Baking Powder Market Report

Published Date: 31 January 2026 | Report Code: baking-powder

Baking Powder Market Size, Share, Industry Trends and Forecast to 2033

This report examines the Baking Powder market, highlighting insights and forecasts from 2023 to 2033. It encapsulates market dynamics, trends, and regional analyses to provide stakeholders with a comprehensive understanding of the industry's future landscape.

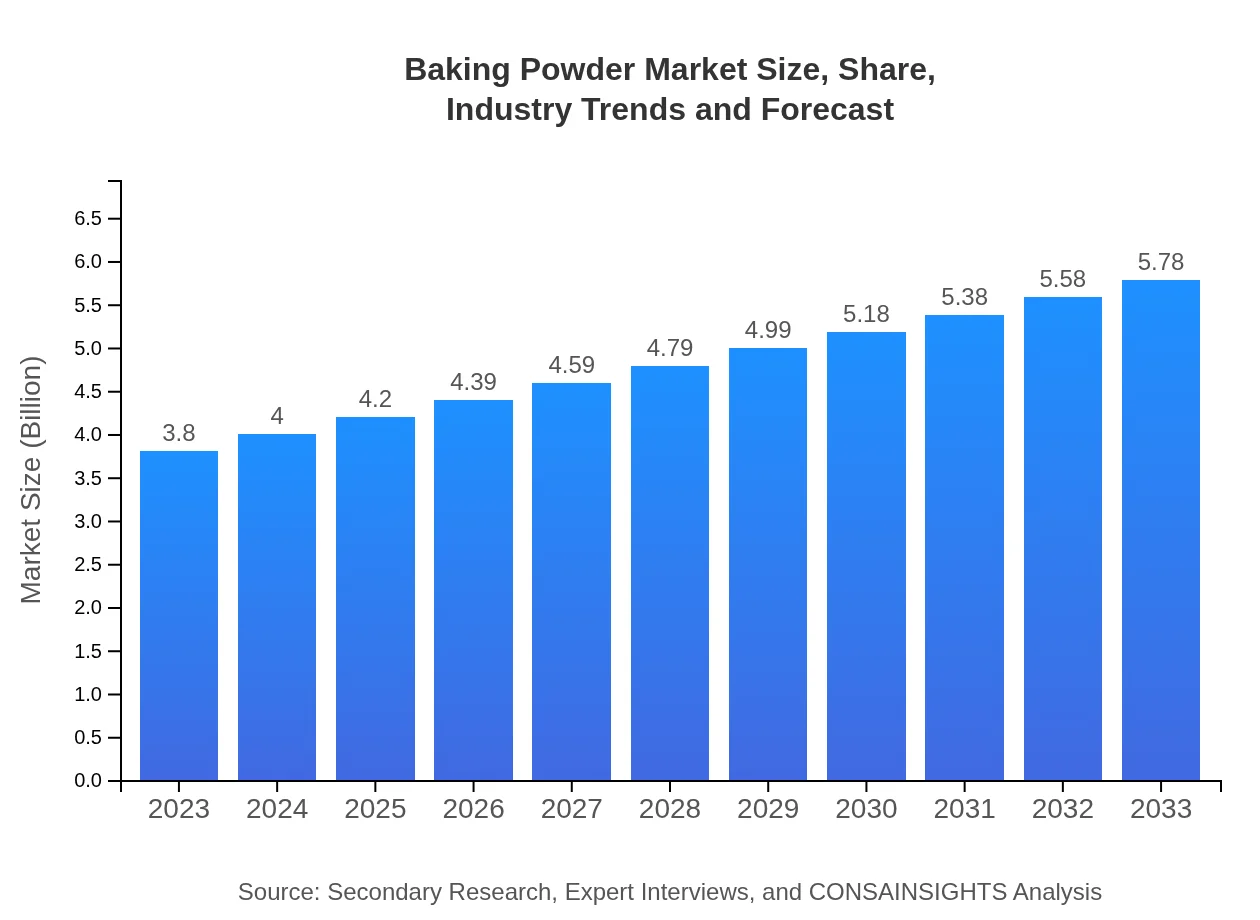

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.80 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $5.78 Billion |

| Top Companies | McCormick & Company, Inc., ARM & HAMMER, King Arthur Baking Company, Bob's Red Mill Natural Foods, DuoNian |

| Last Modified Date | 31 January 2026 |

Baking Powder Market Overview

Customize Baking Powder Market Report market research report

- ✔ Get in-depth analysis of Baking Powder market size, growth, and forecasts.

- ✔ Understand Baking Powder's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Baking Powder

What is the Market Size & CAGR of Baking Powder market in 2033?

Baking Powder Industry Analysis

Baking Powder Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Baking Powder Market Analysis Report by Region

Europe Baking Powder Market Report:

The European market is anticipated to expand from USD 1.29 billion in 2023 to USD 1.97 billion by 2033. The demand for clean-label products and the trend towards home baking, especially post-pandemic, are key growth factors. Europe also exhibits diverse consumer preferences, leading to a variety of product formulations.Asia Pacific Baking Powder Market Report:

The Asia-Pacific Baking Powder market is projected to grow from USD 0.68 billion in 2023 to USD 1.04 billion by 2033. The rise in the urban population and increased disposable income are driving demand for both commercial and home baking. Additionally, the growing trend of baking shows and workshops is influencing consumer interest.North America Baking Powder Market Report:

The North American Baking Powder market, valued at USD 1.27 billion in 2023, is expected to reach USD 1.93 billion by 2033. The region's strong focus on health and wellness is driving innovation in low-calorie and organic products, making it a principal market for new product launches.South America Baking Powder Market Report:

In South America, the market size is expected to grow from USD 0.20 billion in 2023 to USD 0.31 billion by 2033. Increasing popularity of Western food culture and growing bakery sector are major contributors. Local manufacturers are capitalizing on this trend by enhancing distribution channels.Middle East & Africa Baking Powder Market Report:

In the Middle East and Africa, the market is projected to grow from USD 0.35 billion in 2023 to USD 0.54 billion by 2033. Increasing investment in modern retail stores and rising consumer awareness about baking ingredients are contributing to market growth in this region.Tell us your focus area and get a customized research report.

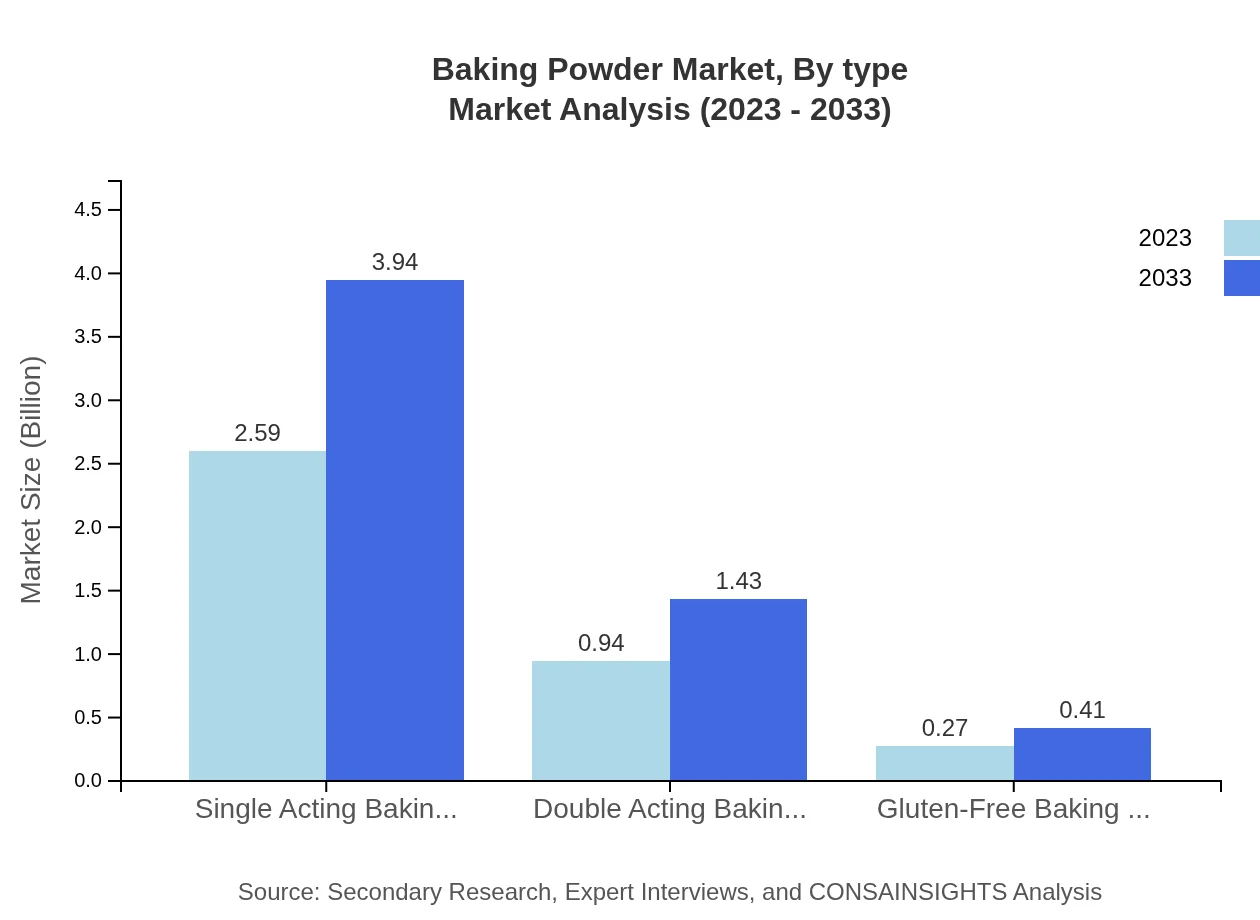

Baking Powder Market Analysis By Type

The Baking Powder market, segmented by type, reveals that Single Acting Baking Powder dominates with a market size of USD 2.59 billion in 2023 and expected to grow to USD 3.94 billion by 2033. Double Acting Baking Powder follows, with sizes of USD 0.94 billion in 2023, projected to reach USD 1.43 billion by 2033, while Gluten-Free options are gaining traction, with current values of USD 0.27 billion, expected to grow to USD 0.41 billion.

Baking Powder Market Analysis By End Use

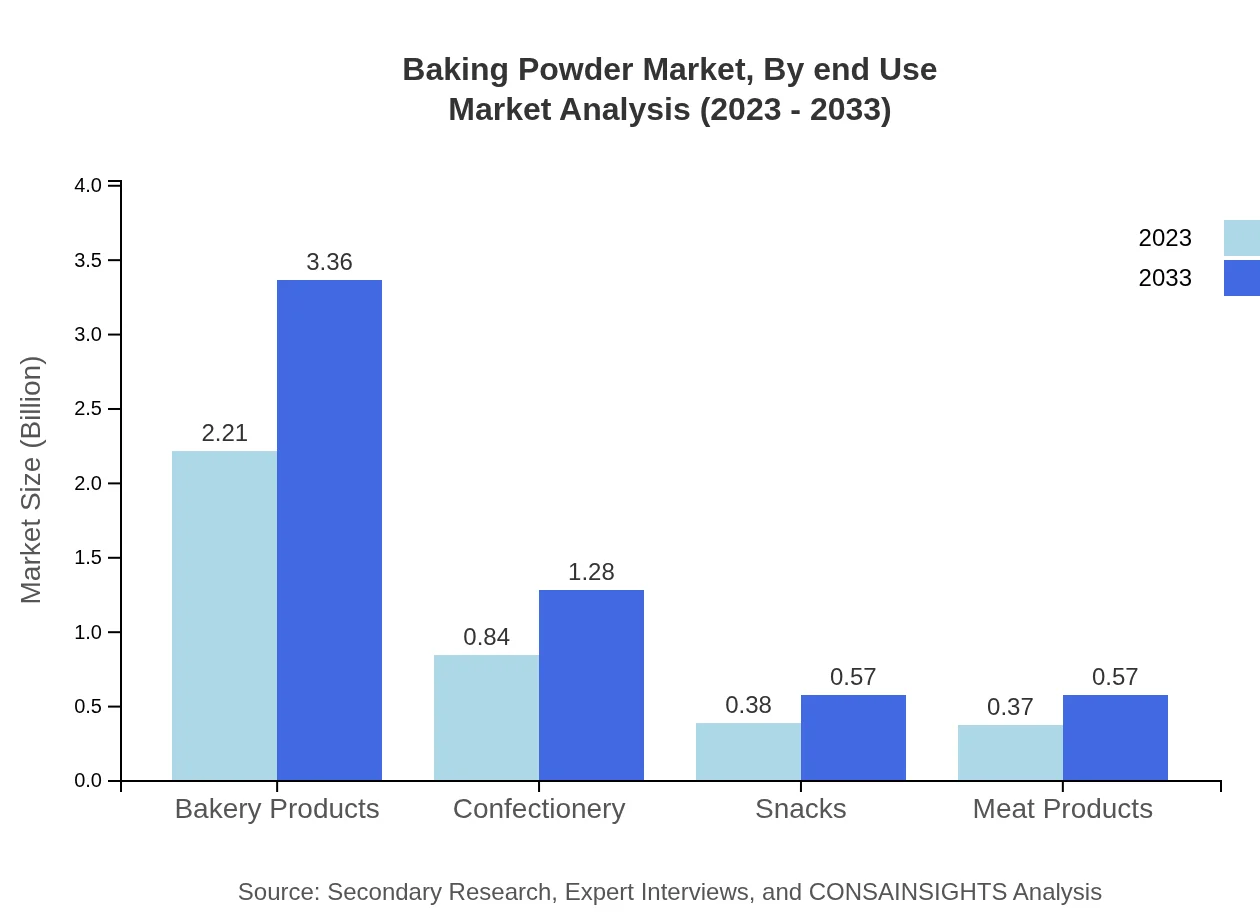

In the end-use segmentation, Bakery Products account for the largest share, with a size of USD 2.21 billion in 2023, projected to be USD 3.36 billion by 2033. The Confectionery sector adds USD 0.84 billion, heading towards USD 1.28 billion, while Snacks and Meat Products are also significant contributors to the market growth.

Baking Powder Market Analysis By Distribution Channel

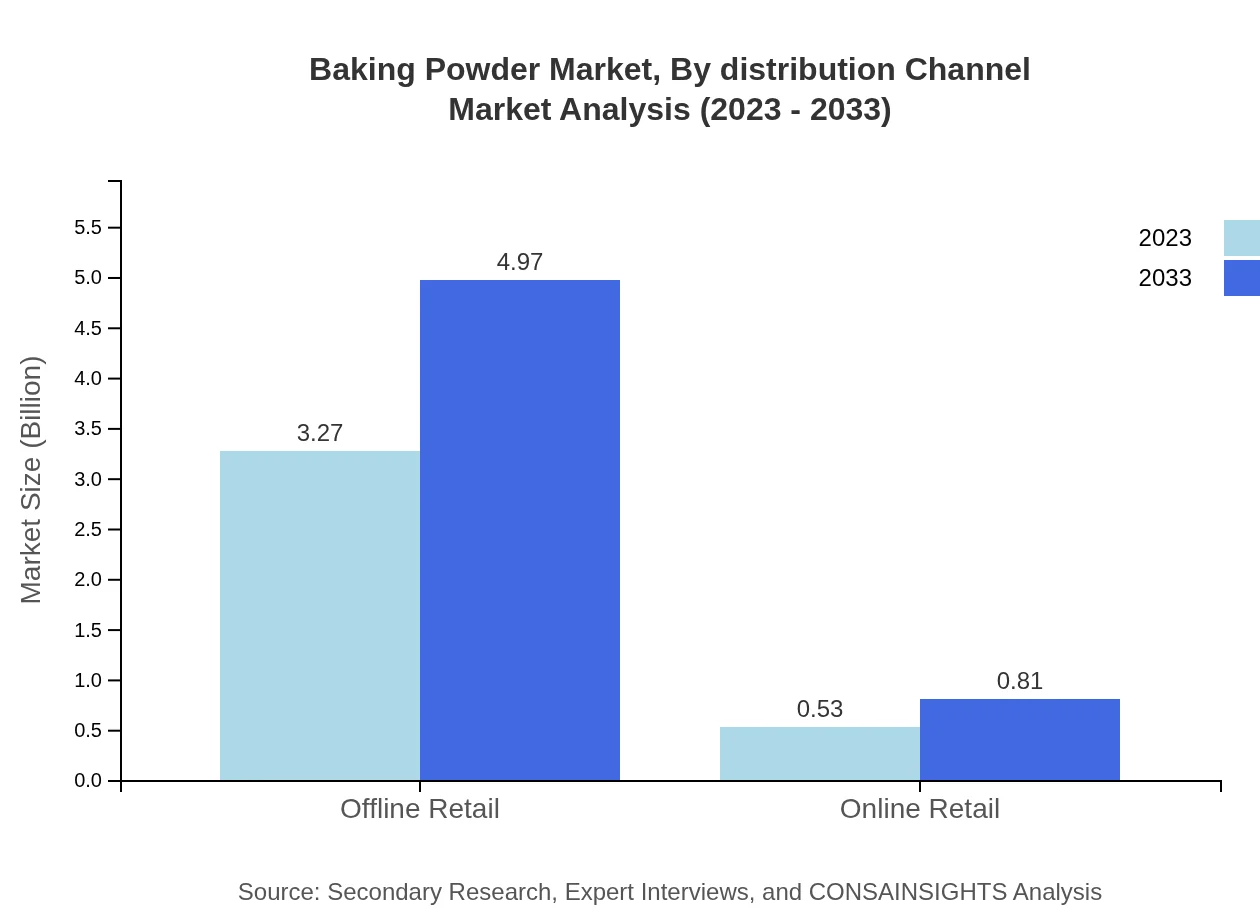

The distribution channel analysis indicates a strong preference for offline retail, which currently holds a market size of USD 3.27 billion, growing to USD 4.97 billion. Online retail, although smaller, shows significant growth potential from USD 0.53 billion to USD 0.81 billion by 2033, driven by changing consumer habits and increased e-commerce activity.

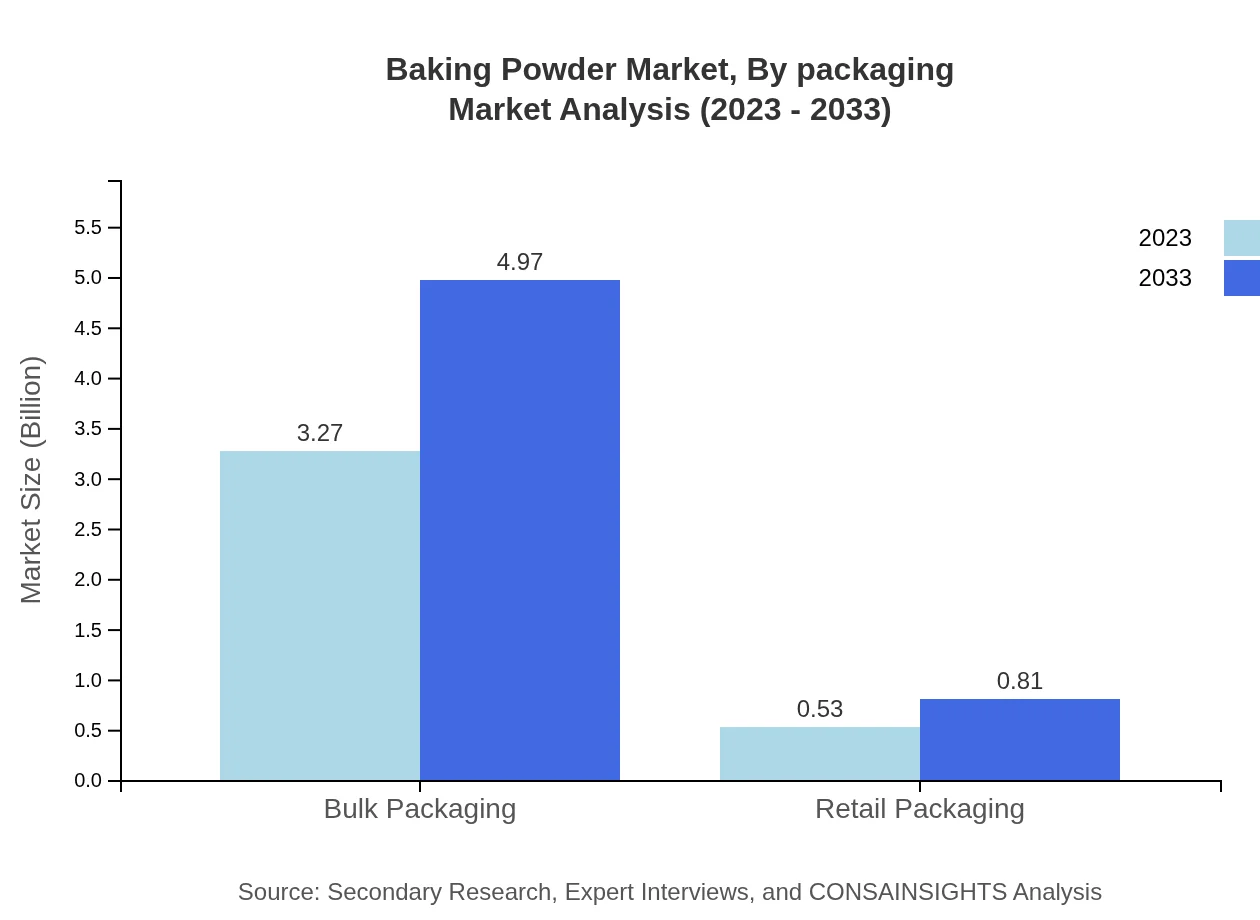

Baking Powder Market Analysis By Packaging

Bulk packaging remains dominant, valued at USD 3.27 billion in 2023 and expected to rise to USD 4.97 billion. Retail packaging, while smaller in comparison, is also poised for growth, increasing from USD 0.53 billion to USD 0.81 billion by 2033, reflecting a growing trend towards smaller, consumer-friendly packages.

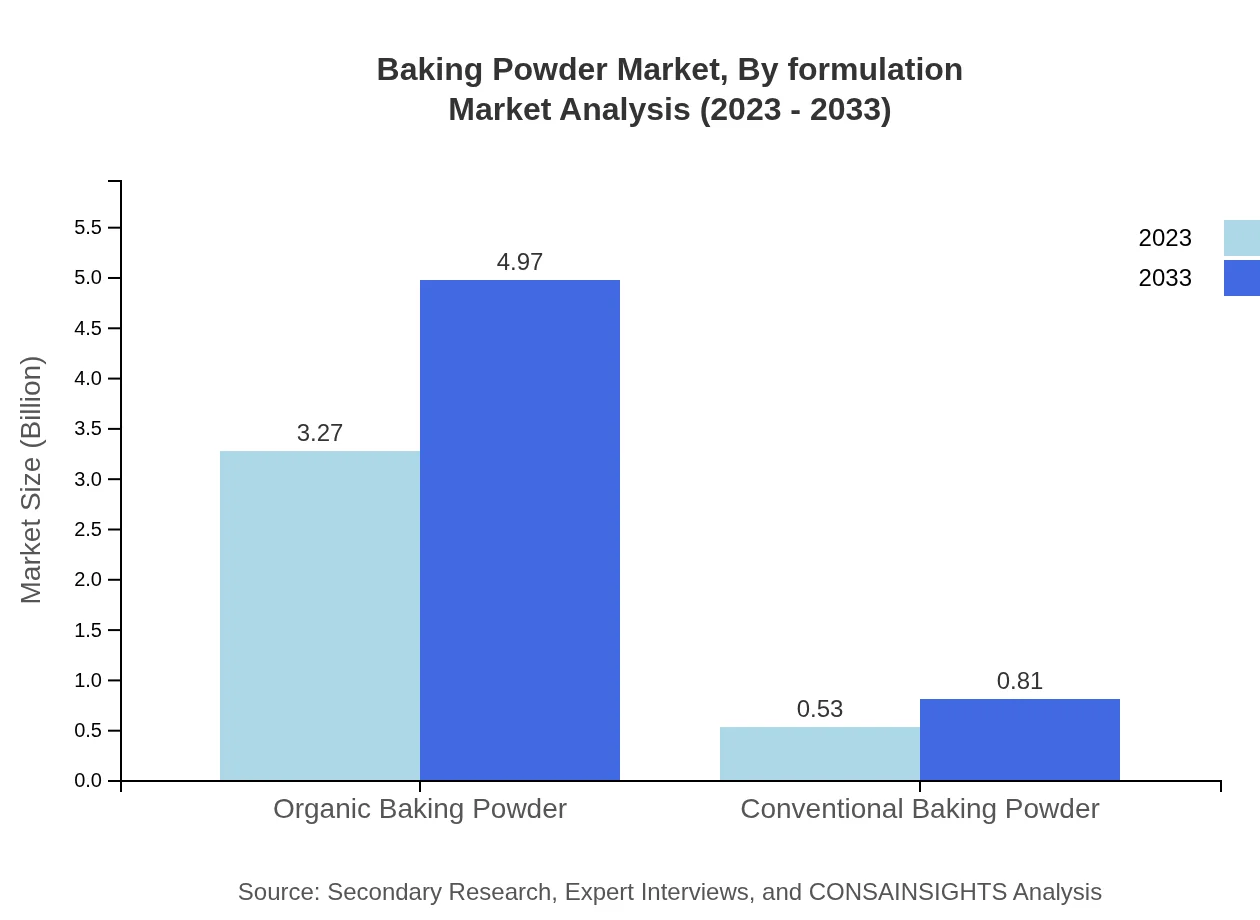

Baking Powder Market Analysis By Formulation

In terms of formulation, Organic Baking Powder leads the sector with a substantial size of USD 3.27 billion in 2023, projected to hit USD 4.97 billion by the end of the forecast period. Conversely, Conventional Baking Powder holds a smaller market at USD 0.53 billion, expected to grow to USD 0.81 billion, indicating a shift in consumer preference towards organic and clean-label products.

Baking Powder Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Baking Powder Industry

McCormick & Company, Inc.:

A global leader in flavor solutions and baking products, McCormick is renowned for its innovative product offerings and commitment to quality.ARM & HAMMER:

Known for its baking soda and baking powder products, ARM & HAMMER leverages its brand heritage and wide distribution networks to dominate the market.King Arthur Baking Company:

A family-owned baking company that focuses on premium flours and baking ingredients, including a range of baking powders catering to health-conscious consumers.Bob's Red Mill Natural Foods:

Specializes in natural and organic products, including gluten-free and premium baking powders, emphasizing wellness and quality.DuoNian:

A key player in the Asian market known for producing high-quality baking ingredients, particularly catering to local culinary preferences.We're grateful to work with incredible clients.

FAQs

What is the market size of baking powder?

The global baking powder market is valued at $3.8 billion in 2023, with a projected CAGR of 4.2% leading to significant growth opportunities by 2033.

What are the key market players or companies in the baking powder industry?

Key players in the baking powder industry include prominent companies such as Clabber Girl Corporation, Rumford, and Davis Baking Powder with a focus on product innovation and regional expansion.

What are the primary factors driving the growth in the baking powder industry?

Growth in the baking powder industry is driven by the increasing popularity of home baking, rising demand for convenience foods, and health-conscious consumer preferences, including gluten-free options.

Which region is the fastest Growing in the baking powder market?

The Asia Pacific region is the fastest-growing market for baking powder, projected to grow from $0.68 billion in 2023 to $1.04 billion by 2033, reflecting a rapid increase in demand.

Does ConsaInsights provide customized market report data for the baking powder industry?

Yes, ConsaInsights offers customized market report data tailored to client-specific needs, providing in-depth analyses, trends, and forecasts in the baking powder industry.

What deliverables can I expect from this baking powder market research project?

Deliverables include comprehensive reports featuring market size estimates, segment analyses, competitive landscape, regional insights, and future growth forecasts for the baking powder market.

What are the market trends of baking powder?

Current trends in the baking powder market include an increasing shift towards organic products, the rising demand for gluten-free baking options, and enhanced packaging solutions to maintain product freshness.