Bacterial Biopesticides Market Report

Published Date: 02 February 2026 | Report Code: bacterial-biopesticides

Bacterial Biopesticides Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive market report analyzes the Bacterial Biopesticides market from 2023 to 2033, providing insights on market size, trends, segmentation, and competitive landscape to inform strategic business decisions.

| Metric | Value |

|---|---|

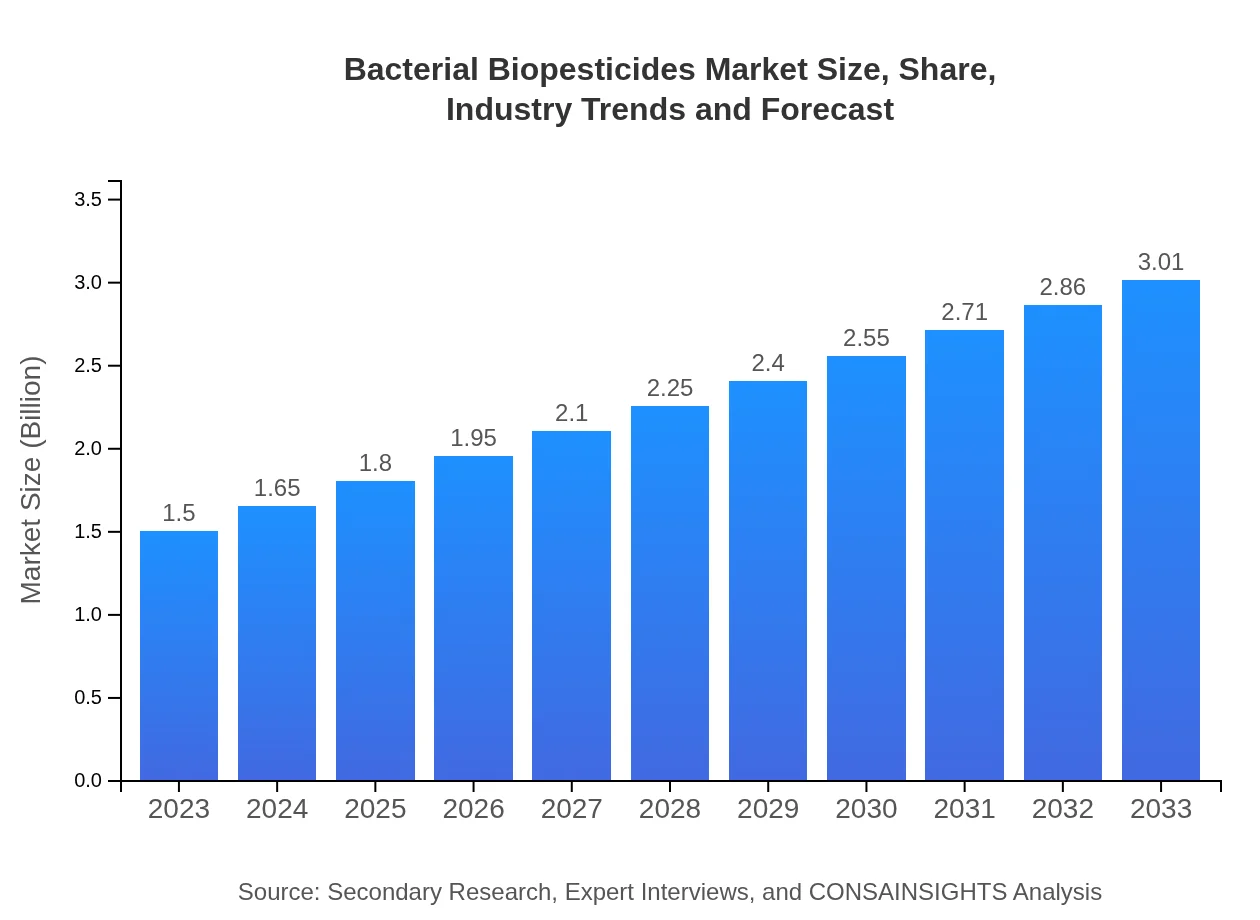

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $3.01 Billion |

| Top Companies | BASF SE, Marrone Bio Innovations, Inc., Certis USA LLC, Valent U.S.A. Corporation |

| Last Modified Date | 02 February 2026 |

Bacterial Biopesticides Market Overview

Customize Bacterial Biopesticides Market Report market research report

- ✔ Get in-depth analysis of Bacterial Biopesticides market size, growth, and forecasts.

- ✔ Understand Bacterial Biopesticides's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bacterial Biopesticides

What is the Market Size & CAGR of Bacterial Biopesticides market in 2023 and 2033?

Bacterial Biopesticides Industry Analysis

Bacterial Biopesticides Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bacterial Biopesticides Market Analysis Report by Region

Europe Bacterial Biopesticides Market Report:

Europe's Bacterial Biopesticides market is expected to expand from $0.38 billion in 2023 to $0.77 billion in 2033. With increasing emphasis on sustainability and reduction of chemical pesticide usage, European countries are adopting biopesticides at a faster rate, supported by policies that encourage eco-friendly practices.Asia Pacific Bacterial Biopesticides Market Report:

The Asia Pacific region is expected to experience substantial growth in the Bacterial Biopesticides market, increasing from $0.30 billion in 2023 to $0.59 billion in 2033. Factors such as the rise in organic farming activities, increasing awareness regarding the harmful effects of chemical pesticides, and government initiatives promoting sustainable agriculture practices are driving industry expansion in this region.North America Bacterial Biopesticides Market Report:

North America holds a significant share of the global Bacterial Biopesticides market, projected to increase from $0.51 billion in 2023 to $1.03 billion by 2033. This robust growth is fueled by stringent regulatory frameworks promoting biopesticides, a strong consumer preference for organic products, and advancements in agricultural technologies.South America Bacterial Biopesticides Market Report:

The South American market, starting at $0.13 billion in 2023 and growing to $0.26 billion by 2033, is also witnessing a gradual acceptance of biological pest control methods. The region's diverse agricultural landscape, comprising a variety of crops cultivated using both traditional and modern farming techniques, enhances market potential for bacterial biopesticides.Middle East & Africa Bacterial Biopesticides Market Report:

The market in the Middle East and Africa, starting at $0.18 billion and projected to reach $0.36 billion by 2033, remains relatively smaller but is growing due to rising demand for sustainable farming practices amid climate concerns. The increasing recognition of biopesticides as viable alternatives to chemical pesticides is expected to enhance market accessibility.Tell us your focus area and get a customized research report.

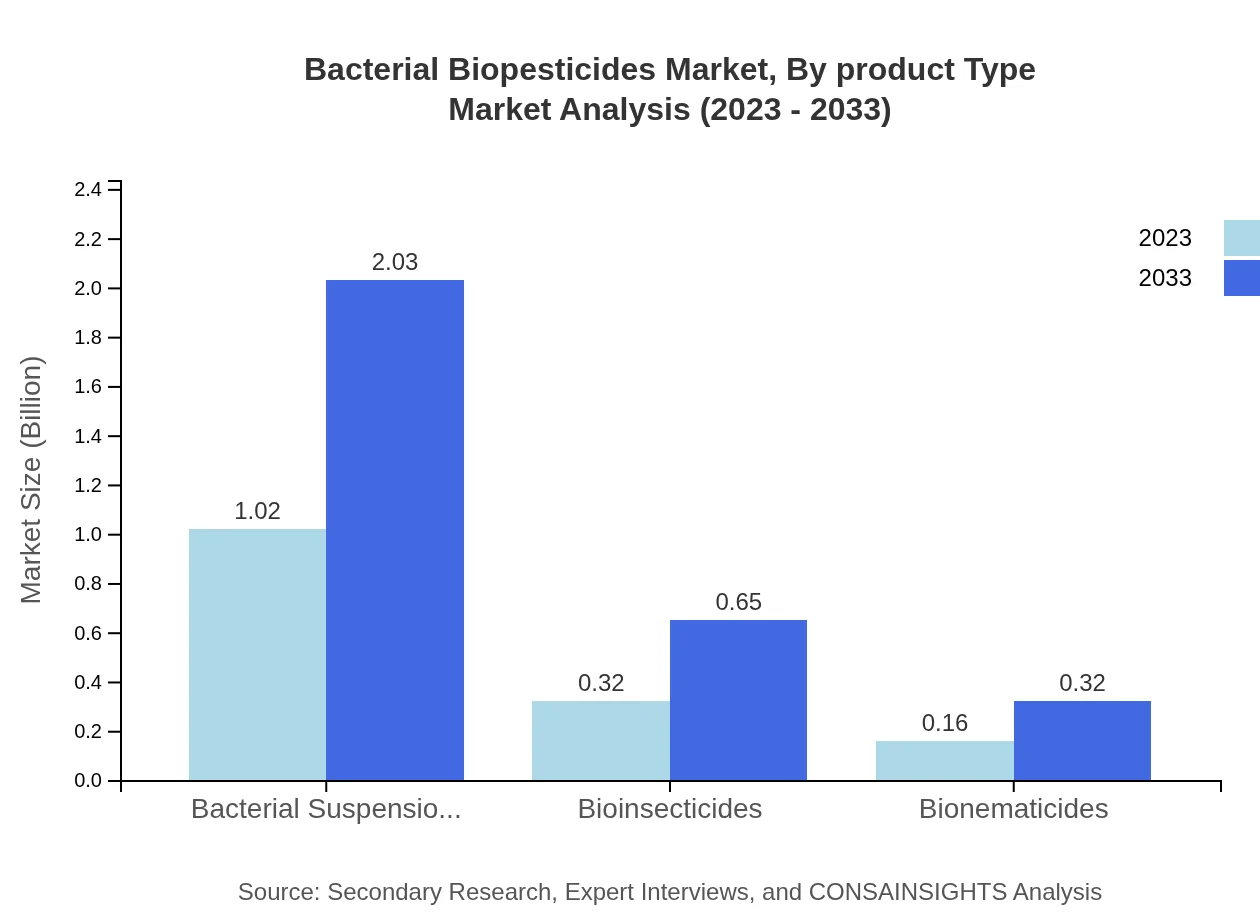

Bacterial Biopesticides Market Analysis By Product Type

The Bacterial Biopesticides market demonstrates diverse product lines, with Bacterial Suspensions holding significant market share due to their effectiveness and safety. Bioinsecticides and Bionematicides also represent essential segments, catering to specific pest challenges faced by growers. The estimated market size in 2023 displays Bacterial Suspensions at $1.02 billion, projected to increase to $2.03 billion by 2033, reflecting a strong dependency and trust in this product type.

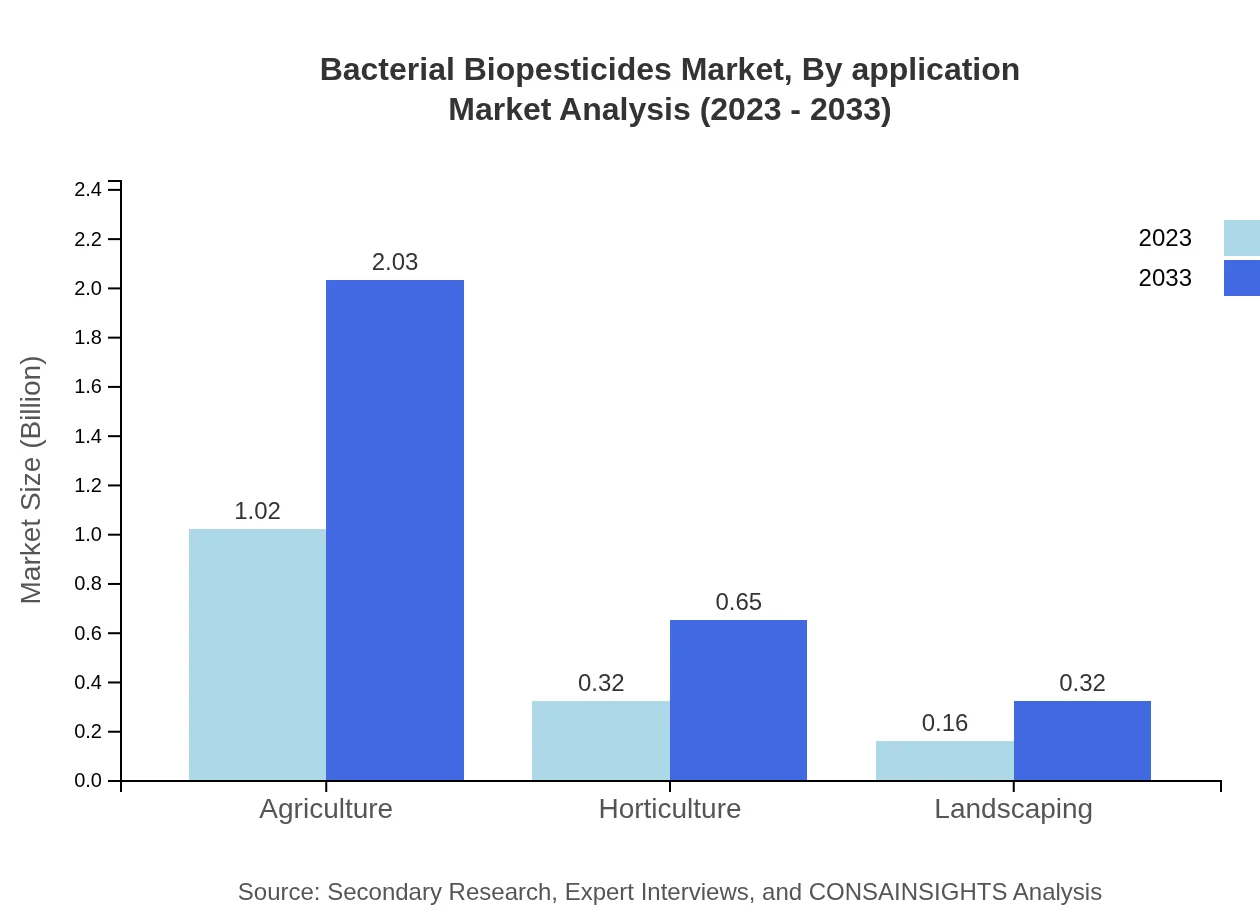

Bacterial Biopesticides Market Analysis By Application

The application of bacterial biopesticides is segmented primarily into Agriculture and Horticulture, which together constitute around 89.23% of the market in 2023. Agriculture leads with $1.02 billion, while Horticulture, showing rapid growth, is expected to capture a larger share given the increasing demand for organic produce in urban settings.

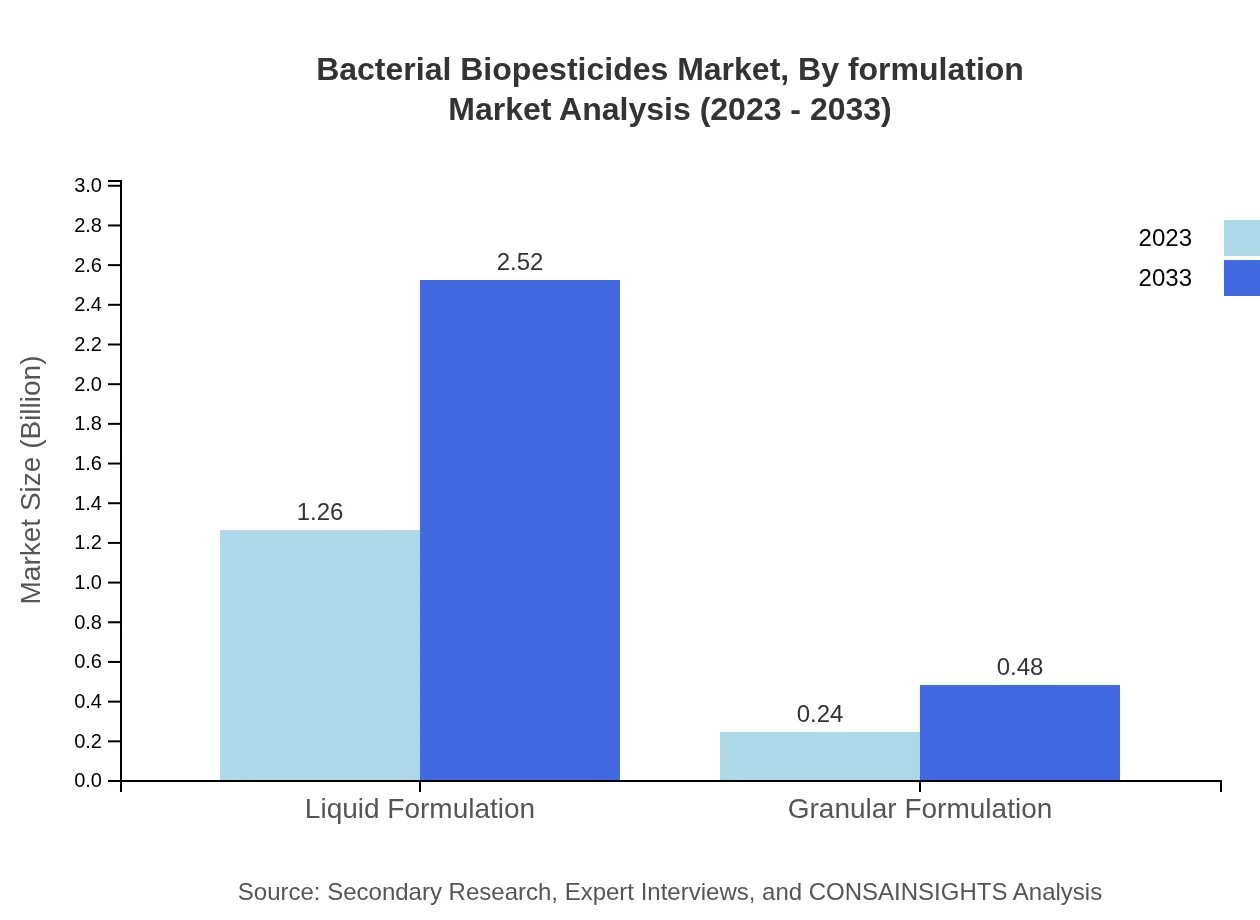

Bacterial Biopesticides Market Analysis By Formulation

Liquid Formulations dominate the Bacterial Biopesticides market, accounting for approximately 83.93% market share, valued at $1.26 billion in 2023 and expected to reach $2.52 billion by 2033. Granular formulations, while smaller at 16.07%, provide specific benefits to particular applications in agriculture and horticulture.

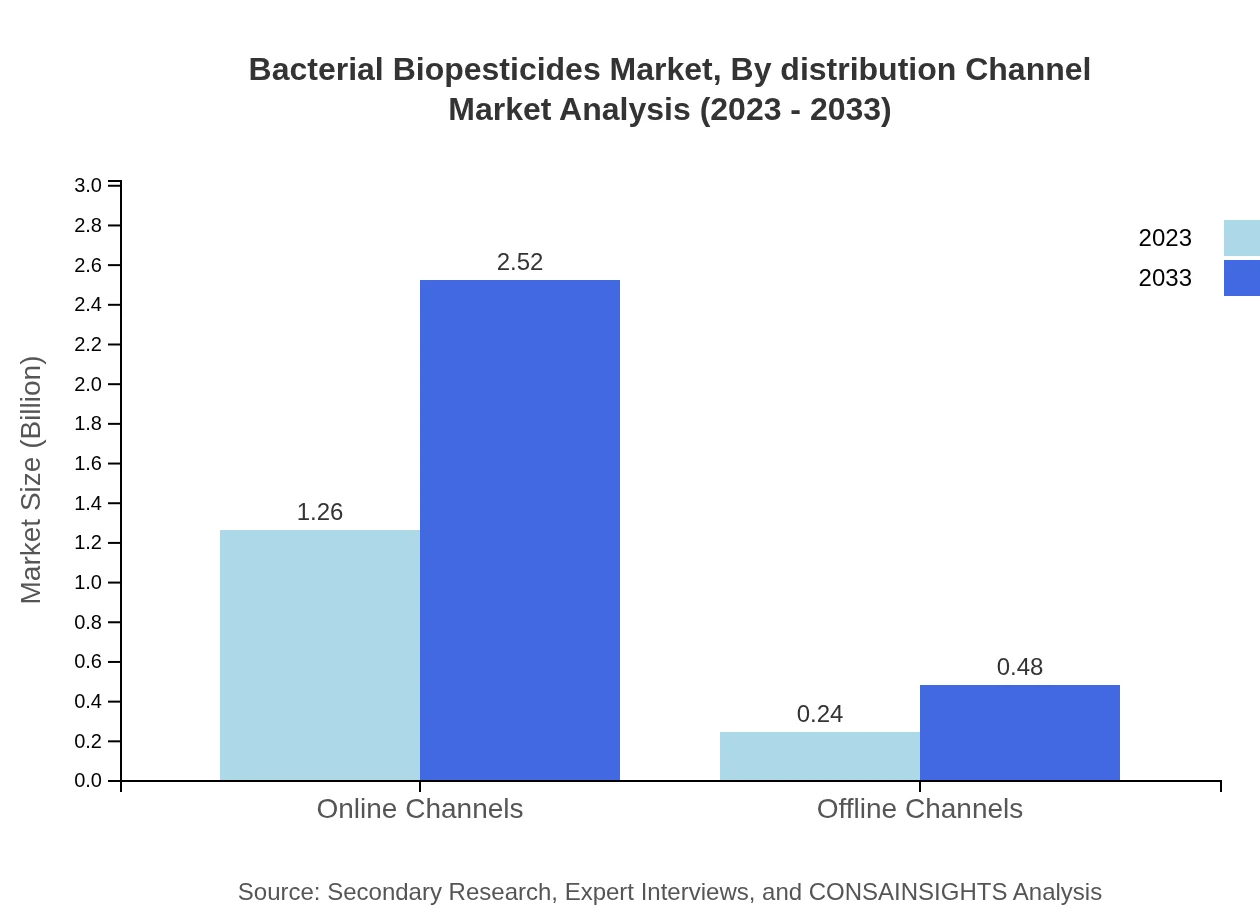

Bacterial Biopesticides Market Analysis By Distribution Channel

Online channels have emerged as the primary distribution method for bacterial biopesticides, projected to account for 83.93% of market share due to the increased accessibility of products. Offline channels, while only constituting 16.07% of distribution, retain importance especially in regions with less internet penetration.

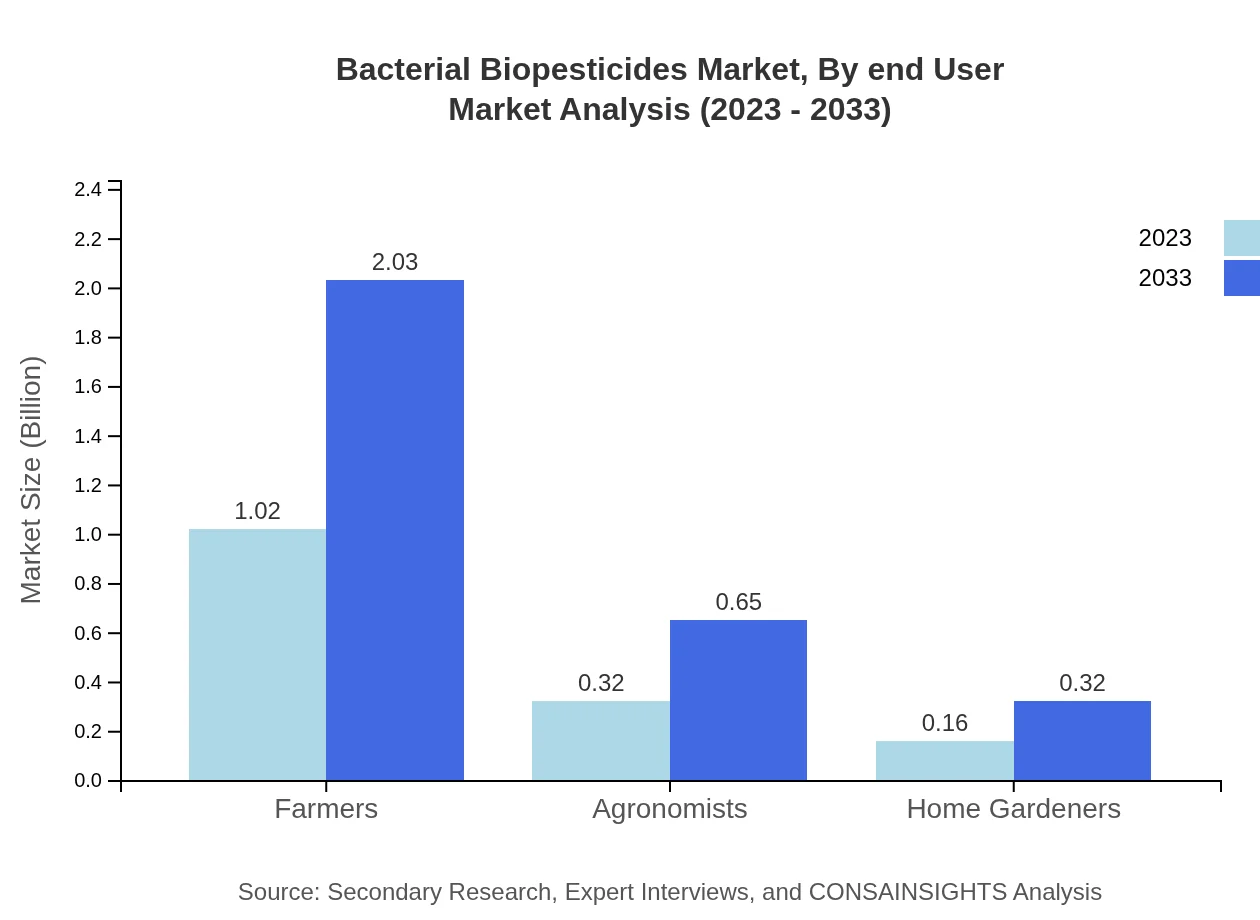

Bacterial Biopesticides Market Analysis By End User

Farmers remain the primary end-user category, with a market share of approximately 67.67% in 2023, expected to continue dominating the market. However, agronomists and home gardeners are emerging as critical groups, due to the rising popularity of home gardening and personal crop cultivation.

Bacterial Biopesticides Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bacterial Biopesticides Industry

BASF SE:

A leading chemical company with a strong portfolio in agricultural solutions, BASF focuses on sustainable agricultural practices and has developed several innovative products in the bacterial biopesticides sector.Marrone Bio Innovations, Inc.:

Specializing in biopesticides, Marrone Bio Innovations is committed to providing sustainable pest management solutions for both professional agricultural operations and home gardeners.Certis USA LLC:

Certis USA is a key player in the market offering a variety of biopesticide solutions, including innovative bacterial products designed for diverse agricultural applications.Valent U.S.A. Corporation:

Valent focusess on providing effective pest control solutions and has invested heavily in developing biopesticides, including bacterial-based products to serve a wide range of crops.We're grateful to work with incredible clients.

FAQs

What is the market size of bacterial Biopesticides?

The global bacterial biopesticides market is projected to grow from $1.5 billion in 2023 to significant levels by 2033. With a CAGR of 7%, increasing interest in sustainable agriculture is driving this growth.

What are the key market players or companies in this bacterial Biopesticides industry?

The bacterial biopesticides industry includes several key players such as Bayer AG, BASF SE, and Syngenta. These companies are focusing on innovation and expanding their product offerings to meet growing demand.

What are the primary factors driving the growth in the bacterial Biopesticides industry?

Key factors driving growth in the bacterial biopesticides market include increasing concerns over pesticide residues, rising adoption of organic farming, and regulatory support for sustainable agricultural practices.

Which region is the fastest Growing in the bacterial Biopesticides?

The Asia Pacific region is the fastest-growing market for bacterial biopesticides, expected to grow from $0.30 billion in 2023 to $0.59 billion by 2033, driven by intensive agricultural practices.

Does ConsaInsights provide customized market report data for the bacterial Biopesticides industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the bacterial biopesticides industry, ensuring relevant insights for stakeholders.

What deliverables can I expect from this bacterial Biopesticides market research project?

Expect comprehensive deliverables including detailed market size analysis, growth forecasts, competitive landscape assessment, and strategic recommendations tailored to specific segments.

What are the market trends of bacterial Biopesticides?

Trends in the bacterial biopesticides market include a shift towards eco-friendly pest control methods, increasing investment in R&D for innovative formulations, and a growing preference for online distribution channels such as e-commerce.