Bakery Products Market Report

Published Date: 31 January 2026 | Report Code: bakery-products

Bakery Products Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Bakery Products market from 2023 to 2033, highlighting key market trends, regional insights, growth opportunities, and competitive landscapes within the industry.

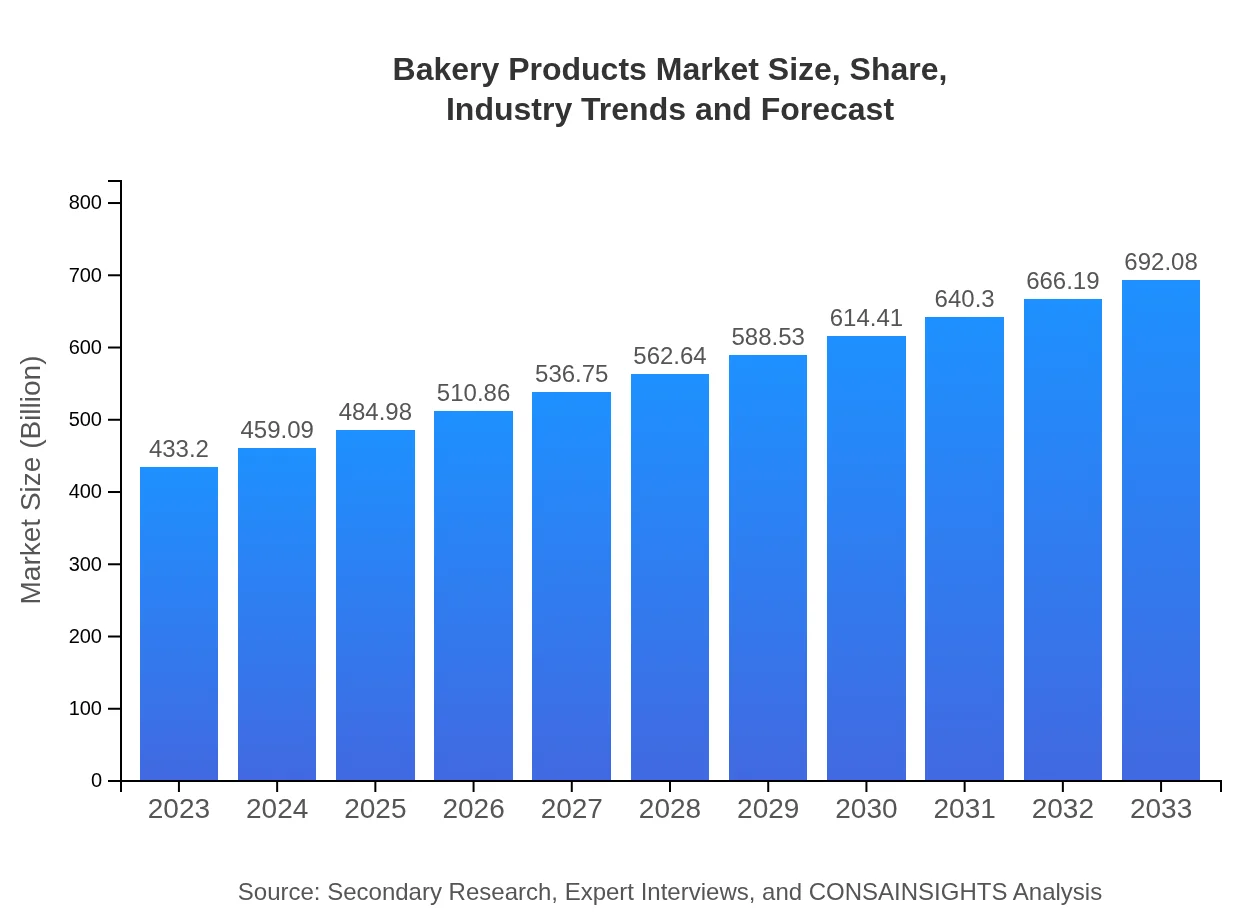

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $433.20 Billion |

| CAGR (2023-2033) | 4.7% |

| 2033 Market Size | $692.08 Billion |

| Top Companies | Grupo Bimbo, Breadtalk Group, Flowers Foods, M. D. Foods, Associated British Foods |

| Last Modified Date | 31 January 2026 |

Bakery Products Market Overview

Customize Bakery Products Market Report market research report

- ✔ Get in-depth analysis of Bakery Products market size, growth, and forecasts.

- ✔ Understand Bakery Products's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bakery Products

What is the Market Size & CAGR of Bakery Products market in 2023?

Bakery Products Industry Analysis

Bakery Products Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bakery Products Market Analysis Report by Region

Europe Bakery Products Market Report:

As of 2023, Europe's Bakery Products market stands at $110.55 billion and is forecasted to grow to $176.62 billion by 2033. The region is characterized by a robust demand for traditional and sourdough bread, with consumers showing a preference for handmade products. The increasing focus on sustainability and clean labeling practices is pushing manufacturers to reformulate existing products.Asia Pacific Bakery Products Market Report:

In 2023, the Bakery Products market in the Asia Pacific region is valued at $87.85 billion, projected to grow to $140.35 billion by 2033. The rising urban population, along with increasing disposable incomes and changing dietary habits towards Western-style bakery products, is driving market growth in this region. Additionally, the growth of modern retail formats and e-commerce channels is facilitating greater product accessibility.North America Bakery Products Market Report:

In North America, the market was valued at $147.42 billion in 2023 and is anticipated to reach $235.51 billion by 2033. The growth is driven by a strong consumer base looking for artisanal and organic options. Health-driven trends, such as the demand for gluten-free products, significantly influence the product development strategies of leading firms.South America Bakery Products Market Report:

The South American Bakery Products market, valued at $35.35 billion in 2023, is expected to expand to $56.47 billion by 2033. Brazil and Argentina are leading contributors, with increasing consumer interest in premium and health-focused bakery items. Innovations in flavors and local adaptations are key trends supporting market expansion throughout the region.Middle East & Africa Bakery Products Market Report:

In the Middle East and Africa, the market is valued at $52.03 billion in 2023 and expected to grow to $83.12 billion by 2033. Factors such as urbanization, fast-paced lifestyles, and an increasing preference for convenience foods are propelling demand. The development of local tastes and flavor profiles is supporting the growth of the industry.Tell us your focus area and get a customized research report.

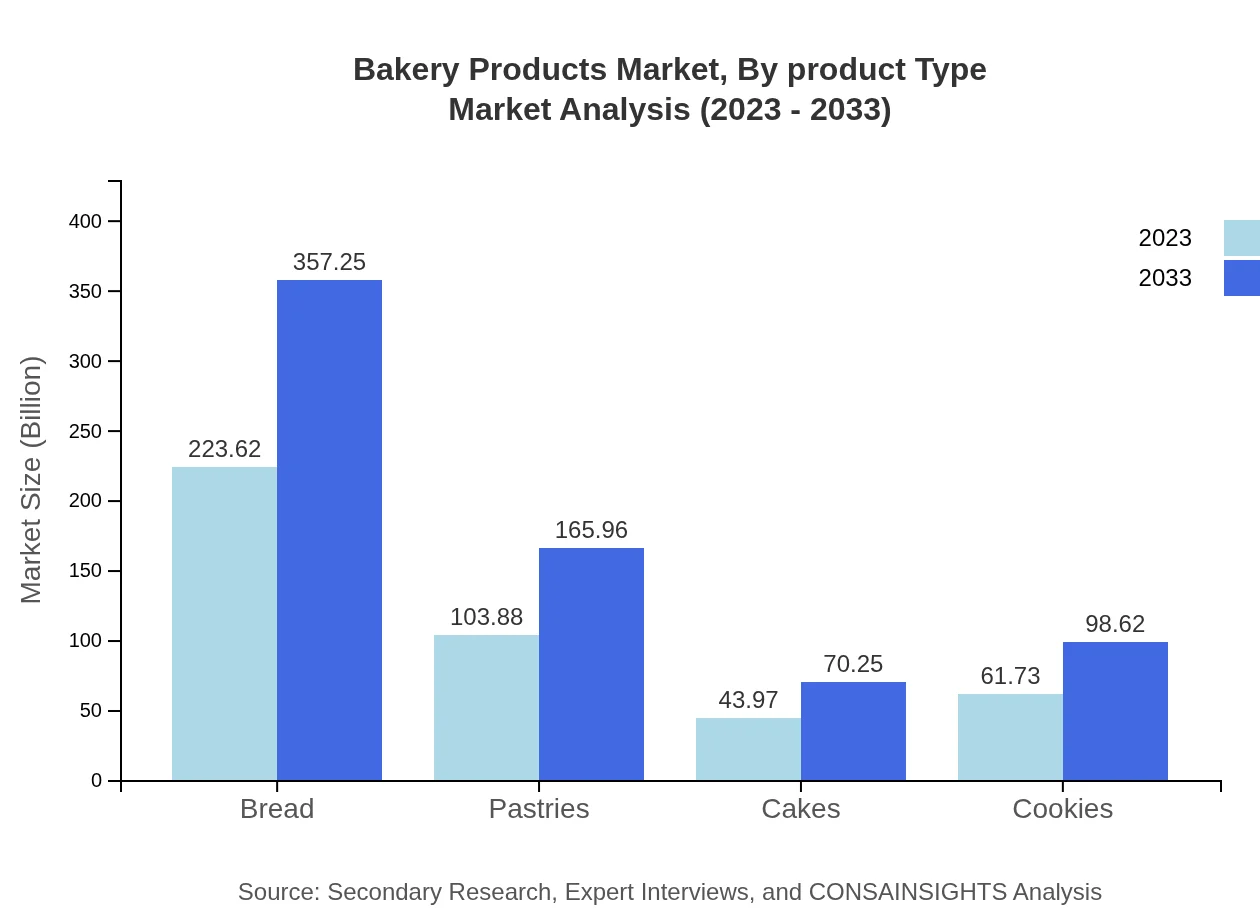

Bakery Products Market Analysis By Product Type

Bread dominates the Bakery Products market with a size of $223.62 billion in 2023, increasing to $357.25 billion by 2033, holding a consistent market share of 51.62%. Pastries follow, valued at $103.88 billion in 2023 with an expected rise to $165.96 billion by 2033 (23.98% share). Cakes and cookies also play significant roles, with cakes reaching $70.25 billion and cookies at $98.62 billion by 2033. Traditional baking methods are favored by consumers seeking authenticity, while industrial baking caters to mass production needs.

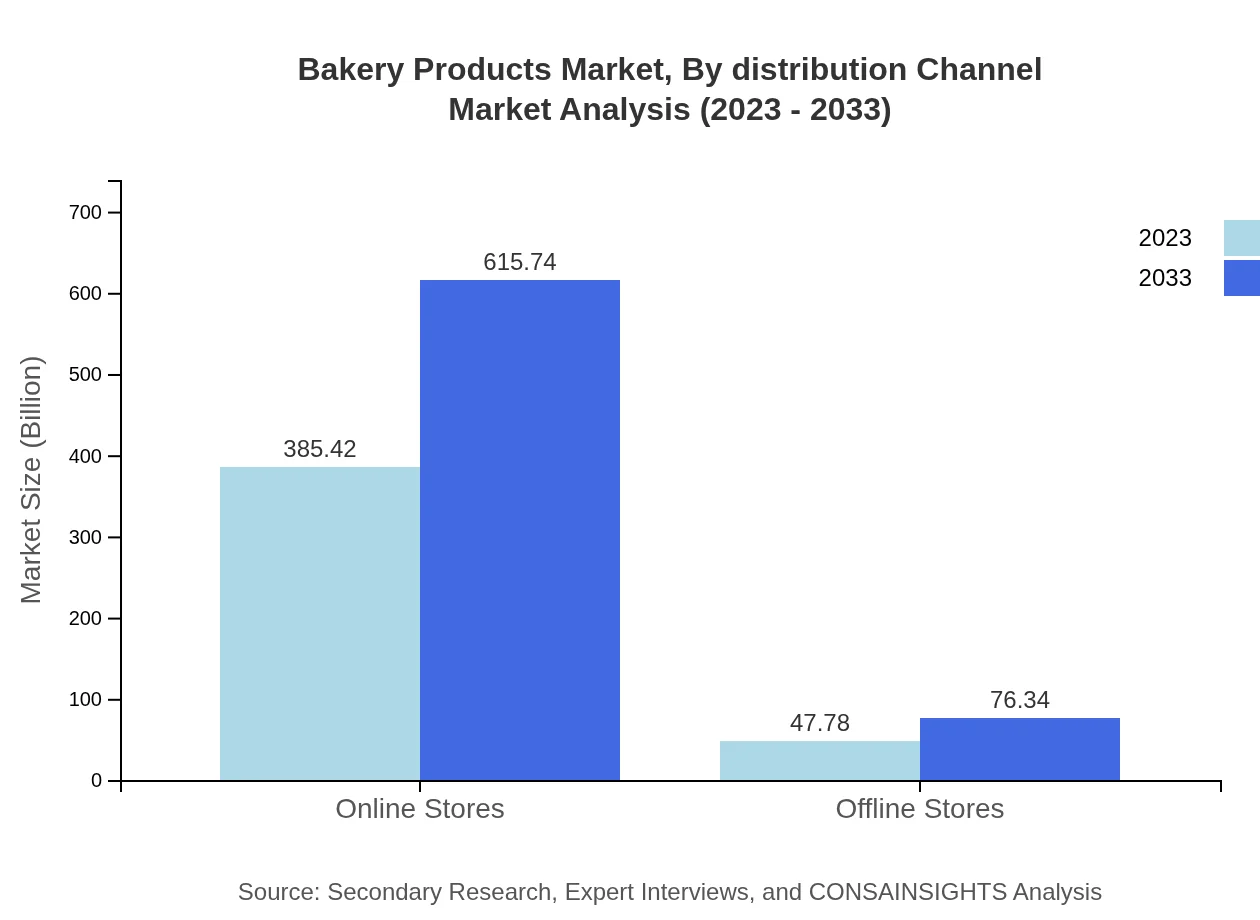

Bakery Products Market Analysis By Distribution Channel

The distribution of bakery products is primarily categorized into online and offline stores. Online sales will witness tremendous growth, from $385.42 billion in 2023 to $615.74 billion by 2033, predominantly due to the increased digital shopping trend. In comparison, offline channels will persist slightly behind, swelling from $47.78 billion to $76.34 billion, still important for traditional consumer bases.

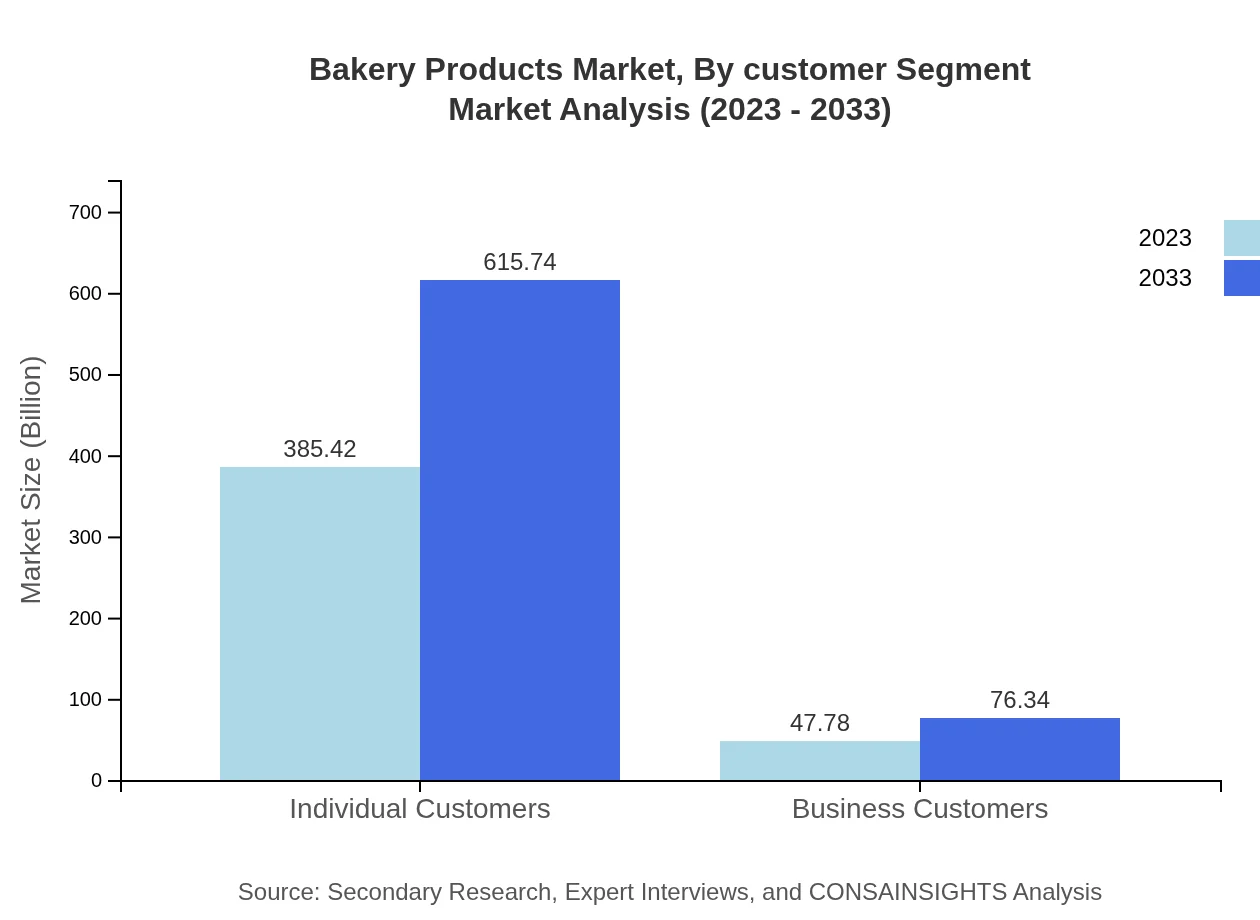

Bakery Products Market Analysis By Customer Segment

The customer segmentation reveals a strong inclination towards individual customers, comprising a market size of $385.42 billion in 2023 and projected to reach $615.74 billion by 2033 (88.97% share). Business customers will grow from $47.78 billion to $76.34 billion (11.03% share), driven by the increasing supply demands from cafes and restaurants investing in high-quality bakery goods.

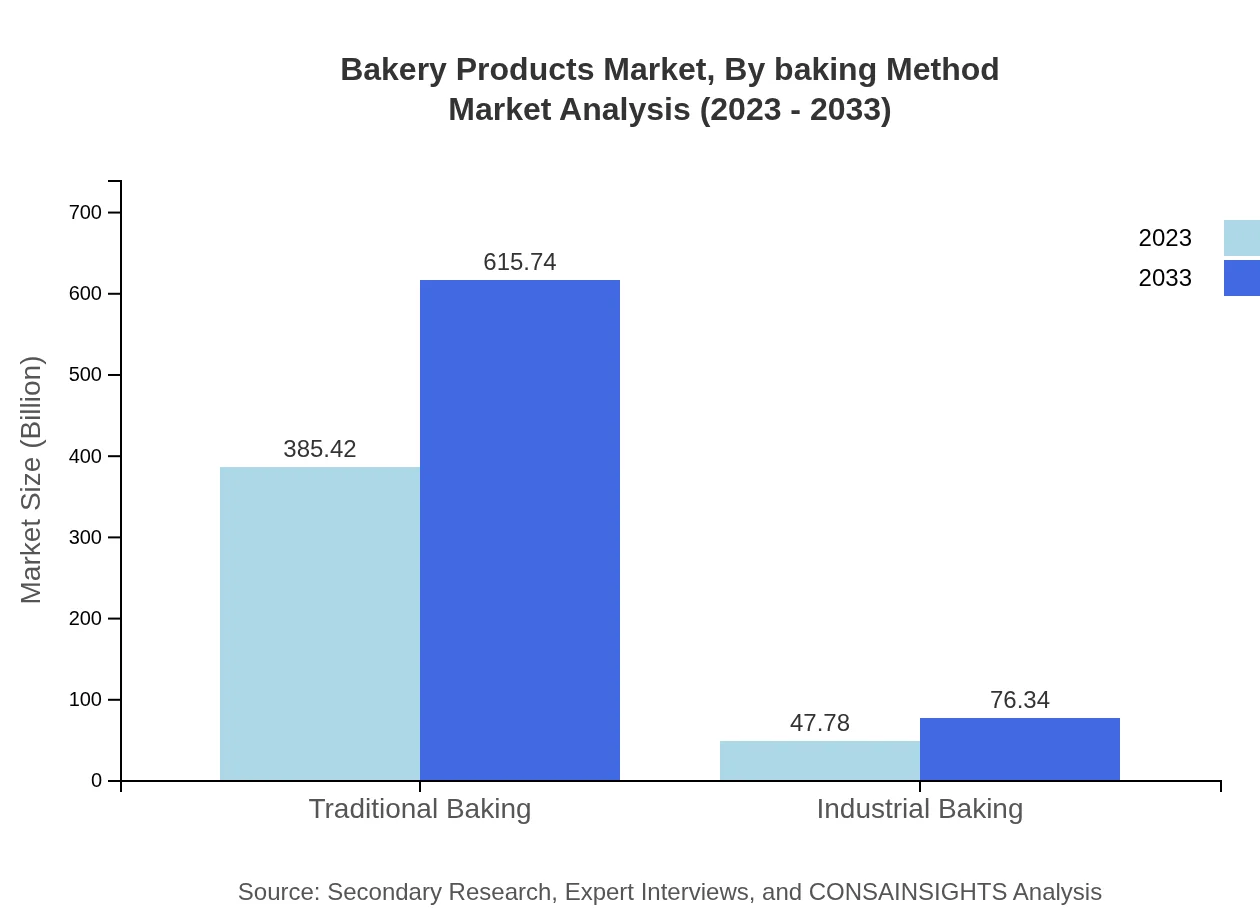

Bakery Products Market Analysis By Baking Method

Both traditional and industrial baking hold substantial shares in the Bakery Products market. Traditional baking remains renowned for its artisanal appeal, commanding a market size of $385.42 billion in 2023 and expected to reach $615.74 billion in 2033 (88.97% share). Industrial baking, essential for mass production, grows from $47.78 billion to $76.34 billion (11.03% share), as companies seek to optimize production efficiencies.

Bakery Products Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bakery Products Industry

Grupo Bimbo:

A leading global bakery company based in Mexico, Grupo Bimbo is known for producing a wide range of baked goods and has a robust international presence.Breadtalk Group:

Based in Singapore, Breadtalk Group specializes in bakery and food retailing, known for its innovative products and modern bakery concepts.Flowers Foods:

An American food company, Flowers Foods is one of the largest producers of packaged bakery foods in the U.S., offering a variety of bread and snack cake products.M. D. Foods:

This company produces and distributes a variety of baked goods, focusing on quality and customer satisfaction across various retail channels.Associated British Foods:

A diversified international food, ingredients, and retail group, known for its brands like Kingsmill bread and Twinings tea, actively involved in the bakery sector.We're grateful to work with incredible clients.

FAQs

What is the market size of bakery products?

The global bakery products market is valued at approximately $433.2 billion in 2023, with a projected CAGR of 4.7% from 2023 to 2033. This forecast indicates steady growth across various segments and regions.

What are the key market players or companies in this bakery products industry?

Key players in the bakery products market include industry leaders such as Grupo Bimbo, Mondelez International, and Nestlé, which dominate due to their extensive product portfolios and established distribution networks.

What are the primary factors driving the growth in the bakery products industry?

The growth in the bakery products industry is primarily driven by increasing consumer demand for convenience foods, the rise of health-conscious consumers seeking whole grain and organic options, and advancements in technology for better production processes.

Which region is the fastest Growing in the bakery products market?

The Asia Pacific region is the fastest-growing area in the bakery products market, projected to expand from $87.85 billion in 2023 to $140.35 billion by 2033, driven by urbanization and changing consumer lifestyles.

Does ConsaInsights provide customized market report data for the bakery products industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the bakery products industry, ensuring that clients receive relevant insights that align with their business objectives.

What deliverables can I expect from this bakery products market research project?

Expect comprehensive reports including market size analysis, growth forecasts, competitor assessments, regional breakdowns, and detailed insights on consumer trends and behaviors related to bakery products.

What are the market trends of bakery products?

Current market trends in bakery products include rising demand for gluten-free and healthy snack options, increasing popularity of artisanal and gourmet baked goods, and a shift towards online sales channels facilitating easier access for consumers.