B2b Enterprise Industrial Wearables Market Report

Published Date: 31 January 2026 | Report Code: b2b-enterprise-industrial-wearables

B2b Enterprise Industrial Wearables Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the B2B Enterprise Industrial Wearables market, presenting insights and forecasts from 2023 to 2033. It provides a comprehensive analysis of market trends, sizing, segmentation, regional performance, and key players, helping stakeholders make informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

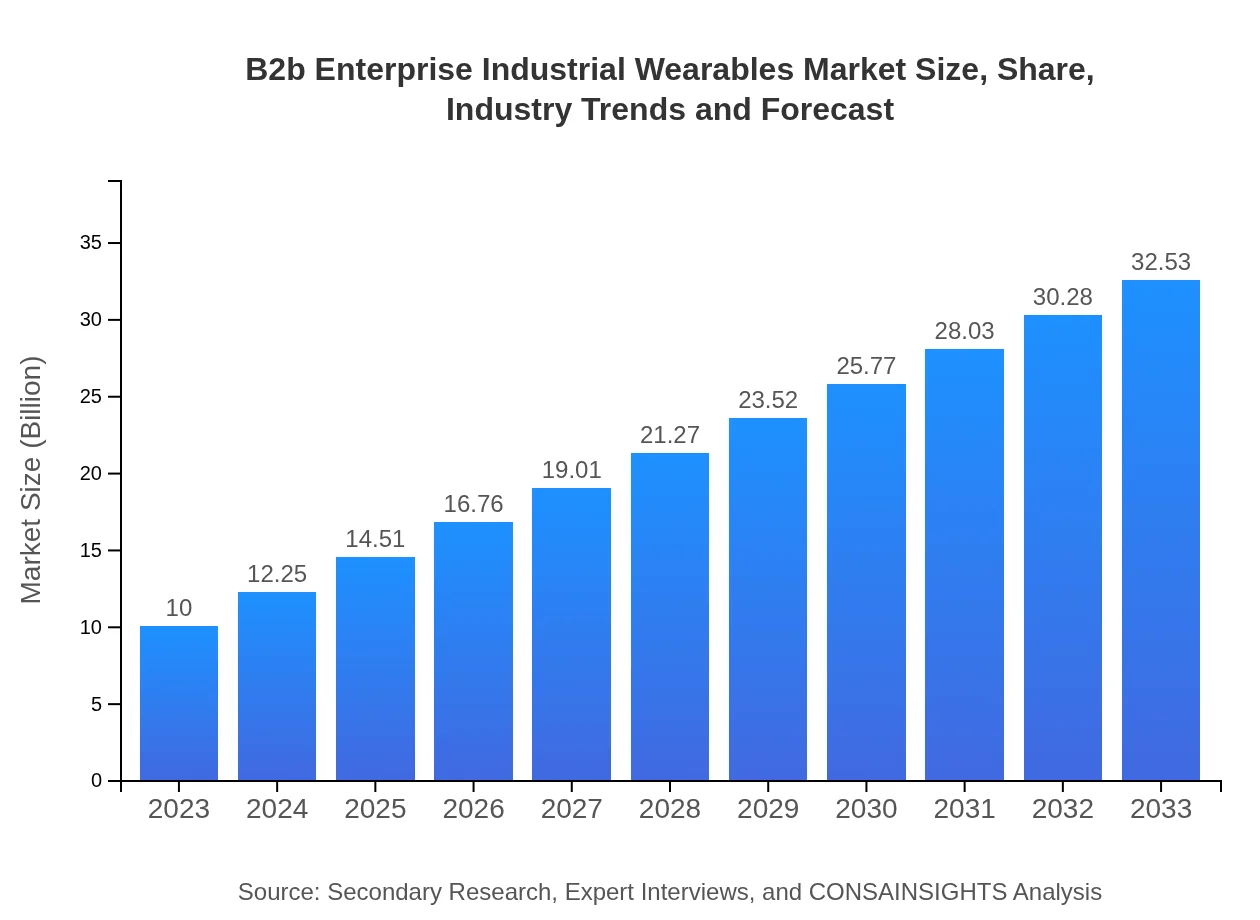

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $32.53 Billion |

| Top Companies | Honeywell International Inc., Microsoft Corporation, Vuzix Corporation, Google LLC |

| Last Modified Date | 31 January 2026 |

B2b Enterprise Industrial Wearables Market Overview

Customize B2b Enterprise Industrial Wearables Market Report market research report

- ✔ Get in-depth analysis of B2b Enterprise Industrial Wearables market size, growth, and forecasts.

- ✔ Understand B2b Enterprise Industrial Wearables's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in B2b Enterprise Industrial Wearables

What is the Market Size & CAGR of B2b Enterprise Industrial Wearables market in 2023?

B2b Enterprise Industrial Wearables Industry Analysis

B2b Enterprise Industrial Wearables Market Segmentation and Scope

Tell us your focus area and get a customized research report.

B2b Enterprise Industrial Wearables Market Analysis Report by Region

Europe B2b Enterprise Industrial Wearables Market Report:

The European market is anticipated to increase from $3.03 billion in 2023 to $9.86 billion by 2033, driven by regulatory frameworks promoting workplace safety and an emphasis on health monitoring amid the ongoing digital transformation across industries.Asia Pacific B2b Enterprise Industrial Wearables Market Report:

The Asia Pacific region is witnessing significant growth in the B2B Enterprise Industrial Wearables market, projected to increase from $1.83 billion in 2023 to $5.97 billion by 2033. This growth is driven by increasing industrial automation and a focus on improving worker productivity across emerging economies such as China and India.North America B2b Enterprise Industrial Wearables Market Report:

North America dominates the B2B Enterprise Industrial Wearables market, projected to grow from $3.86 billion in 2023 to $12.56 billion by 2033. The region benefits from technological advancements and a high concentration of industries utilizing smart technologies for workforce management.South America B2b Enterprise Industrial Wearables Market Report:

In South America, the market is expected to grow from $0.36 billion in 2023 to $1.17 billion by 2033. Factors like urbanization and expanding industrial sectors are contributing to the adoption of wearable technologies, albeit at a slower rate than more developed regions.Middle East & Africa B2b Enterprise Industrial Wearables Market Report:

The Middle East and Africa region will see growth from $0.92 billion in 2023 to $2.98 billion by 2033. The adoption of wearables in logistics and construction is expected to enhance efficiency and safety in these key sectors.Tell us your focus area and get a customized research report.

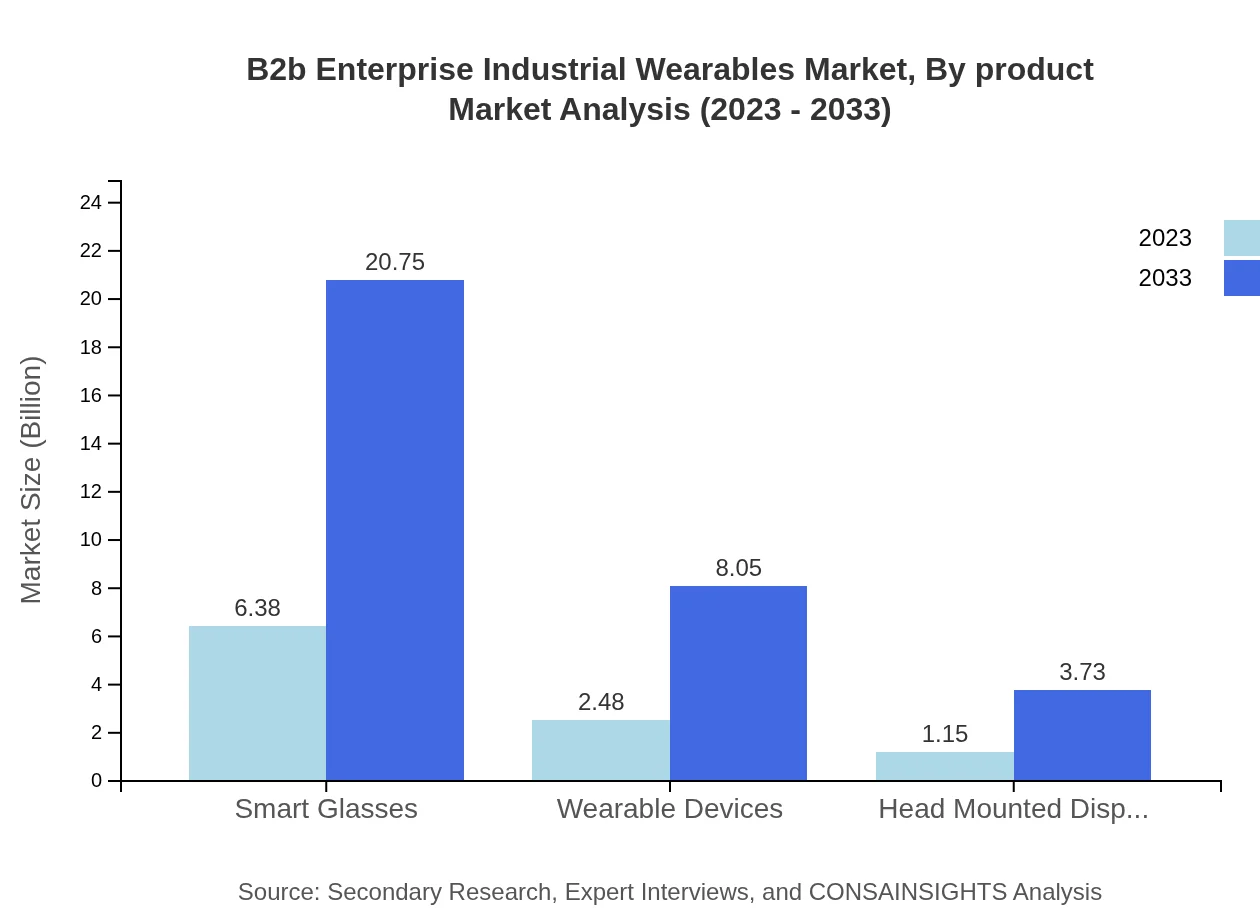

B2b Enterprise Industrial Wearables Market Analysis By Product

The product segmentation includes Smart Glasses, Wearable Devices, and Head Mounted Displays, with Smart Glasses dominating the market share at 63.78% in 2023. By 2033, Smart Glasses are projected to hold a market size of $20.75 billion, proving crucial for augmented and remote assistance needs in industrial environments.

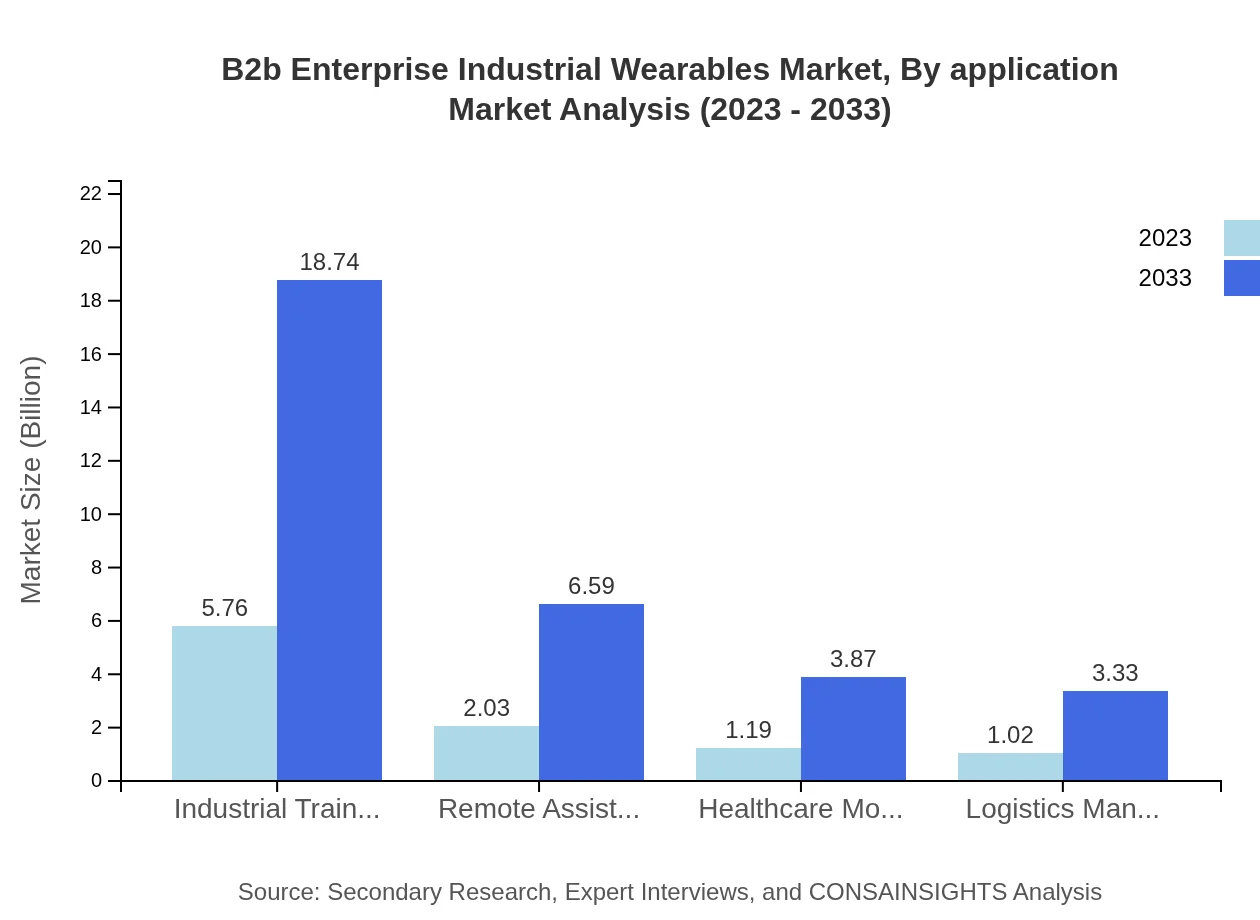

B2b Enterprise Industrial Wearables Market Analysis By Application

Applications in Healthcare, Manufacturing, Construction, and Transportation exhibit significant demand. Notably, Manufacturing leads with a market size of $5.76 billion in 2023, comprising 57.61% of the segment. This share indicates the critical need for efficiency-improving measures in diverse industrial operations.

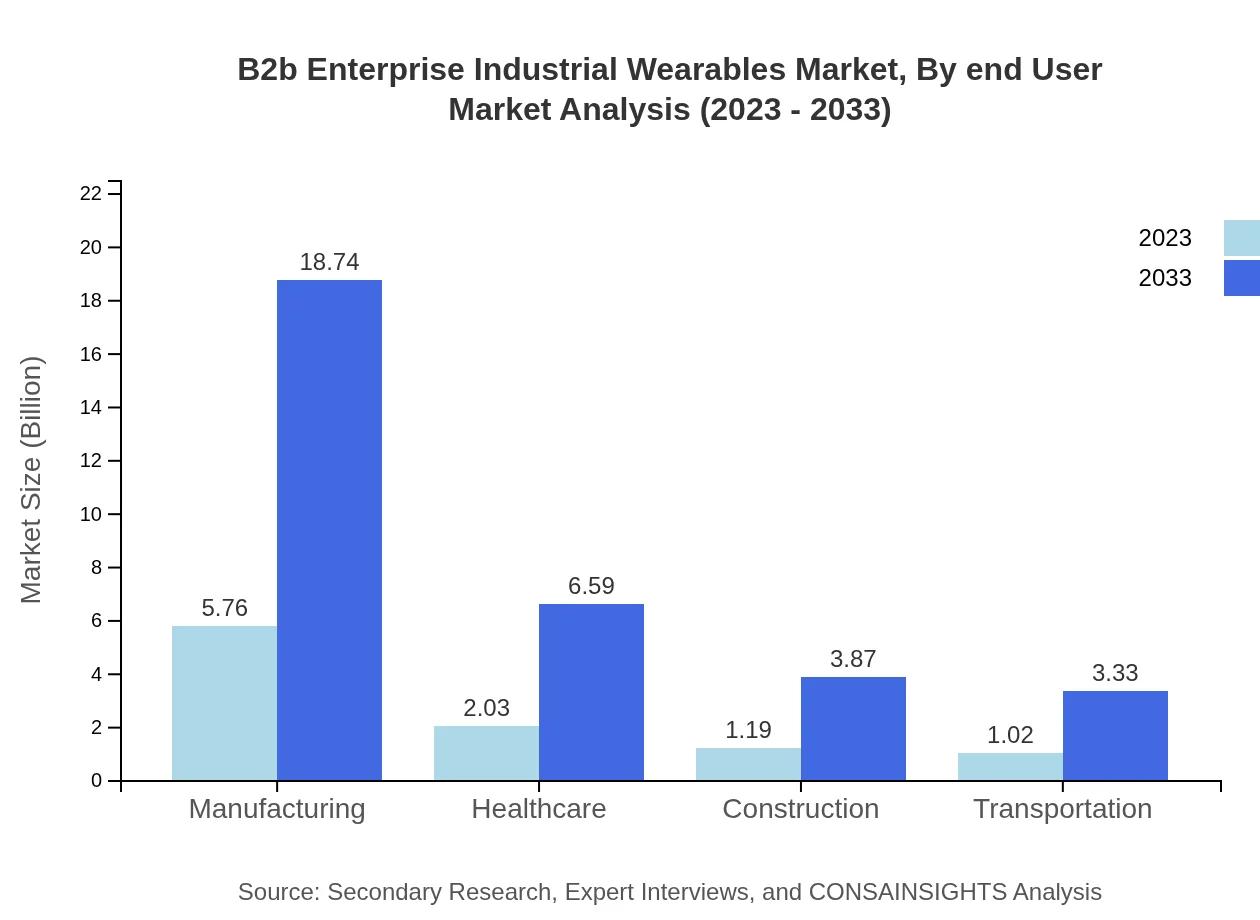

B2b Enterprise Industrial Wearables Market Analysis By End User

The end-user segment reveals that Manufacturing and Healthcare are prominent users of wearables. Their focus on employee efficiency and health monitoring is increasing demand, with Manufacturing contributing significantly to the overall market growth for wearables.

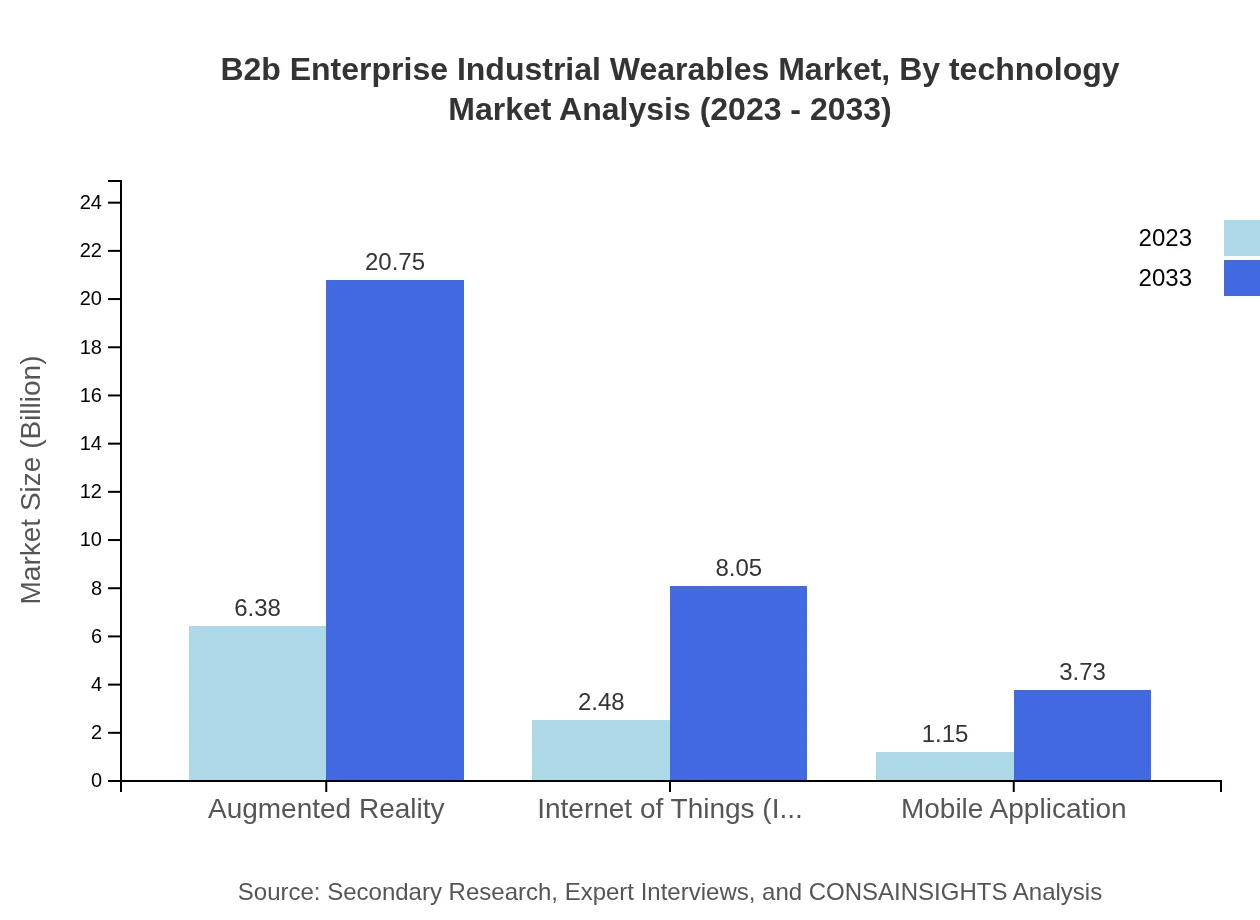

B2b Enterprise Industrial Wearables Market Analysis By Technology

Technologically, augmented reality and IoT functionality are driving innovations in wearable devices. By 2033, augmented reality is projected to dominate the market with advancements enhancing the training and operational effectiveness of wearables.

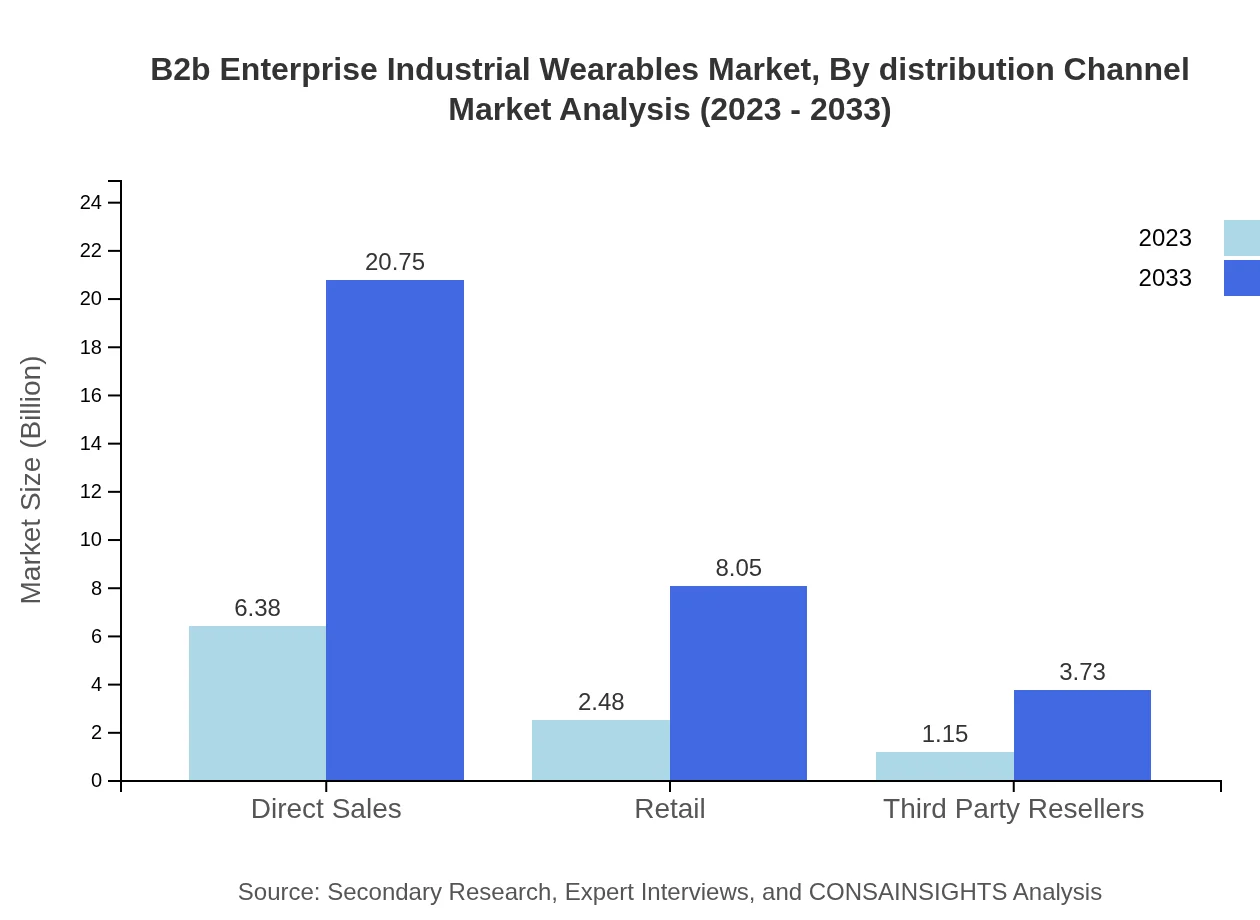

B2b Enterprise Industrial Wearables Market Analysis By Distribution Channel

Direct Sales channels are projected to capture the largest share at 63.78% in 2023. This channel is pivotal, ensuring businesses gain direct access to the latest technologies and innovations specifically tailored for industrial applications.

B2b Enterprise Industrial Wearables Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in B2b Enterprise Industrial Wearables Industry

Honeywell International Inc.:

Honeywell provides high-tech wearables designed for industrial safety, leveraging IoT technology to improve operational processes and worker productivity.Microsoft Corporation:

Microsoft's HoloLens offers augmented reality wearables for industrial applications, enhancing remote assistance and training capabilities within enterprises.Vuzix Corporation:

Vuzix designs and manufactures smart glasses specifically for enterprise applications, focusing on improving efficiency in hands-free work environments.Google LLC:

Google has ventured into the industrial wearables landscape with its Google Glass Enterprise Edition, targeting sectors where visual assistance is critical.We're grateful to work with incredible clients.

FAQs

What is the market size of b2b Enterprise Industrial Wearables?

The B2B Enterprise Industrial Wearables market is valued at approximately $10 billion in 2023, with an expected CAGR of 12%. By 2033, the market size is projected to grow significantly due to advancements in wearable technology.

What are the key market players or companies in this b2b Enterprise Industrial Wearables industry?

Key market players in the B2B enterprise industrial wearables sector include companies such as Vuzix, Google, Microsoft, and Epson. These players contribute to the innovation and market expansion through their cutting-edge wearable technology.

What are the primary factors driving the growth in the b2b Enterprise Industrial Wearables industry?

The growth of the B2B enterprise industrial wearables market is driven by increased demand for remote assistance, enhanced operational efficiency, the adoption of IoT technologies, and the need for real-time data analytics in various industries.

Which region is the fastest Growing in the b2b Enterprise Industrial Wearables?

North America is the fastest-growing region in the B2B Enterprise Industrial Wearables market, projected to grow from $3.86 billion in 2023 to $12.56 billion by 2033. This growth is fueled by advancements in technology and a strong industrial base.

Does ConsaInsights provide customized market report data for the b2b Enterprise Industrial Wearables industry?

Yes, ConsaInsights offers customized market report data for the B2B enterprise industrial wearables industry, allowing clients to acquire tailored insights that align with their specific business needs and strategic objectives.

What deliverables can I expect from this b2b Enterprise Industrial Wearables market research project?

Deliverables from this market research project include thorough market analysis, segmentation insights, growth forecasts, competitive landscape assessments, and actionable recommendations for strategic decision-making in the B2B enterprise industrial wearables sector.

What are the market trends of b2b Enterprise Industrial Wearables?

Current market trends in B2B enterprise industrial wearables indicate a shift towards more integrated solutions like smart glasses and IoT devices, with an emphasis on enhancing productivity, employee safety, and streamlined operations across industrial sectors.