Base Metals Market Report

Published Date: 02 February 2026 | Report Code: base-metals

Base Metals Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Base Metals market, covering market size, growth forecasts, industry trends, and competitive landscape from 2023 to 2033, offering crucial insights for stakeholders.

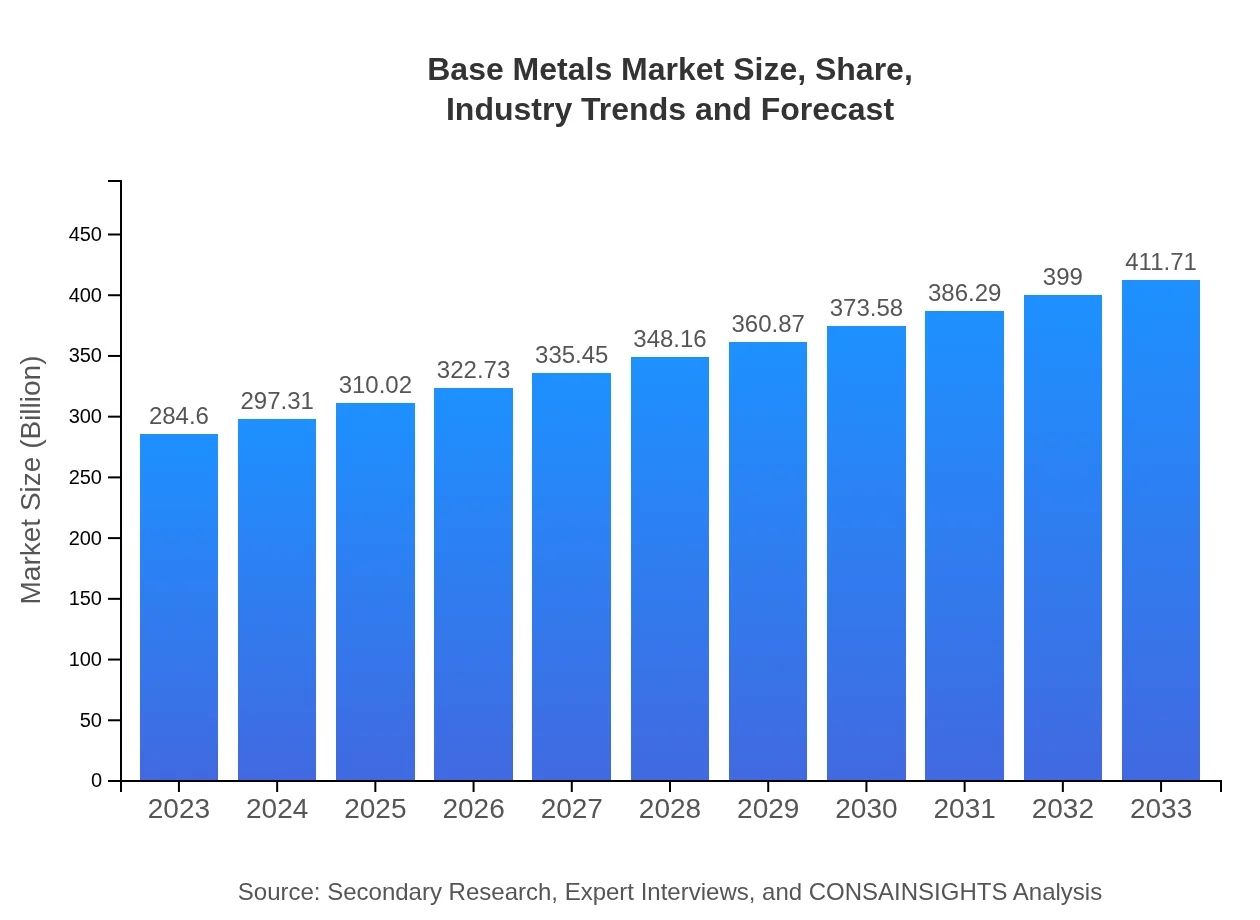

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $284.60 Billion |

| CAGR (2023-2033) | 3.7% |

| 2033 Market Size | $411.71 Billion |

| Top Companies | BHP Group, Rio Tinto, Glencore, Southern Copper Corporation, Alcoa Corporation |

| Last Modified Date | 02 February 2026 |

Base Metals Market Overview

Customize Base Metals Market Report market research report

- ✔ Get in-depth analysis of Base Metals market size, growth, and forecasts.

- ✔ Understand Base Metals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Base Metals

What is the Market Size & CAGR of Base Metals market in 2023?

Base Metals Industry Analysis

Base Metals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Base Metals Market Analysis Report by Region

Europe Base Metals Market Report:

Europe's base metals market will expand from $95.31 billion in 2023 to $137.88 billion by 2033. The market growth is supported by strengthening green initiatives and the European Union's commitment to sustainability. The shift towards electric vehicles in the automotive sector further influences demand for base metals.Asia Pacific Base Metals Market Report:

In the Asia Pacific region, the base metals market is estimated to reach $63.12 billion by 2033, up from $43.63 billion in 2023. The growth is driven by significant industrialization, urban activities, and increasing demand from infrastructure projects. China remains a significant contributor to market growth, supported by government initiatives aimed at enhancing infrastructure and technology advancements.North America Base Metals Market Report:

In North America, the market is expected to grow from $103.31 billion in 2023 to $149.45 billion in 2033. The region shows robust growth fueled by significant investments in electric vehicles and renewable energy projects, which underscore the need for copper and aluminum.South America Base Metals Market Report:

The South American market is projected to grow from $26.27 billion in 2023 to $38.00 billion in 2033. Mining activities in countries like Chile and Peru contribute significantly to this market due to their rich mineral resources. Environmental concerns and shifts to sustainable mining practices are shaping the future landscape of the industry.Middle East & Africa Base Metals Market Report:

The Middle East and Africa are anticipated to see market growth from $16.08 billion in 2023 to $23.26 billion in 2033. Factors such as infrastructural upgrades and urban development projects in the region are anticipated to drive base metal demand, particularly copper and aluminum.Tell us your focus area and get a customized research report.

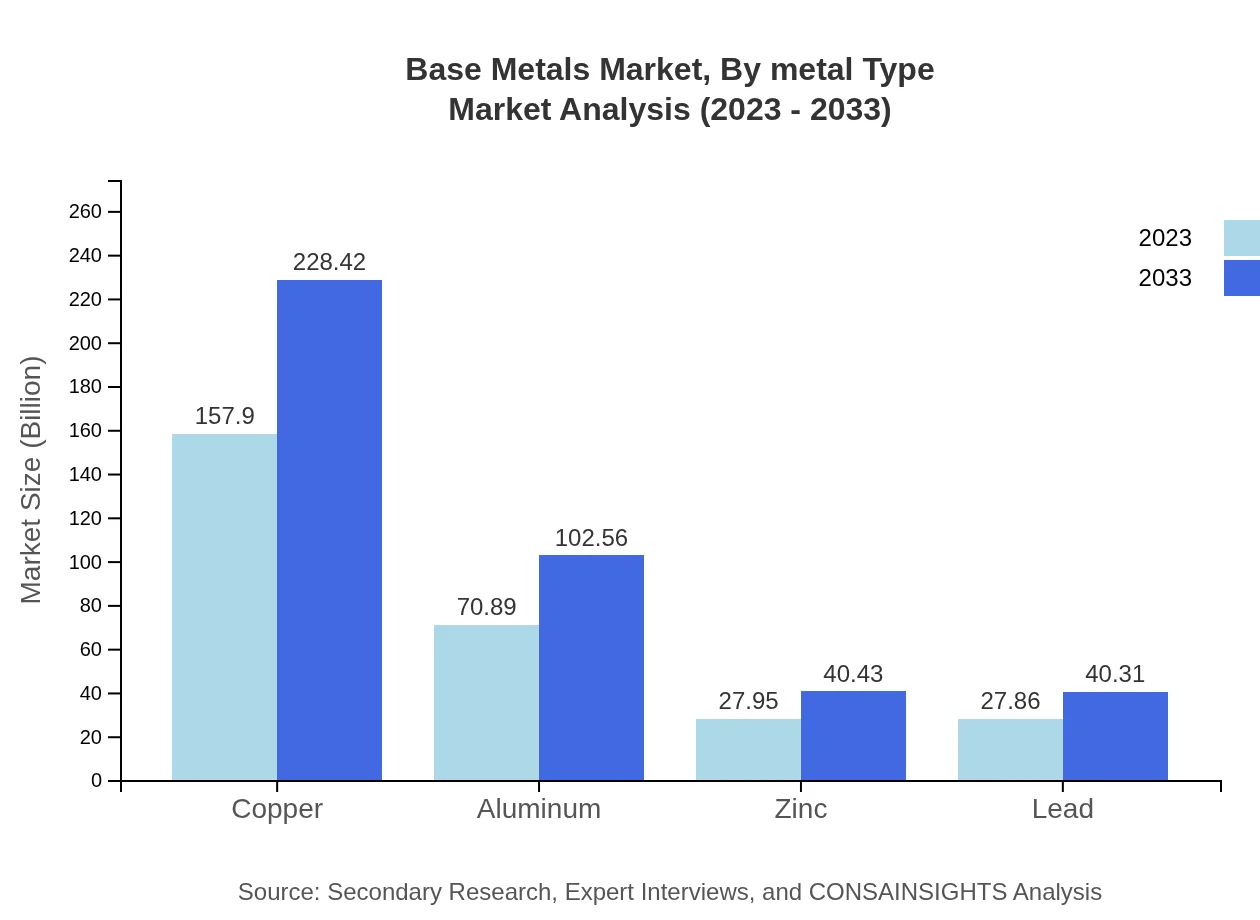

Base Metals Market Analysis By Metal Type

The base metals market by metal type includes notable segments such as Copper, Aluminum, Zinc, and Lead. Copper is projected to grow from $157.90 billion in 2023 to $228.42 billion in 2033, primarily fueled by its vast applications in electrical systems and renewable energy. Aluminum is expected to rise from $70.89 billion to $102.56 billion, owing to its lightweight properties, essential for the automotive industry. Zinc and Lead also show growth potential, driven by construction and manufacturing activities.

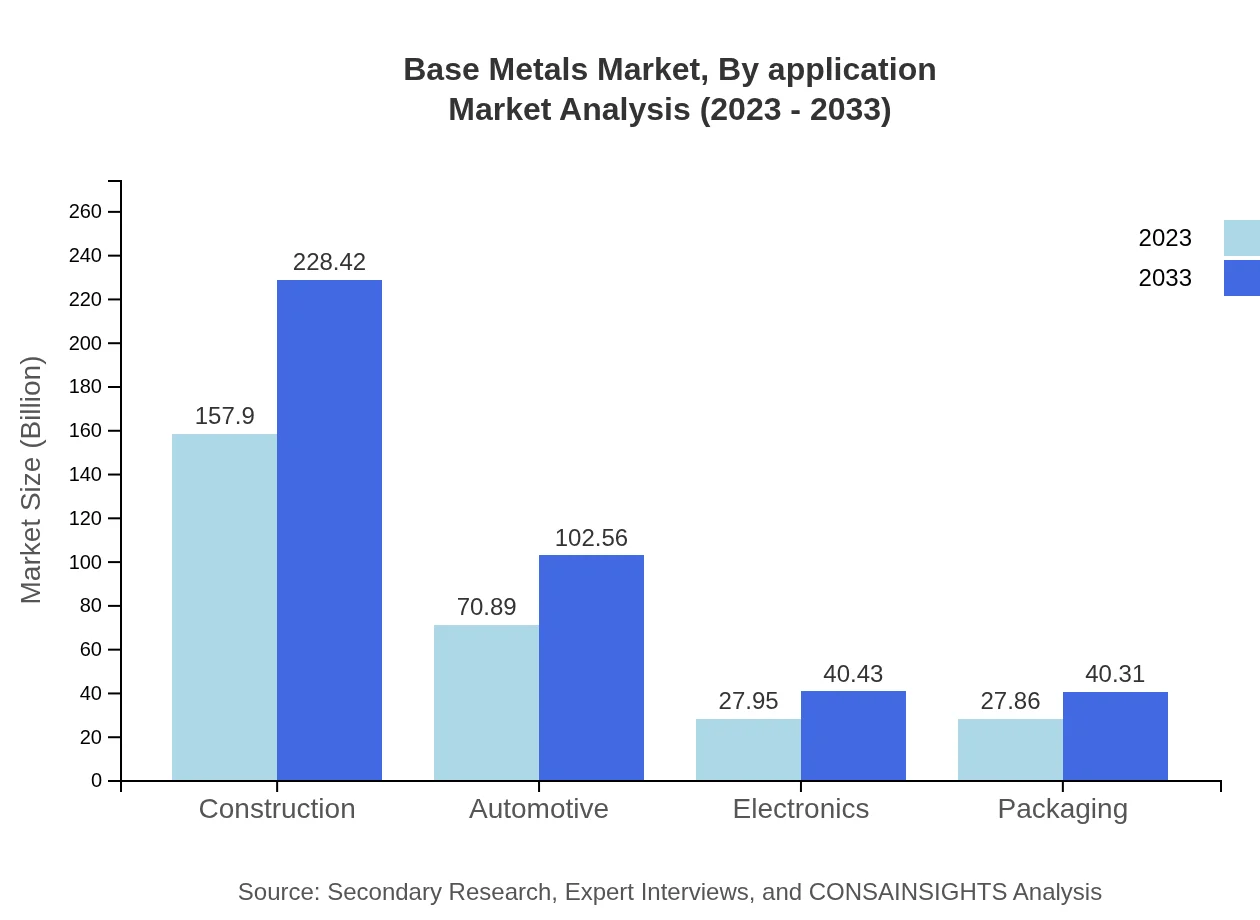

Base Metals Market Analysis By Application

By application, the base metals market is segmented into construction, automotive, electronics, and packaging. Construction leads the segment, expected to significantly rise from $157.90 billion to $228.42 billion by 2033, driven by urbanization and infrastructure projects. The automotive application is forecasted to grow from $70.89 billion to $102.56 billion as electric vehicles and lightweight components gain traction. Electronics and packaging sectors also show steady demand due to technological advancements and increased consumer goods packaging needs.

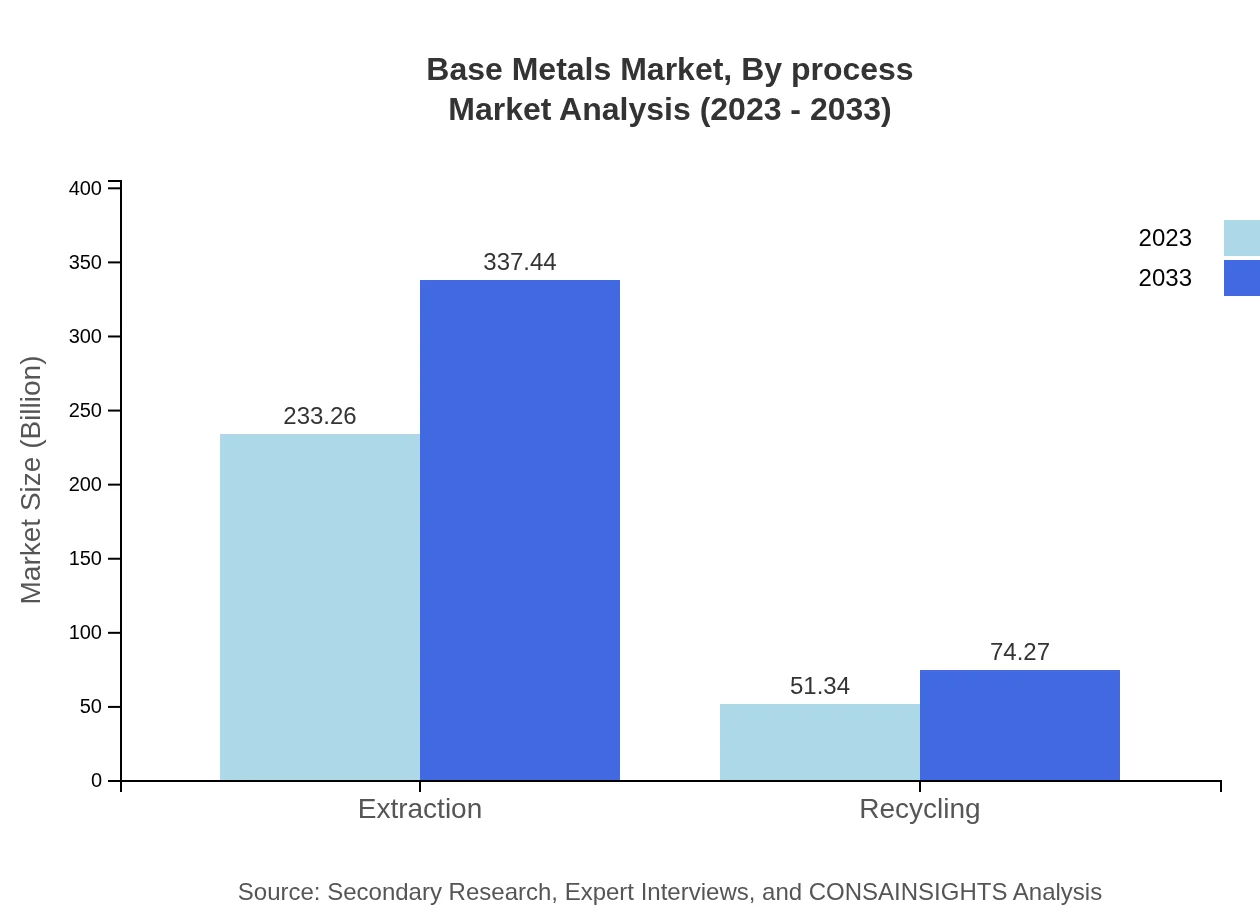

Base Metals Market Analysis By Process

The base metals market by process includes extraction and recycling. Extraction is forecasted to grow from $233.26 billion in 2023 to $337.44 billion by 2033, indicating continuous investment in mining technologies and techniques. Recycling is anticipated to see growth from $51.34 billion to $74.27 billion as sustainability becomes increasingly important, emphasizing the recycling of metal resources to reduce waste and environmental impacts.

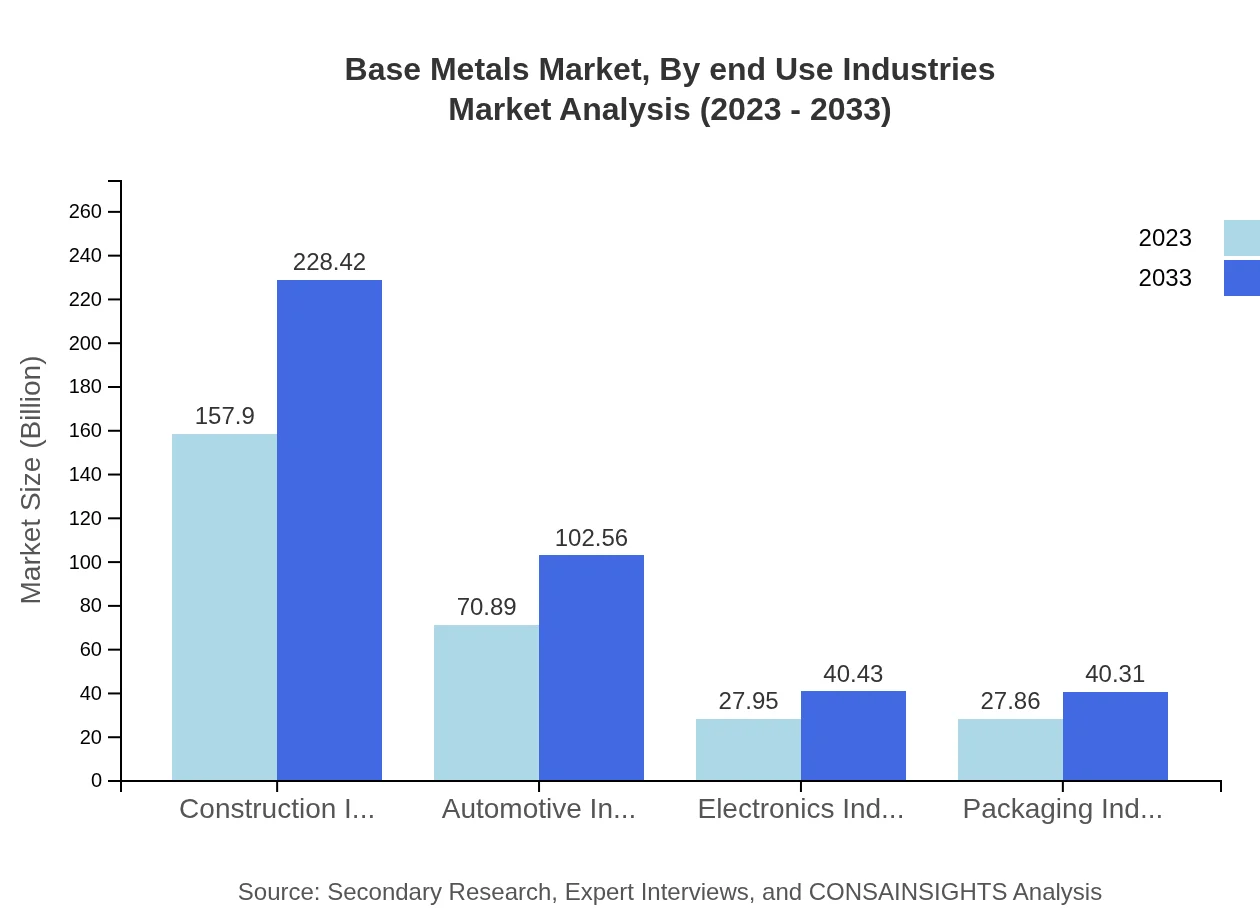

Base Metals Market Analysis By End Use Industries

The end-use industries include construction, automotive, electronics, and packaging, each driving demand for base metals. The construction industry, which heavily relies on metals for building infrastructure, is expected to grow from $157.90 billion to $228.42 billion by 2033. The automotive industry is set to experience growth from $70.89 billion to $102.56 billion owing to the rising focus on vehicle lightweighting and EV production. Electronics and packaging industries are also expected to grow steadily, indicating diversified demand across applications.

Base Metals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Base Metals Industry

BHP Group:

BHP is a leading global resources company engaged in the mining, production, and trading of base metals, known for its extensive copper and nickel operations.Rio Tinto:

Rio Tinto is a prominent mining group with operations across several base metals, focusing on sustainable practices and innovation in mineral resource development.Glencore:

Glencore is a multinational commodity trading and mining company that plays a crucial role in the distribution and processing of essential base metals like copper and zinc.Southern Copper Corporation:

Southern Copper Corporation is one of the largest copper producers globally, with a focus on sustainable practices and community engagement.Alcoa Corporation:

Alcoa is a leading producer of aluminum, significantly influencing the aluminum market and investing in innovative, sustainable technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of base Metals?

The global base metals market is valued at approximately 284.6 billion in 2023, with a projected CAGR of 3.7% from 2023 to 2033. This growth reflects increasing demand across various industries, including construction and electronics.

What are the key market players or companies in this base Metals industry?

Key players in the base metals industry include major multinational corporations and regional companies. They often engage in mining, processing, and distributing metals such as copper, aluminum, and zinc, which are crucial for industrial applications.

What are the primary factors driving the growth in the base Metals industry?

Growth in the base metals industry is primarily driven by infrastructure development, increasing automotive production, and the rise in electronic devices. Sustainable practices like recycling also contribute significantly to overall market expansion.

Which region is the fastest Growing in the base Metals market?

The Asia-Pacific region is the fastest-growing in the base metals market, projected to grow from 43.63 billion in 2023 to 63.12 billion by 2033, driven by industrial expansion and urbanization in countries like China and India.

Does ConsaInsights provide customized market report data for the base Metals industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the base metals industry, providing insights on market size, competitive landscape, and regional trends, ensuring relevance to your strategic decisions.

What deliverables can I expect from this base Metals market research project?

Expect comprehensive deliverables, including detailed market analysis, regional insights, competitor profiles, forecasts, and recommendations tailored to the base metals sector, aiding in strategic planning and decision-making.

What are the market trends of base Metals?

Current market trends in base metals include a shift towards sustainable extraction methods, increased recycling efforts, and heightened demand due to technological advancements in electric vehicles and renewable energy sectors.