Banking Maintenance Support Services Market Report

Published Date: 31 January 2026 | Report Code: banking-maintenance-support-services

Banking Maintenance Support Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Banking Maintenance Support Services market, detailing key insights, growth opportunities, and regional trends for the forecast period 2023-2033.

| Metric | Value |

|---|---|

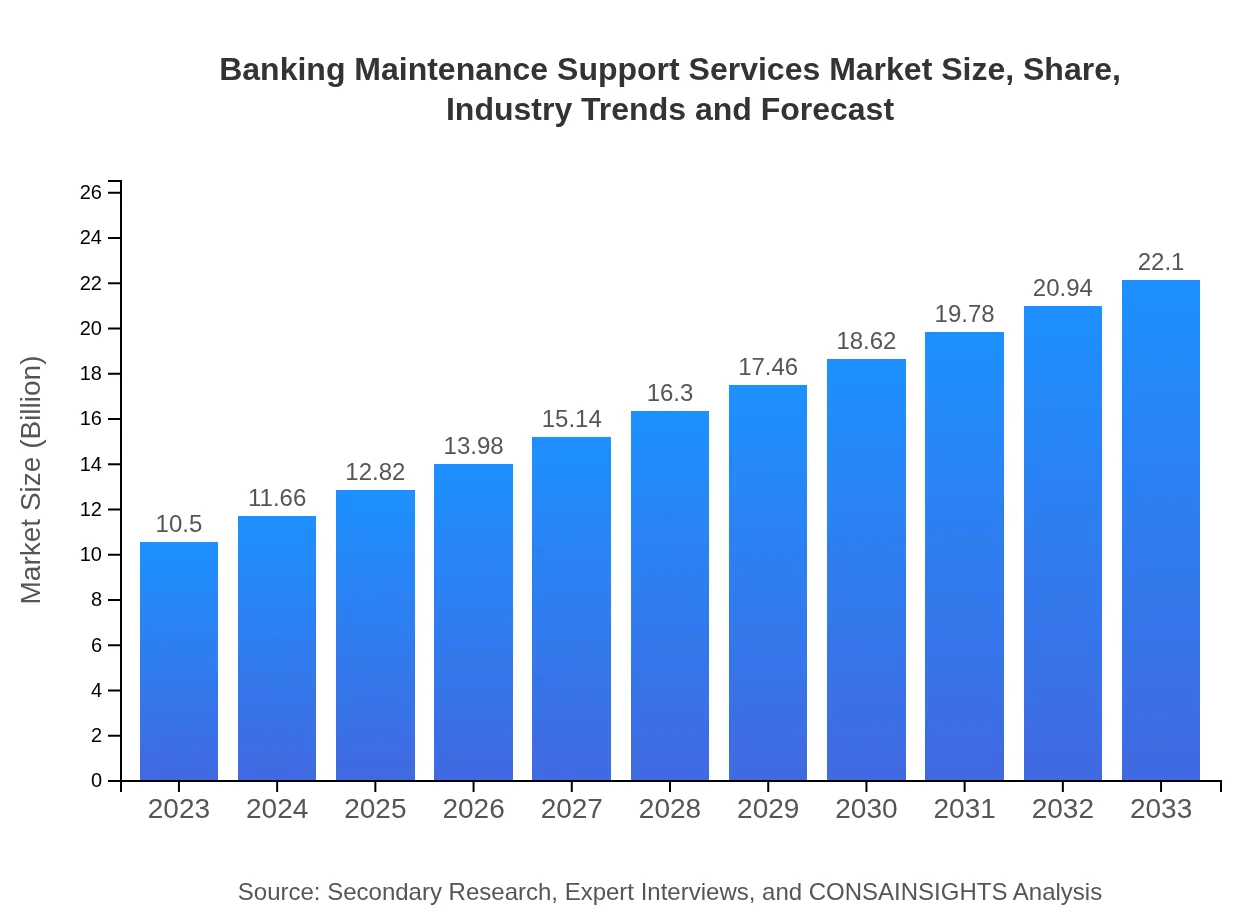

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $22.10 Billion |

| Top Companies | IBM Corporation, FIS Global, Accenture, Oracle Corporation |

| Last Modified Date | 31 January 2026 |

Banking Maintenance Support Services Market Overview

Customize Banking Maintenance Support Services Market Report market research report

- ✔ Get in-depth analysis of Banking Maintenance Support Services market size, growth, and forecasts.

- ✔ Understand Banking Maintenance Support Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Banking Maintenance Support Services

What is the Market Size & CAGR of Banking Maintenance Support Services market in 2023?

Banking Maintenance Support Services Industry Analysis

Banking Maintenance Support Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Banking Maintenance Support Services Market Analysis Report by Region

Europe Banking Maintenance Support Services Market Report:

Europe's market is set to rise from $3.10 billion in 2023 to $6.52 billion by 2033. Regulatory compliance and digitalization initiatives across European banks highlight the increasing need for maintenance support services.Asia Pacific Banking Maintenance Support Services Market Report:

In Asia Pacific, the market size is projected to grow from $2.00 billion in 2023 to $4.20 billion by 2033. This growth is driven by rapid digital transformation among banks and increasing fintech adoption. The region's young population and push towards cashless transactions further fuel the demand for these services.North America Banking Maintenance Support Services Market Report:

North America leads the market, with a size of $3.83 billion in 2023, anticipated to reach $8.07 billion by 2033. The presence of established banking institutions and advanced technological adoption drive the demand for comprehensive maintenance and support services.South America Banking Maintenance Support Services Market Report:

The South American market for Banking Maintenance Support Services is expected to increase from $1.02 billion in 2023 to $2.16 billion by 2033. Economic reforms and the modernization of banking infrastructure are key factors contributing to this growth.Middle East & Africa Banking Maintenance Support Services Market Report:

The Middle East and Africa market is expected to grow from $0.55 billion in 2023 to $1.16 billion by 2033. Emerging markets in the region are enhancing their banking services, leading to increased investment in maintenance support.Tell us your focus area and get a customized research report.

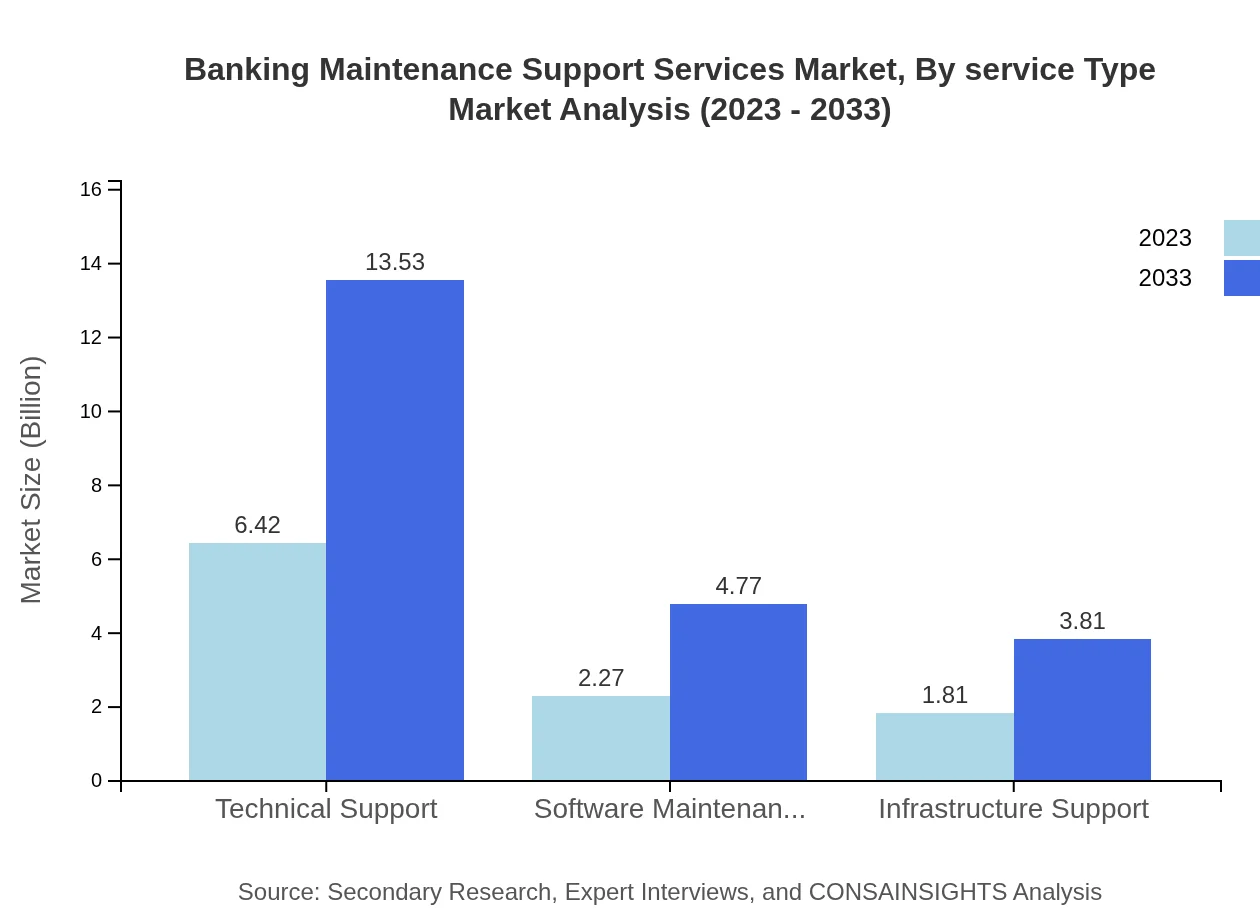

Banking Maintenance Support Services Market Analysis By Service Type

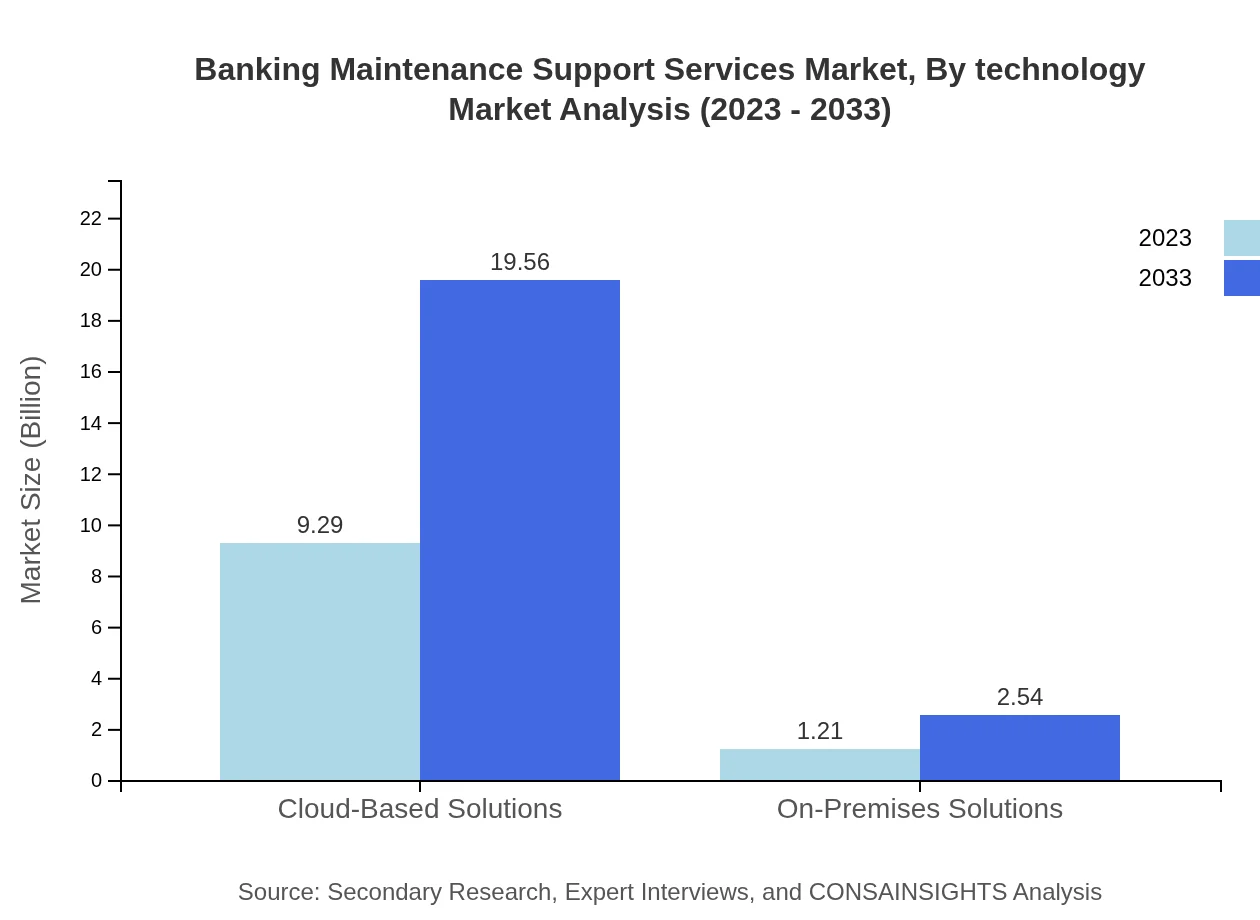

The market is primarily dominated by Cloud-Based Solutions, which are expected to increase from $9.29 billion in 2023 to $19.56 billion by 2033, holding a significant market share of 88.51% throughout the forecast period. On-Premises Solutions are also notable, projected to grow from $1.21 billion to $2.54 billion with a smaller share of 11.49%.

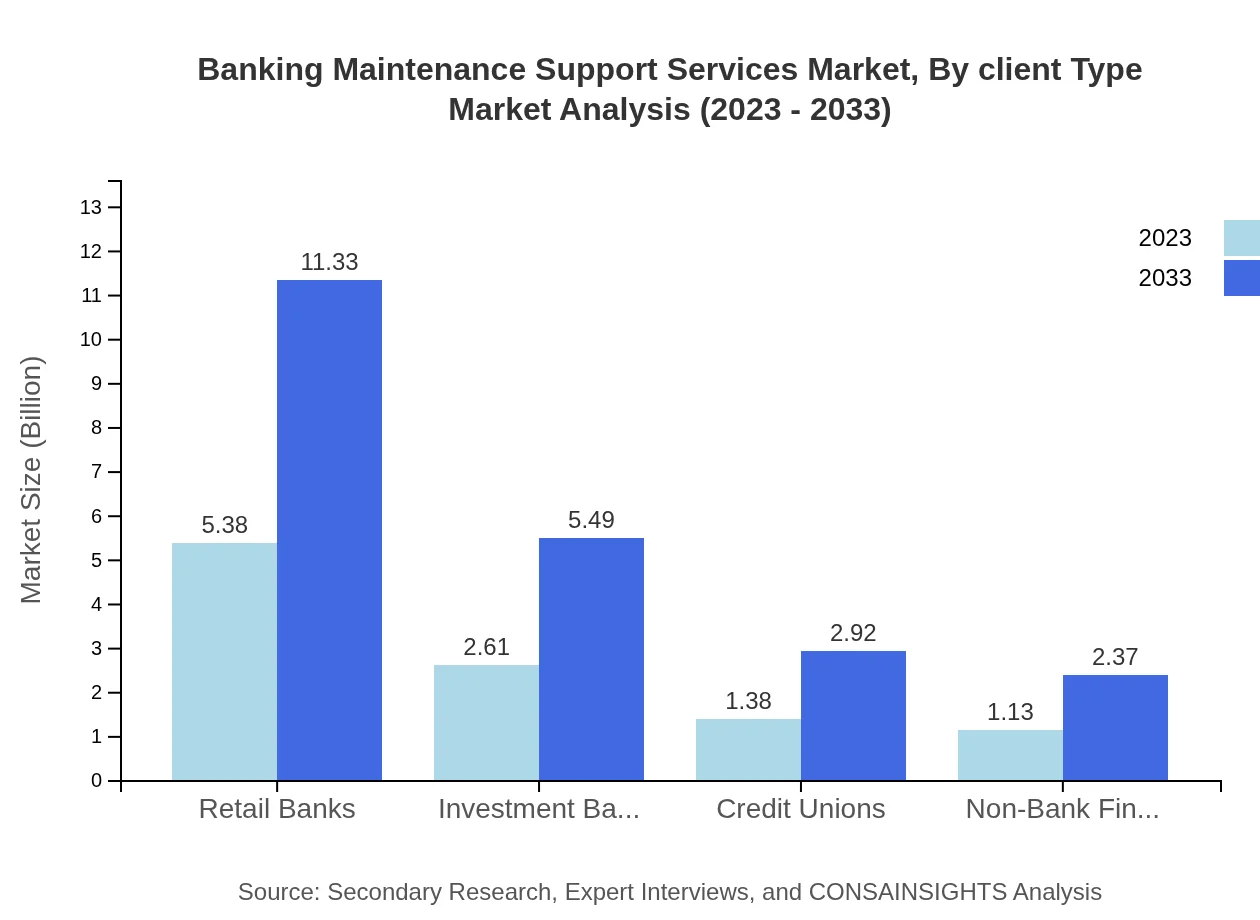

Banking Maintenance Support Services Market Analysis By Client Type

Retail Banks account for a significant market presence, growing from $5.38 billion in 2023 to $11.33 billion by 2033, with a market share of 51.25%. Investment Banks and Credit Unions also have considerable market shares, with investment banks expected to grow from $2.61 billion to $5.49 billion (24.82% share) and credit unions growing from $1.38 billion to $2.92 billion (13.19% share).

Banking Maintenance Support Services Market Analysis By Technology

Technical Support represents the largest component, expected to rise from $6.42 billion in 2023 to $13.53 billion (61.19% share). Software Maintenance is also significant, projected to grow from $2.27 billion to $4.77 billion (21.59% share).

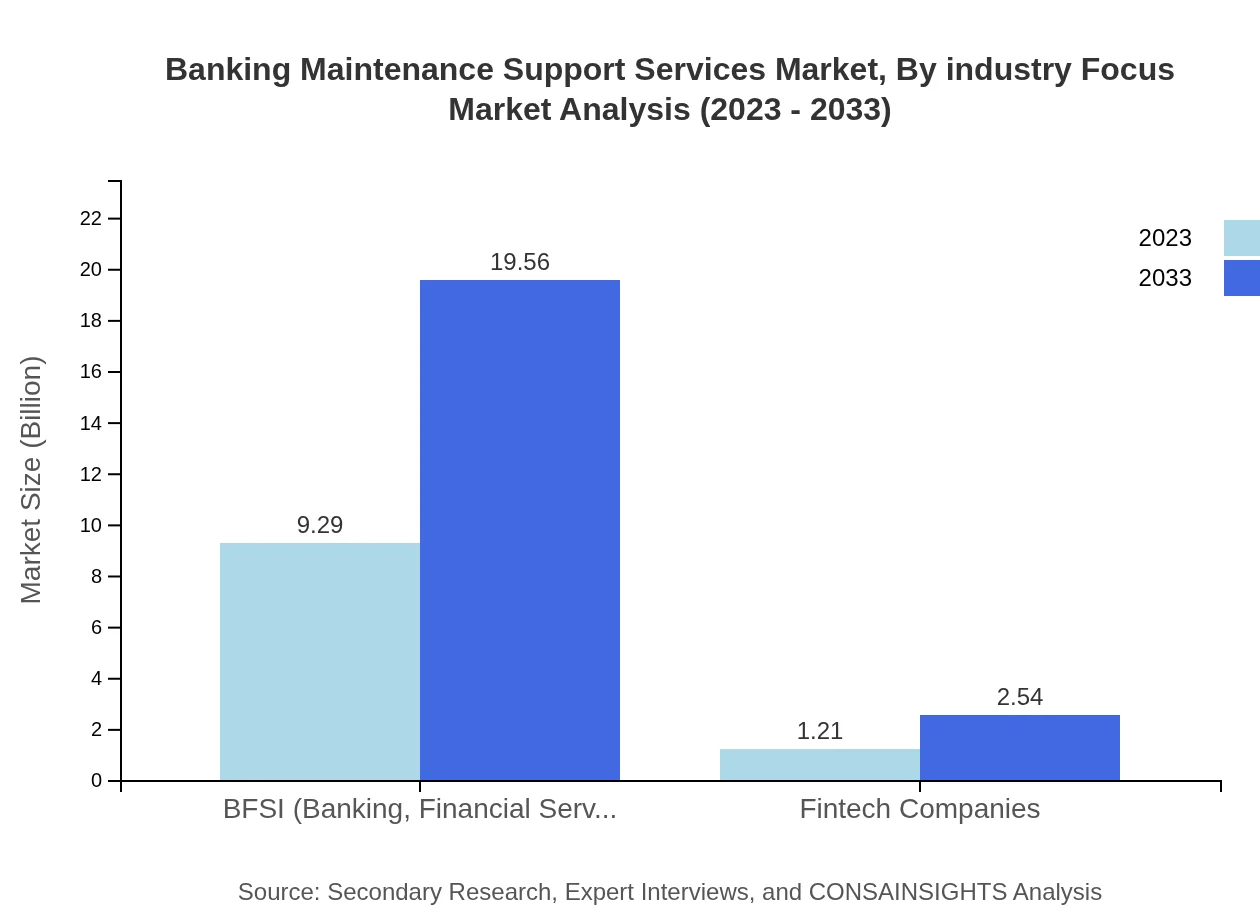

Banking Maintenance Support Services Market Analysis By Industry Focus

The BFSI sector holds a central position, with expected growth from $9.29 billion in 2023 to $19.56 billion, representing a market share of 88.51%. Fintech companies, while smaller, show promising growth from $1.21 billion to $2.54 billion, capturing an 11.49% market share.

Banking Maintenance Support Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Banking Maintenance Support Services Industry

IBM Corporation:

IBM provides comprehensive banking solutions and robust maintenance support that enable financial institutions to streamline operations while ensuring compliance and enhanced security protocols.FIS Global:

FIS Global specializes in software solutions for banking, offering maintenance and support services that cater to retail and commercial banks with advanced technology and customer-centric innovations.Accenture:

Accenture delivers consulting and technology services to the banking industry, focusing on improving operational efficiencies through innovative maintenance support frameworks.Oracle Corporation:

Oracle provides banks with a versatile range of database management systems and application solutions, including dedicated maintenance services to ensure optimal performance.We're grateful to work with incredible clients.

FAQs

What is the market size of banking maintenance support services?

The global banking maintenance support services market is projected to grow from $10.5 billion in 2023, with a compound annual growth rate (CAGR) of 7.5%, reaching significant expansion by 2033.

What are the key market players or companies in this banking maintenance support services industry?

Key players in the banking maintenance support services industry include major financial institutions, technology providers, and IT service management companies, all focused on delivering top-notch support and maintenance solutions to banks and financial service organizations.

What are the primary factors driving the growth in the banking maintenance support services industry?

Growth in the banking maintenance support services industry is primarily driven by the increasing reliance on digital banking solutions, the need for regulatory compliance, growing cybersecurity concerns, and advancements in technology enhancing operational efficiencies.

Which region is the fastest Growing in the banking maintenance support services?

North America is the fastest-growing region in the banking maintenance support services market, expanding from $3.83 billion in 2023 to $8.07 billion by 2033, fueled by technological adoption and robust financial services infrastructure.

Does ConsaInsights provide customized market report data for the banking maintenance support services industry?

Yes, ConsaInsights offers customized market report data for the banking maintenance support services industry, tailored to specific needs, helping businesses make informed decisions based on unique market dynamics.

What deliverables can I expect from this banking maintenance support services market research project?

From the banking maintenance support services market research project, you can expect comprehensive reports, detailed analysis of market trends, segmented data, competitive landscape insights, and forecasts that detail future growth potential.

What are the market trends of banking maintenance support services?

Current trends in banking maintenance support services include increasing adoption of cloud-based solutions, a focus on technical support enhancements, and the rise of fintech partnerships, reflecting a shift towards more integrated financial technology solutions.