Aviation Blockchain Market Report

Published Date: 31 January 2026 | Report Code: aviation-blockchain

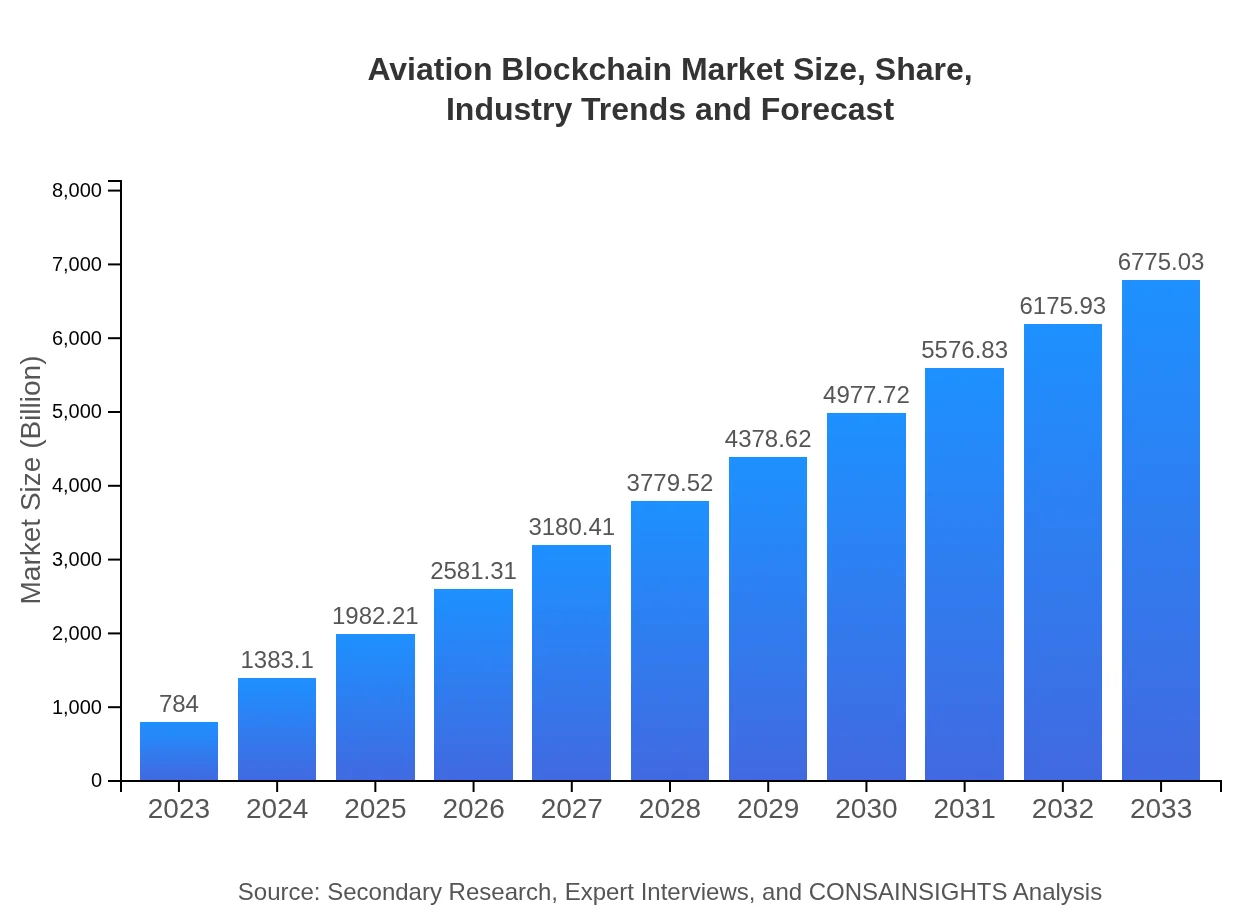

Aviation Blockchain Market Size, Share, Industry Trends and Forecast to 2033

This report encompasses the Aviation Blockchain market, offering insights into market size, trends, and forecasts from 2023 to 2033, including various applications, technologies, and regional analyses.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $784.00 Million |

| CAGR (2023-2033) | 22.6% |

| 2033 Market Size | $6775.03 Million |

| Top Companies | IBM, Microsoft, Accenture, Honeywell , Airbus |

| Last Modified Date | 31 January 2026 |

Aviation Blockchain Market Overview

Customize Aviation Blockchain Market Report market research report

- ✔ Get in-depth analysis of Aviation Blockchain market size, growth, and forecasts.

- ✔ Understand Aviation Blockchain's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aviation Blockchain

What is the Market Size & CAGR of Aviation Blockchain market in 2023?

Aviation Blockchain Industry Analysis

Aviation Blockchain Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aviation Blockchain Market Analysis Report by Region

Europe Aviation Blockchain Market Report:

Europe's Aviation Blockchain market is expected to escalate from $246.02 million in 2023 to $2.13 billion by 2033. The region's emphasis on innovation, alongside strict regulatory requirements, is driving advanced blockchain solutions in logistics and identity management within aviation.Asia Pacific Aviation Blockchain Market Report:

In the Asia Pacific region, the Aviation Blockchain market is expected to grow from $142.69 million in 2023 to $1.23 billion by 2033. The growth is attributed to rising technological adoption among airlines and government support for blockchain initiatives. Key players are focusing on enhancing operational efficiency and customer experiences through digital solutions.North America Aviation Blockchain Market Report:

North America dominates the Aviation Blockchain market, with projections showing growth from $284.12 million in 2023 to $2.46 billion by 2033. Major airlines in the U.S. are leading the charge in blockchain research and implementation, focusing on enhancing supply chain management and regulatory compliance.South America Aviation Blockchain Market Report:

The South American market for Aviation Blockchain is projected to expand from $40.53 million in 2023 to $350.27 million by 2033. Challenges such as regulatory obstacles and limited digital infrastructure are being addressed through partnerships and collaborative frameworks aimed at promoting blockchain adoption.Middle East & Africa Aviation Blockchain Market Report:

The Middle East and Africa region anticipates growth from $70.64 million in 2023 to $610.43 million by 2033. Investment in aviation infrastructure and growing demand for secure data management systems boost blockchain initiatives, positioning the region as a future leader in aviation digital transformation.Tell us your focus area and get a customized research report.

Aviation Blockchain Market Analysis Commercial_aviation

Global Aviation Blockchain Market, By Commercial Aviation Market Analysis (2023 - 2033)

Commercial aviation represents the largest segment in the Aviation Blockchain market, with an expected size of $507.33 million in 2023, growing to $4.38 billion by 2033. This segment accounts for approximately 64.71% of the market due to the widespread adoption of blockchain solutions to enhance ticketing processes, baggage handling, and customer relationship management.

Aviation Blockchain Market Analysis Cargo_aviation

Global Aviation Blockchain Market, By Cargo Aviation Market Analysis (2023 - 2033)

The Cargo aviation segment is projected to grow from $184.00 million in 2023 to $1.59 billion by 2033, holding about 23.47% of the market. Blockchain technology aids in improving transparency, traceability, and efficiency in cargo transportation, addressing major logistics challenges faced by this sector.

Aviation Blockchain Market Analysis Military_aviation

Global Aviation Blockchain Market, By Military Aviation Market Analysis (2023 - 2033)

The Military aviation segment is anticipated to experience significant growth, increasing from $92.67 million in 2023 to $800.81 million by 2033, representing an 11.82% market share. Blockchain enhances security and data integrity, which is crucial for military operations and procurement processes.

Aviation Blockchain Market Analysis Regulatory_issues

Global Aviation Blockchain Market, By Regulatory Issues Market Analysis (2023 - 2033)

This segment addresses the challenges posed by regulatory environments, with market size projections moving from $655.74 million in 2023 to $5.67 billion by 2033, holding a staggering 83.64% share. Regulatory solutions integrated with blockchain frameworks simplify compliance and facilitate smoother cross-border operations.

Aviation Blockchain Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aviation Blockchain Industry

IBM:

IBM is a pioneer in blockchain technology, providing solutions that enhance security, transparency, and efficiency across the aviation supply chain.Microsoft:

Microsoft offers comprehensive blockchain solutions aimed at addressing complex challenges in data sharing and regulatory compliance within the aviation sector.Accenture:

Accenture specializes in consulting and implementing blockchain strategies for airlines and cargo, focusing on operational enhancement and risk management.Honeywell :

Honeywell is leveraging blockchain for advanced aviation operations, including asset tracking and smart contracts, to streamline their processes.Airbus:

Airbus actively develops blockchain applications for improving aircraft manufacturing and maintenance operations, focusing on supply chain efficiencies.We're grateful to work with incredible clients.

FAQs

What is the market size of aviation Blockchain?

The aviation blockchain market is valued at approximately $784 million in 2023, with a robust CAGR of 22.6% projected over the next decade, indicating significant growth potential through 2033.

What are the key market players or companies in the aviation Blockchain industry?

Key players in the aviation blockchain industry include major airline companies, blockchain technology firms, and various tech startups focused on integrating blockchain solutions into aviation processes for enhanced efficiency and security.

What are the primary factors driving the growth in the aviation Blockchain industry?

Growth in the aviation blockchain industry is driven by increasing demand for efficient supply chain management, enhanced data security, regulatory compliance needs, and the rising trend of digital transformation across the aviation sector.

Which region is the fastest Growing in the aviation Blockchain?

The fastest-growing region for aviation blockchain is North America, projected to grow from $284.12 million in 2023 to $2,455.27 million by 2033, reflecting a strong adoption rate of blockchain technologies.

Does Consainsights provide customized market report data for the aviation Blockchain industry?

Yes, Consainsights offers customized market report data tailored to specific needs within the aviation-blockchain industry, allowing clients to gain insights relevant to their particular business interests.

What deliverables can I expect from this aviation Blockchain market research project?

Deliverables include a comprehensive market analysis report, data on market size and segmentation, growth forecasts, competitive landscape insights, and detailed region-specific growth opportunities.

What are the market trends of aviation Blockchain?

Current market trends indicate a shift towards increased utilization of smart contracts, enhanced regulatory adherence, improved supply chain visibility, and growing investments in distributed ledger technologies within the aviation sector.