Baby Food Market Report

Published Date: 31 January 2026 | Report Code: baby-food

Baby Food Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Baby Food market, covering current trends, market size, segmented insights, and forecasts from 2023 to 2033. Insights include detailed industry analysis, regional dynamics, technology impacts, and competitive landscape assessments.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

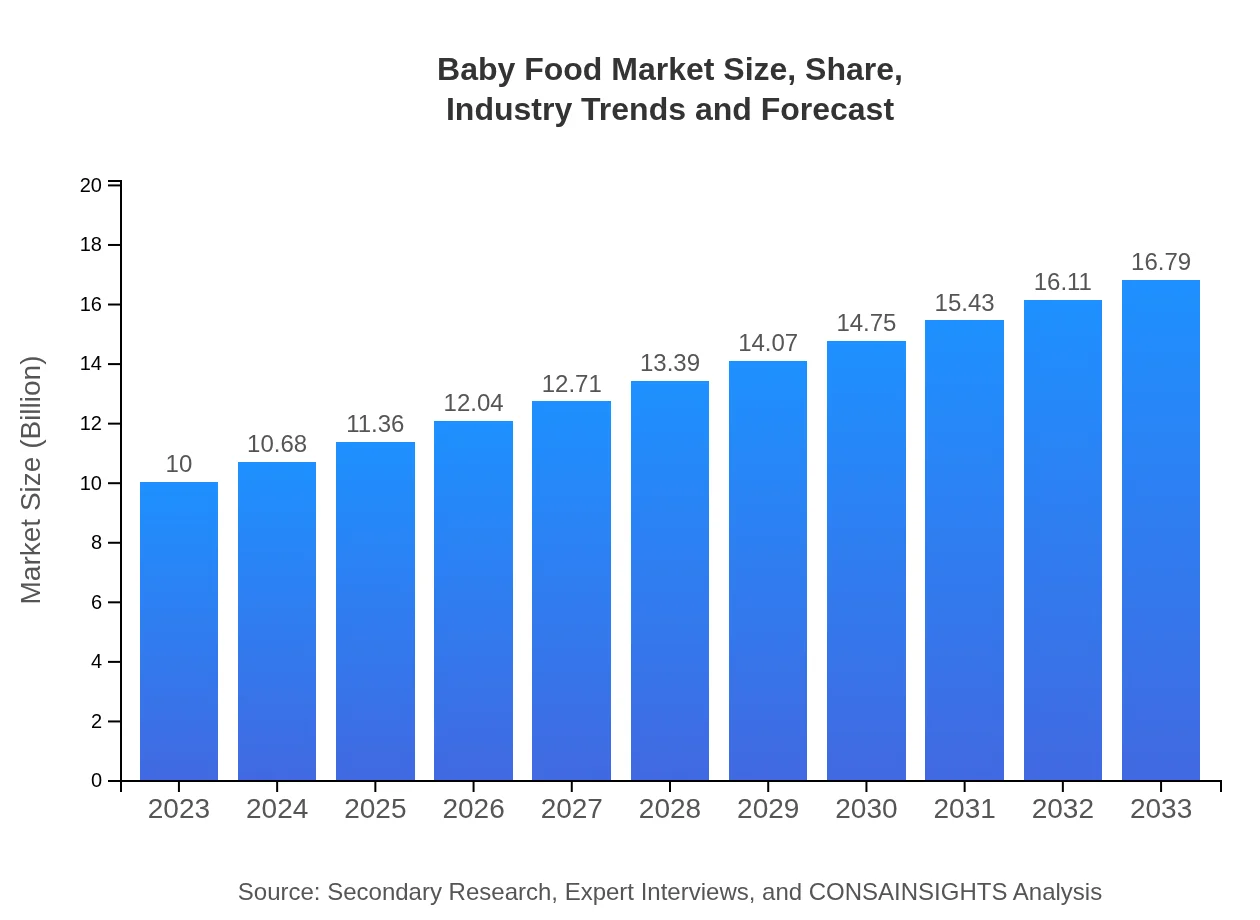

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $16.79 Billion |

| Top Companies | Nestlé S.A., Danone S.A., Abbott Laboratories, Mead Johnson Nutrition Company (Reckitt Benckiser Group), Hero Group |

| Last Modified Date | 31 January 2026 |

Baby Food Market Overview

Customize Baby Food Market Report market research report

- ✔ Get in-depth analysis of Baby Food market size, growth, and forecasts.

- ✔ Understand Baby Food's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Baby Food

What is the Market Size & CAGR of Baby Food market in 2023?

Baby Food Industry Analysis

Baby Food Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Baby Food Market Analysis Report by Region

Europe Baby Food Market Report:

Europe's Baby Food market stands at $2.60 billion in 2023, with a forecast to reach $4.36 billion by 2033. Rising demand for clean-label products and health-conscious eating habits drive sales, alongside stringent regulations promoting food safety.Asia Pacific Baby Food Market Report:

In Asia Pacific, the Baby Food market size is valued at $2.17 billion in 2023, projected to grow to $3.65 billion by 2033. The rapid urbanization and rising disposable income levels are contributing factors. Additionally, growing awareness about child nutrition is leading to increased consumption of fortified and organic products.North America Baby Food Market Report:

North America holds a significant share of the Baby Food market with a size of approximately $3.55 billion in 2023, expected to rise to $5.97 billion by 2033. Trends favoring organic food production and safety regulations are steering growth in this mature market.South America Baby Food Market Report:

The South American Baby Food market is estimated at $0.45 billion in 2023, with growth to $0.76 billion anticipated by 2033. Brazil and Argentina emerge as key markets due to their increasing focus on health and hygiene standards influencing purchase decisions among parents.Middle East & Africa Baby Food Market Report:

The Middle East and Africa Baby Food market is valued at approximately $1.22 billion in 2023 and projected to reach $2.05 billion by 2033. The market is propelled by increasing birth rates alongside rising consumer awareness concerning nutrition and health of infants.Tell us your focus area and get a customized research report.

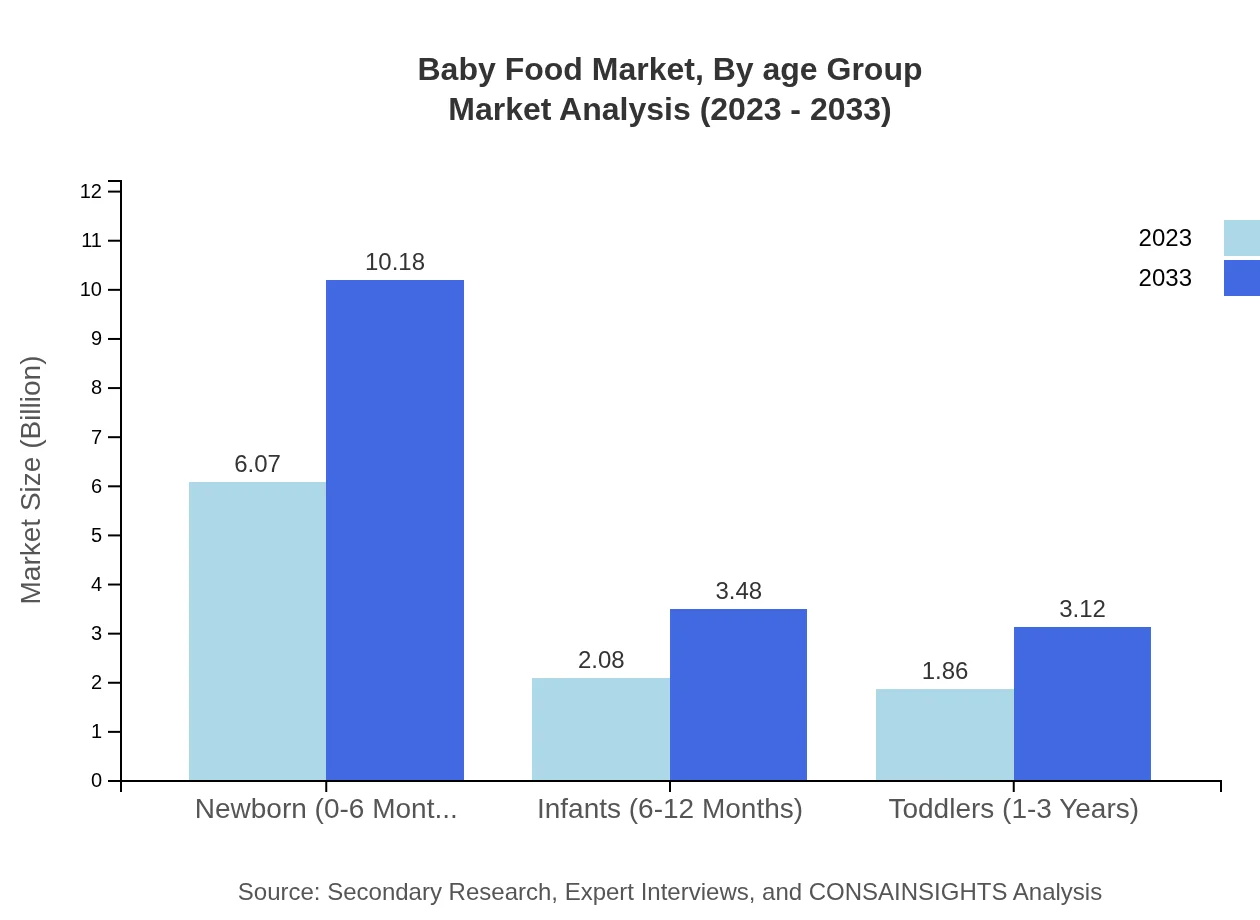

Baby Food Market Analysis By Age Group

In 2023, the Newborn (0-6 Months) segment generates a significant revenue of $6.07 billion, expected to increase to $10.18 billion by 2033, holding a steady market share of 60.66%. Infants (6-12 Months) follow with a revenue of $2.08 billion, projected to grow to $3.48 billion by 2033, contributing 20.76% to the market. The Toddlers (1-3 Years) segment is anticipated to grow from $1.86 billion in 2023 to $3.12 billion in 2033, maintaining an 18.58% market share.

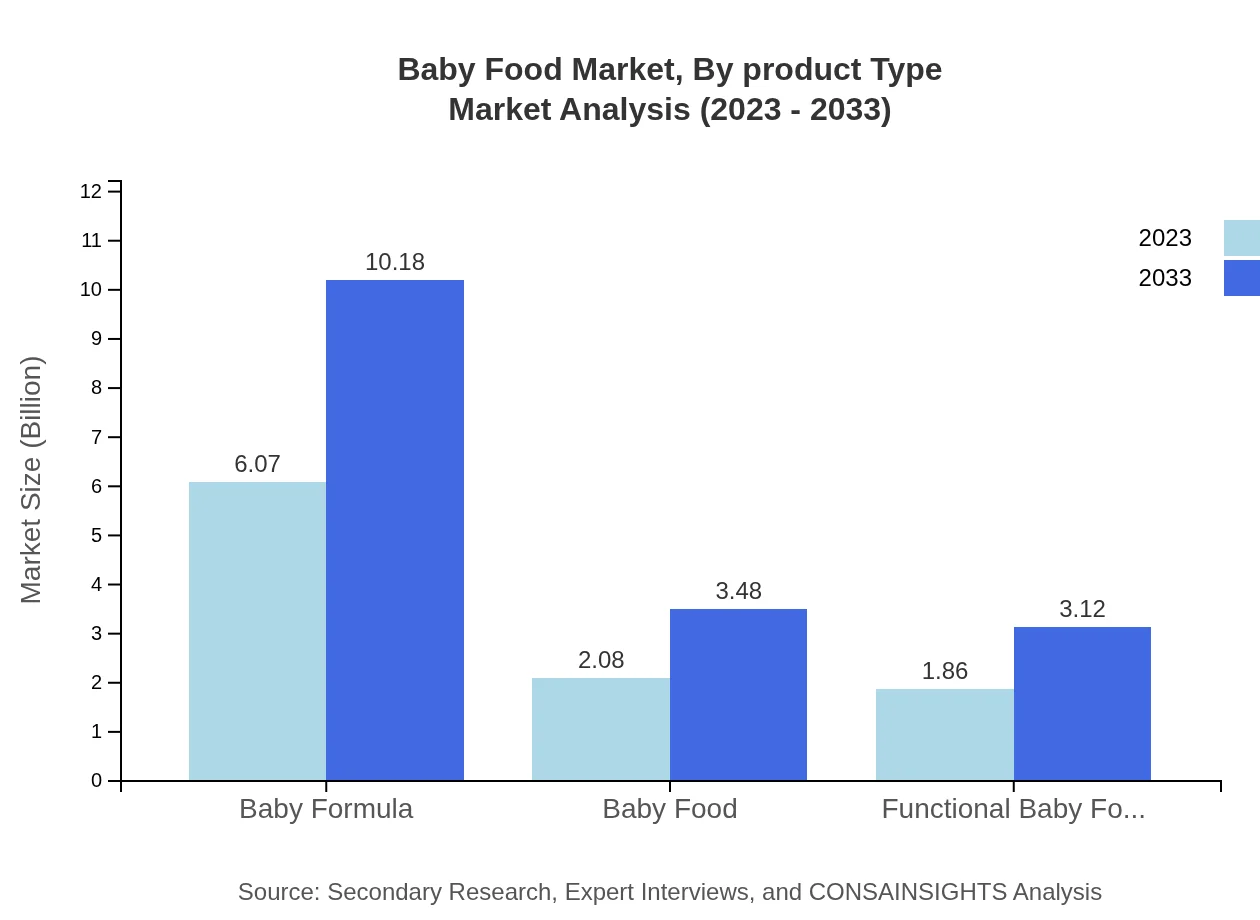

Baby Food Market Analysis By Product Type

The Baby Formula segment stands out, valued at $6.07 billion in 2023, and expected to reach $10.18 billion by 2033. Organic Baby Foods also maintain a robust market size, growing from $6.07 billion to $10.18 billion by 2033. Functional Baby Foods and Allergy-Friendly Foods, highlighting specific nutritional needs, are expected to grow significantly, indicating a trend of increasing consumer focus on product benefits.

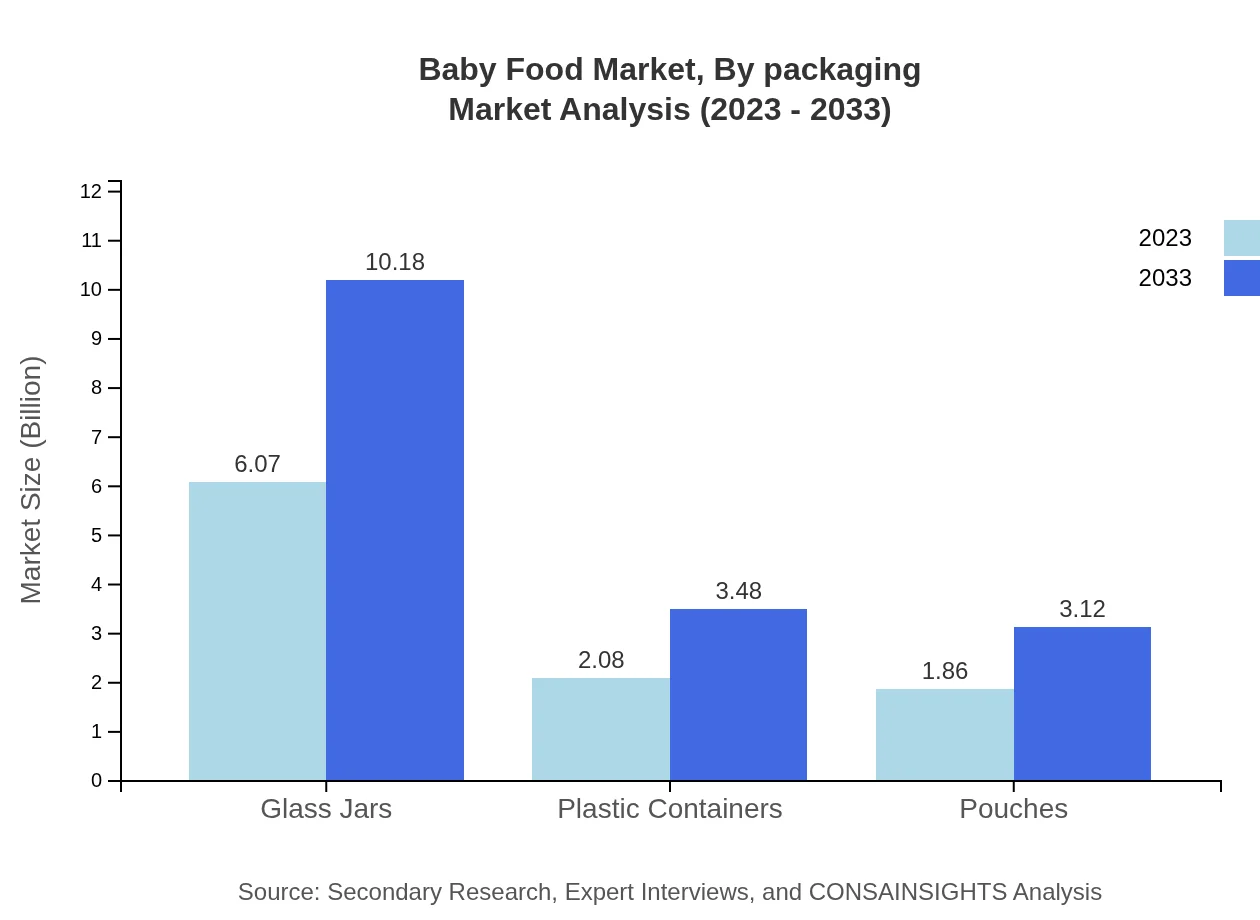

Baby Food Market Analysis By Packaging

Glass Jars maintain a strong market presence, with revenues of $6.07 billion in 2023, projected to rise to $10.18 billion by 2033. Plastic Containers and Pouches also contribute significantly, with revenues of $2.08 billion and $1.86 billion in 2023, expecting growth to $3.48 billion and $3.12 billion, respectively, highlighting flexibility in consumer preferences for convenience and storage.

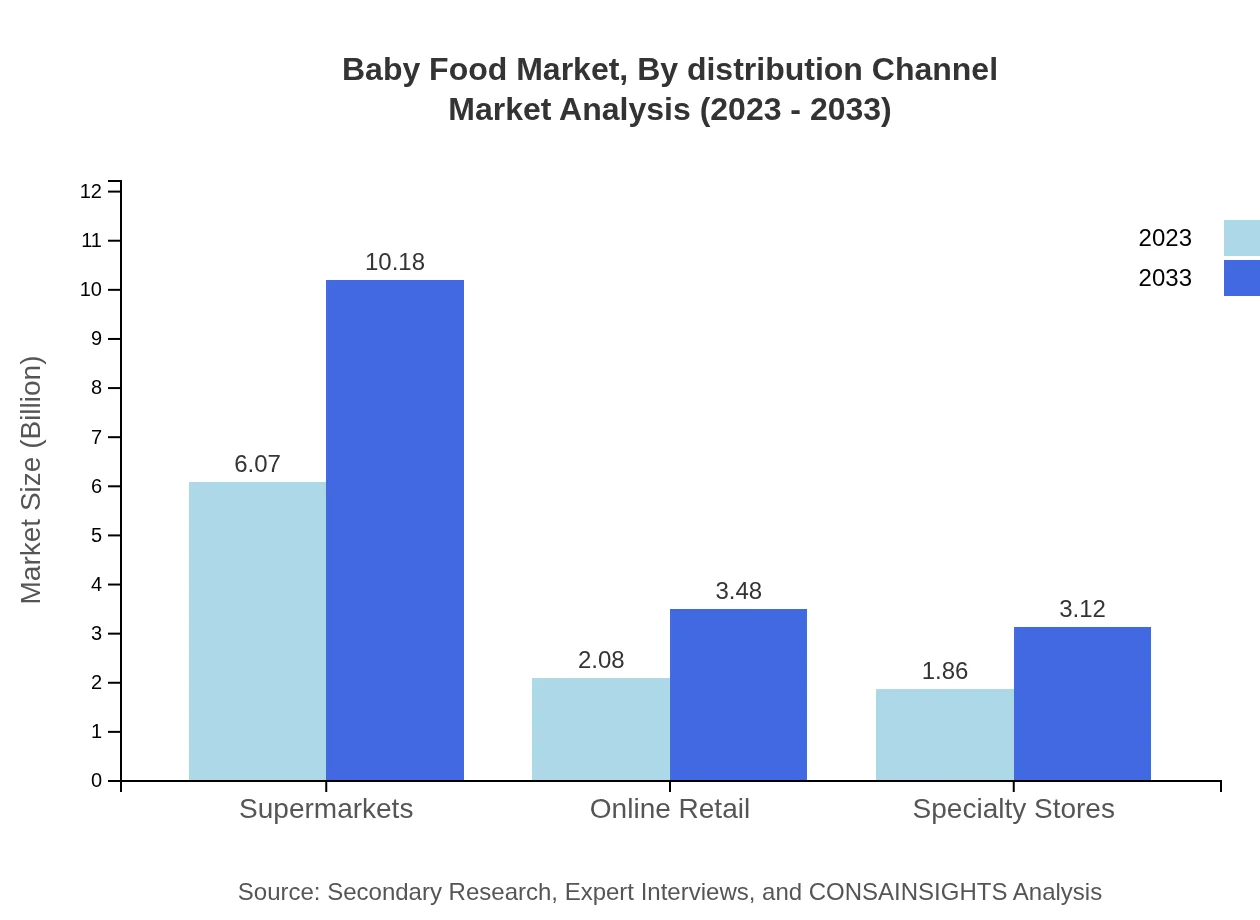

Baby Food Market Analysis By Distribution Channel

Supermarkets remain the primary distribution channel for Baby Food products, accounting for $6.07 billion in revenue in 2023 and projected to reach $10.18 billion by 2033. Online Retail and Specialty Stores are increasingly gaining ground, with revenues of $2.08 billion and $1.86 billion respectively, reflecting ongoing shifts in shopping behavior towards digital platforms.

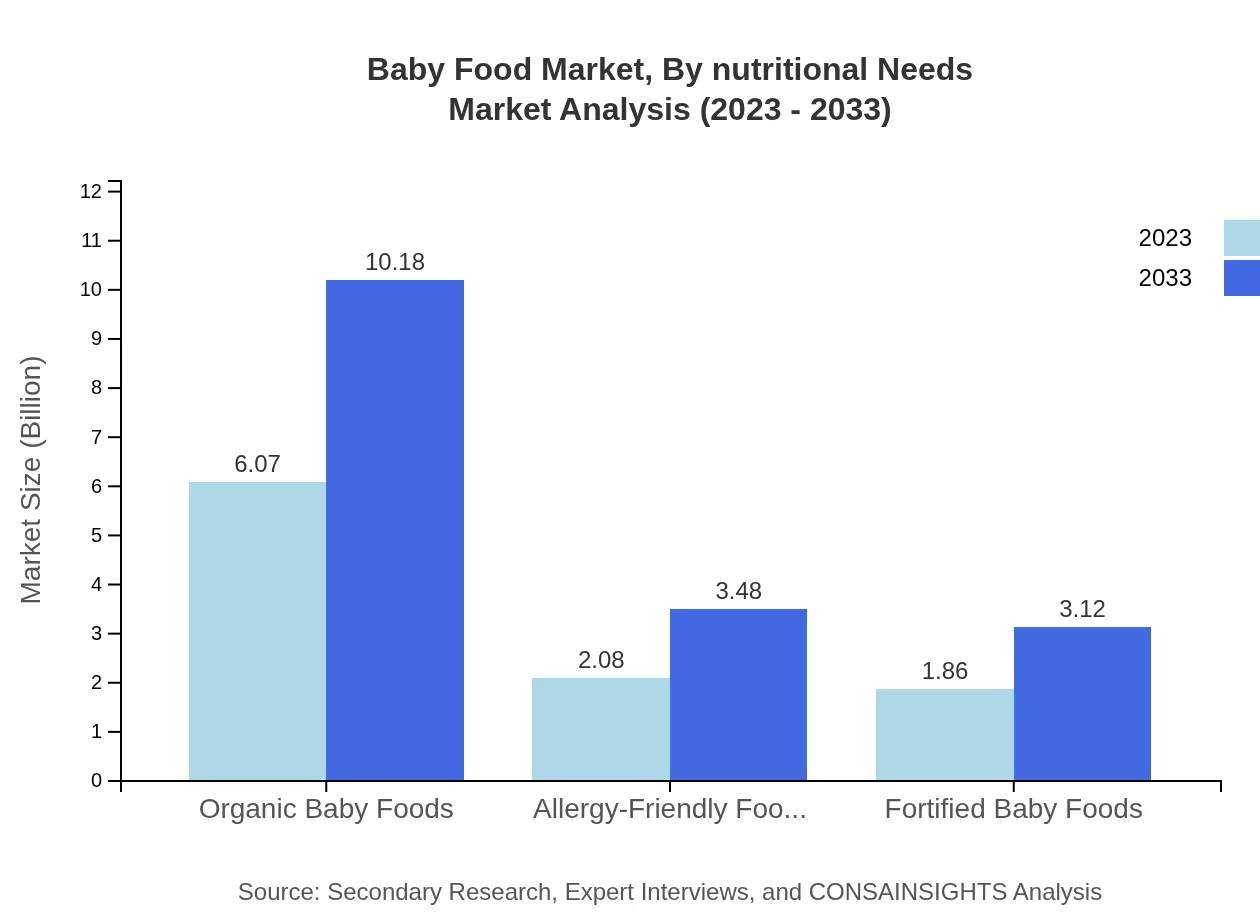

Baby Food Market Analysis By Nutritional Needs

Segmenting the Baby Food market by nutritional needs reveals a strong demand for Functional and Fortified Baby Foods, with market values projected to grow significantly over the coming decade. This trend emphasizes the increasing priority parents place on nutrition and health during early childhood development.

Baby Food Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Baby Food Industry

Nestlé S.A.:

A worldwide leader in the Baby Food market, Nestlé offers a wide range of infant nutrition products, emphasizing quality and safety.Danone S.A.:

Known for their focus on health and wellness, Danone provides various organic and fortified baby food formulas, catering to health-conscious consumers.Abbott Laboratories:

Abbott is a leading player providing infant formula and nutritional products, known for their extensive research and product innovation.Mead Johnson Nutrition Company (Reckitt Benckiser Group):

Mead Johnson specializes in pediatric nutrition and offers a variety of formulas targeting specific age groups and needs.Hero Group:

Hero is recognized for their high-quality organic baby food products, focusing on the nutritional and developmental needs of infants.We're grateful to work with incredible clients.

FAQs

What is the market size of baby Food?

The global baby food market is projected to reach approximately $10 billion by 2033, growing at a CAGR of 5.2%. In 2023, the market was valued around $6.08 billion, with significant growth anticipated over the next decade.

What are the key market players or companies in this baby Food industry?

Key players in the baby food industry include Nestlé, Danone, and Abbott Laboratories. These companies dominate the market due to their broad product ranges, extensive distribution networks, and strong brand equity, continuously innovating to meet consumer demands.

What are the primary factors driving the growth in the baby Food industry?

Growth in the baby food industry is driven by increasing health consciousness among parents, rising disposable incomes, and a growing trend towards organic and functional foods. The expansion of retail channels also plays a critical role in facilitating market access.

Which region is the fastest Growing in the baby Food market?

The fastest-growing region in the baby food market is Asia Pacific, projected to grow from $2.17 billion in 2023 to $3.65 billion by 2033. This growth is bolstered by urbanization, rising birth rates, and increasing demand for nutritious products.

Does ConsaInsights provide customized market report data for the baby Food industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the baby food industry. Clients can request detailed insights, tracking evolving trends, competitive landscapes, and market forecasts beyond standard reports.

What deliverables can I expect from this baby Food market research project?

Deliverables from the baby food market research project include comprehensive reports, market forecasts, competitor analysis, segment-based insights, and strategic recommendations tailored to assist in decision-making and growth strategies.

What are the market trends of baby Food?

Current trends in the baby food market include a shift towards organic and plant-based products, an increasing preference for convenience packaging like pouches, and a growing demand for allergen-free options, reflecting parents' health-conscious choices.