Aviation Gasoline Market Report

Published Date: 22 January 2026 | Report Code: aviation-gasoline

Aviation Gasoline Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Aviation Gasoline market from 2023 to 2033, covering critical insights, market growth projections, segmentation data, and regional trends that influence the industry dynamics.

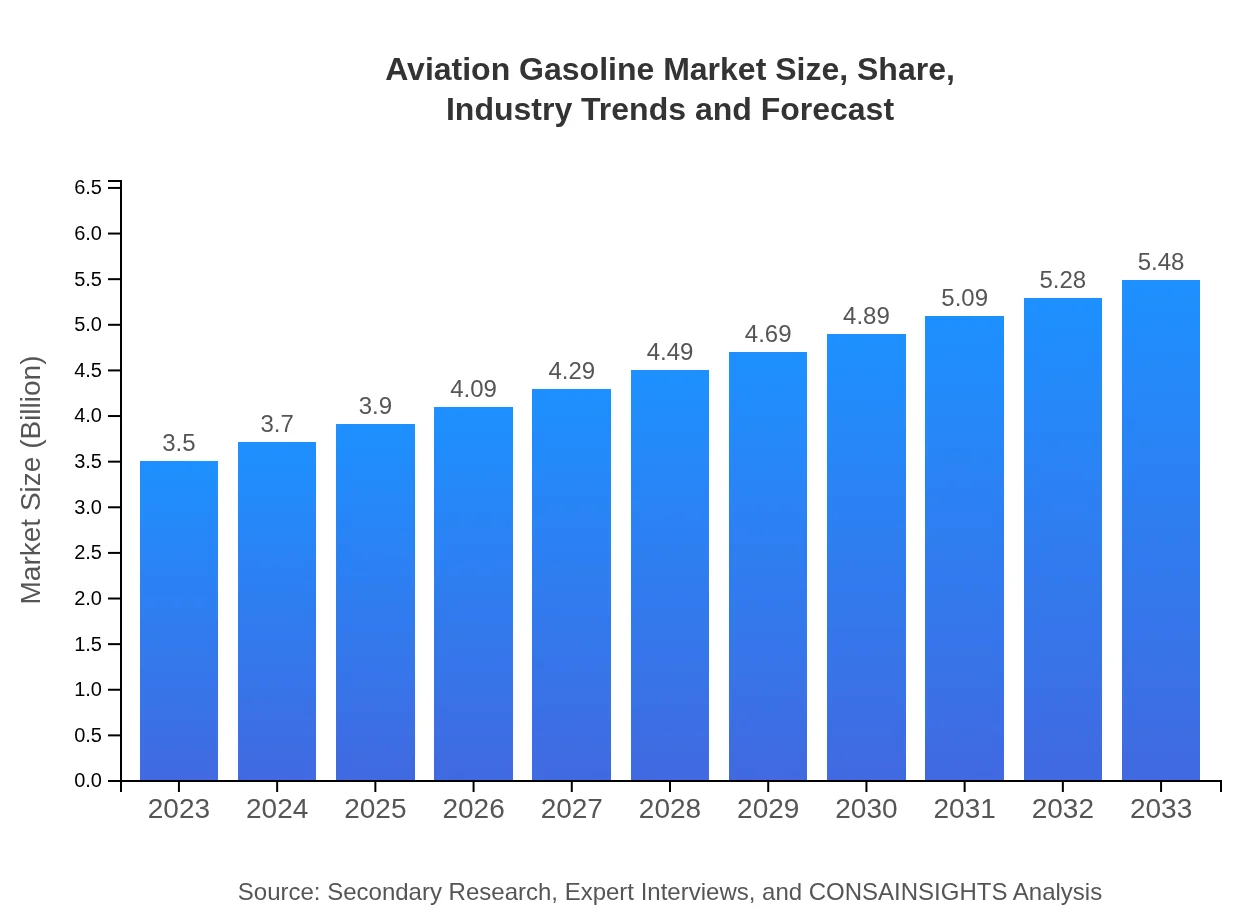

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $5.48 Billion |

| Top Companies | BP plc, Shell Aviation, ExxonMobil, TotalEnergies, Air BP |

| Last Modified Date | 22 January 2026 |

Aviation Gasoline Market Overview

Customize Aviation Gasoline Market Report market research report

- ✔ Get in-depth analysis of Aviation Gasoline market size, growth, and forecasts.

- ✔ Understand Aviation Gasoline's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aviation Gasoline

What is the Market Size & CAGR of the Aviation Gasoline market in 2023?

Aviation Gasoline Industry Analysis

Aviation Gasoline Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aviation Gasoline Market Analysis Report by Region

Europe Aviation Gasoline Market Report:

The European market for Aviation Gasoline stands at $1.27 billion in 2023, with forecasts estimating it to reach $1.99 billion by 2033. The rise of eco-friendly aviation initiatives and stringent regulations on aircraft emissions are key drivers influencing market dynamics.Asia Pacific Aviation Gasoline Market Report:

In 2023, the Aviation Gasoline market in the Asia Pacific region is valued at $0.65 billion, with projected growth to $1.02 billion by 2033. This growth is supported by increasing air travel and airport expansions across countries like China and India, alongside rising disposable incomes and a growing number of flight schools.North America Aviation Gasoline Market Report:

North America holds a significant share of the Aviation Gasoline market, valued at $1.14 billion in 2023, expected to rise to $1.78 billion by 2033. The region’s robust aviation infrastructure and the large number of general aviation aircraft contribute to this growth.South America Aviation Gasoline Market Report:

The South American market for Aviation Gasoline is currently valued at $0.13 billion in 2023, anticipated to reach $0.20 billion by 2033. This region shows a gradual recovery in aviation activity, driven by tourism and local aviation industries, which are enhancing the need for aviation fuel.Middle East & Africa Aviation Gasoline Market Report:

In 2023, the Aviation Gasoline market in the Middle East and Africa is estimated at $0.31 billion, projected to grow to $0.49 billion by 2033. This growth reflects increasing investments in aviation infrastructure and a expanding regional airline market.Tell us your focus area and get a customized research report.

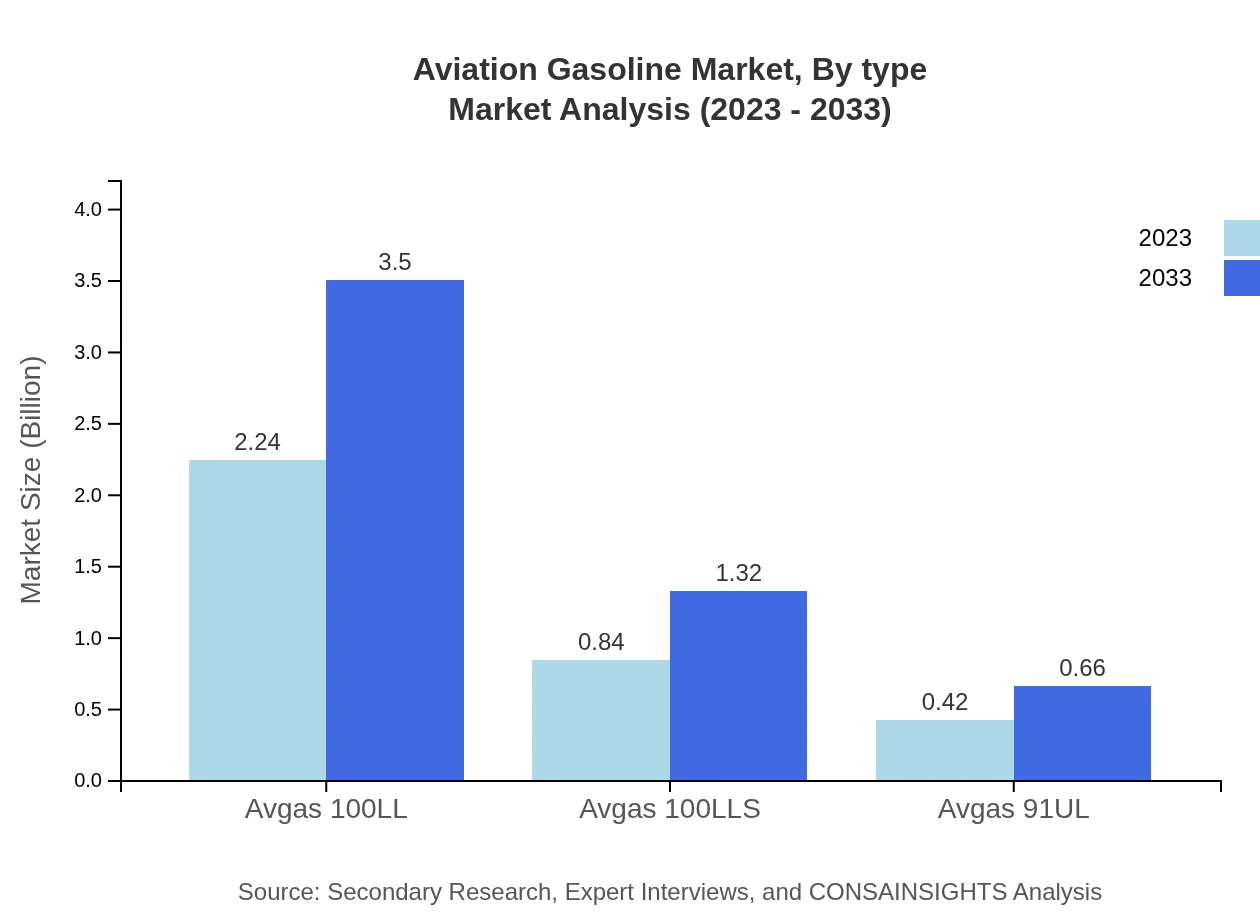

Aviation Gasoline Market Analysis By Type

The Aviation Gasoline market is segmented into several key product types. Among them, Avgas 100LL holds a dominant position with market sizes of $2.24 billion in 2023, expected to grow to $3.50 billion by 2033. Avgas 100LLS is also significant, projected to escalate from $0.84 billion to $1.32 billion over the same period. Furthermore, Avgas 91UL is expected to increase modestly from $0.42 billion to $0.66 billion. This analysis illustrates the trend towards specialized fuel types catering to different aircraft requirements.

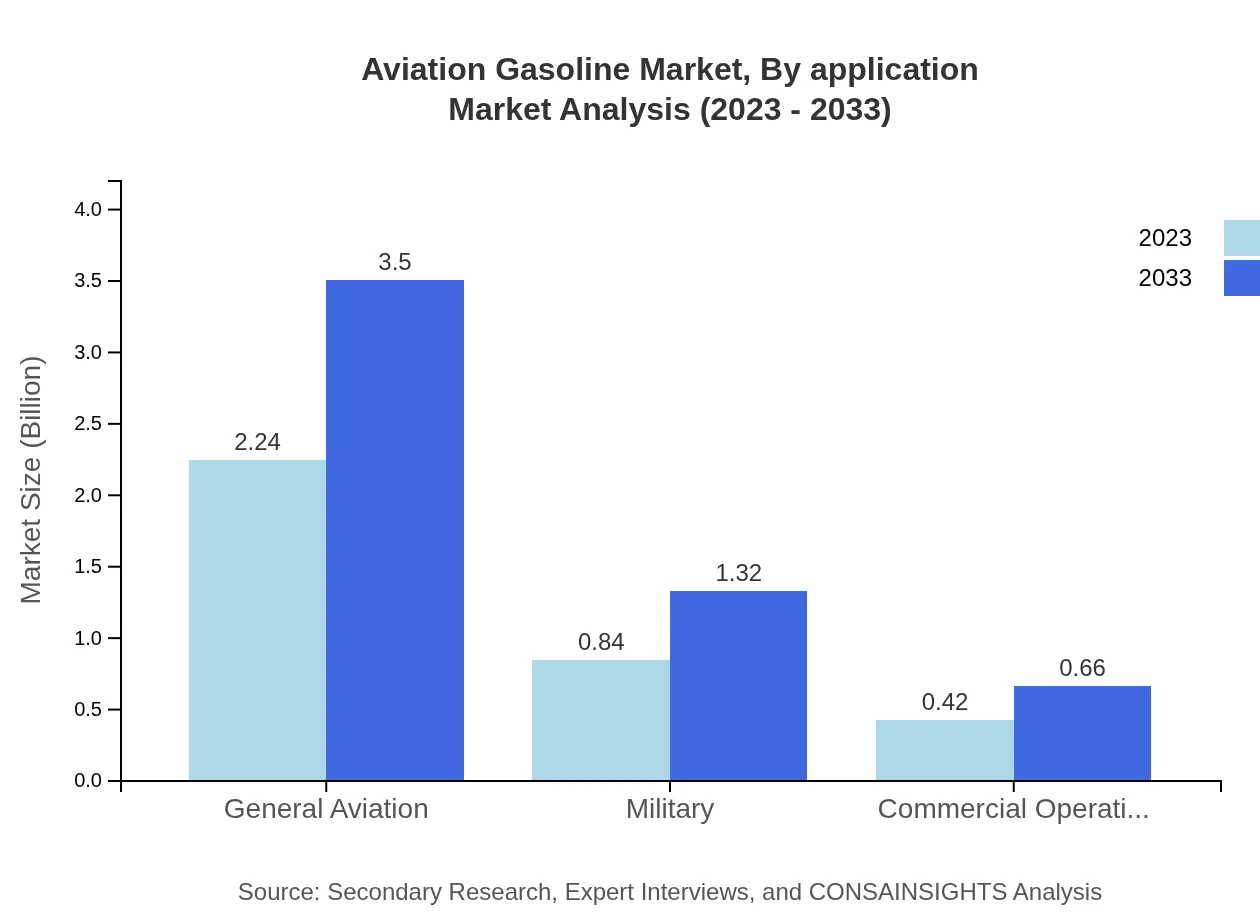

Aviation Gasoline Market Analysis By Application

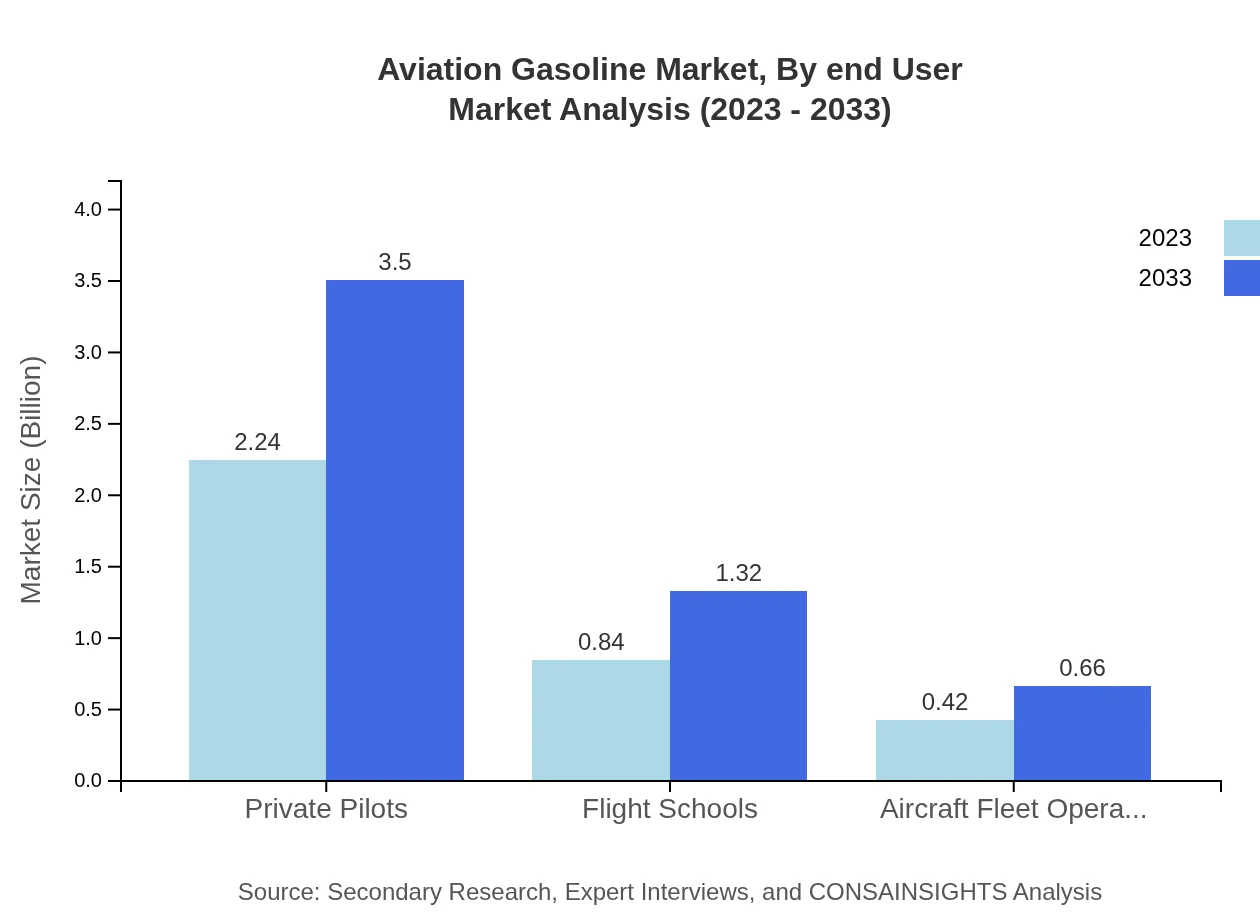

The application segment identifies key user categories such as private pilots, flight schools, and military operations. For instance, private pilots account for a substantial market share at 63.87% in 2023, with a projected value of $2.24 billion, increasing to $3.50 billion by 2033. Flight schools are expected to grow from $0.84 billion to $1.32 billion, while military usage remains steady as a critical market player.

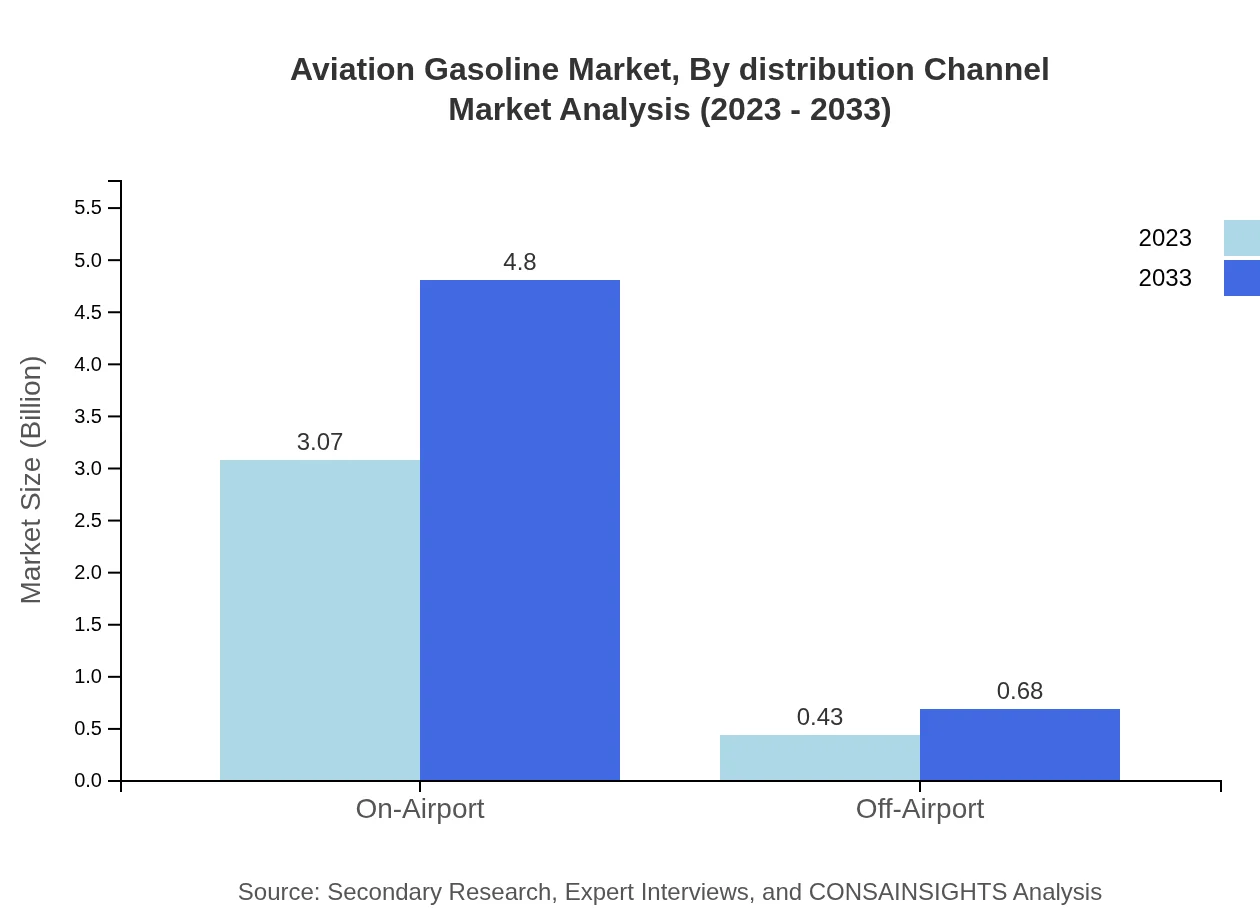

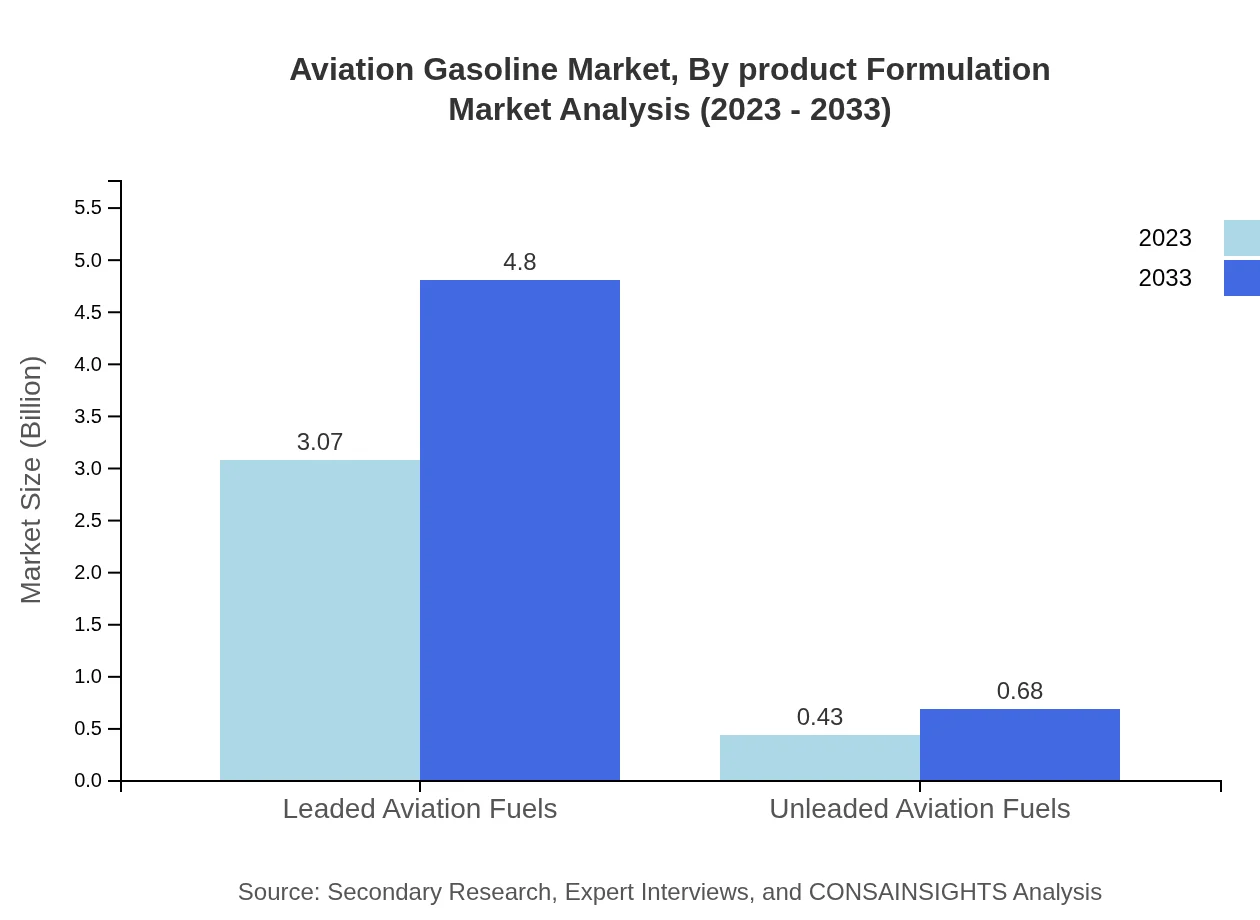

Aviation Gasoline Market Analysis By Distribution Channel

Distribution channels are crucial for connecting producers with end-users. In 2023, on-airport sales generated a revenue of $3.07 billion, projected to reach $4.80 billion by 2033. Conversely, off-airport sales are anticipated to grow from $0.43 billion to $0.68 billion, reflecting shifts in purchasing preferences among general aviation users.

Aviation Gasoline Market Analysis By End User

End-users in the Aviation Gasoline market include private pilots, commercial operations, and military operations. The general aviation sector, led by private pilots, will remain the largest segment, holding 63.87% of the market share. Commercial operations are essential yet smaller, occupying around 12.01%, poised for growth with increased demand for charter flights and private jet hire.

Aviation Gasoline Market Analysis By Product Formulation

Product formulation has two major categories: Leaded Aviation Fuels and Unleaded Aviation Fuels. The leaded segment is currently at $3.07 billion in 2023 and is forecasted to increase to $4.80 billion by 2033, encompassing 87.63% of the market. Unleaded fuels also show promise, expanding from $0.43 billion to $0.68 billion, reflecting a transition towards cleaner alternatives.

Aviation Gasoline Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Aviation Gasoline Industry

BP plc:

A major player in the global petroleum market, BP offers a wide range of aviation fuels and services that meet the needs of both commercial and general aviation.Shell Aviation:

Shell is a leading supplier of aviation fuels with a commitment to innovative products that improve performance and compliance with environmental standards.ExxonMobil:

ExxonMobil provides high-quality aviation gasoline, contributing significantly to the general aviation market through advanced fuel technology.TotalEnergies:

TotalEnergies plays a vital role in the Aviation Gasoline sector, focusing on sustainability and quality fuel delivery across its global network.Air BP:

A subsidiary of BP, Air BP is dedicated solely to aviation fuels, providing tailored solutions that enhance fleet performance and operational efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of aviation gasoline?

The aviation gasoline market is valued at approximately $3.5 billion in 2023, with a projected CAGR of 4.5% from 2023 to 2033, indicating steady growth and increasing demand across various segments.

What are the key market players or companies in the aviation gasoline industry?

Key players in the aviation gasoline industry include major oil companies, specialty fuel producers, and distributors. Leading firms are focusing on production efficiency, safety standards, and expanding their distribution networks to capture emerging markets.

What are the primary factors driving the growth in the aviation gasoline industry?

Growth in the aviation gasoline market is primarily driven by the expansion of general aviation, rising air travel demand, and technological advancements in fuel efficiency. Additionally, regulatory support for aviation infrastructure fuels further contributes to market growth.

Which region is the fastest Growing in the aviation gasoline market?

The fastest-growing region in the aviation gasoline market is Asia Pacific, expected to grow from $0.65 billion in 2023 to $1.02 billion by 2033, driven by increasing air traffic and investment in aviation infrastructure.

Does ConsaInsights provide customized market report data for the aviation gasoline industry?

Yes, ConsaInsights offers customized market report data for the aviation gasoline industry. Clients can request tailored insights that cater to specific market needs, providing detailed analysis aligned with strategic objectives.

What deliverables can I expect from this aviation gasoline market research project?

Deliverables from the aviation gasoline market research project will include comprehensive reports, detailed regional and segmental analyses, as well as actionable insights, charts, and forecasts to support strategic decision-making.

What are the market trends of aviation gasoline?

Trends in the aviation gasoline market include a shift towards unleaded fuels, growth in private pilot training, and an increased focus on sustainability in aviation. Additionally, the rising demand for fuel-efficient aircraft is shaping market dynamics.