Aviation Maintenance Repair And Overhaul Mro Software Market Report

Published Date: 03 February 2026 | Report Code: aviation-maintenance-repair-and-overhaul-mro-software

Aviation Maintenance Repair And Overhaul Mro Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Aviation Maintenance Repair and Overhaul (MRO) Software market from 2023 to 2033. It includes market size estimates, CAGR forecasts, industry analysis, and segmentation insights, along with regional evaluations and predictions for future trends.

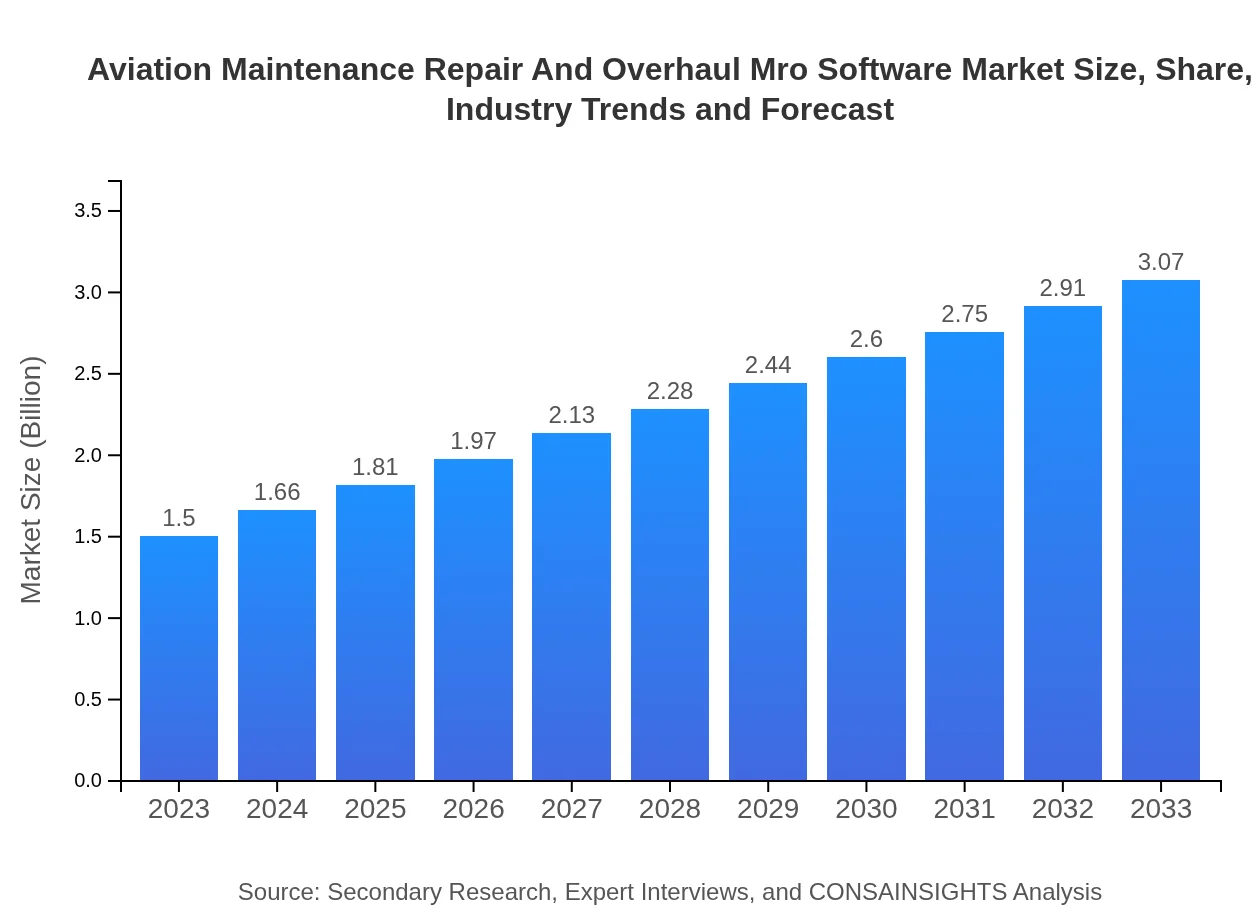

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $3.07 Billion |

| Top Companies | Siemens AG, IBM Watson, Rockwell Collins, Boeing , Honeywell |

| Last Modified Date | 03 February 2026 |

Aviation Maintenance Repair And Overhaul Mro Software Market Overview

Customize Aviation Maintenance Repair And Overhaul Mro Software Market Report market research report

- ✔ Get in-depth analysis of Aviation Maintenance Repair And Overhaul Mro Software market size, growth, and forecasts.

- ✔ Understand Aviation Maintenance Repair And Overhaul Mro Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aviation Maintenance Repair And Overhaul Mro Software

What is the Market Size & CAGR of Aviation Maintenance Repair And Overhaul Mro Software market in 2023?

Aviation Maintenance Repair And Overhaul Mro Software Industry Analysis

Aviation Maintenance Repair And Overhaul Mro Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aviation Maintenance Repair And Overhaul Mro Software Market Analysis Report by Region

Europe Aviation Maintenance Repair And Overhaul Mro Software Market Report:

The European MRO software market is also robust, projected to rise from $0.42 billion in 2023 to $0.86 billion by 2033. Strong regulatory frameworks and a history of early software adoption contribute to growing investments in advanced MRO solutions.Asia Pacific Aviation Maintenance Repair And Overhaul Mro Software Market Report:

In the Asia-Pacific region, the MRO software market is projected to grow from $0.30 billion in 2023 to $0.62 billion by 2033, driven by expanding aviation operations and increasing travel safety regulations. Countries like China and India are investing heavily in upgrading their aviation infrastructure, providing a solid market for innovative MRO software solutions.North America Aviation Maintenance Repair And Overhaul Mro Software Market Report:

North America holds the largest market share, expected to grow from $0.54 billion in 2023 to $1.10 billion by 2033. The prevalence of advanced technology and the presence of major airlines and MRO providers fuel this significant growth in the region.South America Aviation Maintenance Repair And Overhaul Mro Software Market Report:

The South American market is smaller, with expectations to grow from $0.04 billion in 2023 to $0.08 billion by 2033. Economic conditions and the rise in air travel contribute to the gradual adoption of MRO software solutions in commercial operations across the region.Middle East & Africa Aviation Maintenance Repair And Overhaul Mro Software Market Report:

This region is projected to grow from $0.20 billion in 2023 to $0.41 billion by 2033, as the aviation markets expand and regional airlines look for competitive advantages through improved maintenance solutions.Tell us your focus area and get a customized research report.

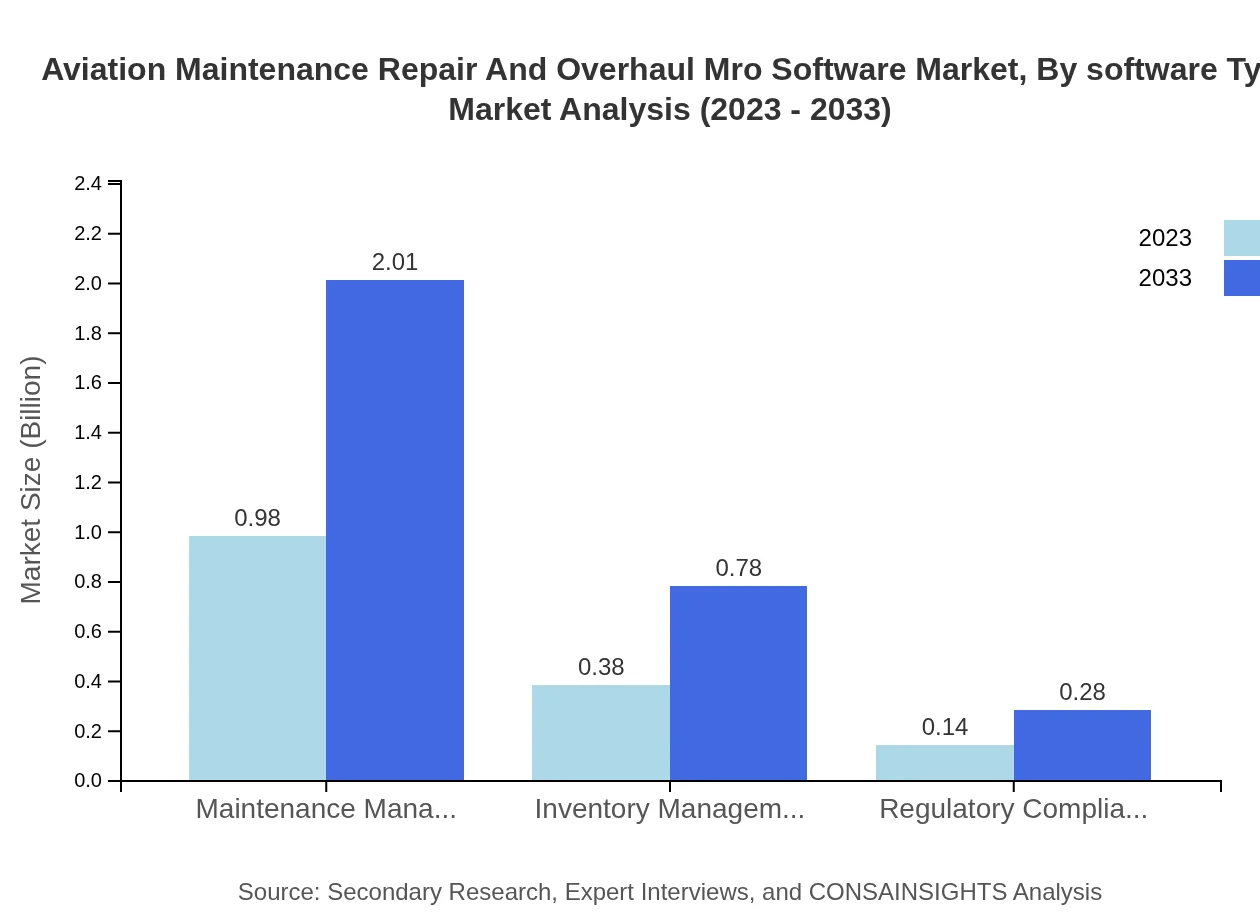

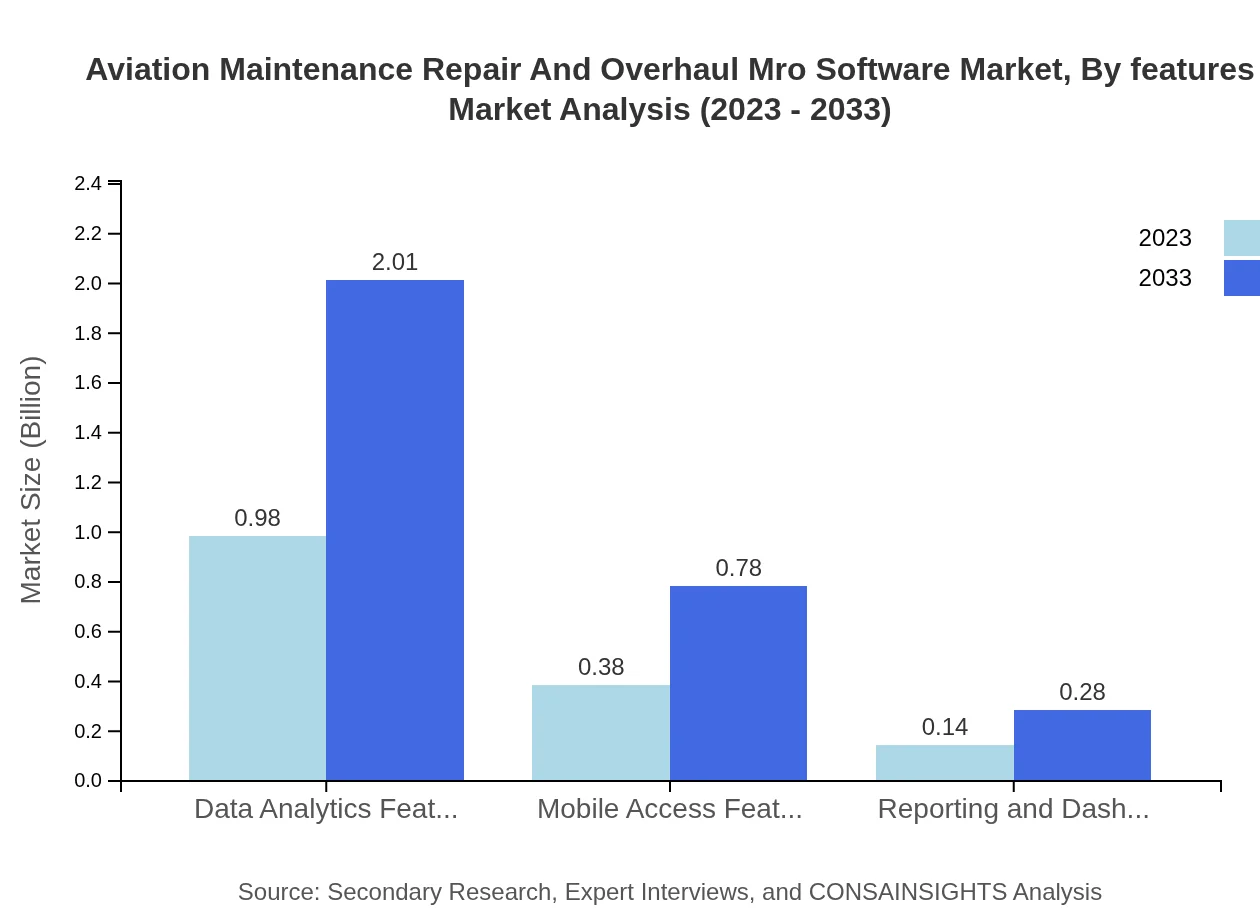

Aviation Maintenance Repair And Overhaul Mro Software Market Analysis By Software Type

The MRO software market is divided into major types including maintenance management software, inventory management software, and regulatory compliance software. Maintenance management software dominates, expected to grow from $0.98 billion in 2023 to $2.01 billion by 2033, while inventory management solutions are projected to increase from $0.38 billion to $0.78 billion over the same period.

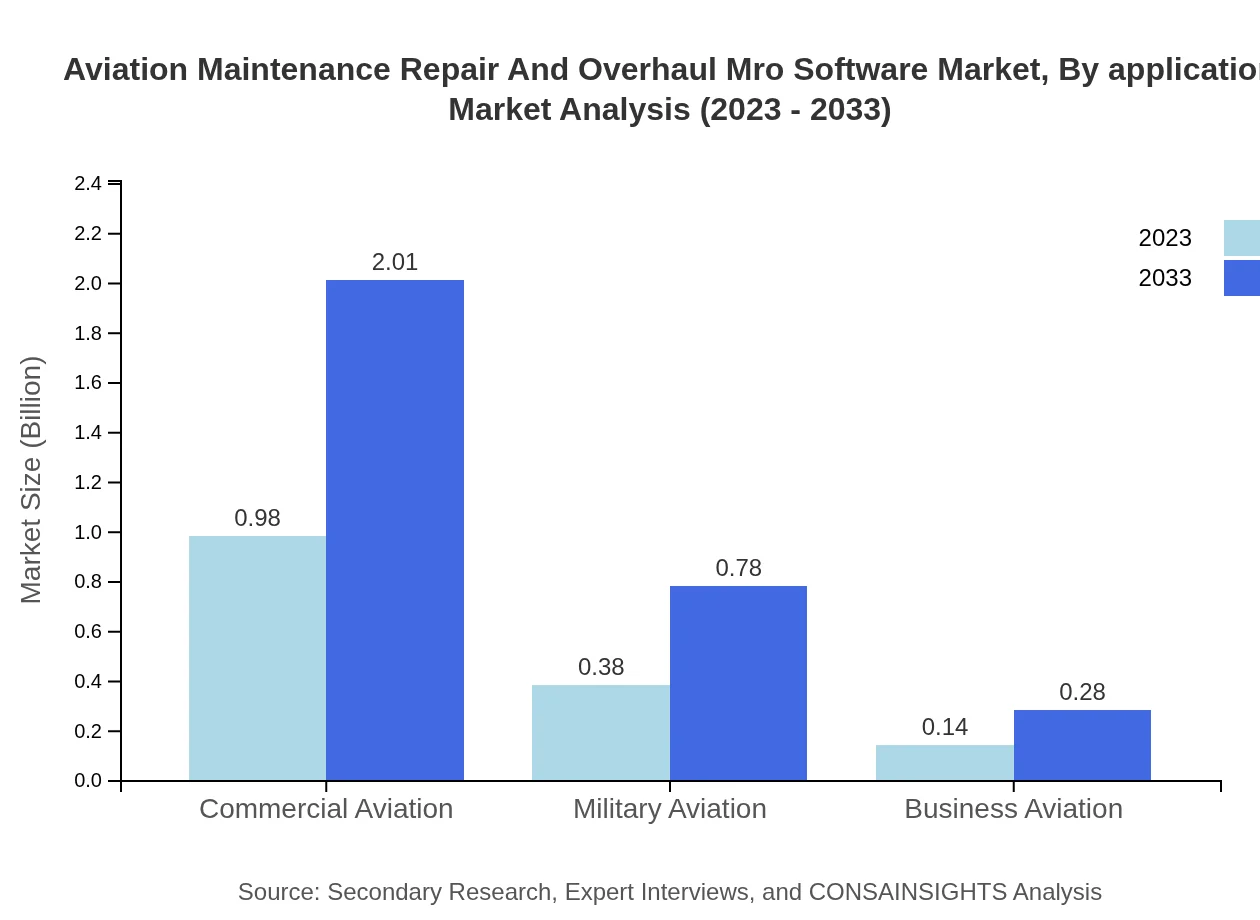

Aviation Maintenance Repair And Overhaul Mro Software Market Analysis By Application

The MRO software is applied across various sectors such as commercial aviation, military aviation, and business aviation. Commercial aviation accounts for 65.54% of the market share, reflecting significant growth potential driven by increased passenger traffic and airline operations.

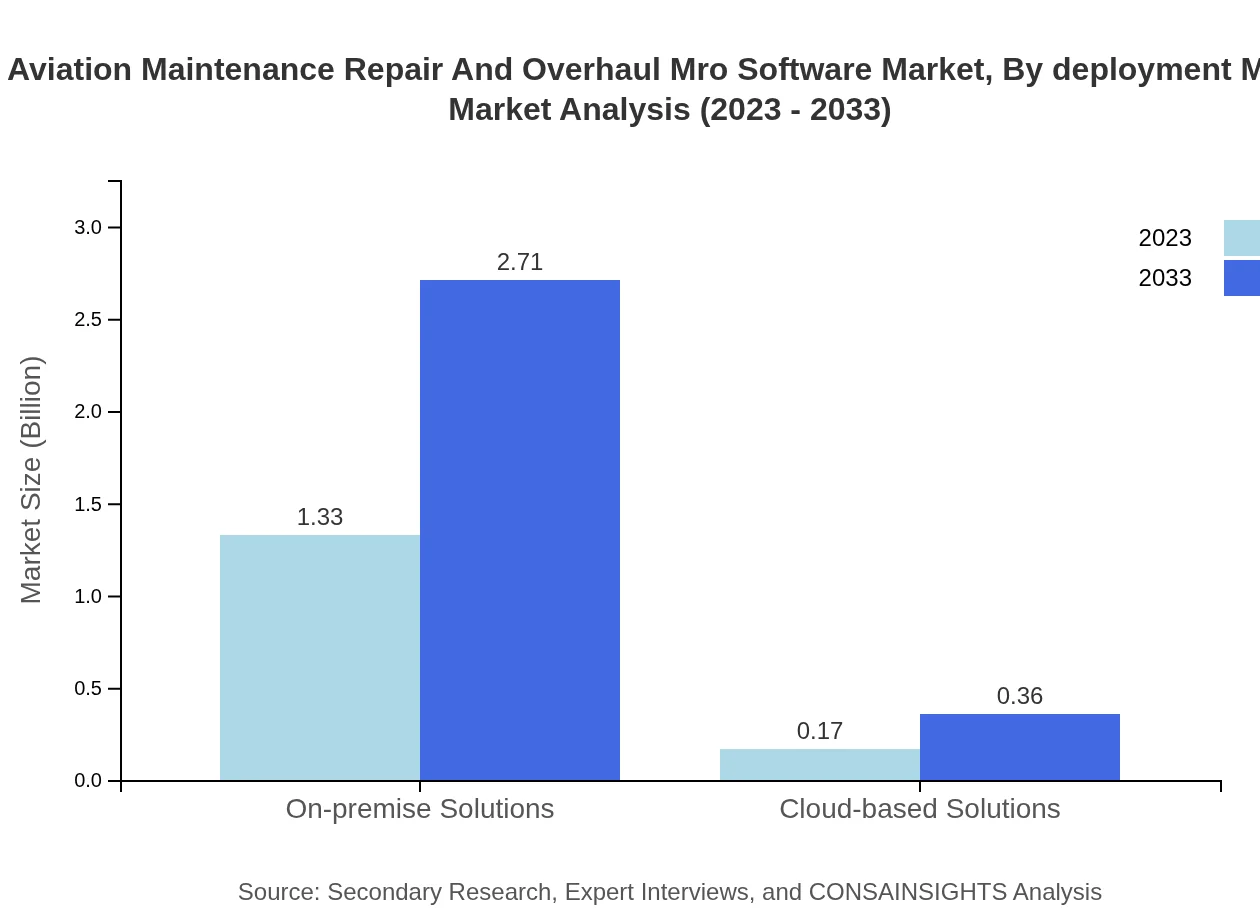

Aviation Maintenance Repair And Overhaul Mro Software Market Analysis By Deployment Model

Deployment models range from on-premise solutions, holding a significant 88.34% of the market, to cloud-based options which capture 11.66% of the market share. Cloud solutions are expected to see accelerated growth as organizations seek flexibility and cost-efficiency.

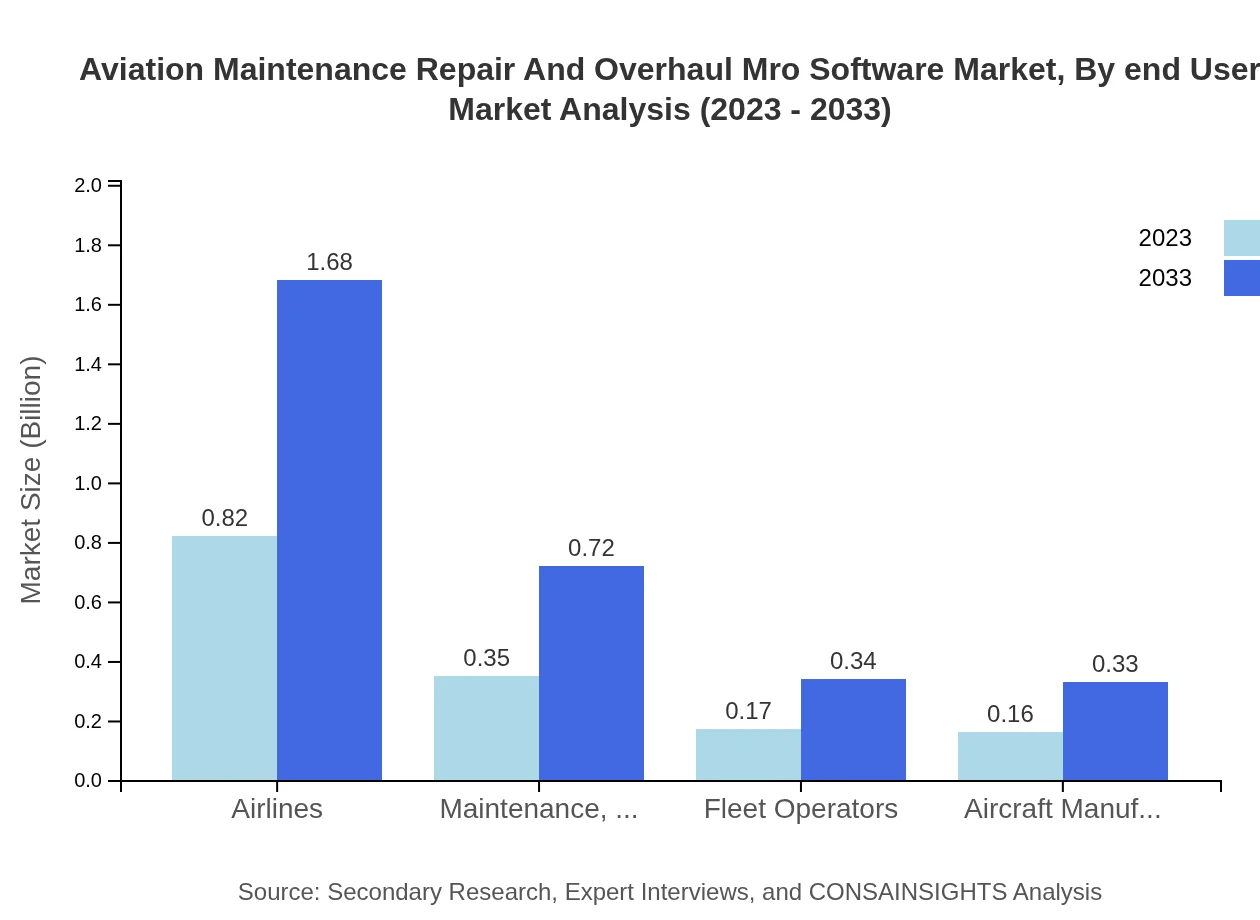

Aviation Maintenance Repair And Overhaul Mro Software Market Analysis By End User

End-users of MRO software include airlines, maintenance repair organizations, and fleet operators. Airlines represent the largest segment, with a market size of $0.82 billion in 2023, growing to $1.68 billion by 2033, driven by substantial operational needs and compliance to safety regulations.

Aviation Maintenance Repair And Overhaul Mro Software Market Analysis By Features

The software features segment includes data analytics, mobile access, and reporting capabilities. Data analytics features are leading the market, expected to dominate with a 65.54% share, as airlines and maintenance organizations emphasize data-driven decision-making to enhance operational performance.

Aviation Maintenance Repair And Overhaul Mro Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aviation Maintenance Repair And Overhaul Mro Software Industry

Siemens AG:

Siemens is a leader in the MRO software industry, providing solutions that enhance predictive maintenance and operational efficiency across multiple domains of aviation, particularly in commercial applications.IBM Watson:

IBM Watson offers advanced AI-driven analytics solutions that support sophisticated decision-making processes in the MRO sector, helping organizations streamline operations and ensure compliance.Rockwell Collins:

A subsidiary of RTX Corporation, Rockwell Collins is known for its aviation technology and services, including comprehensive MRO software that enhances operational visibility and support.Boeing :

Boeing provides a suite of innovative MRO solutions focusing on improving efficiencies in maintenance processes for both commercial and military aviation sectors.Honeywell :

Honeywell delivers advanced MRO software designed for both commercial and military aviation, emphasizing real-time data analysis and compliance management.We're grateful to work with incredible clients.

FAQs

What is the market size of aviation maintenance repair and overhaul (MRO) software?

The global aviation MRO software market is valued at approximately $1.5 billion in 2023, with a projected CAGR of 7.2% during the forecast period. By 2033, the market is expected to grow significantly, reflecting the increasing demand for advanced MRO solutions.

What are the key market players or companies in this aviation maintenance repair and overhaul (MRO) software industry?

Key players in the aviation MRO software industry include industry leaders like Airbus, Boeing, and Honeywell. Additionally, many software providers specialize in MRO solutions and actively contribute to market growth through innovative offerings.

What are the primary factors driving the growth in the aviation maintenance repair and overhaul (MRO) software industry?

Key growth drivers for the aviation MRO software industry include increased air traffic, rising demand for efficient maintenance processes, and regulatory compliance requirements. Moreover, technological advancements in software solutions are enhancing operational efficiencies, propelling market growth.

Which region is the fastest Growing in the aviation maintenance repair and overhaul (MRO) software market?

The North American region is currently the fastest-growing area within the aviation MRO software market. It is expected to grow from a market size of $0.54 billion in 2023 to $1.10 billion by 2033, indicating a strong demand for advanced MRO technologies.

Does ConsaInsights provide customized market report data for the aviation maintenance repair and overhaul (MRO) software industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the aviation MRO software industry. This flexibility allows businesses to gain insights that align closely with their strategic goals and operational requirements.

What deliverables can I expect from this aviation maintenance repair and overhaul (MRO) software market research project?

Deliverables from the MRO software market research project typically include comprehensive market analysis reports, segmentation insights, competitive landscape assessments, trend analyses, and forecast data—all designed to support informed business decision-making.

What are the market trends of aviation maintenance repair and overhaul (MRO) software?

Current market trends in aviation MRO software include increased adoption of cloud-based solutions, enhanced mobile access features, and integrations of data analytics. These trends reflect a growing emphasis on efficiency, compliance, and real-time decision-making capabilities in the sector.