Base Oil Market Report

Published Date: 02 February 2026 | Report Code: base-oil

Base Oil Market Size, Share, Industry Trends and Forecast to 2033

This report presents an in-depth analysis of the Base Oil market, covering insights into market size, segmentation, regional characteristics, and key players. It forecasts trends from 2023 to 2033, highlighting growth potential and industry challenges.

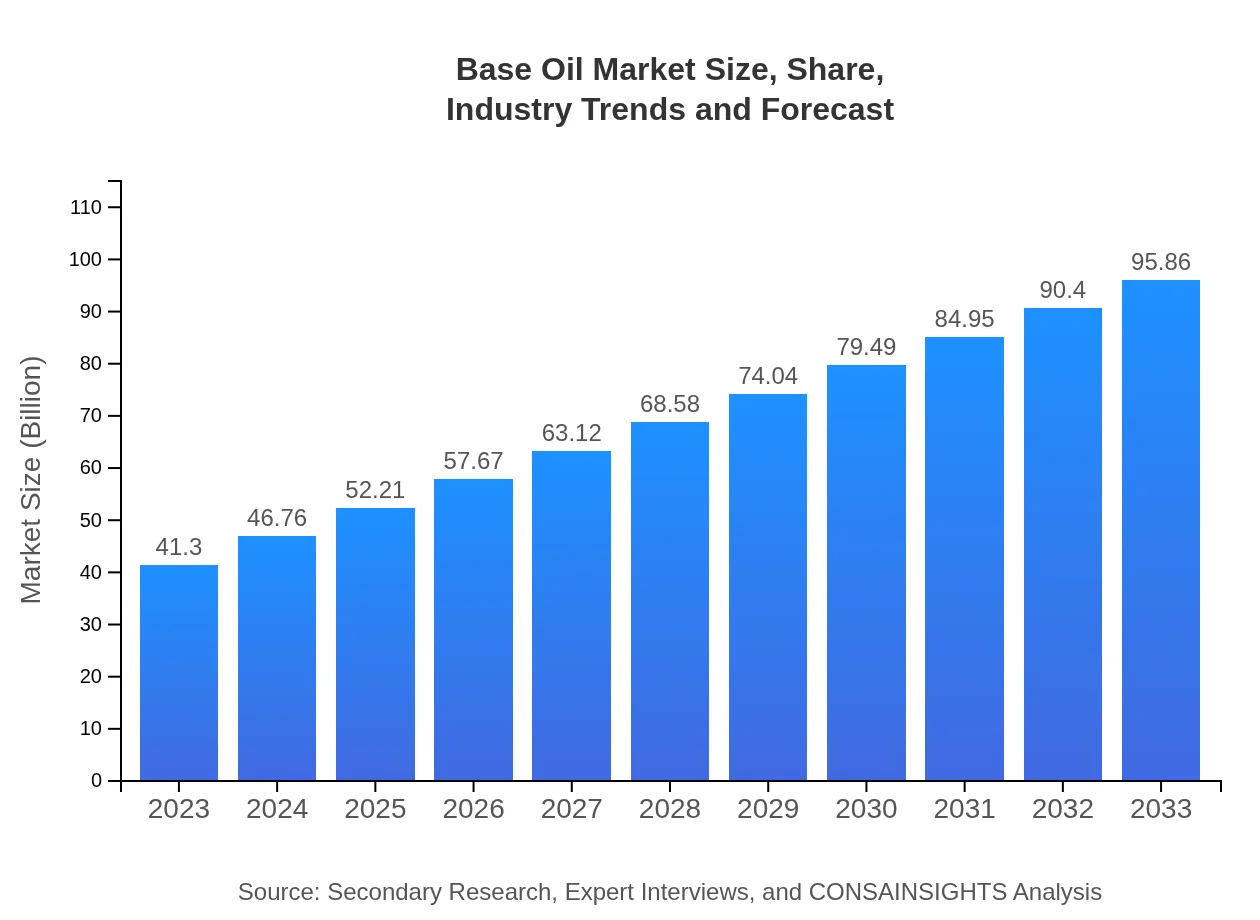

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $41.30 Billion |

| CAGR (2023-2033) | 8.5% |

| 2033 Market Size | $95.86 Billion |

| Top Companies | ExxonMobil, Shell, Sasol, Chevron, TotalEnergies |

| Last Modified Date | 02 February 2026 |

Base Oil Market Overview

Customize Base Oil Market Report market research report

- ✔ Get in-depth analysis of Base Oil market size, growth, and forecasts.

- ✔ Understand Base Oil's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Base Oil

What is the Market Size & CAGR of Base Oil market in 2023?

Base Oil Industry Analysis

Base Oil Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Base Oil Market Analysis Report by Region

Europe Base Oil Market Report:

Europe is anticipated to witness significant growth within the Base Oil market, increasing from $13.47 million in 2023 to $31.26 million by 2033. Strict regulations regarding emissions and sustainability, along with strong automotive and machinery sectors, underpin this rising demand.Asia Pacific Base Oil Market Report:

The Asia Pacific region is a significant market for Base Oils, projected to grow from $7.12 million in 2023 to $16.54 million by 2033. This growth is driven by rapid industrialization, increasing automotive production, and a rising emphasis on high-quality lubricants. Countries like China and India are the major contributors due to their expanding manufacturing sectors.North America Base Oil Market Report:

The North American Base Oil market is projected to expand from $14.78 million in 2023 to $34.30 million by 2033. The region's focus on technological advancements in refining processes and a growing trend towards sustainable products play a crucial role in this growth.South America Base Oil Market Report:

In South America, the Base Oil market is expected to increase from $3.02 million in 2023 to $7.01 million by 2033. The growth is primarily attributed to increasing automotive sales and a recognized need for effective lubricant solutions in various industries.Middle East & Africa Base Oil Market Report:

The Middle East and Africa region are set for growth from $2.91 million in 2023 to $6.76 million by 2033. Economic diversification and increased industrial activities promote the use of high-performance base oils, enhancing market opportunities.Tell us your focus area and get a customized research report.

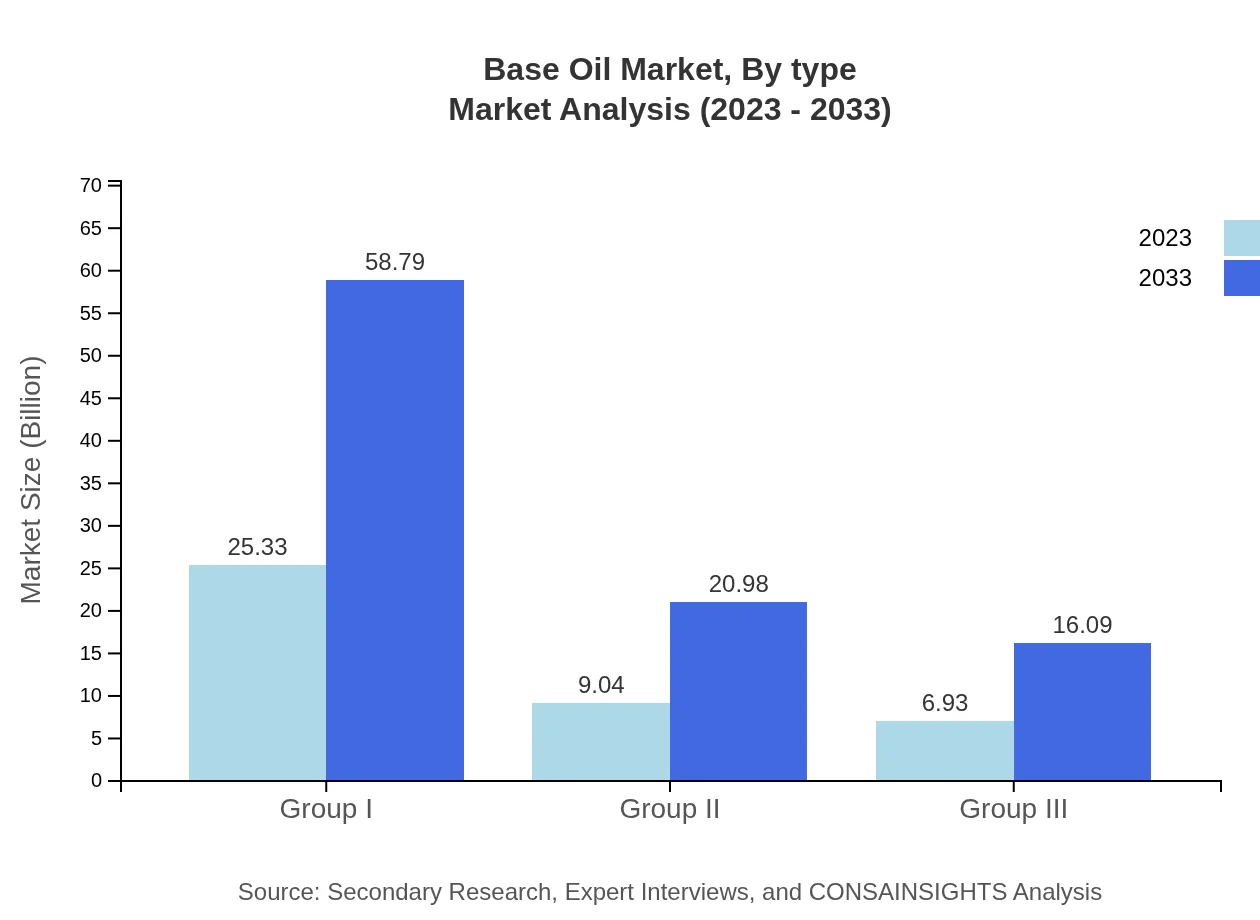

Base Oil Market Analysis By Type

In the Base Oil market, Group I oils currently dominate with a market size of $25.33 million in 2023, projected to grow to $58.79 million by 2033, accounting for a stable share of 61.33%. Group II oils have a market size of $9.04 million in 2023, anticipated to reach $20.98 million by 2033, holding a share of 21.89%. Group III oils also show significant growth potential, moving from $6.93 million in 2023 to $16.09 million by 2033, with a consistent share of 16.78%.

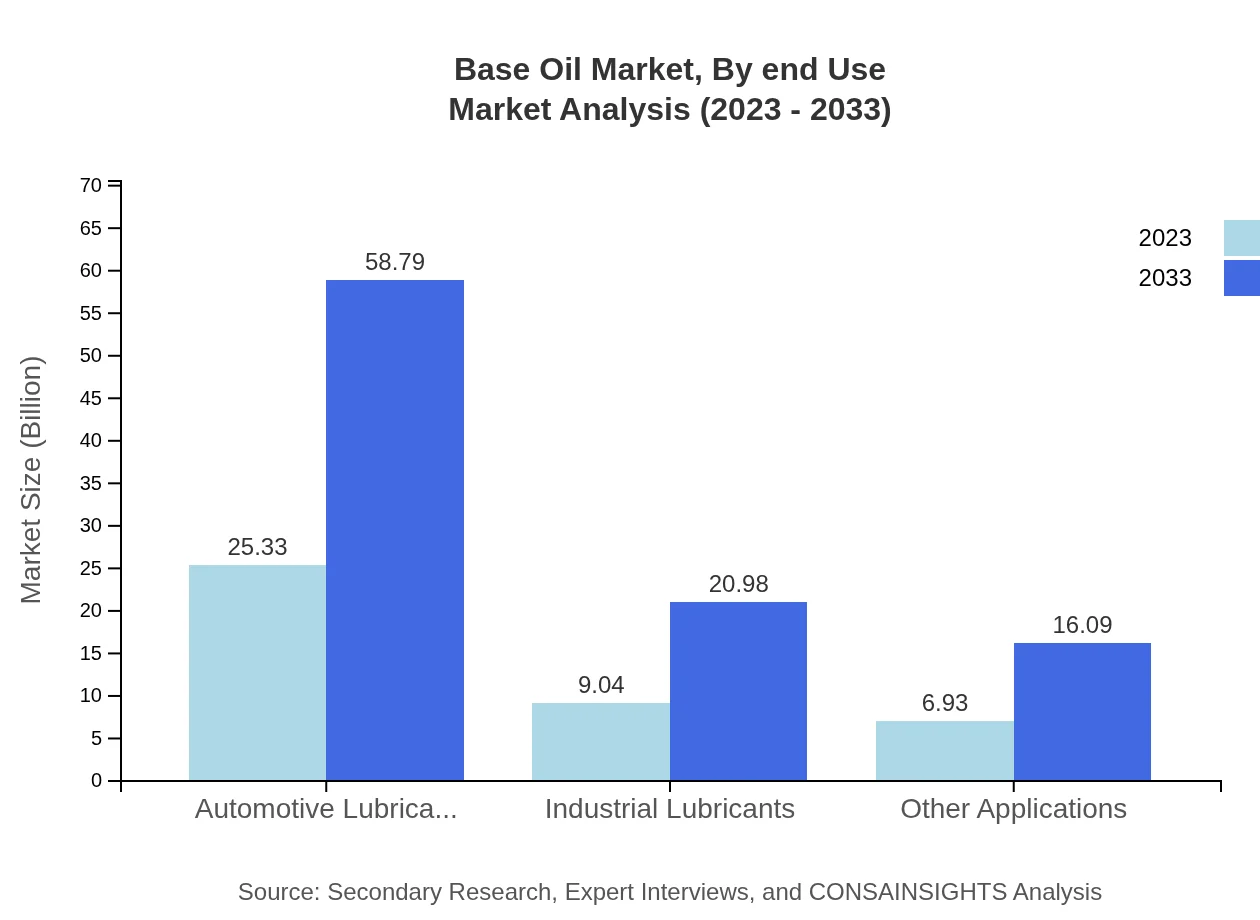

Base Oil Market Analysis By End Use

Automotive lubricants are the leading segment in the Base Oil market, projected to grow from $25.33 million in 2023 to $58.79 million by 2033, representing a market share of 61.33%. Industrial lubricants follow, with a market size of $9.04 million in 2023 to $20.98 million by 2033, maintaining a share of 21.89%. Other applications, including specialty lubricants, are expected to rise from $6.93 million in 2023 to $16.09 million by 2033, holding a 16.78% market share.

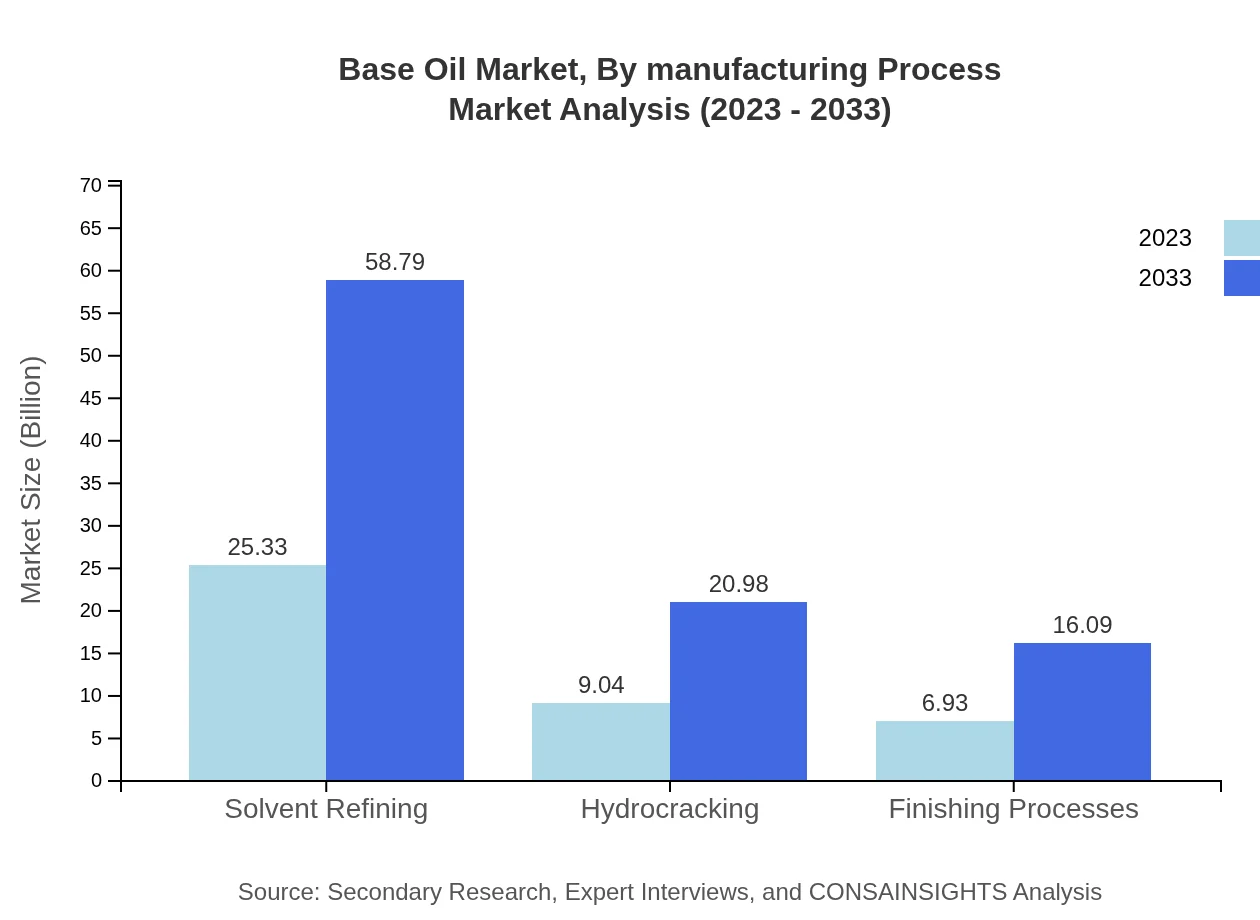

Base Oil Market Analysis By Manufacturing Process

Solvent refining dominates the manufacturing processes with a size of $25.33 million in 2023, projected to grow to $58.79 million by 2033, maintaining a market share of 61.33%. Hydrocracking is expected to expand from $9.04 million in 2023 to $20.98 million by 2033 with a consistent share of 21.89%. Finishing processes have a market size of $6.93 million in 2023 and are projected to grow to $16.09 million by 2033, holding a share of 16.78%.

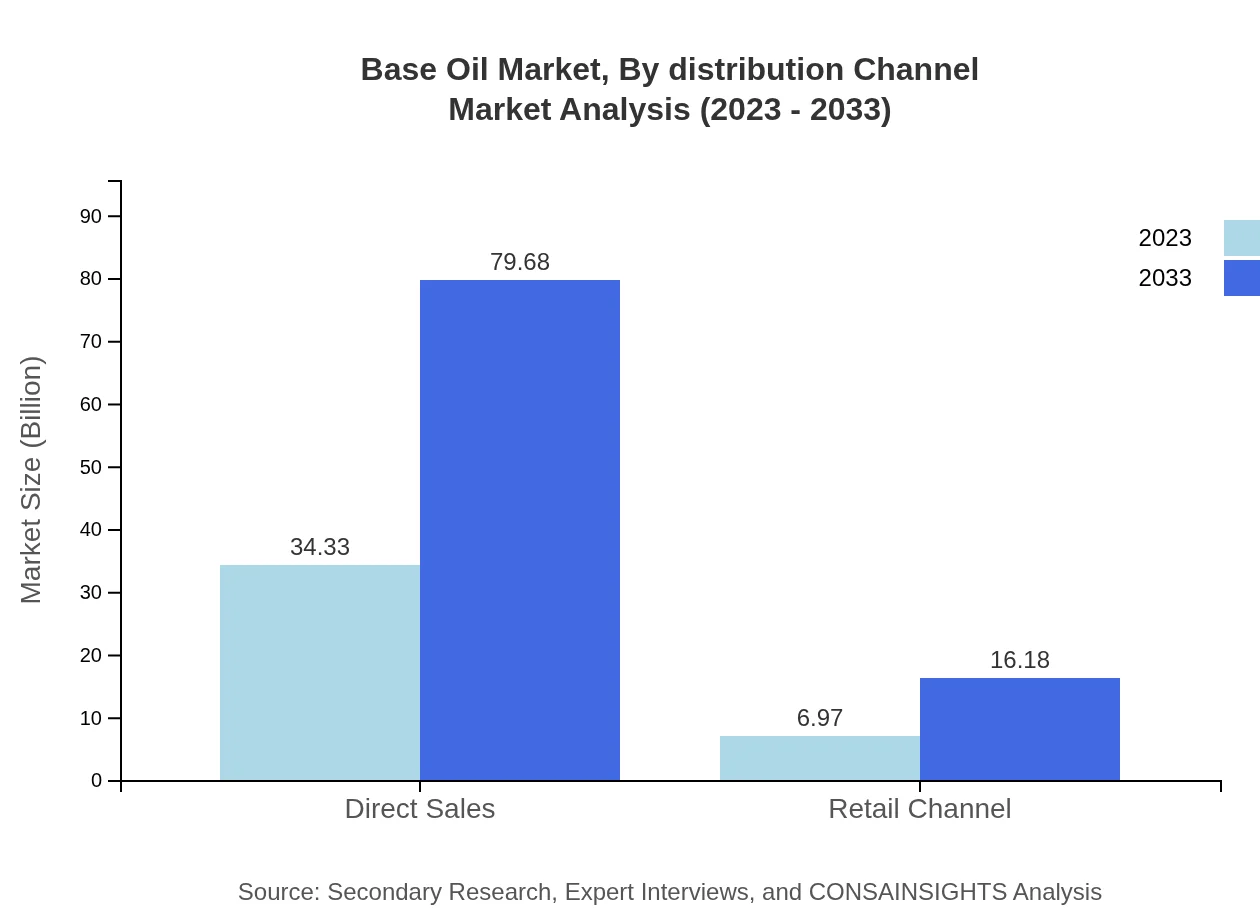

Base Oil Market Analysis By Distribution Channel

Direct sales lead the distribution channels with a market size of $34.33 million in 2023, expected to reach $79.68 million by 2033, representing a share of 83.12%. The retail channel holds $6.97 million in 2023, projected to grow to $16.18 million by 2033, contributing 16.88% to the overall market.

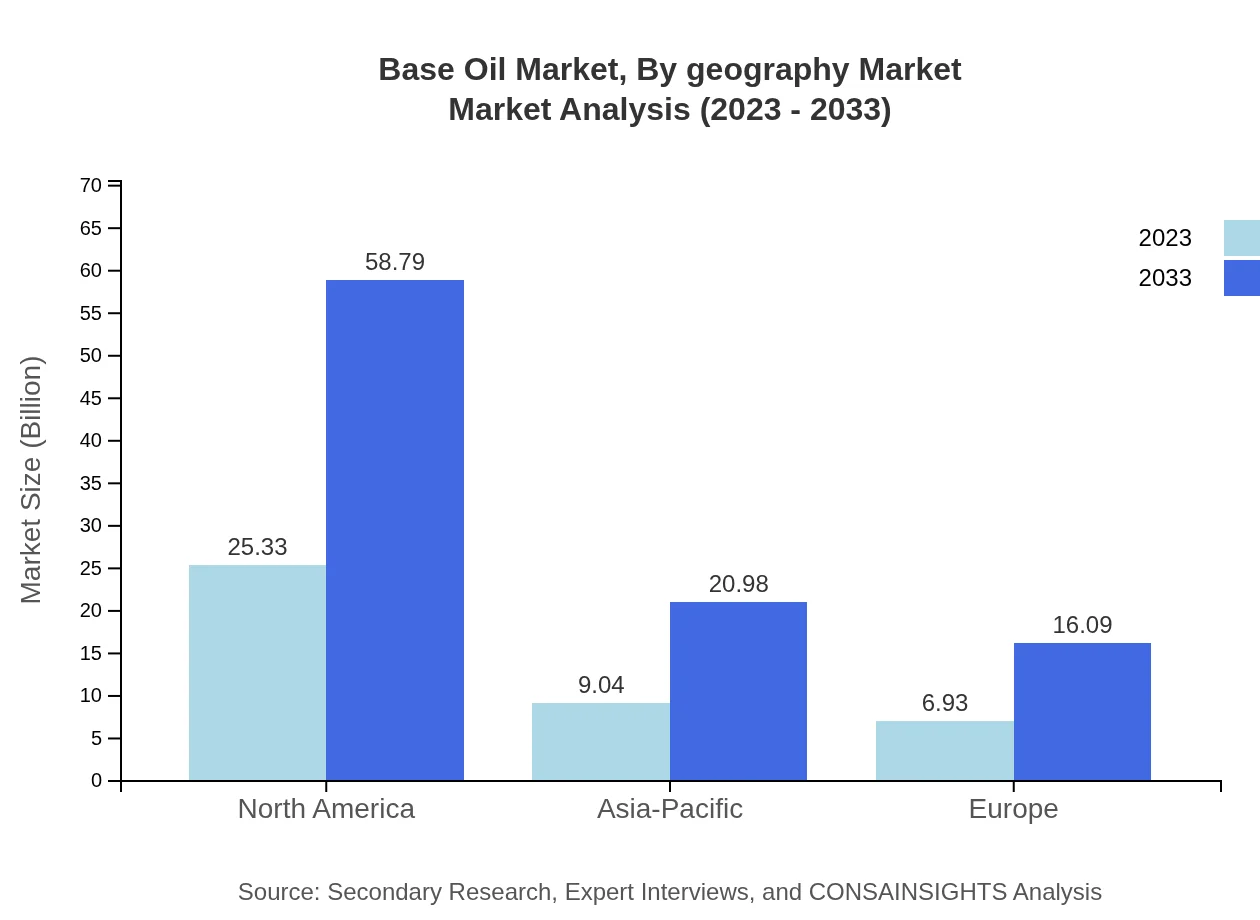

Base Oil Market Analysis By Geography Market

In terms of geography, North America stands out with a size of $25.33 million in 2023 and forecasted growth to $58.79 million by 2033. The Asia-Pacific region follows, with expectations of moving from $9.04 million to $20.98 million in the same period, while Europe will see growth from $6.93 million to $16.09 million, indicating its critical role in the global base oil market.

Base Oil Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Base Oil Industry

ExxonMobil:

A leading player in the base oil industry, ExxonMobil is renowned for its extensive portfolio of high-quality lubricants and base oils, contributing to refining innovation and environmental sustainability.Shell:

Shell is a key market leader, recognized for its advanced base oil technologies and large-scale production facilities, ensuring reliable supply and quality for various lubricant sectors.Sasol:

Sasol operates as a major integrated energy and chemicals company providing a wide range of specialty chemicals and base oils, emphasizing sustainability and innovative refining processes.Chevron:

Chevron is another prominent player in base oil production, known for its high-performance products and commitment to reducing environmental footprints through advanced technologies.TotalEnergies:

TotalEnergies plays a significant role in the global base oil market, delivering high-quality synthetic and mineral-based lubricants, enhancing performance and sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of base Oil?

The global base oil market is valued at approximately $41.3 billion in 2023 and is projected to grow at a CAGR of 8.5% through 2033.

What are the key market players or companies in this base Oil industry?

Key players in the base-oil industry include major oil refining companies, lubricant manufacturing firms, and specialty chemical suppliers. These entities play a crucial role in shaping market dynamics and innovation.

What are the primary factors driving the growth in the base Oil industry?

Growth in the base-oil industry is driven by rising demand for automotive lubricants, expanding industrial applications, and increased environmental regulations favoring high-quality, eco-friendly lubricants.

Which region is the fastest Growing in the base Oil market?

The fastest-growing region in the base-oil market is Asia-Pacific, with market size expected to rise from $7.12 billion in 2023 to $16.54 billion by 2033, reflecting significant growth.

Does ConsaInsights provide customized market report data for the base Oil industry?

Yes, ConsaInsights offers customized market reports tailored to specific requirements in the base-oil industry, enabling clients to obtain targeted insights and data.

What deliverables can I expect from this base Oil market research project?

You can expect comprehensive reports, market analysis, detailed regional data, key player insights, forecasts, and tailored recommendations as deliverables from this market research project.

What are the market trends of base Oil?

Current market trends in the base-oil industry include a shift towards synthetics, increased investments in refining technologies, and an emphasis on sustainable and eco-friendly lubricant solutions.