Base Metal Mining Market Report

Published Date: 22 January 2026 | Report Code: base-metal-mining

Base Metal Mining Market Size, Share, Industry Trends and Forecast to 2033

This report presents an in-depth analysis of the Base Metal Mining market, providing insights into market size, segmentation, regional analysis, and future forecasts from 2023 to 2033.

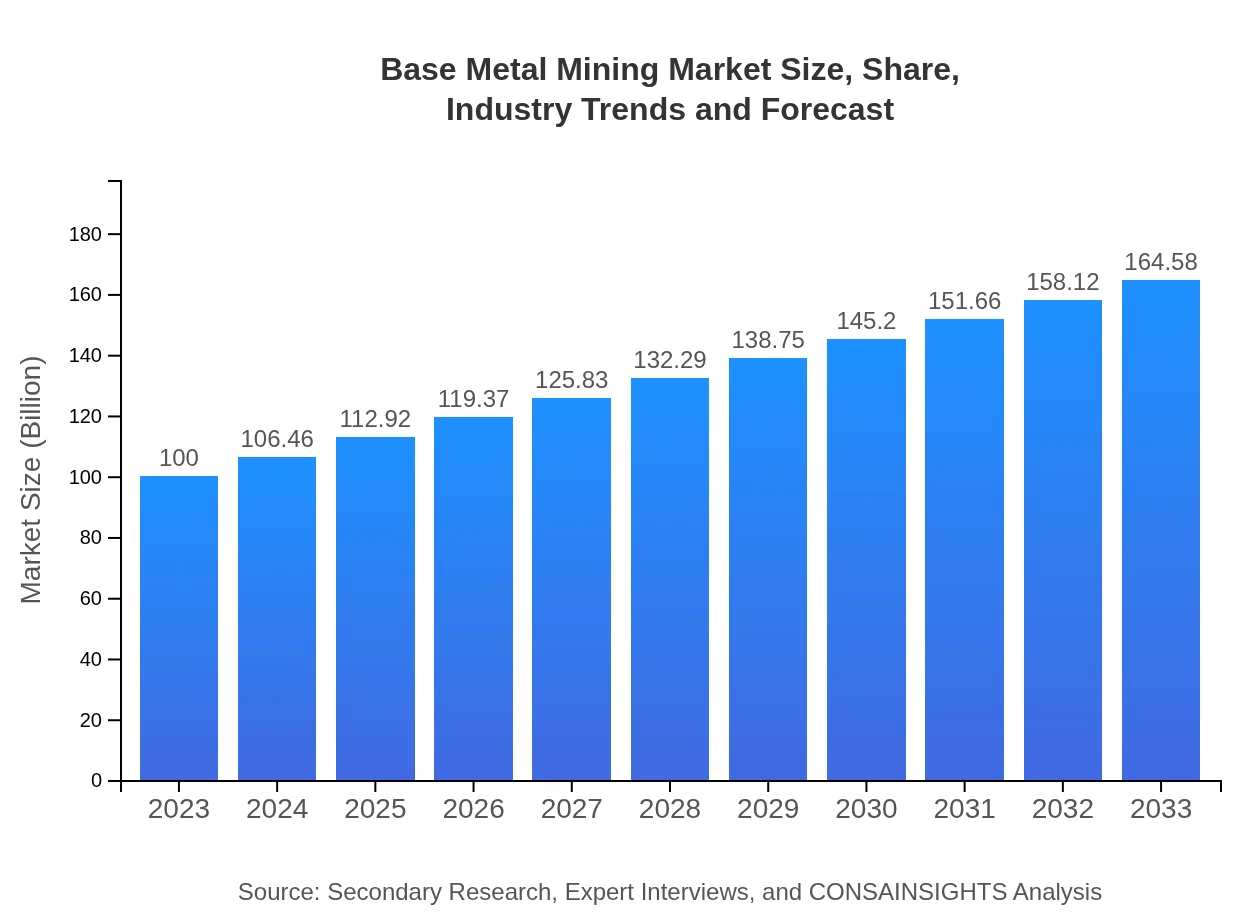

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Billion |

| Top Companies | BHP Group, Rio Tinto, Glencore, Vale S.A., Southern Copper Corporation |

| Last Modified Date | 22 January 2026 |

Base Metal Mining Market Overview

Customize Base Metal Mining Market Report market research report

- ✔ Get in-depth analysis of Base Metal Mining market size, growth, and forecasts.

- ✔ Understand Base Metal Mining's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Base Metal Mining

What is the Market Size & CAGR of Base Metal Mining market in 2023?

Base Metal Mining Industry Analysis

Base Metal Mining Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Base Metal Mining Market Analysis Report by Region

Europe Base Metal Mining Market Report:

The European market for base metal mining is projected to scale from $33.20 billion in 2023 to $54.64 billion by 2033, underpinned by stringent regulations aimed at sustainable practices and increasing demand for base metals in renewable energy sectors.Asia Pacific Base Metal Mining Market Report:

In the Asia Pacific region, the Base Metal Mining market recorded a size of $16.97 billion in 2023, projected to grow to $27.93 billion by 2033. The growth is mainly driven by expanding industrial activities, urbanization, and infrastructure projects in countries like China and India.North America Base Metal Mining Market Report:

North America's Base Metal Mining market, valued at $34.86 billion in 2023, is expected to reach $57.37 billion by 2033. A robust focus on sustainable mining practices and the presence of some of the biggest mining companies stimulate growth in this region.South America Base Metal Mining Market Report:

South America has witnessed significant activities in base metal mining, particularly in countries like Chile and Peru. The market size was $3.52 billion in 2023 and is anticipated to increase to $5.79 billion by 2033, driven by valuable mineral deposits and favorable government policies.Middle East & Africa Base Metal Mining Market Report:

In the Middle East and Africa, the Base Metal Mining market size of $11.45 billion in 2023 is expected to elevate to $18.84 billion by 2033, driven by natural resource exploration and growing industrial demand in both regions.Tell us your focus area and get a customized research report.

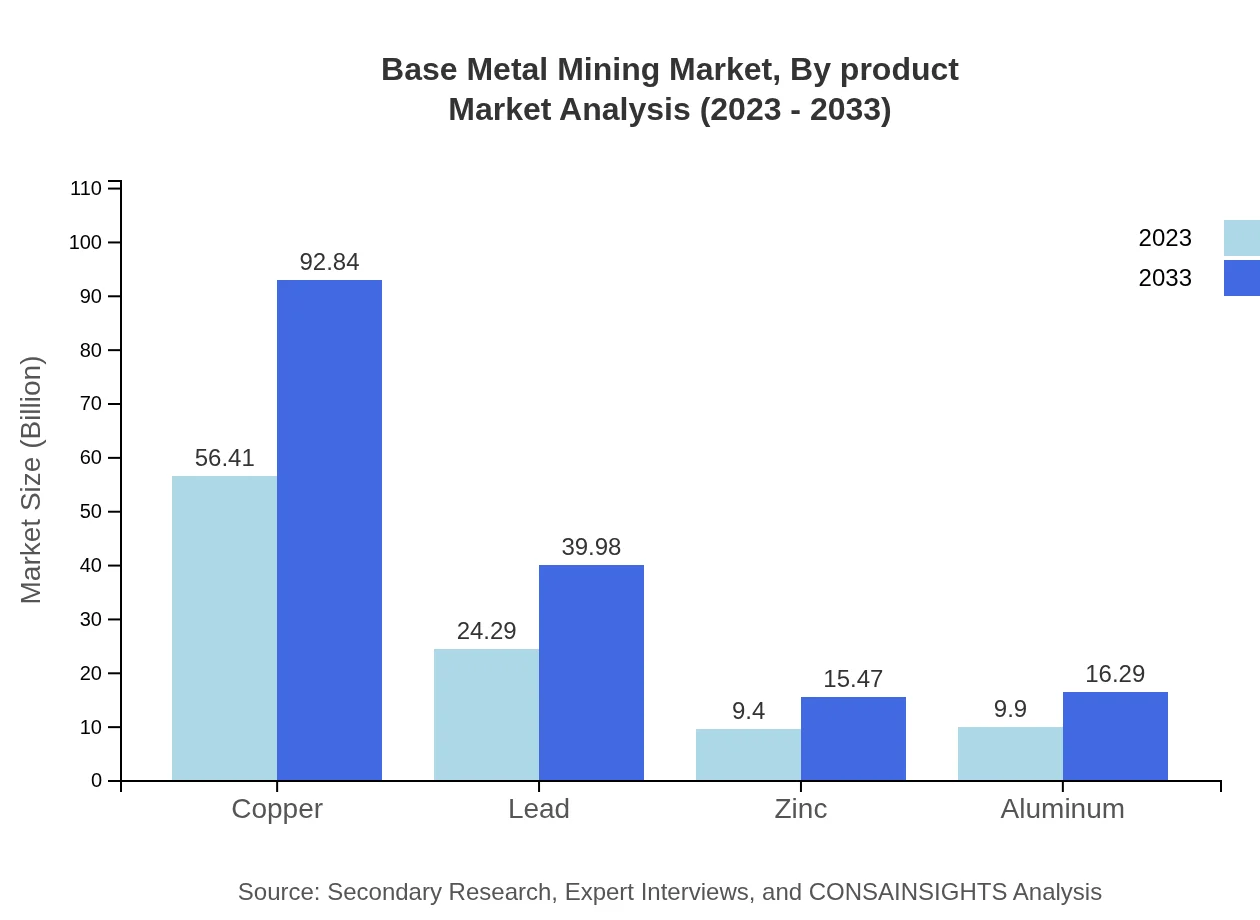

Base Metal Mining Market Analysis By Product

In the segment of product types, copper leads the market with a size of $56.41 billion in 2023, forecasted to grow to $92.84 billion by 2033. Lead follows, with a size projected to increase from $24.29 billion to $39.98 billion over the same period. Zinc is expected to grow from $9.40 billion to $15.47 billion, while aluminum is anticipated to rise from $9.90 billion to $16.29 billion, indicating a steady demand across various applications.

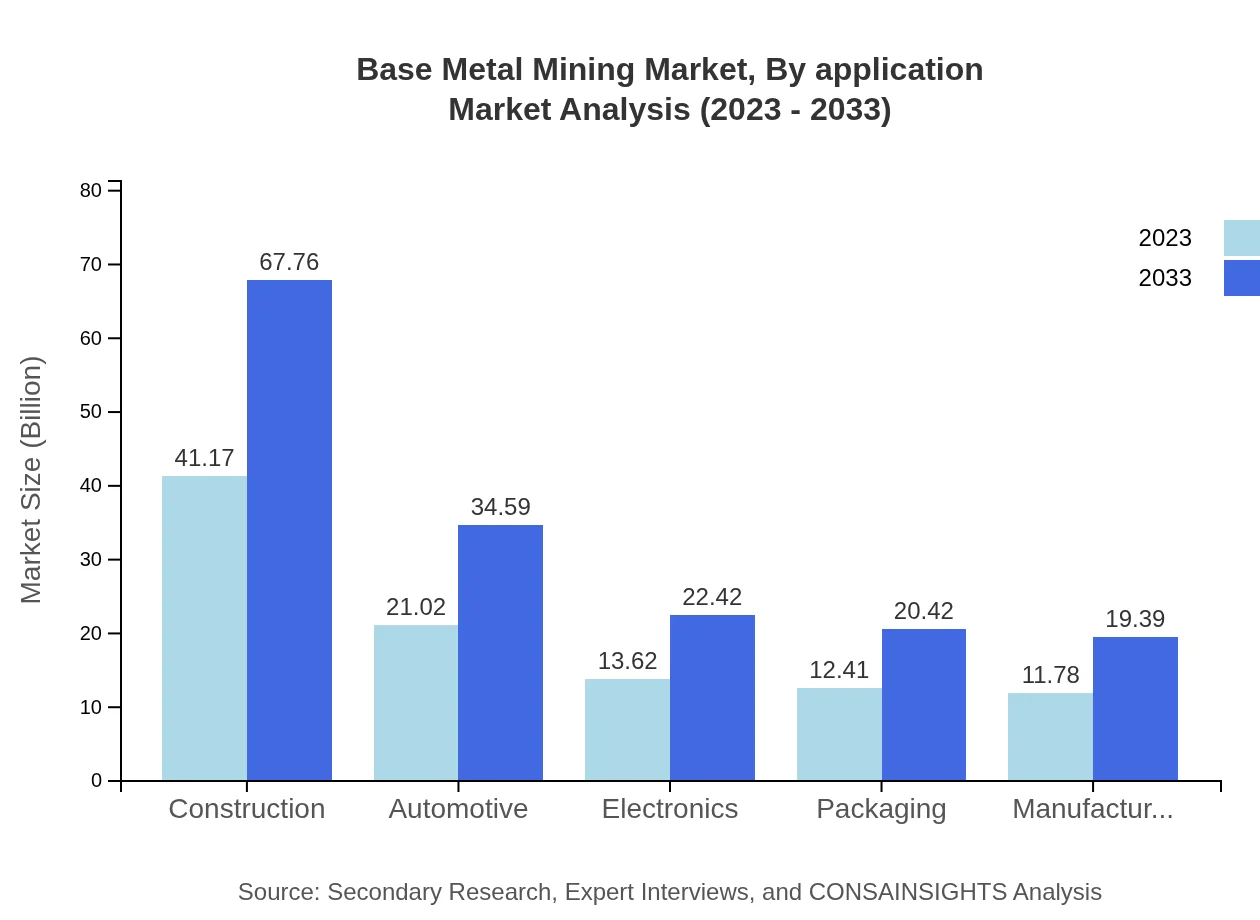

Base Metal Mining Market Analysis By Application

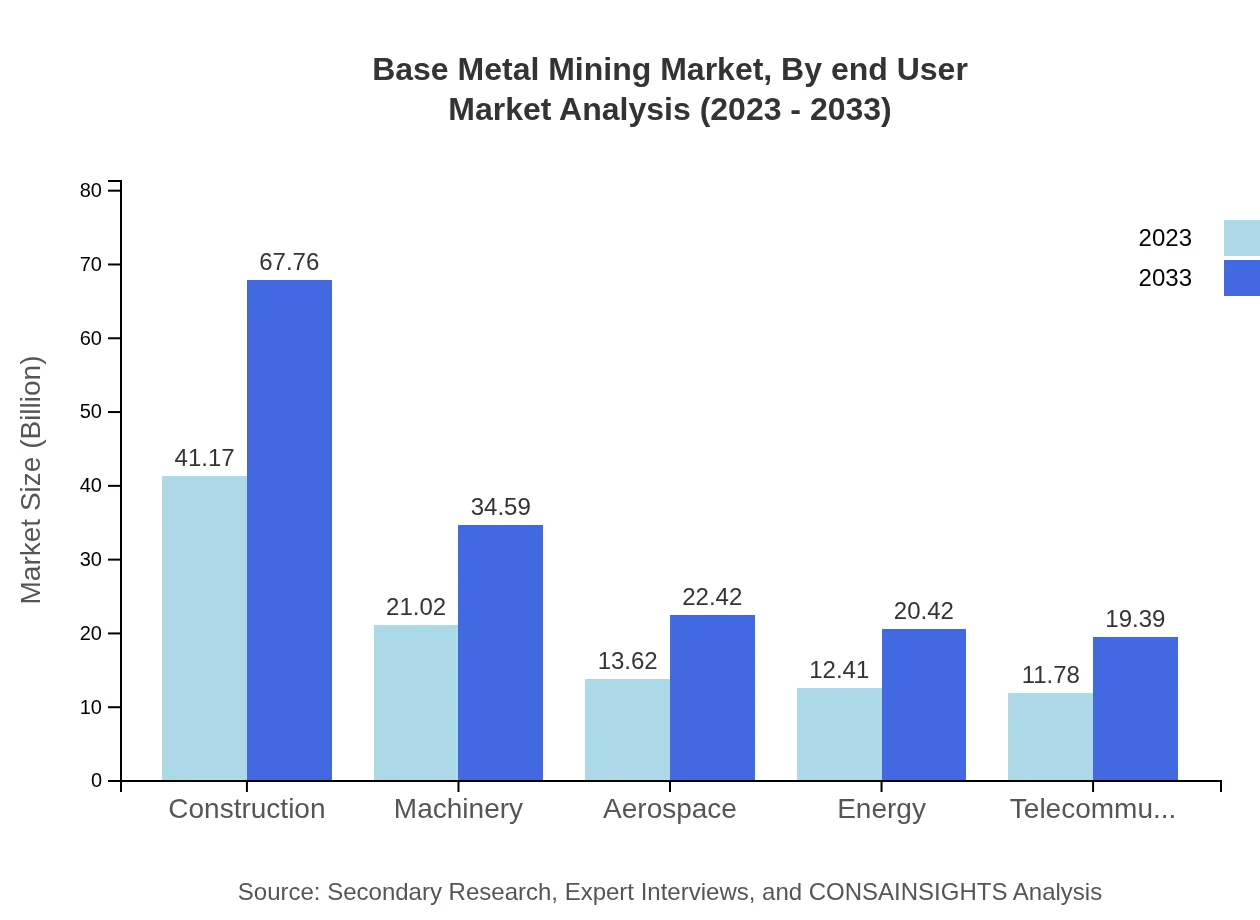

Construction leads application segments, starting at $41.17 billion in 2023 and expected to reach $67.76 billion by 2033. The automotive and machinery sectors also showcase robust potential, with sizes of $21.02 billion in 2023 set to increase to $34.59 billion. The electronics sector is forecasted to grow from $13.62 billion to $22.42 billion, highlighting the broad applicability of base metals.

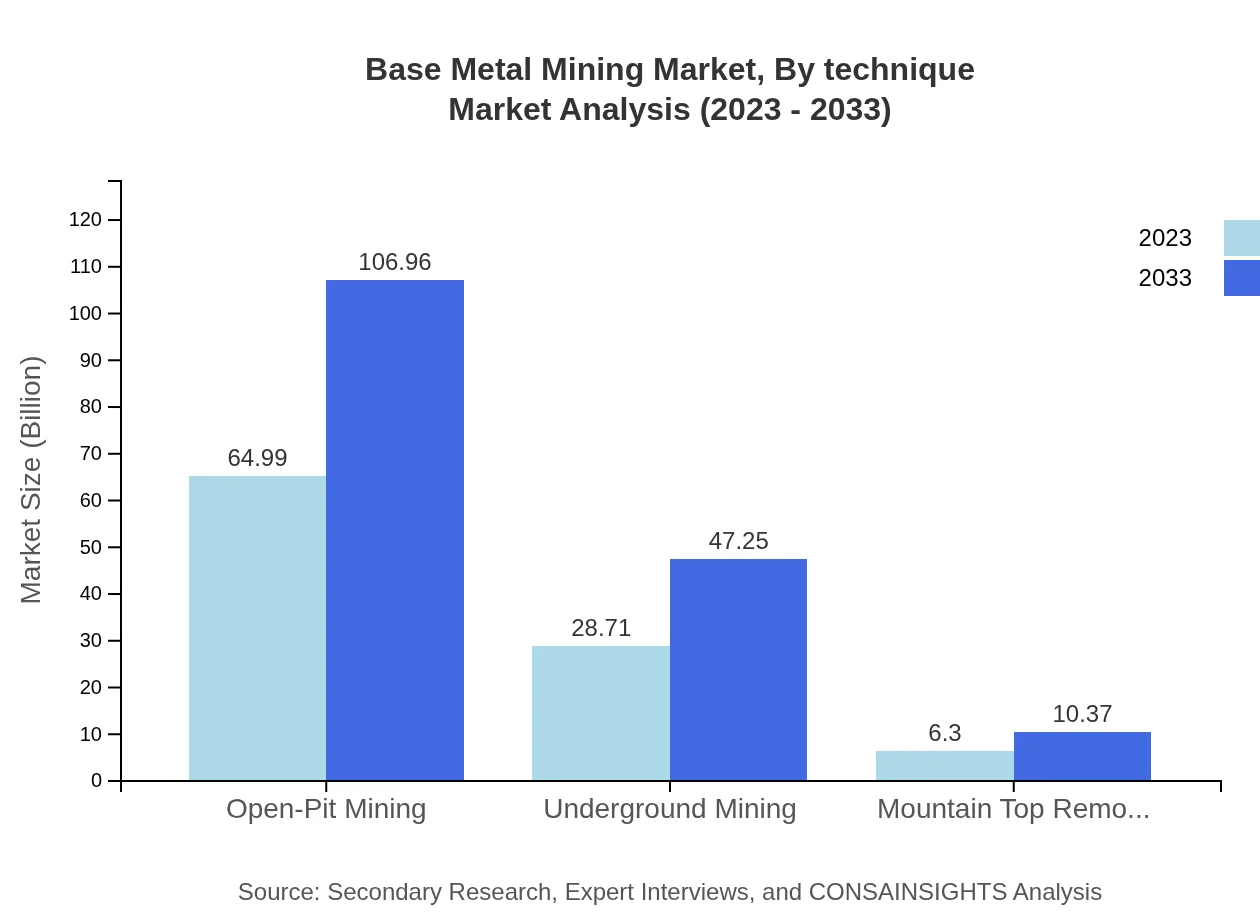

Base Metal Mining Market Analysis By Technique

Open-pit mining dominates mining techniques, starting with a market size of $64.99 billion in 2023 and projected to grow to $106.96 billion. Underground mining is also significant, moving from $28.71 billion to $47.25 billion. Meanwhile, mountain top removal is anticipated to increase from $6.30 billion to $10.37 billion, reflecting trends in extraction techniques.

Base Metal Mining Market Analysis By End User

The demand for base metals in the construction sector remains robust, with market size recording $41.17 billion in 2023. Manufacturing and telecommunications also contribute significantly to the demand, with initial sizes of $11.78 billion projected to rise steadily, showing the relevance of base metals across diverse industries.

Base Metal Mining Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Base Metal Mining Industry

BHP Group:

BHP is a leading global resources company, involved in the extraction and production of various base metals, particularly copper and nickel, significantly contributing to the overall market.Rio Tinto:

Rio Tinto operates numerous mining assets worldwide, focusing on aluminum production and copper mining. Their sustainable initiatives position them as a critical player in the base metals market.Glencore:

Glencore is a major player in the base metal industry, with a global trading structure and extensive mining operations, particularly known for producing copper, zinc, and lead.Vale S.A.:

Vale is one of the largest mining companies in the world, with significant operations in base metal mining, particularly nickel and copper, impacting global market dynamics.Southern Copper Corporation:

A key player in copper mining, Southern Copper Corporation operates in major markets in North and South America, contributing to the growing demand for this essential base metal.We're grateful to work with incredible clients.

FAQs

What is the market size of base Metal Mining?

The global base metal mining market is valued at approximately $100 billion in 2023, with a projected CAGR of 5% by 2033. This growth reflects increasing global demand for various metals produced from mining activities.

What are the key market players or companies in the base Metal Mining industry?

Key players in the base metal mining industry include major corporations such as BHP Group, Rio Tinto, Glencore, and Freeport-McMoRan. These companies significantly influence market dynamics through production capacity and technological advancements.

What are the primary factors driving the growth in the base Metal Mining industry?

Key drivers of growth in the base metal mining sector include rising demand for copper and aluminum in construction and electronics, increased industrialization in emerging economies, and technological advancements in mining processes that enhance efficiency.

Which region is the fastest Growing in the base Metal Mining?

North America, particularly the U.S., is the fastest-growing region in base metal mining, with market growth from $34.86 billion in 2023 to $57.37 billion by 2033, driven by rising infrastructural development and mining investments.

Does ConsaInsights provide customized market report data for the base Metal Mining industry?

Yes, ConsaInsights offers customized market report services for the base-metal mining industry, allowing clients to receive tailored insights based on specific business requirements and regional focus.

What deliverables can I expect from this base Metal Mining market research project?

Clients can expect comprehensive deliverables including detailed market analysis, regional growth forecasts, competitor profiling, and trend assessments to facilitate informed strategic decisions in the base metal mining sector.

What are the market trends of base Metal Mining?

Current trends in base metal mining include increasing adoption of sustainable practices, advancements in automation and digitalization, and growing investments in recycling technologies to meet the rising demand for metals sustainably.