Aviation Gas Turbine Market Report

Published Date: 22 January 2026 | Report Code: aviation-gas-turbine

Aviation Gas Turbine Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Aviation Gas Turbine market, providing comprehensive insights, analyses, and forecasts from 2023 to 2033. It covers market dynamics, trends, segmentation, and regional performance to guide stakeholders in strategic planning.

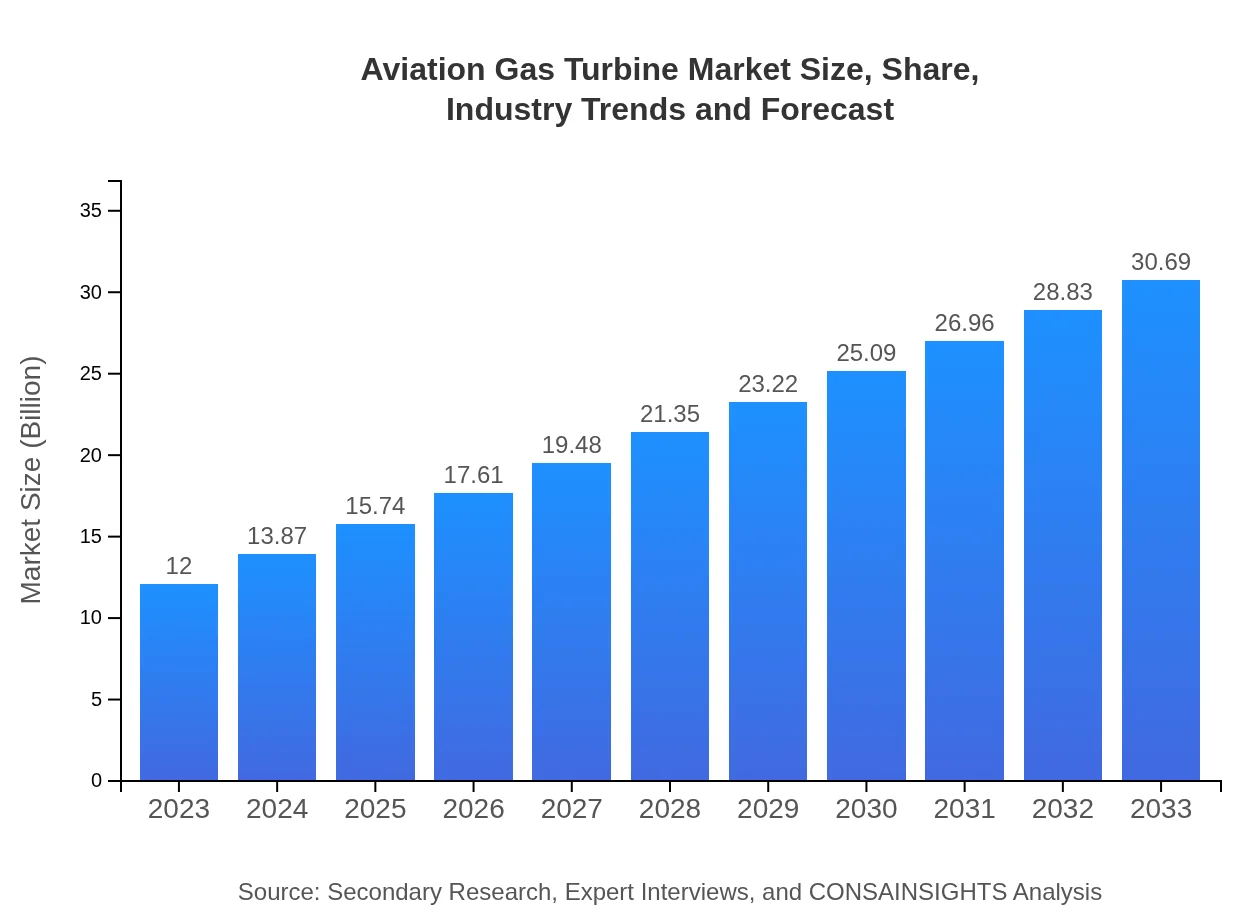

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $30.69 Billion |

| Top Companies | General Electric, Rolls-Royce, Pratt & Whitney, Safran Aircraft Engines, Honeywell Aerospace |

| Last Modified Date | 22 January 2026 |

Aviation Gas Turbine Market Overview

Customize Aviation Gas Turbine Market Report market research report

- ✔ Get in-depth analysis of Aviation Gas Turbine market size, growth, and forecasts.

- ✔ Understand Aviation Gas Turbine's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aviation Gas Turbine

What is the Market Size & CAGR of Aviation Gas Turbine market in 2023?

Aviation Gas Turbine Industry Analysis

Aviation Gas Turbine Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aviation Gas Turbine Market Analysis Report by Region

Europe Aviation Gas Turbine Market Report:

Europe's Aviation Gas Turbine market is projected to grow from $3.09 billion in 2023 to $7.92 billion by 2033. The region is witnessing a surge in demand for greener aviation solutions as the EU emphasizes sustainability. Investments in fuel-efficient engines are set to rise, alongside an increase in air travel post-pandemic.Asia Pacific Aviation Gas Turbine Market Report:

In 2023, the Aviation Gas Turbine market in Asia Pacific is valued at $2.54 billion and is projected to grow to $6.51 billion by 2033. Rapid urbanization, a growing middle class, and increased air travel demand are primary growth drivers. Countries like China and India are expanding their aviation fleets, while governments focus on enhancing airport infrastructure to accommodate rising traffic volumes.North America Aviation Gas Turbine Market Report:

North America dominates the Aviation Gas Turbine market, with a value of $4.04 billion in 2023, expected to reach $10.33 billion by 2033. The region benefits from established aerospace manufacturers, a large fleet of commercial and military aircraft, and high R&D spending, particularly in sustainable aviation technologies.South America Aviation Gas Turbine Market Report:

The South American Aviation Gas Turbine market is expected to grow from $0.99 billion in 2023 to $2.52 billion by 2033. Although the market is relatively smaller, the increasing tourism and domestic travel are fostering demand for new aircraft and modern engines, particularly in Brazil and Argentina.Middle East & Africa Aviation Gas Turbine Market Report:

The Middle East and Africa market is anticipated to increase from $1.34 billion in 2023 to $3.42 billion by 2033. The Middle East, in particular, is emerging as a global aviation hub, with several major airlines expanding their fleet and operations, driving demand for advanced gas turbine technologies.Tell us your focus area and get a customized research report.

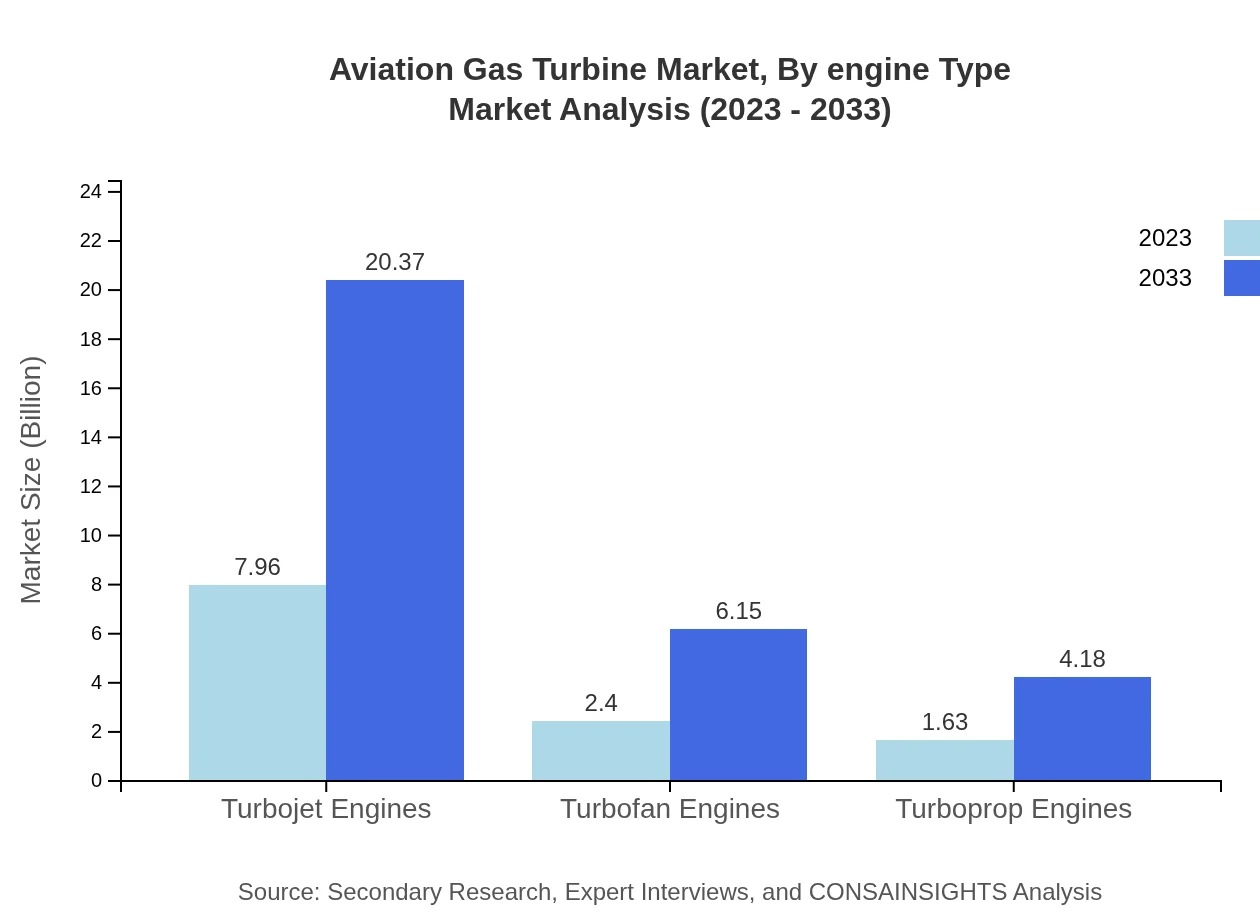

Aviation Gas Turbine Market Analysis By Engine Type

In 2023, turbojet engines dominate the market size at $7.96 billion, projected to reach $20.37 billion by 2033, holding a share of 66.35%. Turbofan engines follow with a size of $2.40 billion (20.04% share in 2023) and are expected to grow to $6.15 billion by 2033. Turboprop engines, valued at $1.63 billion in 2023 (13.61% share), are likely to grow to $4.18 billion, driven by demand in regional and commuter aircraft.

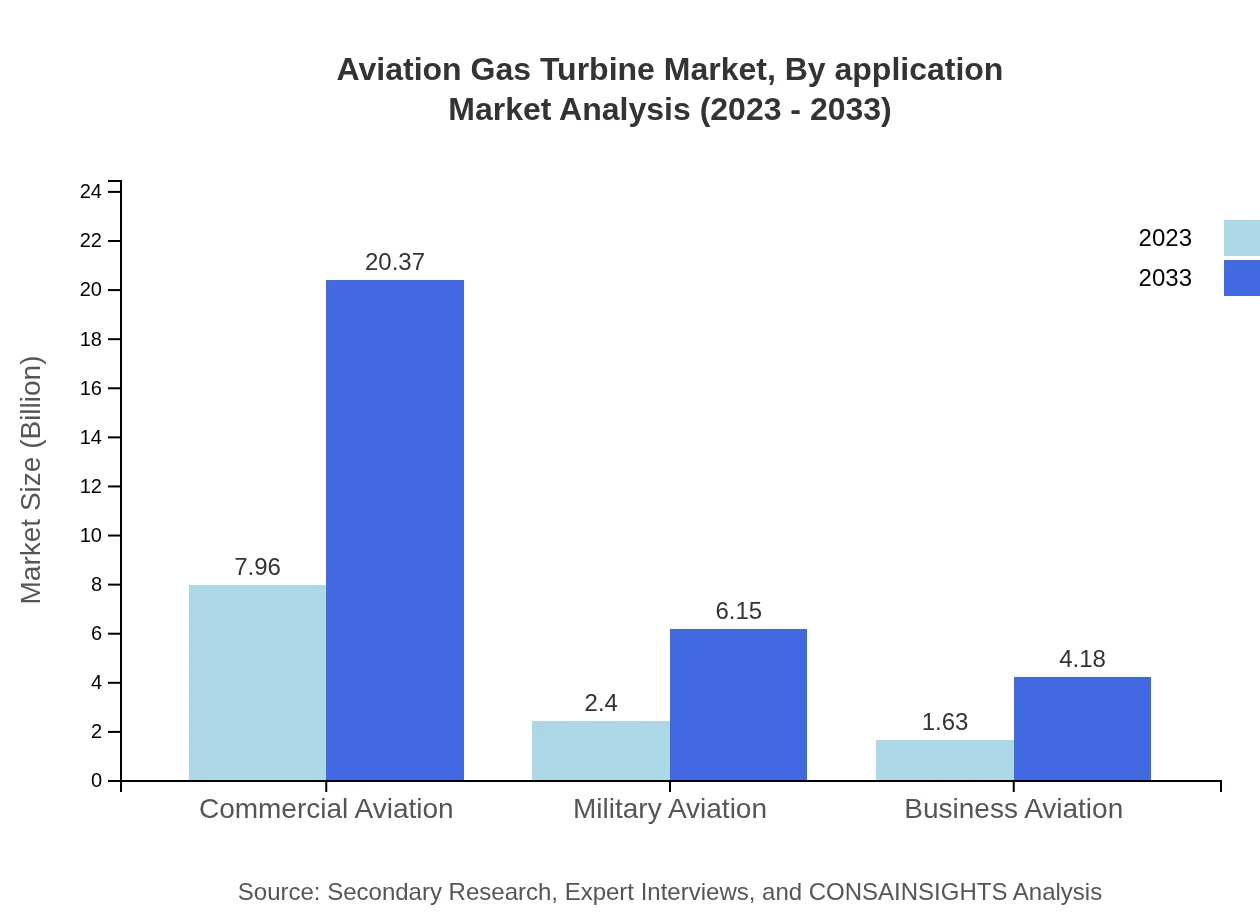

Aviation Gas Turbine Market Analysis By Application

Commercial aviation is the leading segment with a current market size of $7.96 billion (66.35% share), projected to grow to $20.37 billion by 2033. Military aviation also sees notable growth, from $2.40 billion (20.04% share) in 2023 to $6.15 billion, while business aviation grows from $1.63 billion (13.61% share) to $4.18 billion, driven by rising corporate travel.

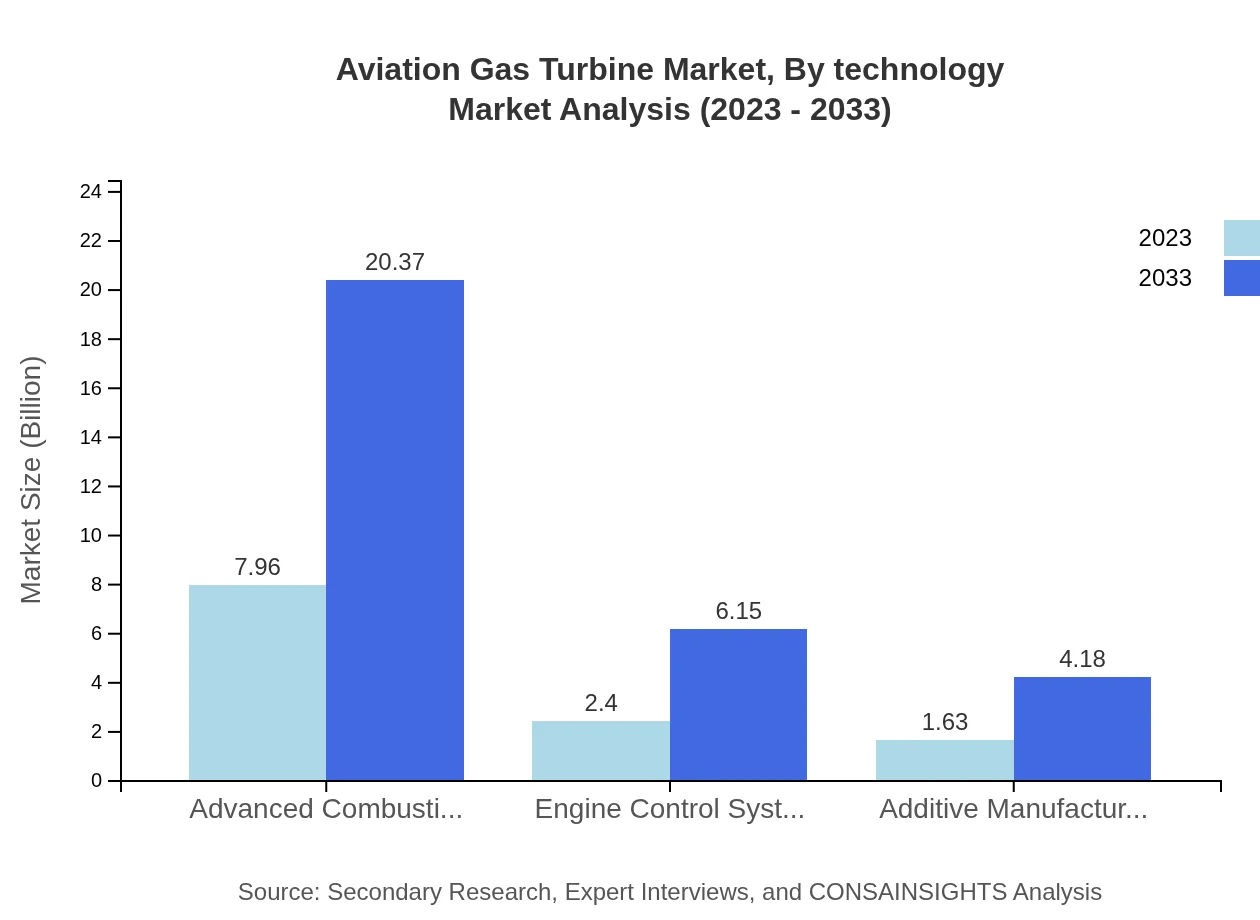

Aviation Gas Turbine Market Analysis By Technology

The demand for advanced combustion technology is projected to grow from $7.96 billion (66.35% share) in 2023 to $20.37 billion by 2033. Engine control systems, valued at $2.40 billion (20.04% share), anticipate growth to $6.15 billion. Additive manufacturing, currently at $1.63 billion (13.61% share), is expected to reach $4.18 billion, reflecting innovations in turbine production processes.

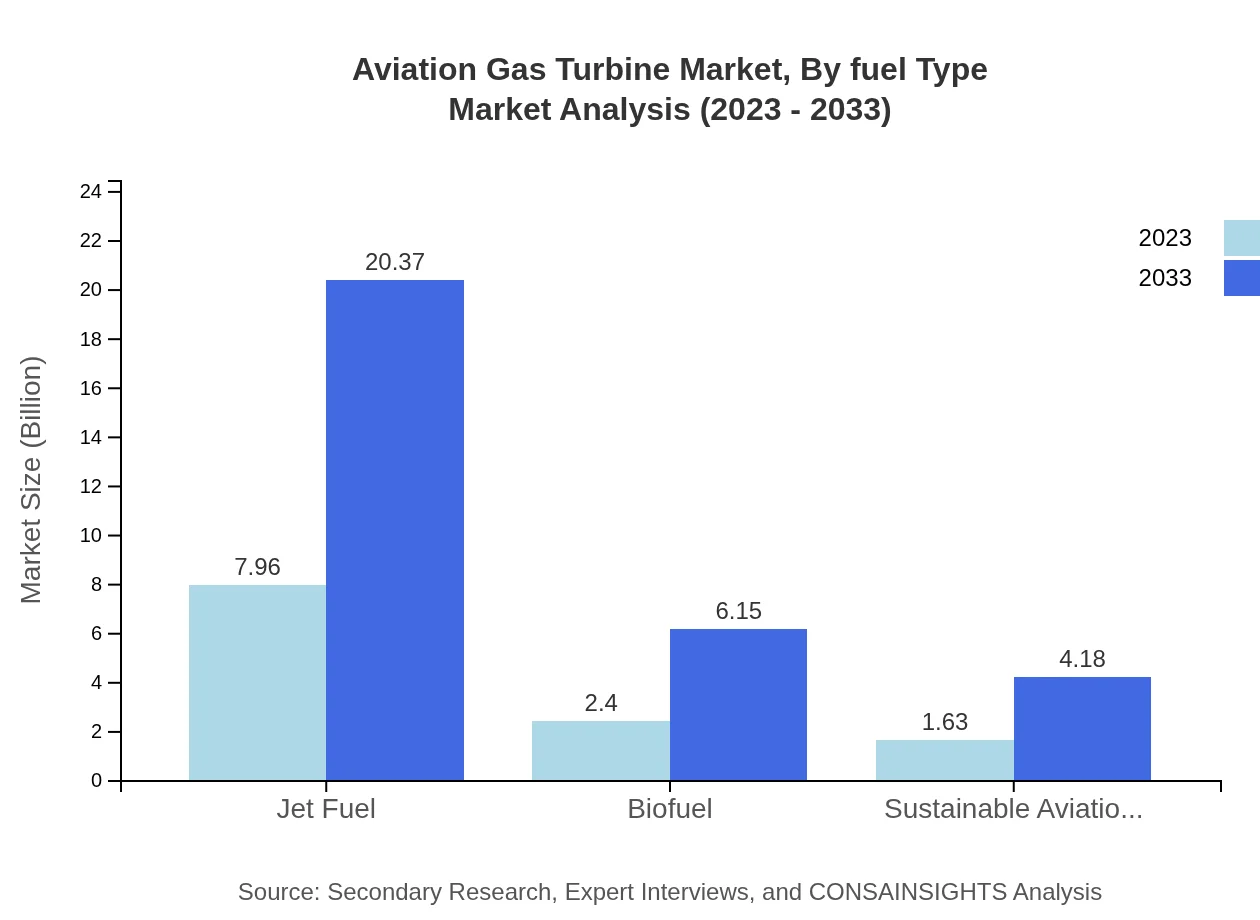

Aviation Gas Turbine Market Analysis By Fuel Type

In terms of fuel type, the jet fuel segment dominates with a current size of $7.96 billion (66.35% share), forecasting growth to $20.37 billion by 2033. Biofuel and Sustainable Aviation Fuel (SAF) are also gaining traction, with biofuel increasing from $2.40 billion (20.04% share) to $6.15 billion, and SAF growing from $1.63 billion (13.61% share) to $4.18 billion, driven by the aviation industry's sustainability commitments.

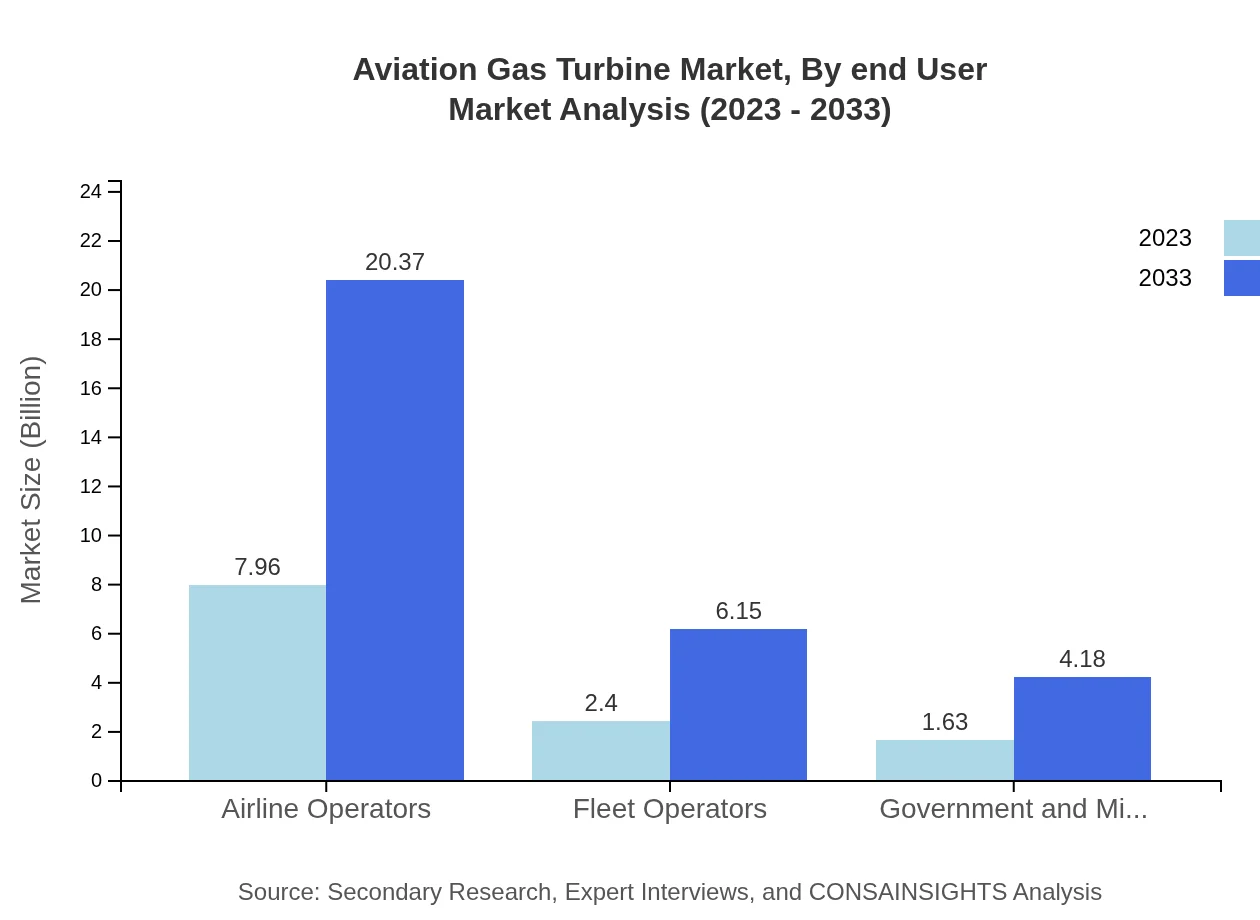

Aviation Gas Turbine Market Analysis By End User

Key end-users include commercial airlines, military fleets, and private aviation sectors. Commercial airlines command the largest market share, currently at $7.96 billion (66.35%) and expected to grow to $20.37 billion by 2033. Military applications, starting from $2.40 billion (20.04%), will likely see increased investment, while business aviation expands from $1.63 billion (13.61%).

Aviation Gas Turbine Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aviation Gas Turbine Industry

General Electric:

General Electric is a leader in jet engine technology, known for its innovative turbofan engines and extensive R&D in sustainable aviation solutions.Rolls-Royce:

Rolls-Royce specializes in high-thrust engines and is at the forefront of developing fuel-efficient technologies for both military and commercial aviation.Pratt & Whitney:

A subsidiary of Raytheon Technologies, Pratt & Whitney is renowned for its advanced engine designs and commitment to reducing aviation's environmental impact.Safran Aircraft Engines:

Safran focuses on developing green propulsion systems and is key in partnerships aimed at innovating aviation fuels and technologies.Honeywell Aerospace:

Honeywell Aerospace develops advanced engines and systems for a variety of aircraft, enhancing performance and operational efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of aviation Gas Turbine?

The aviation gas turbine market is currently valued at approximately $12 billion, with a projected compound annual growth rate (CAGR) of 9.5%. This growth indicates robust demand in the industry over the coming years.

What are the key market players or companies in the aviation Gas Turbine industry?

Key players in the aviation gas turbine sector include major manufacturers such as General Electric, Rolls-Royce, Pratt & Whitney, and Safran. These companies dominate the market with innovative technologies and comprehensive service offerings.

What are the primary factors driving the growth in the aviation Gas Turbine industry?

Growth in the aviation gas turbine industry is driven by increasing air travel demand, technological advancements in engine efficiency, and heightened focus on sustainability. Additionally, government investments in aviation infrastructure contribute to market expansion.

Which region is the fastest Growing in the aviation Gas Turbine?

The fastest-growing region in the aviation gas turbine market is Asia Pacific, projected to grow from $2.54 billion in 2023 to $6.51 billion by 2033. North America and Europe also show significant growth potential in this industry.

Does ConsaInsights provide customized market report data for the aviation Gas Turbine industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the aviation gas turbine industry. Clients can request in-depth analyses focusing on particular segments or geographic regions.

What deliverables can I expect from this aviation Gas Turbine market research project?

Deliverables from the aviation gas turbine market research include comprehensive market analysis reports, forecasts, competitive landscape assessments, and insights on key trends, segmented data, and strategic recommendations.

What are the market trends of aviation Gas Turbine?

Current trends in the aviation gas turbine market include the rise in sustainable aviation fuels, advancements in additive manufacturing, and a shift towards more efficient turbojet and turbofan engines, reflecting the sector's focus on innovation.