Bank Kiosk Market Report

Published Date: 24 January 2026 | Report Code: bank-kiosk

Bank Kiosk Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Bank Kiosk market from 2023 to 2033. It covers market trends, size, growth forecast, segmentation, and insights from key regions, highlighting technological advancements and the competitive landscape.

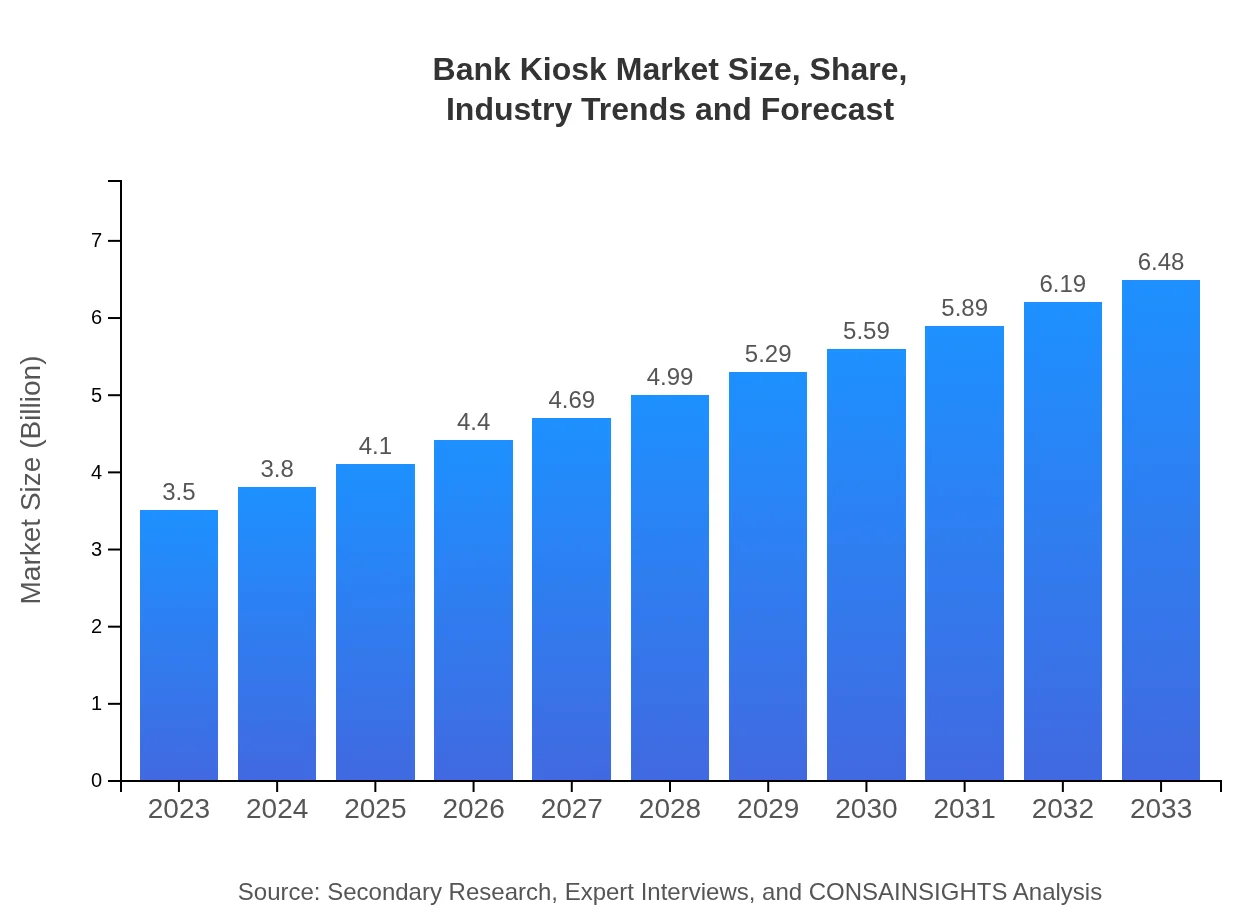

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $6.48 Billion |

| Top Companies | NCR Corporation, Diebold Nixdorf, KIOSK Information Systems, GRG Banking |

| Last Modified Date | 24 January 2026 |

Bank Kiosk Market Overview

Customize Bank Kiosk Market Report market research report

- ✔ Get in-depth analysis of Bank Kiosk market size, growth, and forecasts.

- ✔ Understand Bank Kiosk's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bank Kiosk

What is the Market Size & CAGR of Bank Kiosk market in 2023?

Bank Kiosk Industry Analysis

Bank Kiosk Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bank Kiosk Market Analysis Report by Region

Europe Bank Kiosk Market Report:

The European Bank Kiosk market is expected to expand from $1.26 billion in 2023 to $2.34 billion by 2033. Key drivers include rising demand for efficient banking solutions and the substantial presence of major banking institutions leveraging kiosk technology for enhanced customer service.Asia Pacific Bank Kiosk Market Report:

The Asia Pacific region is witnessing substantial growth in the Bank Kiosk market, driven by rapid urbanization and adoption of digital banking. In 2023, the market size is approximately $0.61 billion and is expected to reach $1.12 billion by 2033. The growing number of banking institutions and government initiatives promoting financial inclusion are significant contributing factors.North America Bank Kiosk Market Report:

North America holds a leading position in the Bank Kiosk market, valued at $1.16 billion in 2023 and anticipated to grow to $2.15 billion by 2033. The region benefits from a high concentration of advanced banking technologies and a strong consumer inclination towards self-service options.South America Bank Kiosk Market Report:

In South America, the Bank Kiosk market is projected to grow from $0.16 billion in 2023 to $0.30 billion by 2033. This growth is fueled by increasing smartphone penetration and a shift towards automated banking solutions, despite existing economic challenges in some regions.Middle East & Africa Bank Kiosk Market Report:

In the Middle East and Africa, the Bank Kiosk market is growing from $0.31 billion in 2023, projected to reach $0.58 billion by 2033. Increasing investment in financial technology and efforts to improve banking accessibility in underserved regions are pivotal in driving this growth.Tell us your focus area and get a customized research report.

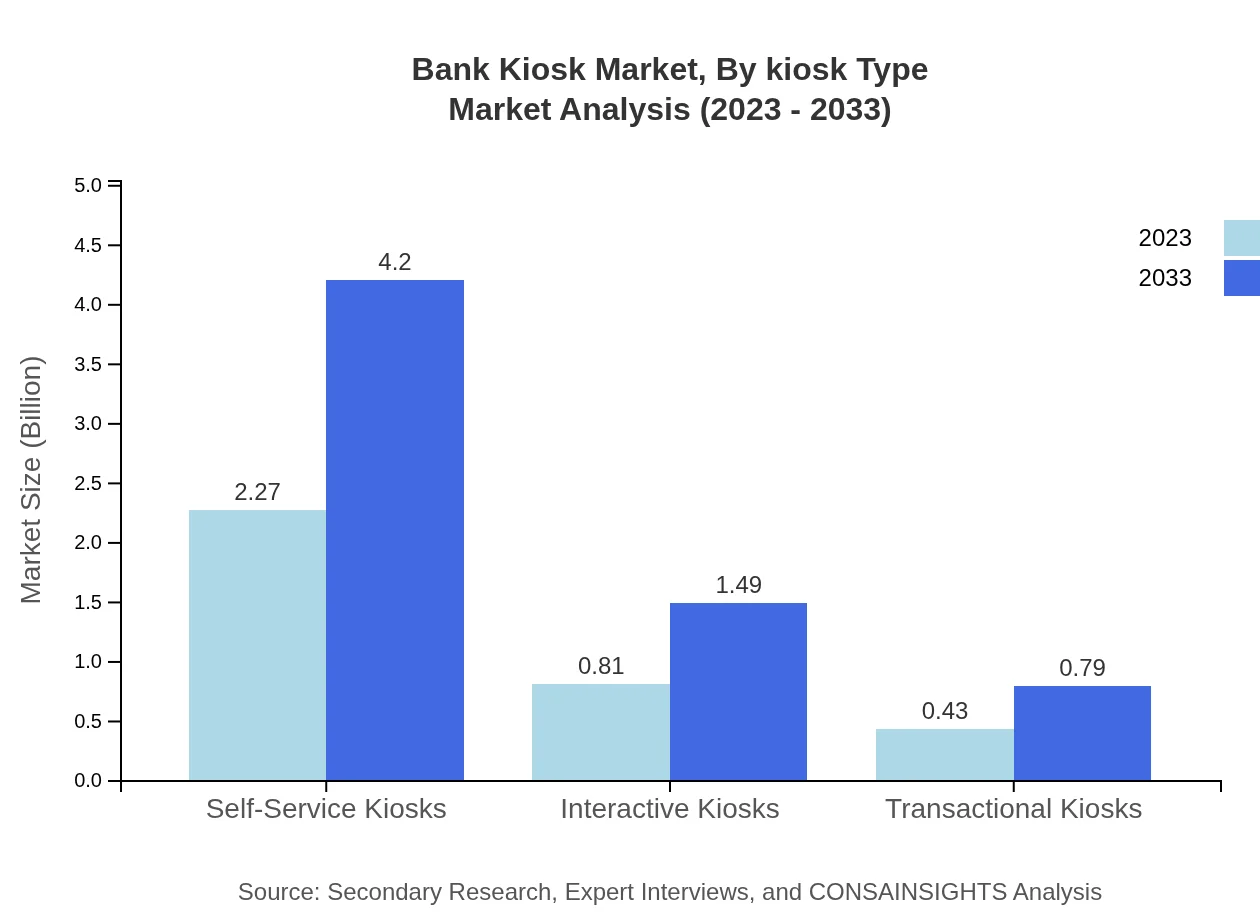

Bank Kiosk Market Analysis By Kiosk Type

The Bank Kiosk market by type is dominated by self-service kiosks, which accounted for a market size of $2.27 billion in 2023, and is expected to rise to $4.20 billion by 2033. Interactive kiosks and transactional kiosks are also significant contributors, with market shares of 23.05% and 12.21% respectively in 2023.

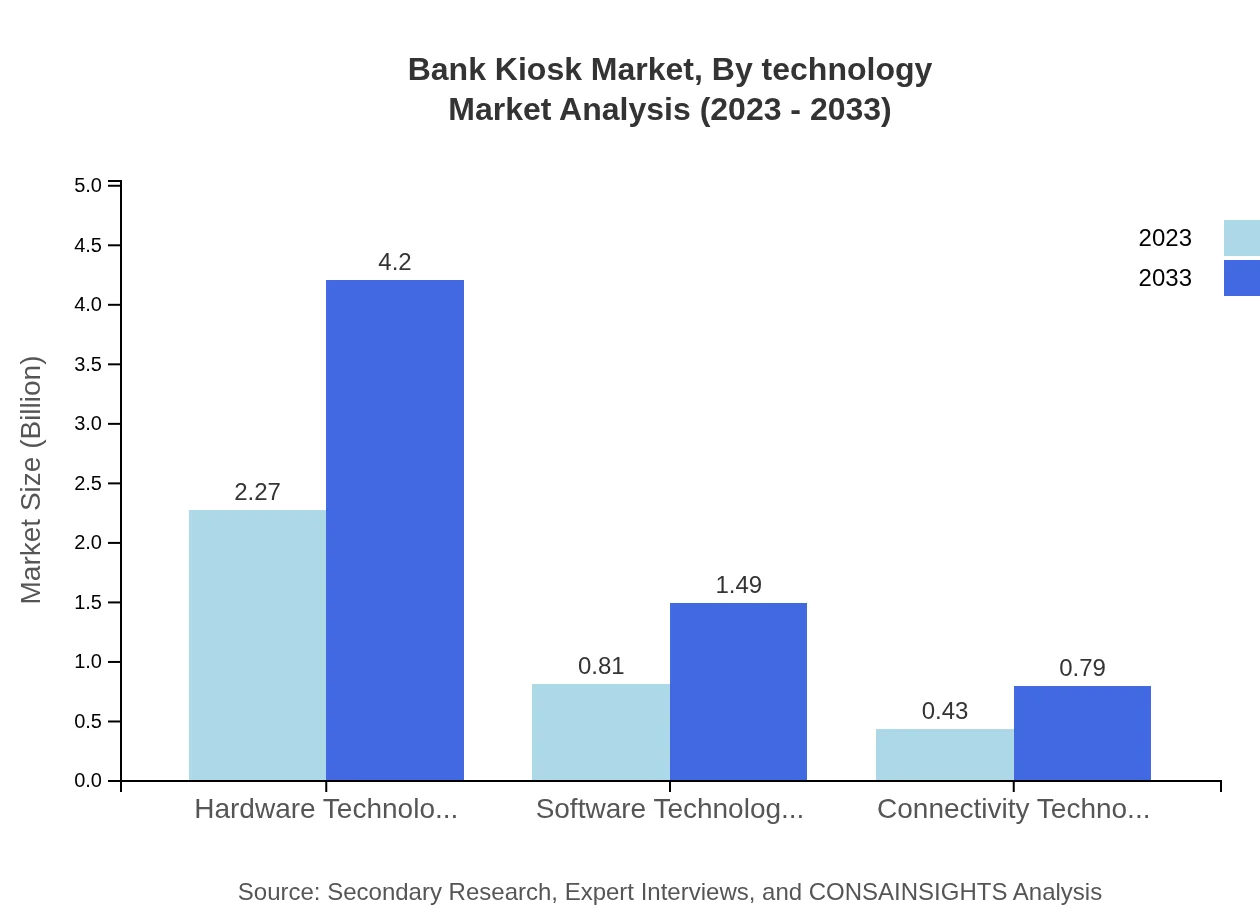

Bank Kiosk Market Analysis By Technology

In terms of technology, hardware technologies are the primary segment in the Bank Kiosk market, valued at approximately $2.27 billion in 2023 and projected to grow to $4.20 billion by 2033. Software solutions and connectivity technologies also represent essential components for enhancing kiosk functionalities.

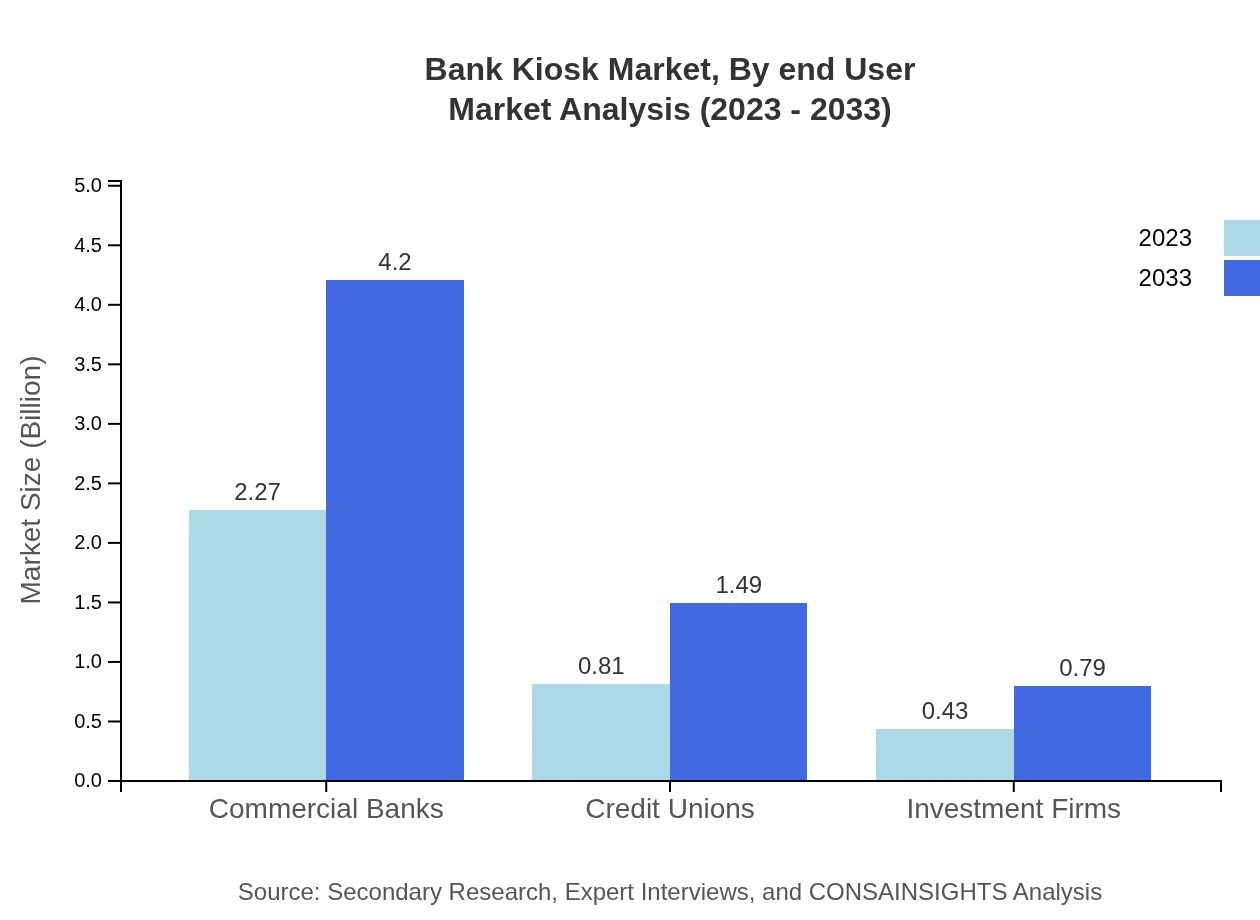

Bank Kiosk Market Analysis By End User

The commercial banks segment is the largest in the Bank Kiosk market, accounting for about 64.74% market share in 2023 and expected to maintain this share through 2033. Credit unions and investment firms also play critical roles, with respective market sizes of $0.81 billion and $0.43 billion in 2023.

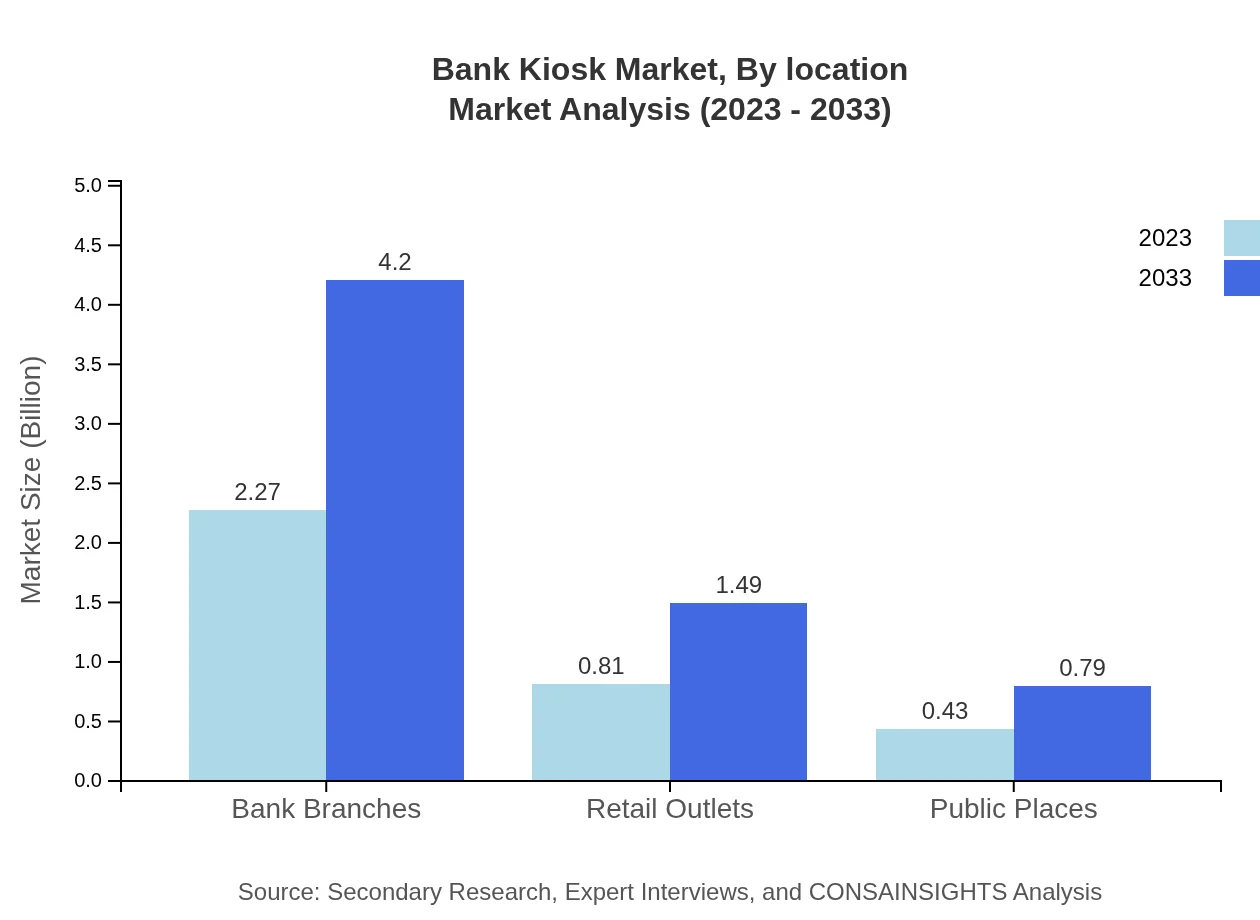

Bank Kiosk Market Analysis By Location

Locations for bank kiosks include retail outlets and public spaces. Retail outlets hold a significant portion of the market with $0.81 billion as of 2023 and expected to grow to $1.49 billion by 2033. Public places also contribute, with a market growth from $0.43 billion in 2023 to $0.79 billion by 2033.

Bank Kiosk Market Analysis By Service Offering

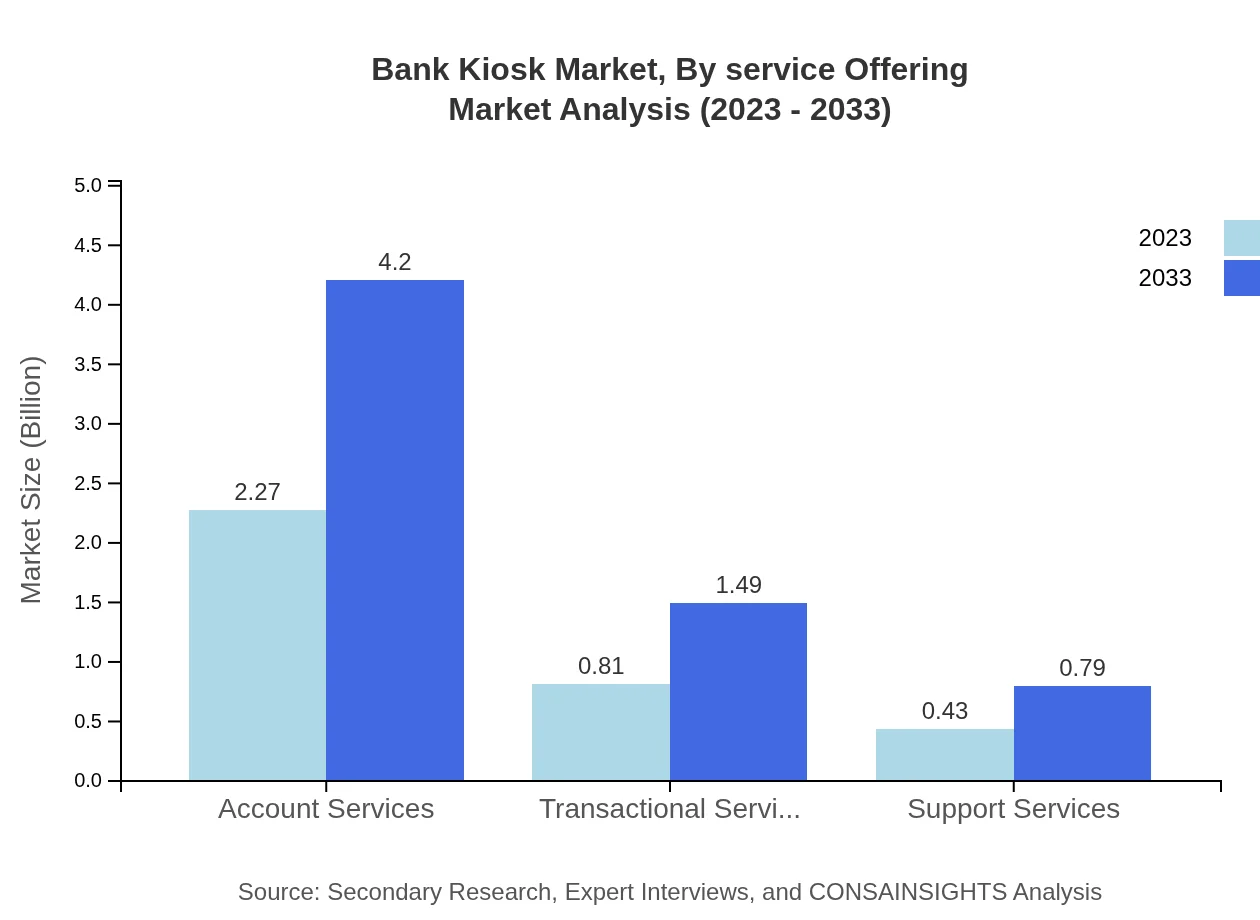

Service offerings through kiosks include account services, transactional services, and support services, with account services leading at a market share of 64.74% in 2023. Transactional and support services account for 23.05% and 12.21% respectively, reflecting their increasing importance in enhancing customer engagement.

Bank Kiosk Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bank Kiosk Industry

NCR Corporation:

NCR Corporation is a leader in banking technology with an extensive portfolio of self-service kiosks and ATMs, known for their innovation in customer experience solutions.Diebold Nixdorf:

Diebold Nixdorf specializes in automated banking solutions and services, offering advanced kiosk technologies that enhance transaction efficiency and customer satisfaction.KIOSK Information Systems:

KIOSK Information Systems is recognized for designing and manufacturing self-service kiosks, providing solutions tailored to the banking sector's needs.GRG Banking:

GRG Banking is a prominent player in the banking kiosk market, focusing on manufacturing ATM and self-service banking solutions with advanced technology.We're grateful to work with incredible clients.

FAQs

What is the market size of bank Kiosk?

The bank-kiosk market is currently valued at approximately $3.5 billion and is projected to grow at a CAGR of 6.2% over the next decade, reflecting increasing consumer demand for self-service banking options.

What are the key market players or companies in this bank Kiosk industry?

Key market players in the bank-kiosk industry include major financial institutions, technology providers, and kiosk manufacturers, although specific company names may vary based on competitive analysis and market research.

What are the primary factors driving the growth in the bank Kiosk industry?

Growth in the bank-kiosk industry is primarily driven by increased demand for self-service banking, technological advancements in kiosk functionalities, and the need for operational efficiency in financial institutions.

Which region is the fastest Growing in the bank Kiosk?

The fastest-growing region for bank kiosks is expected to be Europe, increasing from a market size of $1.26 billion in 2023 to approximately $2.34 billion by 2033, fueled by expanding financial services and user adoption.

Does ConsaInsights provide customized market report data for the bank Kiosk industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the bank-kiosk industry, providing precise data and insights that meet unique business requirements.

What deliverables can I expect from this bank Kiosk market research project?

Expect comprehensive deliverables including detailed market analysis, segmentation data, growth forecasts, competitive landscape insights, and tailored recommendations specific to the bank-kiosk market.

What are the market trends of bank Kiosk?

Key market trends in the bank-kiosk sector include increased digital integration, enhanced user experiences through interactive designs, and the adoption of advanced technologies to streamline customer transactions.