Axial Piston Hydraulic Motors And Pumps Market Report

Published Date: 22 January 2026 | Report Code: axial-piston-hydraulic-motors-and-pumps

Axial Piston Hydraulic Motors And Pumps Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Axial Piston Hydraulic Motors and Pumps market from 2023 to 2033, providing insights on market size, growth trends, and key players in the industry. It highlights different segments and regional analysis to present a comprehensive view of the market.

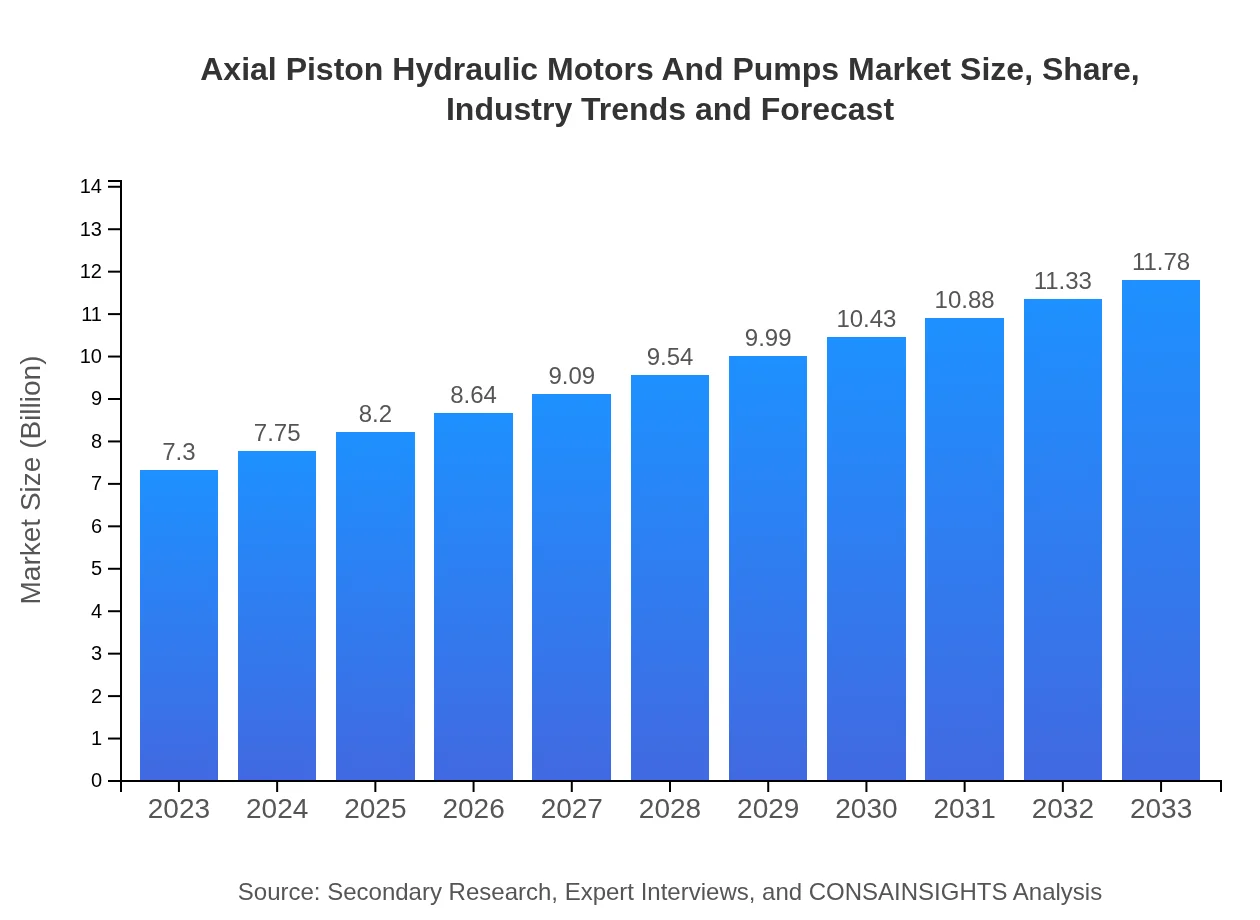

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.30 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $11.78 Billion |

| Top Companies | Bosch Rexroth AG, Parker Hannifin Corporation, Eaton Corporation, Hydro Gear Limited |

| Last Modified Date | 22 January 2026 |

Axial Piston Hydraulic Motors And Pumps Market Overview

Customize Axial Piston Hydraulic Motors And Pumps Market Report market research report

- ✔ Get in-depth analysis of Axial Piston Hydraulic Motors And Pumps market size, growth, and forecasts.

- ✔ Understand Axial Piston Hydraulic Motors And Pumps's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Axial Piston Hydraulic Motors And Pumps

What is the Market Size & CAGR of Axial Piston Hydraulic Motors And Pumps market in 2023?

Axial Piston Hydraulic Motors And Pumps Industry Analysis

Axial Piston Hydraulic Motors And Pumps Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Axial Piston Hydraulic Motors And Pumps Market Analysis Report by Region

Europe Axial Piston Hydraulic Motors And Pumps Market Report:

Europe's market will rise from $2.20 billion to $3.55 billion in the same forecast period, spurred by stringent environmental regulations that promote energy-efficient hydraulic systems, and a robust industrial sector.Asia Pacific Axial Piston Hydraulic Motors And Pumps Market Report:

In the Asia Pacific, the market is set to grow from $1.39 billion in 2023 to $2.25 billion in 2033, driven by rapid industrialization and infrastructure projects. Countries like China and India are contributing significantly to this growth.North America Axial Piston Hydraulic Motors And Pumps Market Report:

North America is a prominent market, growing from $2.47 billion in 2023 to $3.99 billion by 2033. The United States leads in adoption, particularly in manufacturing and defense applications, supported by a strong technological base.South America Axial Piston Hydraulic Motors And Pumps Market Report:

The South American market, though smaller, is projected to increase from $0.27 billion to $0.44 billion by 2033. Brazil and Argentina are the primary contributors, thanks to their expanding construction and agriculture sectors.Middle East & Africa Axial Piston Hydraulic Motors And Pumps Market Report:

The Middle East and Africa are expected to grow from $0.96 billion to $1.54 billion by 2033. This growth is largely influenced by oil and gas exploration activities, requiring advanced hydraulic technology.Tell us your focus area and get a customized research report.

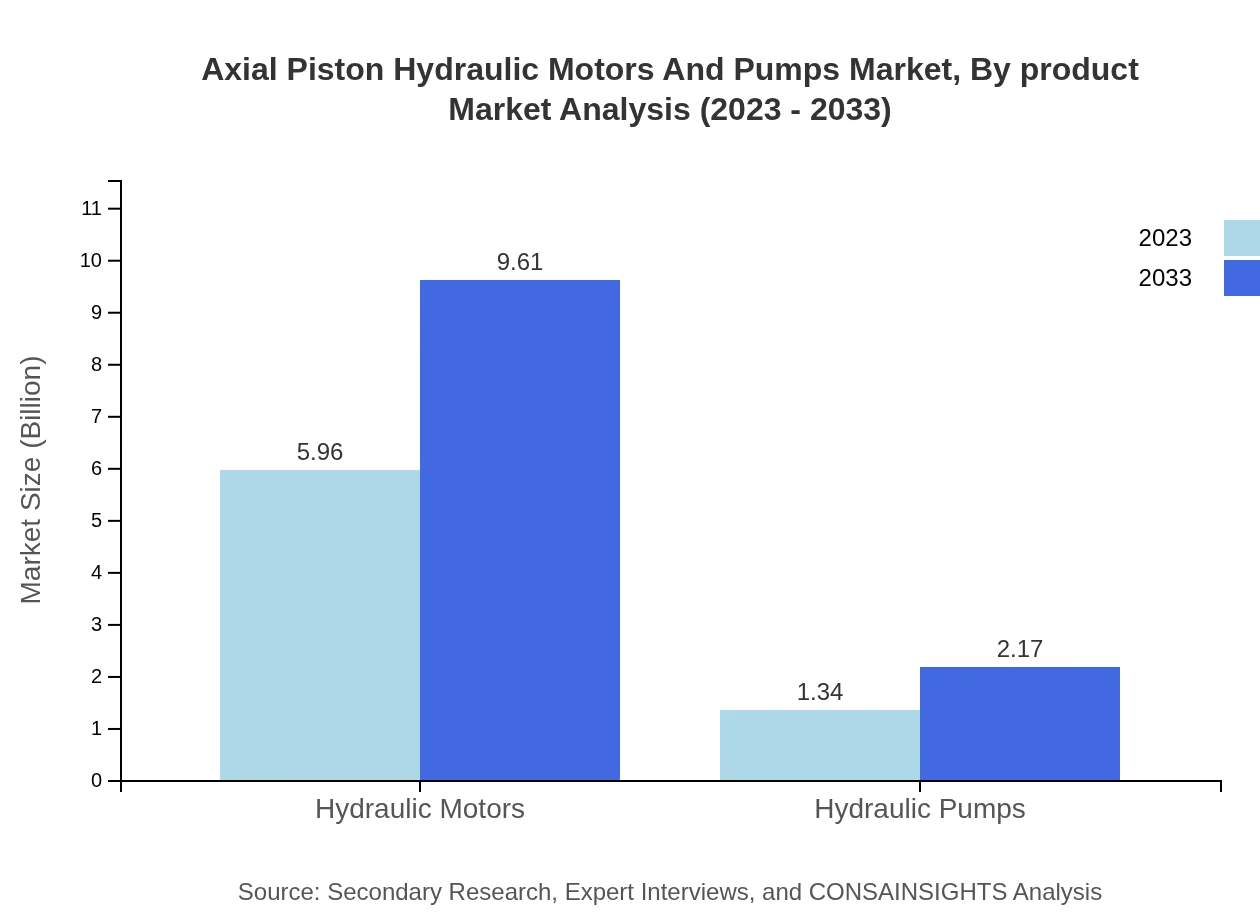

Axial Piston Hydraulic Motors And Pumps Market Analysis By Product

The market for Axial Piston Hydraulic Motors dominates the segment, expected to grow from $5.96 billion in 2023 to $9.61 billion by 2033, representing a steady market share of 81.6%. In contrast, hydraulic pumps will grow from $1.34 billion to $2.17 billion, maintaining an 18.4% market share.

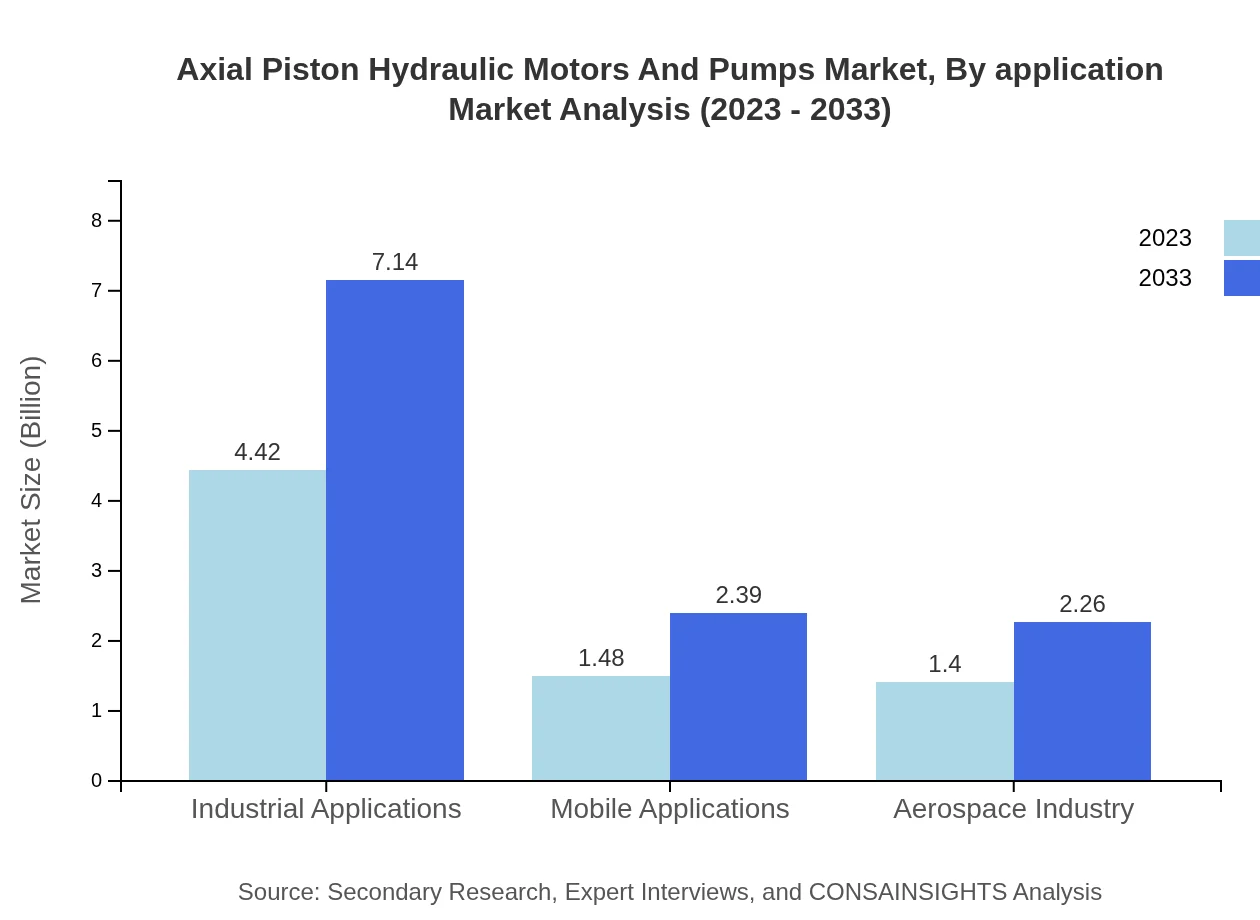

Axial Piston Hydraulic Motors And Pumps Market Analysis By Application

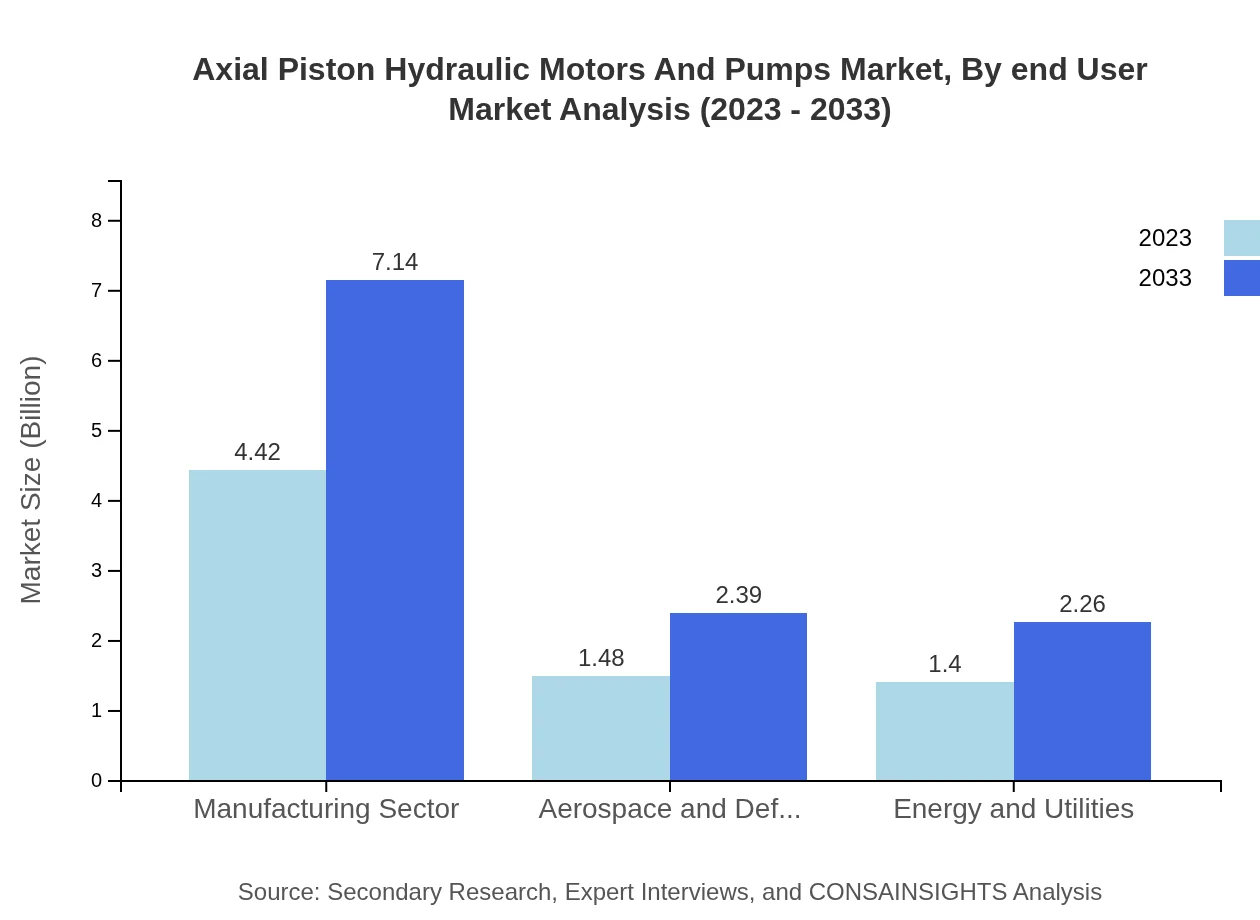

Industrial Applications lead with a significant market size of $4.42 billion in 2023, projected to reach $7.14 billion by 2033, holding 60.58% of the market share. The Aerospace and Defense sector follows, increasing from $1.48 billion to $2.39 billion with a 20.26% share.

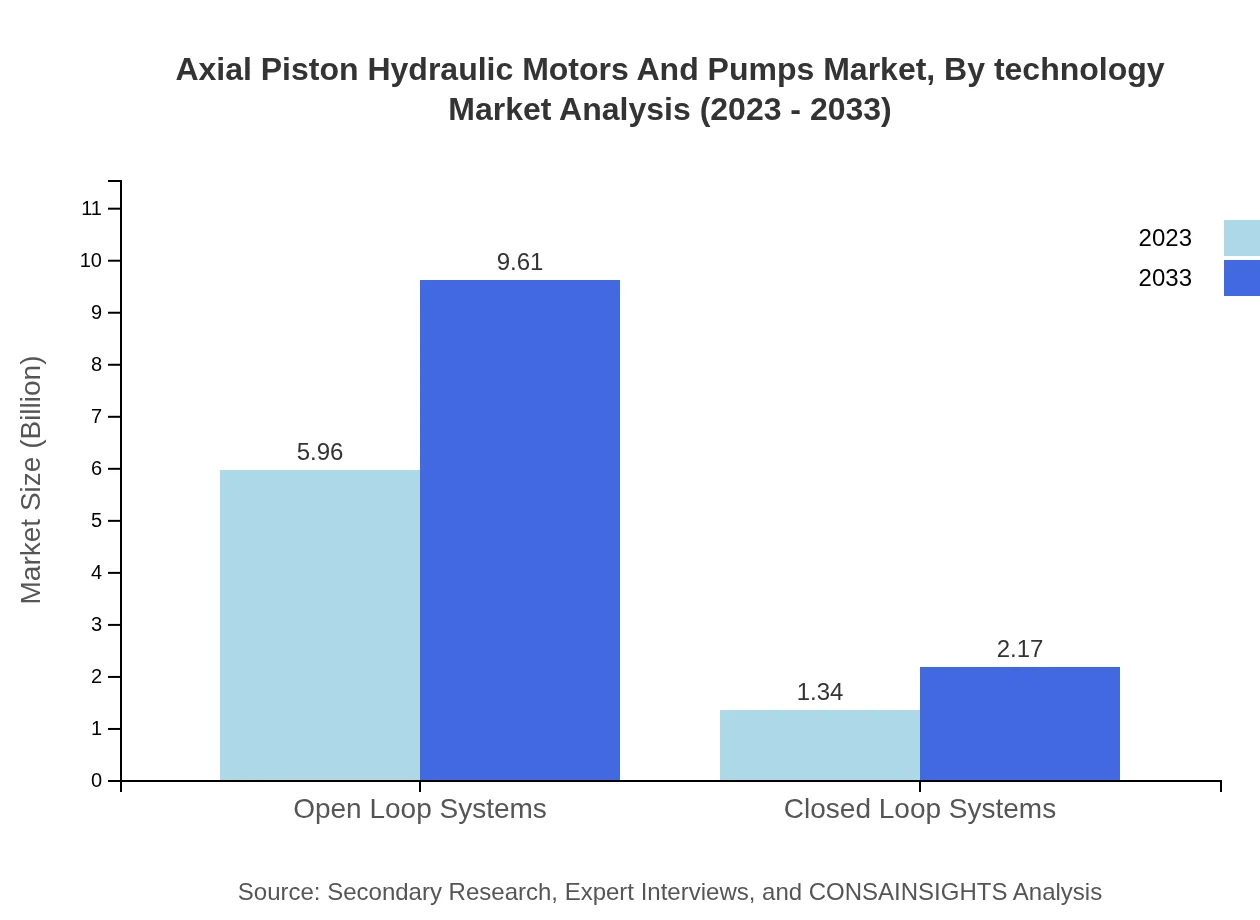

Axial Piston Hydraulic Motors And Pumps Market Analysis By Technology

Open Loop Systems command the predominant market size of $5.96 billion in 2023, growing to $9.61 billion by 2033, reflecting an 81.6% share. Closed Loop Systems will also see growth from $1.34 billion to $2.17 billion, with an 18.4% share.

Axial Piston Hydraulic Motors And Pumps Market Analysis By End User

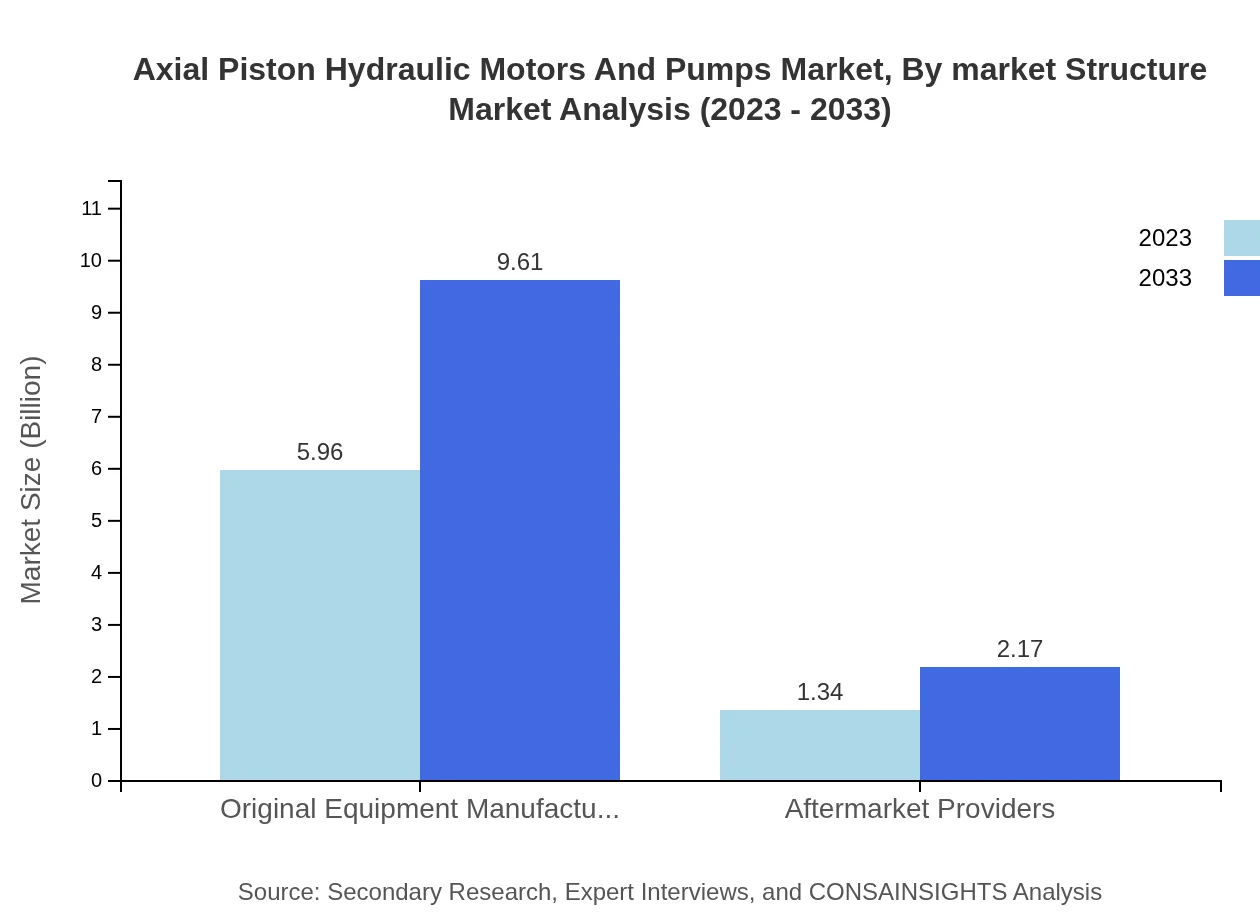

Original Equipment Manufacturers (OEMs) constitute a major segment, with revenue projected to expand from $5.96 billion in 2023 to $9.61 billion in 2033, retaining an 81.6% market share, while Aftermarket Providers will grow from $1.34 billion to $2.17 billion, holding an 18.4% share.

Axial Piston Hydraulic Motors And Pumps Market Analysis By Market Structure

This segment outlines the competitive landscape, with larger players dominating the market share and smaller firms often focusing on niche applications. The market is characterized by ongoing consolidation to enhance operational efficiencies and expand product offerings.

Axial Piston Hydraulic Motors And Pumps Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Axial Piston Hydraulic Motors And Pumps Industry

Bosch Rexroth AG:

A leading global supplier of drives and control technologies, Bosch Rexroth offers innovative hydraulic pumps and motors that enhance performance and efficiency.Parker Hannifin Corporation:

Parker is recognized for its comprehensive range of motion and control technologies, firmly establishing itself as a key player in hydraulic systems solutions.Eaton Corporation:

Eaton provides advanced hydraulic products and solutions and focuses on integrating energy-efficient technologies across its offerings.Hydro Gear Limited:

Hydro Gear excels in providing hydraulic components and systems, serving diverse markets from aerospace to agriculture.We're grateful to work with incredible clients.

FAQs

What is the market size of Axial Piston Hydraulic Motors and Pumps?

The Axial Piston Hydraulic Motors and Pumps market is valued at approximately $7.3 billion in 2023 with a projected compound annual growth rate (CAGR) of 4.8% through 2033, indicating robust growth in demand across various sectors.

What are the key market players or companies in the Axial Piston Hydraulic Motors and Pumps industry?

Key players in the Axial Piston Hydraulic Motors and Pumps industry include major manufacturers and suppliers who dominate the market through innovation, strategic partnerships, and comprehensive service offerings, positioning themselves as leaders in hydraulic technology.

What are the primary factors driving the growth in the Axial Piston Hydraulic Motors and Pumps industry?

The growth in this industry is propelled by advancements in hydraulic technologies, increasing demand from manufacturing and aerospace sectors, and the rising need for automation solutions, enhancing efficiency and operational capabilities in various applications.

Which region is the fastest Growing in the Axial Piston Hydraulic Motors and Pumps?

Asia-Pacific is the fastest-growing region, with market growth from $1.39 billion in 2023 to $2.25 billion in 2033. Europe also sees significant growth from $2.20 billion to $3.55 billion in the same timeframe, indicating strong regional demand.

Does ConsaInsights provide customized market report data for the Axial Piston Hydraulic Motors and Pumps industry?

Yes, ConsaInsights specializes in providing customized market reports tailored to client needs, offering detailed insights and data specific to the Axial Piston Hydraulic Motors and Pumps industry, including trends, forecasts, and analysis.

What deliverables can I expect from this Axial Piston Hydraulic Motors and Pumps market research project?

Clients can expect comprehensive deliverables such as in-depth market analysis, segmentation studies, competitive landscape reviews, growth forecasts, and insights into emerging trends that shape the Axial Piston Hydraulic Motors and Pumps market.

What are the market trends of Axial Piston Hydraulic Motors and Pumps?

Current market trends include the increased adoption of open loop and closed loop systems in diverse industries, with hydraulic motors dominating market share at 81.6%, and a focus on sustainability driving innovations in efficient hydraulic solutions.