are the key market players or companies in the autosamplers industry?

Major players in the autosamplers market include Thermo Fisher Scientific, Agilent Technologies, PerkinElmer, and Waters Corporation. These companies dominate through innovation, extensive product lines, and strong global distribution networks.

What are the primary factors driving the growth in the autosamplers industry?

Key drivers for the autosamplers market include advancements in laboratory automation, increasing demand in pharmaceuticals and food testing sectors, and a growing focus on quality control standards. Enhanced efficiency and accuracy in testing processes further spur market growth.

Which region is the fastest Growing in the autosamplers?

Asia Pacific is the fastest-growing region in the autosamplers market, estimated to grow from $0.56 billion in 2023 to $1.05 billion by 2033. This growth is fueled by expanding laboratory facilities and increased research activities in the region.

Does Consainsights provide customized market report data for the autosamplers industry?

Yes, Consainsights offers customized market report data tailored to client specifications within the autosamplers industry. This includes in-depth insights into market trends, key players, and segment performance, allowing for informed decision-making.

What deliverables can I expect from this autosamplers market research project?

Deliverables from the autosamplers market research project include a comprehensive report detailing market size, growth forecasts, regional analyses, competitive landscape, and segment-wise insights, ensuring a thorough understanding of the market dynamics.

What are the market trends of autosamplers?

Current trends in the autosamplers market include a shift toward automation, an increase in demand for customized sampling solutions, and rising investments in laboratory technologies. These trends indicate an evolving landscape targeted at improving laboratory efficiency.