Barite Market Report

Published Date: 02 February 2026 | Report Code: barite

Barite Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive market report explores the global barite market from 2023 to 2033, providing valuable insights into market dynamics, growth drivers, challenges, and regional trends. It highlights size estimations, forecasts, and analysis across different segments and applications.

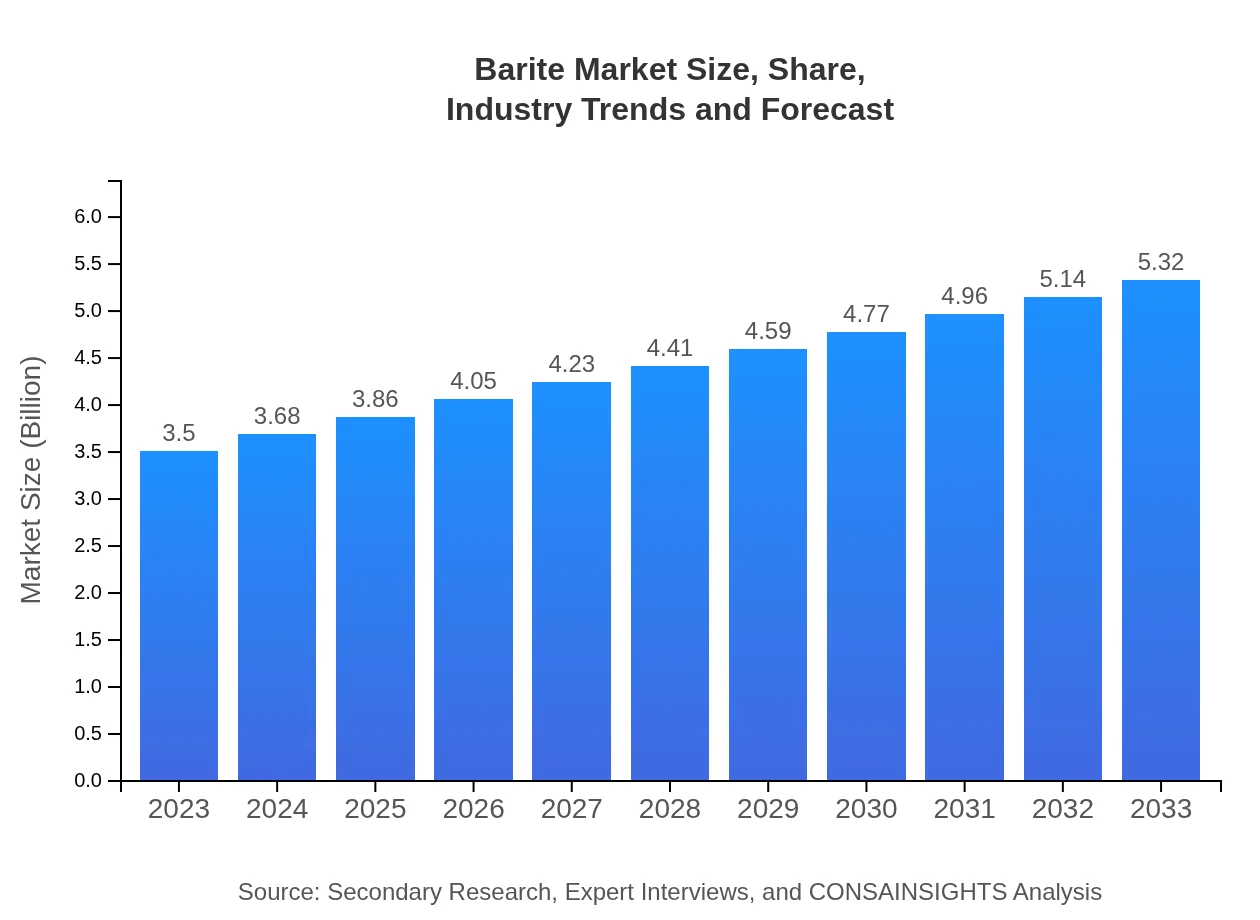

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $5.32 Billion |

| Top Companies | Schlumberger, Halliburton, Baroid Industrial Drilling Products, M-I SWACO |

| Last Modified Date | 02 February 2026 |

Barite Market Overview

Customize Barite Market Report market research report

- ✔ Get in-depth analysis of Barite market size, growth, and forecasts.

- ✔ Understand Barite's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Barite

What is the Market Size & CAGR of Barite market in 2023?

Barite Industry Analysis

Barite Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Barite Market Analysis Report by Region

Europe Barite Market Report:

Europe's barite market is projected to rise from USD 1.23 billion in 2023 to USD 1.87 billion by 2033, driven by the region's strong regulations on oil and gas drilling fluids and increasing construction projects. Countries like the UK and Germany are key players enhancing product adoption.Asia Pacific Barite Market Report:

In the Asia Pacific region, the barite market is expected to grow from USD 0.62 billion in 2023 to USD 0.94 billion in 2033. The region's booming construction and mining activities, coupled with increasing energy needs, significantly drive the demand for barite. Countries like China and India are major contributors, leveraging their robust industrial sectors.North America Barite Market Report:

The North American barite market is expected to see substantial growth, with an increase from USD 1.21 billion in 2023 to USD 1.84 billion in 2033. The United States remains the largest consumer due to its vast offshore oil drilling activities, while innovation in extraction techniques continues to augment market potential.South America Barite Market Report:

South America is projected to exhibit moderate growth, with the market size increasing from USD 0.05 billion in 2023 to USD 0.08 billion by 2033. Brazil and Argentina lead the market, focusing on oil and gas exploration and basic industrial needs, despite challenges related to economic stability.Middle East & Africa Barite Market Report:

The Middle East and Africa region will experience growth from USD 0.39 billion in 2023 to USD 0.59 billion by 2033, primarily due to the rising investments in oil and gas exploration. Key markets include Saudi Arabia and Nigeria, which continue to develop their energy sectors.Tell us your focus area and get a customized research report.

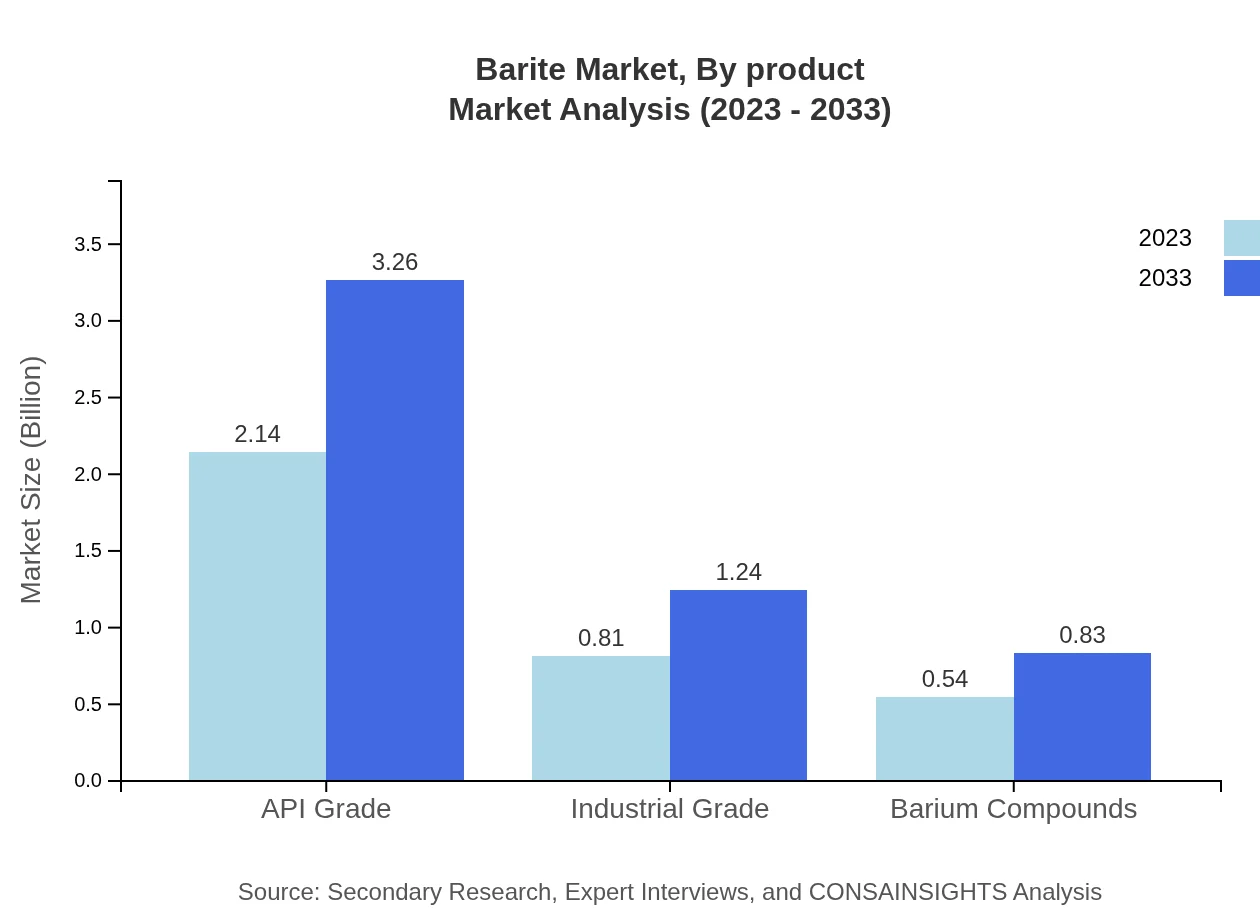

Barite Market Analysis By Product

The barite market segmented by product shows significant demand for API Grade barite, projected to increase from USD 2.14 billion in 2023 to USD 3.26 billion by 2033, capturing a 61.23% share throughout this period. Industrial Grade is anticipated to grow steadily from USD 0.81 billion to USD 1.24 billion, retaining a 23.23% market share. Barium Compounds, though smaller in scale, will reach USD 0.54 billion to USD 0.83 billion, comprising 15.54% of the market.

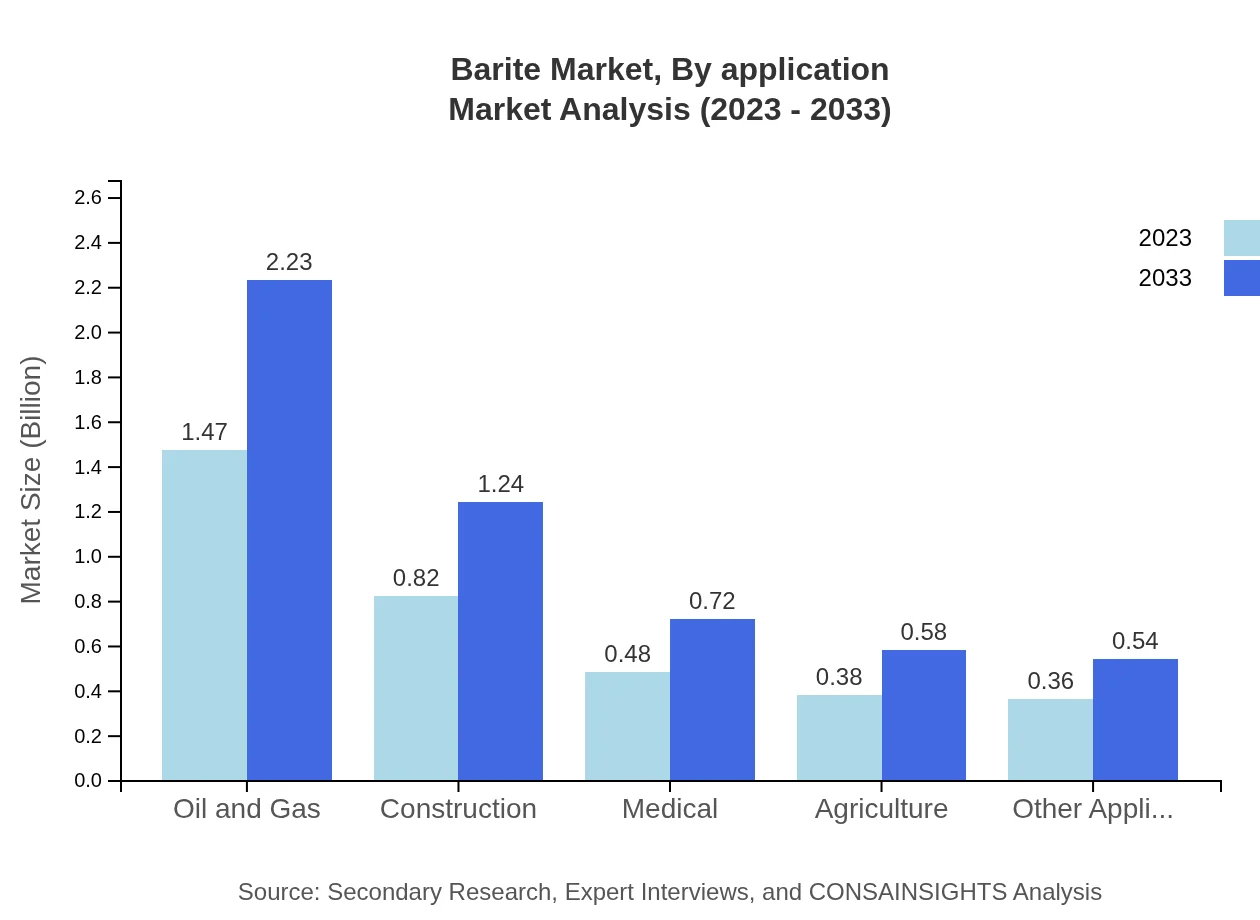

Barite Market Analysis By Application

In application segmentation, the Oil and Gas sector dominates, expanding from USD 1.47 billion to USD 2.23 billion in the forecast period, holding a robust 41.89% market share. The Construction sector follows closely, growing from USD 0.82 billion to USD 1.24 billion. Other notable applications include Medical and Agriculture, each demonstrating steady growth patterns throughout the decade.

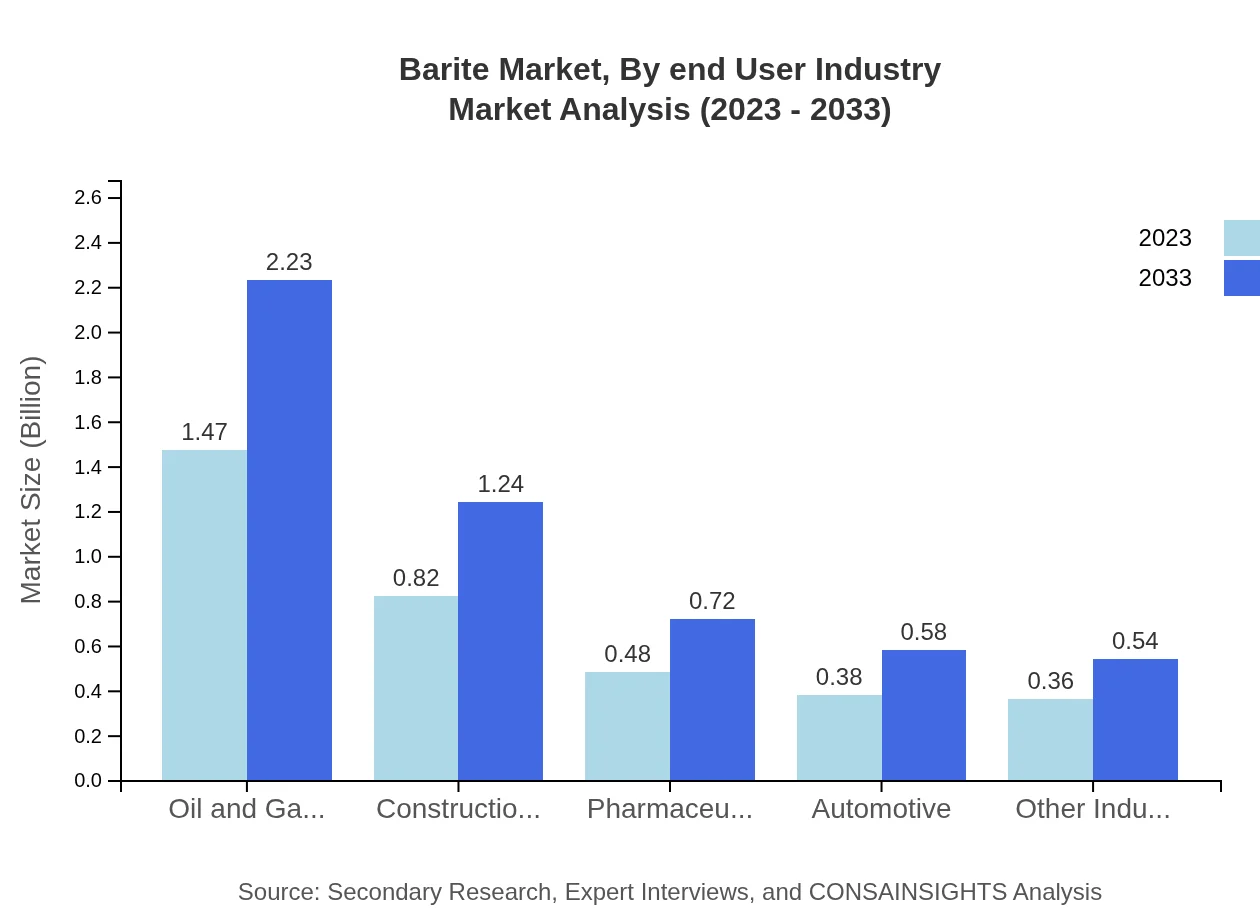

Barite Market Analysis By End User Industry

Key end-user industries for barite include Pharmaceuticals, Automotive, and Other Industries. Pharmaceuticals will see market growth from USD 0.48 billion to USD 0.72 billion, while Automotive expands similarly. Other Industries present modest growth rates in this segmented market, showcasing the extensive utility of barite across diverse applications.

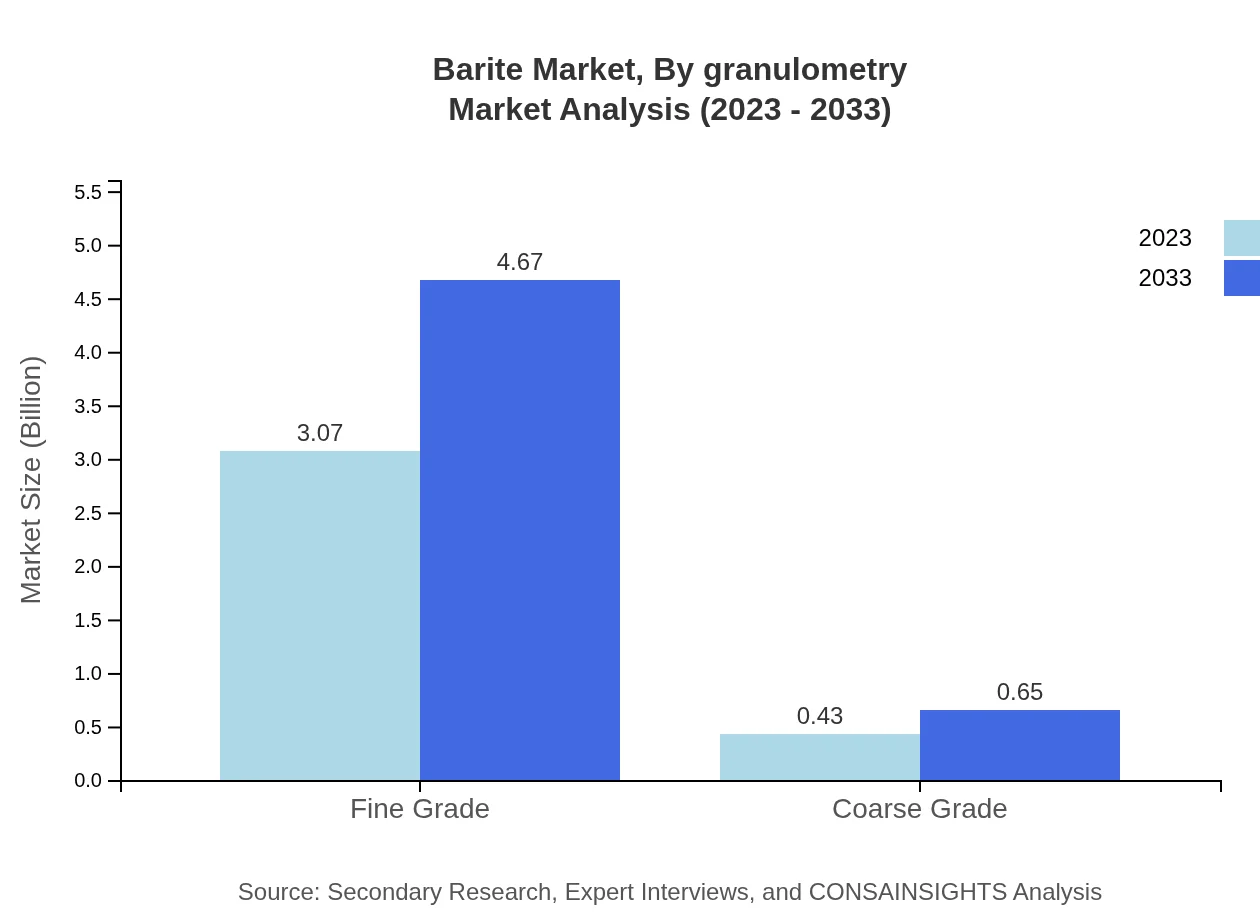

Barite Market Analysis By Granulometry

Granulometry classification highlights Fine Grade barite as the leader with a market size growing from USD 3.07 billion to USD 4.67 billion, capturing 87.76% share by 2033. Coarse Grade barite, while smaller, indicates a growth trajectory from USD 0.43 billion to USD 0.65 billion, holding a 12.24% market influence.

Barite Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Barite Industry

Schlumberger:

A leading oilfield services company that provides technologies and services for drilling and production, actively involved in the barite supply chain.Halliburton:

One of the largest providers of products and services to the energy industry, focused on the barite market for its oil and gas exploration activities.Baroid Industrial Drilling Products:

A prolific supplier of high-quality barite products designed for drilling, particularly known for its innovations in weight material for drilling fluids.M-I SWACO:

A subsidiary of Schlumberger, M-I SWACO specializes in drilling fluids and has a significant portfolio of barite products catered for the energy sector.We're grateful to work with incredible clients.

FAQs

What is the market size of barite?

The global barite market is valued at approximately $3.5 billion in 2023 and is projected to grow at a CAGR of 4.2% over the next decade.

What are the key market players or companies in the barite industry?

Key players in the barite industry include major mining companies, chemical manufacturers, and distributors focused on oil and gas, construction, and medical applications.

What are the primary factors driving the growth in the barite industry?

Growth drivers include increasing demand from the oil and gas sector, rising construction activities, and the use of barite in pharmaceuticals and agriculture.

Which region is the fastest Growing in the barite market?

Europe emerges as the fastest-growing region with a market increase from $1.23 billion in 2023 to $1.87 billion by 2033, reflecting strong demand.

Does ConsaInsights provide customized market report data for the barite industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the barite industry.

What deliverables can I expect from this barite market research project?

Deliverables typically include detailed market analysis, future trends, competitive landscape, and insights into regional and segment growth.

What are the market trends of barite?

Current trends indicate a shift towards sustainable mining practices and increasing use of barite in new industrial applications, alongside steady demand in traditional sectors.