Aviation Carbon Fiber Market Report

Published Date: 03 February 2026 | Report Code: aviation-carbon-fiber

Aviation Carbon Fiber Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aviation Carbon Fiber market, including market trends, size, and growth forecasts from 2023 to 2033. It examines various segments, regional insights, and technology advancements that are shaping the industry.

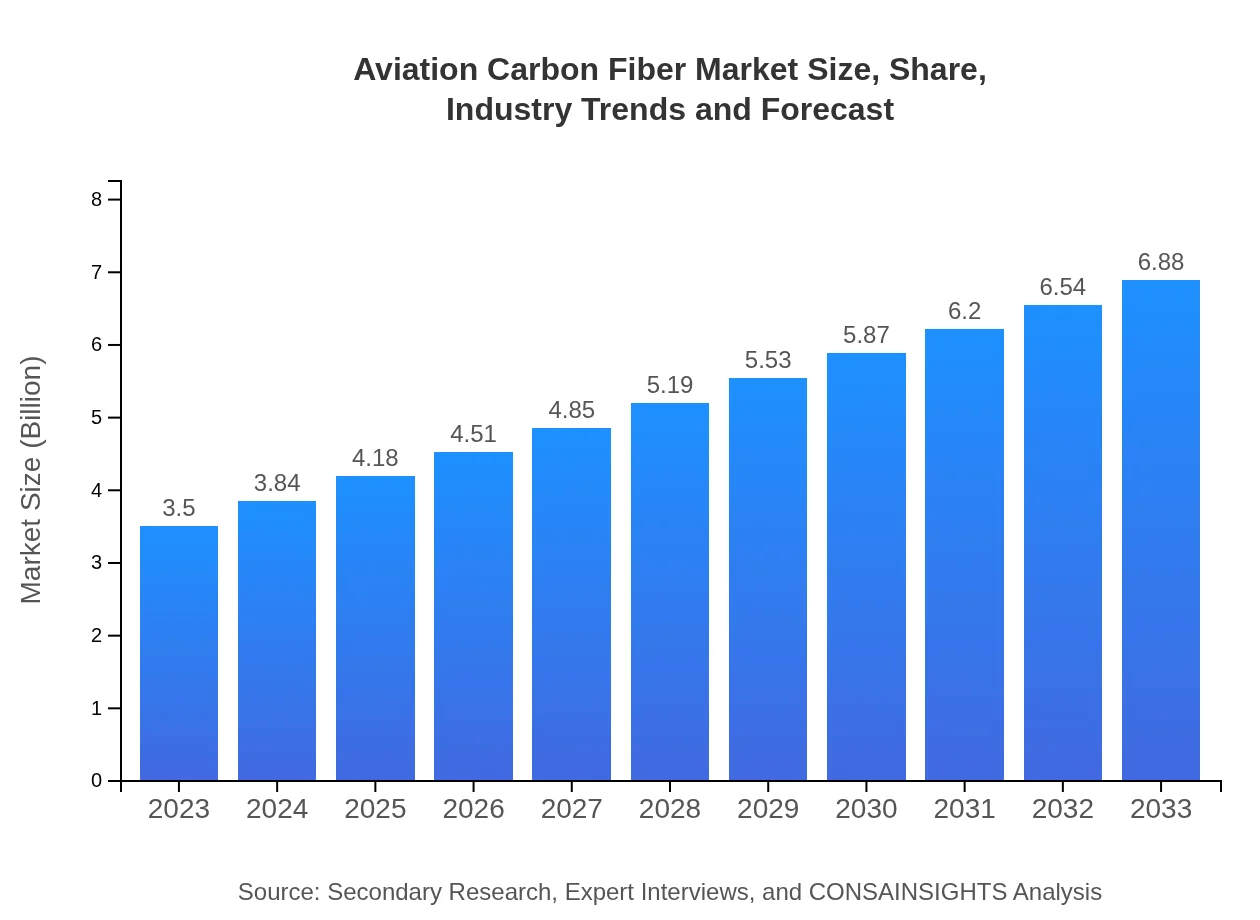

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Hexcel Corporation, Toray Industries, Solvay S.A., Mitsubishi Chemical Holdings, Teijin Limited |

| Last Modified Date | 03 February 2026 |

Aviation Carbon Fiber Market Overview

Customize Aviation Carbon Fiber Market Report market research report

- ✔ Get in-depth analysis of Aviation Carbon Fiber market size, growth, and forecasts.

- ✔ Understand Aviation Carbon Fiber's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aviation Carbon Fiber

What is the Market Size & CAGR of Aviation Carbon Fiber market in 2023?

Aviation Carbon Fiber Industry Analysis

Aviation Carbon Fiber Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aviation Carbon Fiber Market Analysis Report by Region

Europe Aviation Carbon Fiber Market Report:

The European market is expected to grow from USD 1.04 billion in 2023 to USD 2.05 billion by 2033. The presence of leading aviation companies and stringent regulations on emissions is driving the utilization of carbon fiber in aircraft, setting the stage for rapid growth in this region.Asia Pacific Aviation Carbon Fiber Market Report:

In 2023, the Asia Pacific market for Aviation Carbon Fiber is valued at USD 0.69 billion, projected to grow to USD 1.35 billion by 2033. Factors like increased aircraft manufacturing and investments in the aerospace sector drive growth in countries like China and India. The demand for lighter materials in regional aircraft is also propelling this market's expansion.North America Aviation Carbon Fiber Market Report:

The North American market is set at USD 1.12 billion in 2023 and is projected to grow to USD 2.20 billion by 2033. Home to major aircraft manufacturers and a strong demand for military aircraft, North America remains a pivotal region, with continuous innovation and upgrades in carbon fiber technologies.South America Aviation Carbon Fiber Market Report:

The South American market is valued at USD 0.21 billion in 2023 and is anticipated to reach USD 0.40 billion by 2033. Although the market is smaller compared to other regions, growth is facilitated by increasing aviation activities and regional partnerships, enhancing the aviation infrastructure.Middle East & Africa Aviation Carbon Fiber Market Report:

With a current market size of USD 0.44 billion in 2023, the Middle East and Africa region is projected to reach USD 0.87 billion by 2033. Increased focus on airline expansions and modernization of outdated fleets drive demand for advanced materials like carbon fiber, alongside developing a more robust aviation infrastructure.Tell us your focus area and get a customized research report.

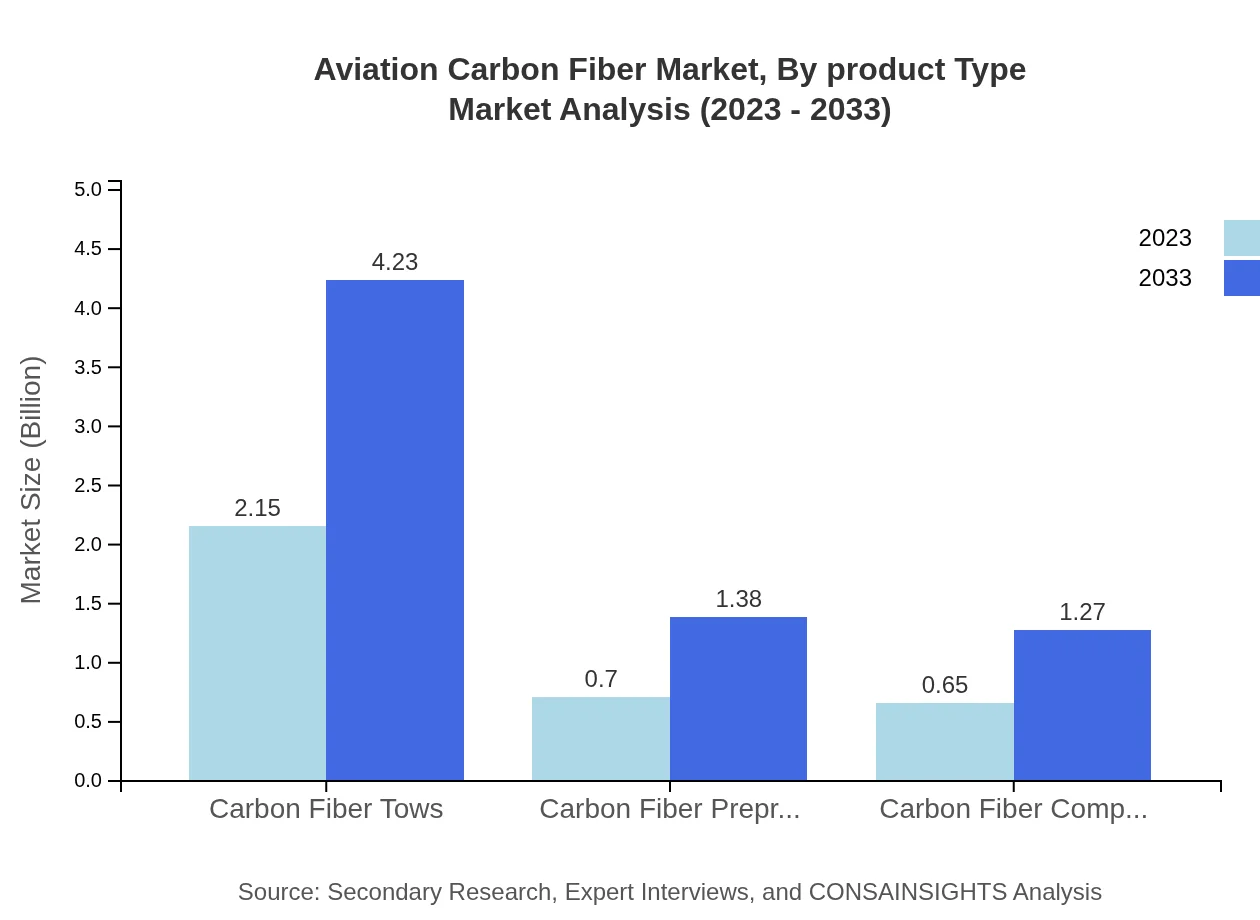

Aviation Carbon Fiber Market Analysis By Product Type

The segment for carbon fiber tows leads the market, valued at USD 2.15 billion in 2023 and expected to grow to USD 4.23 billion by 2033. Prepregs and composites also hold significant market shares, playing essential roles in various structural and non-structural components. Their lightweight and durable characteristics foster a growing reliance on these products within the aviation sector.

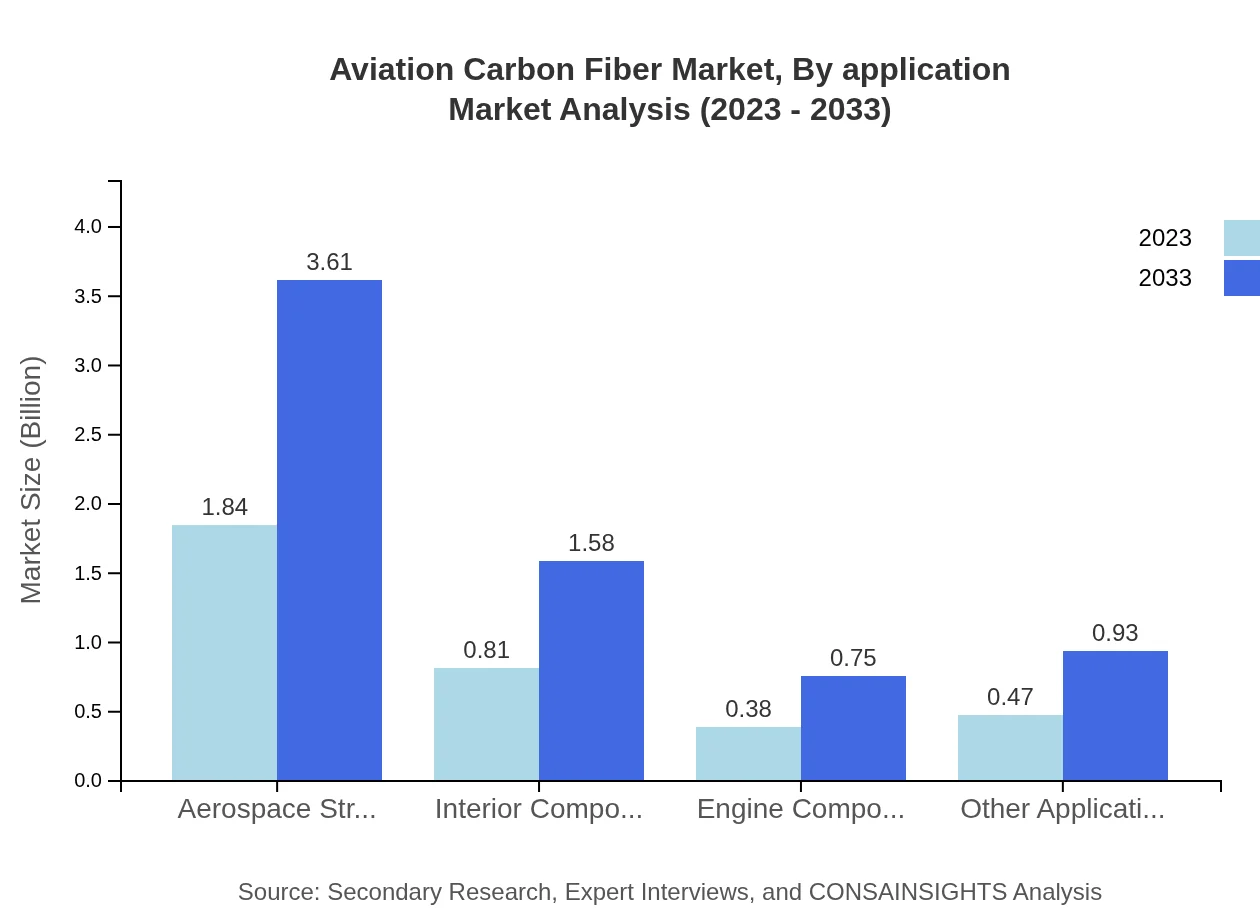

Aviation Carbon Fiber Market Analysis By Application

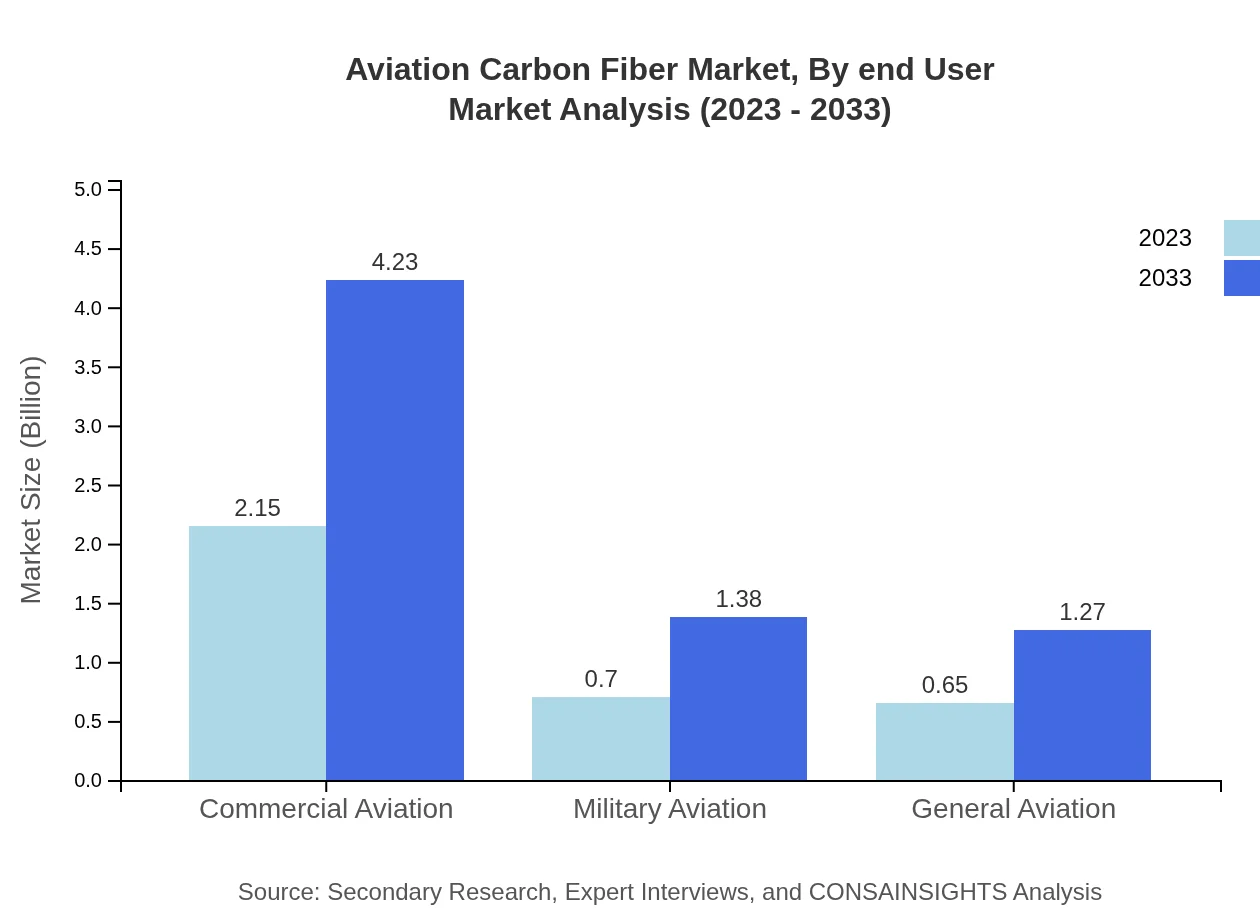

Commercial aviation dominates the application segment, valued at USD 2.15 billion in 2023, with a market share of 61.47%. Military aviation and general aviation follow, reflecting the diverse application of carbon fiber across different types of aircraft, enhancing performance and efficiency.

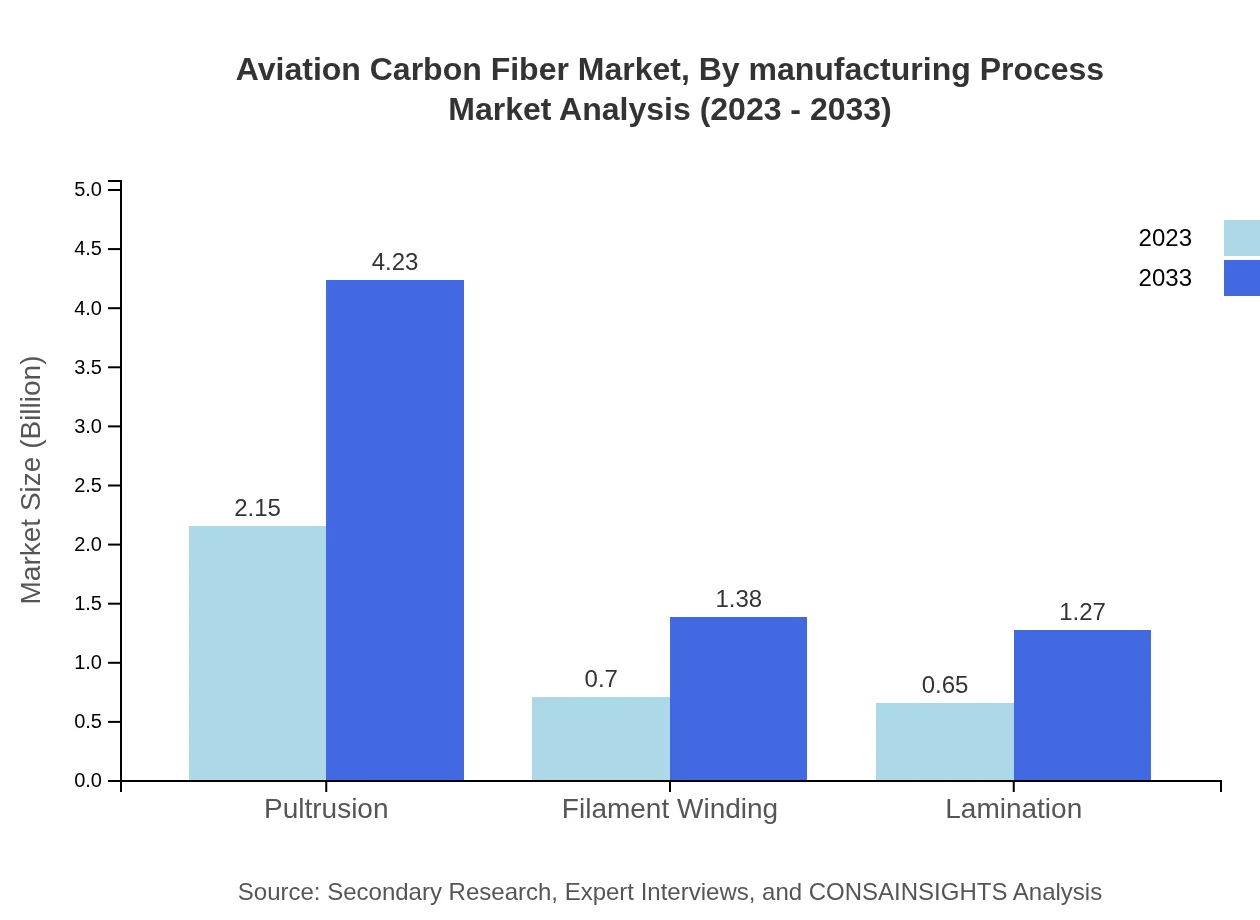

Aviation Carbon Fiber Market Analysis By Manufacturing Process

The manufacturing processes utilizing pultrusion and filament winding are leading segments. Pultrusion, accounting for USD 2.15 billion in 2023, is expected to maintain a critical position, allowing for the creation of complex shapes that are lightweight and structurally sound. Filament winding also sees substantial growth, driven by efficiency and high strength-to-weight ratios.

Aviation Carbon Fiber Market Analysis By End User

The end-user segment is extensively characterized by commercial aircraft manufacturers who are increasingly adopting carbon fiber throughout their designs. The military sector presents a growing opportunity, pushing for advanced material use in combat and freight aircraft designs, thus enriching the market dynamics.

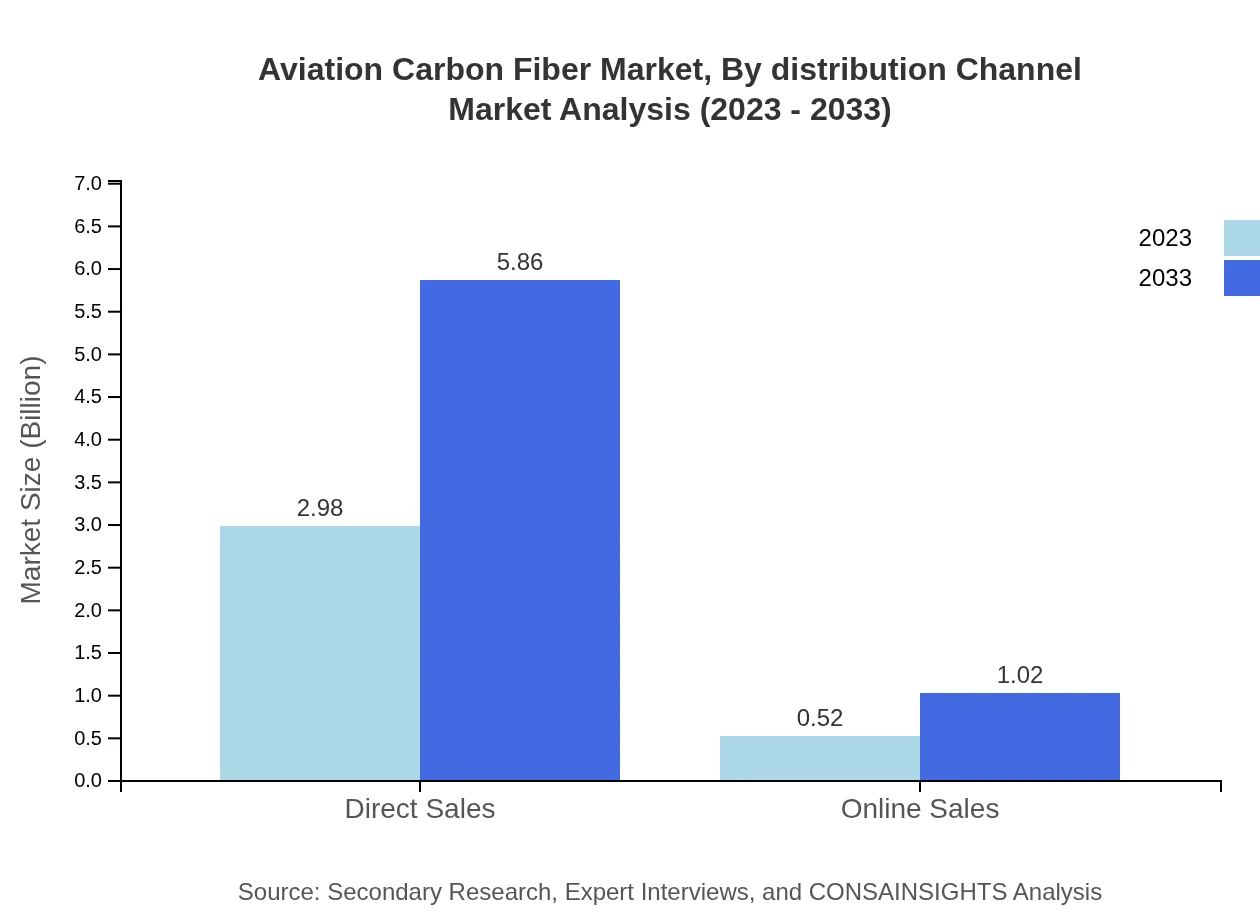

Aviation Carbon Fiber Market Analysis By Distribution Channel

This segment consists of direct and online sales, with direct sales dominating at USD 2.98 billion in 2023. The online sales channel is steadily expanding as manufacturers explore e-commerce options to reach a more extensive customer base and enhance service offerings.

Aviation Carbon Fiber Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aviation Carbon Fiber Industry

Hexcel Corporation:

Hexcel is a leading global supplier of carbon fiber and composite materials, pioneering innovations in aviation applications to enhance performance and sustainability.Toray Industries:

Toray is a major player in the carbon fiber market, providing high-quality products that cater to aerospace material needs, renowned for their advanced technological capabilities.Solvay S.A.:

Solvay specializes in advanced polymers and composites, focusing significantly on the aerospace sector, fostering innovations that drive carbon fiber adoption.Mitsubishi Chemical Holdings:

Mitsubishi Chemical engages in diverse applications of carbon fiber, continuously advancing their technology and contributing to lightweight aviation solutions.Teijin Limited:

Teijin is recognized for its comprehensive portfolio of carbon fiber materials, committed to enhancing the efficiency and safety of aviation applications.We're grateful to work with incredible clients.

FAQs

What is the market size of aviation Carbon Fiber?

The aviation carbon fiber market is projected to grow from $3.5 billion in 2023 to significantly higher by 2033. The anticipated Compound Annual Growth Rate (CAGR) is approximately 6.8%, indicating strong demand and expansion in aerospace applications.

What are the key market players or companies in the aviation Carbon Fiber industry?

Key players in the aviation carbon fiber industry include major manufacturers and suppliers focused on innovation and sustainability. These companies hold significant market share and drive technological advancements to meet evolving aerospace industry standards.

What are the primary factors driving the growth in the aviation Carbon Fiber industry?

Growth in the aviation carbon fiber industry is driven by increasing demand for lightweight materials in aviation, advancements in manufacturing technology, and the need for fuel efficiency and emission reduction in aircraft design.

Which region is the fastest Growing in the aviation Carbon Fiber?

Asia Pacific is the fastest-growing region in the aviation carbon fiber market, expected to increase from $0.69 billion in 2023 to $1.35 billion in 2033. Other regions like Europe and North America also show notable growth trajectories.

Does ConsaInsights provide customized market report data for the aviation Carbon Fiber industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs of businesses in the aviation carbon fiber industry, providing detailed insights into market trends, sizes, and forecasts based on unique requirements.

What deliverables can I expect from this aviation Carbon Fiber market research project?

Deliverables from the aviation carbon fiber market research include comprehensive market analysis reports, segmented data insights, competitive landscape analysis, and actionable recommendations for market entry or expansion strategies.

What are the market trends of aviation Carbon Fiber?

Current trends in the aviation carbon fiber market involve increasing adoption of advanced manufacturing techniques, emphasis on sustainability, and innovations in composite materials, fueling the growth of lightweight aircraft designs.