Bacteriocide Market Report

Published Date: 31 January 2026 | Report Code: bacteriocide

Bacteriocide Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Bacteriocide market, including market size, growth trends, segmentation, regional insights, and key player details from 2023 to 2033.

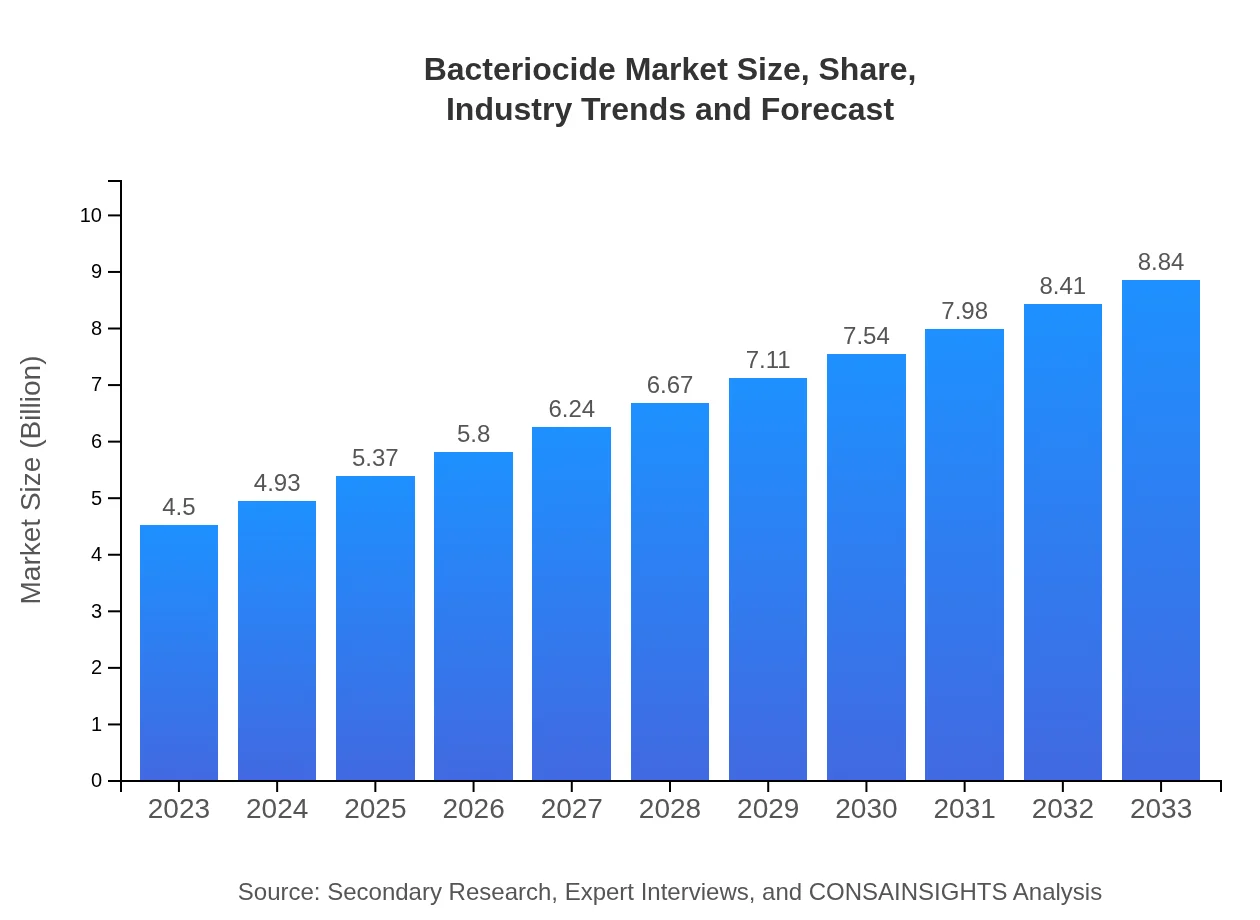

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $8.84 Billion |

| Top Companies | BASF SE, Syngenta AG, Dow AgroSciences, FMC Corporation |

| Last Modified Date | 31 January 2026 |

Bacteriocide Market Overview

Customize Bacteriocide Market Report market research report

- ✔ Get in-depth analysis of Bacteriocide market size, growth, and forecasts.

- ✔ Understand Bacteriocide's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bacteriocide

What is the Market Size & CAGR of Bacteriocide market in 2023?

Bacteriocide Industry Analysis

Bacteriocide Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bacteriocide Market Analysis Report by Region

Europe Bacteriocide Market Report:

The European market for bacteriocides is expected to grow from $1.36 billion in 2023 to $2.68 billion by 2033. Stringent regulatory frameworks and increasing demand for organic and sustainable agricultural practices contribute to this growth.Asia Pacific Bacteriocide Market Report:

The Asia Pacific market is expanding, with a 2023 value of $0.84 billion, projected to reach $1.65 billion by 2033. Growth is driven by increased agricultural productivity and reliance on bacteriocide formulations to enhance crop yields while maintaining environmental standards.North America Bacteriocide Market Report:

North America is among the largest markets, currently valued at $1.64 billion, with expectations to double to $3.22 billion by 2033. There is a significant emphasis on advanced agricultural practices and stringent hygiene regulations in various industries.South America Bacteriocide Market Report:

In South America, the market is projected to grow from $0.44 billion in 2023 to $0.86 billion by 2033. The increase is largely attributed to rising agricultural activities and a focus on sustainable farming solutions within the region.Middle East & Africa Bacteriocide Market Report:

The Middle East and Africa region's market is anticipated to grow from $0.22 billion in 2023 to $0.44 billion by 2033. The growth is driven by increasing investments in healthcare and agricultural sectors, coupled with rising awareness of hygiene standards.Tell us your focus area and get a customized research report.

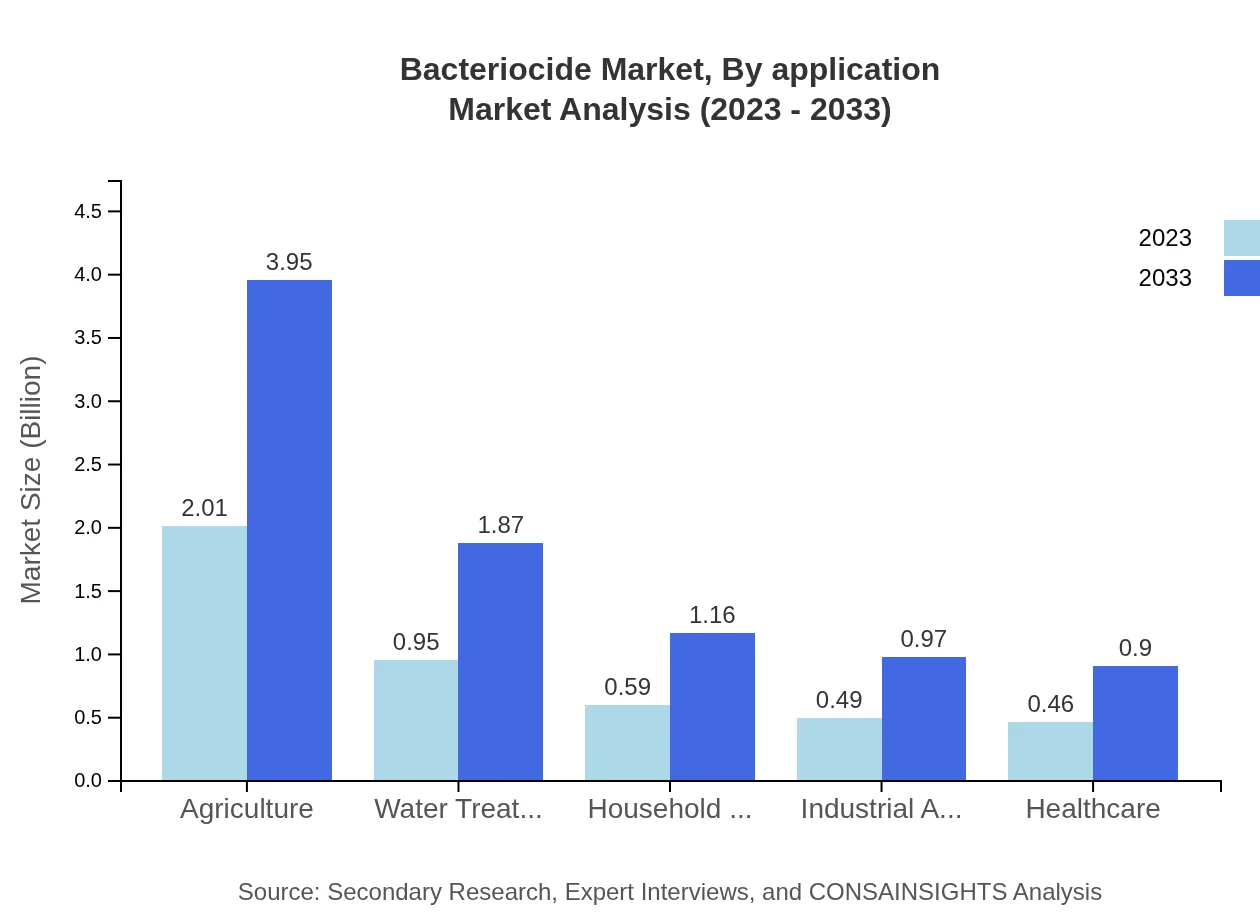

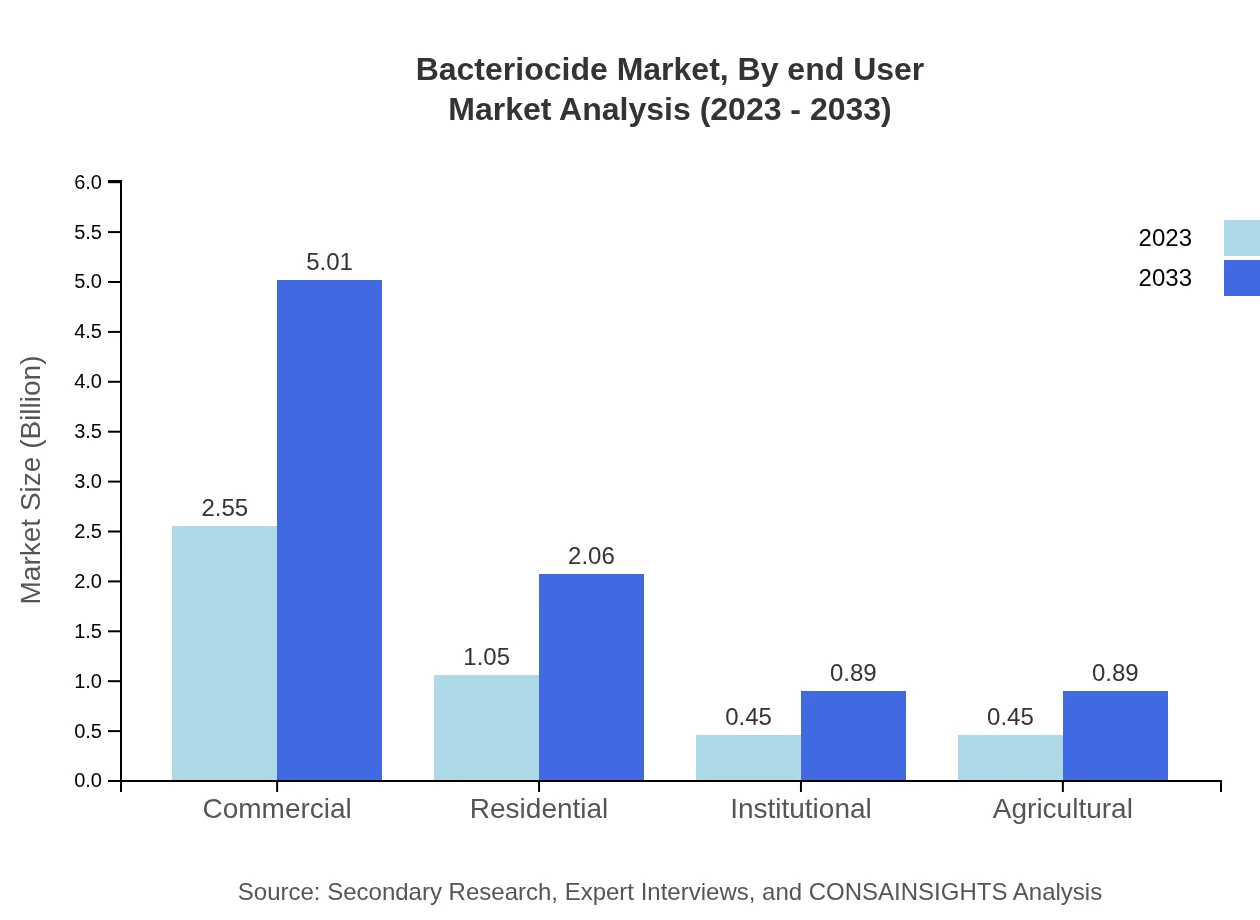

Bacteriocide Market Analysis By Application

The Bacteriocide market segments its applications across commercial, residential, institutional, agricultural, water treatment, and industrial sectors. The commercial segment, valued at $2.55 billion in 2023, will soar to $5.01 billion by 2033. Agriculture occupies a significant market share at 44.64%, showcasing its vital role in increasing food production sustainably.

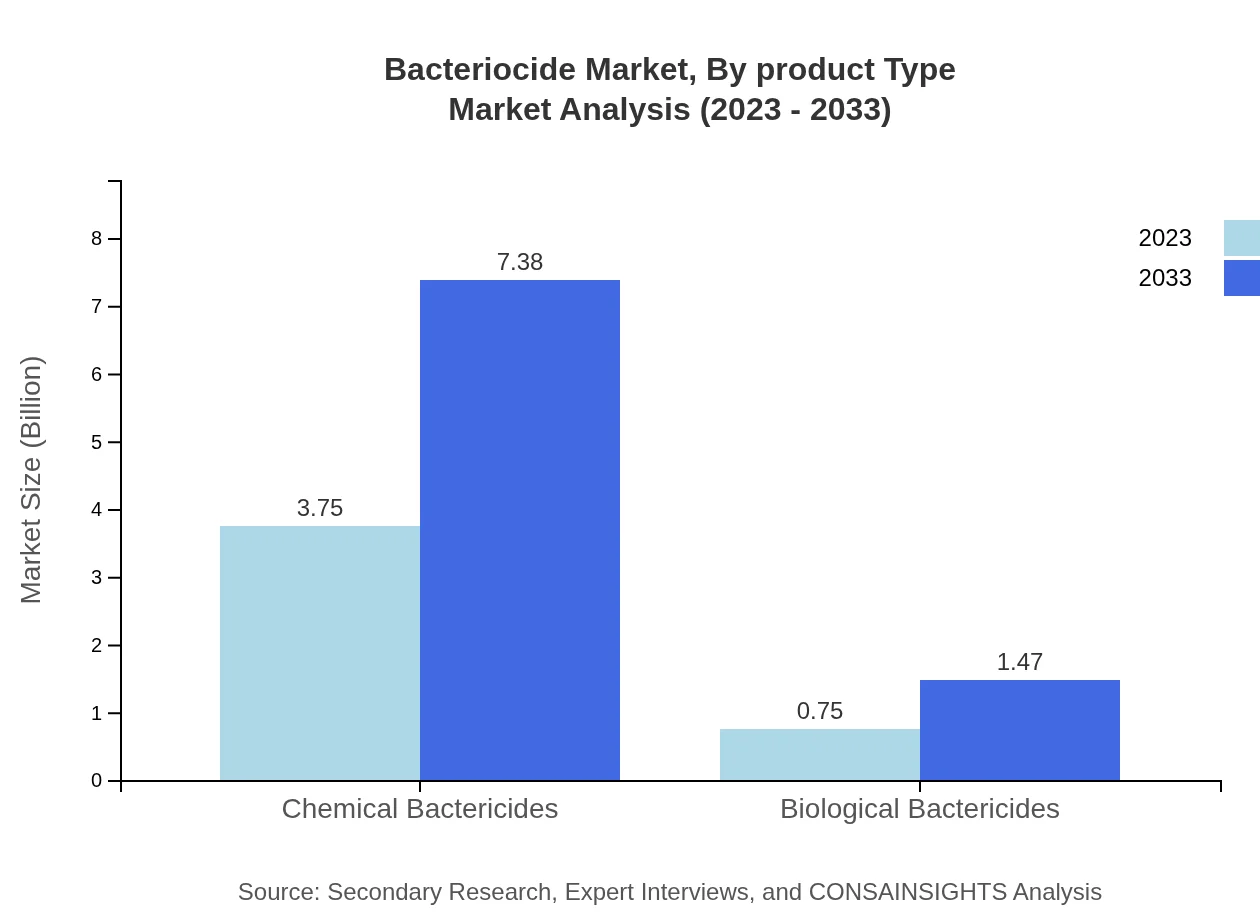

Bacteriocide Market Analysis By Product Type

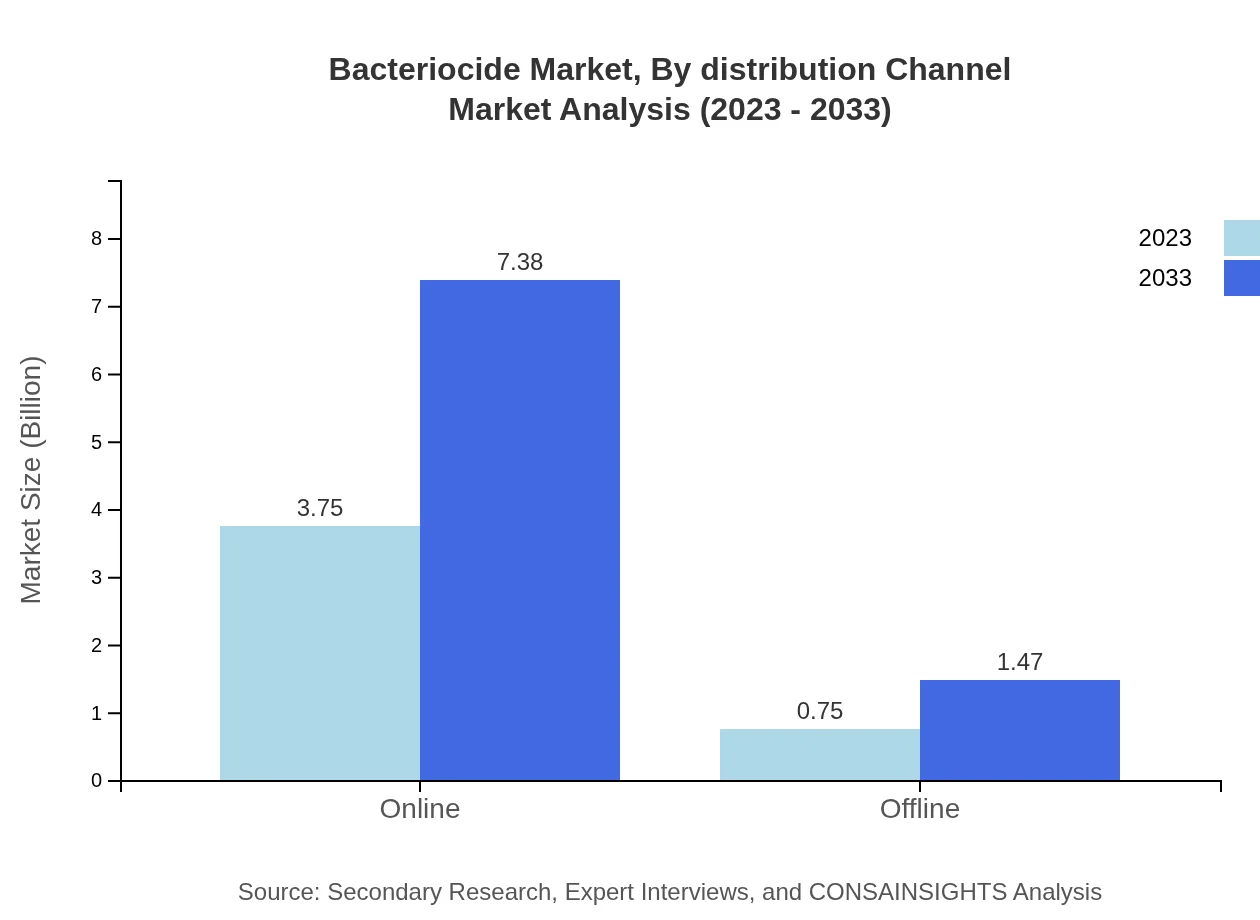

Chemical Bactericides dominate the market, contributing 83.39% in size, with projected growth from $3.75 billion in 2023 to $7.38 billion by 2033. In contrast, biological bactericides cater to niche environmental markets, expected to grow steadily from $0.75 billion to $1.47 billion.

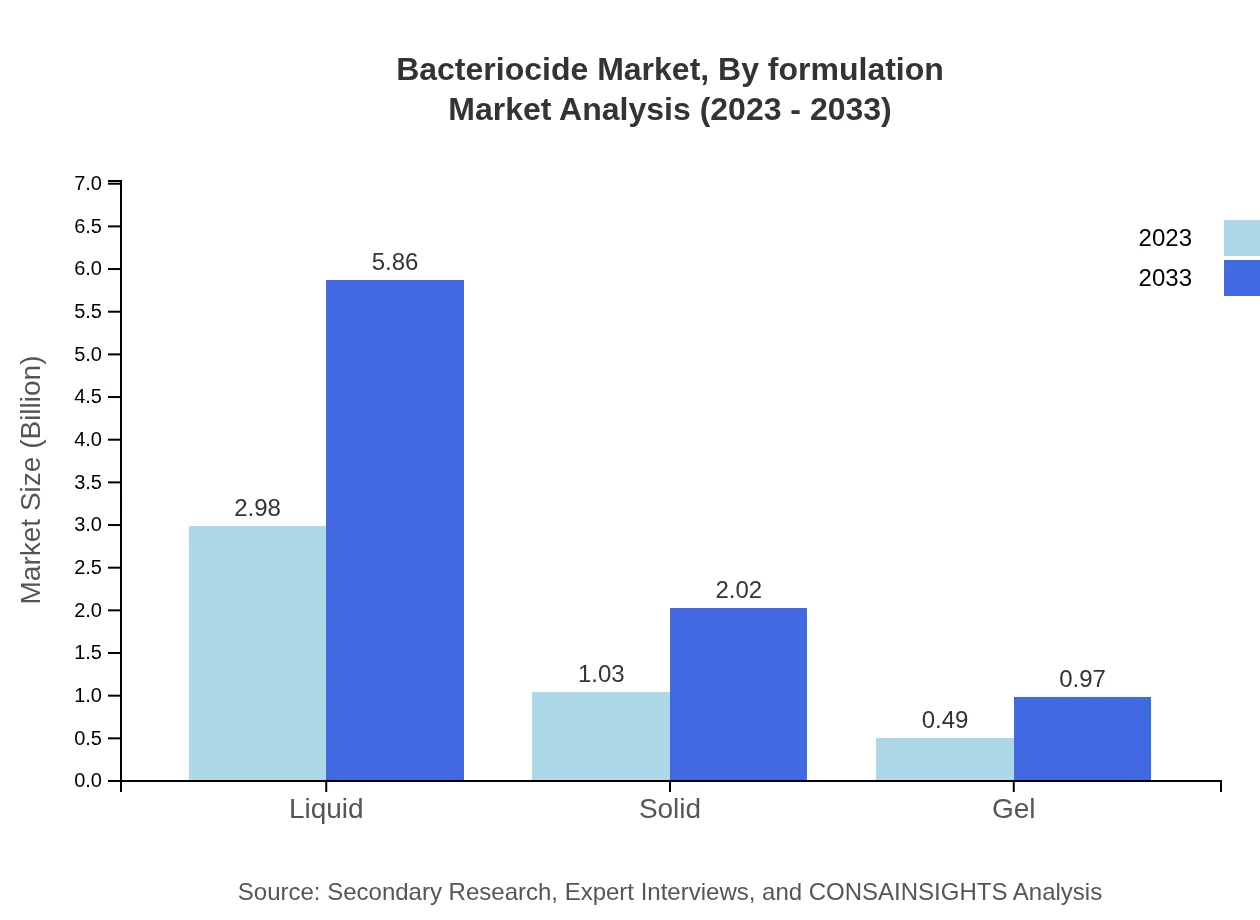

Bacteriocide Market Analysis By Formulation

Liquid formulations lead the bactericide market, accounting for 66.22% of the market share by size. Growth from $2.98 billion to $5.86 billion over the decade signals the consumer preference for easy application methods. Solid and gel formulations continue to sustain their respective market niches.

Bacteriocide Market Analysis By End User

The commercial end-user sector shows strong value, indicating robust sales and application of bactericides in various settings. With a 2023 market share of 56.59% and growth potential, this segment's demand signifies ongoing investments in cleanliness across industries.

Bacteriocide Market Analysis By Distribution Channel

The online distribution segment leads, accounting for 83.39% of sales in size. The shift toward e-commerce has changed how consumers access bactericides, ensuring more extensive reach and availability than traditional offline channels.

Bacteriocide Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bacteriocide Industry

BASF SE:

BASF is a leader in chemical manufacturing, offering a wide range of bactericides for agricultural and industrial applications. Their commitment to sustainability and innovation drives their product development.Syngenta AG:

Syngenta specializes in crop protection products, including advanced bactericide formulations, focusing on enhancing agricultural productivity while meeting environmental regulations.Dow AgroSciences:

Dow AgroSciences provides agricultural solutions, including high-performing bactericides aimed at improving crop quality and yields, with a strong emphasis on research and development.FMC Corporation:

FMC is known for its innovative agrochemicals, including bactericides, to support sustainable agriculture and enhance productivity across various crops.We're grateful to work with incredible clients.

FAQs

What is the market size of bacteriocide?

The global bacteriocide market is valued at approximately $4.5 billion in 2023 with a projected CAGR of 6.8% from 2023 to 2033, indicating robust growth and demand for bactericide products in various applications.

What are the key market players or companies in this bacteriocide industry?

The bacteriocide market comprises several key players including global chemical manufacturers and biocidal product companies that lead innovation. Their influence shapes market trends and product availability across various segments and regions.

What are the primary factors driving the growth in the bacteriocide industry?

Growth in the bacteriocide industry is driven by increased agricultural activities, stringent pest control regulations, and the rising demand for safe and efficient disinfection solutions, particularly in healthcare and food safety applications.

Which region is the fastest Growing in the bacteriocide?

The fastest-growing region in the bacteriocide market is North America, expected to grow from $1.64 billion in 2023 to $3.22 billion in 2033, supported by advancements in agricultural technology and healthcare solutions.

Does ConsaInsights provide customized market report data for the bacteriocide industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the bacteriocide industry, ensuring businesses receive pertinent insights for strategic decision-making.

What deliverables can I expect from this bacteriocide market research project?

Deliverables from the bacteriocide market research project include comprehensive reports detailing market insights, trends, forecasts, competitive landscape analyses, and segmented data for specific applications and regions.

What are the market trends of bacteriocide?

Key market trends in the bacteriocide sector include a shift towards eco-friendly products, increasing regulatory focus on safe chemical usage, growing demand for biological alternatives, and advancements in application technologies.