Bariatric Surgery Devices Market Report

Published Date: 31 January 2026 | Report Code: bariatric-surgery-devices

Bariatric Surgery Devices Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Bariatric Surgery Devices market, providing insights into market size, segmentation, trends, and regional dynamics from 2023 to 2033, helping industry stakeholders understand the growth trajectory and innovations in the sector.

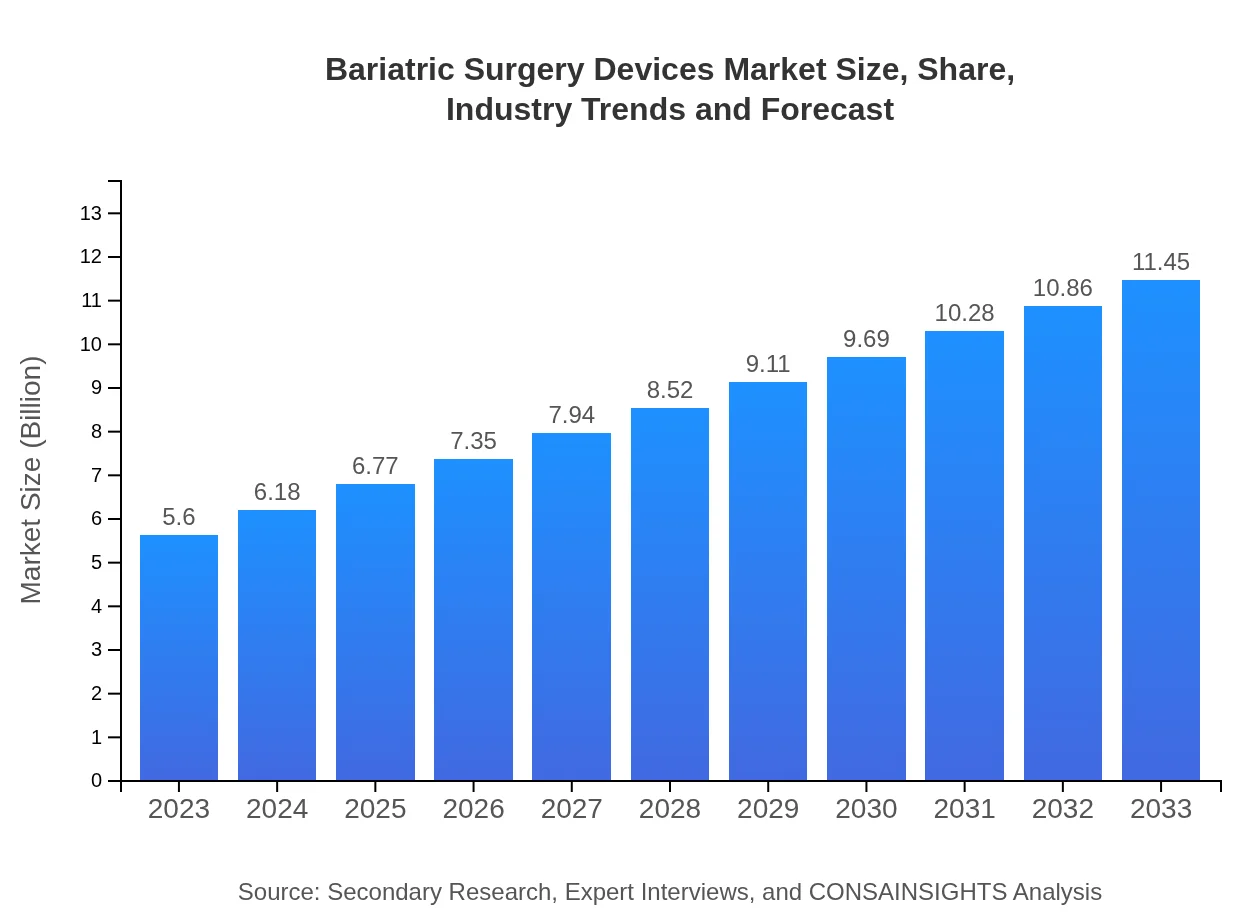

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | Ethicon, Inc., Medtronic , Apollo Endosurgery, Stryker Corporation |

| Last Modified Date | 31 January 2026 |

Bariatric Surgery Devices Market Overview

Customize Bariatric Surgery Devices Market Report market research report

- ✔ Get in-depth analysis of Bariatric Surgery Devices market size, growth, and forecasts.

- ✔ Understand Bariatric Surgery Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bariatric Surgery Devices

What is the Market Size & CAGR of Bariatric Surgery Devices market in 2023?

Bariatric Surgery Devices Industry Analysis

Bariatric Surgery Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bariatric Surgery Devices Market Analysis Report by Region

Europe Bariatric Surgery Devices Market Report:

The European market for Bariatric Surgery Devices was valued at USD $1.83 billion in 2023, anticipated to reach USD $3.74 billion by 2033. Factors such as rising obesity rates, technological advancements in surgical devices, and increased public health initiatives are driving market expansion.Asia Pacific Bariatric Surgery Devices Market Report:

In the Asia-Pacific region, the market is estimated at USD $1.08 billion in 2023, projected to reach USD $2.20 billion by 2033. The growing obesity epidemic, coupled with rising healthcare infrastructures and increasing awareness about surgical options, is driving significant growth in this market.North America Bariatric Surgery Devices Market Report:

North America accounts for a substantial share of the market, with an expected size of USD $1.81 billion in 2023, growing to USD $3.69 billion by 2033. The high prevalence of obesity and well-established healthcare facilities support this growth, alongside favorable insurance reimbursements for bariatric procedures.South America Bariatric Surgery Devices Market Report:

In South America, the Bariatric Surgery Devices market is estimated at USD $0.36 billion in 2023 and is expected to grow to USD $0.75 billion by 2033. The slight but steady growth is attributed to rising obesity rates and the improvement of healthcare systems in the region.Middle East & Africa Bariatric Surgery Devices Market Report:

The Middle East and African market is expected to grow from USD $0.52 billion in 2023 to about USD $1.07 billion by 2033. The improving healthcare policies and the growing awareness of obesity-related health concerns are key drivers of this growth.Tell us your focus area and get a customized research report.

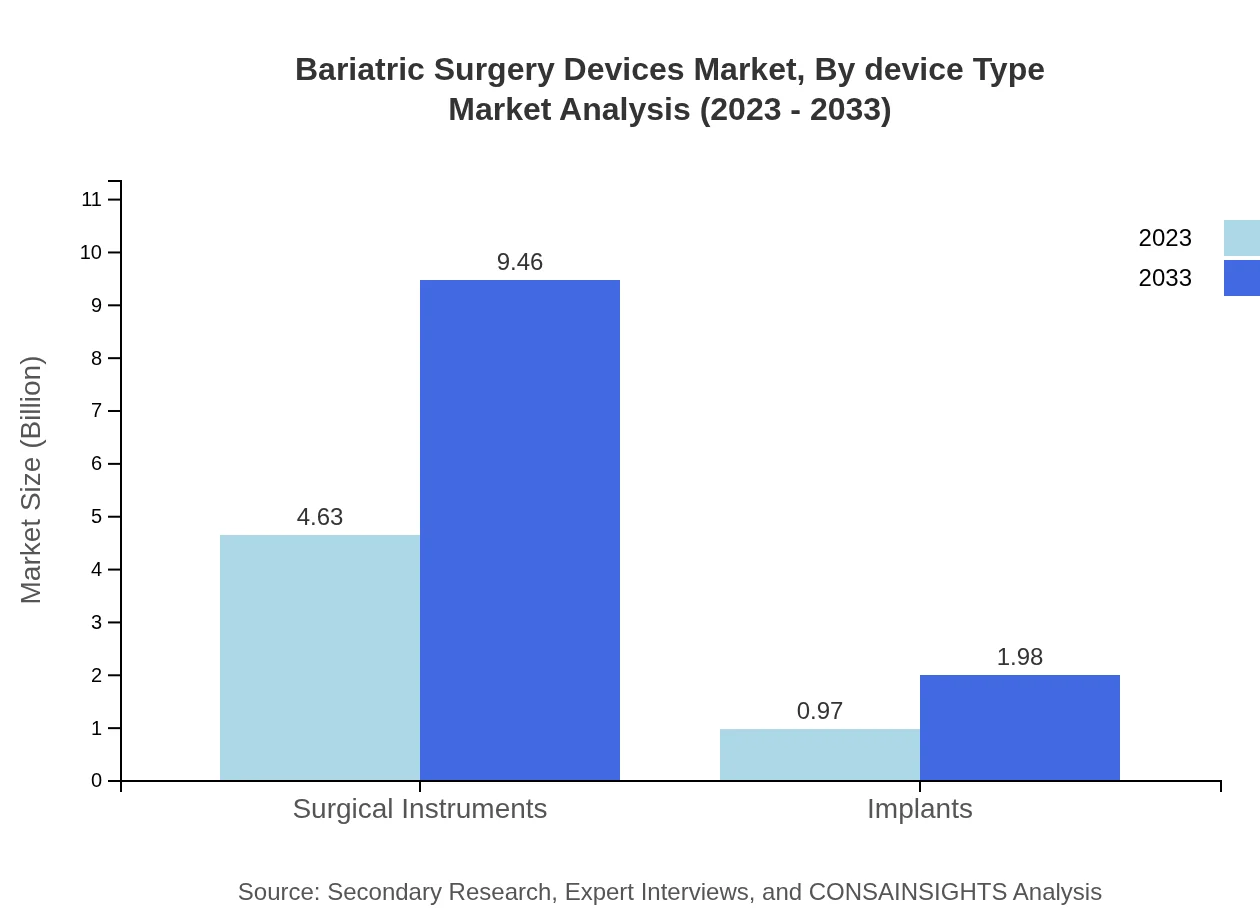

Bariatric Surgery Devices Market Analysis By Device Type

The device type segmentation indicates a strong market presence for surgical instruments, which are estimated to constitute 82.67% market share. Surgical devices are projected to have an overall size of USD $4.63 billion in 2023, growing to USD $9.46 billion by 2033. Implants follow, representing a smaller segment of 17.33% of the market, with revenues expected to double from USD $0.97 billion in 2023 to USD $1.98 billion by 2033.

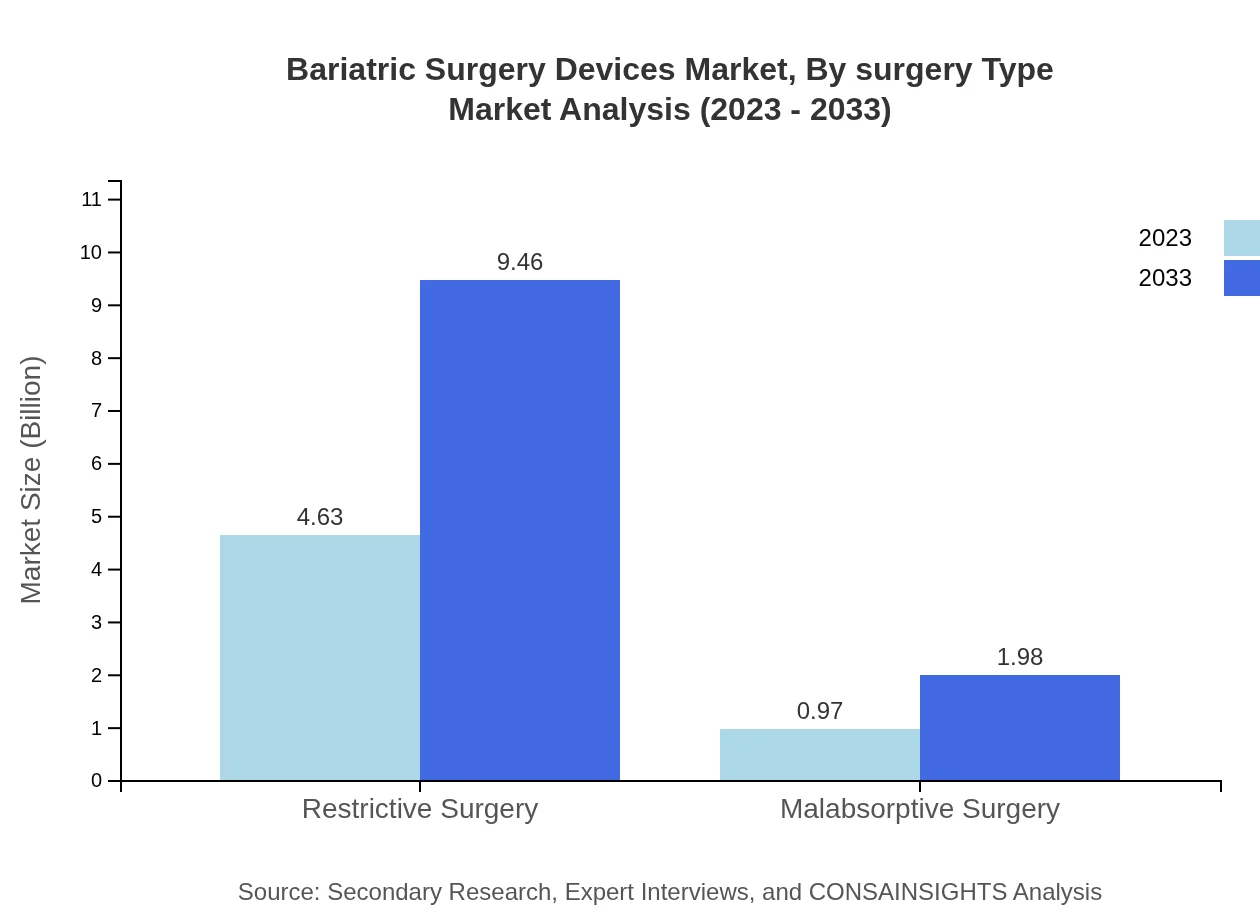

Bariatric Surgery Devices Market Analysis By Surgery Type

The market is divided between restrictive and malabsorptive surgeries, with restrictive surgery devices representing a larger portion at 82.67% of the market. Growth for restrictive surgery devices is expected from USD $4.63 billion in 2023 to USD $9.46 billion by 2033, highlighting its dominance in this sector.

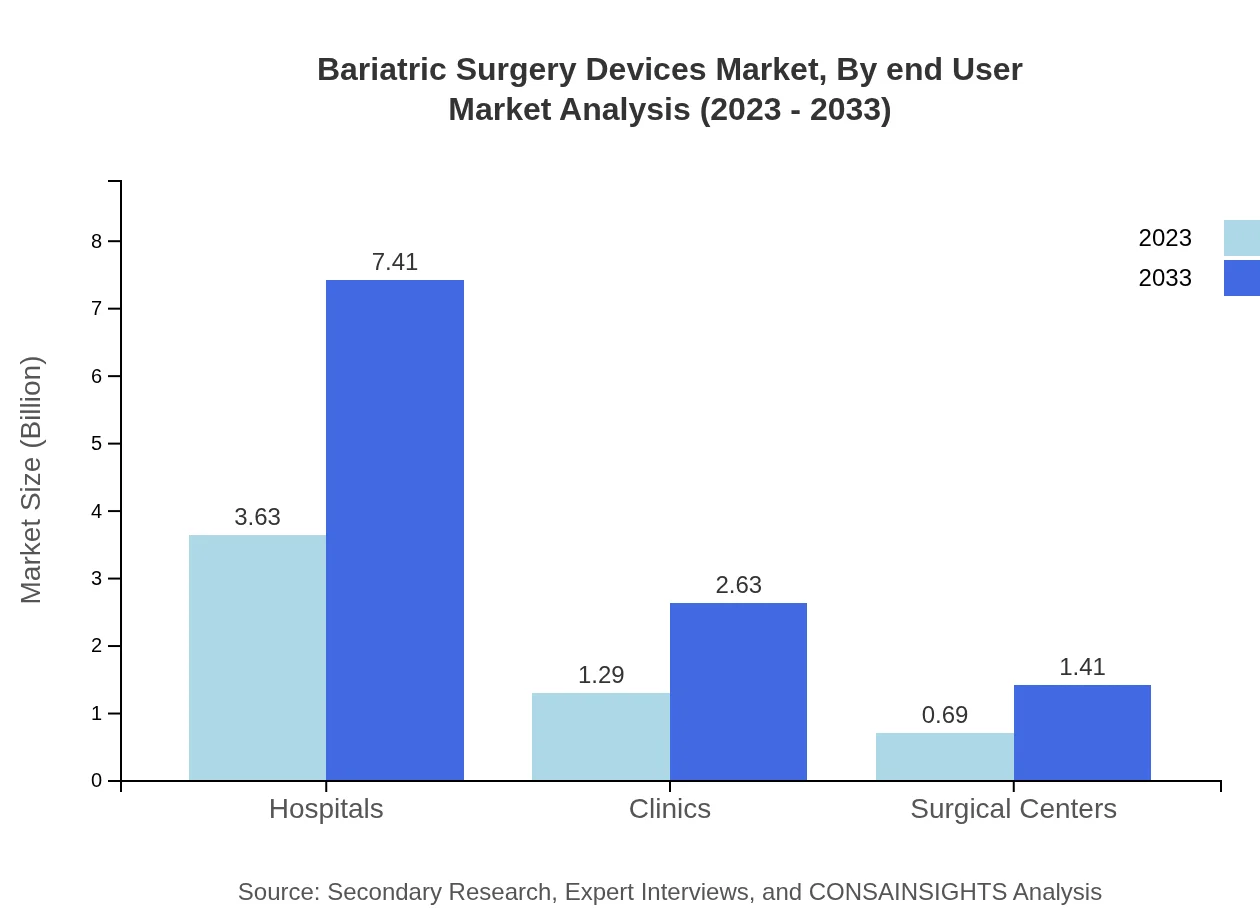

Bariatric Surgery Devices Market Analysis By End User

Hospitals maintain the largest share of market utilization, accounting for 64.75% with a projected size of USD $3.63 billion in 2023, increasing to USD $7.41 billion by 2033. Clinics and surgical centers also play significant roles, with market sizes of USD $1.29 billion and USD $0.69 billion, respectively, in 2023.

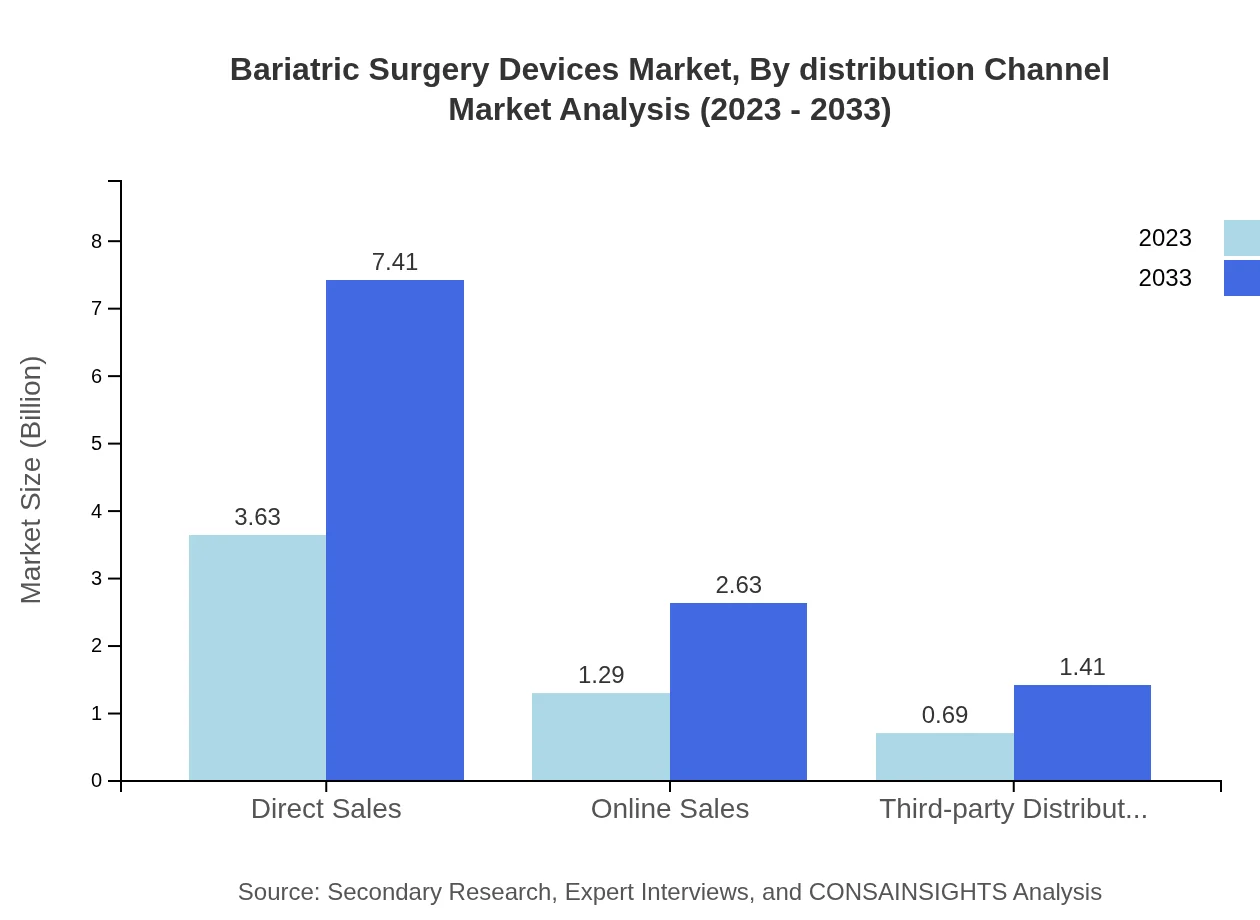

Bariatric Surgery Devices Market Analysis By Distribution Channel

Direct sales remain the primary distribution channel with a 64.75% market share; expected to grow from USD $3.63 billion in 2023 to USD $7.41 billion by 2033. Online sales are also gaining traction, projected to grow from USD $1.29 billion to USD $2.63 billion during the same period.

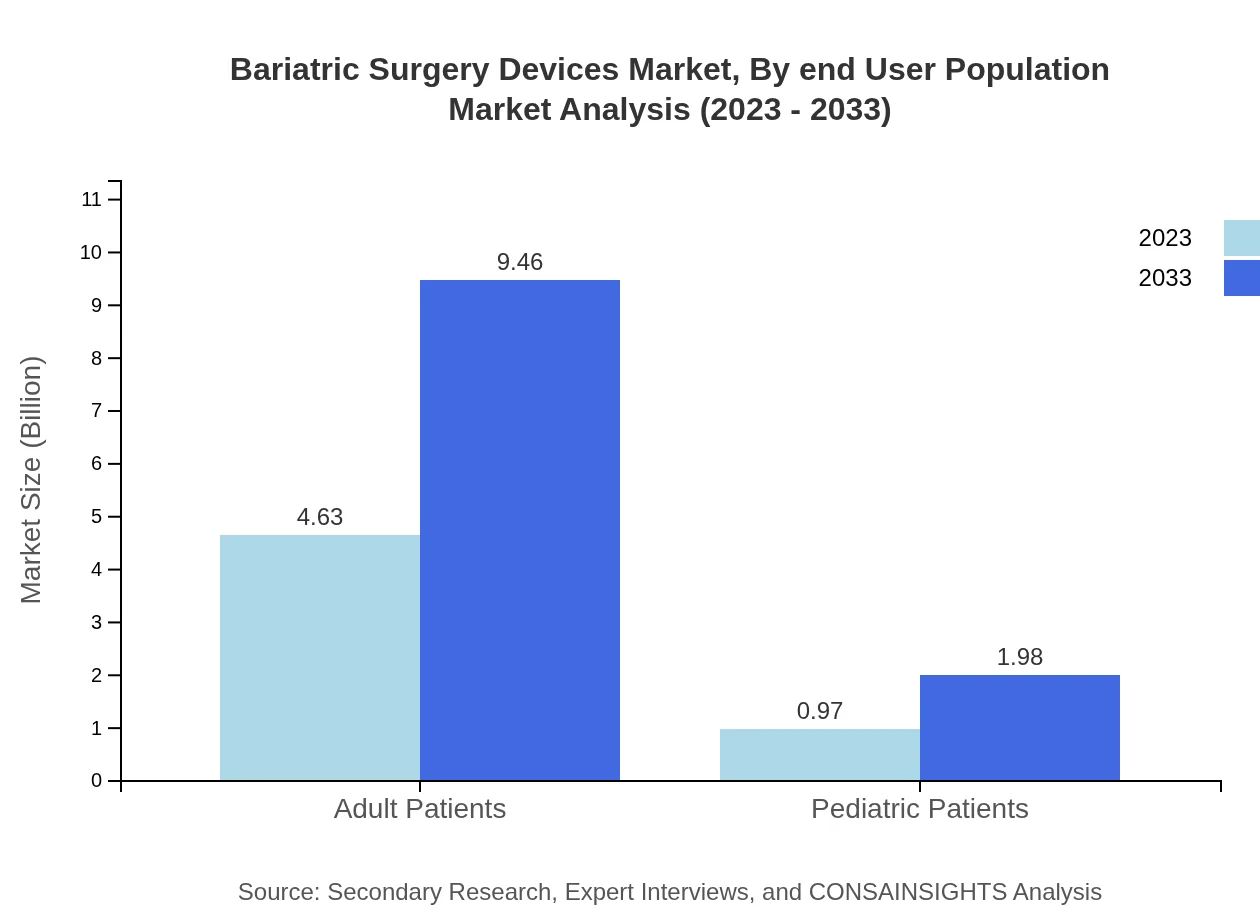

Bariatric Surgery Devices Market Analysis By End User Population

Adult patients dominate the end-user population segment, accounting for 82.67% of the market, with projected revenue growth from USD $4.63 billion in 2023 to USD $9.46 billion by 2033. Pediatric patients form a smaller segment, expected to grow from USD $0.97 billion to USD $1.98 billion over the same period.

Bariatric Surgery Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bariatric Surgery Devices Industry

Ethicon, Inc.:

A subsidiary of Johnson & Johnson, Ethicon is known for producing advanced surgical devices, including minimally invasive solutions for bariatric surgery, contributing to improved patient outcomes.Medtronic :

Medtronic is a leader in medical technology that offers a wide range of devices and procedures for obesity treatment, focusing on innovative therapies and devices.Apollo Endosurgery:

Apollo Endosurgery focuses on less invasive surgical options, providing effective devices used in various bariatric procedures, enhancing patient recovery.Stryker Corporation:

Stryker is recognized for its surgical instruments and technologies for improving surgical procedures, including those used in bariatric surgeries.We're grateful to work with incredible clients.

FAQs

What is the market size of bariatric Surgery Devices?

The bariatric surgery devices market is projected to reach a size of $5.6 billion by 2033, growing at a robust CAGR of 7.2%. This growth is driven by increasing obesity rates and rising awareness of surgical weight loss options.

What are the key market players or companies in the bariatric Surgery Devices industry?

Key players in the bariatric surgery devices market include major medical device manufacturers. These companies dominate through innovative product development, extensive distribution networks, and comprehensive post-surgery care services.

What are the primary factors driving the growth in the bariatric Surgery Devices industry?

The growth of the bariatric surgery devices market is driven by rising obesity prevalence, increasing acceptance of surgical weight loss solutions, advancements in minimally invasive surgical technologies, and improved healthcare infrastructure.

Which region is the fastest Growing in the bariatric Surgery Devices market?

Europe is expected to be the fastest-growing region in the bariatric surgery devices market, projected to expand from $1.83 billion in 2023 to $3.74 billion by 2033, alongside significant growth in Asia Pacific.

Does ConsaInsights provide customized market report data for the bariatric Surgery Devices industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the bariatric surgery devices industry, providing insights on market dynamics, trends, and growth opportunities.

What deliverables can I expect from this bariatric Surgery Devices market research project?

Expect comprehensive reports outlining market size, growth forecasts, detailed segmentation analysis, competitive landscape, and regional insights in the bariatric surgery devices market research project.

What are the market trends of bariatric Surgery Devices?

Market trends in bariatric surgery devices include the rise of innovative minimally invasive techniques, increasing adoption of robotic-assisted surgeries, and an emphasis on personalized treatment plans for better patient outcomes.