Barcode Software Market Report

Published Date: 31 January 2026 | Report Code: barcode-software

Barcode Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Barcode Software market, covering various segments, regional insights, technology trends, and competitive landscape from 2023 to 2033. It aims to deliver valuable forecasts and insights into market dynamics and future growth opportunities.

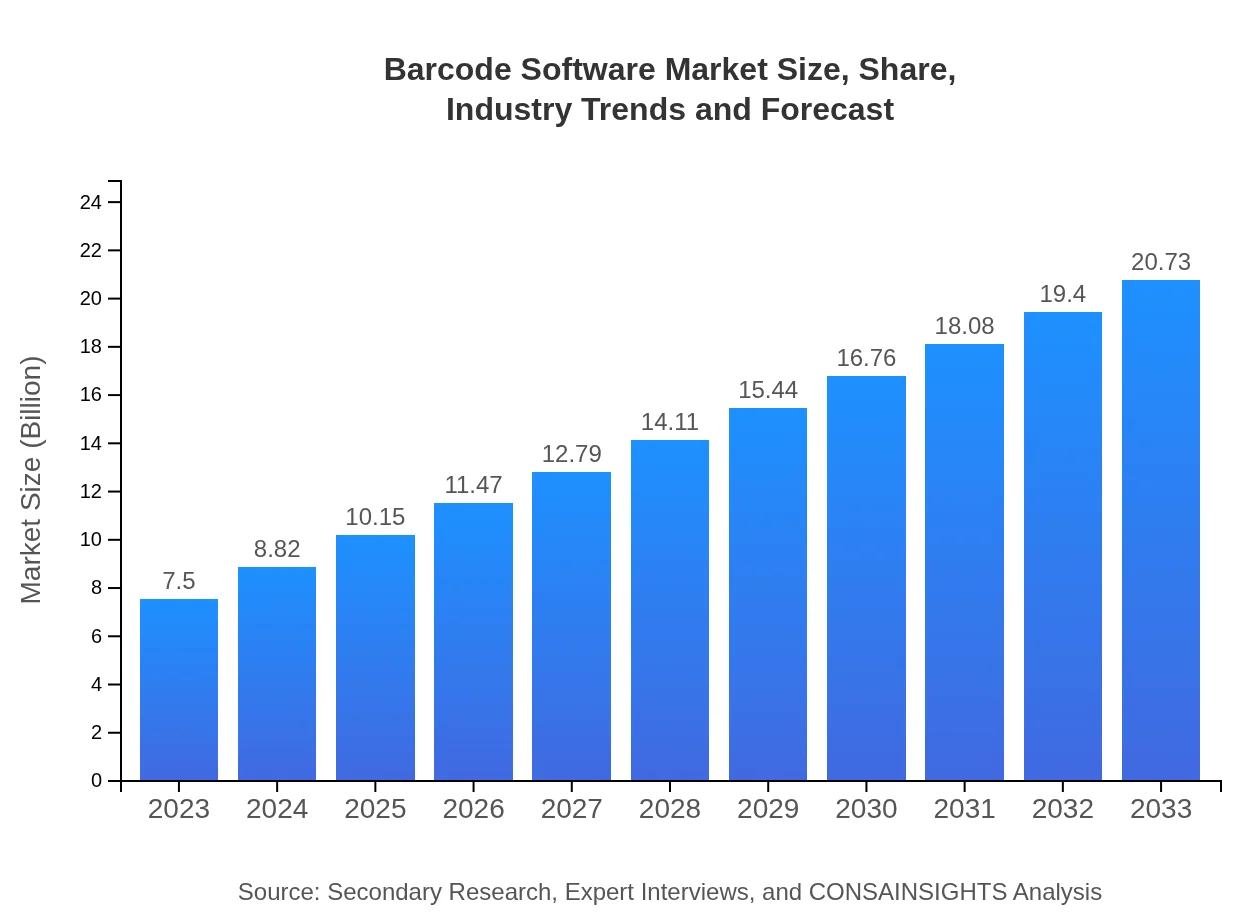

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.50 Billion |

| CAGR (2023-2033) | 10.3% |

| 2033 Market Size | $20.73 Billion |

| Top Companies | Zebra Technologies, Honeywell International Inc., SATO Holdings Corporation, Datalogic S.p.A. |

| Last Modified Date | 31 January 2026 |

Barcode Software Market Overview

Customize Barcode Software Market Report market research report

- ✔ Get in-depth analysis of Barcode Software market size, growth, and forecasts.

- ✔ Understand Barcode Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Barcode Software

What is the Market Size & CAGR of Barcode Software market in 2023?

Barcode Software Industry Analysis

Barcode Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Barcode Software Market Analysis Report by Region

Europe Barcode Software Market Report:

The European Barcode Software market is projected to grow from $1.94 billion in 2023 to $5.36 billion in 2033. The region's growth is propelled by regulatory mandates for inventory tracking and a strong push towards digital transformation in industries such as automotive and retail.Asia Pacific Barcode Software Market Report:

In 2023, the Barcode Software market in the Asia Pacific region is valued at $1.49 billion and is projected to grow to $4.11 billion by 2033, marking a robust increase due to the manufacturing boom and retail sector growth. Countries like China and India are leading the way in adopting barcode software to streamline their operations and enhance supply chain management.North America Barcode Software Market Report:

With a market size of $2.92 billion in 2023 and forecasted to reach $8.07 billion by 2033, North America dominates the Barcode Software market. The high adoption rates of advanced technologies by enterprises seeking to enhance supply chain visibility and efficiency are key drivers for this growth.South America Barcode Software Market Report:

The South American market for Barcode Software stands at $0.27 billion in 2023 and is expected to reach $0.75 billion by 2033. The growth is slowly gaining momentum, driven by increasing demand from the retail sector and small and medium enterprises seeking automation solutions to enhance operational efficiencies.Middle East & Africa Barcode Software Market Report:

In the Middle East and Africa, the market is expected to grow from $0.88 billion in 2023 to $2.44 billion by 2033. The adoption of barcode software is gaining traction in logistics and retail sectors, as businesses recognize the importance of streamlining operations and tracking products efficiently.Tell us your focus area and get a customized research report.

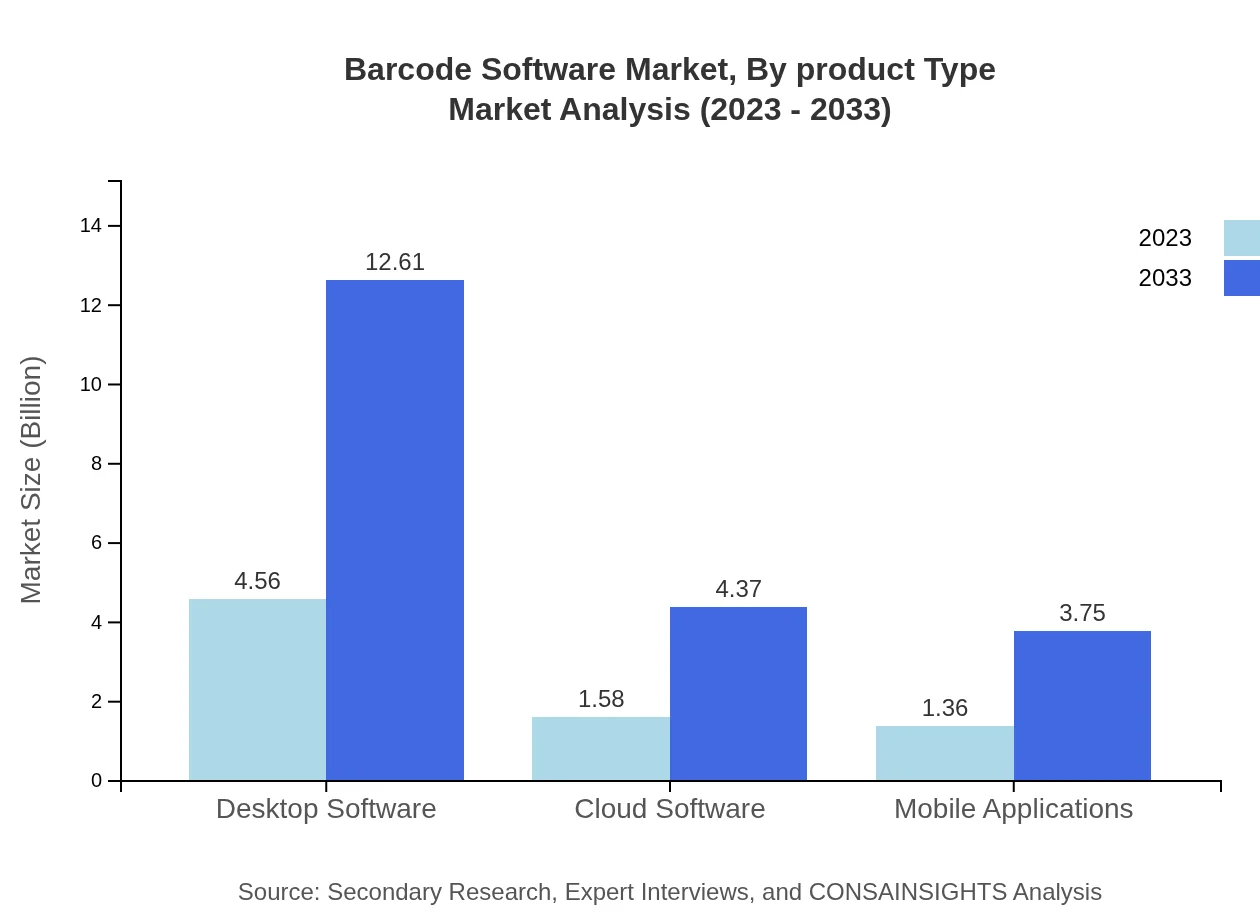

Barcode Software Market Analysis By Product Type

The analysis of the Barcode Software Market by product type reveals significant trends. The Barcode Scanning type leads with a market size of $4.56 billion in 2023, expected to rise to $12.61 billion by 2033. This is followed by Label Printing, with figures rising from $1.58 billion in 2023 to $4.37 billion by 2033, showcasing the increase in demand for comprehensive labeling solutions.

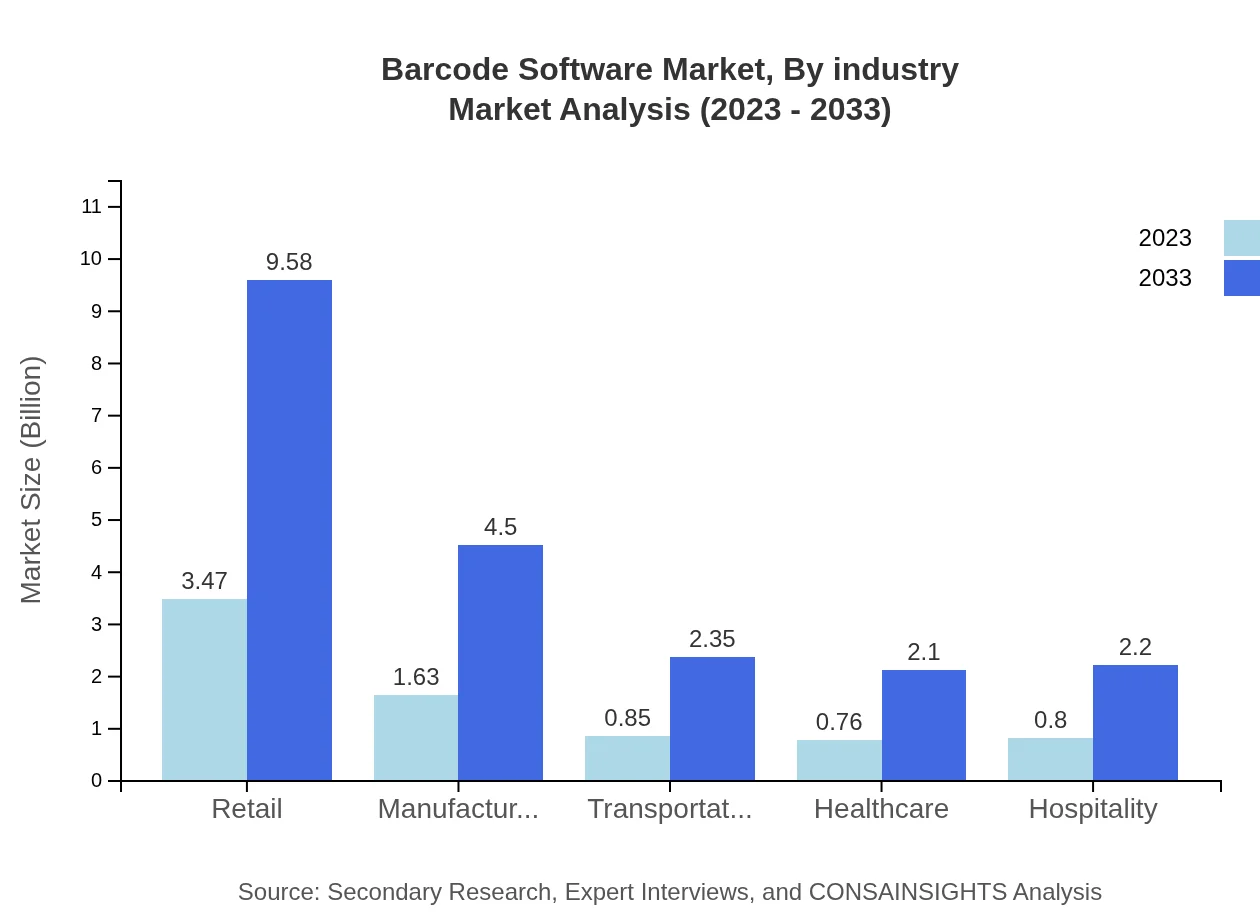

Barcode Software Market Analysis By Industry

Segmenting by industry, the Retail sector holds substantial market share, valued at $3.47 billion in 2023, and is anticipated to reach $9.58 billion in 2033. Manufacturing follows closely, maintaining robust growth driven by automation and efficiency needs. Key segments continue to evolve, indicating the importance of tailored solutions for industry-specific challenges.

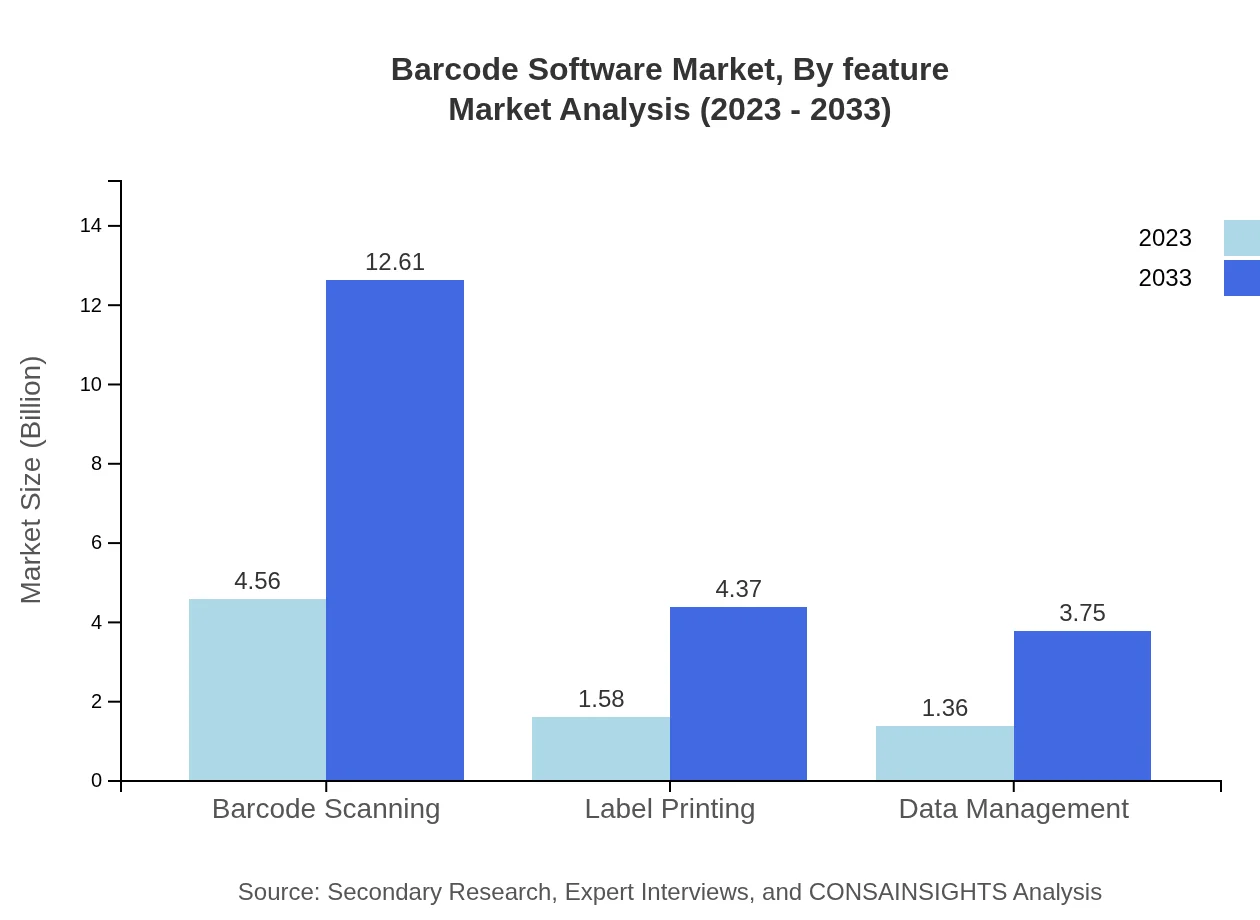

Barcode Software Market Analysis By Feature

This segment analysis illustrates that features focusing on cloud integration and mobile application capabilities are increasingly prioritized by businesses. With greater reliance on inventory management and tracking solutions, there is a notable push towards software that offers real-time data analysis and easy accessibility.

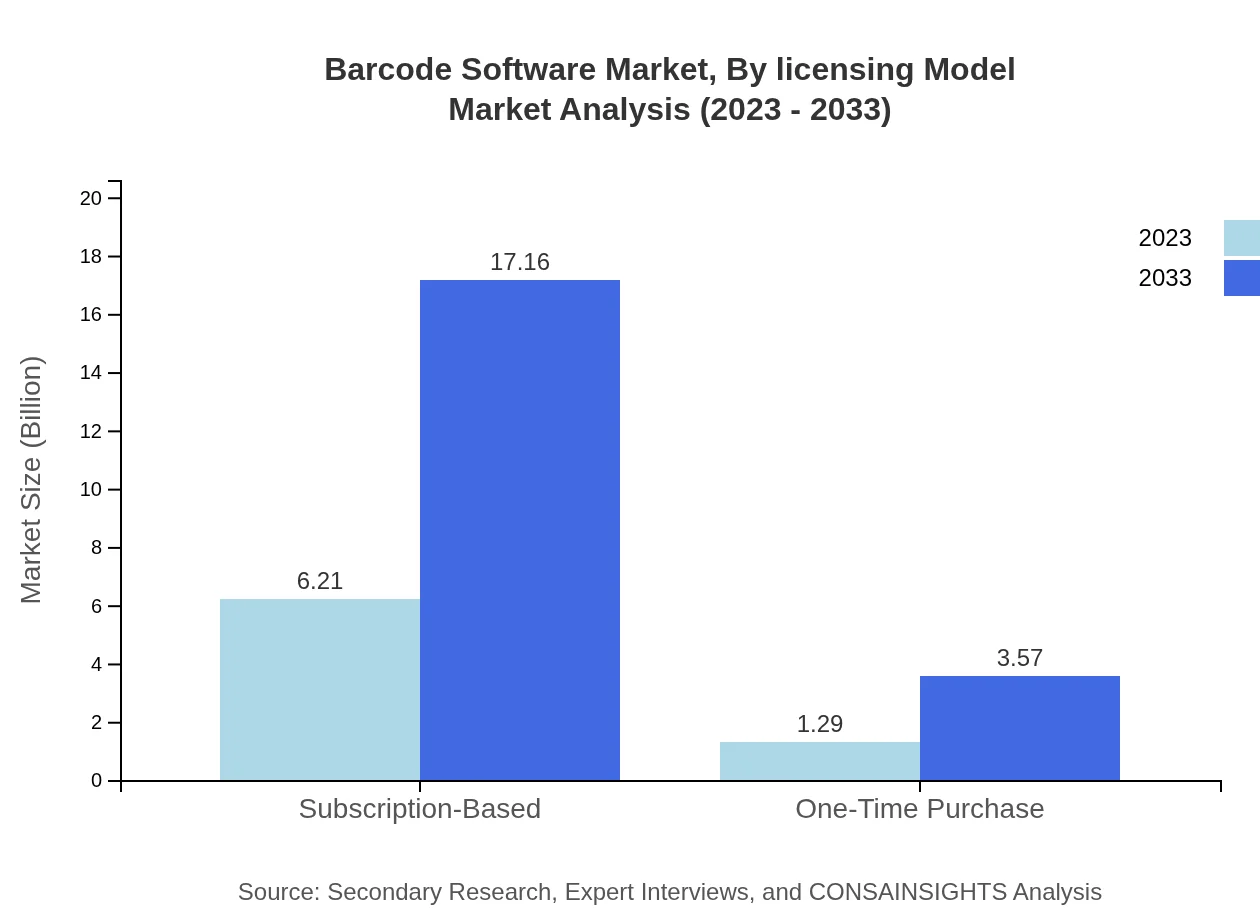

Barcode Software Market Analysis By Licensing Model

The licensing model analysis indicates that subscription-based models dominate, with a market share of 82.77% in 2023. This trend is supported by the increasing preference for flexibility and cost management among businesses looking to adopt barcode solutions.

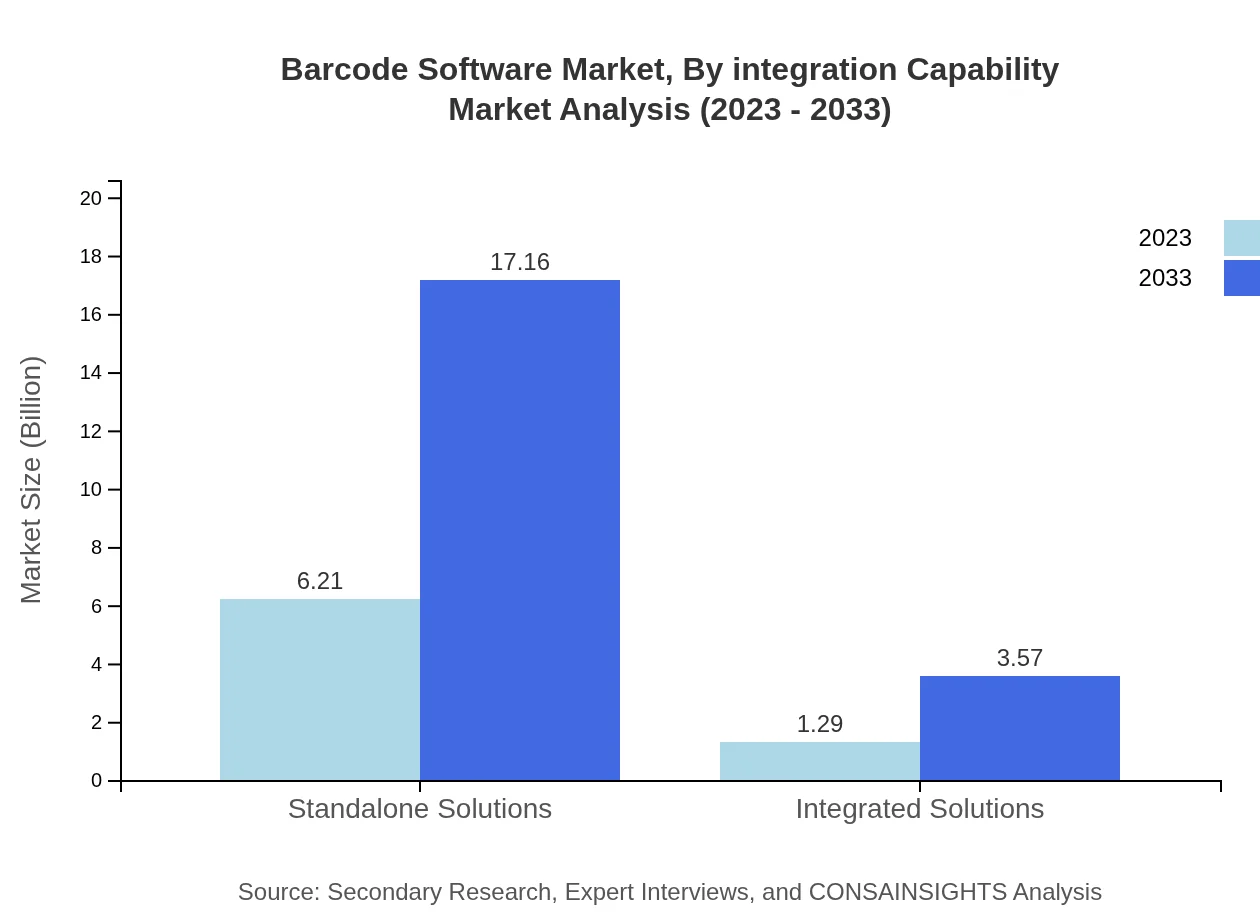

Barcode Software Market Analysis By Integration Capability

Integration capability remains a crucial component of the Barcode Software market. Standalone solutions account for a significant market segment, while integrated solutions are experiencing growth as companies seek to streamline operations across platforms for better data coherence and application usability.

Barcode Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Barcode Software Industry

Zebra Technologies:

Zebra Technologies leads the Barcode Software industry by providing innovative scanning and printing solutions that enhance device capabilities and operational efficiencies.Honeywell International Inc.:

Honeywell offers comprehensive barcode software and hardware solutions that cater to various sectors, facilitating better tracking and productivity in supply chains.SATO Holdings Corporation:

SATO specializes in printing solutions and RFID technology, contributing to advanced barcode management systems focused on efficiency and reliability.Datalogic S.p.A.:

Datalogic is recognized for its barcode reader solutions and image processing technologies, widely utilized in retail, healthcare, and logistics.We're grateful to work with incredible clients.

FAQs

What is the market size of barcode Software?

The barcode software market is valued at approximately $7.5 billion in 2023, with a robust CAGR of 10.3%, indicating significant growth as technological advancements continue to enhance barcode applications across various sectors.

What are the key market players or companies in the barcode Software industry?

Key players in the barcode software industry include companies like Zebra Technologies, Datalogic, Honeywell, Panasonic, and many others, each competing to innovate and provide advanced solutions in barcode scanning and management.

What are the primary factors driving the growth in the barcode software industry?

Factors driving growth include increasing adoption of automated inventory systems, demand for supply chain efficiency, and advancements in barcode technology, as businesses seek to enhance operational accuracy and reduce costs.

Which region is the fastest Growing in the barcode software market?

North America is currently the fastest-growing region in the barcode software market, projected to increase from $2.92 billion in 2023 to $8.07 billion by 2033, showcasing substantial market expansion in this area.

Does ConsaInsights provide customized market report data for the barcode software industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the barcode software industry, allowing clients to gain insights relevant to their business objectives and competitive landscape.

What deliverables can I expect from this barcode software market research project?

Clients can expect comprehensive reports, including detailed market sizing, growth forecasts, competitive analysis, and specific insights into regional and segment breakdowns, ensuring informed decision-making.

What are the market trends of barcode software?

Major trends in the barcode software market include the rise of mobile barcode applications, increasing cloud-based solutions adoption, and a shift towards subscription-based models, reflecting changing consumer preferences and business needs.