Avionics Market Report

Published Date: 03 February 2026 | Report Code: avionics

Avionics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the avionics market, covering market size, growth forecasts from 2023 to 2033, industry dynamics, segmentation, and regional insights. It serves as a comprehensive guide for stakeholders seeking to understand market trends and opportunities.

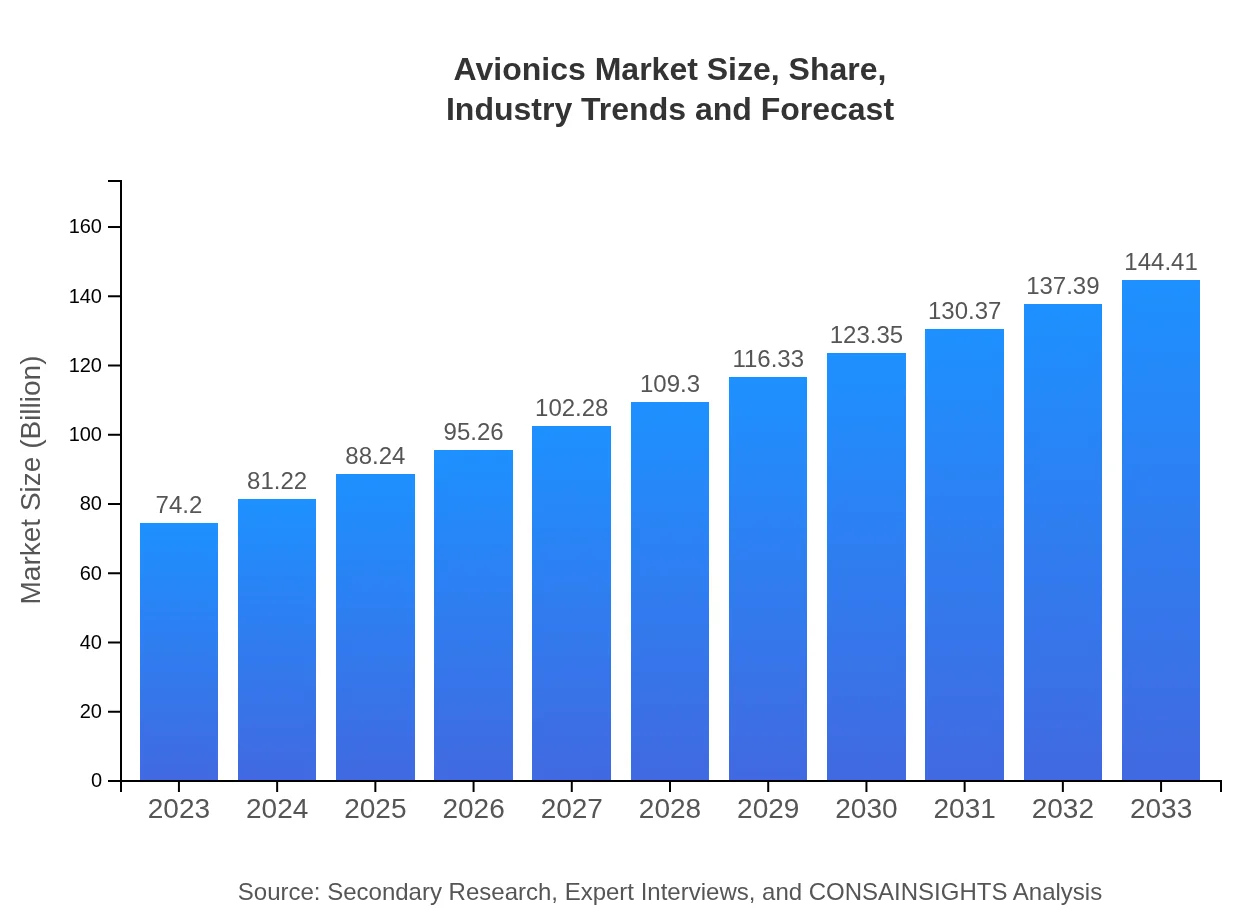

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $74.20 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $144.41 Billion |

| Top Companies | Honeywell Aerospace, Garmin Ltd., Rockwell Collins, Thales Group, BAE Systems |

| Last Modified Date | 03 February 2026 |

Avionics Market Overview

Customize Avionics Market Report market research report

- ✔ Get in-depth analysis of Avionics market size, growth, and forecasts.

- ✔ Understand Avionics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Avionics

What is the Market Size & CAGR of Avionics market in 2023?

Avionics Industry Analysis

Avionics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Avionics Market Analysis Report by Region

Europe Avionics Market Report:

The European avionics market is expected to witness growth from $25.00 billion in 2023 to $48.65 billion by 2033, supported by stringent safety regulations and a high demand for innovative avionics solutions in both commercial and defense sectors.Asia Pacific Avionics Market Report:

In the Asia-Pacific region, the avionics market is projected to grow from $14.13 billion in 2023 to $27.50 billion by 2033, driven by increasing air travel and the modernization of air traffic management systems. Countries like China and India are leading the demand for advanced avionics systems due to their expanding airline sectors.North America Avionics Market Report:

North America holds the largest market share, with the avionics market anticipated to grow from $23.92 billion in 2023 to $46.56 billion by 2033. This growth is primarily fueled by significant investments from key industry players and the presence of advanced military and commercial aviation sectors.South America Avionics Market Report:

The South American avionics market is expected to rise from $4.04 billion in 2023 to $7.87 billion by 2033. Growth in this region is propelled by a gradual recovery of economies post-COVID and increasing investments in upgrading air transportation infrastructure.Middle East & Africa Avionics Market Report:

The avionics market in the Middle East and Africa is projected to increase from $7.11 billion in 2023 to $13.83 billion by 2033, driven by rising air travel demand and government initiatives towards improving aviation infrastructure.Tell us your focus area and get a customized research report.

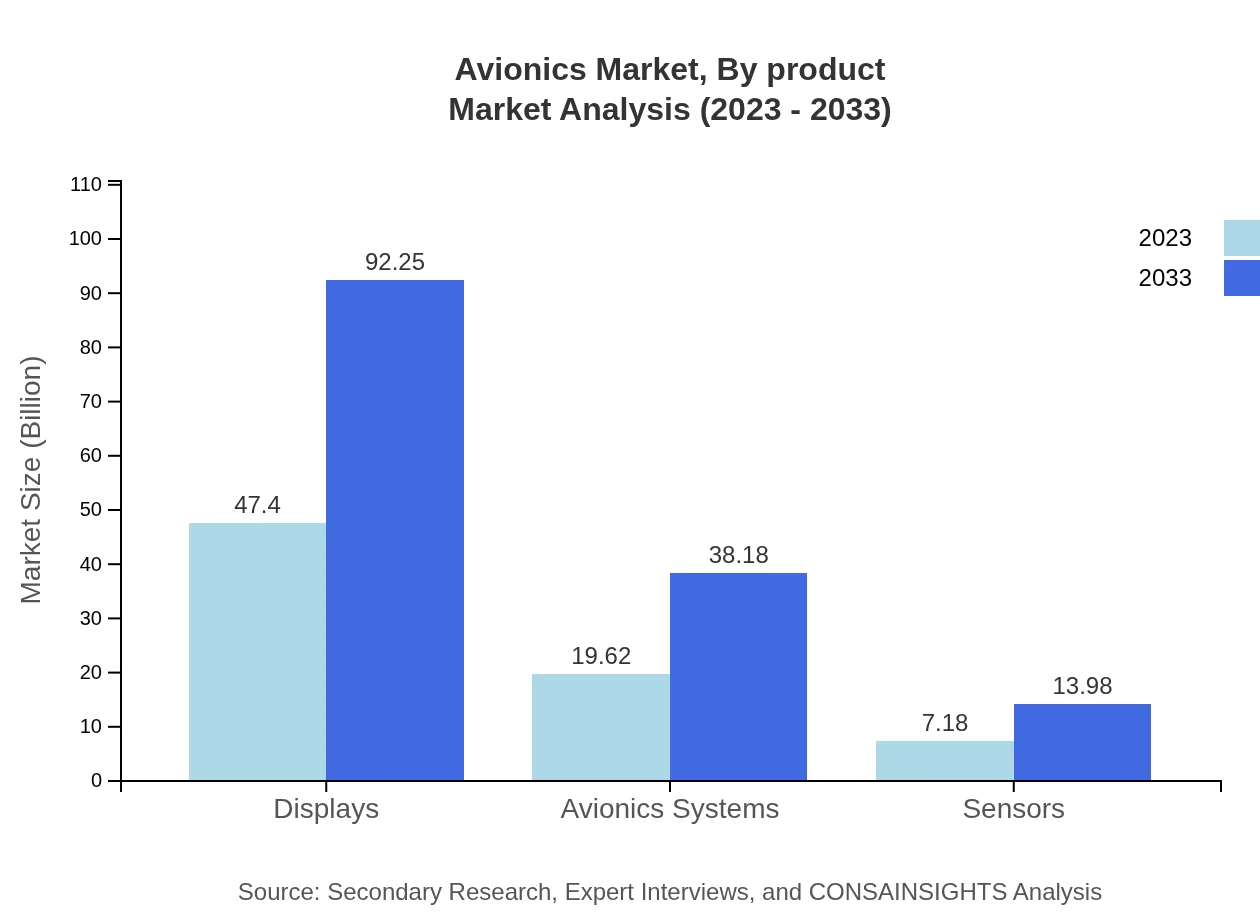

Avionics Market Analysis By Product

Key segments in the avionics market based on product include Displays, Avionics Systems, and Sensors. Displays are anticipated to grow from $47.40 billion in 2023 to $92.25 billion by 2033, showcasing the growing need for advanced cockpit displays and information management systems.

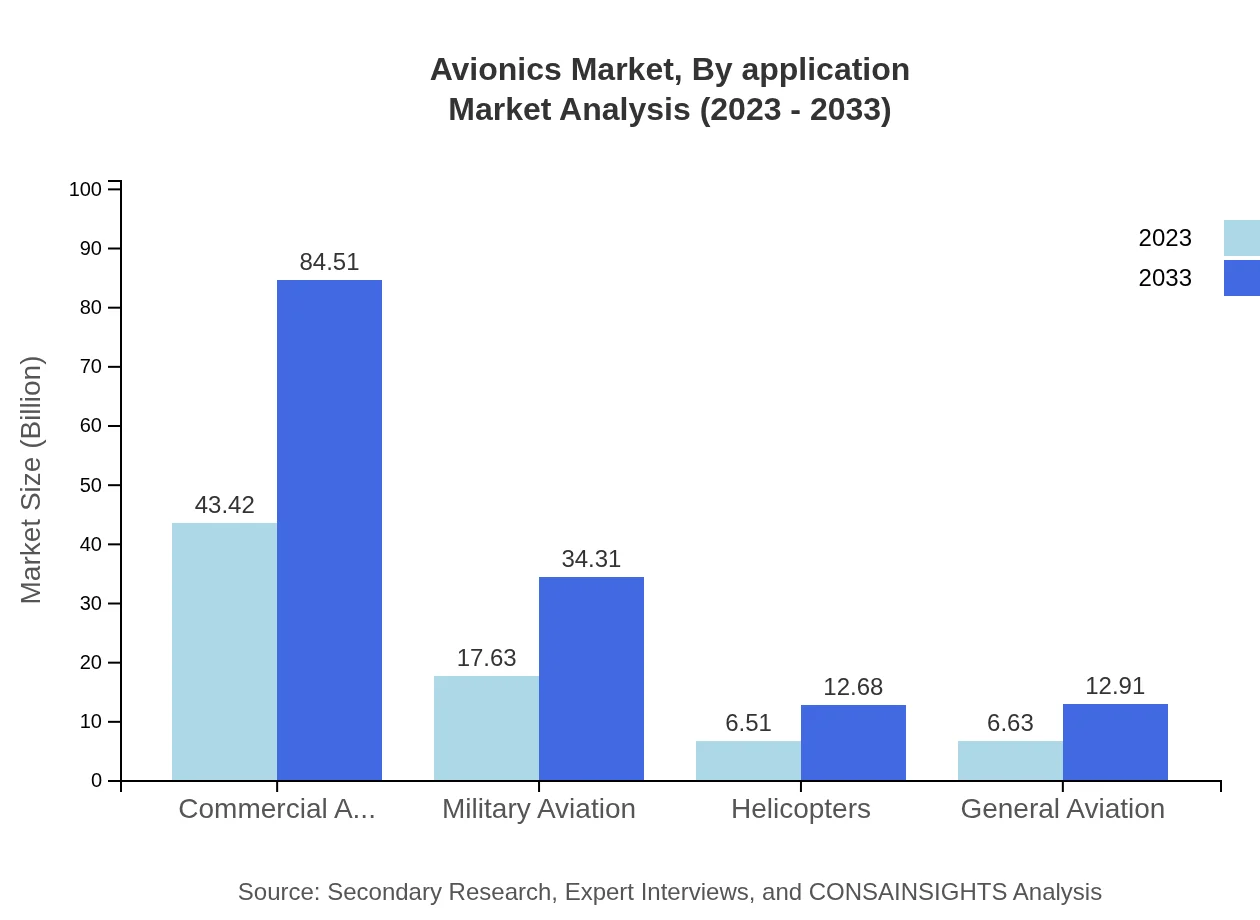

Avionics Market Analysis By Application

The avionics market is segmented by application into Commercial Aviation, Military Aviation, and General Aviation. Commercial aviation is projected to dominate the market, growing from $43.42 billion in 2023 to $84.51 billion by 2033 as airlines invest in modern systems to enhance safety and efficiency.

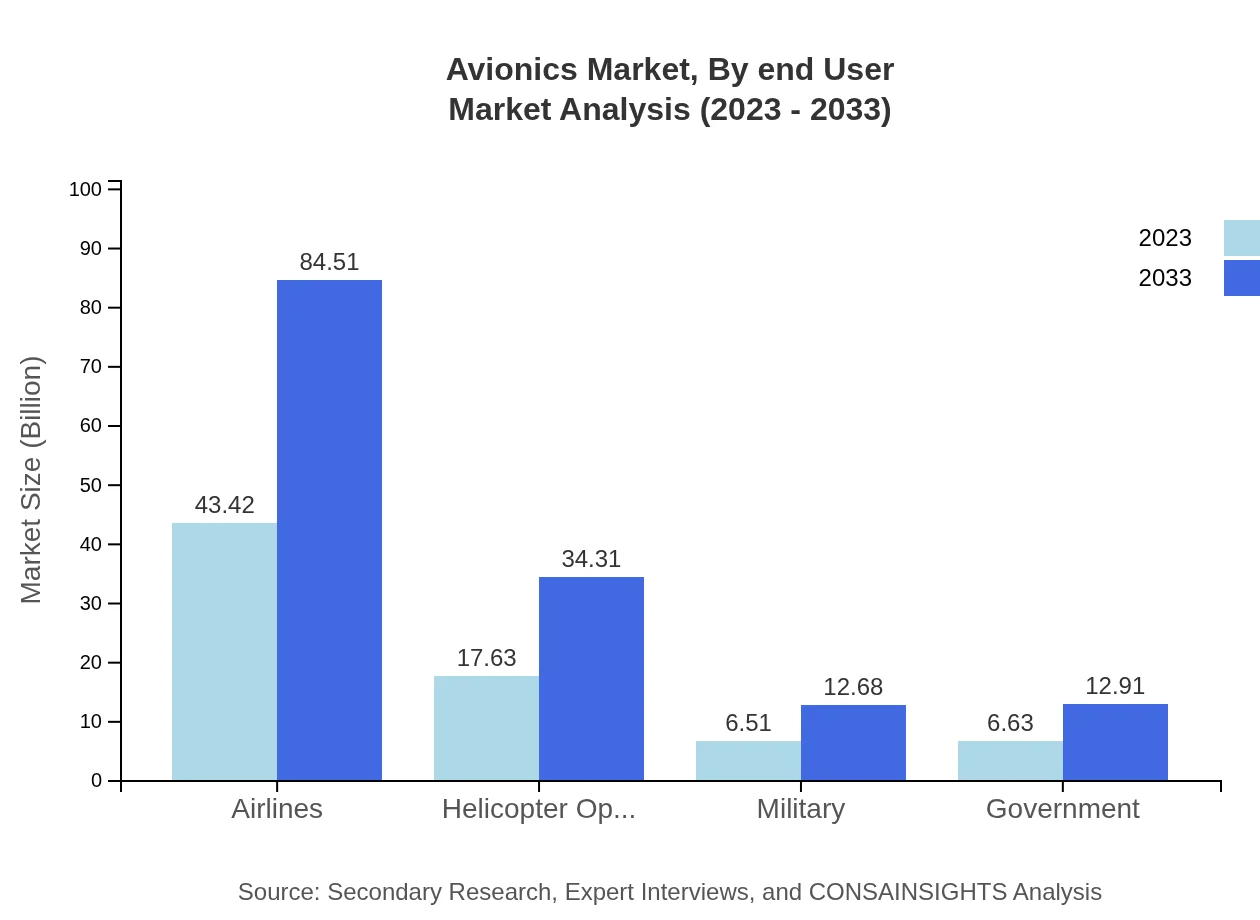

Avionics Market Analysis By End User

End-user segments include Airlines, Helicopter Operators, Military, and Government agencies. Airlines are expected to see market size growth from $43.42 billion in 2023 to $84.51 billion by 2033, reflecting the ongoing expansion of passenger and cargo air transport.

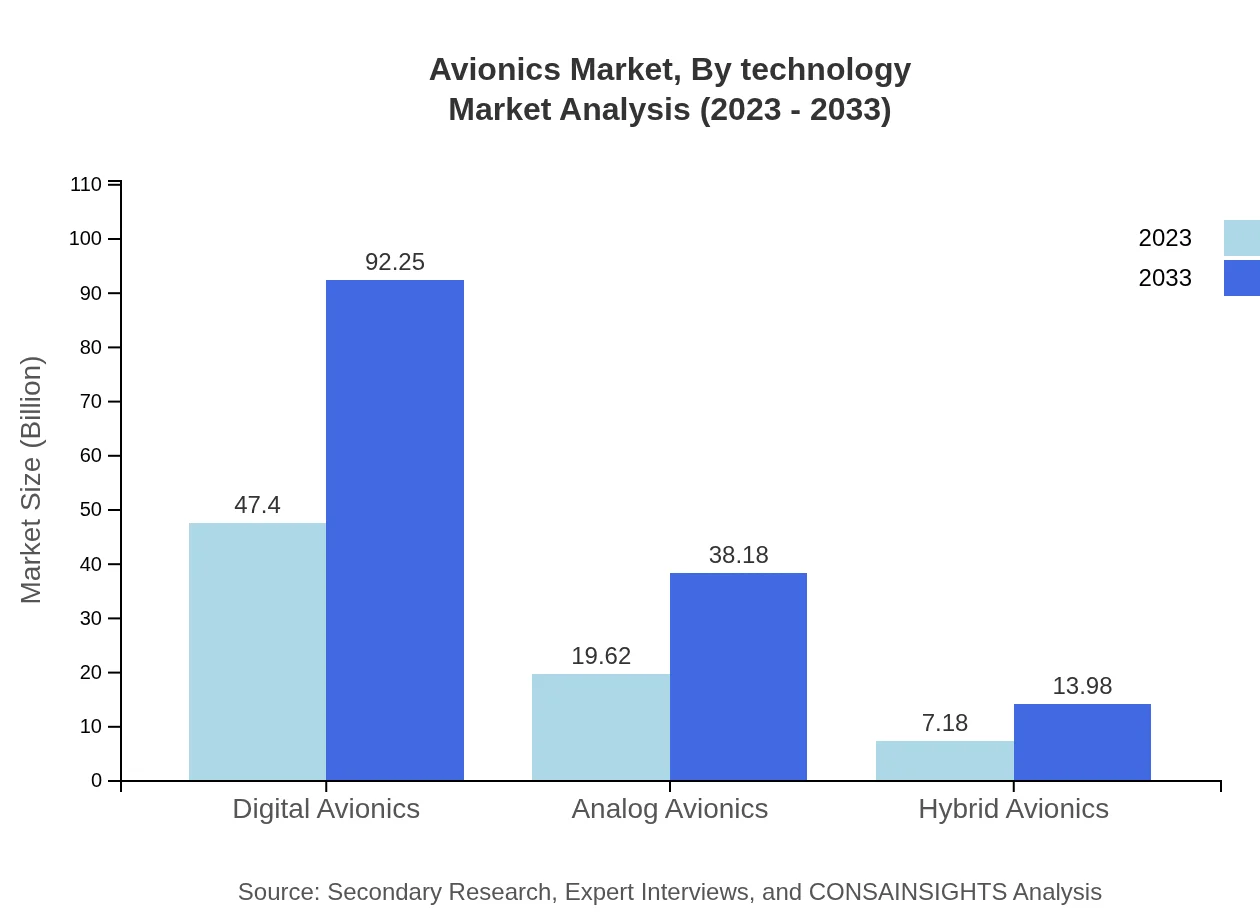

Avionics Market Analysis By Technology

Technology segments include Digital Avionics, Analog Avionics, and Hybrid Avionics. Digital avionics is expected to grow from $47.40 billion in 2023 to $92.25 billion by 2033, driven by advancements in data processing and sensor technology.

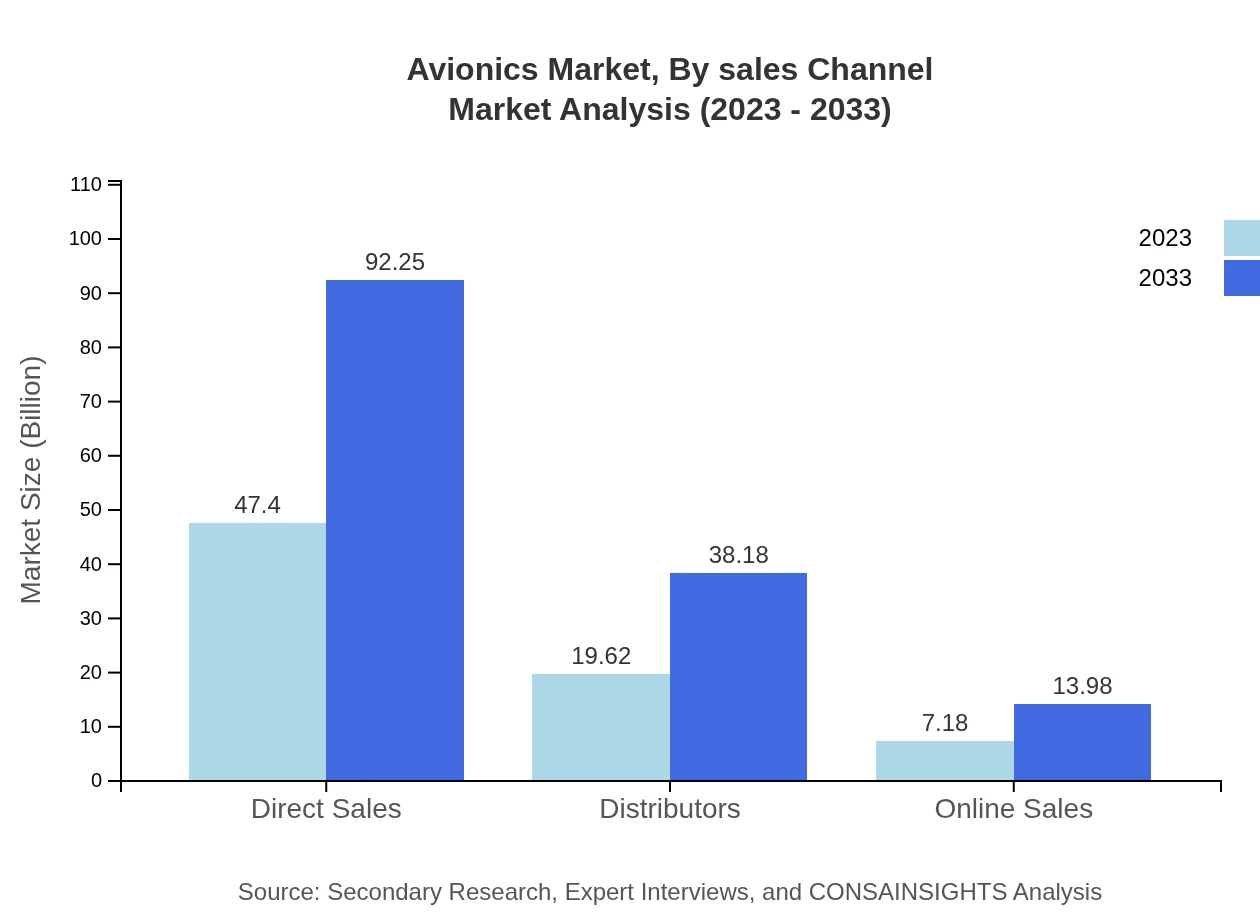

Avionics Market Analysis By Sales Channel

Sales channels are segmented into Direct Sales, Distributors, and Online Sales. Direct sales are projected to grow from $47.40 billion in 2023 to $92.25 billion by 2033, as manufacturers seek more direct relationships with clients.

Avionics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Avionics Industry

Honeywell Aerospace:

Honeywell Aerospace provides advanced avionics systems, services, and solutions aimed at improving aircraft safety, efficiency, and performance across various aviation segments.Garmin Ltd.:

Garmin specializes in GPS technology and avionics for aviation, offering innovative products that improve navigation and situational awareness for pilots.Rockwell Collins:

Rockwell Collins designs and develops electronic communication and aviation systems for commercial and military sectors, focusing on enhancing travel safety and efficiency.Thales Group:

Thales is a global leader in aerospace and defense technology, known for providing advanced avionics solutions aimed at improving aircraft systems and engagement across all aviation sectors.BAE Systems:

BAE Systems delivers advanced electronics and avionics systems that provide crucial support for military operations and commercial aviation worldwide.We're grateful to work with incredible clients.

FAQs

What is the market size of avionics?

The avionics market is projected to reach approximately $74.2 billion by 2033, growing at a CAGR of 6.7% from its current valuation. This growth is indicative of increasing demand across various aviation sectors.

What are the key market players or companies in the avionics industry?

Key players in the avionics industry include major aerospace giants such as Honeywell Aerospace, Rockwell Collins, Thales Group, and Northrop Grumman. These companies drive innovation and product development alongside enhancing safety standards.

What are the primary factors driving the growth in the avionics industry?

Factors such as the increasing demand for air travel, advancements in technology, and the focus on enhancing aircraft safety and operational efficiency are key drivers. Additionally, government investments in modernization also play a critical role.

Which region is the fastest Growing in the avionics market?

The Asia Pacific region is identified as the fastest-growing market, projected to expand from $14.13 billion in 2023 to $27.50 billion by 2033. This growth is driven by rising air travel demand and improving airport infrastructure.

Does ConsaInsights provide customized market report data for the avionics industry?

Yes, ConsaInsights offers customized market reports tailored to the specific needs of clients in the avionics sector. This includes detailed analyses that align with unique business requirements.

What deliverables can I expect from this avionics market research project?

Deliverables from the avionics market research project include comprehensive market analysis reports, segmented data insights, growth projections, competitive landscape evaluations, and tailored recommendations.

What are the market trends of avionics?

Current market trends in avionics reveal a shift towards digital solutions, increased integration of advanced technologies like AI and IoT, and a growing emphasis on sustainability, particularly in reducing carbon emissions.