Baggage Handling System Market Report

Published Date: 03 February 2026 | Report Code: baggage-handling-system

Baggage Handling System Market Size, Share, Industry Trends and Forecast to 2033

This report provides in-depth insights into the baggage handling system market from 2023 to 2033, covering market size, growth rates, segmentation, regional analysis, and emerging trends. A comprehensive overview is designed to aid stakeholders in strategic decision-making.

| Metric | Value |

|---|---|

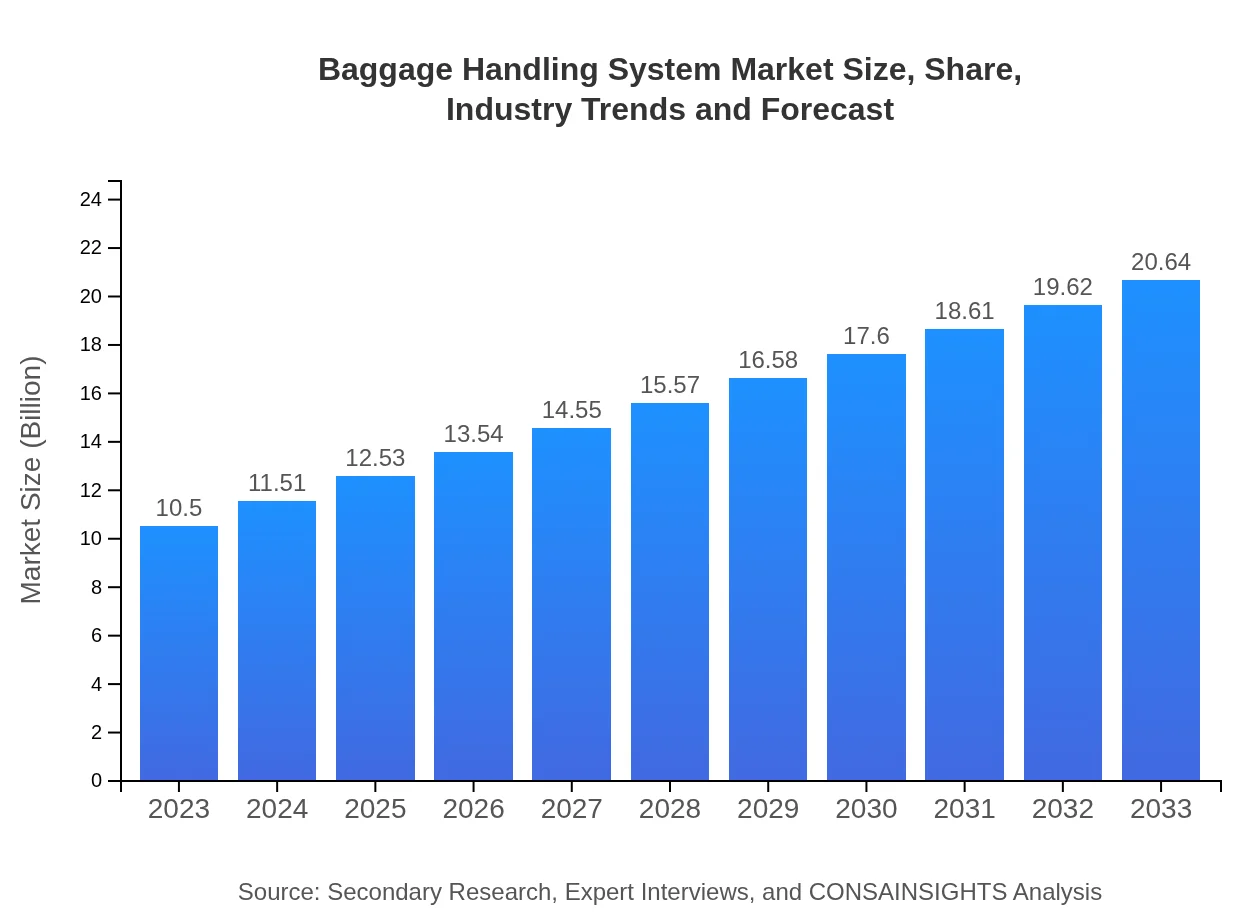

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Siemens AG, Daifuku Co., Ltd., Vanderlande Industries, Beumer Group, Honeywell International Inc. |

| Last Modified Date | 03 February 2026 |

Baggage Handling System Market Overview

Customize Baggage Handling System Market Report market research report

- ✔ Get in-depth analysis of Baggage Handling System market size, growth, and forecasts.

- ✔ Understand Baggage Handling System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Baggage Handling System

What is the Market Size & CAGR of Baggage Handling System market in 2023?

Baggage Handling System Industry Analysis

Baggage Handling System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Baggage Handling System Market Analysis Report by Region

Europe Baggage Handling System Market Report:

The European market for baggage handling systems is estimated to grow from USD 2.83 billion in 2023 to USD 5.57 billion by 2033. The growth is attributed to stringent security protocols and the need for automation to handle increasing flight schedules. European airports are progressively investing in modernizing their baggage handling infrastructure to enhance customer experience.Asia Pacific Baggage Handling System Market Report:

The Asia-Pacific region is witnessing a growing market for baggage handling systems, projected to grow from USD 2.00 billion in 2023 to USD 3.93 billion by 2033. Factors such as rapidly expanding airports and increasing air travel demand significantly drive this growth. Innovations in automation and emphasis on improved operational efficiency are also notable trends in this region.North America Baggage Handling System Market Report:

North America is the largest market for baggage handling systems, projected to grow from USD 4.08 billion in 2023 to USD 8.02 billion by 2033. The presence of major airports and a focus on adopting advanced technologies are primary growth factors. Additionally, safety regulations and increasing passenger numbers drive investments in modern baggage systems.South America Baggage Handling System Market Report:

In South America, the market for baggage handling systems is expected to rise from USD 0.37 billion in 2023 to USD 0.72 billion by 2033. The growth is driven by increasing investments in airport infrastructure and the enhancement of passenger services. However, the market faces challenges related to economic fluctuations and inadequate infrastructure in some regions.Middle East & Africa Baggage Handling System Market Report:

The Middle East and Africa region is expected to experience significant growth in the baggage handling system market, growing from USD 1.22 billion in 2023 to USD 2.40 billion by 2033. This growth is spearheaded by expanding airport projects and rising tourism. Moreover, increasing awareness of operational efficiencies encourages the adoption of sophisticated baggage handling solutions.Tell us your focus area and get a customized research report.

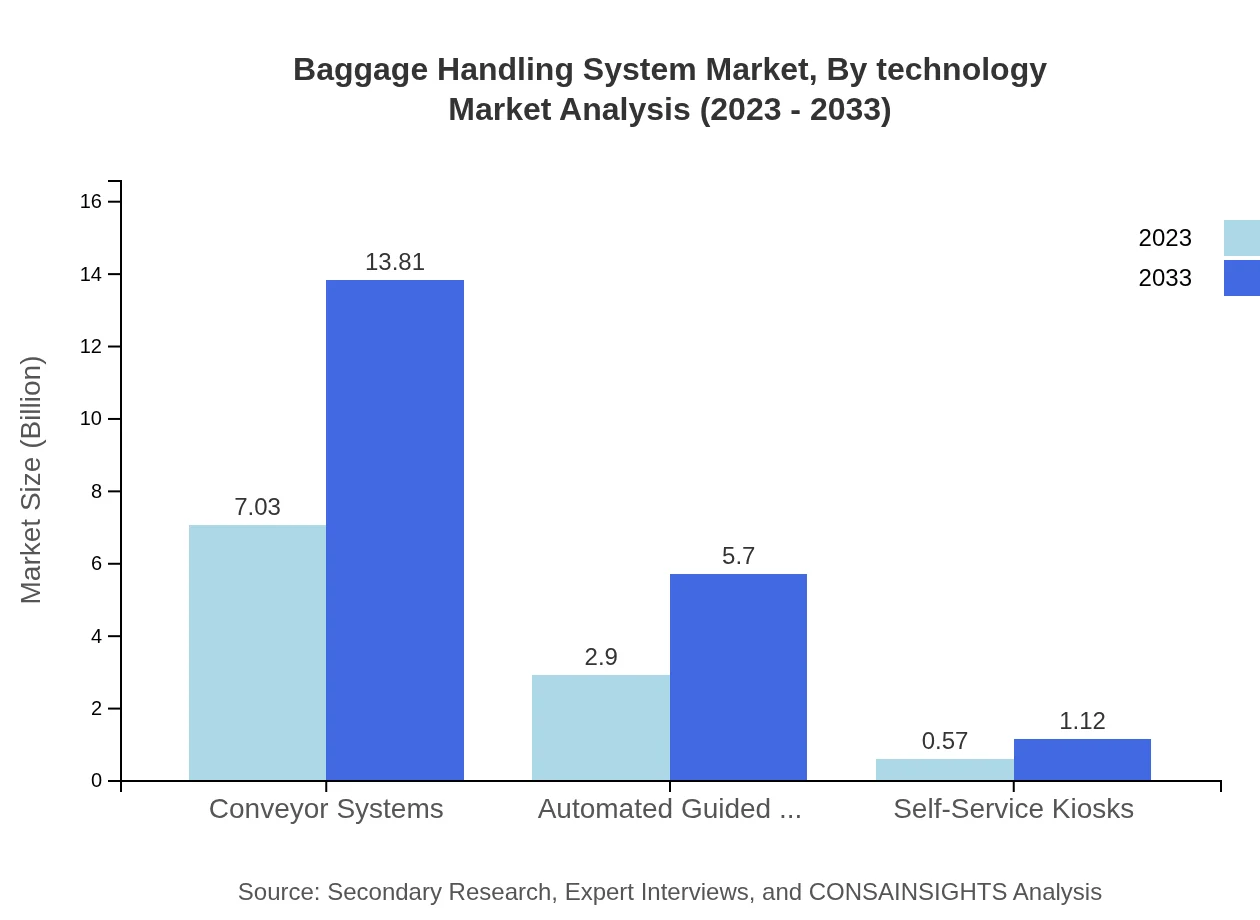

Baggage Handling System Market Analysis By Technology

The market is divided into automated and manual systems. In 2023, automated systems dominate the market, valued at USD 1.74 billion. This segment is expected to reach USD 3.43 billion by 2033, reflecting a growing preference for efficiency and automation. Manual systems will also see growth, increasing from USD 8.76 billion in 2023 to USD 17.21 billion by 2033.

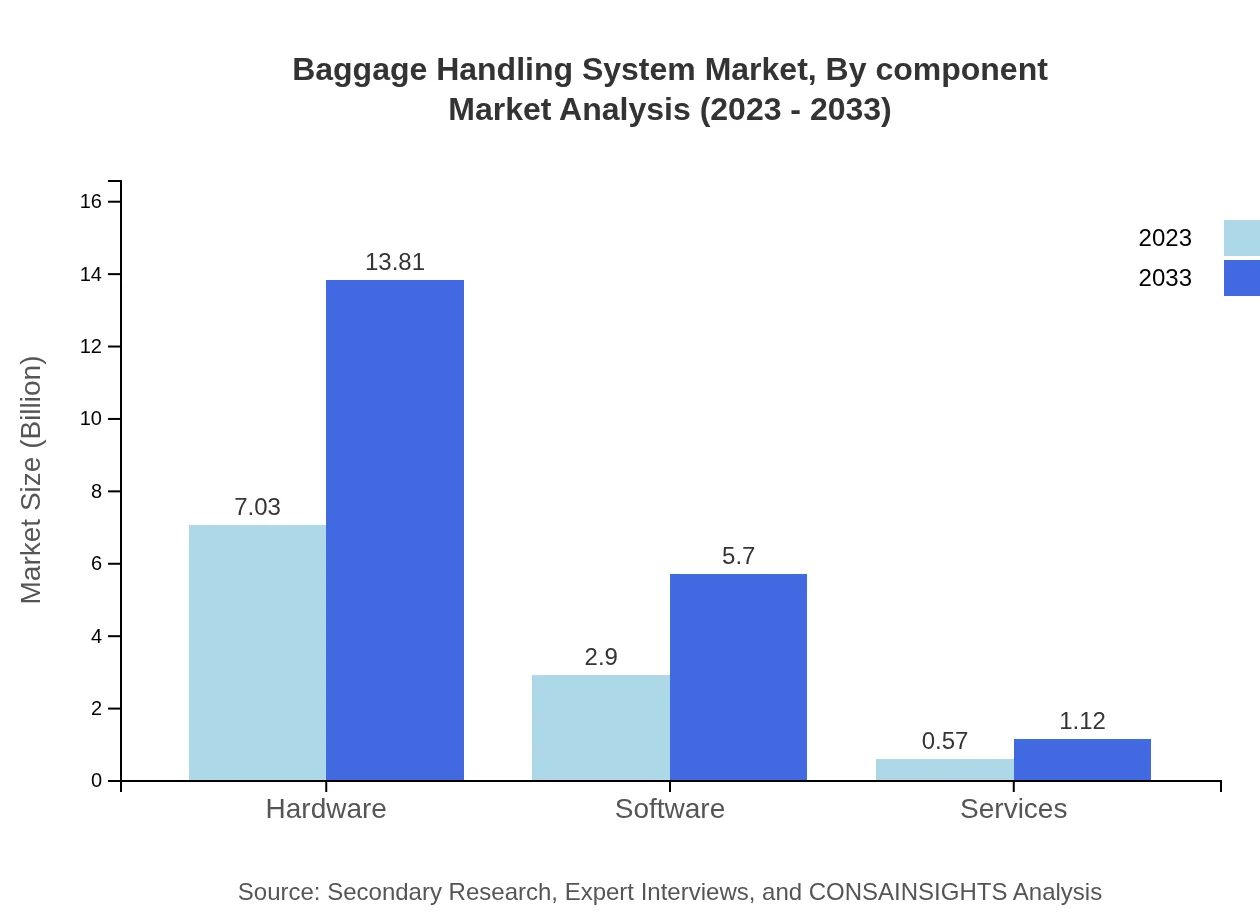

Baggage Handling System Market Analysis By Component

The market can be segmented into software and hardware components. Hardware components hold a larger share, valued at USD 7.03 billion in 2023, expected to grow to USD 13.81 billion by 2033. Software components are also expected to increase their market share, from USD 2.90 billion in 2023 to USD 5.70 billion by 2033 as digital solutions become critical.

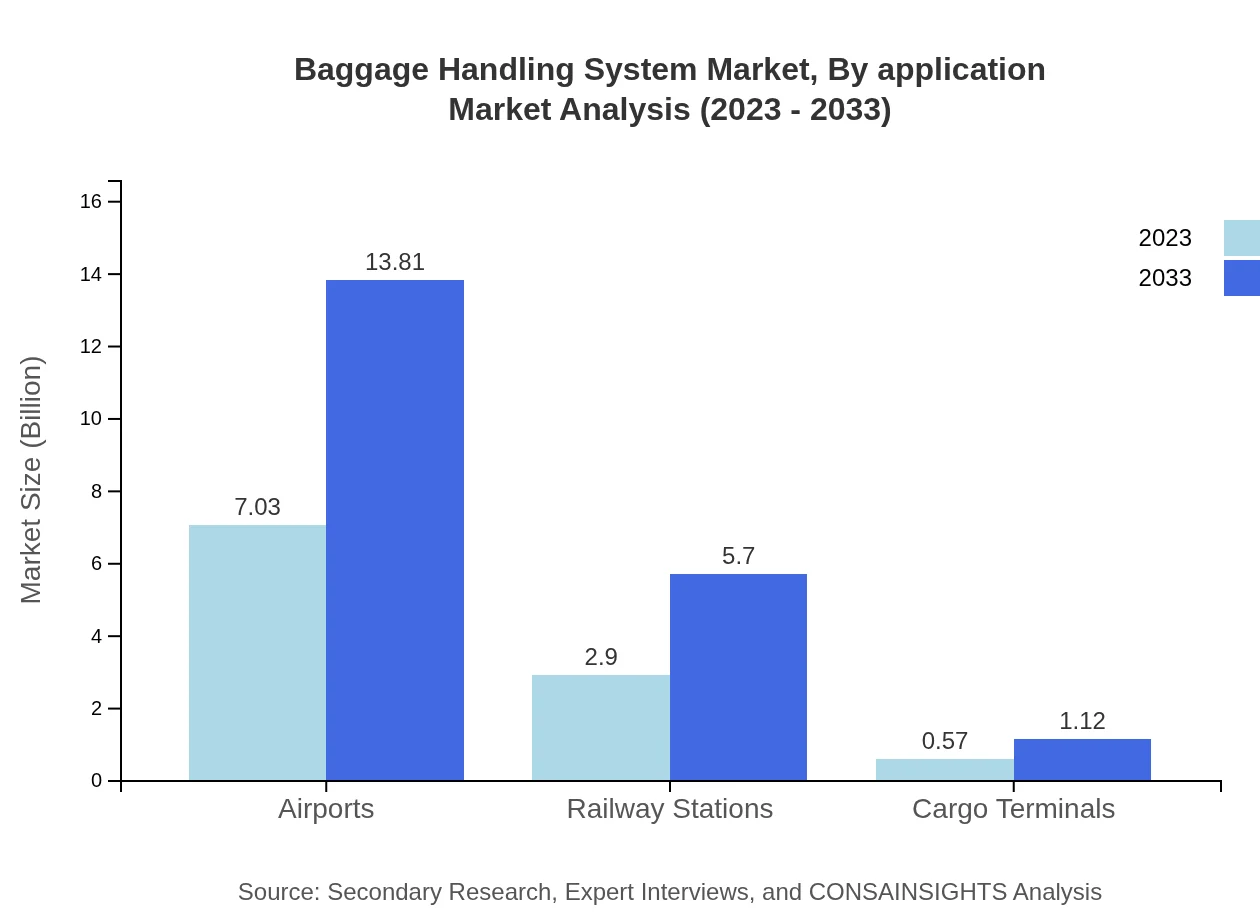

Baggage Handling System Market Analysis By Application

The application segment includes airports, cargo terminals, and railway stations. Airports lead this segment, contributing USD 7.03 billion in 2023 and reaching USD 13.81 billion by 2033. This growth reflects ongoing improvements in passenger experience and baggage management both in domestic and international flights.

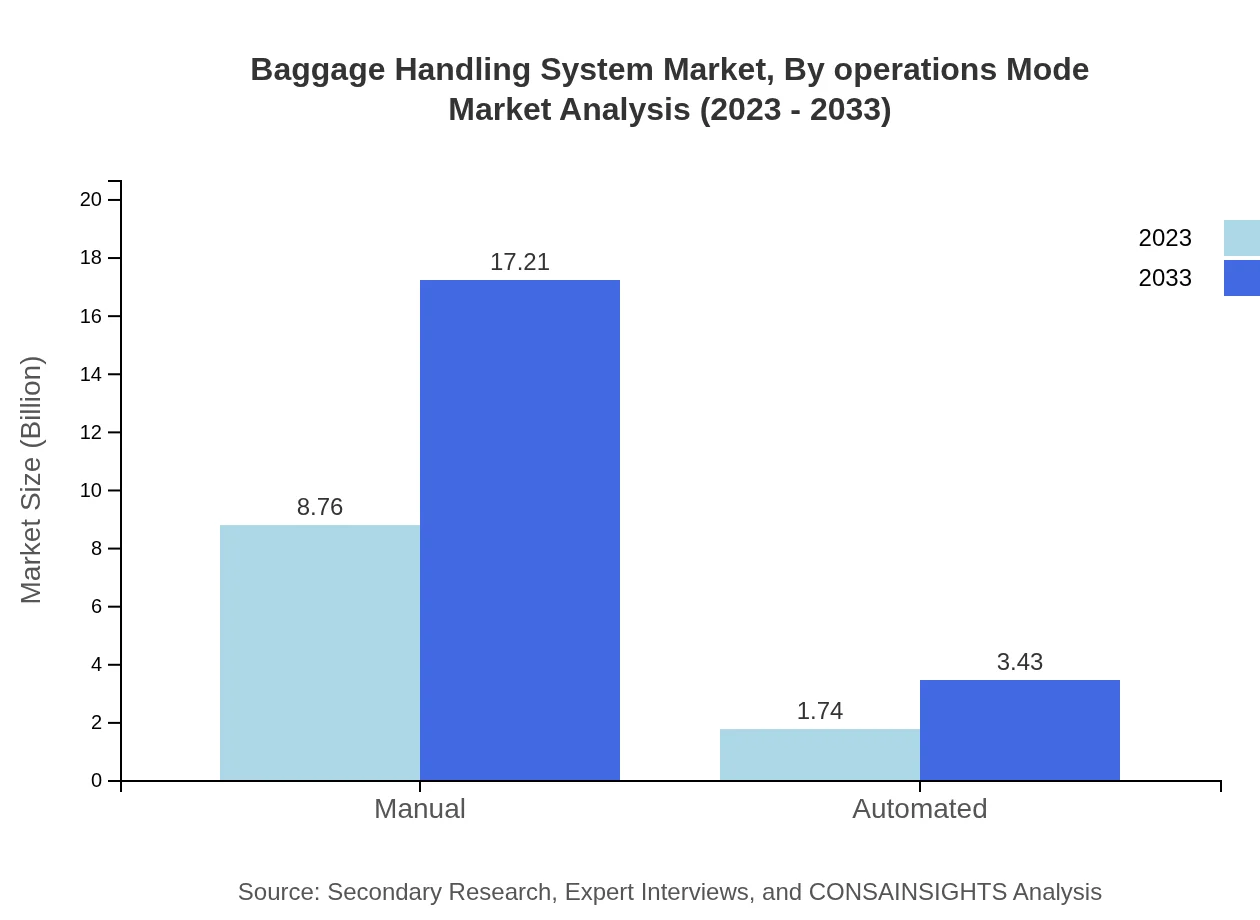

Baggage Handling System Market Analysis By Operations Mode

The market is categorized based on operational modes into automated and manual operations. Automated modes were valued at USD 1.74 billion in 2023 and are projected to double by 2033. The manual operation segment will see continuous demand due to the need for service during peak hours, rising from USD 8.76 billion in 2023 to USD 17.21 billion by 2033.

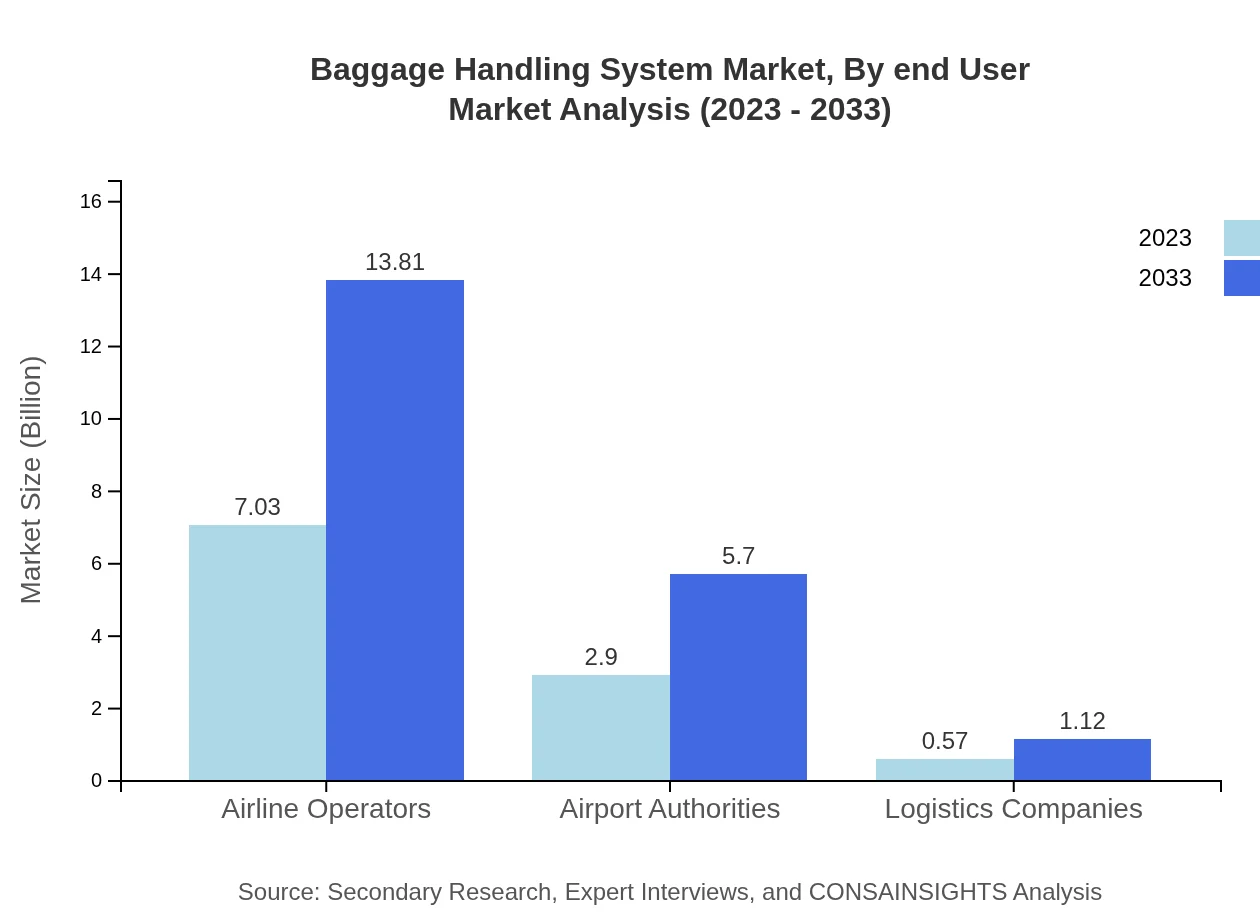

Baggage Handling System Market Analysis By End User

End-user segmentation includes airline operators, airport authorities, and logistics companies. Airline operators hold the largest market share, valued at USD 7.03 billion in 2023 with a market share of 66.94%, expected to maintain that share through 2033. Airport authorities follow, currently at USD 2.90 billion and projected to increase to USD 5.70 billion by 2033.

Baggage Handling System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Baggage Handling System Industry

Siemens AG:

A major player in the automation and optimization of infrastructure solutions globally; Siemens AG provides cutting-edge baggage handling systems characterized by high efficiency.Daifuku Co., Ltd.:

Specializes in material handling systems, including automated baggage handling; Daifuku employs advanced technology for integrated solutions in airports.Vanderlande Industries:

A leading company focusing on baggage handling systems and airport automation; Vanderlande is known for its commitment to innovation and quality service.Beumer Group:

Provides system technology for baggage handling and distribution; Beumer Group emphasizes sustainability and efficiency in its solutions.Honeywell International Inc.:

Integrates technology and automation for improving baggage handling efficiency, offering a range of products that enhance operational capacity while ensuring safety.We're grateful to work with incredible clients.

FAQs

What is the market size of baggage Handling System?

The global baggage handling system market is projected to reach approximately $10.5 billion by 2033, growing at a CAGR of 6.8% during the forecast period. This growth highlights the increasing demand for efficient baggage handling solutions in airports.

What are the key market players or companies in this industry?

Key players in the baggage handling system industry include major companies such as Siemens, Vanderlande, BEUMER Group, and Daifuku. These firms dominate the market through innovative solutions in automation and system integration.

What are the primary factors driving the growth in the baggage handling system industry?

Several factors are driving growth in the baggage handling system industry, including rising air travel demand, advancements in automation technology, and the need for improved operational efficiency in airports and logistics centers.

Which region is the fastest Growing in the baggage handling system market?

The fastest-growing region in the baggage handling system market is North America, where the market is expected to grow from $4.08 billion in 2023 to $8.02 billion by 2033, reflecting increased investment in airport infrastructure.

Does ConsaInsights provide customized market report data for the baggage handling system industry?

Yes, Consainsights offers customized market report data tailored to specific needs in the baggage handling system industry, allowing organizations to gain targeted insights for strategic decision-making.

What deliverables can I expect from this baggage handling system market research project?

Deliverables from the baggage handling system market research project include detailed market analysis reports, trend forecasts, competitive landscape assessments, and region-specific insights to aid informed business decisions.

What are the market trends of baggage handling system?

Current trends in the baggage handling system market include increasing automation, adoption of artificial intelligence for operational improvements, and a shift towards greener technology solutions to enhance efficiency and sustainability.