Aviation Connectors Market Report

Published Date: 02 February 2026 | Report Code: aviation-connectors

Aviation Connectors Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aviation Connectors market, including insights into market dynamics, size, trends, and forecasts from 2023 to 2033. It covers various segments, regional analysis, industry challenges, and competitive landscape.

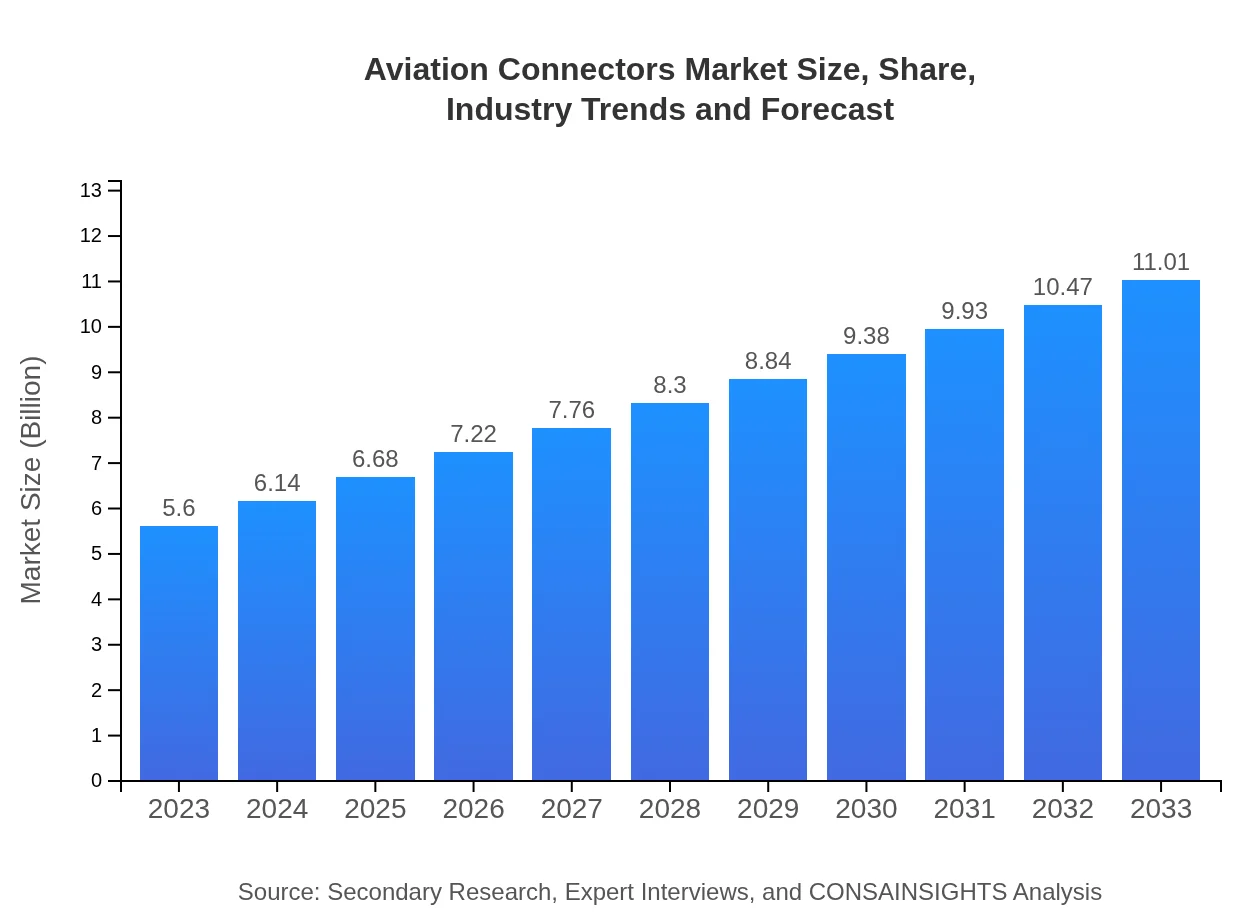

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | TE Connectivity, Amphenol Corporation, Honeywell International Inc., General Electric Company, Molex |

| Last Modified Date | 02 February 2026 |

Aviation Connectors Market Overview

Customize Aviation Connectors Market Report market research report

- ✔ Get in-depth analysis of Aviation Connectors market size, growth, and forecasts.

- ✔ Understand Aviation Connectors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aviation Connectors

What is the Market Size & CAGR of Aviation Connectors market in 2023?

Aviation Connectors Industry Analysis

Aviation Connectors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aviation Connectors Market Analysis Report by Region

Europe Aviation Connectors Market Report:

The European aviation connectors market is projected to grow from USD 1.69 billion in 2023 to USD 3.32 billion by 2033. The region's focus on military modernization, along with sustainable aviation initiatives, supports this growth trajectory.Asia Pacific Aviation Connectors Market Report:

The Asia Pacific aviation connectors market is poised to grow from USD 1.13 billion in 2023 to USD 2.23 billion by 2033, driven by strong demand for commercial aircraft in emerging economies and increasing investments in aerospace infrastructure.North America Aviation Connectors Market Report:

North America remains a key market, with the aviation connectors segment expected to increase from USD 1.80 billion in 2023 to USD 3.55 billion by 2033. The presence of major aircraft manufacturers and defense contractors significantly contributes to market expansion.South America Aviation Connectors Market Report:

In South America, the market for aviation connectors is expanding from USD 0.49 billion in 2023 to USD 0.97 billion by 2033. Rising air travel demand and government initiatives to bolster aviation capabilities are key growth drivers in this region.Middle East & Africa Aviation Connectors Market Report:

The Middle East and Africa market for aviation connectors is anticipated to rise from USD 0.48 billion in 2023 to USD 0.94 billion by 2033. Increasing investments in the aviation sector and tourism activities fuel this region's growth.Tell us your focus area and get a customized research report.

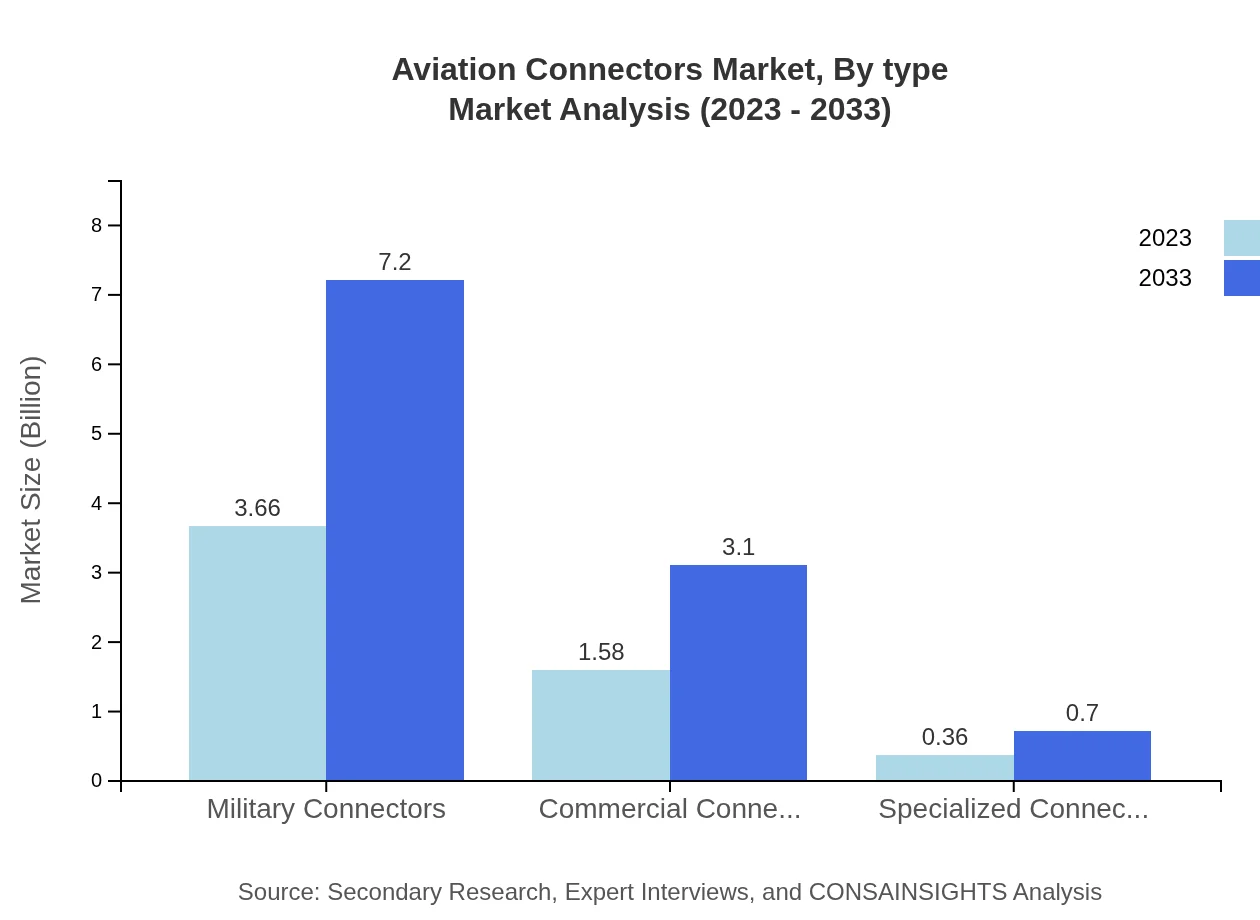

Aviation Connectors Market Analysis By Type

The market analysis reveals significant growth in Military Connectors, which are projected to increase from USD 3.66 billion in 2023 to USD 7.20 billion by 2033, maintaining a market share of 65.44%. Commercial connectors are also expanding, expected to rise from USD 1.58 billion to USD 3.10 billion, accounting for 28.16% of the market share. Specialized connectors, though smaller, are expected to experience growth from USD 0.36 billion to USD 0.70 billion, with a market share of 6.4%.

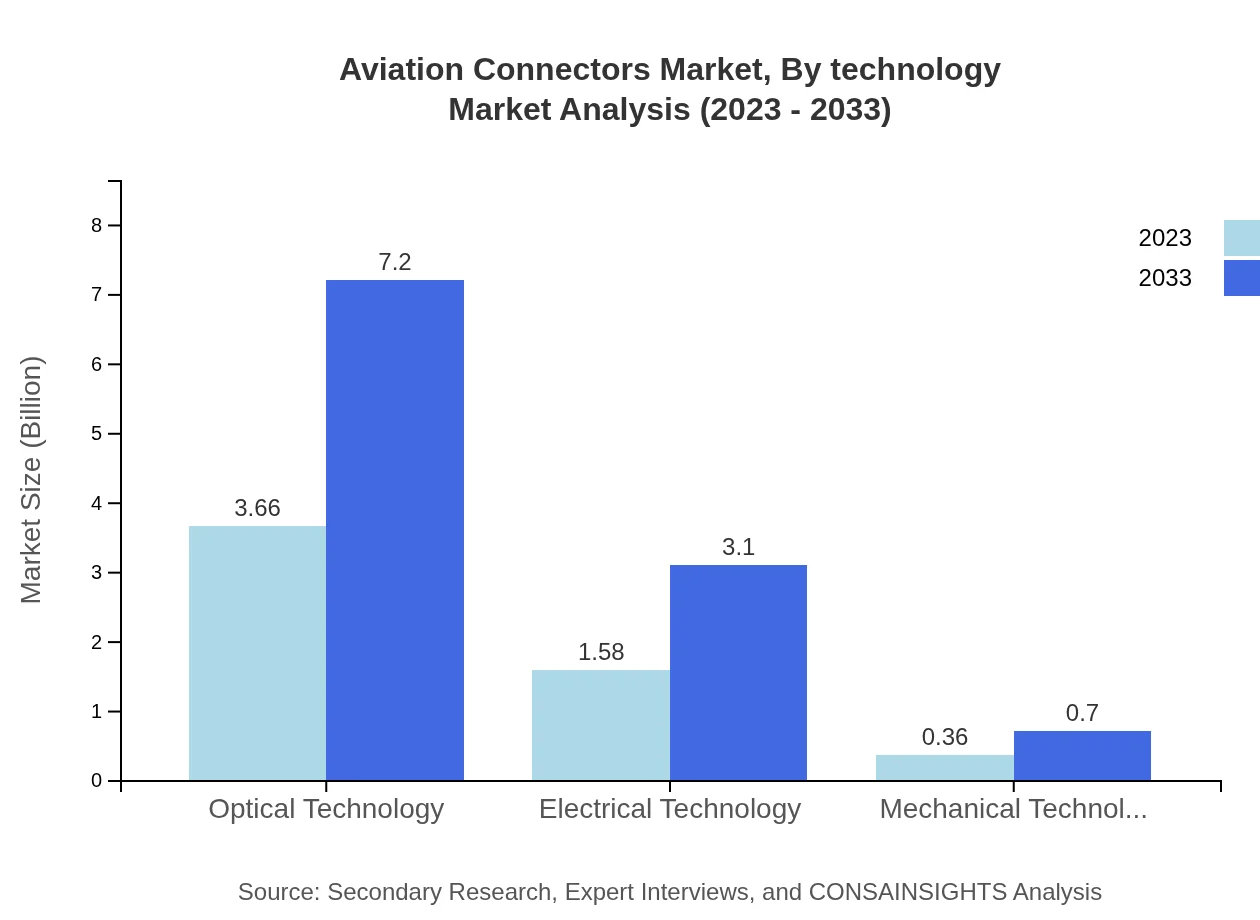

Aviation Connectors Market Analysis By Technology

Segmenting the market by technology shows strong performance in Optical Technology, projected to grow from USD 3.66 billion to USD 7.20 billion with a market share of 65.44%. Electrical Technology is also expected to see substantial growth from USD 1.58 billion to USD 3.10 billion, having a share of 28.16%, while Mechanical Technology will slightly increase from USD 0.36 billion to USD 0.70 billion, maintaining 6.4% market share.

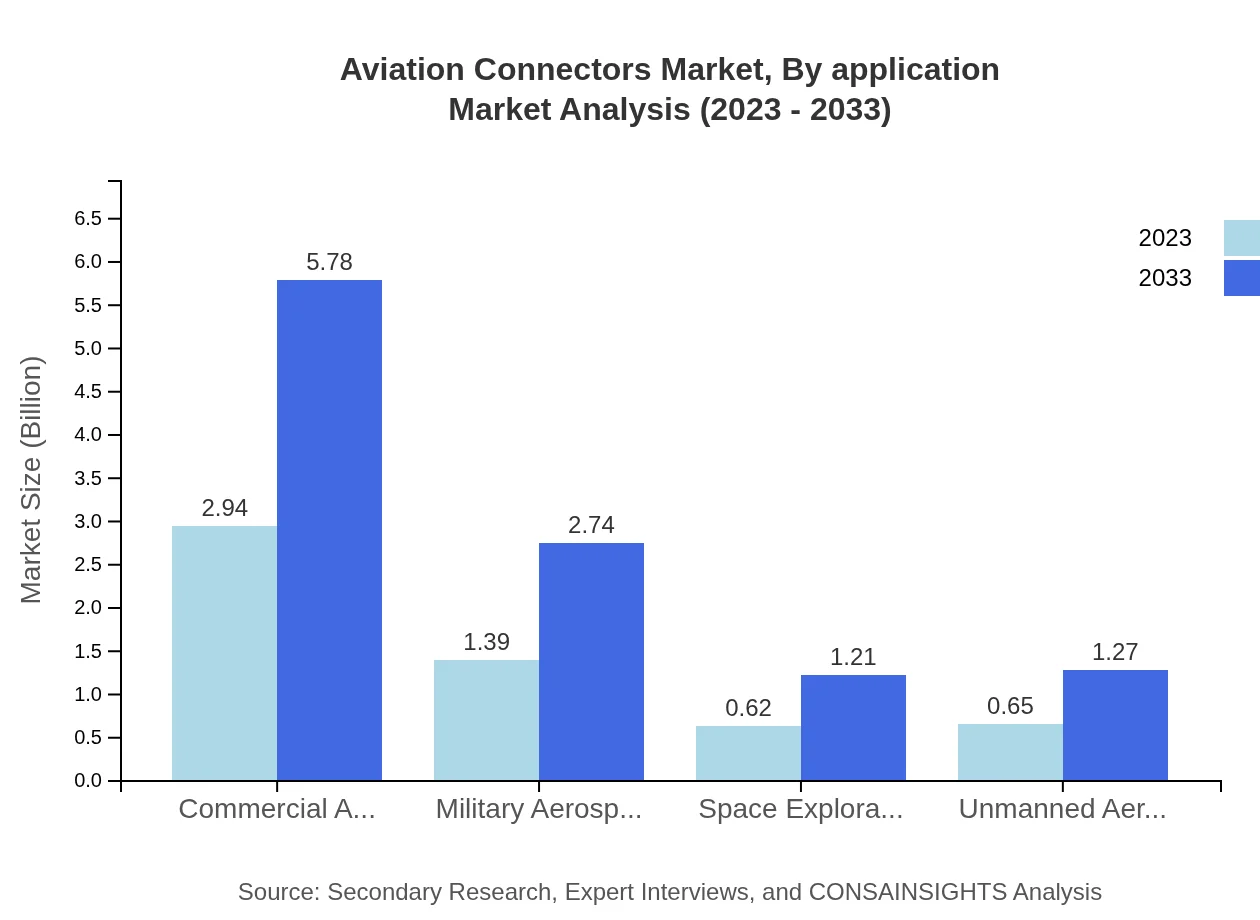

Aviation Connectors Market Analysis By Application

In application-based analysis, the market shows promising growth in Commercial Aerospace, expanding from USD 2.94 billion to USD 5.78 billion, dominating with a market share of 52.54%. Military Aerospace is projected to grow from USD 1.39 billion to USD 2.74 billion with a 24.86% share, while Space Exploration and Unmanned Aerial Vehicles are anticipated to increase from USD 0.62 billion to USD 1.21 billion and from USD 0.65 billion to USD 1.27 billion, respectively, representing 11.02% each in market share.

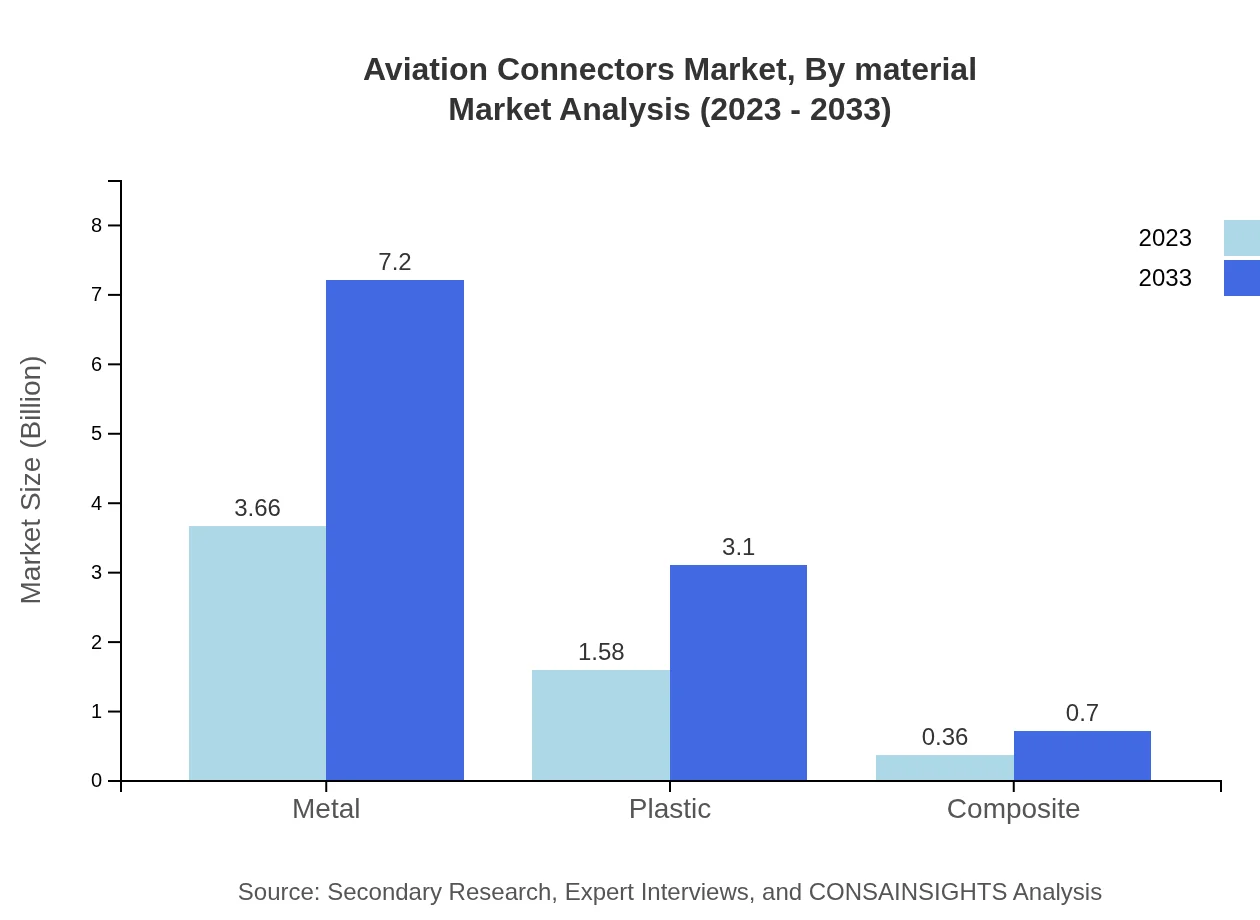

Aviation Connectors Market Analysis By Material

By material, the market analysis indicates that Metal connectors will continue to dominate, growing from USD 3.66 billion to USD 7.20 billion, maintaining a market share of 65.44%. Plastic connectors are expected to rise from USD 1.58 billion to USD 3.10 billion, with a 28.16% share, and Composite connectors will grow from USD 0.36 billion to USD 0.70 billion, holding a 6.4% market share.

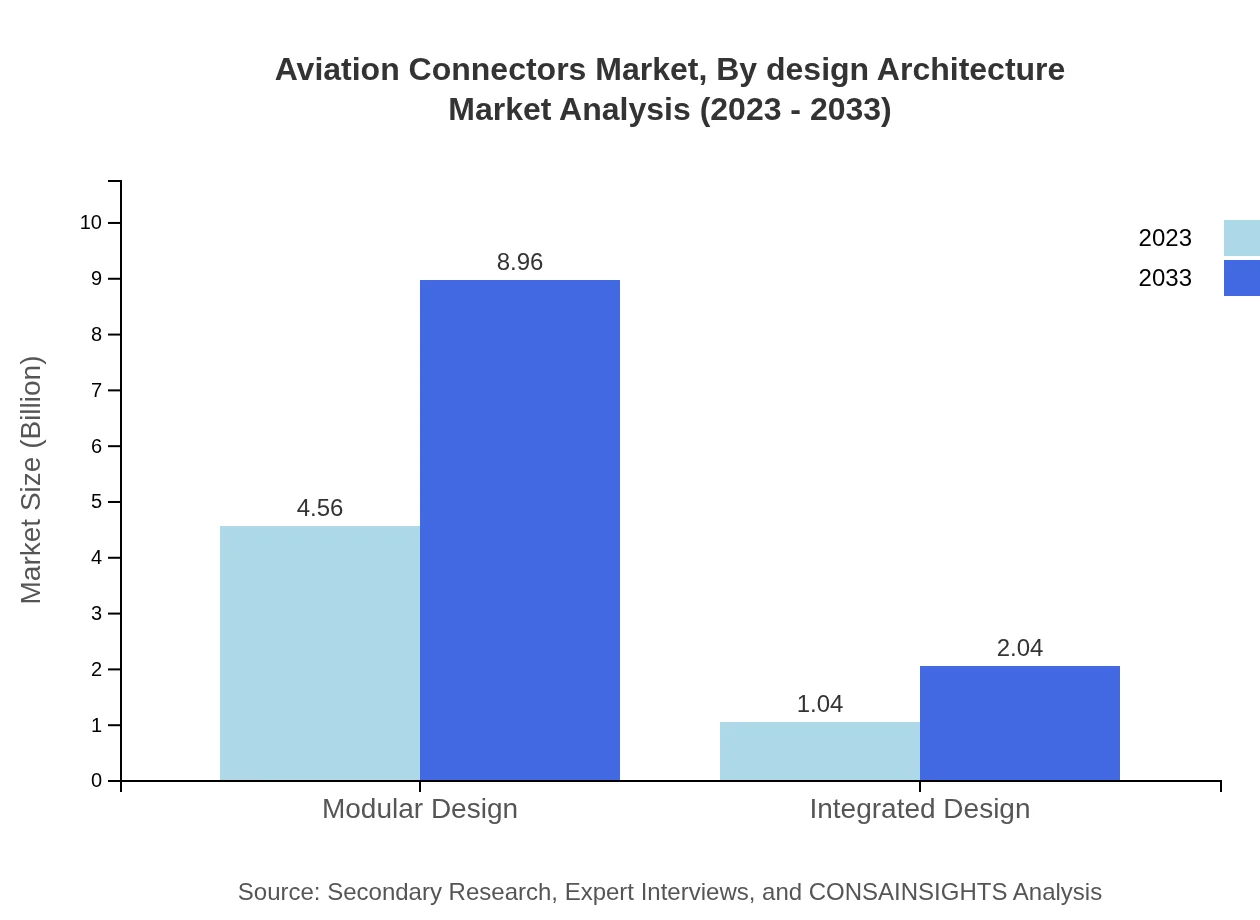

Aviation Connectors Market Analysis By Design Architecture

Analysis of design architecture highlights Modular Designs leading the sector with growth from USD 4.56 billion to USD 8.96 billion, contributing 81.42% of the market share. Integrated Designs witness moderate growth, increasing from USD 1.04 billion to USD 2.04 billion, with an 18.58% market share, reflecting the trend towards more integrated and efficient systems in aviation.

Aviation Connectors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aviation Connectors Industry

TE Connectivity:

TE Connectivity is recognized for its innovation in connectivity and sensor solutions, catering to various sectors including commercial and military aerospace applications.Amphenol Corporation:

Amphenol Corporation specializes in interconnect systems and offers a wide range of aviation connectors tailored for high-performance use.Honeywell International Inc.:

Honeywell is a leader in aerospace systems and provides comprehensive connector solutions that meet the rigorous demands of the aviation market.General Electric Company:

GE Aerospace supplies connectors and connectivity solutions for commercial and military aircraft, ensuring reliability and performance.Molex:

Molex designs and manufactures electronic connectors, specializing in advanced solutions for modern aircraft systems.We're grateful to work with incredible clients.

FAQs

What is the market size of aviation Connectors?

The aviation connectors market is projected to grow from USD 5.6 billion in 2023 to significant sizes by 2033, with a CAGR of 6.8% over the period.

What are the key market players or companies in this aviation Connectors industry?

Key players in the aviation connectors market include companies like Amphenol Aerospace, TE Connectivity, and Smiths Interconnect, who dominate the landscape with innovative products and strong market strategies.

What are the primary factors driving the growth in the aviation Connectors industry?

Growth in the aviation connectors market is driven by factors such as rising air travel demand, technological advancements in aerospace manufacturing, and the increasing adoption of automation in the aviation sector.

Which region is the fastest Growing in the aviation Connectors?

The Asia Pacific region is the fastest-growing segment in the aviation connectors market, expanding from USD 1.13 billion in 2023 to USD 2.23 billion by 2033, reflecting robust growth potential.

Does ConsInsights provide customized market report data for the aviation Connectors industry?

Yes, ConsInsights offers customized market report data for the aviation connectors industry, catering to specific business needs and delivering tailored insights for strategic decision-making.

What deliverables can I expect from this aviation Connectors market research project?

The deliverables from this aviation connectors market research project include comprehensive market analysis reports, segmentation breakdowns, growth forecasts, and strategic recommendations tailored to your needs.

What are the market trends of aviation Connectors?

Key trends in the aviation connectors market include the surge in demand for military connectors, advancements in optical and electrical technologies, and the shift towards modular connector designs.