Ballistic Composites Market Report

Published Date: 02 February 2026 | Report Code: ballistic-composites

Ballistic Composites Market Size, Share, Industry Trends and Forecast to 2033

This report provides insights into the Ballistic Composites market, covering detailed analysis, trends, and forecasts from 2023 to 2033. It examines market size, segmentation, regional dynamics, and profiles of leading companies within the industry.

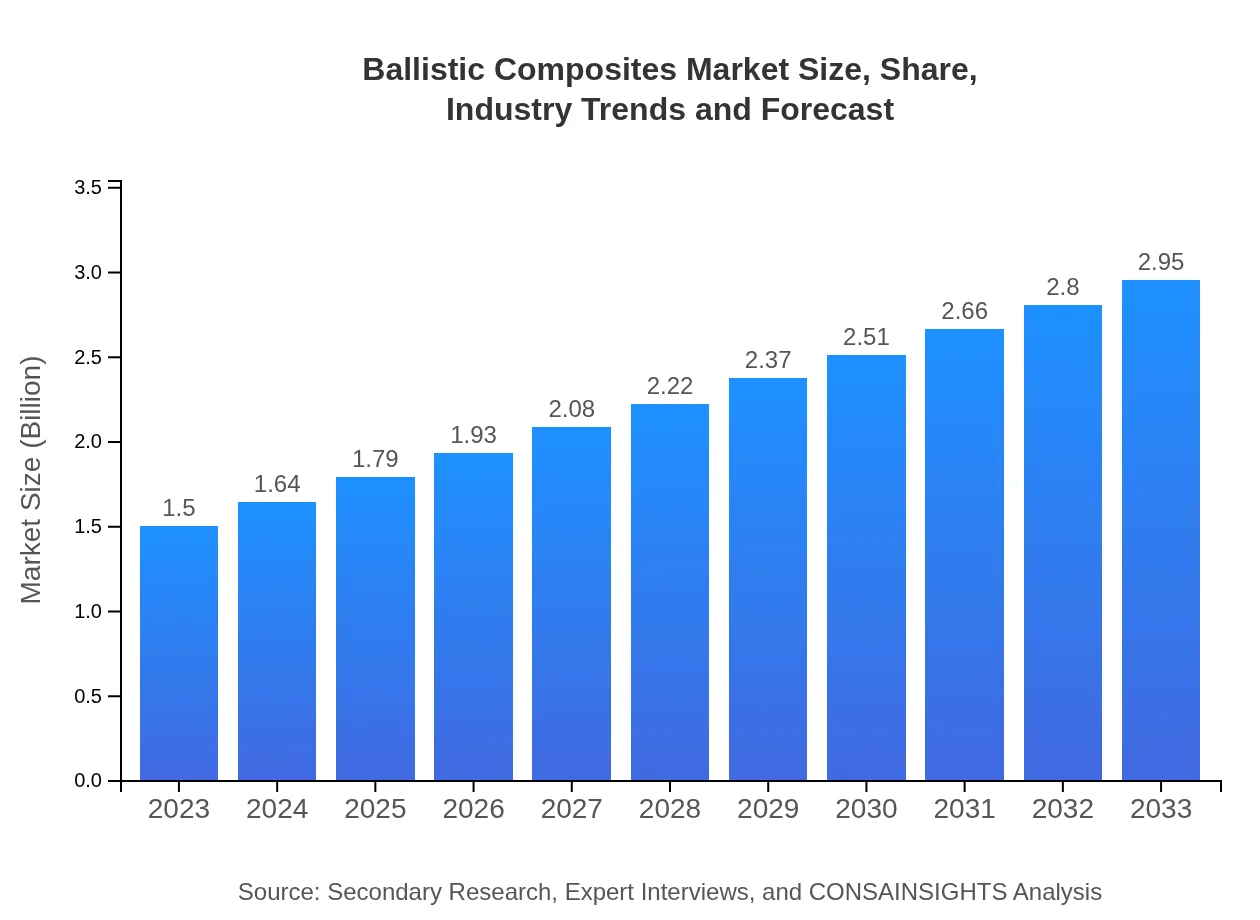

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $2.95 Billion |

| Top Companies | DuPont, Honeywell International Inc., 3M Company, Point Blank Enterprises, Armor Express |

| Last Modified Date | 02 February 2026 |

Ballistic Composites Market Overview

Customize Ballistic Composites Market Report market research report

- ✔ Get in-depth analysis of Ballistic Composites market size, growth, and forecasts.

- ✔ Understand Ballistic Composites's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ballistic Composites

What is the Market Size & CAGR of Ballistic Composites Market in 2023?

Ballistic Composites Industry Analysis

Ballistic Composites Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ballistic Composites Market Analysis Report by Region

Europe Ballistic Composites Market Report:

The European ballistic composites market is predicted to expand from $0.50 billion in 2023 to $0.99 billion by 2033, influenced by stringent regulations and rising military expenditures amidst the evolving geopolitical landscape. Countries like Germany and France are at the forefront of this advancement.Asia Pacific Ballistic Composites Market Report:

In the Asia-Pacific region, the ballistic composites market is anticipated to grow from $0.28 billion in 2023 to $0.56 billion by 2033, fueled by increased military spending and the growing demand for personal protection equipment. Countries like India and China are investing significantly in defense capabilities, rising the demand for advanced ballistic solutions.North America Ballistic Composites Market Report:

North America leads the market with a growth from $0.50 billion in 2023 projected to $0.98 billion by 2033. The United States is the largest contributor, with substantial investments in defense, law enforcement, and private security sectors, increasing the demand for high-quality ballistic protection.South America Ballistic Composites Market Report:

The South American market for ballistic composites, while smaller, is expected to grow from $0.04 billion in 2023 to $0.09 billion by 2033. This growth is primarily driven by increasing crime rates and government initiatives to enhance public safety through better protective gear.Middle East & Africa Ballistic Composites Market Report:

Middle East and Africa are expected to see growth from $0.17 billion in 2023 to $0.33 billion by 2033. The rise in regional conflicts and terrorism incidents is propelling governments to enhance their defense capabilities, thereby boosting demand for ballistic composites products.Tell us your focus area and get a customized research report.

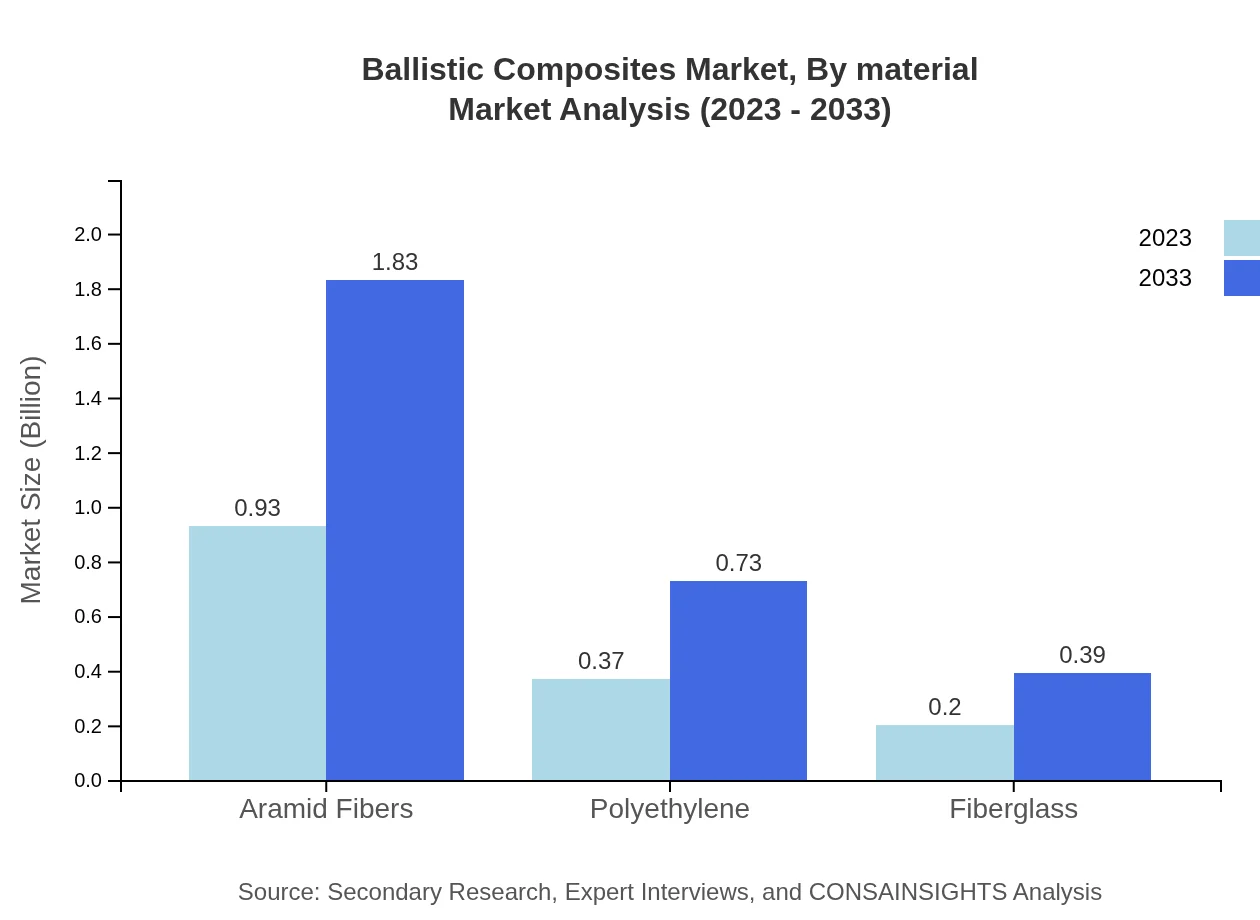

Ballistic Composites Market Analysis By Material

Aramid fibers dominate the market, expected to grow from $0.93 billion in 2023 to $1.83 billion by 2033, accounting for nearly 62% market share due to their superior protective qualities. Polyethylene follows suit with a projection from $0.37 billion to $0.73 billion, highlighting the push towards lighter materials. Fiberglass also holds a significant share, driven by its cost-effectiveness and sufficient protective features.

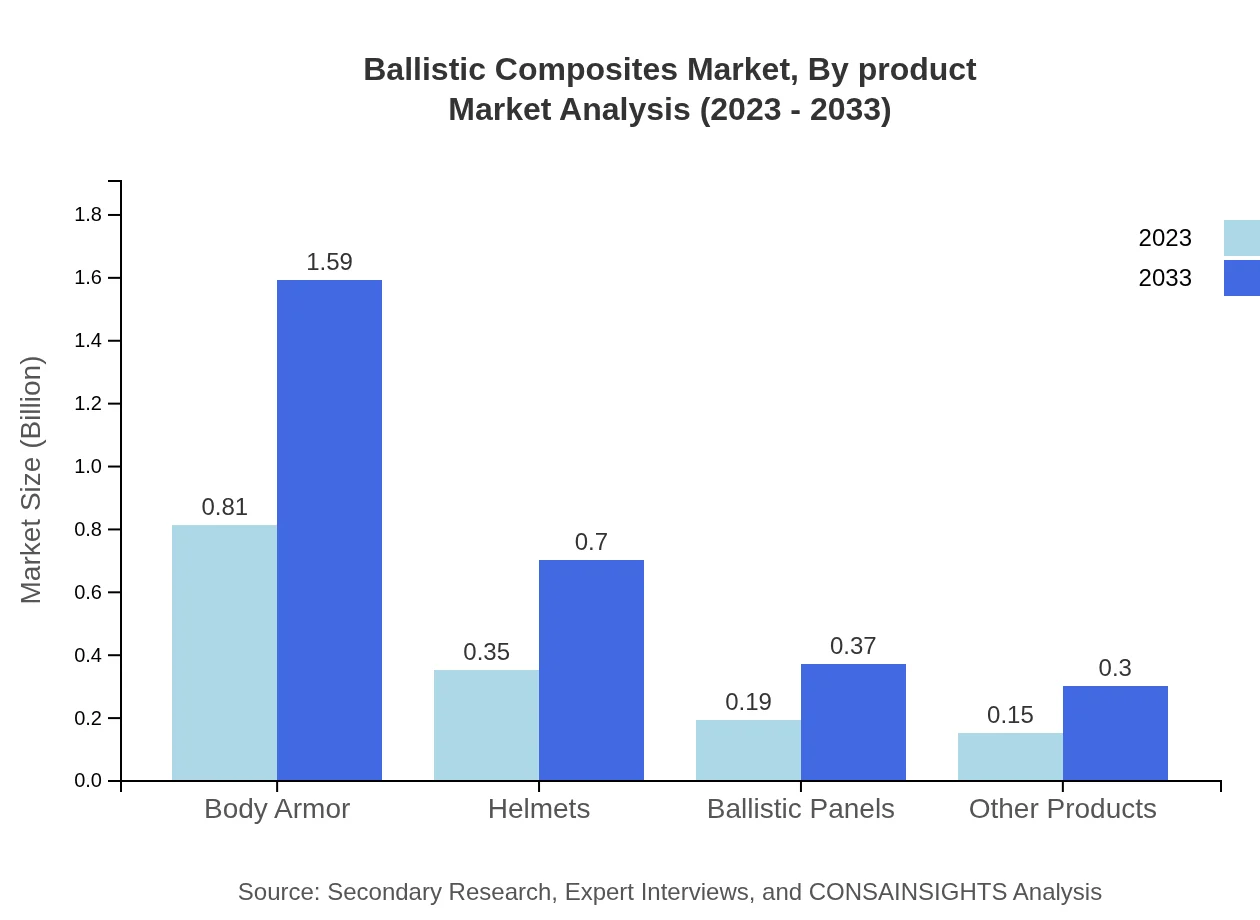

Ballistic Composites Market Analysis By Product

Body armor remains the leading product segment, indicating significant growth from $0.81 billion in 2023 to $1.59 billion by 2033. Helmets also represent a substantial share, expanding from $0.35 billion to $0.70 billion. The demand for ballistic panels is rising especially in the civil and military applications. Other products such as protective shields and vests reflect a growing focus on personal safety.

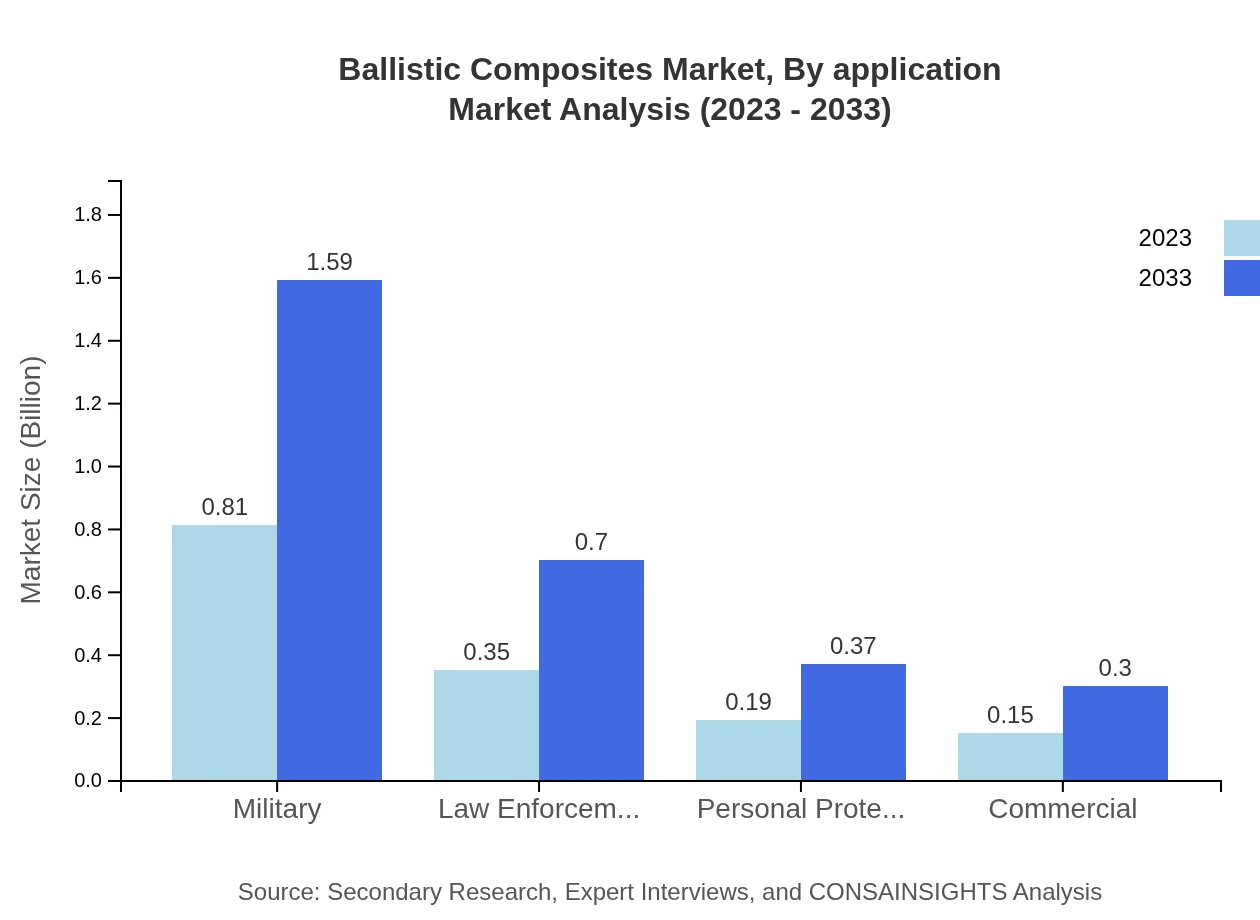

Ballistic Composites Market Analysis By Application

Military applications account for approximately 54% market share, growing from $0.81 billion to $1.59 billion in the next decade. Law enforcement follows closely, with projected growth reflecting the heightened need for protective gear among officers. Civilian applications are also witnessing a rise, particularly in high-risk areas, indicating the increasing importance of personal safety.

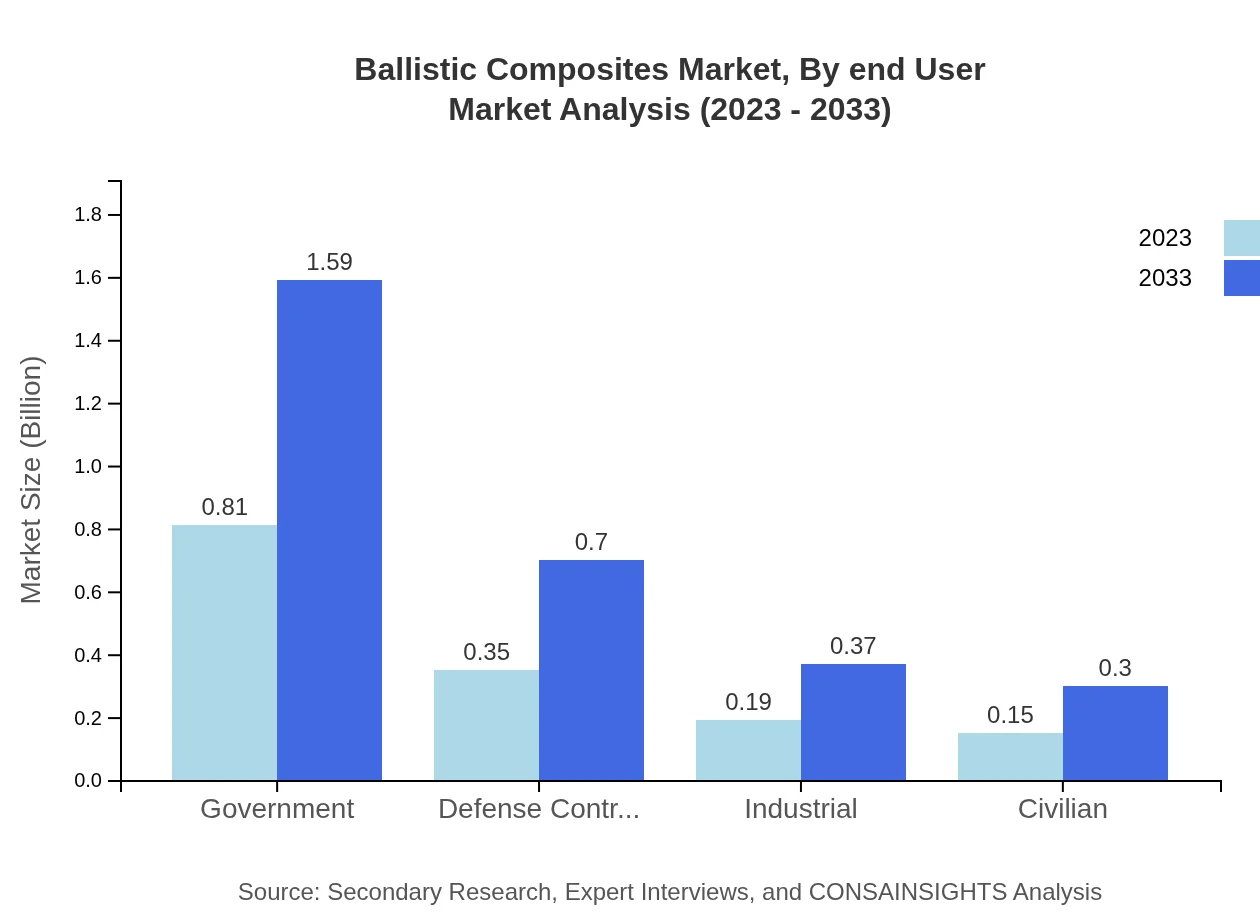

Ballistic Composites Market Analysis By End User

Government contracts represent significant demand, especially in the defense sector, reflecting robust growth due to national security commitments. Defense contractors significantly influence market dynamics, with their growing adoption of advanced materials for armored vehicles and personal gear. The industrial sector also garners attention, focusing on employee safety in hazardous environments.

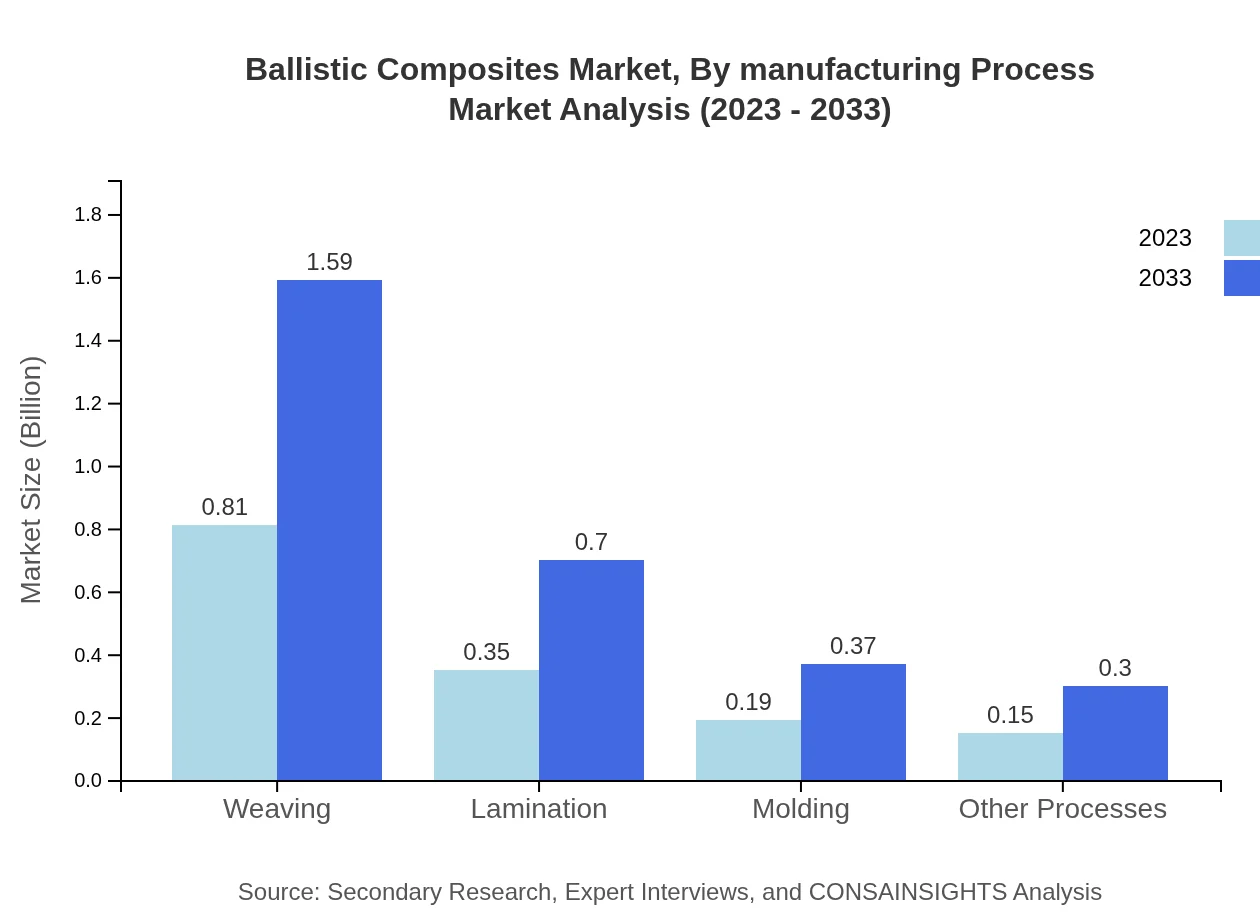

Ballistic Composites Market Analysis By Manufacturing Process

Advancements in manufacturing processes such as weaving, lamination, and molding are crucial for improving product efficiency and performance. Weaving remains a dominant method, fostering increased production capacity and innovative designs that enhance the protection offered by ballistic gear.

Ballistic Composites Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ballistic Composites Industry

DuPont:

A pioneer in advanced materials, DuPont is known for its Kevlar brand, widely used in ballistic protection for its high strength and lightweight properties.Honeywell International Inc.:

Honeywell specializes in high-performance polymers and composite materials and its Spectra fiber is a key component in ballistic vests and armor.3M Company:

3M provides a diverse range of ballistic-resistant products tailored for military and law enforcement, leveraging their innovation in material sciences.Point Blank Enterprises:

A leading manufacturer of ballistic armor, Point Blank focuses on developing custom solutions for the law enforcement and military sectors.Armor Express:

Known for producing high-performance body armor solutions, Armor Express serves military and law enforcement agencies with advanced protective gear.We're grateful to work with incredible clients.

FAQs

What is the market size of ballistic Composites?

The ballistic composites market is currently valued at approximately $1.5 billion in 2023, with a projected CAGR of 6.8% leading to significant growth by 2033.

What are the key market players or companies in this ballistic Composites industry?

Key players in the ballistic composites industry include renowned manufacturers that provide advanced protective solutions, integrating cutting-edge technologies and materials to enhance performance and safety in military and civilian applications.

What are the primary factors driving the growth in the ballistic Composites industry?

Growth in the ballistic composites industry is primarily driven by increasing defense expenditures, rising concerns about personal safety and security, and advancements in composite material technologies that enhance lightweight and durable solutions.

Which region is the fastest Growing in the ballistic Composites?

The fastest-growing region in the ballistic composites market is expected to be North America, with market growth from $0.50 billion in 2023 to an estimated $0.98 billion by 2033, driven by increasing defense spending.

Does ConsaInsights provide customized market report data for the ballistic Composites industry?

Yes, ConsaInsights offers customized market report data, tailored to specific business needs in the ballistic composites industry, providing detailed insight into market dynamics and projections.

What deliverables can I expect from this ballistic Composites market research project?

Deliverables from the ballistic composites market research project typically include comprehensive market analysis reports, trend forecasts, competitive landscape assessments, and detailed segmentation data.

What are the market trends of ballistic Composites?

Current trends in the ballistic composites market include the increased use of lightweight materials, the rise in demand for personal protective equipment, and the growing incorporation of smart textiles in protective gear.