Aviation Asset Management Market Report

Published Date: 03 February 2026 | Report Code: aviation-asset-management

Aviation Asset Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Aviation Asset Management market, offering insights into its size, growth, trends, and forecasts from 2023 to 2033. The report also includes segmentation by solutions and asset types, along with a regional analysis.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $13.29 Billion |

| Top Companies | Airbus, Boeing , GE Aviation, Honeywell |

| Last Modified Date | 03 February 2026 |

Aviation Asset Management Market Overview

Customize Aviation Asset Management Market Report market research report

- ✔ Get in-depth analysis of Aviation Asset Management market size, growth, and forecasts.

- ✔ Understand Aviation Asset Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aviation Asset Management

What is the Market Size & CAGR of the Aviation Asset Management market in 2023?

Aviation Asset Management Industry Analysis

Aviation Asset Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aviation Asset Management Market Analysis Report by Region

Europe Aviation Asset Management Market Report:

With a market size of $1.75 billion in 2023, Europe is expected to expand to $3.58 billion by 2033. The European Aviation market continues to embrace asset management technologies to comply with stringent regulations and enhance operational sustainability amidst the growing focus on green aviation practices.Asia Pacific Aviation Asset Management Market Report:

In 2023, the Asia Pacific region's Aviation Asset Management market is valued at $1.27 billion and is expected to reach $2.60 billion by 2033. Rapid urbanization, expanding middle-class populations, and increased air traffic in countries like China and India are fuelling market expansion. The emphasis on modernizing airports and investing in fleet capabilities further supports growth.North America Aviation Asset Management Market Report:

North America holds a substantial market share, valued at $2.14 billion in 2023 and projected to grow to $4.37 billion by 2033. The presence of key players and technologically advanced solutions, alongside a robust demand for aircraft leasing, drives market dynamics in this region.South America Aviation Asset Management Market Report:

The South American Aviation Asset Management market is estimated at $0.57 billion in 2023, climbing to $1.17 billion by 2033. The region's recovery from economic downturns and infrastructure development projects are pivotal factors enhancing aviation asset management practices, along with efforts to improve airline operations.Middle East & Africa Aviation Asset Management Market Report:

The Middle East and Africa region is anticipated to show steady growth from $0.77 billion in 2023 to $1.57 billion by 2033. Regional developments in air travel and a strategic focus on building modern aviation infrastructure in the Gulf countries contribute to market growth.Tell us your focus area and get a customized research report.

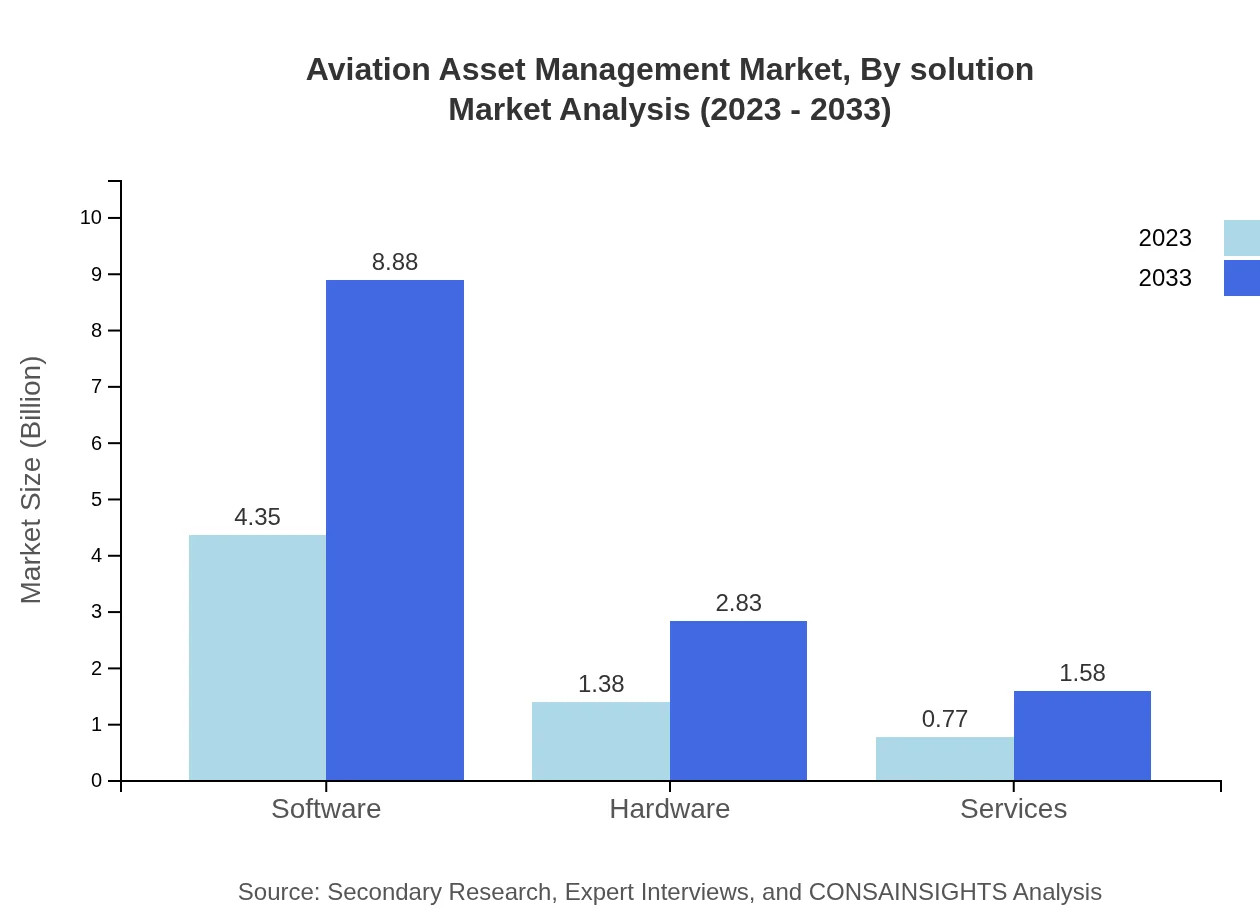

Aviation Asset Management Market Analysis By Solution

The Aviation Asset Management sector features solutions such as software, hardware, and services. Software solutions dominate the market with a size of $4.35 billion in 2023 and a growth to $8.88 billion by 2033, representing 66.85% of the market share. Hardware and service segments follow with significant contributions, emphasizing the crucial roles they play in asset management.

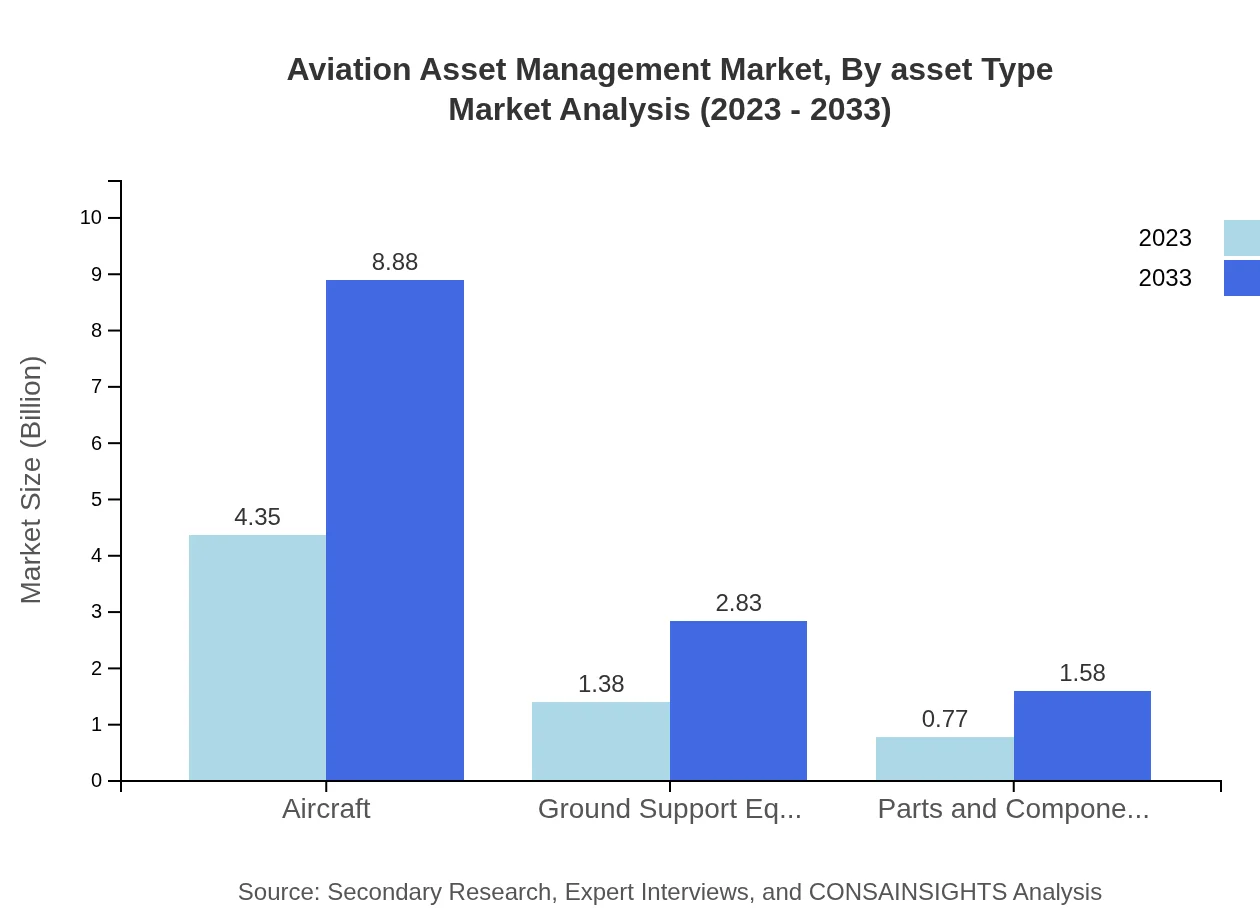

Aviation Asset Management Market Analysis By Asset Type

The key asset types include Aircraft, Ground Support Equipment, Parts and Components, with the Aircraft segment leading with a market size of $4.35 billion in 2023. This segment is projected to maintain its share and expand to $8.88 billion by 2033, underlining its significance in asset management.

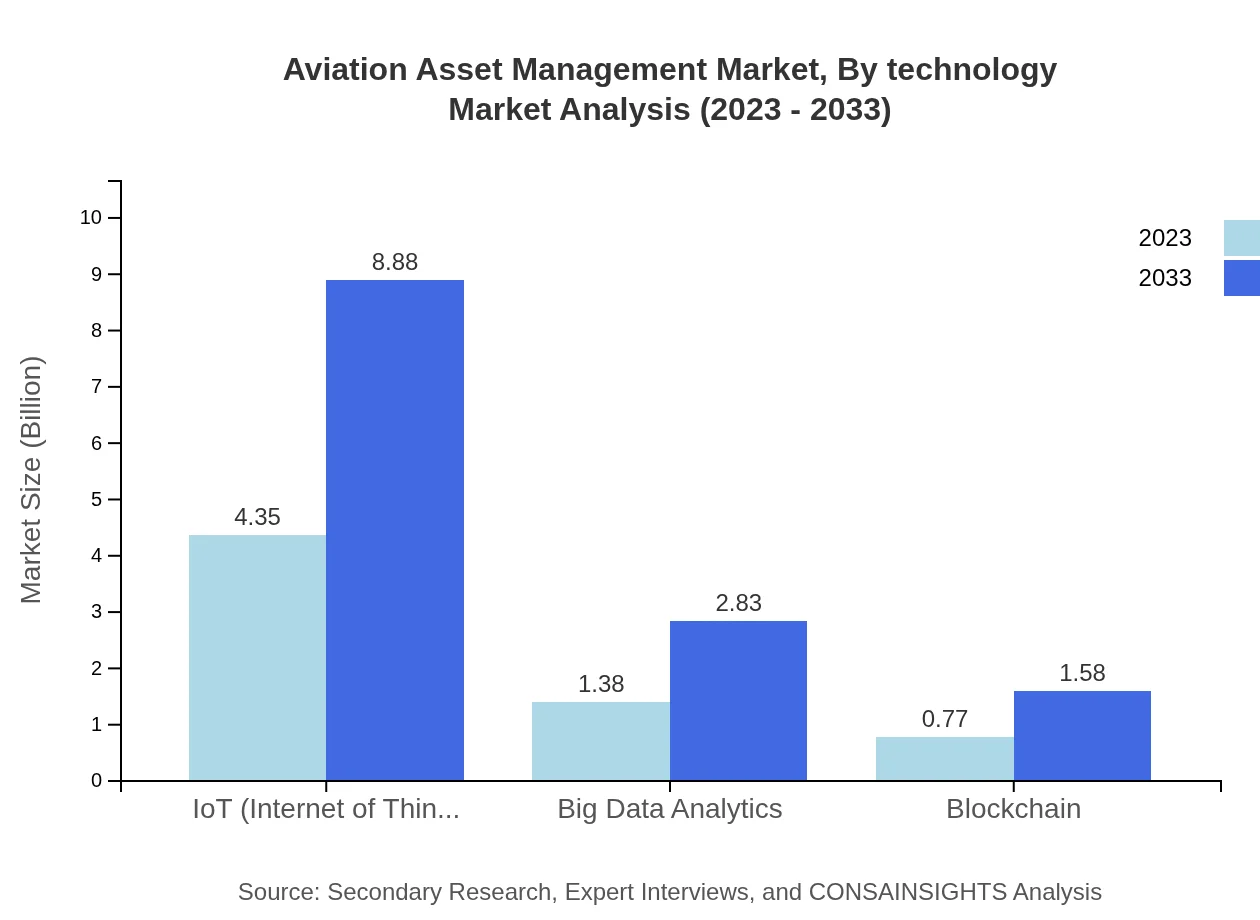

Aviation Asset Management Market Analysis By Technology

Technological advancements play a vital role in the Aviation Asset Management market with key technologies like IoT, Big Data Analytics and Blockchain. The IoT segment, valued at $4.35 billion in 2023, reflects its critical role in real-time asset tracking and management.

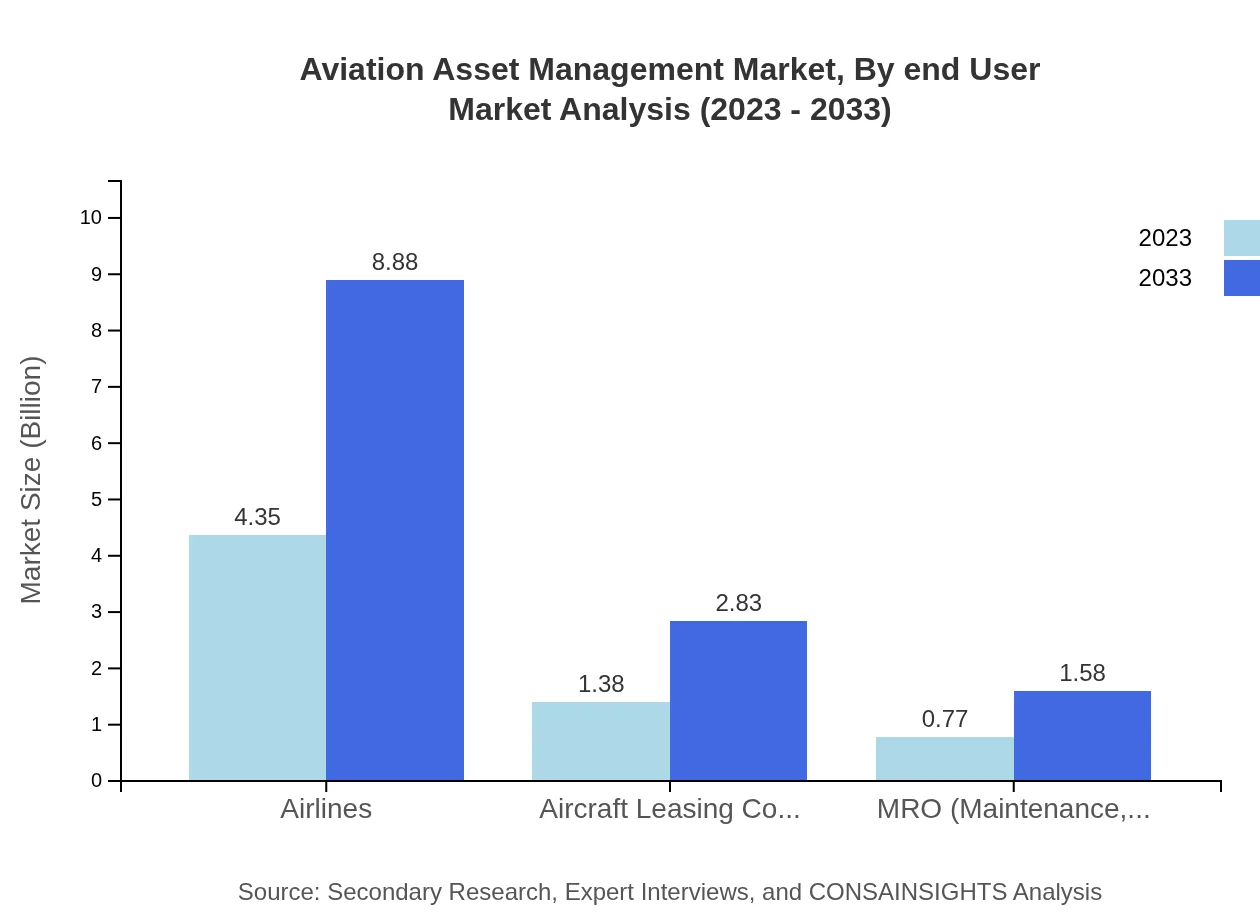

Aviation Asset Management Market Analysis By End User

End-users of Aviation Asset Management services primarily include Airlines, Aircraft Leasing Companies, and MRO Organizations. Airlines hold the largest market share, emphasizing the importance of asset management for operational efficiency.

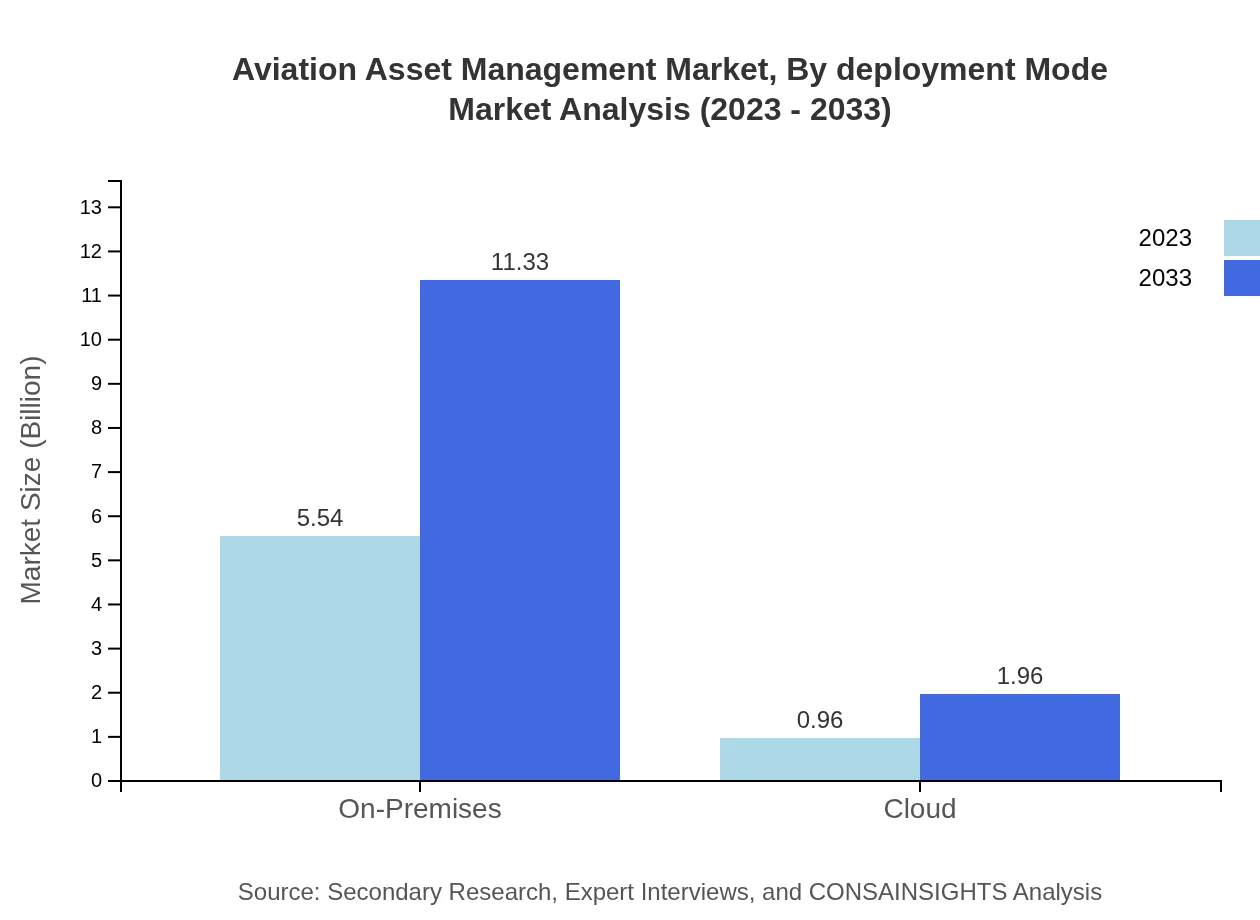

Aviation Asset Management Market Analysis By Deployment Mode

The market is segmented by deployment mode into On-Premises and Cloud solutions. On-Premises solutions dominate with a significant market size of $5.54 billion in 2023, reflecting businesses' preference for customized and secure solutions.

Aviation Asset Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aviation Asset Management Industry

Airbus:

Airbus is a leading aircraft manufacturer that provides innovative asset management solutions fueling the aviation industry's growth with a focus on technology and sustainability.Boeing :

Boeing offers a range of asset management services focusing on efficiency and reliability while ensuring compliance with industry standards.GE Aviation:

GE Aviation specializes in technology and advanced analytics, delivering critical insights for optimized fleet and asset management processes.Honeywell :

Honeywell provides integrated solutions and technologies that enhance operational efficiencies and improve maintenance practices for aviation assets.We're grateful to work with incredible clients.

FAQs

What is the market size of aviation asset management?

The aviation asset management market is projected to reach approximately $6.5 billion by 2033, with a compound annual growth rate (CAGR) of 7.2% during the period from 2023 to 2033.

What are the key market players or companies in the aviation asset management industry?

Key players include major airlines, aircraft leasing companies, and software providers. These entities drive innovation and offer comprehensive solutions of asset tracking, maintenance, and leasing services to optimize operations and reduce costs.

What are the primary factors driving the growth in the aviation asset management industry?

Growth drivers include increasing air travel demand, advancements in asset management technologies, and the need for cost efficiency among airlines as they seek to optimize fleet utilization. Environmental regulations also push for better management practices.

Which region is the fastest Growing in the aviation asset management market?

The North America region is the fastest-growing market for aviation asset management, projected to expand from $2.14 billion in 2023 to $4.37 billion by 2033, driven by high air travel rates and technological adoption.

Does ConsaInsights provide customized market report data for the aviation asset management industry?

Yes, ConsaInsights provides customized market report data tailored to specific needs. Clients can request in-depth analysis by region, segment, or technology to meet their specific business objectives.

What deliverables can I expect from this aviation asset management market research project?

Deliverables include comprehensive market analysis reports, segment breakdown, regional insights, competitive landscape summaries, and actionable recommendations tailored to guide decision-making in the aviation asset management space.

What are the market trends of aviation asset management?

Key trends include increasing investments in digital solutions, emphasis on sustainability, growing integration of IoT, and big data analytics for predictive maintenance and operational efficiency in managing aviation assets.