Baby Led Weaning Food Products

Published Date: 31 January 2026 | Report Code: baby-led-weaning-food-products

Baby Led Weaning Food Products Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report provides an in-depth analysis of the Baby Led Weaning Food Products market, offering detailed insights into current market conditions, size, growth metrics, and technological as well as product innovations. Covering the forecast period from 2024 through 2033, the report highlights segmentation, regional performance, and key industry trends to guide stakeholders in making informed decisions.

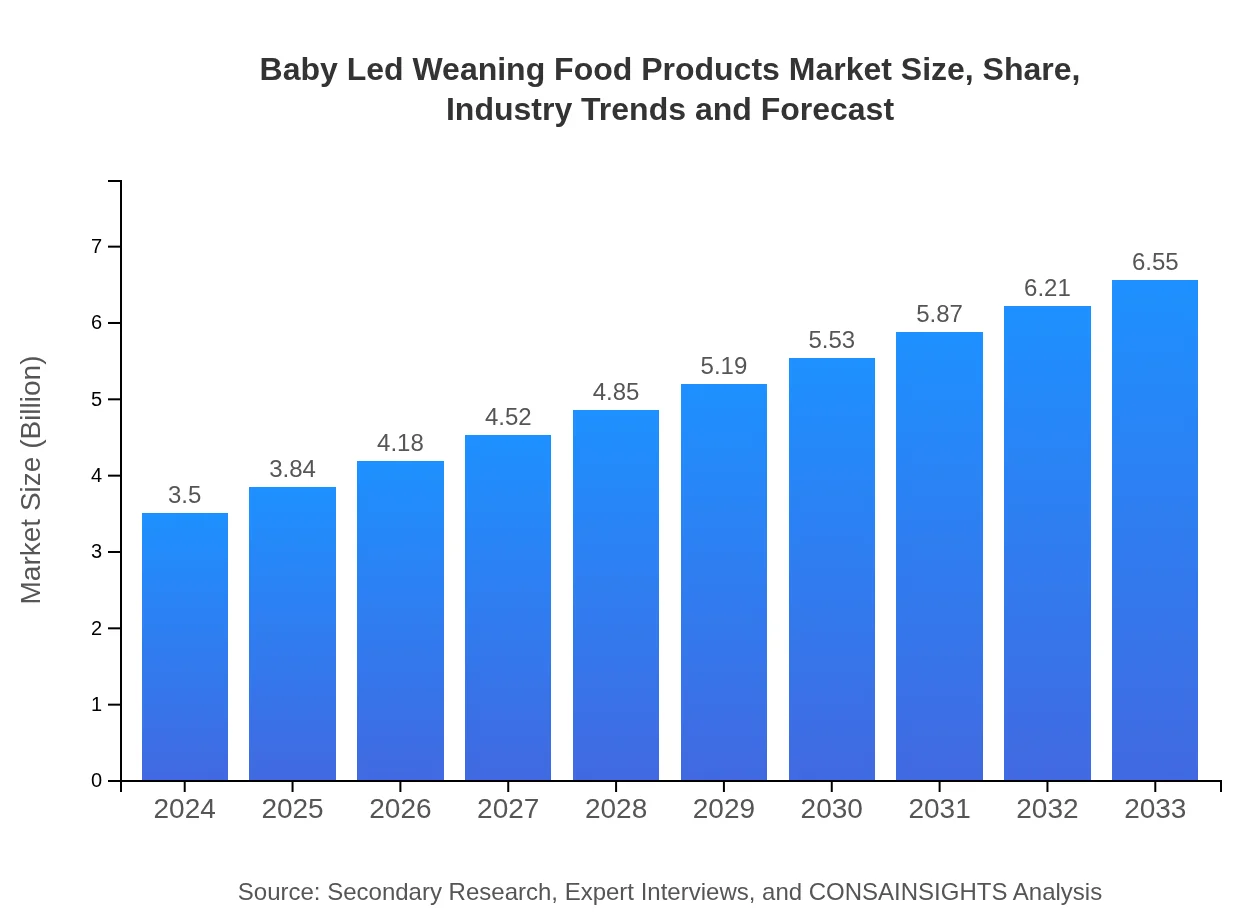

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $3.50 Billion |

| CAGR (2024-2033) | 7.0% |

| 2033 Market Size | $6.55 Billion |

| Top Companies | NutriStart Inc., TinyBite Foods, WeanWell Nutrition |

| Last Modified Date | 31 January 2026 |

Baby Led Weaning Food Products Market Overview

Customize Baby Led Weaning Food Products market research report

- ✔ Get in-depth analysis of Baby Led Weaning Food Products market size, growth, and forecasts.

- ✔ Understand Baby Led Weaning Food Products's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Baby Led Weaning Food Products

What is the Market Size & CAGR of Baby Led Weaning Food Products market in 2024?

Baby Led Weaning Food Products Industry Analysis

Baby Led Weaning Food Products Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Baby Led Weaning Food Products Market Analysis Report by Region

Europe Baby Led Weaning Food Products:

Europe has established itself as a robust market for Baby Led Weaning Food Products, with a clear focus on organic and natural product offerings. The European market is projected to expand from 1.14 in 2024 to 2.13 by 2033. High consumer awareness, favorable regulatory standards, and increasing demand for quality and safety in infant nutrition are driving this growth. European companies have continuously innovated in formulation and packaging, ensuring that the market remains dynamic and responsive to consumer needs.Asia Pacific Baby Led Weaning Food Products:

In the Asia Pacific region, the market has shown promising growth fueled by increasing urbanization, higher disposable incomes, and a heightened awareness of early childhood nutrition. The market size is expected to grow from 0.63 in 2024 to 1.18 by 2033, reflective of both rising demand and competitive product innovations. Advances in local production capabilities and a large base of young families have contributed to robust market expansion. Additionally, government initiatives and supportive regulatory frameworks are further enabling market penetration in various countries across the region.North America Baby Led Weaning Food Products:

North America remains one of the key regions with a mature market landscape where product innovation, quality assurance, and nutritional benefits are highly valued. The market size is anticipated to nearly double from 1.21 in 2024 to 2.26 by 2033 as companies invest heavily in developing formulations that meet rigorous health standards. Strategic collaborations and consistent investments in R&D further bolster the market, making it one of the most competitive landscapes globally.South America Baby Led Weaning Food Products:

South America is witnessing steady growth in Baby Led Weaning Food Products driven by a shift in consumer lifestyle preferences and an increasing focus on infant health. Though the market size is comparatively smaller, the region has benefitted from increased investments in modern food processing technologies and awareness programs. Market players are gradually entering the space, introducing products that cater to health-conscious parents and aiming to create distribution channels that enhance consumer accessibility.Middle East & Africa Baby Led Weaning Food Products:

In the Middle East and Africa region, the market is in a nascent yet promising stage. With a growth projection from 0.45 in 2024 to 0.84 by 2033, the market is gradually building momentum. Rising awareness regarding infant nutrition and the adoption of global best practices in product manufacturing are steering market development. Although the trajectory of growth is moderate compared to other regions, focused investments in infrastructure and the expansion of retail networks are expected to unlock significant opportunities over the forecast period.Tell us your focus area and get a customized research report.

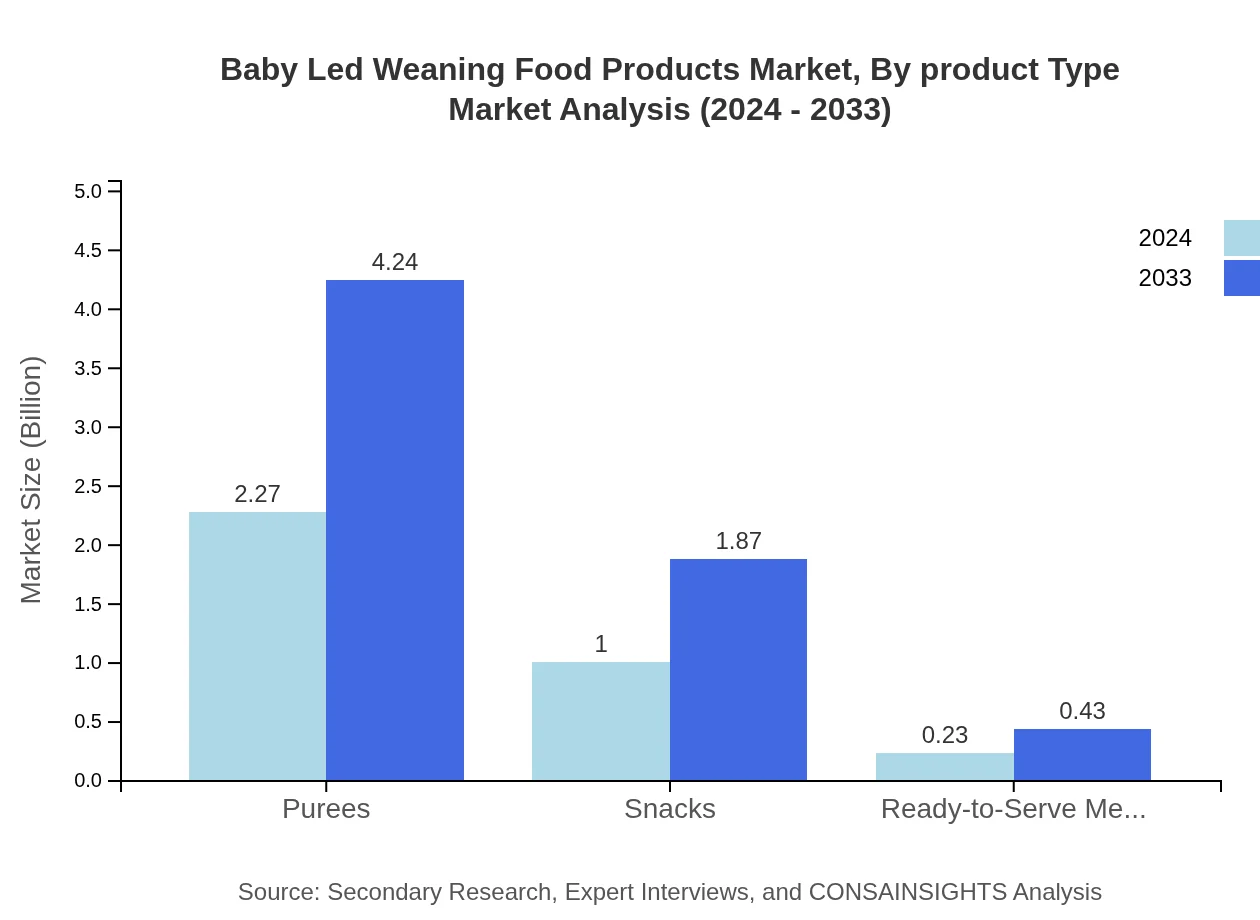

Baby Led Weaning Food Products Market Analysis By Product Type

The product type segmentation in the Baby Led Weaning Food Products market distinguishes between various formulations such as pouches, jars, boxes, purees, snacks, and ready-to-serve meals. Among these, pouches and purees dominate the market share with both categories growing at a consistent pace. Detailed analysis shows that in 2024, the pouch segment recorded a market size of 2.27 with a stable share of approximately 64.81%, while similar trends are observed in purees. Consumers prefer these formats for their convenience, nutritional retention, and ease of storage, which has been further validated by increased uptake over the forecast period.

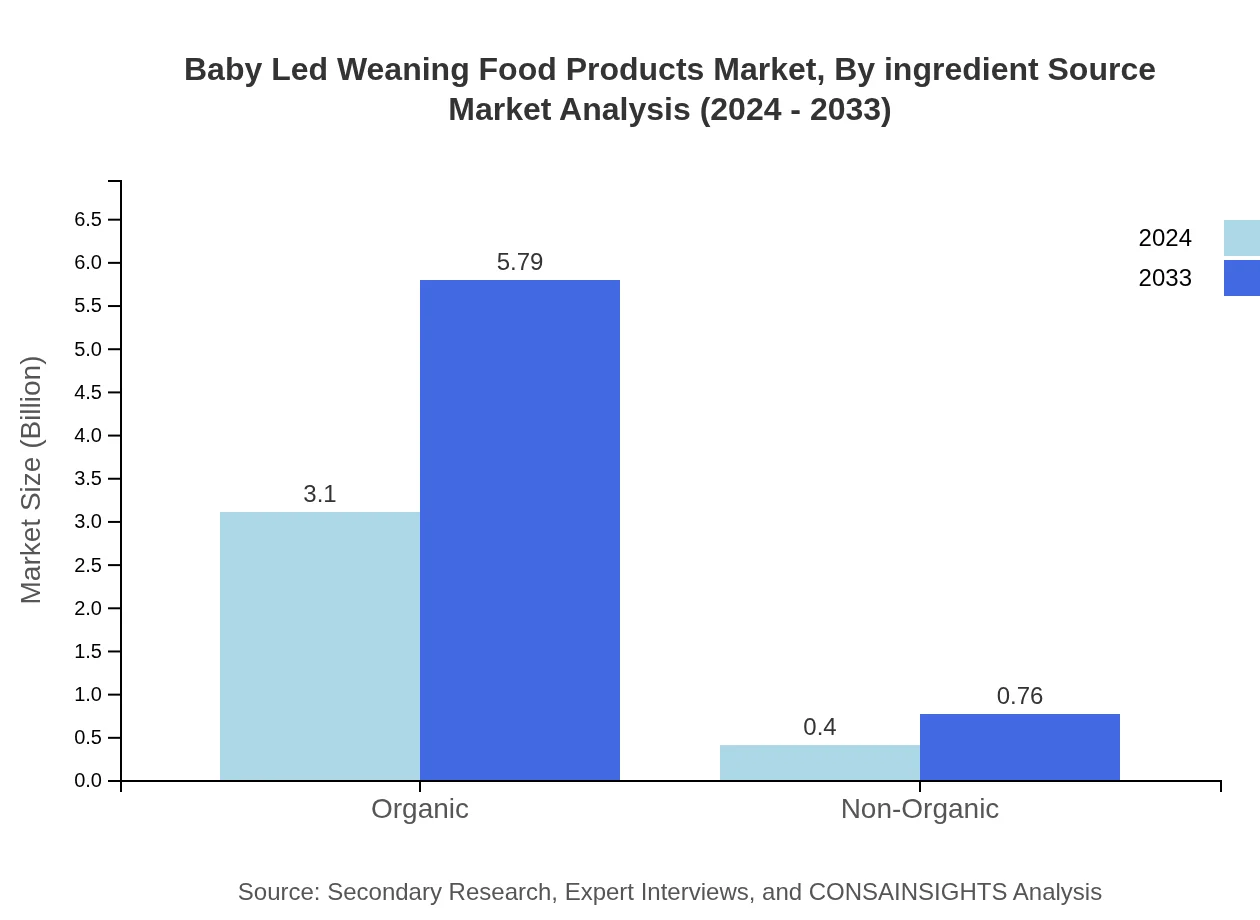

Baby Led Weaning Food Products Market Analysis By Ingredient Source

Ingredient source segmentation categorizes the market into organic and non-organic products. A significant driver in this segment is consumer preference for natural, additive-free ingredients that ensure maximum nutritional benefits for infants. As of 2024, the organic segment stands strong with a market size of 3.10, reflecting a dominant share of 88.43% as opposed to the non-organic segment which maintains a modest share. This trend is expected to continue, driven by increasing health consciousness among parents and stricter regulatory standards for infant foods.

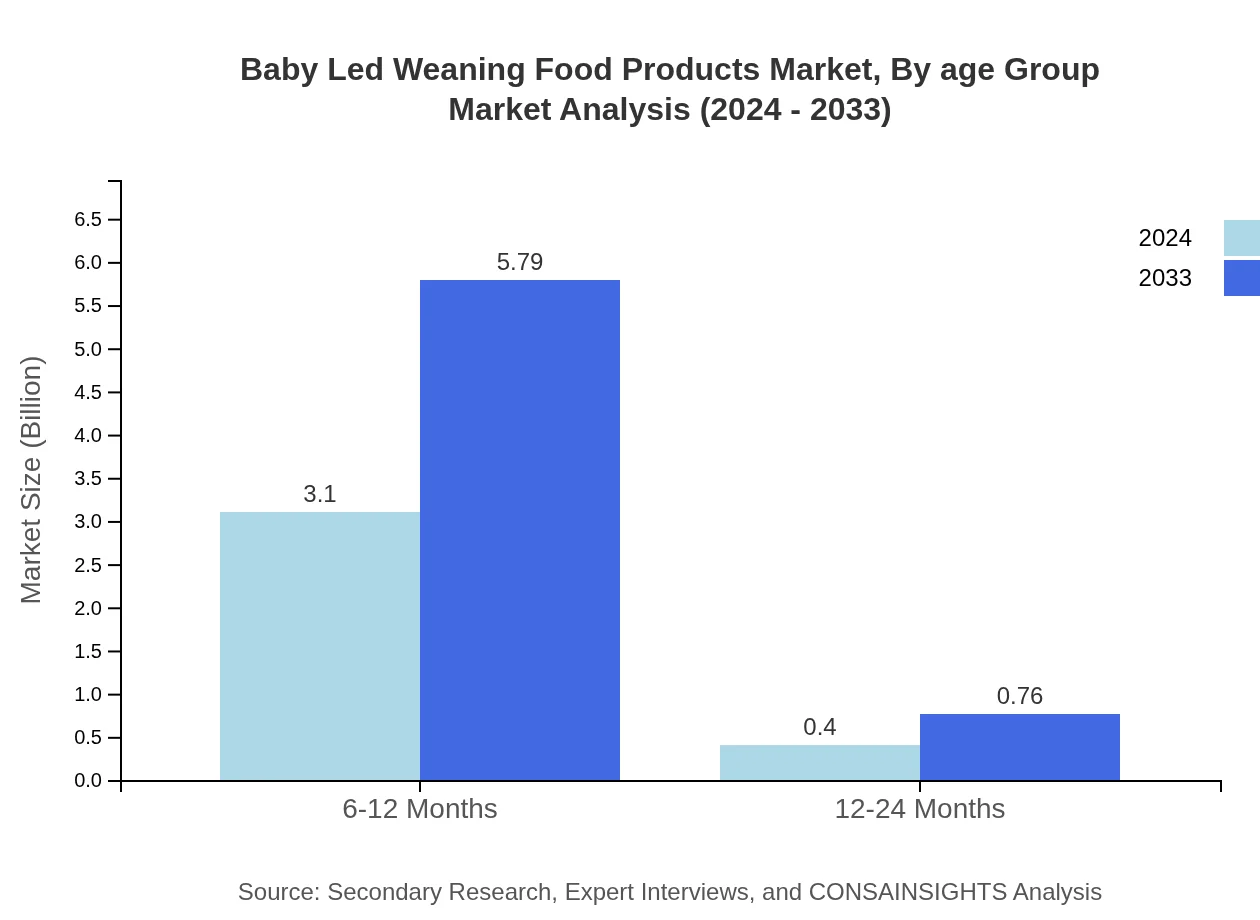

Baby Led Weaning Food Products Market Analysis By Age Group

The age group segmentation primarily divides the market into 6-12 months and 12-24 months categories. In 2024, the 6-12 months segment holds a larger market size of 3.10 and commands a share of 88.43%, indicating that early weaning products are the preferred choice for new parents. The 12-24 months segment, while smaller with a market size of 0.40 and a share of 11.57%, is also expected to witness proportional growth driven by consumer demand for more diverse nutritional formulations as infants grow older. This segmentation ensures targeted marketing strategies that resonate with specific developmental needs.

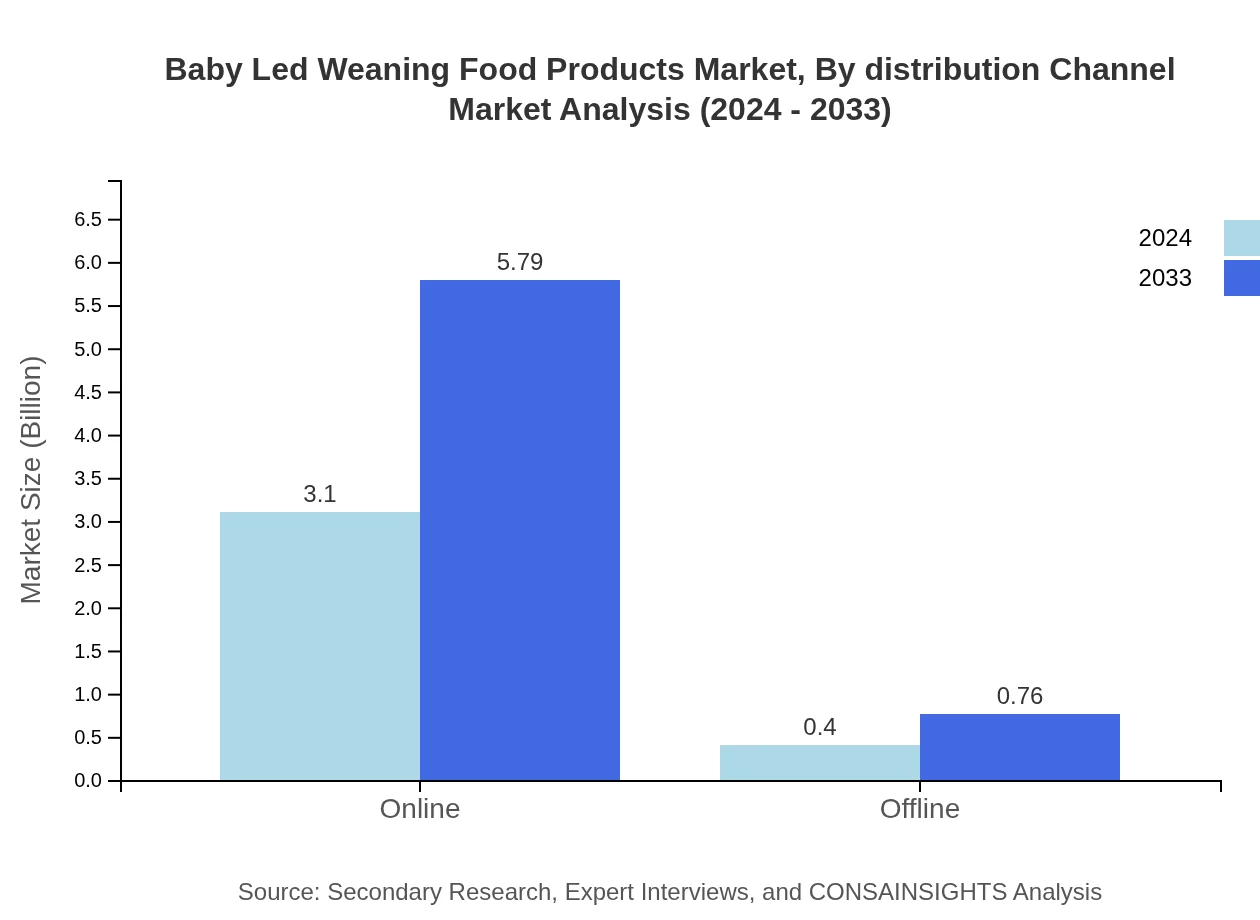

Baby Led Weaning Food Products Market Analysis By Distribution Channel

Distribution channel analysis reflects the increasing consumer shift towards varied purchasing platforms. In 2024, online channels recorded a dominant market size of 3.10 with a share of 88.43%, underscoring the significant role of e-commerce in driving market growth. Conversely, offline channels possess a smaller but stable market presence reflected by a size of 0.40 and a share of 11.57%. As digital penetration increases and consumer trust in online shopping strengthens, this segment is set to expand further, aided by innovative digital marketing strategies and enhanced logistic solutions.

Baby Led Weaning Food Products Market Analysis By Packaging

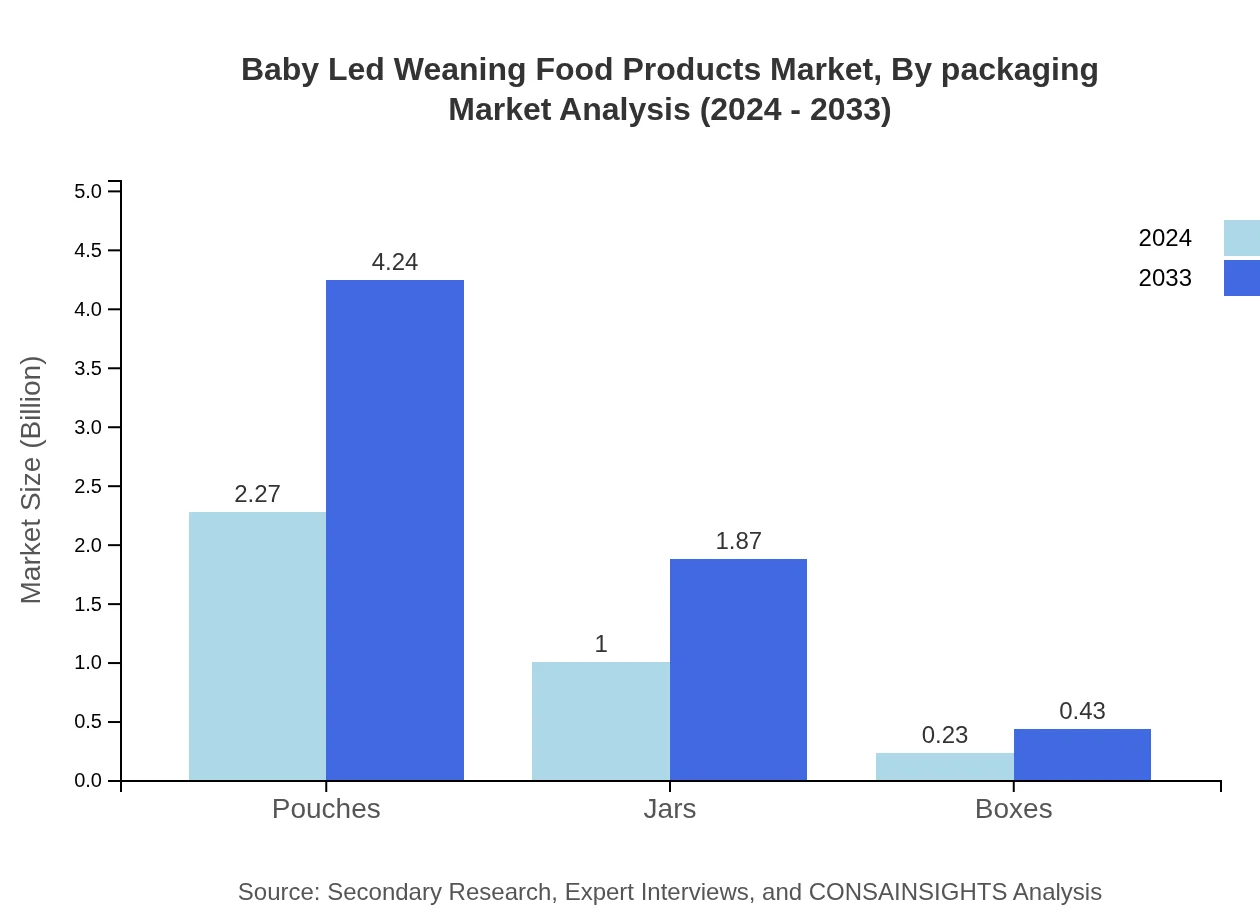

Packaging segmentation examines the impact of packaging innovations on product performance and consumer appeal. In 2024, products packaged in pouches and jars have shown considerable market traction. Pouches, with a market size of 2.27 and share of 64.81%, are highly favored for their convenience and portability. Jars, contributing a market size of 1.00 with a 28.63% share, remain a popular choice for preserving product integrity and enhancing shelf life. Similarly, boxes and other formats, though representing a smaller percentage of the market, are critical in delivering niche solutions. Improved packaging technologies continue to revolutionize the way products are presented and preserved in the marketplace.

Baby Led Weaning Food Products Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Baby Led Weaning Food Products Industry

NutriStart Inc.:

NutriStart Inc. is at the forefront of innovation in the Baby Led Weaning Food Products industry. With a focus on organic and nutritionally balanced products, the company has been instrumental in developing advanced packaging solutions and expanding its global footprint.TinyBite Foods:

TinyBite Foods has established itself as a key player by introducing a diversified product portfolio that meets the evolving needs of young families. Their commitment to research and quality assurance has set high standards in the market.WeanWell Nutrition:

WeanWell Nutrition is renowned for its research-driven approach, emphasizing baby-led weaning techniques and the development of safe, nutritious, and appealing products that resonate with modern parental values.We're grateful to work with incredible clients.

FAQs

How can the baby Led Weaning Food Products report help align our marketing strategy with customer adoption trends?

The baby-led weaning food products market has achieved a size of $3.5 billion with a CAGR of 7.0%. Understanding this growth helps tailor marketing strategies to reflect customer preferences and increase adoption rates by focusing on trending flavors and formats.

What product features are in highest demand according to the baby Led Weaning Food Products trends?

Analysis shows pouches and organic options lead user preference, holding 64.81% and 88.43% market share respectively for 6-12 months segment. Emphasizing these features can increase customer satisfaction and market penetration.

Which regions offer the best market entry and expansion opportunities in the baby Led Weaning Food Products industry?

Asia Pacific and North America show promising growth. North America projects a market size growth from $1.21 billion in 2024 to $2.26 billion by 2033, indicating robust entry opportunities in these regions.

What emerging technologies and innovations are shaping the baby Led Weaning Food Products market?

Innovations in packaging, such as resealable pouches, enhance product freshness, while advancements in organic sourcing resonate with health-conscious parents. These technologies attract more buyers and expand market reach significantly.

Does the baby Led Weaning Food Products report include competitive landscape and market share analysis?

Yes, the report contains a detailed analysis of competitive landscape, highlighting market shares of key players in segments such as organic and non-organic products, essential for strategic planning and market entry.

How can executives use the baby Led Weaning Food Products report to evaluate investment risks and ROI?

The report outlines market forecasts and trends, equipping executives to assess potential risks versus expected ROI. With clear growth trajectories, such as a projected $3.5 billion value by 2033, informed investment decisions become feasible.

What is the market size of baby Led Weaning Food Products?

The baby-led-weaning food products market is currently valued at $3.5 billion with a projected CAGR of 7.0% through 2033, indicating significant growth potential over the next decade.

What are the market forecasts for baby Led Weaning Food Products by region?

By 2033, Europe's market will reach $2.13 billion, North America $2.26 billion, and Asia Pacific $1.18 billion. These regional forecasts highlight areas of strong demand and market potential.

What segment data can be highlighted for baby Led Weaning Food Products?

The 6-12 months age segment dominates at $3.10 billion, while organic products retain 88.43% share. These insights reflect consumer preferences, guiding product development and marketing focus.