Aviation Fuel Market Report

Published Date: 22 January 2026 | Report Code: aviation-fuel

Aviation Fuel Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the global aviation fuel market, detailing forecasted trends, market size, segmentation, and regional dynamics from 2023 to 2033.

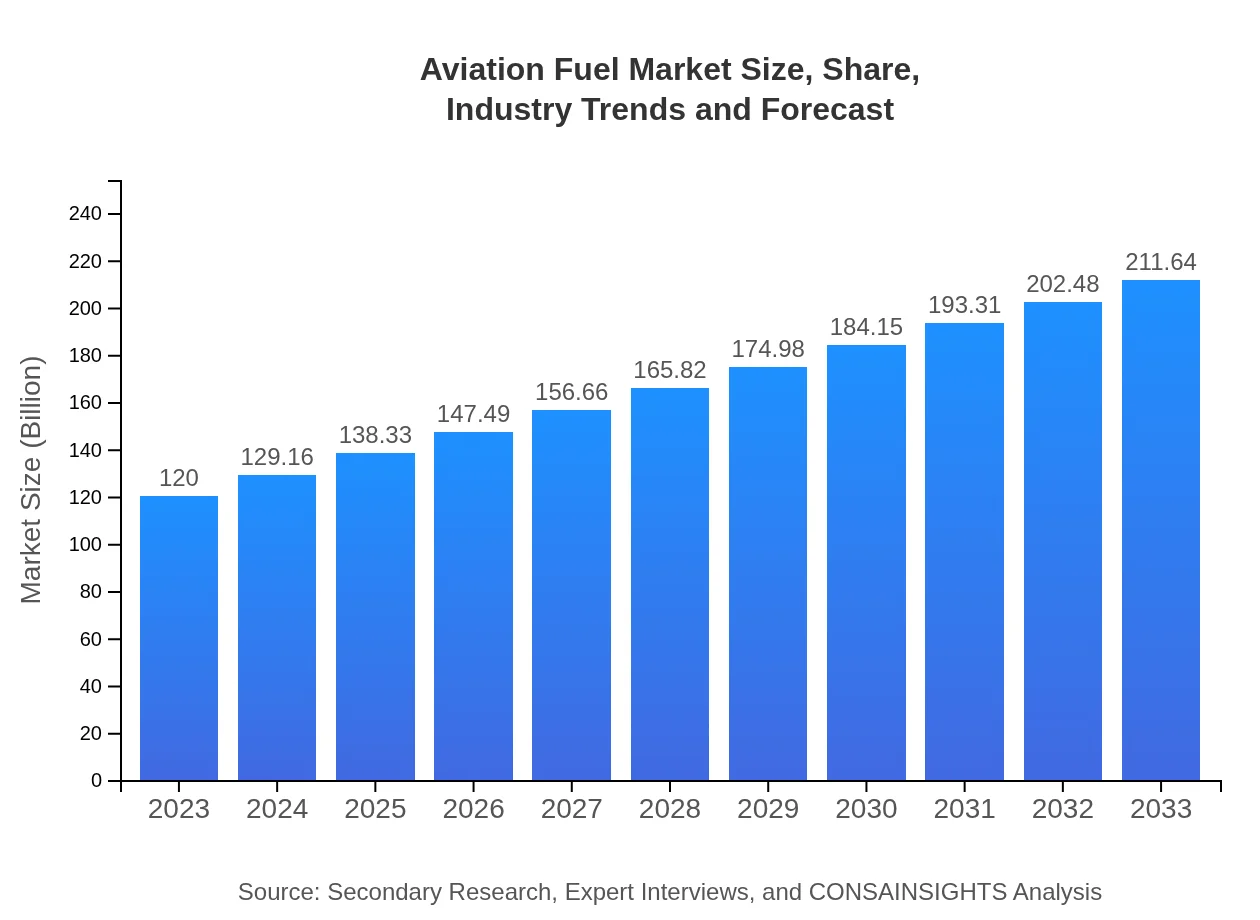

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $120.00 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $211.64 Billion |

| Top Companies | British Petroleum (BP), ExxonMobil, Shell, Chevron |

| Last Modified Date | 22 January 2026 |

Aviation Fuel Market Overview

Customize Aviation Fuel Market Report market research report

- ✔ Get in-depth analysis of Aviation Fuel market size, growth, and forecasts.

- ✔ Understand Aviation Fuel's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aviation Fuel

What is the Market Size & CAGR of Aviation Fuel market in 2023?

Aviation Fuel Industry Analysis

Aviation Fuel Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aviation Fuel Market Analysis Report by Region

Europe Aviation Fuel Market Report:

The European aviation fuel market is projected to expand from $37.70 billion in 2023 to $66.50 billion by 2033. Regulatory frameworks supporting the use of sustainable fuels are expected to reshape the market landscape and drive innovation.Asia Pacific Aviation Fuel Market Report:

The Asia Pacific region is expected to grow from $24.82 billion in 2023 to $43.77 billion by 2033, fueled by rising air travel demand in countries like China and India. Investment in new airports and fleet expansions significantly contribute to this growth.North America Aviation Fuel Market Report:

North America remains a dominant market, with an expected growth from $38.88 billion in 2023 to $68.57 billion by 2033. The region benefits from a well-established aviation sector and increasing passenger traffic, alongside significant investments in SAF.South America Aviation Fuel Market Report:

In South America, the market is expected to rise from $10.26 billion in 2023 to $18.10 billion by 2033. Government initiatives aimed at improving aviation infrastructure are expected to drive this growth despite economic challenges.Middle East & Africa Aviation Fuel Market Report:

The Middle East and Africa region is expected to grow from $8.34 billion in 2023 to $14.71 billion by 2033, supported by increasing investments in the aviation sector, particularly in the UAE and Saudi Arabia.Tell us your focus area and get a customized research report.

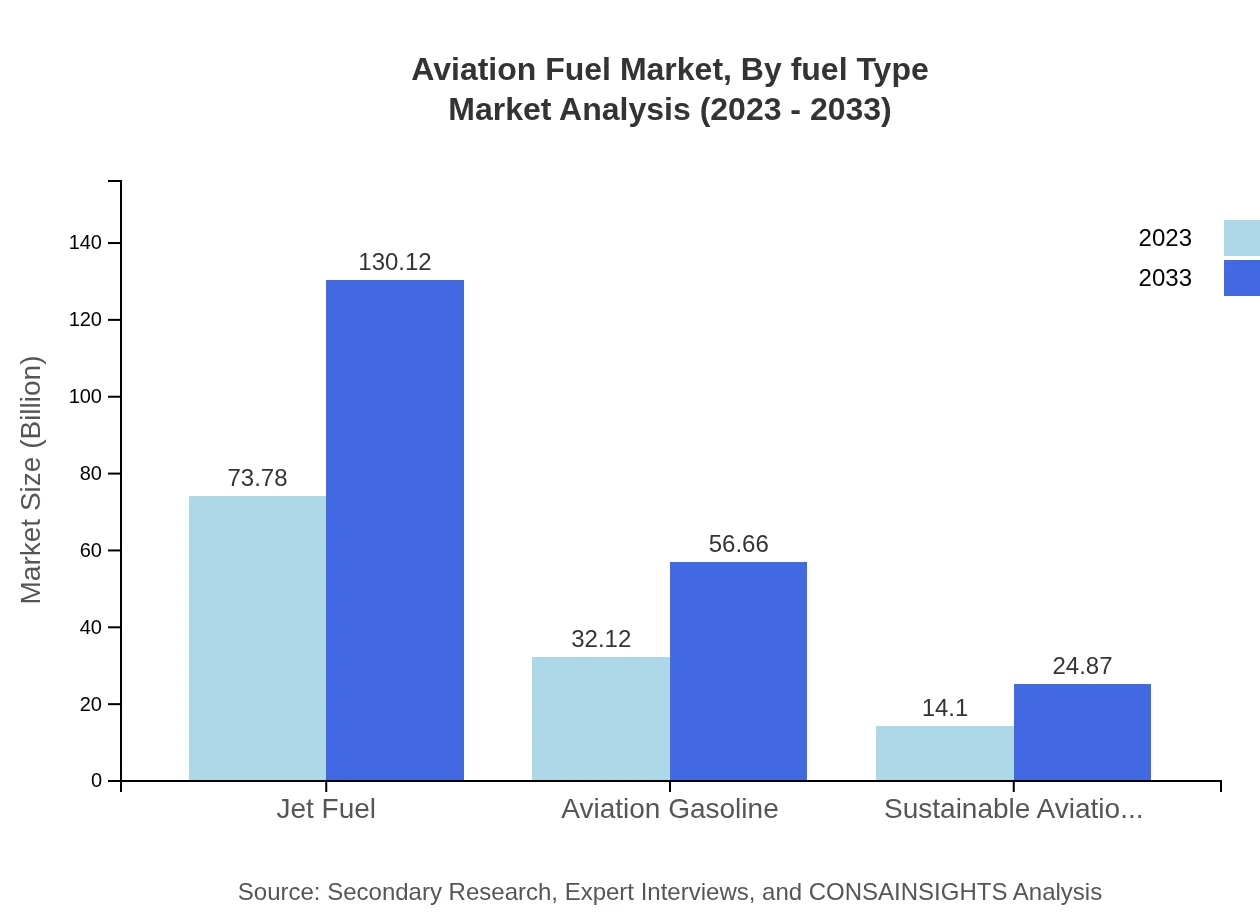

Aviation Fuel Market Analysis By Fuel Type

In the aviation fuel market by fuel type, Jet Fuel is the leading product, anticipated to grow from $73.78 billion in 2023 to $130.12 billion by 2033, maintaining a market share of 61.48%. Aviation Gasoline is projected to increase from $32.12 billion to $56.66 billion, holding a 26.77% share. Sustainability initiatives are enhancing the growth of Sustainable Aviation Fuels (SAFs), expected to grow from $14.10 billion to $24.87 billion, representing an 11.75% share.

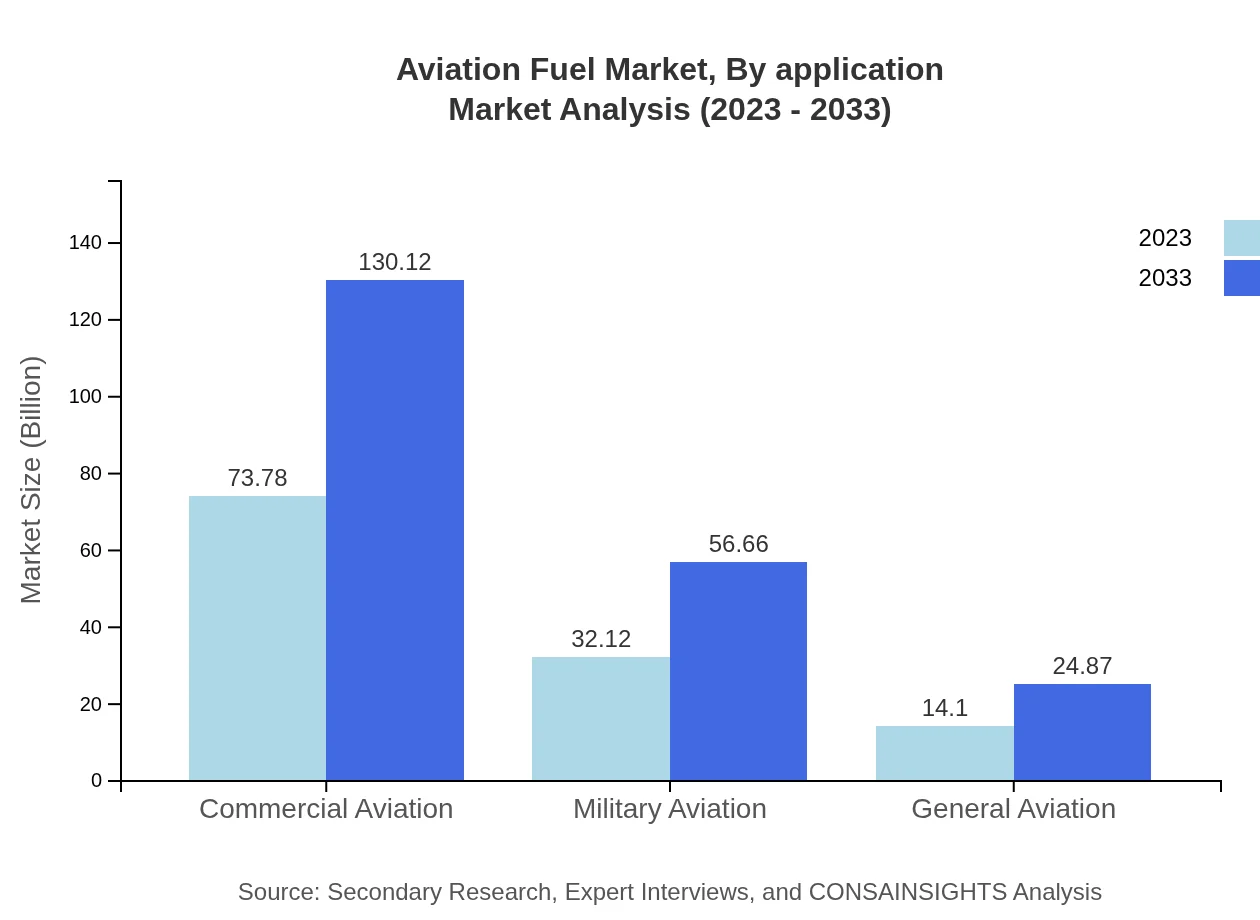

Aviation Fuel Market Analysis By Application

The application-wise segmentation reveals that Commercial Aviation occupies the largest segment with a growth forecast from $73.78 billion in 2023 to $130.12 billion by 2033. Military Aviation will rise from $32.12 billion to $56.66 billion, while General Aviation is set to grow from $14.10 billion to $24.87 billion, driven by increasing private flight demand.

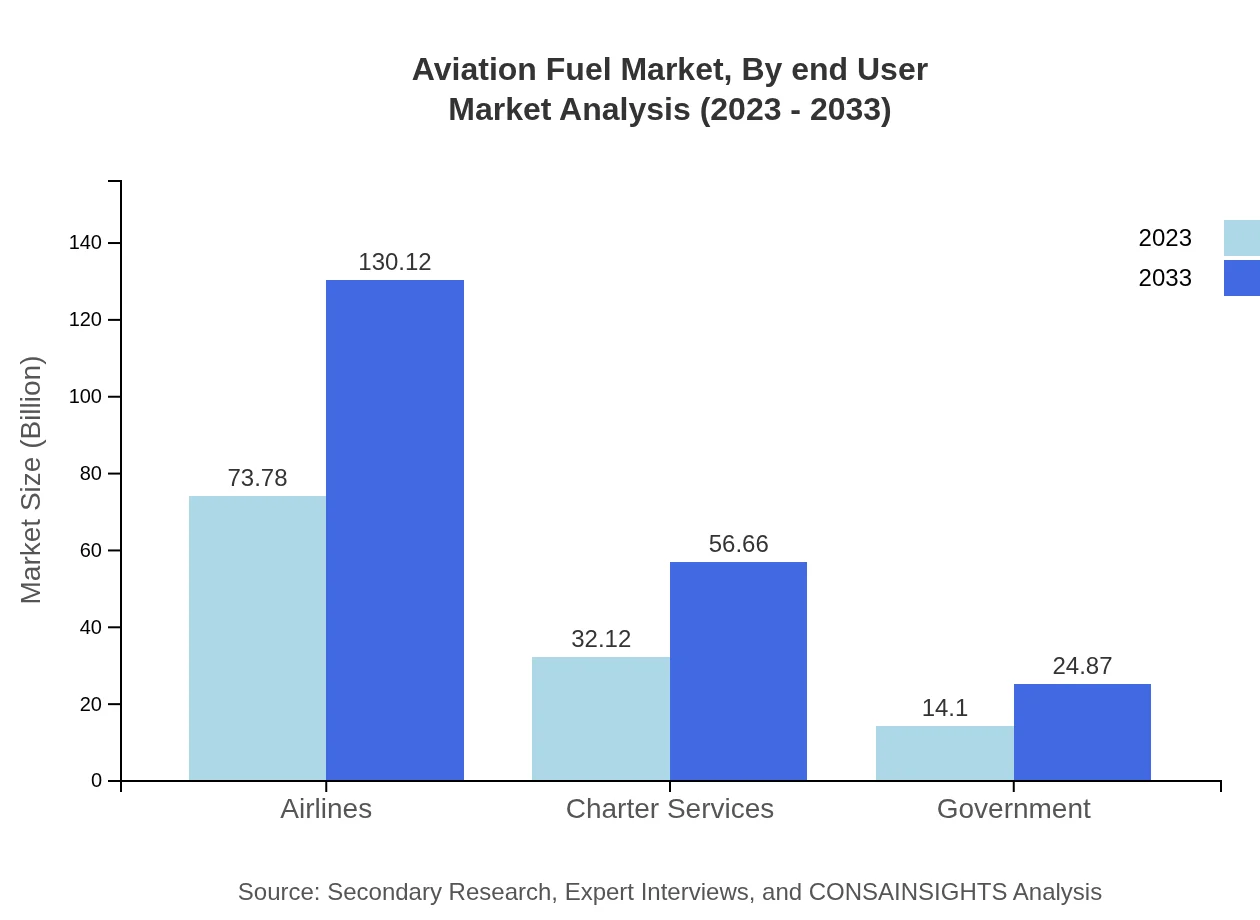

Aviation Fuel Market Analysis By End User

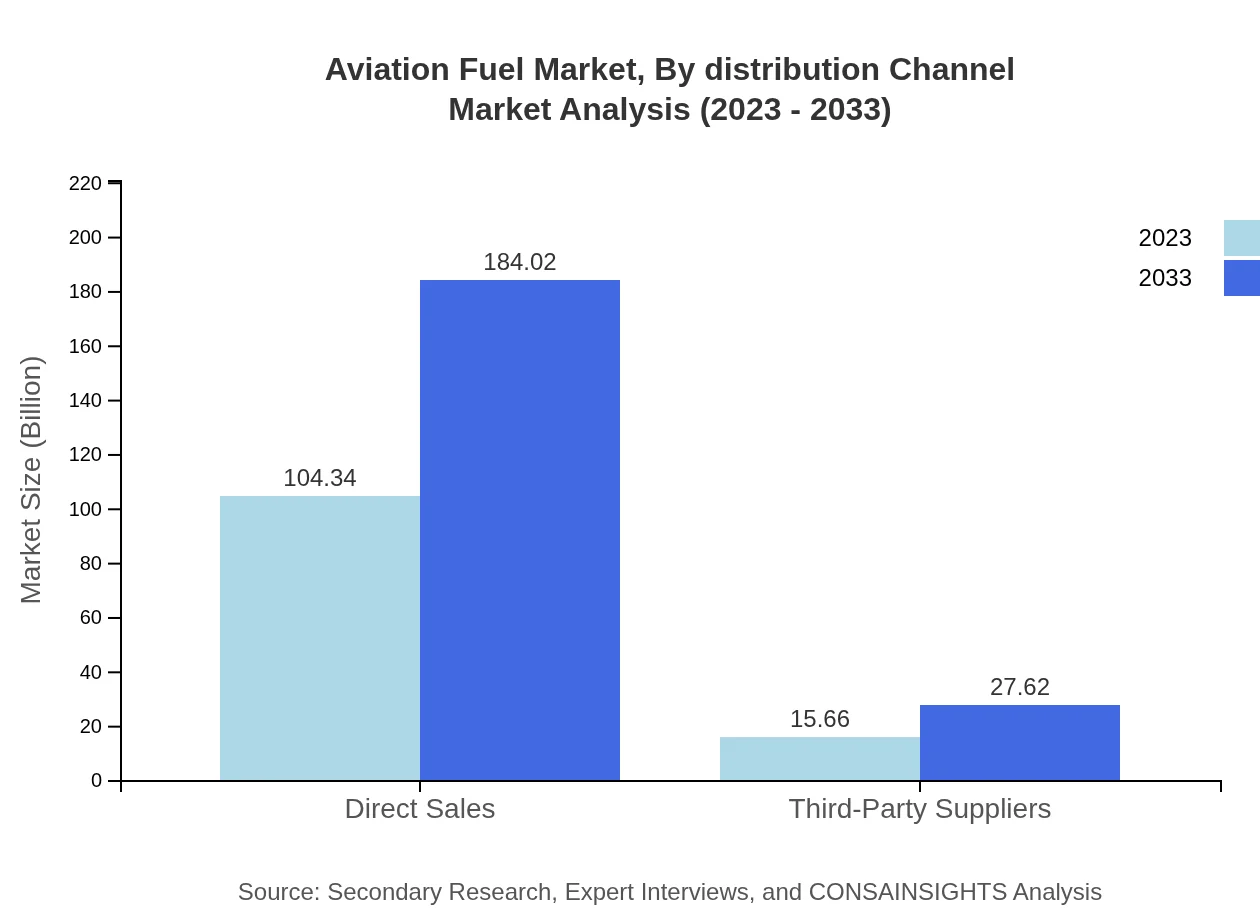

Direct sales dominate the end-user segment and will grow from $104.34 billion in 2023 to $184.02 billion in 2033, accounting for 86.95% of the market. Third-party suppliers also hold an essential position, enlarging their share from $15.66 billion to $27.62 billion.

Aviation Fuel Market Analysis By Distribution Channel

The distribution channel analysis indicates that direct sales will continue to lead the market with significant growth due to established relationships between airlines and suppliers. Third-party suppliers will become increasingly relevant, growing their presence due to outsourcing trends in fuel procurement.

Aviation Fuel Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aviation Fuel Industry

British Petroleum (BP):

A leading energy supplier globally with strong investments in refining and production of aviation fuels, BP is at the forefront of developing sustainable aviation fuel alternatives.ExxonMobil:

ExxonMobil is one of the largest publicly traded oil and gas companies, involved in all facets of the energy sector, including the production and marketing of aviation fuels. Their innovations in fuel processing set industry standards.Shell:

Shell plays a significant role in the aviation fuel market, providing high-quality fuels and focusing on sustainable energy solutions, including SAF initiatives aimed at reducing the carbon footprint of air travel.Chevron:

Chevron is deeply involved in aviation fuel production and distribution, offering a wide range of products while actively pursuing sustainability programs to innovate fuel technology.We're grateful to work with incredible clients.

FAQs

What is the market size of aviation fuel?

The aviation fuel market is valued at approximately $120 billion in 2023, with an expected CAGR of 5.7% from 2023 to 2033. This growth reflects increasing global air traffic and an expanding fleet of aircraft.

What are the key market players or companies in the aviation fuel industry?

Major players in the aviation fuel market include ExxonMobil, Chevron Corporation, Shell, BP, and TotalEnergies. These companies lead in production, supply, and distribution across various segments, influencing market trends and pricing.

What are the primary factors driving the growth in the aviation fuel industry?

Key growth drivers for the aviation fuel market include rising global air travel demand, fleet modernization, advancements in fuel efficiency standards, and the shift towards sustainable aviation fuels.

Which region is the fastest Growing in the aviation fuel market?

The Asia-Pacific region is the fastest-growing market for aviation fuel, expected to increase from $24.82 billion in 2023 to $43.77 billion by 2033, indicating a significant growth trajectory.

Does ConsaInsights provide customized market report data for the aviation fuel industry?

Yes, ConsaInsights offers customized market reports tailored to client specifications within the aviation fuel industry, ensuring relevant and actionable insights for strategic decision-making.

What deliverables can I expect from this aviation fuel market research project?

Deliverables from the aviation fuel market research project include detailed market size analysis, growth forecasts, competitive landscape studies, and regional segment insights to aid strategic planning.

What are the market trends of aviation fuel?

Current trends in the aviation fuel market include increasing reliance on sustainable aviation fuels, the adoption of advanced technologies for fuel efficiency, and a growing focus on carbon reduction strategies in the industry.