Banking As A Service Baas

Published Date: 24 January 2026 | Report Code: banking-as-a-service-baas

Banking As A Service Baas Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Banking as a Service (BaaS) market, covering key insights and data from 2024 to 2033. It includes market size, industry trends, segmentation, regional analysis, and forecasts to help stakeholders understand market dynamics and opportunities.

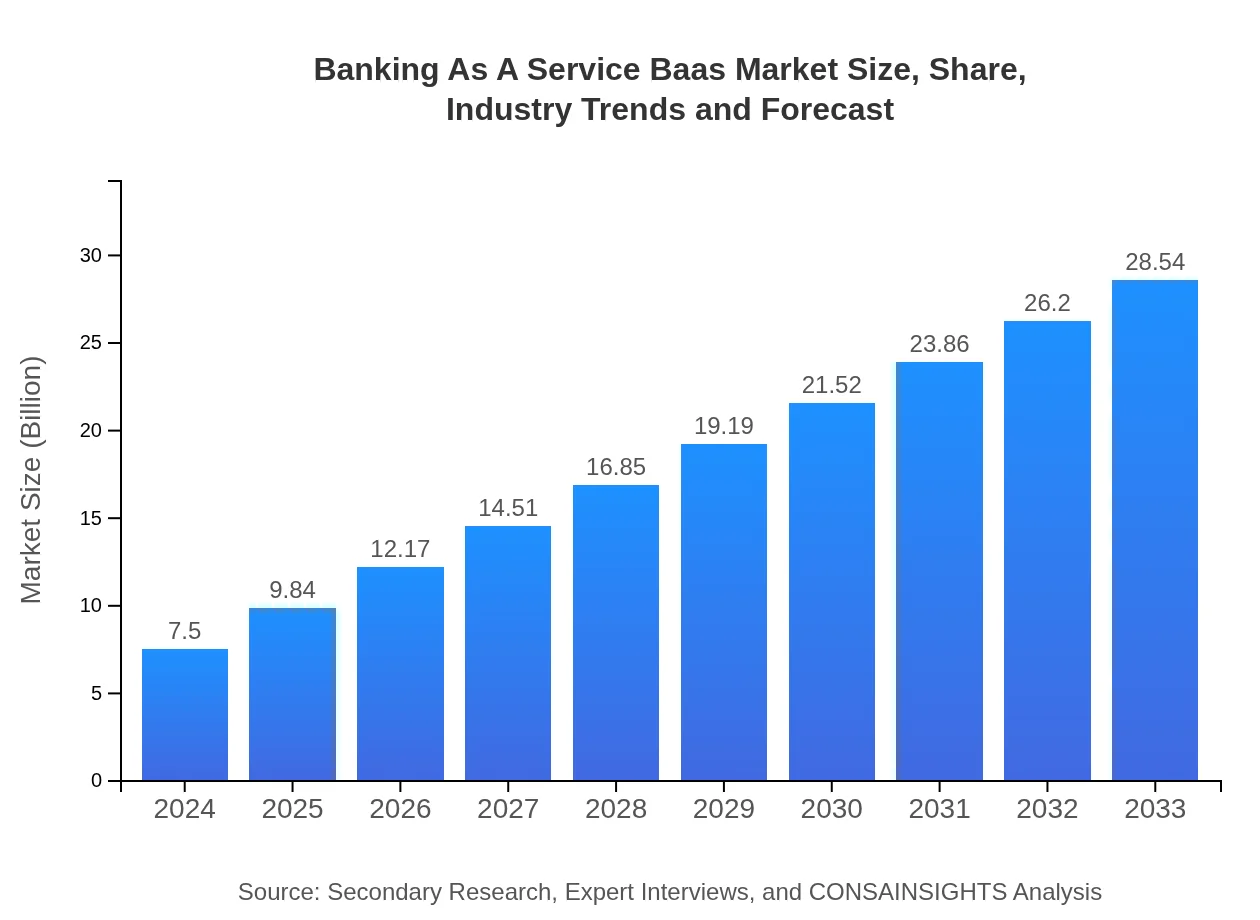

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $7.50 Billion |

| CAGR (2024-2033) | 15.2% |

| 2033 Market Size | $28.54 Billion |

| Top Companies | Solarisbank, Railsbank, Synapse, Galileo Financial Technologies |

| Last Modified Date | 24 January 2026 |

Banking As A Service Baas Market Overview

Customize Banking As A Service Baas market research report

- ✔ Get in-depth analysis of Banking As A Service Baas market size, growth, and forecasts.

- ✔ Understand Banking As A Service Baas's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Banking As A Service Baas

What is the Market Size & CAGR of Banking As A Service Baas market in 2024?

Banking As A Service Baas Industry Analysis

Banking As A Service Baas Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Banking As A Service Baas Market Analysis Report by Region

Europe Banking As A Service Baas:

The European BaaS market is expected to grow from $2.66 billion in 2024 to $10.13 billion by 2033. The region is characterized by stringent regulations promoting transparency and security, which also drives advancement in BaaS solutions to meet compliance requirements.Asia Pacific Banking As A Service Baas:

In the Asia Pacific region, the BaaS market is expected to grow from $1.32 billion in 2024 to $5.03 billion by 2033. Countries like China and India are leading in digital banking adoption, creating significant opportunities for BaaS providers, especially in the fintech sector as they leverage local partnerships.North America Banking As A Service Baas:

In North America, the BaaS market is anticipated to rise from $2.44 billion in 2024 to $9.29 billion by 2033. The United States is at the forefront of this growth, with numerous fintech startups and regulatory frameworks supporting innovation in financial services.South America Banking As A Service Baas:

The South American BaaS market is projected to increase from $0.63 billion in 2024 to $2.39 billion by 2033. The region is witnessing a surge in mobile banking, driven by rising smartphone penetration and changing consumer preferences, propelling the BaaS deployment further.Middle East & Africa Banking As A Service Baas:

The Middle East and Africa market is projected to expand from $0.45 billion in 2024 to $1.70 billion by 2033. Increasing digital financial inclusion initiatives and governmental support for fintech innovations are key factors driving the growth of BaaS in this region.Tell us your focus area and get a customized research report.

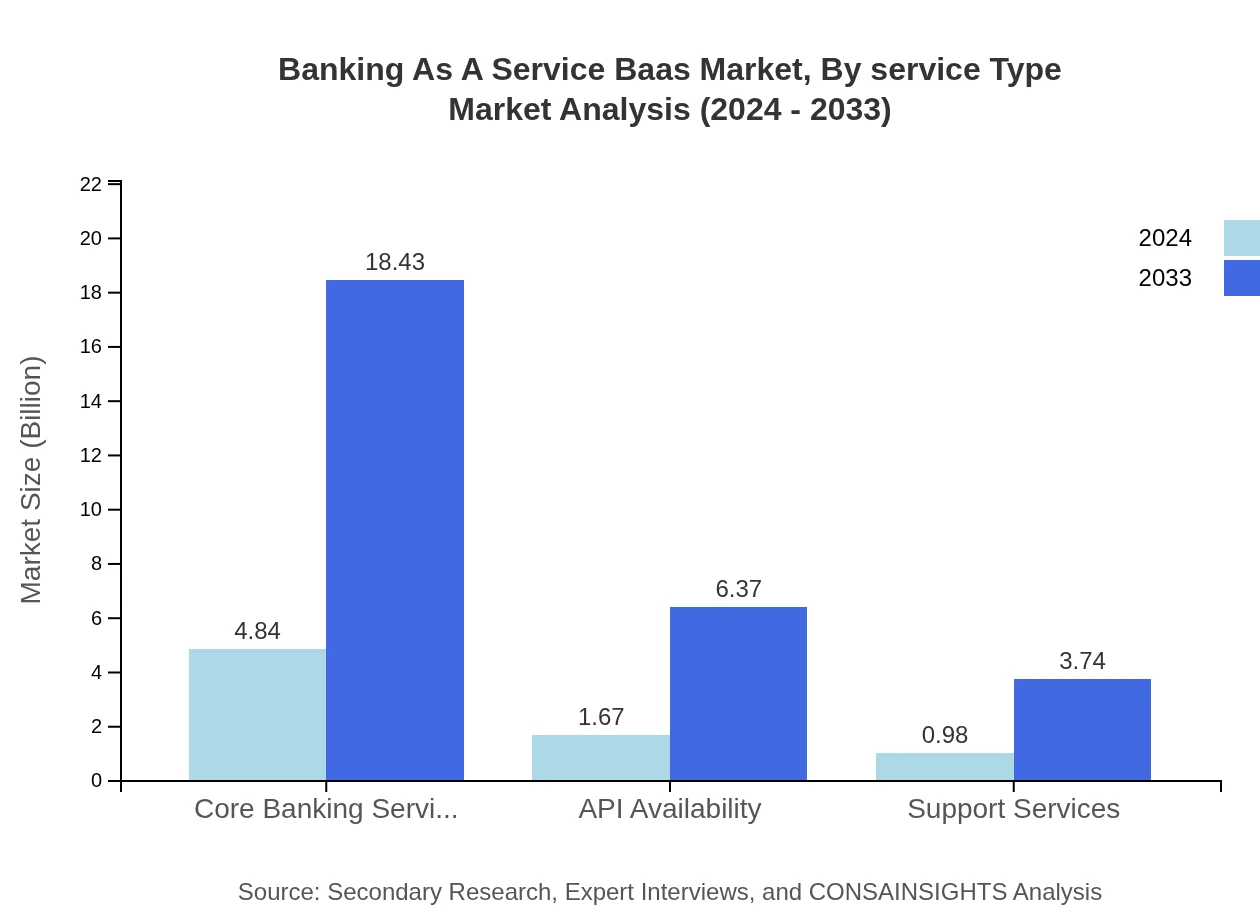

Banking As A Service Baas Market Analysis By Service Type

The BaaS market is heavily driven by service types such as core banking services, which are projected to grow from $4.84 billion in 2024 to $18.43 billion by 2033. Other significant service types include API availability growing from $1.67 billion to $6.37 billion and cybersecurity solutions, which will also see substantial growth. These segments are essential for ensuring operational efficiency and service breadth in the banking ecosystem.

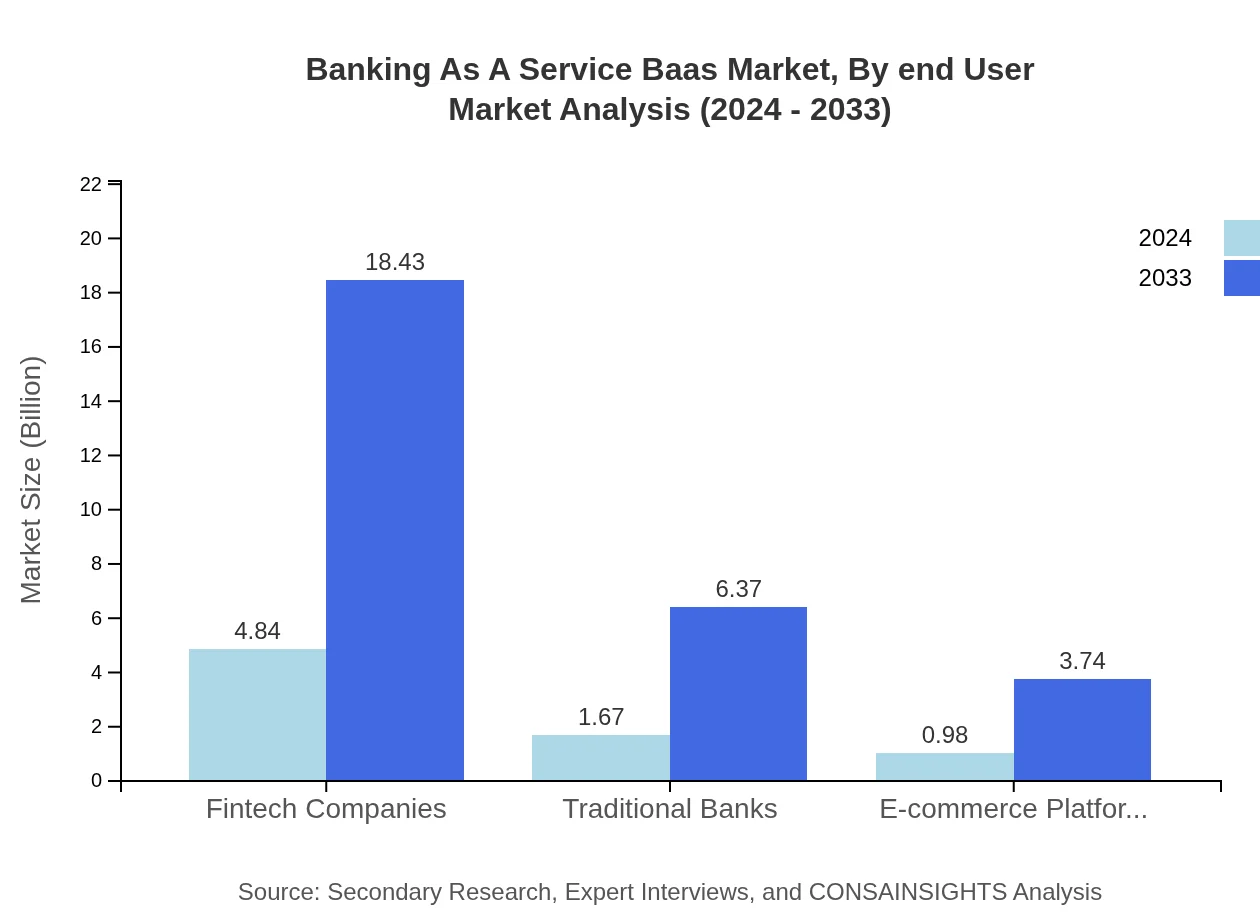

Banking As A Service Baas Market Analysis By End User

Fintech companies dominate the end-user market, growing from $4.84 billion in 2024 to $18.43 billion by 2033, holding a substantial share of 64.57%. Traditional banks, while growing, are projected to represent a share of 22.31%, growing from $1.67 billion to $6.37 billion. E-commerce platforms contribute to market diversity, increasing from $0.98 billion to $3.74 billion.

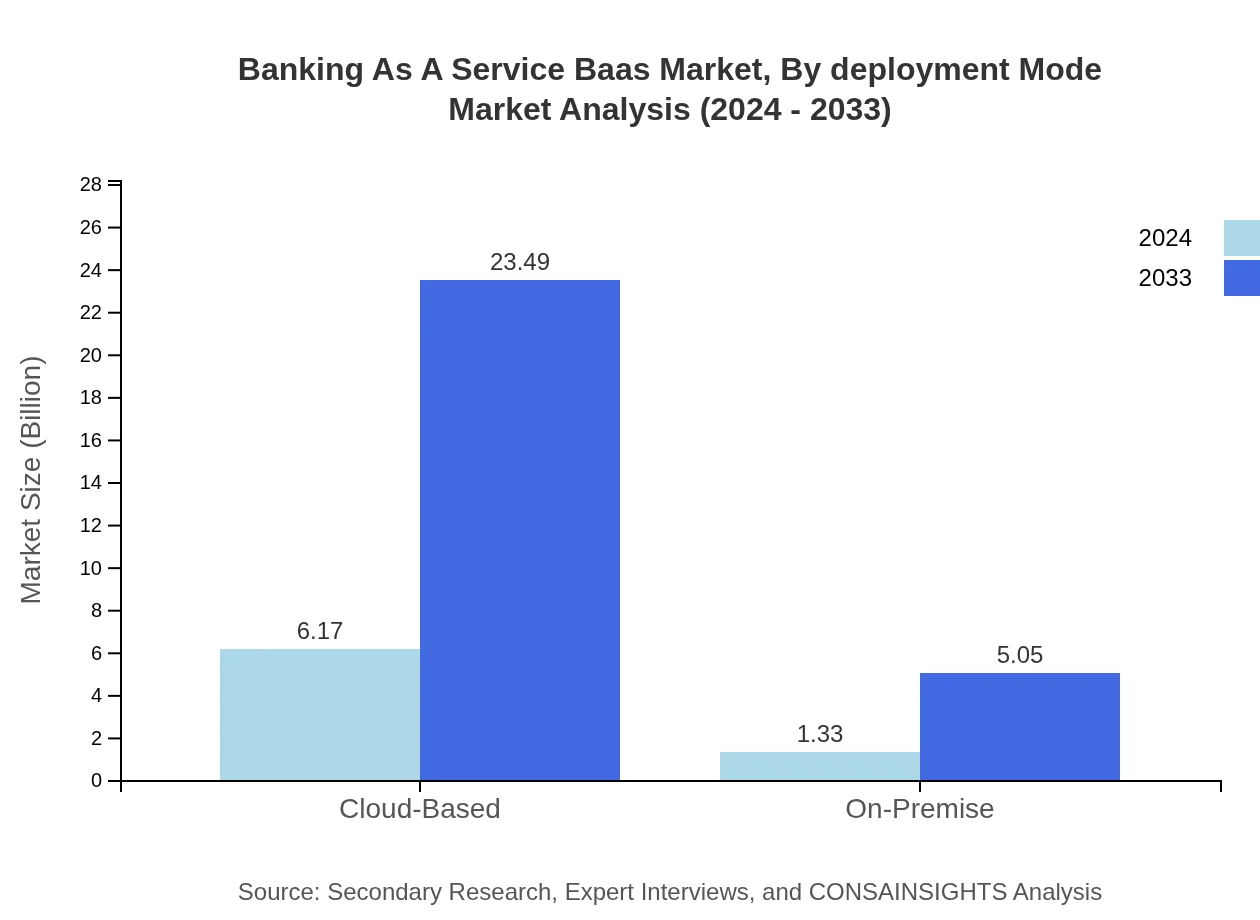

Banking As A Service Baas Market Analysis By Deployment Mode

The deployment mode analysis indicates that cloud-based solutions will thrive, growing from $6.17 billion in 2024 to $23.49 billion by 2033, which represents 82.31% of the market share. Conversely, on-premise solutions will have a modest growth from $1.33 billion to $5.05 billion, making up 17.69%.

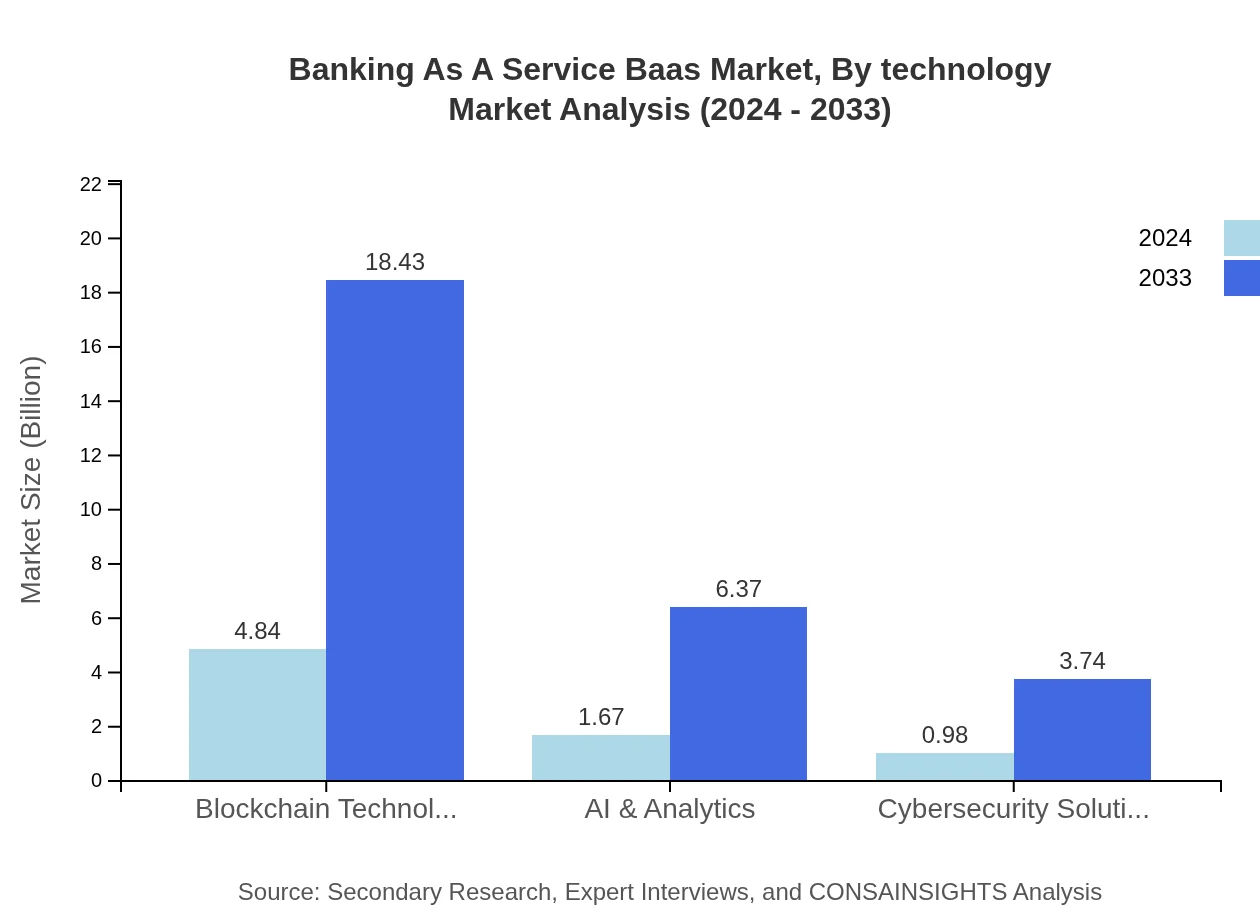

Banking As A Service Baas Market Analysis By Technology

Technological advancements are a major driver in the BaaS market, with trends in blockchain technology and AI & analytics flourishing. Blockchain's market size will expand from $4.84 billion to $18.43 billion, while AI & analytics will grow from $1.67 billion to $6.37 billion. These segments enhance security and enable personalized banking experiences.

Banking As A Service Baas Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Banking As A Service Baas Industry

Solarisbank:

Solarisbank offers a full-stack banking platform that provides businesses with access to banking services while remaining fully compliant with regulations.Railsbank:

Railsbank enables companies to launch financial products seamlessly, providing a combination of banking, payments, and compliance as a service.Synapse:

Synapse provides APIs that power various banking functionalities, streamlining the way companies offer financial services.Galileo Financial Technologies:

Galileo supports payment processing and digital banking, specializing in transaction analytics and strategy design for financial institutions.We're grateful to work with incredible clients.

FAQs

What is the market size of banking As A Service (BaaS)?

The banking-as-a-service market is projected to reach approximately $7.5 billion by 2024, with an impressive CAGR of 15.2% from 2024 to 2033. This growth indicates a strong demand for integrated financial services and digital banking solutions.

What are the key market players or companies in the banking As A Service industry?

Key players in the banking-as-a-service industry include fintech companies, traditional banks, and technology providers specializing in financial services. They drive innovation through API integration and offer various banking solutions to cater to customer needs.

What are the primary factors driving the growth in the banking As A Service industry?

The growth in the BaaS industry is driven by increasing demand for digital banking solutions, the rise of fintech companies, evolving consumer preferences, regulatory support for innovation, and the need for banks to enhance their service offerings.

Which region is the fastest Growing in the banking As A Service market?

The fastest-growing region in the banking-as-a-service market is projected to be Europe, with market size increasing from $2.66 billion in 2024 to $10.13 billion in 2033. North America and Asia Pacific also show robust growth.

Does ConsaInsights provide customized market report data for the banking As A Service industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the banking-as-a-service industry, providing insights and detailed analysis to help businesses make informed strategic decisions.

What deliverables can I expect from this banking As A Service market research project?

Expect comprehensive deliverables, including detailed reports on market size, growth forecasts, competitive analysis, regional insights, and segment data that can guide strategic planning and investment decisions.

What are the market trends of banking As A Service?

Trends in the banking-as-a-service market include the rise of cloud-based solutions, increased API availability, partnerships between fintechs and banks, heightened focus on cybersecurity, and the integration of AI and analytics to enhance service delivery.