Aviation Infrastructure Market Report

Published Date: 03 February 2026 | Report Code: aviation-infrastructure

Aviation Infrastructure Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aviation Infrastructure market from 2023 to 2033, highlighting market trends, regional insights, technological advancements, and forecasts. It aims to equip stakeholders with actionable data and insights to inform strategic decisions.

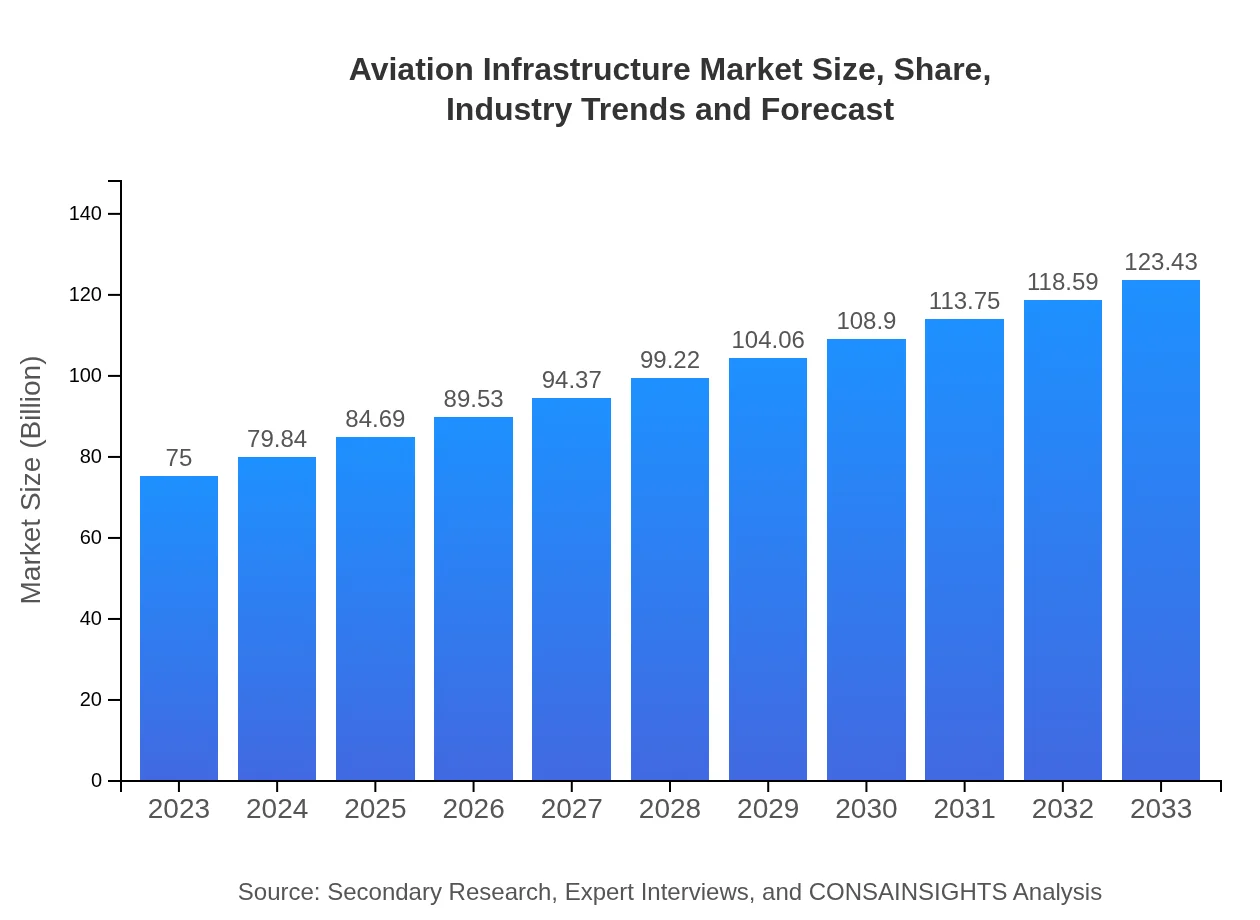

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $75.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $123.43 Billion |

| Top Companies | AECOM, Jacobs Engineering Group, Fluor Corporation, Thales Group, Honeywell International Inc. |

| Last Modified Date | 03 February 2026 |

Aviation Infrastructure Market Overview

Customize Aviation Infrastructure Market Report market research report

- ✔ Get in-depth analysis of Aviation Infrastructure market size, growth, and forecasts.

- ✔ Understand Aviation Infrastructure's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aviation Infrastructure

What is the Market Size & CAGR of Aviation Infrastructure market in 2023?

Aviation Infrastructure Industry Analysis

Aviation Infrastructure Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aviation Infrastructure Market Analysis Report by Region

Europe Aviation Infrastructure Market Report:

The European market is set to grow from $19.22 billion in 2023 to $31.64 billion by 2033, supported by systemic upgrades, sustainability initiatives, and technological evolution aimed at reducing emissions. Major airports across Europe are focusing on digitization and improving infrastructure resilience against climate changes.Asia Pacific Aviation Infrastructure Market Report:

The Asia-Pacific region is experiencing exponential growth, with the market size projected to reach $25.28 billion by 2033 from $15.36 billion in 2023. This growth is fueled by increasing air traffic, significant investments in new airport projects, and the modernization of existing facilities. Countries such as China and India lead the charge with robust infrastructural developments and expansions.North America Aviation Infrastructure Market Report:

North America dominates the aviation infrastructure market with a valuation of $27.46 billion in 2023, expected to grow to $45.19 billion by 2033. This significant growth is driven by advancements in technology and increasing investment in airport modernization projects aimed at enhancing the passenger experience and operational efficiency.South America Aviation Infrastructure Market Report:

In South America, the market is anticipated to grow from $2.98 billion in 2023 to $4.90 billion by 2033. This growth is encouraged by increasing regional connectivity efforts, investments in new airport constructions, and the need for enhanced passenger services. The focus is on improving existing infrastructure to better support rising travel demands.Middle East & Africa Aviation Infrastructure Market Report:

The Middle East and Africa market is projected to expand from $9.98 billion in 2023 to $16.43 billion by 2033. Investments in mega airport projects, particularly in the UAE and Saudi Arabia, are driving growth. This region is also prioritizing the enhancement of customer experience and operational efficiency through advanced technologies.Tell us your focus area and get a customized research report.

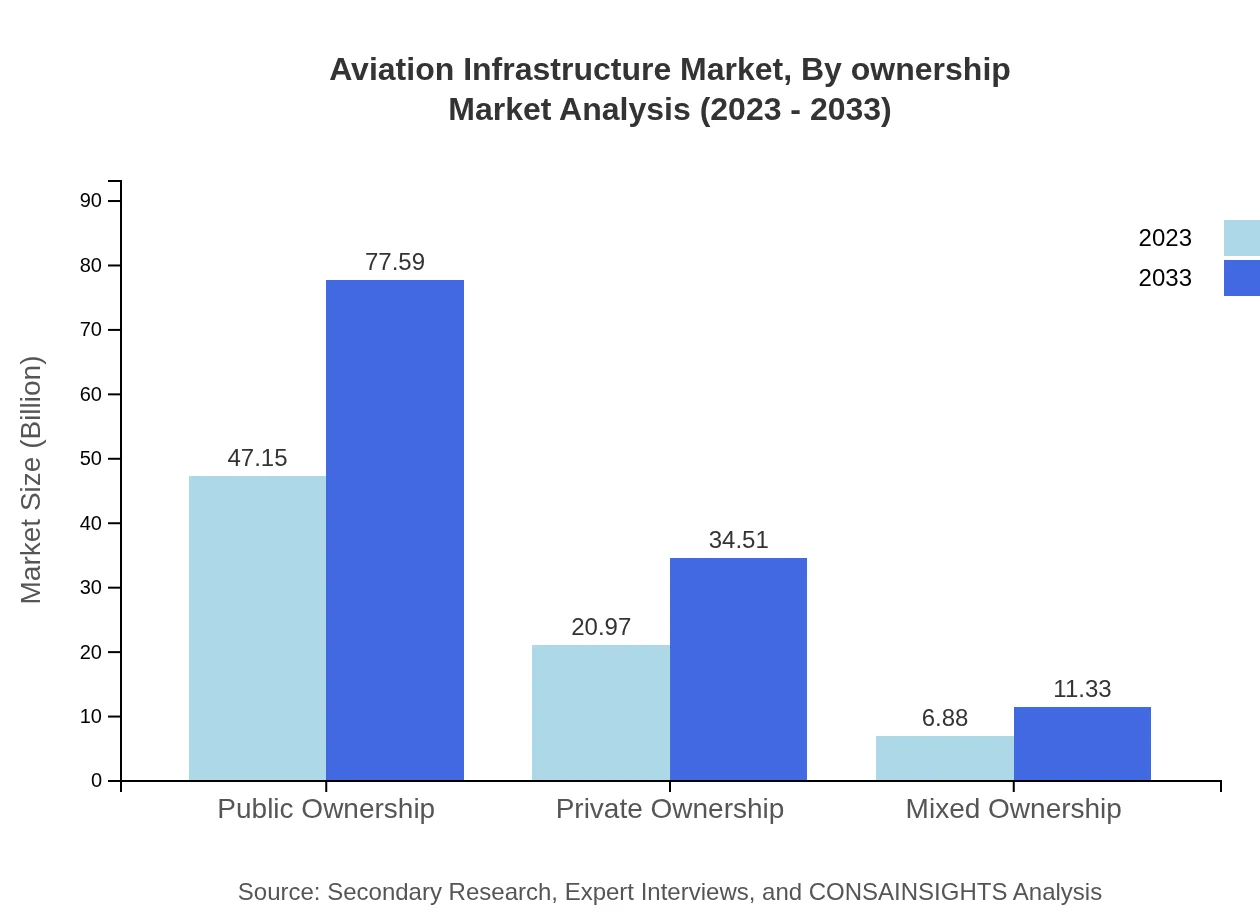

Aviation Infrastructure Market Analysis By Ownership

The share of public ownership in the aviation infrastructure market is projected to grow significantly. In 2023, public ownership market size is approximately $47.15 billion, expected to reach $77.59 billion by 2033. Private ownership is also anticipated to expand from $20.97 billion in 2023 to $34.51 billion in 2033. Meanwhile, mixed ownership will see growth from $6.88 billion to $11.33 billion as stakeholders seek collaborative funding solutions to deliver complex infrastructure needs.

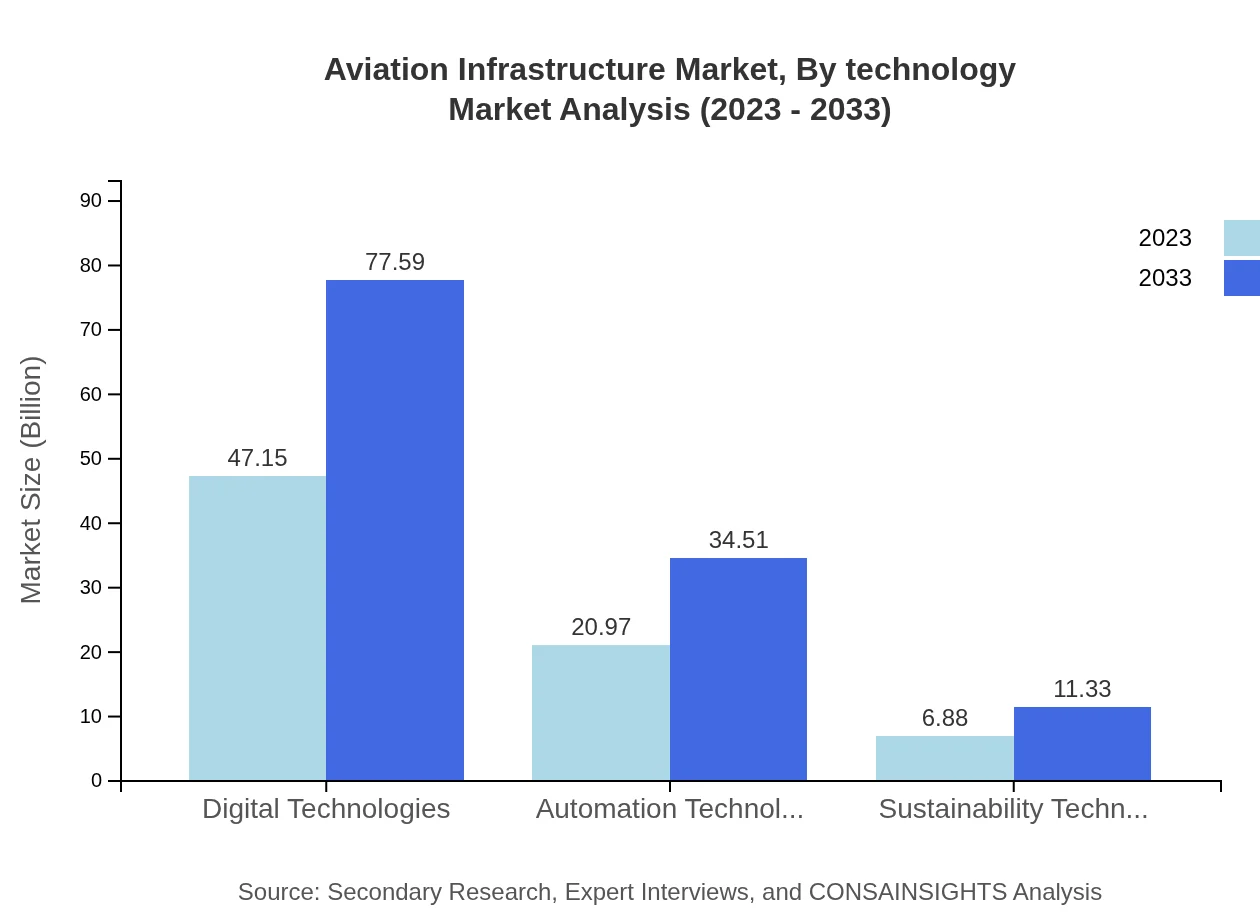

Aviation Infrastructure Market Analysis By Technology

Digital technologies are crucial, representing $47.15 billion in 2023 and rising to $77.59 billion by 2033 in market size. Automation technologies, crucial for operational optimization, will see growth from $20.97 billion to $34.51 billion. Sustainability technologies are also on the rise, reaching $11.33 billion from $6.88 billion as the industry prioritizes green solutions and compliance with global standards.

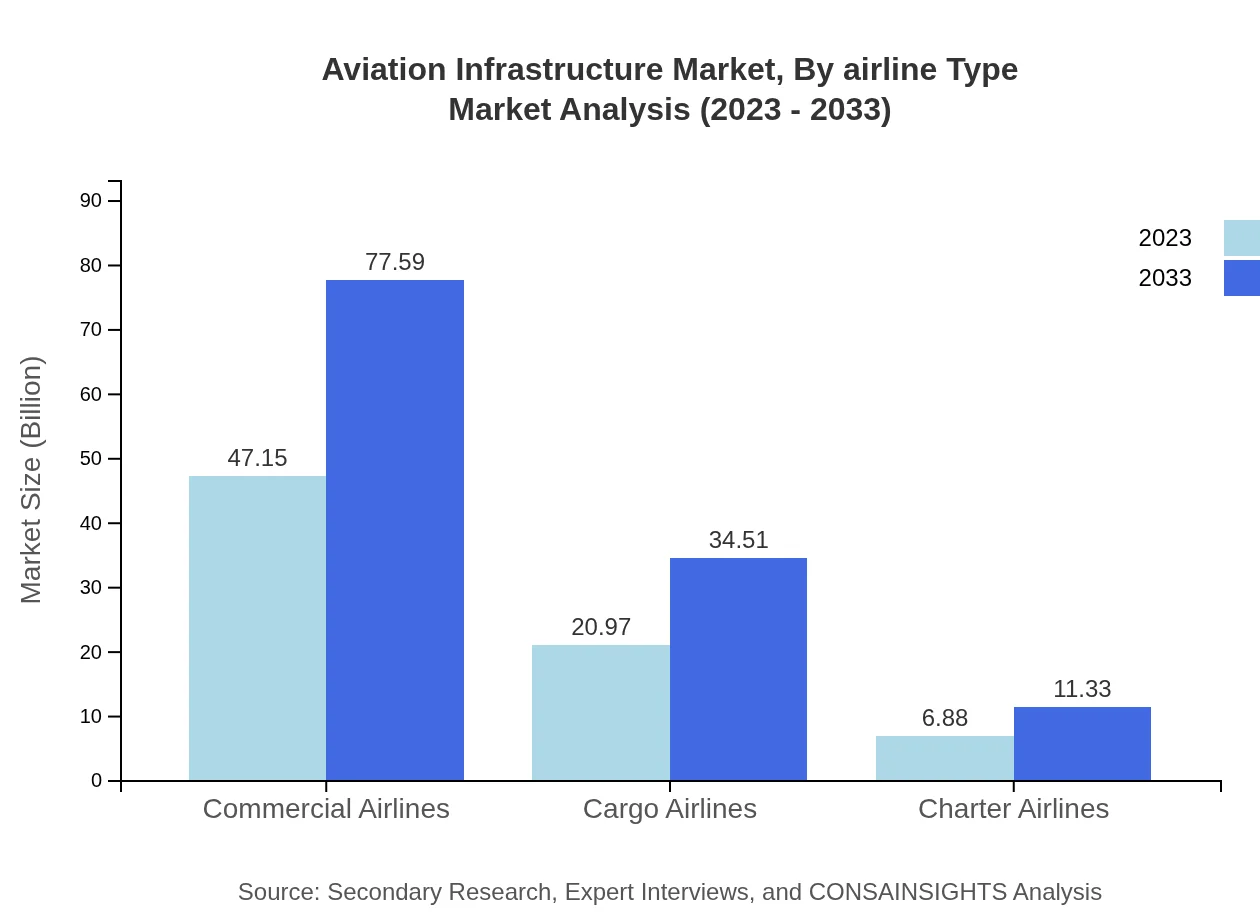

Aviation Infrastructure Market Analysis By Airline Type

Commercial airlines constitute a significant market share, growing from $47.15 billion in 2023 to $77.59 billion by 2033. Cargo airlines and charter services follow, showing growth patterns from $20.97 billion and $6.88 billion respectively in 2023 to $34.51 billion and $11.33 billion by 2033, indicating a robust demand for diverse aviation services.

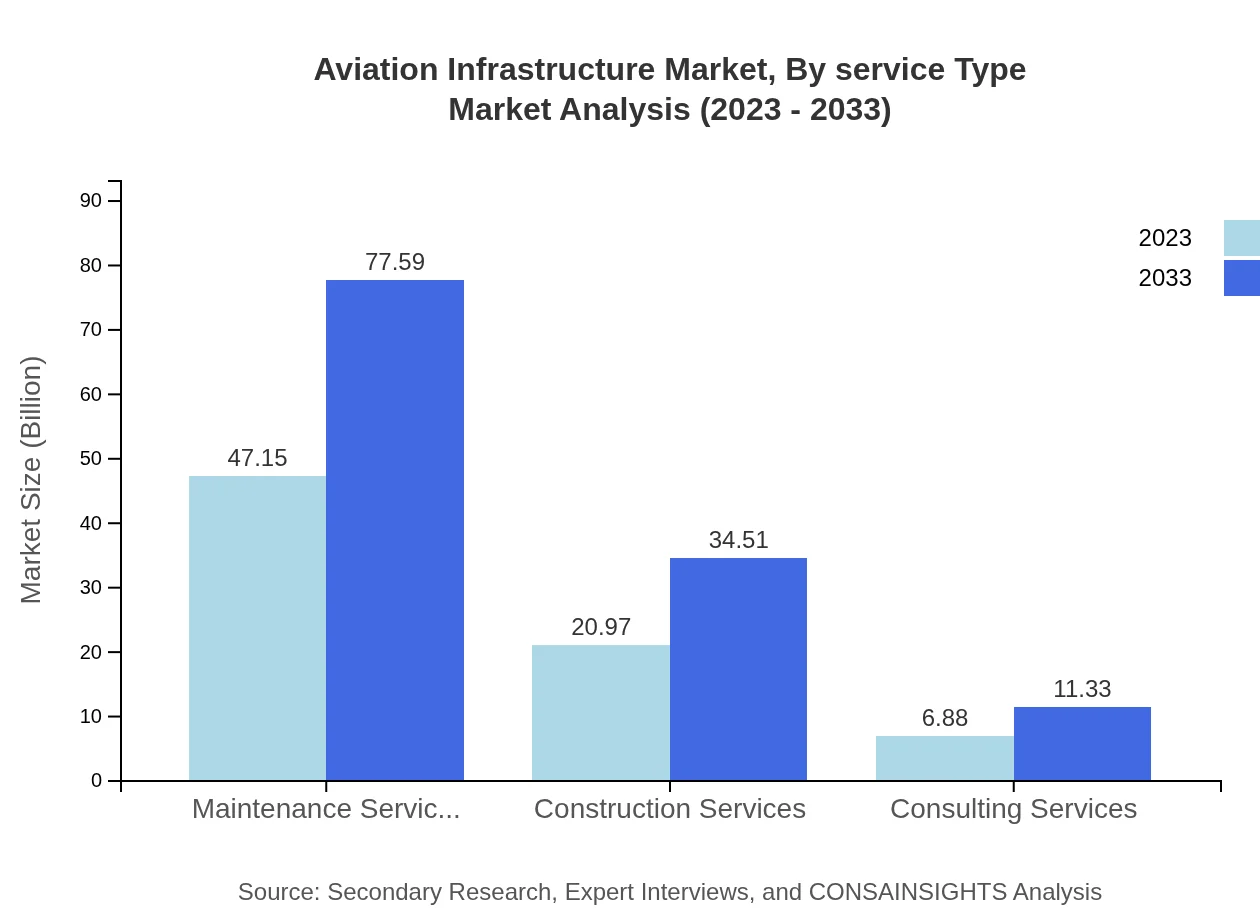

Aviation Infrastructure Market Analysis By Service Type

Maintenance services dominate the market, projected to grow from $47.15 billion to $77.59 billion as airlines emphasize operational reliability. Construction services and consulting, currently at $20.97 billion and $6.88 billion, are set to reach $34.51 billion and $11.33 billion respectively, reflecting ongoing infrastructure development and strategic advisory needs in the sector.

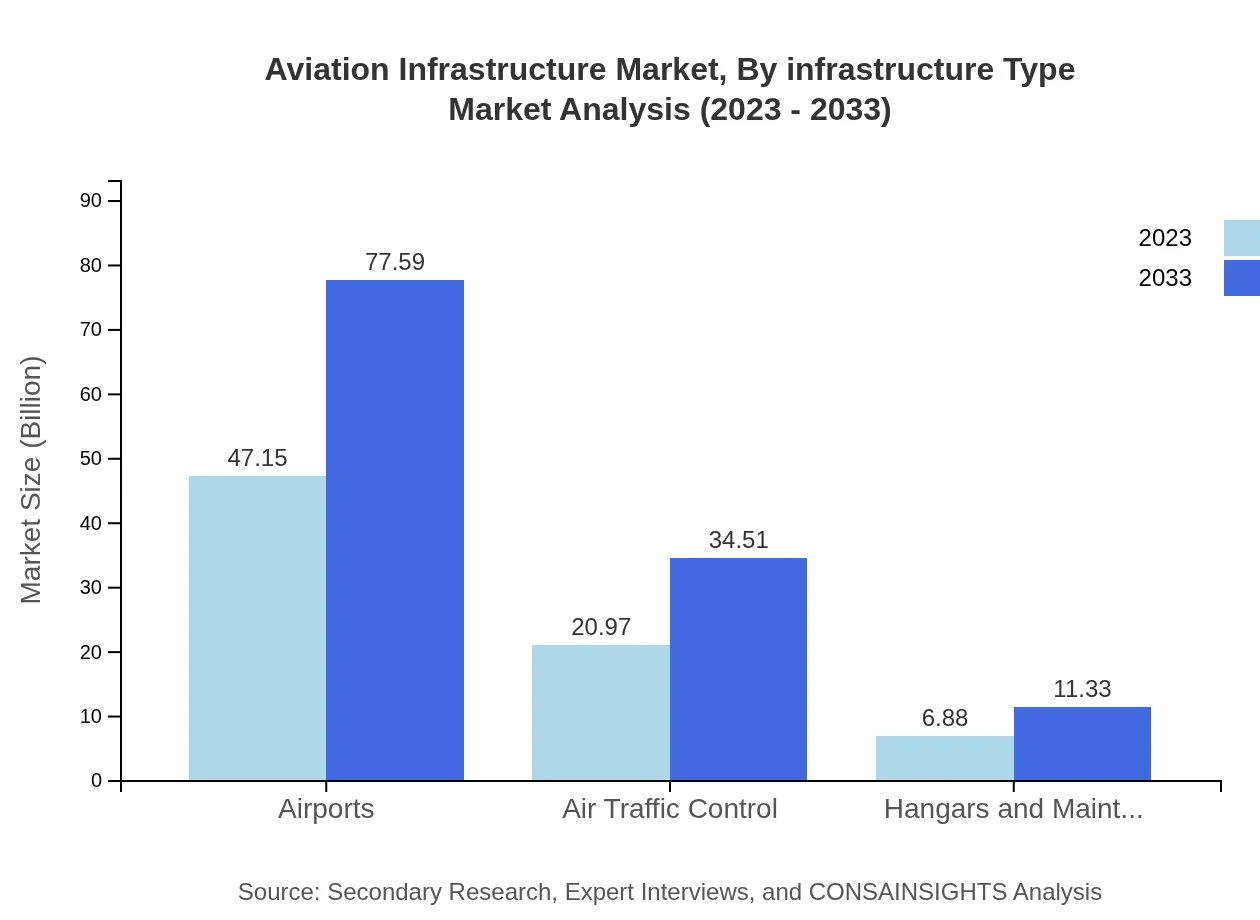

Aviation Infrastructure Market Analysis By Infrastructure Type

Airports are the backbone of the market, with significant investments leading to growth from $47.15 billion to $77.59 billion. Air traffic control systems, currently valued at $20.97 billion, are expected to reach $34.51 billion as the volume of air traffic increases, alongside hangars and maintenance facilities showing healthy growth from $6.88 billion to $11.33 billion in the span of the decade.

Aviation Infrastructure Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aviation Infrastructure Industry

AECOM:

AECOM is a global leader in infrastructure and environmental services, providing a wide range of development and engineering solutions to the aviation industry.Jacobs Engineering Group:

As a leader in airport infrastructure solutions, Jacobs provides design and construction management services, contributing significantly to large-scale aviation projects.Fluor Corporation:

Fluor Corporation offers comprehensive aviation services from design to construction, ensuring safety and efficiency in airport operations.Thales Group:

Thales delivers advanced air traffic management systems and airport solutions that enhance safety and operational efficiency globally.Honeywell International Inc.:

Honeywell is at the forefront of providing integrated aviation maintenance solutions and innovative technologies for airports and airlines.We're grateful to work with incredible clients.

FAQs

What is the market size of Aviation Infrastructure?

The aviation infrastructure market is currently valued at approximately $75 billion as of 2023. It is projected to grow at a compound annual growth rate (CAGR) of 5%, indicating steady growth over the next decade.

What are the key market players or companies in the Aviation Infrastructure industry?

Key players in the aviation infrastructure industry include major airports, construction firms, maintenance service providers, and technology companies focused on automation and sustainability. Their involvement ranges from managing airport facilities to developing essential technologies for operations.

What are the primary factors driving the growth in the Aviation Infrastructure industry?

Growth in the aviation infrastructure sector is primarily driven by rising passenger traffic, technological advancements, increasing air cargo demand, and investments in sustainable practices. Additionally, the expansion of global trade and tourism contributes significantly to this growth.

Which region is the fastest Growing in the Aviation Infrastructure market?

Asia Pacific is the fastest-growing region in the aviation infrastructure market, projected to expand from $15.36 billion in 2023 to $25.28 billion by 2033. This growth is fueled by increasing urbanization and the development of new airports.

Does ConsaInsights provide customized market report data for the Aviation Infrastructure industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the aviation infrastructure industry. This includes detailed reports and insights on various segments, regional analyses, and market forecasts.

What deliverables can I expect from this Aviation Infrastructure market research project?

Expect comprehensive deliverables such as in-depth market analysis reports, regional insights, segmentation data, and future growth forecasts. Customizable presentations and executive summaries may also be provided based on client requirements.

What are the market trends of Aviation Infrastructure?

Current trends in the aviation infrastructure market include increasing investment in automation technologies, a focus on sustainability, and expanded digital solutions. As passenger volumes grow, innovative approaches to managing airport facilities and enhancing passenger experiences are emerging.