Axial Compressor Market Report

Published Date: 22 January 2026 | Report Code: axial-compressor

Axial Compressor Market Size, Share, Industry Trends and Forecast to 2033

This report provides a detailed analysis of the Axial Compressor market, covering insights on market size, growth trends, technological advancements, and competitive landscapes from 2023 to 2033.

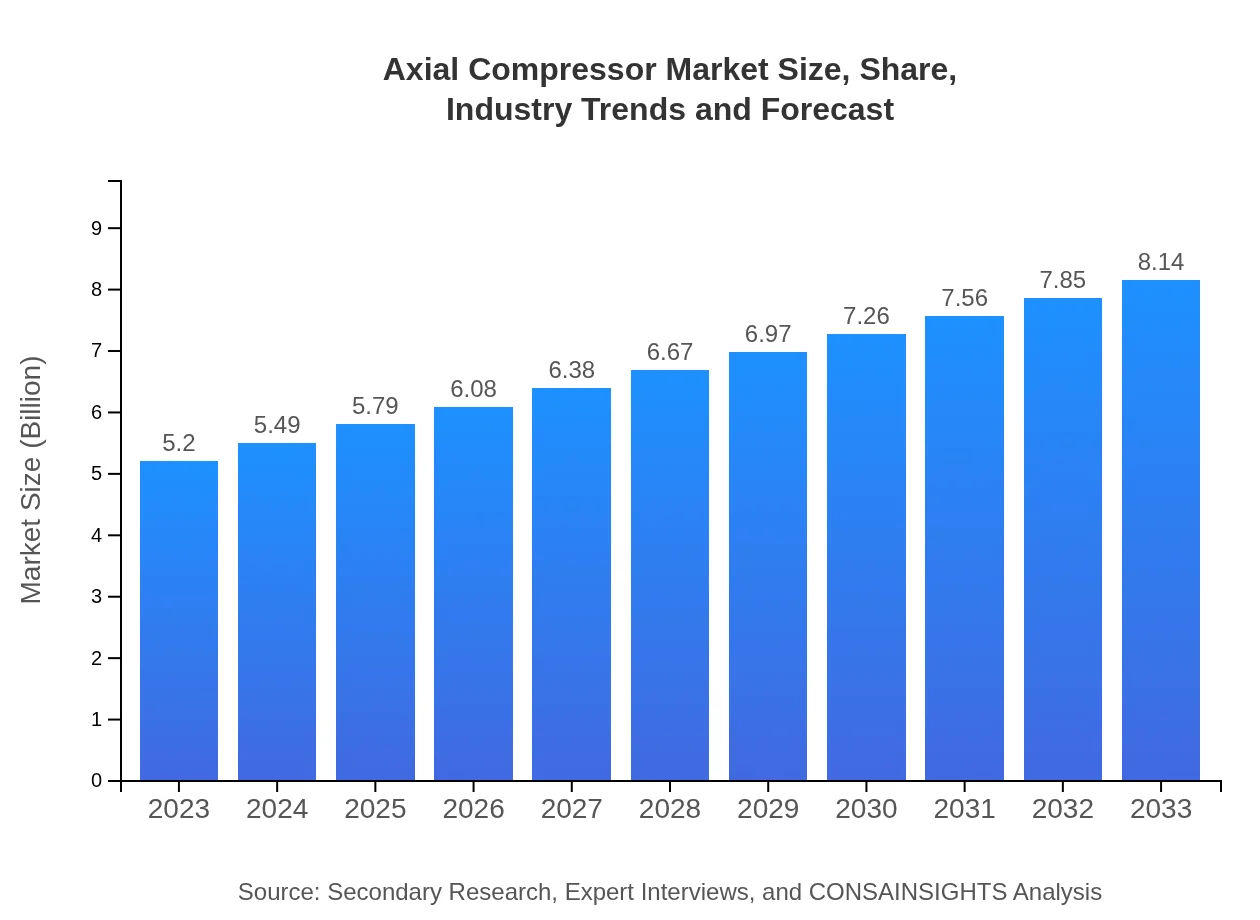

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $8.14 Billion |

| Top Companies | Siemens , GE Aviation, Rolls-Royce, Baker Hughes |

| Last Modified Date | 22 January 2026 |

Axial Compressor Market Overview

Customize Axial Compressor Market Report market research report

- ✔ Get in-depth analysis of Axial Compressor market size, growth, and forecasts.

- ✔ Understand Axial Compressor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Axial Compressor

What is the Market Size & CAGR of Axial Compressor market in 2023?

Axial Compressor Industry Analysis

Axial Compressor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Axial Compressor Market Analysis Report by Region

Europe Axial Compressor Market Report:

The European market, valued at $1.51 billion in 2023, is projected to grow to $2.37 billion by 2033. Continuous innovation in aerospace and increased regulatory pressures towards energy efficiency are pivotal factors for market growth.Asia Pacific Axial Compressor Market Report:

The Asia Pacific region accounted for a market size of $0.96 billion in 2023, with projections reaching $1.50 billion by 2033. This growth is driven by increasing industrialization, particularly in countries like China and India, as well as a surge in aerospace applications.North America Axial Compressor Market Report:

North America, with a market size of $1.99 billion in 2023, is anticipated to reach $3.11 billion by 2033. The region's robust energy sector and technological advancements are primary growth drivers, supported by significant investments in infrastructure.South America Axial Compressor Market Report:

In South America, the Axial Compressor market was valued at $0.36 billion in 2023, expected to grow to $0.56 billion by 2033. The region's growth is influenced by mining and oil extraction activities, necessitating advanced compression technologies.Middle East & Africa Axial Compressor Market Report:

The Middle East and Africa region is expected to grow from $0.38 billion in 2023 to $0.59 billion by 2033. The oil and gas industry remains the key driver, alongside increasing investments in renewable energy projects across the region.Tell us your focus area and get a customized research report.

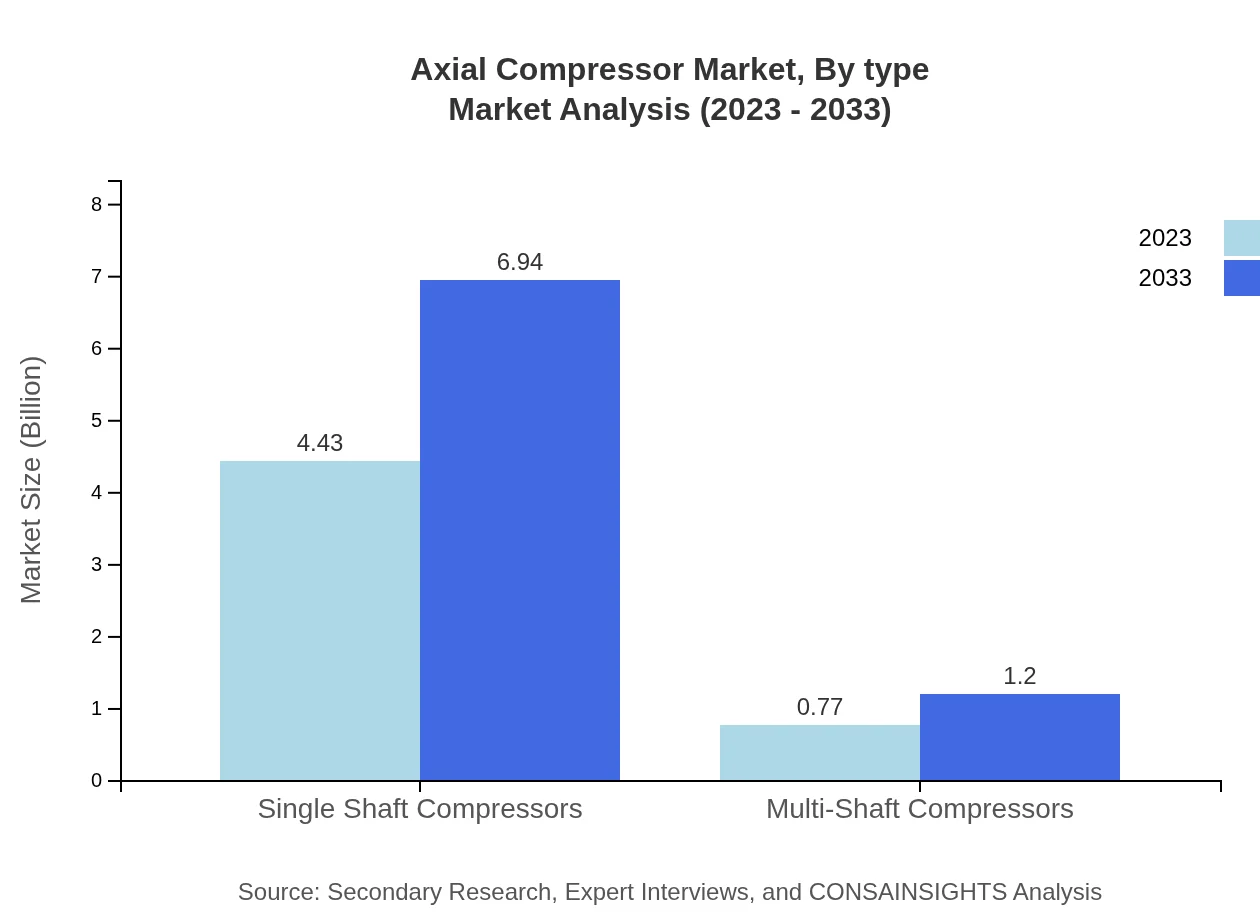

Axial Compressor Market Analysis By Type

The Axial Compressor market is divided into single shaft and multi-shaft compressors. In 2023, the single shaft compressors dominate the market with a size of $4.43 billion and a share of 85.22%. Multi-shaft compressors hold a market size of $0.77 billion, representing a share of 14.78%. By 2033, single shaft compressors are expected to grow to $6.94 billion while multi-shaft compressors will reach $1.20 billion.

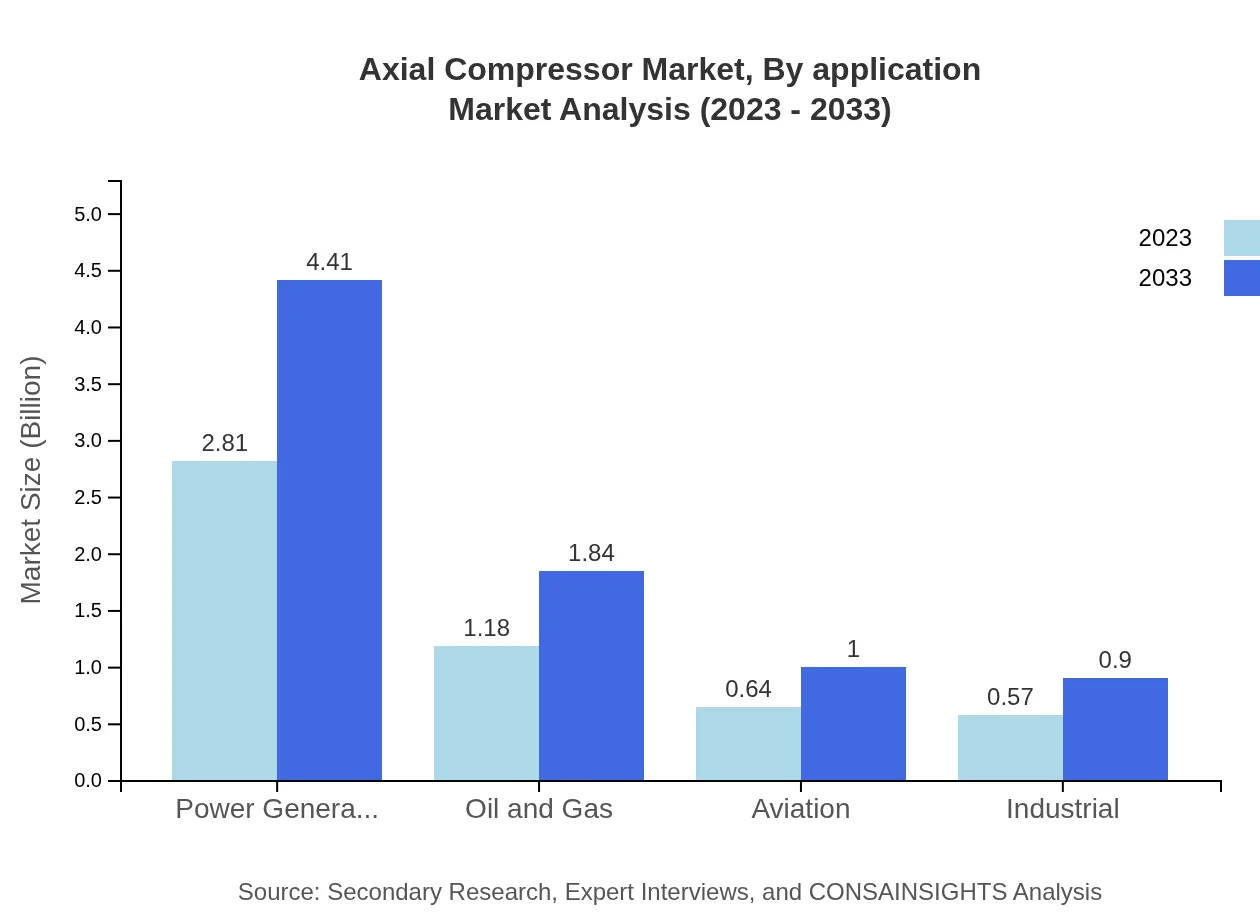

Axial Compressor Market Analysis By Application

Application segmentation indicates that energy, aerospace, industrial, and oil & gas sectors are the largest consumers. Energy applications accounted for a size of $2.81 billion in 2023, expected to rise to $4.41 billion by 2033, maintaining a share of 54.13%.

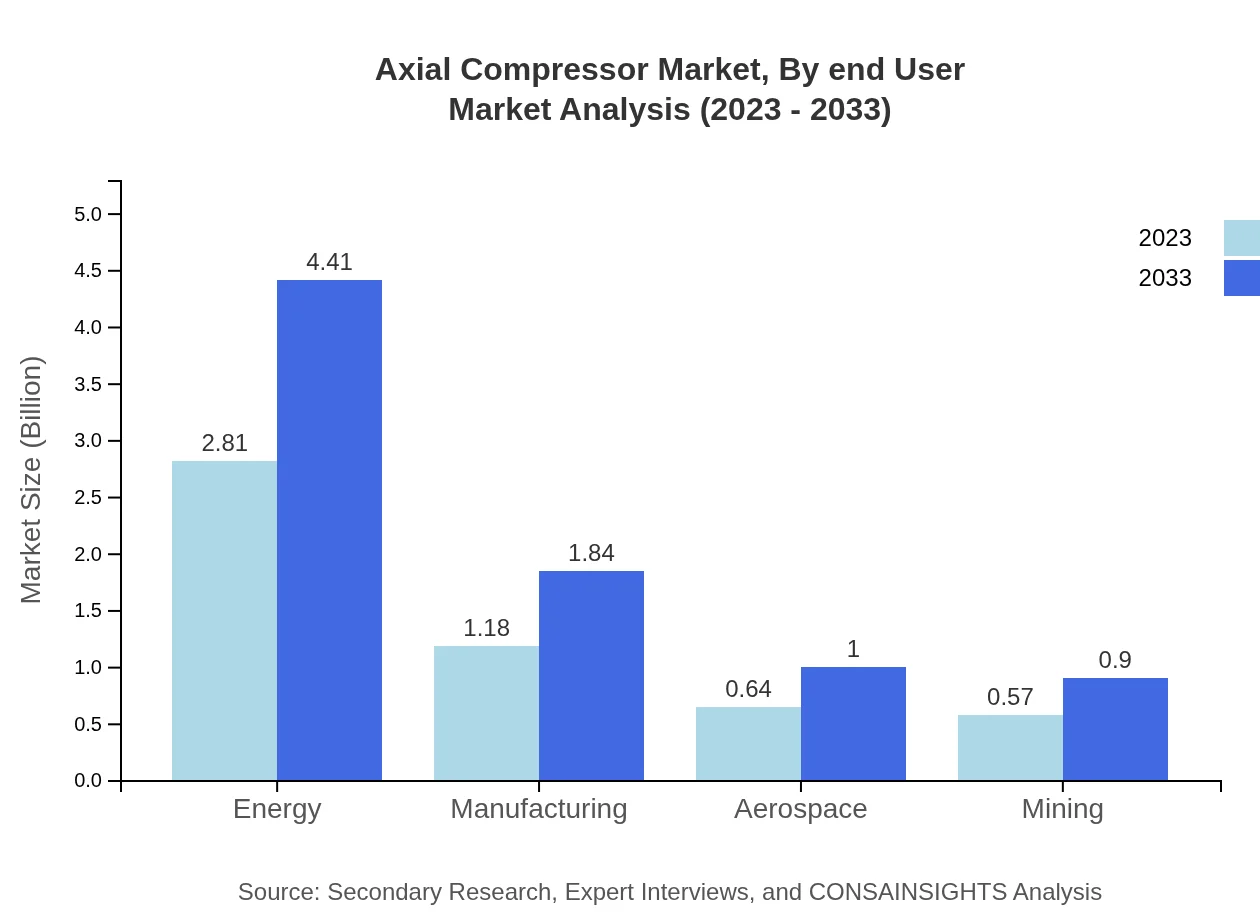

Axial Compressor Market Analysis By End User

Key end-user industries include manufacturing, aerospace, and oil & gas. The manufacturing sector had a market size of $1.18 billion in 2023, anticipated to grow to $1.84 billion by 2033. Aerospace applications show significant potential for growth due to increasing demand for innovative technologies.

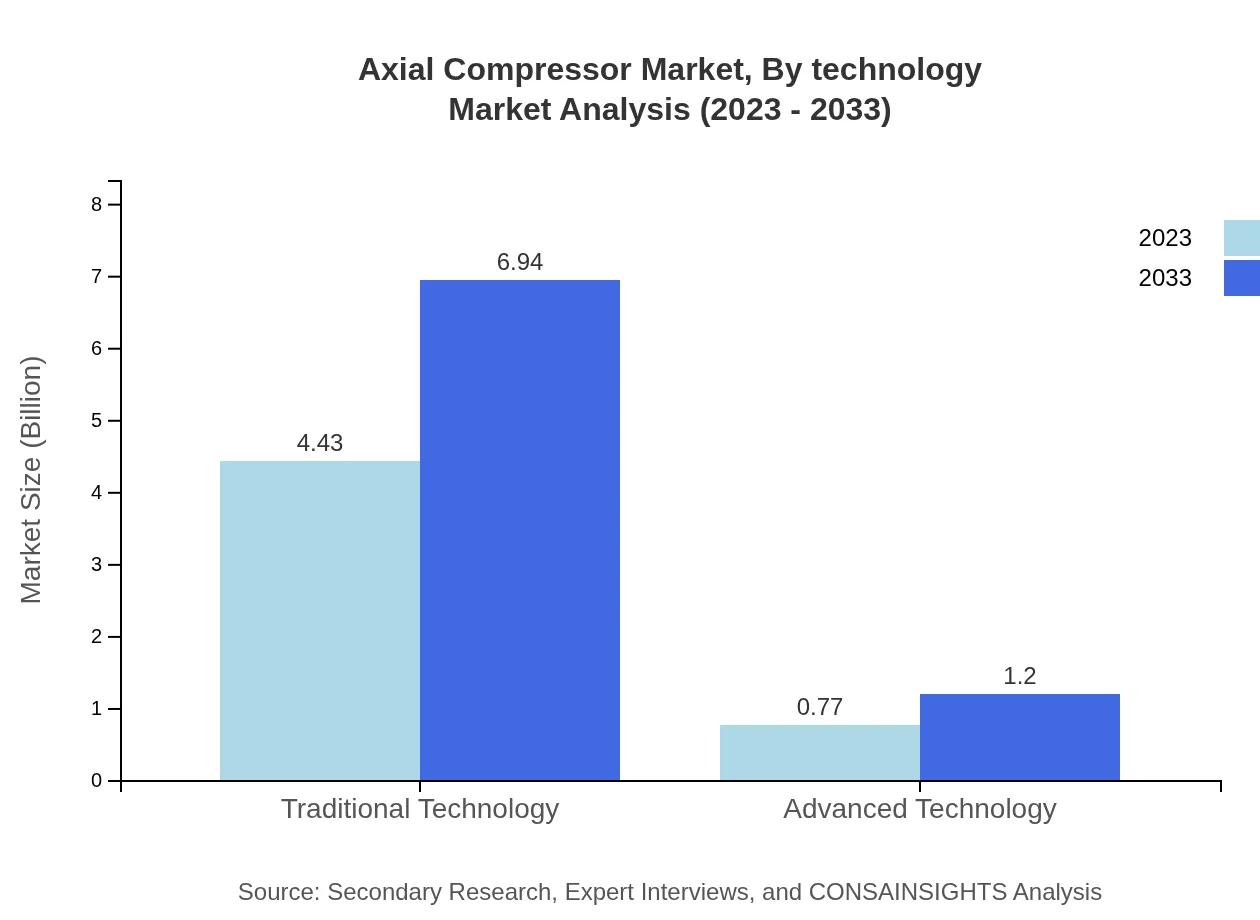

Axial Compressor Market Analysis By Technology

The market is broadly classified into traditional and advanced technologies. Traditional technology accounted for $4.43 billion in 2023 with a market share of 85.22%. Advanced technology is gaining traction, growing from a size of $0.77 billion in 2023 to $1.20 billion by 2033.

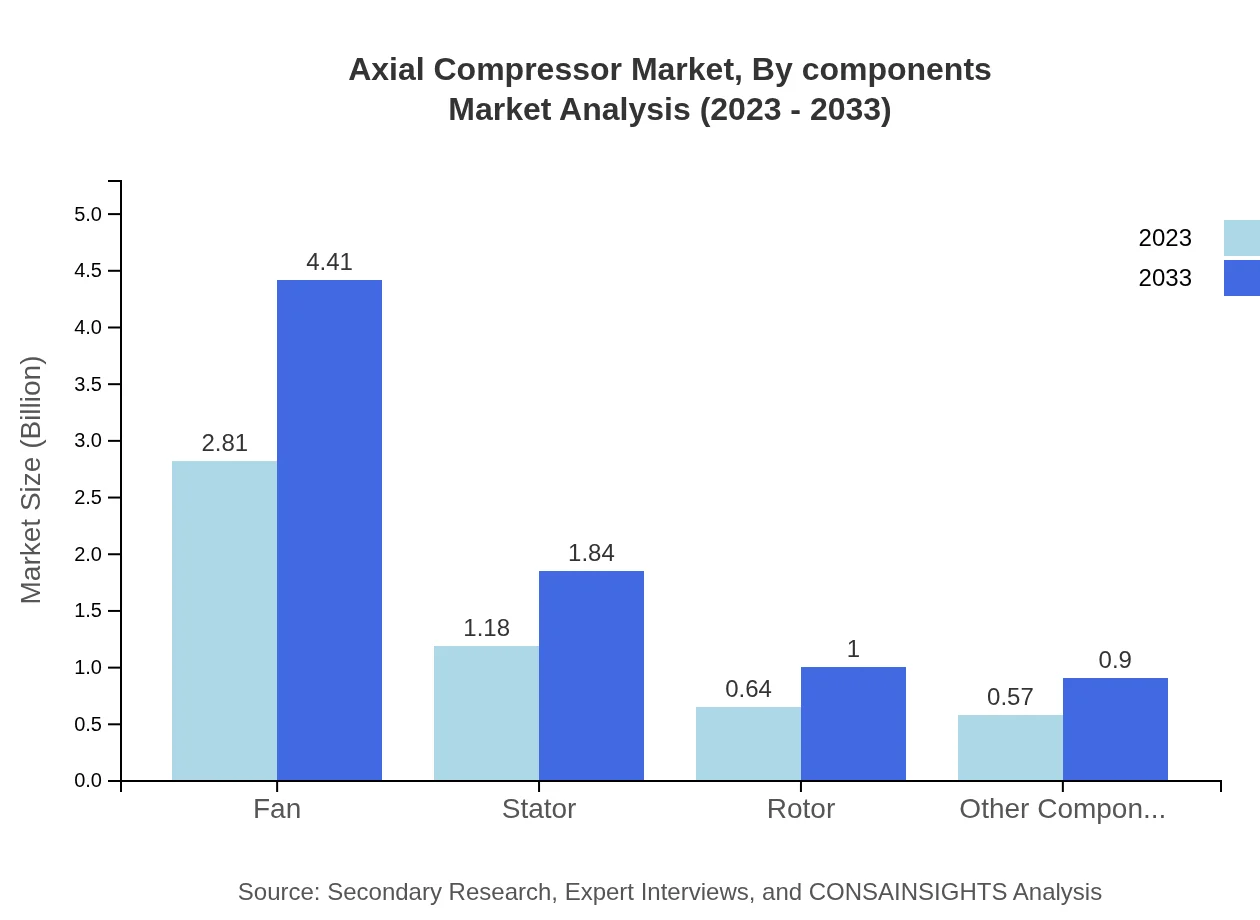

Axial Compressor Market Analysis By Components

Component segmentation reveals that fan components lead with a size of $2.81 billion in 2023, while rotor and stator components are significant as well, holding shares of 12.25% and 22.63%, respectively. By 2033, the growth of these components is expected to reflect the increasing complexity of axial compressors.

Axial Compressor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Axial Compressor Industry

Siemens :

A leading player in the global power generation and industrial manufacturing sector, Siemens provides innovative axial compressor solutions designed for efficiency and reliability.GE Aviation:

GE Aviation is at the forefront of aerospace technology, producing high-performance axial compressors that play a critical role in jet engines.Rolls-Royce:

Known for its advanced technology in aerospace and energy, Rolls-Royce manufactures axial compressors that efficiently meet the rigorous demands of its customers.Baker Hughes:

Baker Hughes offers a variety of axial compressor solutions, particularly in the oil and gas sector, focusing on enhancing operational performance through technology.We're grateful to work with incredible clients.

FAQs

What is the market size of axial Compressor?

The axial compressor market size is projected to reach 5.2 billion by 2033, growing at a CAGR of 4.5% from 2023. This growth signifies increasing demand across sectors such as energy, aerospace, and manufacturing.

What are the key market players or companies in this axial Compressor industry?

Key players in the axial-compressor industry include major manufacturers like Siemens, General Electric, and Mitsubishi Heavy Industries, which lead in technology and innovation, driving market competitiveness and enhancements in compressor performance.

What are the primary factors driving the growth in the axial Compressor industry?

The key drivers for the axial-compressor market growth include rising industrial production, advancements in compressor technology, increasing energy demand, and a shift towards more efficient and eco-friendly energy solutions across different sectors.

Which region is the fastest Growing in the axial Compressor?

North America is the fastest-growing region in the axial-compressor market, expected to rise from $1.99 billion in 2023 to $3.11 billion by 2033. This growth is driven by investments in energy and aerospace sectors.

Does ConsaInsights provide customized market report data for the axial Compressor industry?

Yes, ConsaInsights offers customized market report data for the axial-compressor industry, tailoring insights according to specific client needs, including detailed analysis and forecasts relevant to various segments.

What deliverables can I expect from this axial Compressor market research project?

Deliverables include comprehensive market analysis reports, segment-specific data, forecasts, and insights into competitive landscapes and trends, all essential for informed decision-making in the axial-compressor market.

What are the market trends of axial Compressor?

Current trends in the axial-compressor market include a shift towards advanced technology solutions, increased adoption in renewable energy applications, and growing demand in aerospace and power generation segments.