Barrier Films Market Report

Published Date: 02 February 2026 | Report Code: barrier-films

Barrier Films Market Size, Share, Industry Trends and Forecast to 2033

This report comprehensively examines the barrier films market, offering insights into trends, growth projections, and key factors influencing the market from 2023 to 2033.

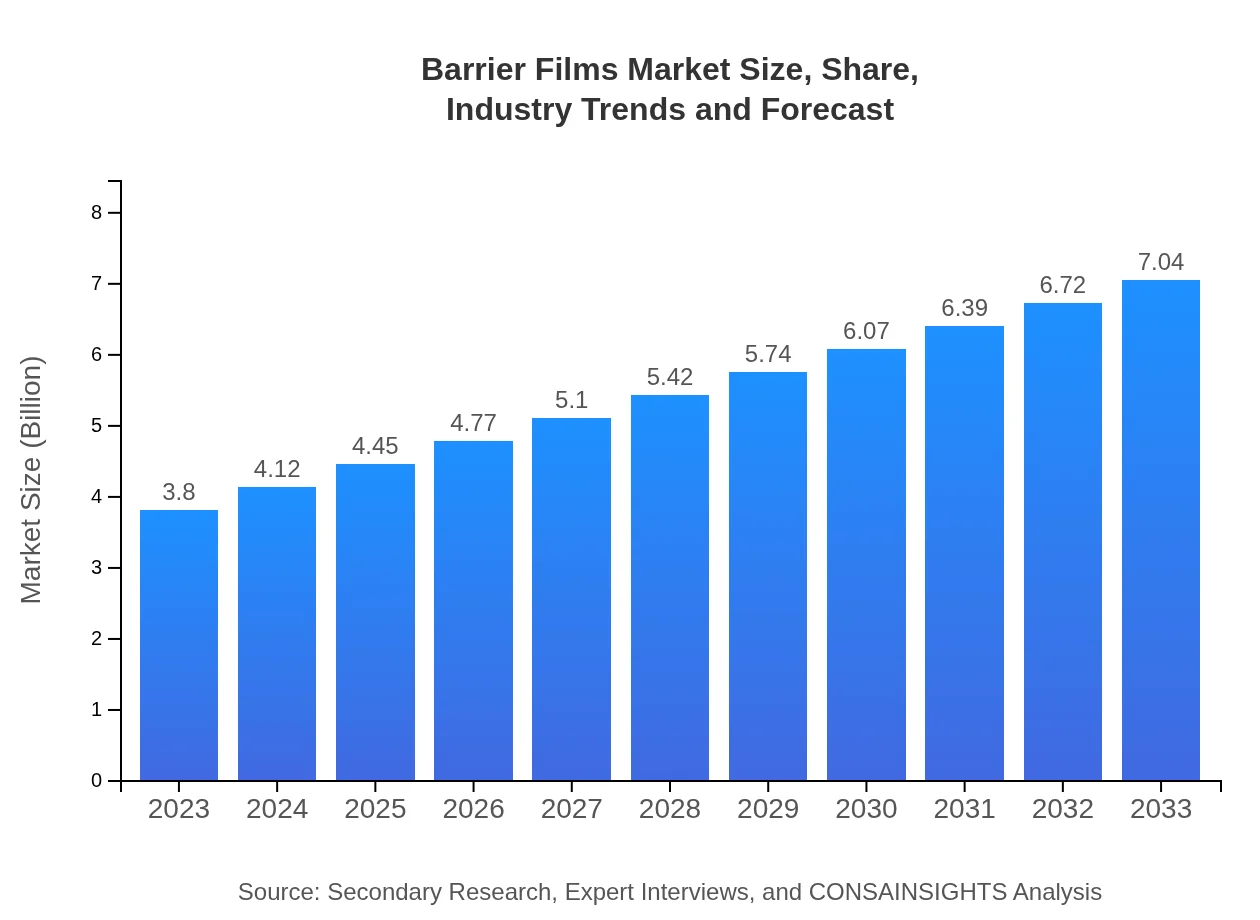

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $7.04 Billion |

| Top Companies | Amcor Plc, Huge Corporation, CCL Industries, Berry Global Group, Inc., Sealed Air Corporation |

| Last Modified Date | 02 February 2026 |

Barrier Films Market Overview

Customize Barrier Films Market Report market research report

- ✔ Get in-depth analysis of Barrier Films market size, growth, and forecasts.

- ✔ Understand Barrier Films's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Barrier Films

What is the Market Size & CAGR of Barrier Films market in 2023?

Barrier Films Industry Analysis

Barrier Films Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Barrier Films Market Analysis Report by Region

Europe Barrier Films Market Report:

Europe's barrier films market was valued at $1.10 billion in 2023 and is projected to grow to $2.04 billion by 2033. The region is characterized by a strong emphasis on sustainability, leading to increased adoption of eco-friendly films. The demand for advanced packaging solutions in pharmaceuticals is also driving market growth, with Germany and the UK as key contributors.Asia Pacific Barrier Films Market Report:

The Asia Pacific region is anticipated to witness substantial growth, with a market size of $0.74 billion in 2023, projected to reach $1.36 billion by 2033. Factors contributing to this growth include increasing urbanization, rising disposable incomes, and growth in the food and pharmaceutical sectors. Countries like China and India are leading the market, driven by robust manufacturing capabilities and expanding consumer bases.North America Barrier Films Market Report:

The North American market stands at $1.39 billion in 2023, with projections reaching $2.58 billion by 2033. The increase is fueled by technological advancements and strict regulations on food safety, necessitating effective barrier solutions. The U.S. dominates this market, with significant contributions from sectors like food and beverage packaging.South America Barrier Films Market Report:

In South America, the barrier films market is valued at $0.23 billion in 2023 and is expected to reach $0.43 billion by 2033. The growth is attributed to rising consumer demand for packaged goods and a growing focus on food preservation techniques. Brazil and Argentina are key markets due to their large agricultural sectors.Middle East & Africa Barrier Films Market Report:

The Middle East and Africa barrier films market is valued at $0.34 billion in 2023, expected to grow to $0.62 billion by 2033. This growth is driven by urbanization and increasing consumption of packaged products in developing countries. The region is witnessing a rising demand for flexible packaging solutions, particularly in the food and beverage sector.Tell us your focus area and get a customized research report.

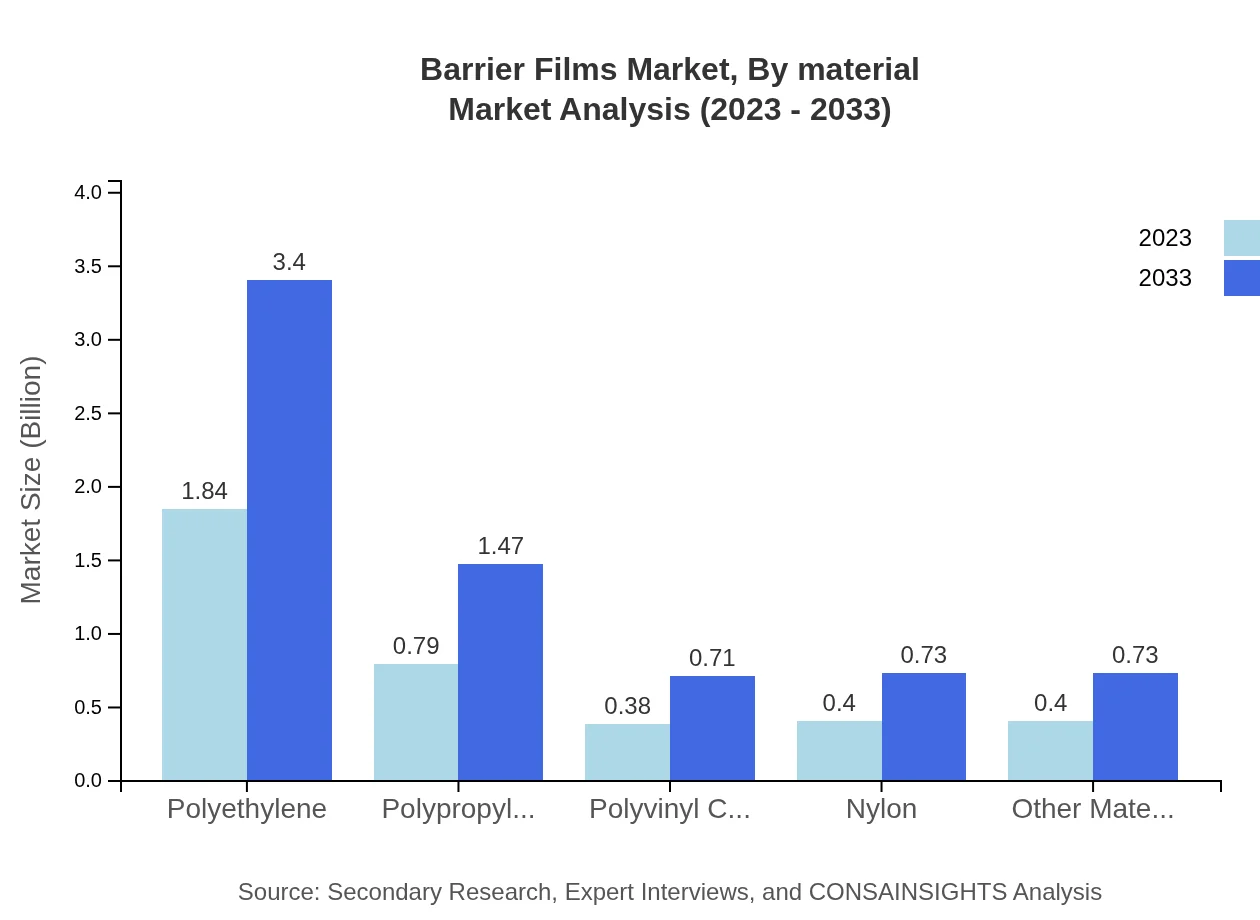

Barrier Films Market Analysis By Material

In the barrier films market, polyethylene holds the largest share due to its excellent moisture barrier properties, projected to grow from $1.84 billion in 2023 to $3.40 billion by 2033 (48.32%). Similarly, polypropylene, with its flexibility and clarity, is expected to witness a rise from $0.79 billion to $1.47 billion (20.84%). Polyvinyl chloride (PVC) and nylon are significant contributors, with PVC valued at $0.38 billion (10.04%) and nylon at $0.40 billion (10.4%).

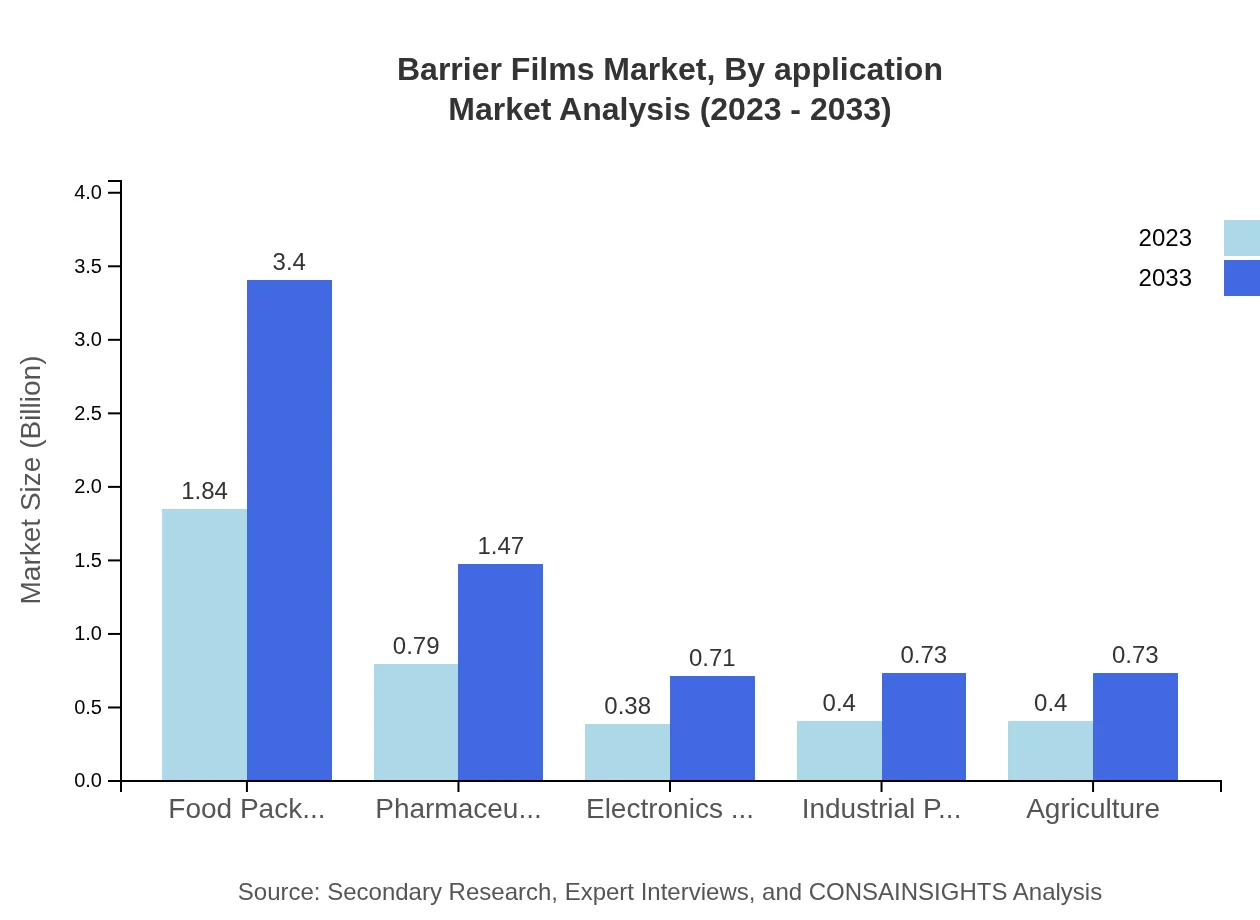

Barrier Films Market Analysis By Application

In applications, food packaging dominates the sector, expected to grow from $1.84 billion in 2023 to $3.40 billion (48.32%). Pharmaceutical packaging is also significant, expected to grow from $0.79 billion to $1.47 billion (20.84%), highlighting the critical role of barrier films in protecting sensitive products. Other applications include electronics and industrial packaging.

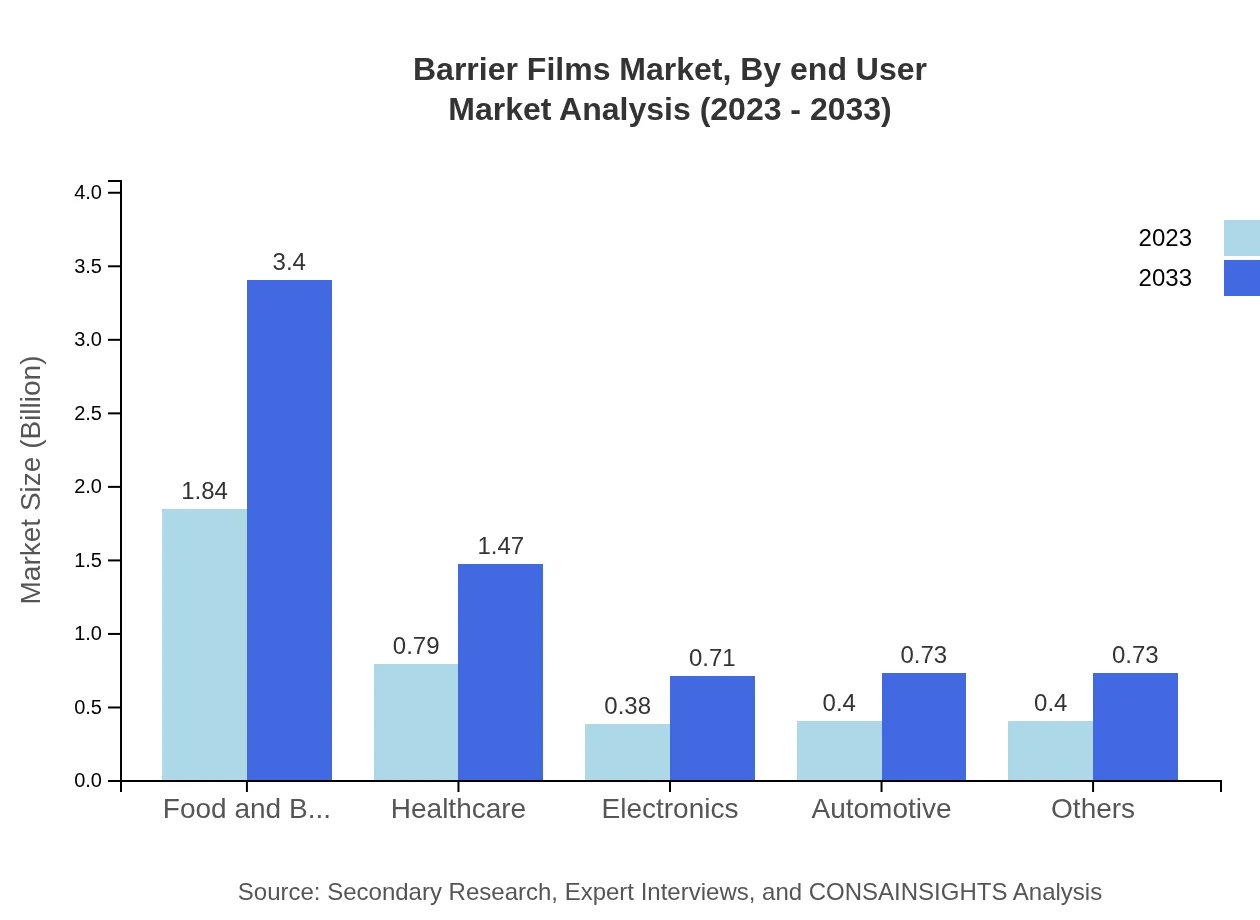

Barrier Films Market Analysis By End User

Among end-users, the food & beverage sector is the largest, projecting a market increase from $1.84 billion in 2023 to $3.40 billion (48.32%). Healthcare follows, with growth from $0.79 billion to $1.47 billion (20.84%) as the demand for effective product preservation intensifies. The electronics sector, critical for maintaining device integrity, has also shown growth potential.

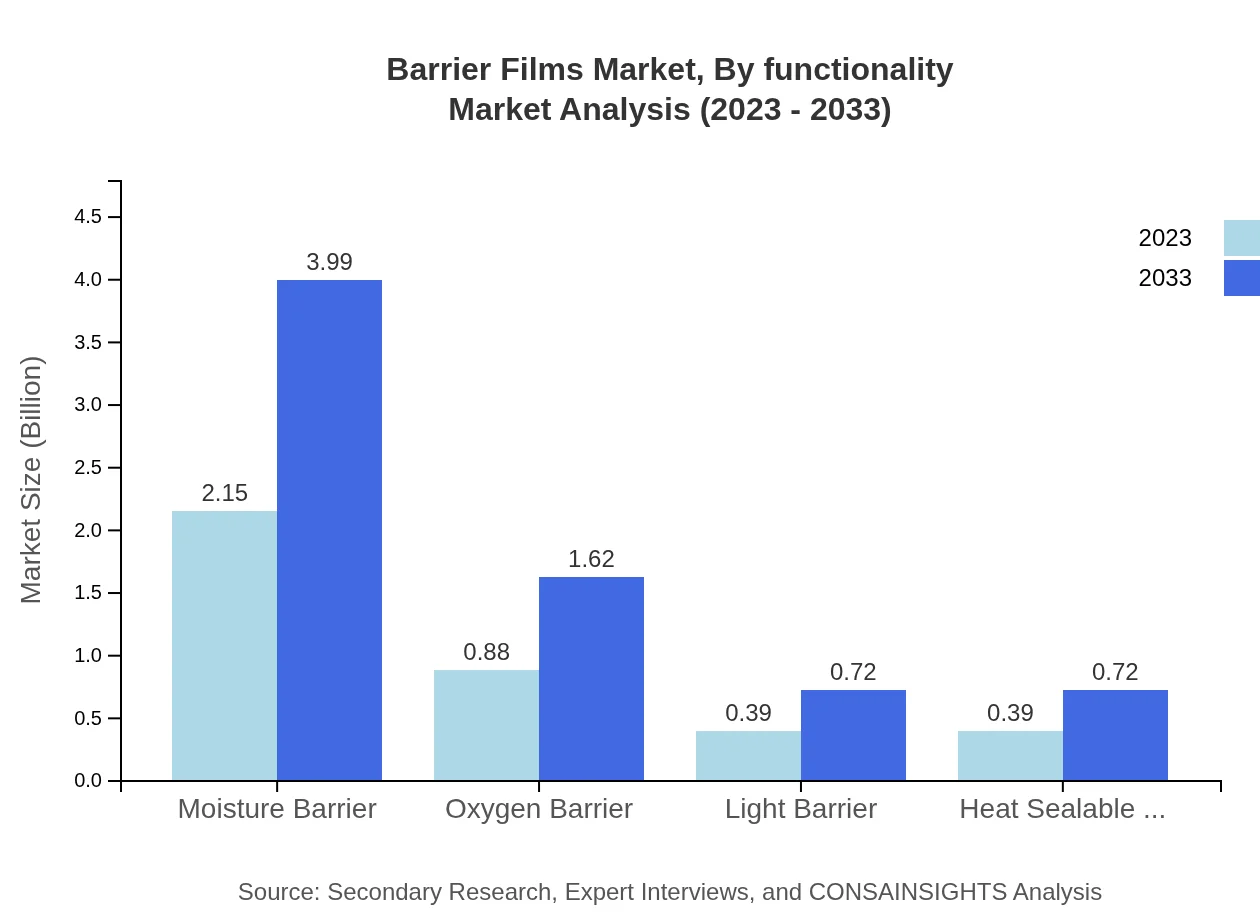

Barrier Films Market Analysis By Functionality

Barrier functionality is vital in determining material use, with moisture barrier films leading the market, projected to grow from $2.15 billion in 2023 to $3.99 billion (56.62%). Oxygen barrier films are also notable, expected to grow from $0.88 billion to $1.62 billion (23.06%), essential in food and pharmaceutical packaging.

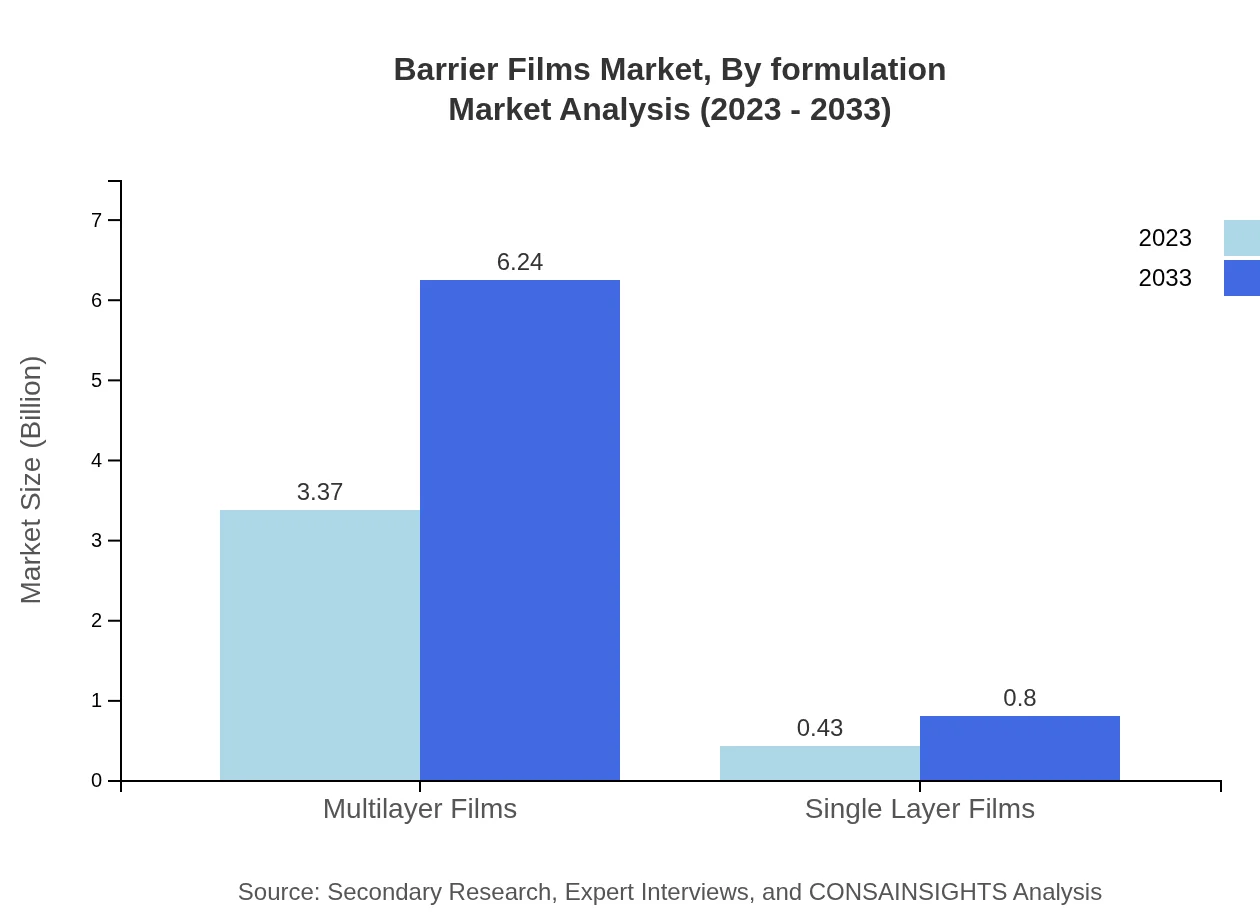

Barrier Films Market Analysis By Formulation

Formulation plays a critical aspect, with multilayer films dominating due to their superior barrier characteristics, expected to grow from $3.37 billion in 2023 to $6.24 billion (88.6%). Single-layer films, while smaller, are expected to increase from $0.43 billion to $0.80 billion (11.4%), highlighting their niche yet essential role.

Barrier Films Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Barrier Films Industry

Amcor Plc:

Amcor is a global leader in packaging solutions, providing a wide range of barrier films tailored for food and healthcare industries, emphasizing sustainable and innovative packaging solutions.Huge Corporation:

Huge Corporation specializes in advanced barrier films and flexible packaging solutions, maintaining a strong presence in the Asia Pacific and North American markets.CCL Industries:

CCL Industries focuses on customized packaging solutions with a strong emphasis on sustainability through specialized barrier films, particularly for food and consumer goods.Berry Global Group, Inc.:

Berry Global manufactures a wide range of barrier films with advanced features, catering to various industries including food packaging and healthcare.Sealed Air Corporation:

Sealed Air Corporation provides innovative packaging solutions that include high-performance barrier films, particularly for the food and beverage sector.We're grateful to work with incredible clients.

FAQs

What is the market size of barrier Films?

In 2023, the global barrier films market is valued at approximately $3.8 billion, projected to grow with a CAGR of 6.2% through to 2033, highlighting significant expansion potential in this industry.

What are the key market players or companies in the barrier Films industry?

Key players in the barrier films market include global packaging leaders who innovate their product lines to enhance performance. They compete through advancements in material science, strategic partnerships, and sustainability initiatives to capture market share.

What are the primary factors driving the growth in the barrier films industry?

Major growth drivers in the barrier films market include rising demand from food packaging and healthcare sectors, increasing regulatory requirements for product safety, and a growing shift towards sustainable packaging solutions that extend product shelf life.

Which region is the fastest Growing in the barrier films?

The fastest-growing region in the barrier films market is expected to be Europe, with a market growth from $1.10 billion in 2023 to $2.04 billion by 2033, followed closely by North America and Asia Pacific.

Does ConsaInsights provide customized market report data for the barrier films industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements of clients in the barrier films industry, including detailed analyses, forecasts, and competitive landscapes that align with individual business objectives.

What deliverables can I expect from this barrier films market research project?

Deliverables from the barrier films market research project typically include comprehensive reports, market forecasts, segment breakdowns, competitive analysis, and actionable insights to assist in strategic decision-making for stakeholders.

What are the market trends of barrier films?

Current market trends in barrier films include a shift toward multilayer films for enhanced protection, increased usage in sustainable packaging, ongoing innovations in material properties, and expansion in various applications ranging from food and beverage to healthcare.