Aviation Lubricants Market Report

Published Date: 02 February 2026 | Report Code: aviation-lubricants

Aviation Lubricants Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aviation Lubricants market from 2023 to 2033, focusing on market size, growth trends, regional insights, and key players. Insights derived will support stakeholders' strategic decision-making processes.

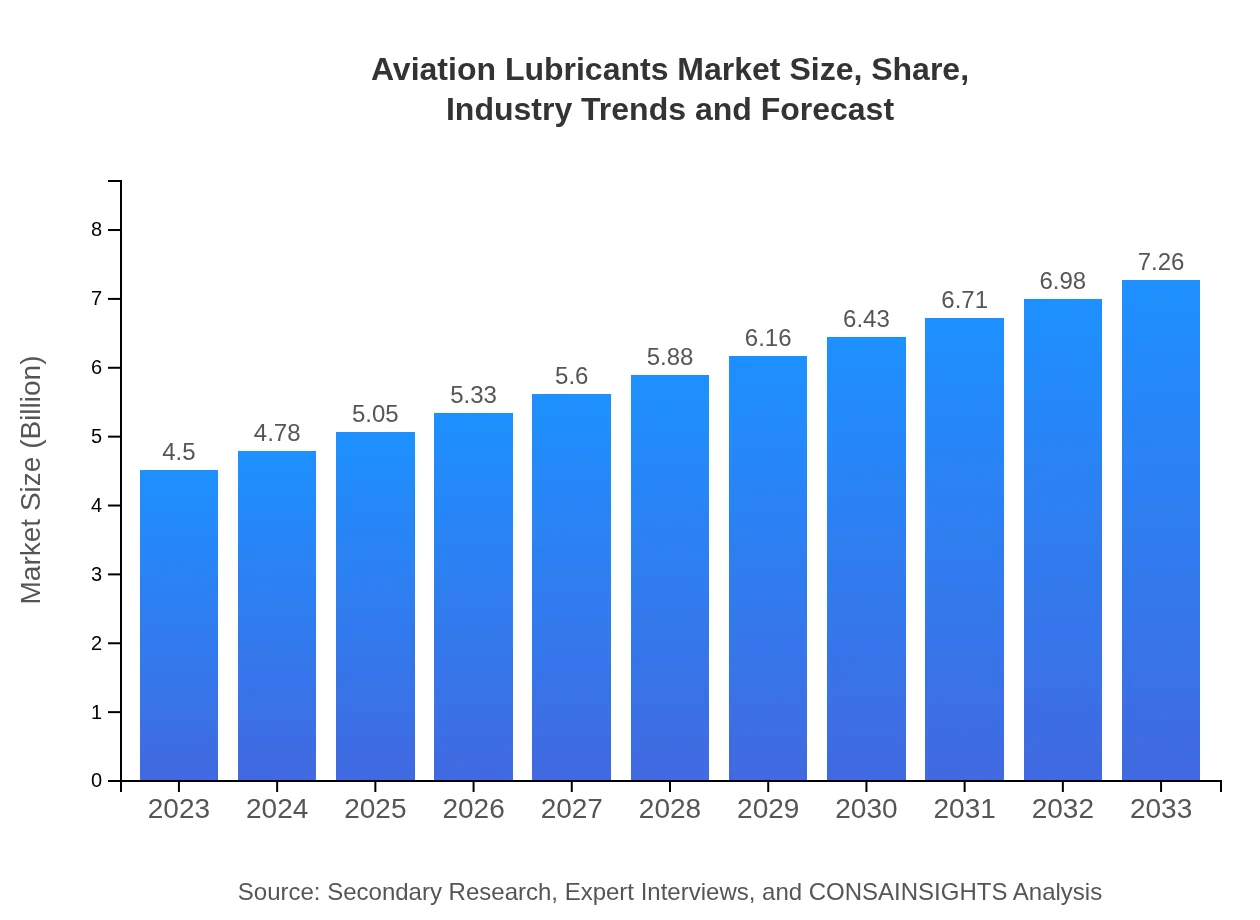

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $7.26 Billion |

| Top Companies | ExxonMobil, TotalEnergies, Shell Global, BP plc |

| Last Modified Date | 02 February 2026 |

Aviation Lubricants Market Overview

Customize Aviation Lubricants Market Report market research report

- ✔ Get in-depth analysis of Aviation Lubricants market size, growth, and forecasts.

- ✔ Understand Aviation Lubricants's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aviation Lubricants

What is the Market Size & CAGR of Aviation Lubricants market in 2023?

Aviation Lubricants Industry Analysis

Aviation Lubricants Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aviation Lubricants Market Analysis Report by Region

Europe Aviation Lubricants Market Report:

Europe's Aviation Lubricants market is projected to grow from $1.19 billion in 2023 to $1.92 billion by 2033, driven by stringent environmental regulations and the increasing need for advanced formulations that enhance aircraft performance and lower emissions. Countries like Germany, France, and the UK are at the forefront of this initiative.Asia Pacific Aviation Lubricants Market Report:

In the Asia Pacific region, the Aviation Lubricants market is forecasted to grow from approximately $0.89 billion in 2023 to $1.44 billion by 2033, driven by increased air travel and rising airline operations in countries like China and India. The growing military expenditure and demand for high-quality lubricants further bolster market expansion.North America Aviation Lubricants Market Report:

North America leads the Aviation Lubricants market, with an estimated size of $1.60 billion in 2023, expected to reach $2.59 billion by 2033. The significant presence of major airlines, military aviation, and OEMs in the USA and Canada contributes to robust demand, showcasing an emphasis on sustainable and high-performance lubricants.South America Aviation Lubricants Market Report:

The South America Aviation Lubricants market is expected to grow from $0.42 billion in 2023 to $0.67 billion by 2033, fueled by the expanding commercial aviation sector, particularly in Brazil and Argentina. The increased focus on enhancing operational efficiency in airlines promotes the adoption of advanced lubricants.Middle East & Africa Aviation Lubricants Market Report:

The Middle East and Africa market is anticipated to expand from $0.40 billion in 2023 to $0.64 billion by 2033, as regional airlines boost fleet sizes and military aviation gains importance. Investment in airport infrastructure and the broader aviation ecosystem further facilitates market growth.Tell us your focus area and get a customized research report.

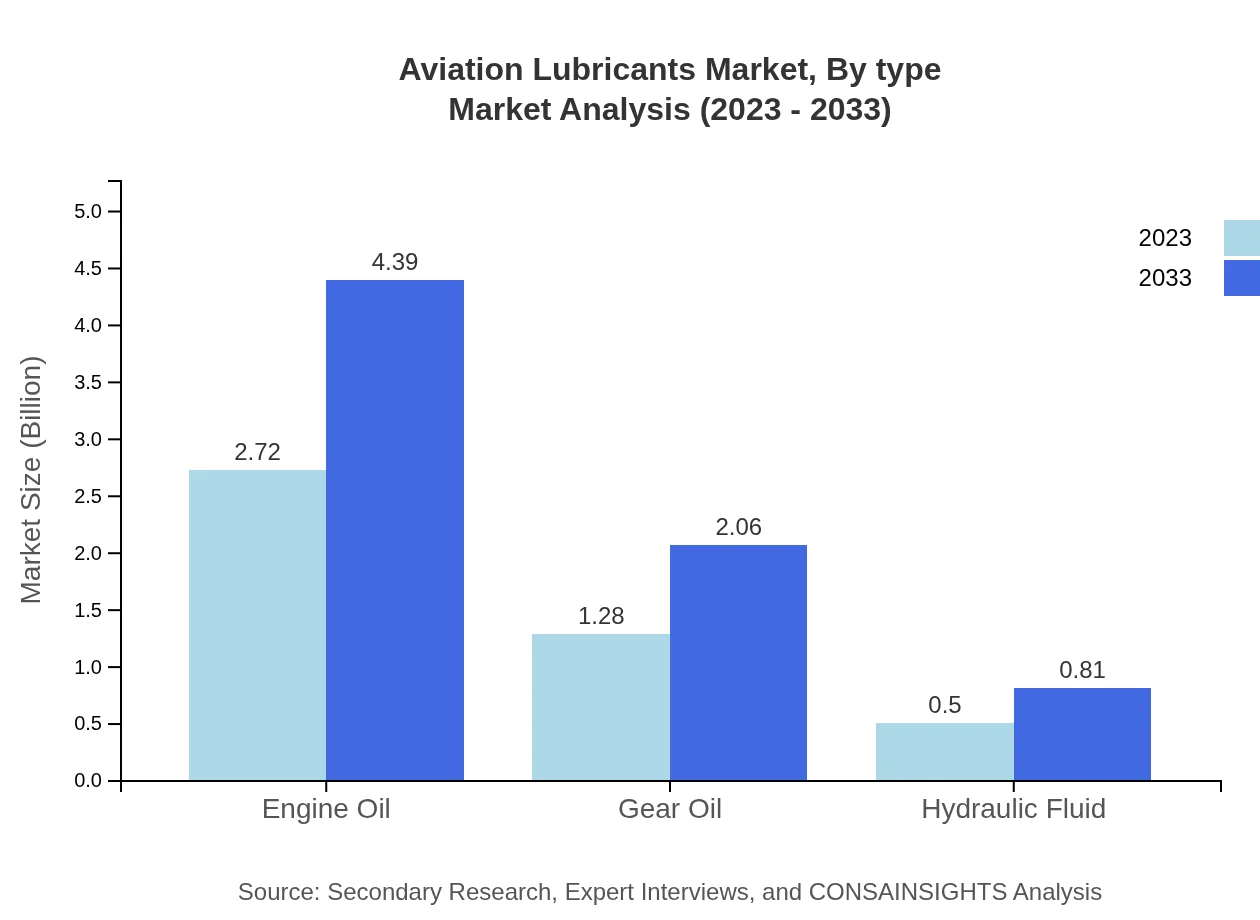

Aviation Lubricants Market Analysis By Type

The Aviation Lubricants market, by type, shows significant variations: Engine Oil is expected to grow from $2.72 billion in 2023 to $4.39 billion by 2033, capturing a 60.49% market share. Gear Oil follows with a growth trajectory from $1.28 billion to $2.06 billion, holding a 28.36% share. Lastly, Hydraulic Fluids, while smaller, will increase from $0.50 billion to $0.81 billion, comprising about 11.15% market share.

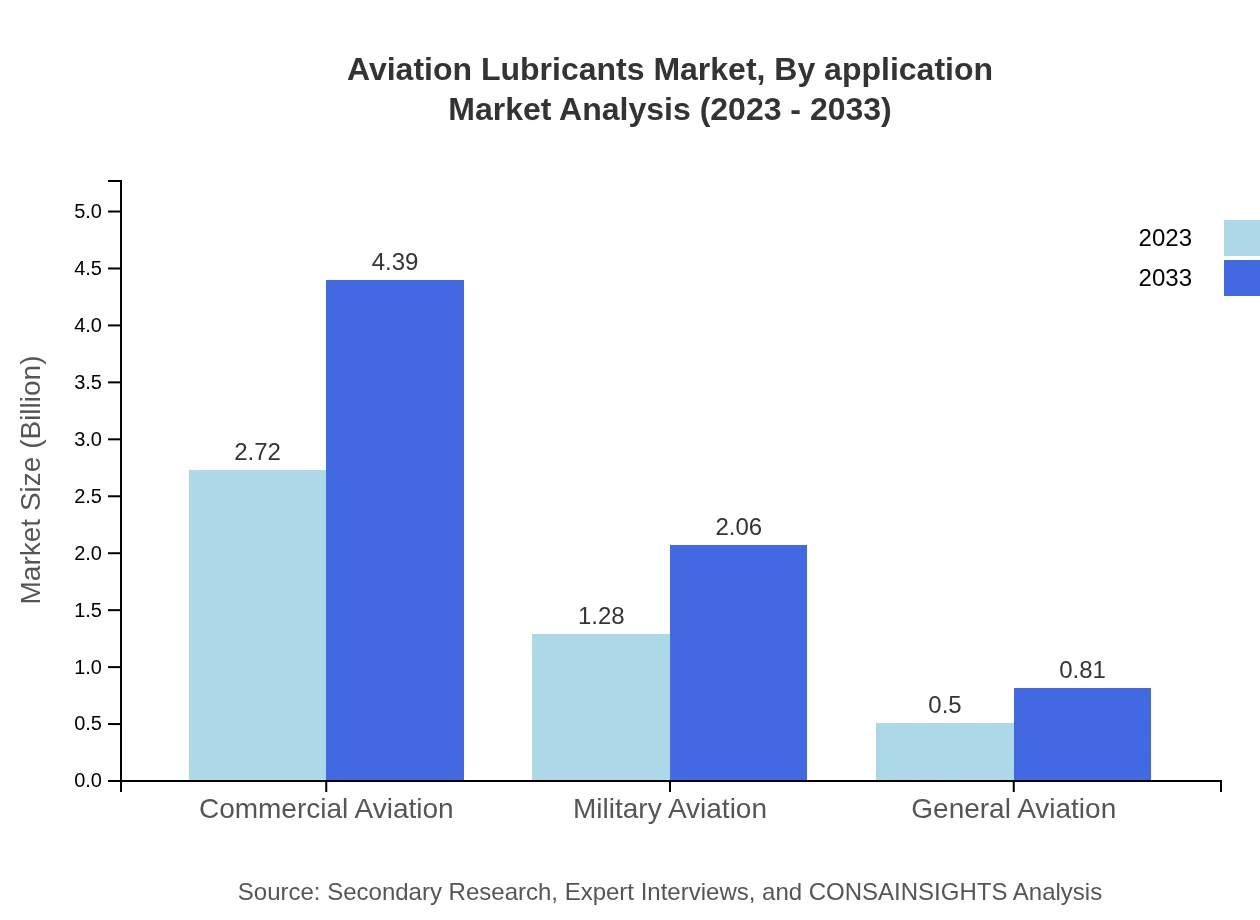

Aviation Lubricants Market Analysis By Application

In terms of applications, Commercial Aviation leads with a size of $2.72 billion in 2023 and projected growth to $4.39 billion by 2033, maintaining a share of 60.49%. Military Aviation, with 28.36% market share, anticipates growth from $1.28 billion to $2.06 billion. General Aviation, though smaller, is expected to grow from $0.50 billion to $0.81 billion, holding an 11.15% share.

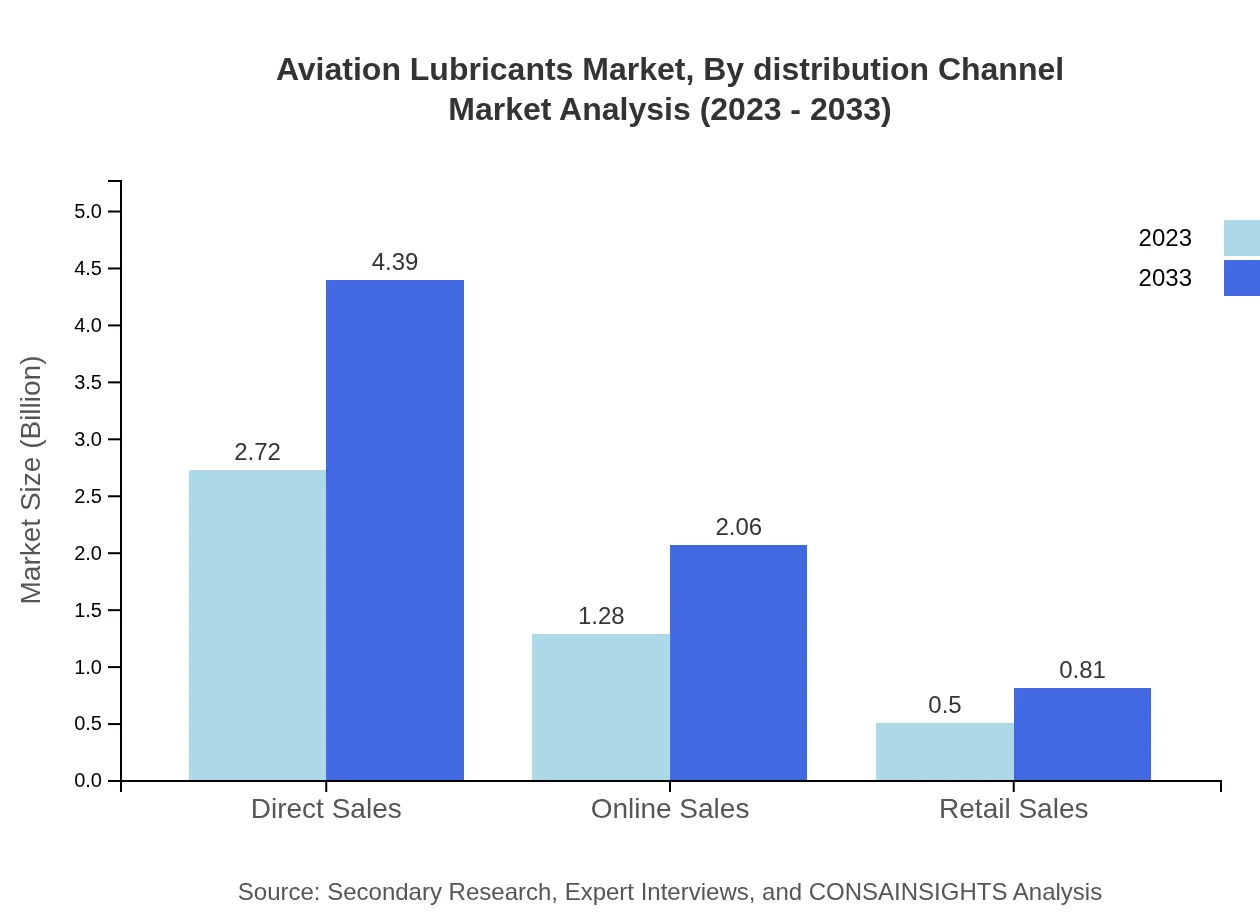

Aviation Lubricants Market Analysis By Distribution Channel

Distribution channels for Aviation Lubricants include Direct Sales ($2.72 billion to $4.39 billion; 60.49% share), Online Sales ($1.28 billion to $2.06 billion; 28.36% share), and Retail Sales ($0.50 billion to $0.81 billion; 11.15% share). Direct Sales remains the primary channel, reflecting the nature of B2B transactions in the aviation sector.

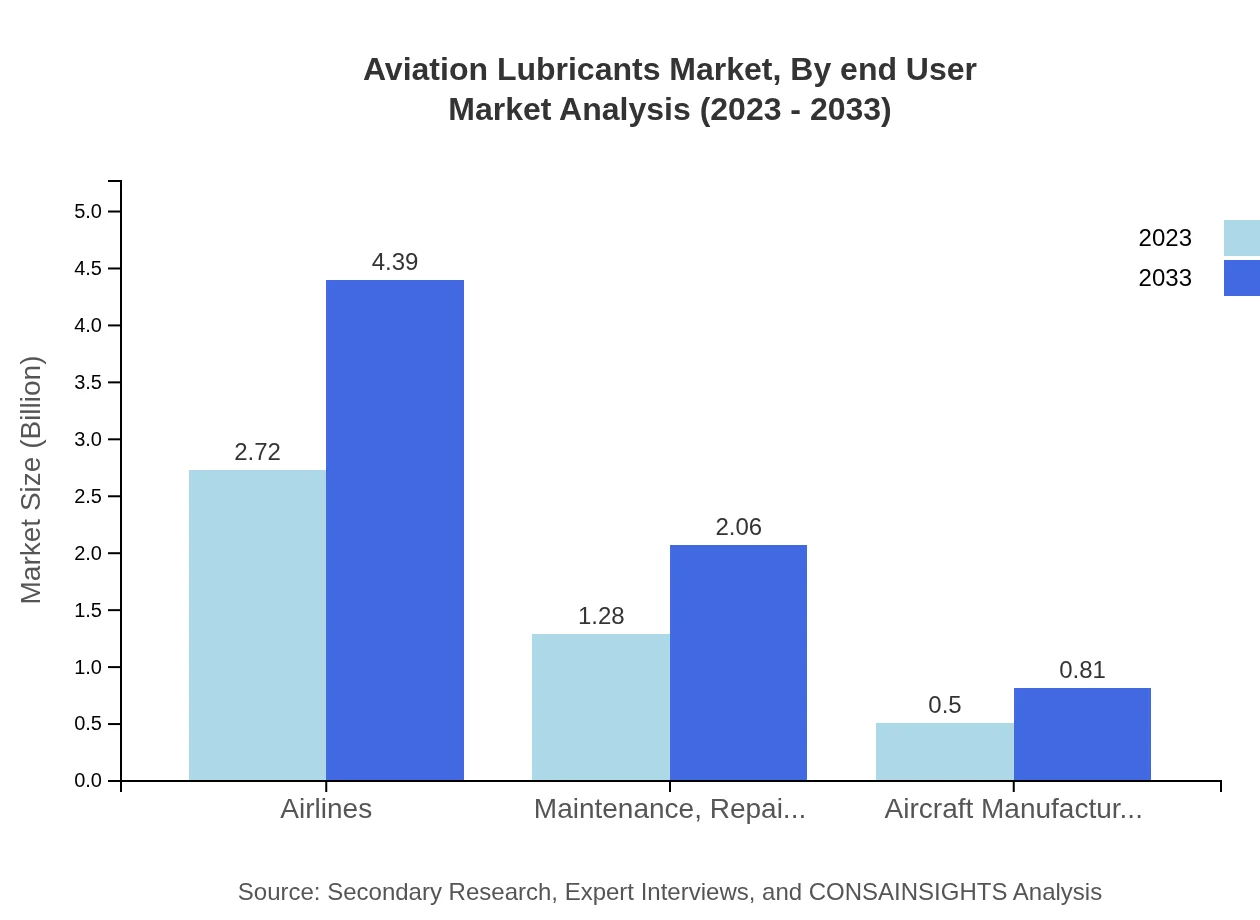

Aviation Lubricants Market Analysis By End User

The end-user segment is comprised of Airlines, MRO, and Aircraft Manufacturers. Airlines dominate, both in size and share, projected to grow from $2.72 billion to $4.39 billion, capturing 60.49%. MROs follow with a share of 28.36% (from $1.28 billion to $2.06 billion), while Aircraft Manufacturers, albeit smaller, will expand from $0.50 billion to $0.81 billion, representing 11.15% market share.

Aviation Lubricants Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aviation Lubricants Industry

ExxonMobil:

A leading player in the aviation lubricants market, ExxonMobil is known for its advanced synthetic lubricant solutions that enhance engine performance and reduce emissions.TotalEnergies:

TotalEnergies provides a wide range of petroleum-based and synthetic aviation lubricants, committed to innovation and sustainability in the aviation sector.Shell Global:

Shell is renowned for its high-performance aviation lubricants, with a strong commitment to R&D to produce eco-friendly and efficient lubrication products.BP plc:

BP offers comprehensive aviation lubricant solutions and is dedicated to driving advancements in lubrication technology to meet future aviation demands.We're grateful to work with incredible clients.

FAQs

What is the market size of aviation lubricants?

The aviation lubricants market is projected to reach $4.5 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 4.8%. This indicates robust growth opportunities within the sector over the coming years.

What are the key market players or companies in the aviation lubricants industry?

Key players in the aviation lubricants industry include major corporations engaged in specialty lubricants production, blending, and distribution, which focus on high-performance solutions tailored to commercial and military aviation applications.

What are the primary factors driving the growth in the aviation lubricants industry?

Growth in the aviation lubricants industry is primarily driven by increasing air travel demand, advancements in aviation technologies, and the need for high-performance lubricants to enhance the efficiency and longevity of aircraft engines.

Which region is the fastest Growing in the aviation lubricants?

North America is the fastest-growing region in the aviation lubricants market, projected to grow from $1.60 billion in 2023 to $2.59 billion by 2033, indicating significant market potential driven by advancements in aviation technology.

Does ConsaInsights provide customized market report data for the aviation lubricants industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the aviation lubricants industry, providing insights into market dynamics, trends, and forecasts based on unique client requirements.

What deliverables can I expect from this aviation lubricants market research project?

Clients can expect comprehensive reports detailing market size, growth forecasts, competitive analysis, segmentation insights, and strategic recommendations, all tailored to inform investment and business strategies in the aviation lubricants market.

What are the market trends of aviation lubricants?

Current trends in the aviation lubricants market include increased demand for synthetic lubricants, a focus on eco-friendly formulations, and innovations aimed at improving fuel efficiency and engine performance in modern aircraft.